5g Industrial Iot Market Report

Published Date: 31 January 2026 | Report Code: 5g-industrial-iot

5g Industrial Iot Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the 5G Industrial IoT market, covering market size, industry analysis, segmentation, regional insights, and trends. The insights are forecasted for the period from 2023 to 2033.

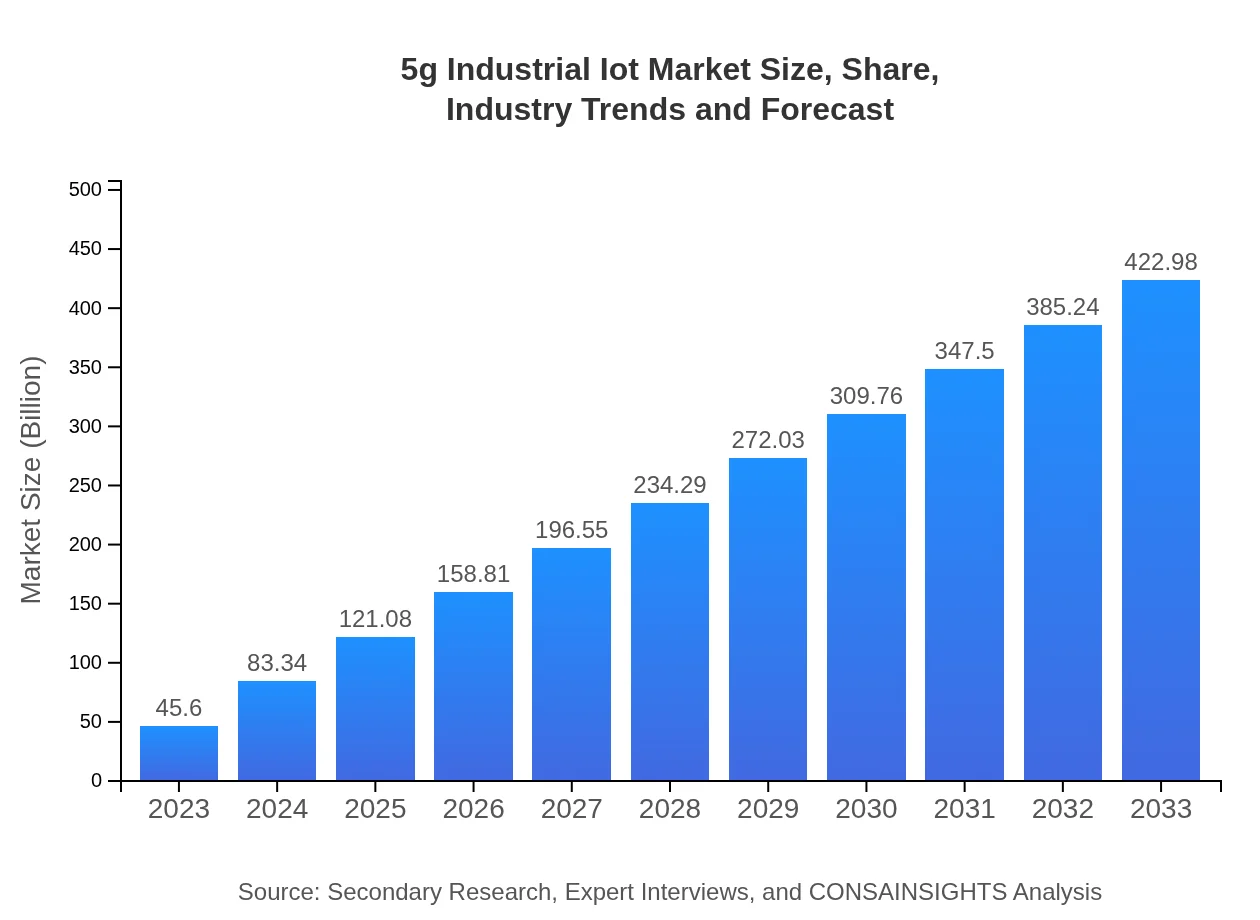

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.60 Billion |

| CAGR (2023-2033) | 23.4% |

| 2033 Market Size | $422.98 Billion |

| Top Companies | Cisco Systems, Huawei Technologies, Siemens AG, IBM |

| Last Modified Date | 31 January 2026 |

5g Industrial Iot Market Overview

Customize 5g Industrial Iot Market Report market research report

- ✔ Get in-depth analysis of 5g Industrial Iot market size, growth, and forecasts.

- ✔ Understand 5g Industrial Iot's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in 5g Industrial Iot

What is the Market Size & CAGR of 5g Industrial Iot market in 2023?

5g Industrial Iot Industry Analysis

5g Industrial Iot Market Segmentation and Scope

Tell us your focus area and get a customized research report.

5g Industrial Iot Market Analysis Report by Region

Europe 5g Industrial Iot Market Report:

Europe's market will increase notably from $13.36 billion in 2023 to $123.89 billion by 2033, driven by regulatory initiatives aimed at fostering industrial digitalization and sustainability.Asia Pacific 5g Industrial Iot Market Report:

In the Asia Pacific region, the size of the 5G Industrial IoT market is expected to expand from $8.95 billion in 2023 to approximately $83.03 billion by 2033, driven by significant investments in smart factories and urban infrastructure projects.North America 5g Industrial Iot Market Report:

North America leads the 5G Industrial IoT market with expected growth from $16.38 billion in 2023 to $151.93 billion by 2033, largely fueled by the high penetration of advanced technologies in manufacturing and logistics.South America 5g Industrial Iot Market Report:

The South American market for 5G Industrial IoT is projected to grow from $2.90 billion in 2023 to $26.86 billion by 2033, supported by increasing digitization efforts in sectors such as agriculture and transportation.Middle East & Africa 5g Industrial Iot Market Report:

The Middle East and Africa 5G Industrial IoT market is projected to evolve from $4.02 billion in 2023 to $37.26 billion by 2033, as regional governments push for smart city initiatives and enhance their industrial sectors.Tell us your focus area and get a customized research report.

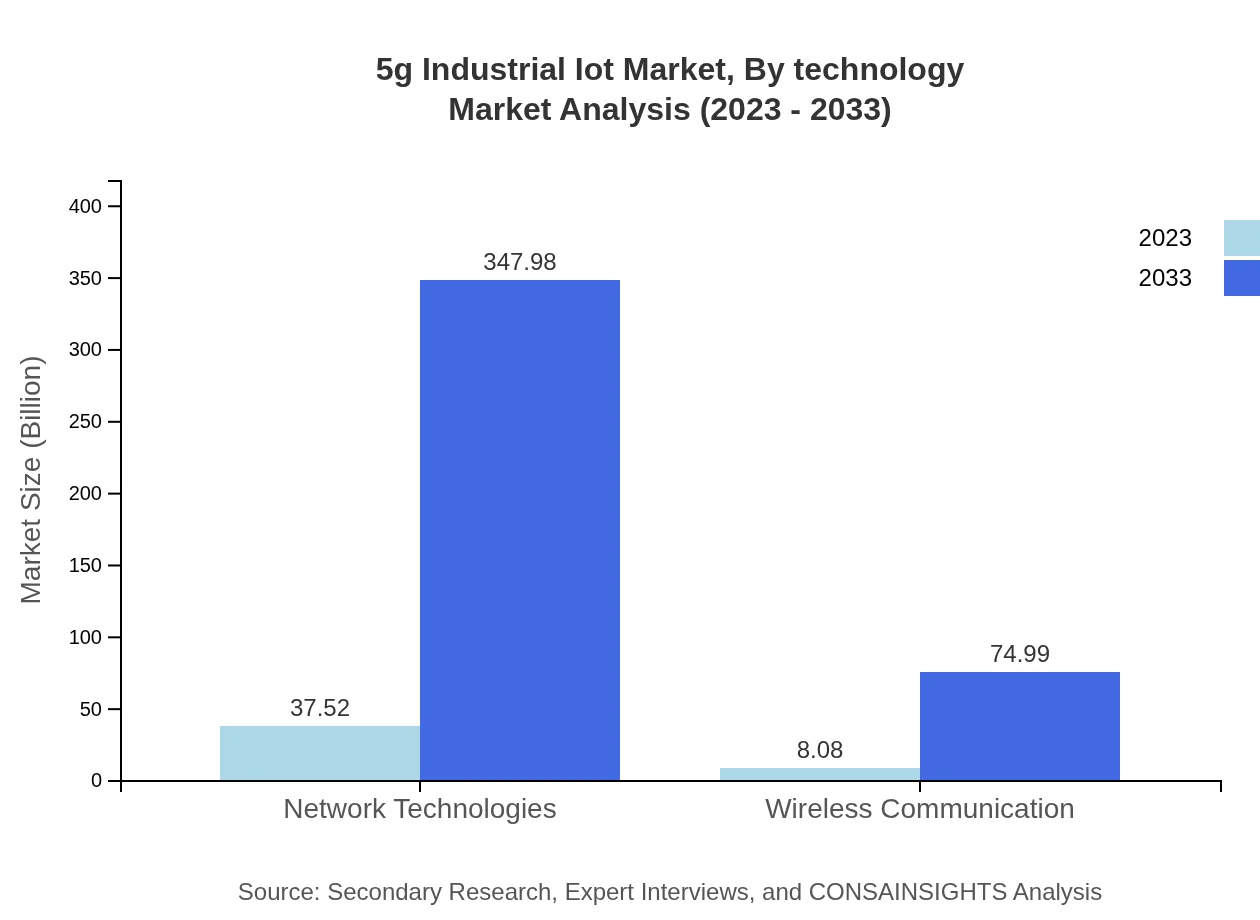

5g Industrial Iot Market Analysis By Technology

The Network Technologies segment is projected to dominate the market, with its size increasing from $37.52 billion in 2023 to $347.98 billion by 2033, maintaining a significant share of 82.27%. Wireless Communication solutions will also expand from $8.08 billion to $74.99 billion, representing 17.73% market share.

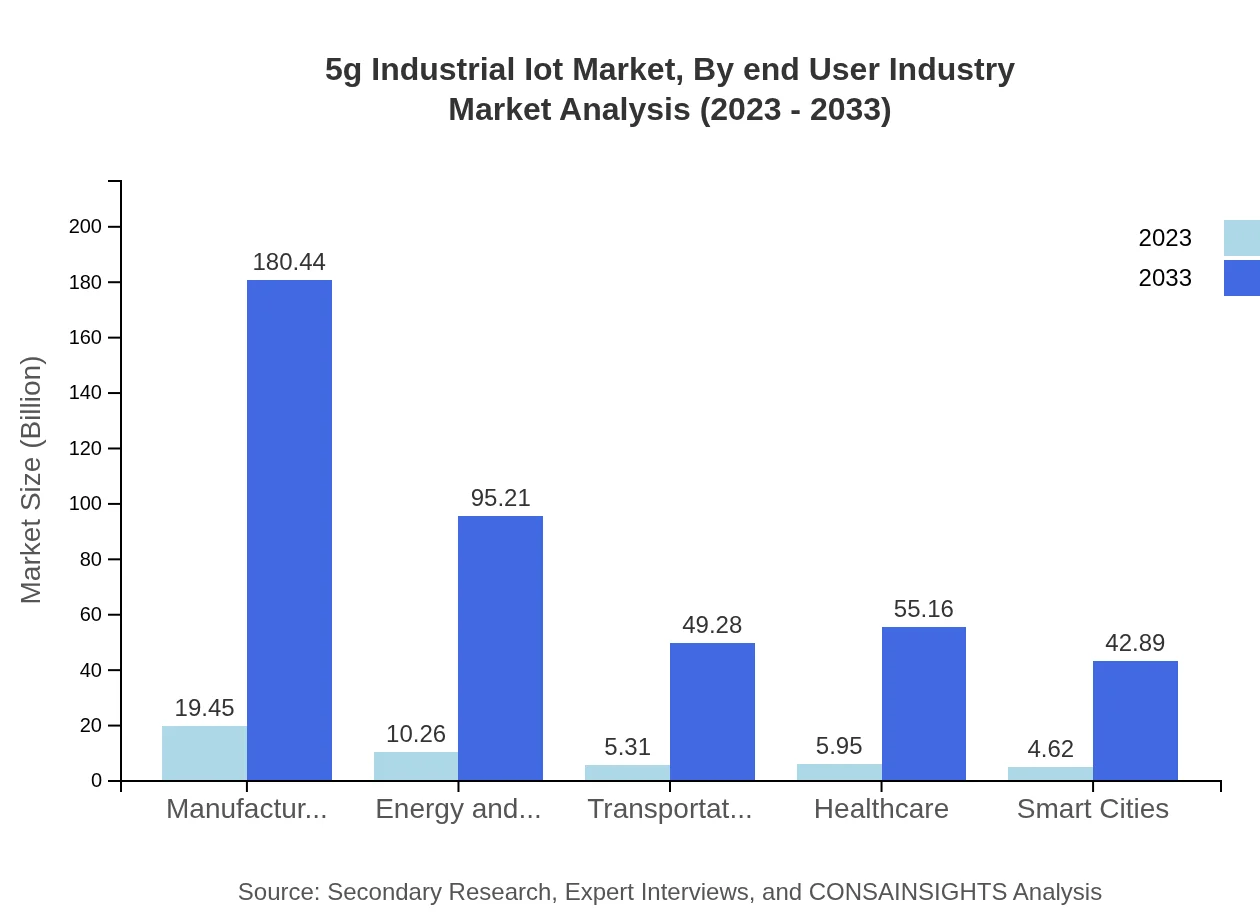

5g Industrial Iot Market Analysis By End User Industry

Key applications such as Manufacturing and Healthcare are anticipated to drive the market, with Manufacturing increasing from $19.45 billion in 2023 to $180.44 billion by 2033, holding 42.66% market share. The Healthcare sector will see growth from $5.95 billion to $55.16 billion.

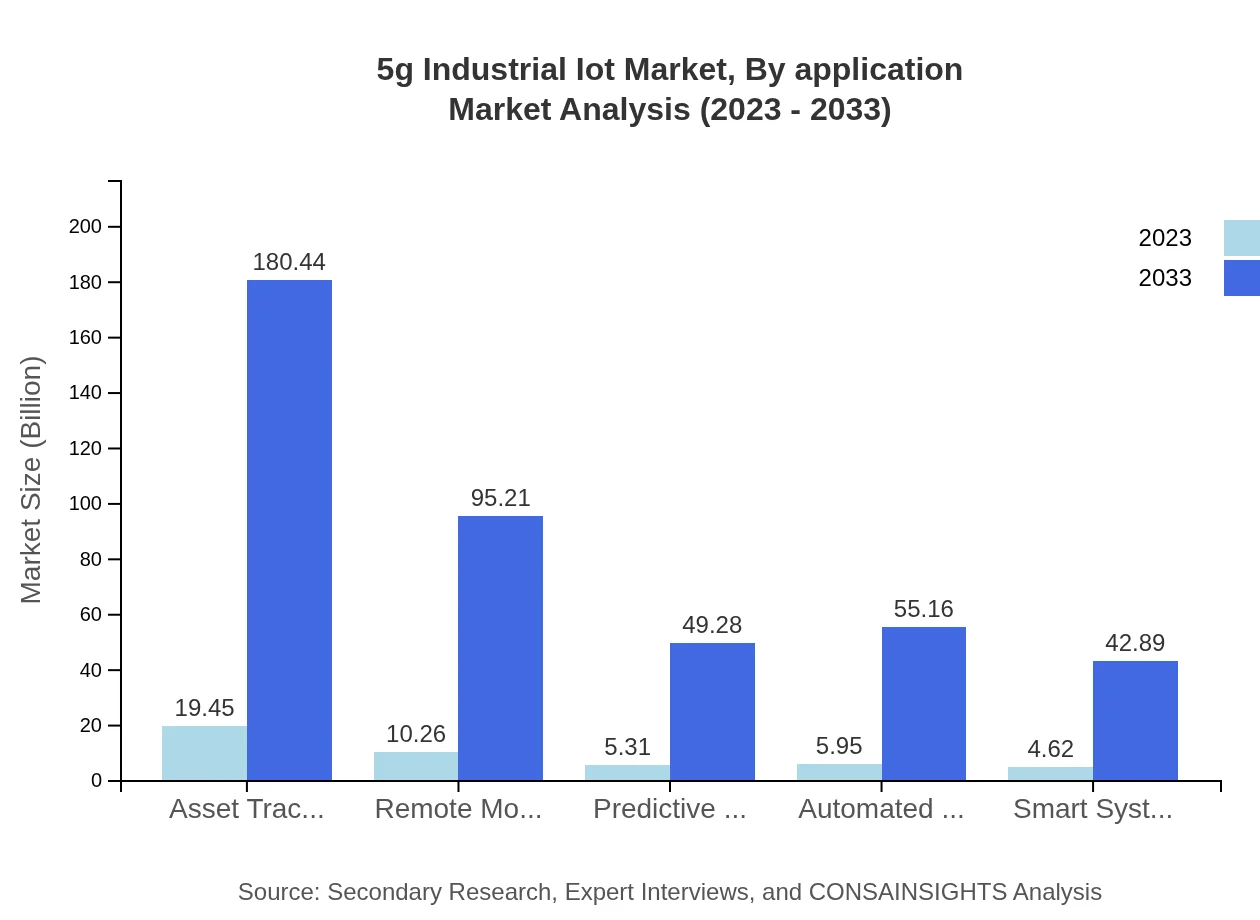

5g Industrial Iot Market Analysis By Application

The Asset Tracking application will significantly expand from $19.45 billion to $180.44 billion, while Remote Monitoring is projected to grow from $10.26 billion to $95.21 billion, demonstrating crucial applications in operational efficiency.

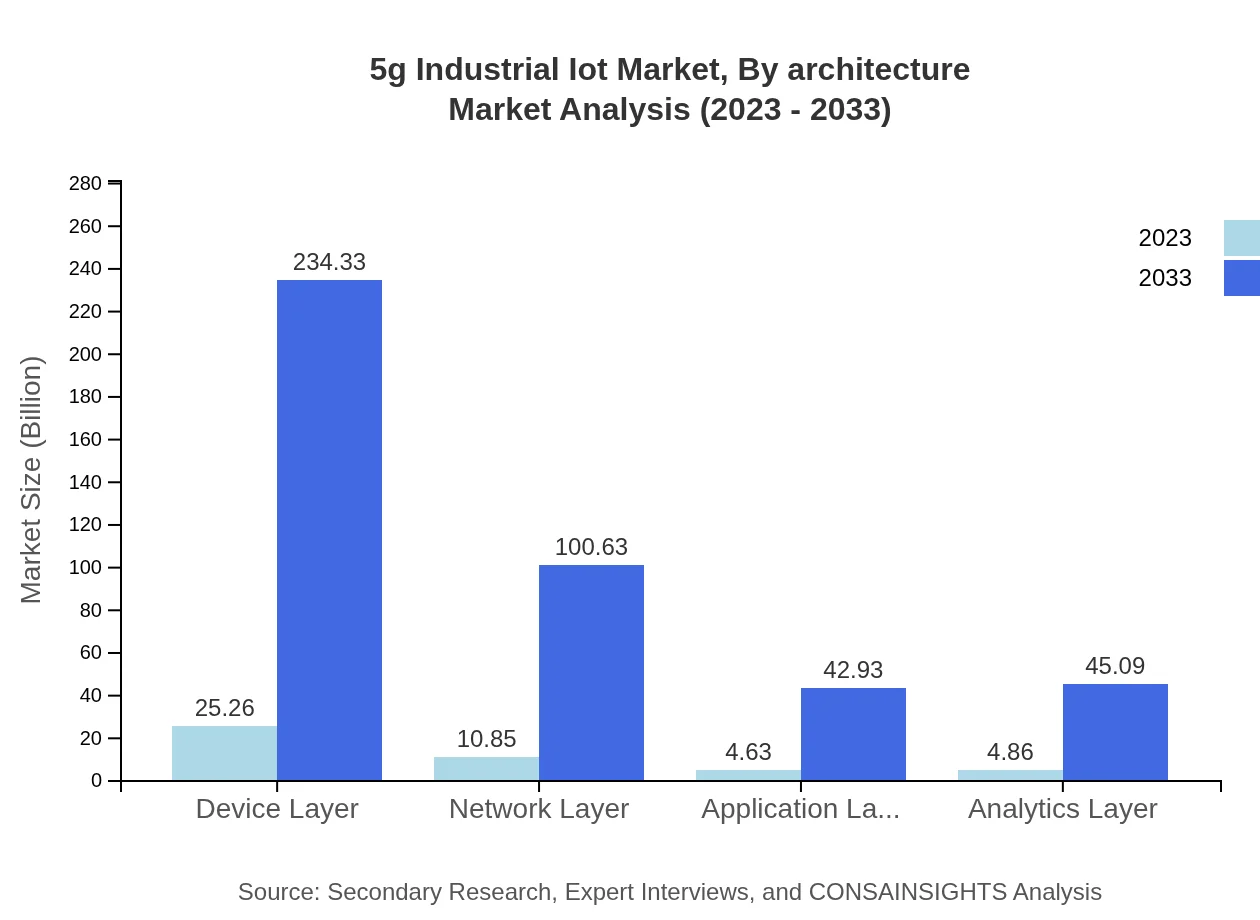

5g Industrial Iot Market Analysis By Architecture

In terms of architecture, the Device Layer is expected to grow from $25.26 billion to $234.33 billion, with a steady share of 55.4%. The Application Layer will similarly expand from $4.63 billion to $42.93 billion.

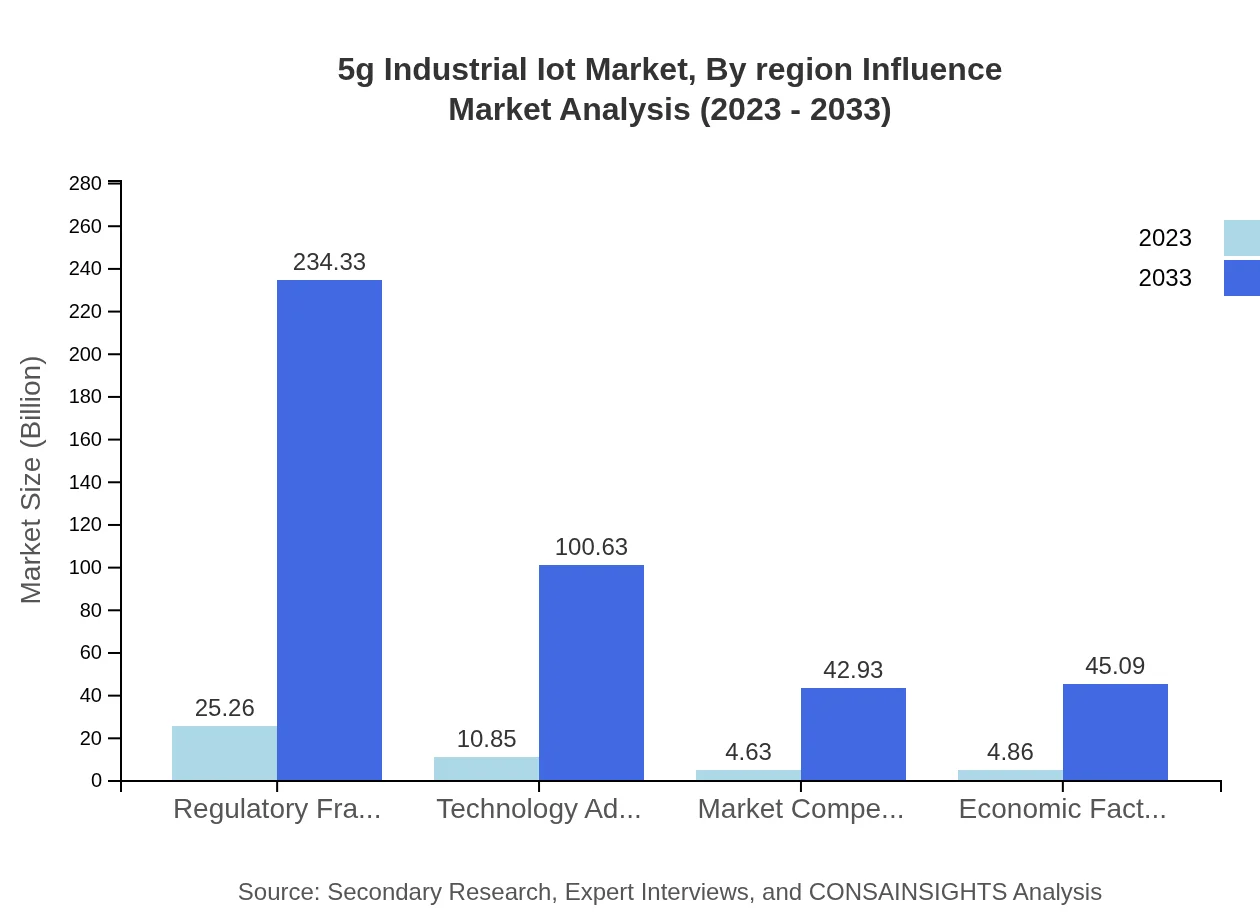

5g Industrial Iot Market Analysis By Region Influence

Influencing factors across regions include technological advancements, government policies on IoT, market competition, economic factors, and evolving customer demands that significantly impact overall market growth.

5g Industrial IoT Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in 5g Industrial Iot Industry

Cisco Systems:

Cisco is a leading provider of networking solutions, focusing on enabling enterprises to leverage IoT technology effectively, driving digital transformation across various industries.Huawei Technologies:

Huawei is a global telecommunications leader that provides advanced 5G solutions and IoT platforms, contributing to numerous industrial applications and smart city projects.Siemens AG:

Siemens specializes in automation and digitalization in industries, offering IoT solutions that enhance efficiency and sustainability in sectors like manufacturing and energy.IBM:

IBM’s Watson IoT platform leverages AI and cloud computing to provide IoT and analytics solutions that optimize industrial processes and predictive maintenance strategies.We're grateful to work with incredible clients.

FAQs

What is the market size of 5G Industrial IoT?

The 5G Industrial IoT market is projected to reach a size of $45.6 billion by 2033, with a robust CAGR of 23.4% over the decade, reflecting significant growth opportunities and technological advancements in this sector.

What are the key market players or companies in the 5G Industrial IoT industry?

Key players in the 5G Industrial IoT sector include major telecommunications firms, IoT solution providers, and tech giants. Their innovative technologies and competitive strategies are crucial in shaping this rapidly evolving market.

What are the primary factors driving the growth in the 5G Industrial IoT industry?

Growth in the 5G Industrial IoT industry is driven by factors such as the increasing demand for smart manufacturing systems, enhanced connectivity solutions, and the need for real-time data analytics to improve operational efficiency across industries.

Which region is the fastest Growing in the 5G Industrial IoT?

North America is currently the fastest-growing region in the 5G Industrial IoT market, projecting an increase from $16.38 billion in 2023 to $151.93 billion by 2033, driven by aggressive technology adoption and infrastructure investment.

Does ConsaInsights provide customized market report data for the 5G Industrial IoT industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the 5G Industrial IoT industry, ensuring that clients receive accurate insights and actionable intelligence unique to their business strategies.

What deliverables can I expect from this 5G Industrial IoT market research project?

From the 5G Industrial IoT market research project, expect comprehensive deliverables including detailed market analysis, segmentation reports, competitive landscape studies, and tailored recommendations based on current trends and forecasts.

What are the market trends of 5G Industrial IoT?

Key trends in the 5G Industrial IoT market include a surge in smart automation, enhanced asset tracking solutions, and integration of AI for predictive maintenance, shaping the future of industry operations and service models.