Acetic Acid Market Report

Published Date: 02 February 2026 | Report Code: acetic-acid

Acetic Acid Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Acetic Acid market, covering market dynamics, segmentation, regional insights, and forecasts from 2023 to 2033. It provides critical insights for stakeholders and investors to understand market trends, growth projections, and competitive landscape.

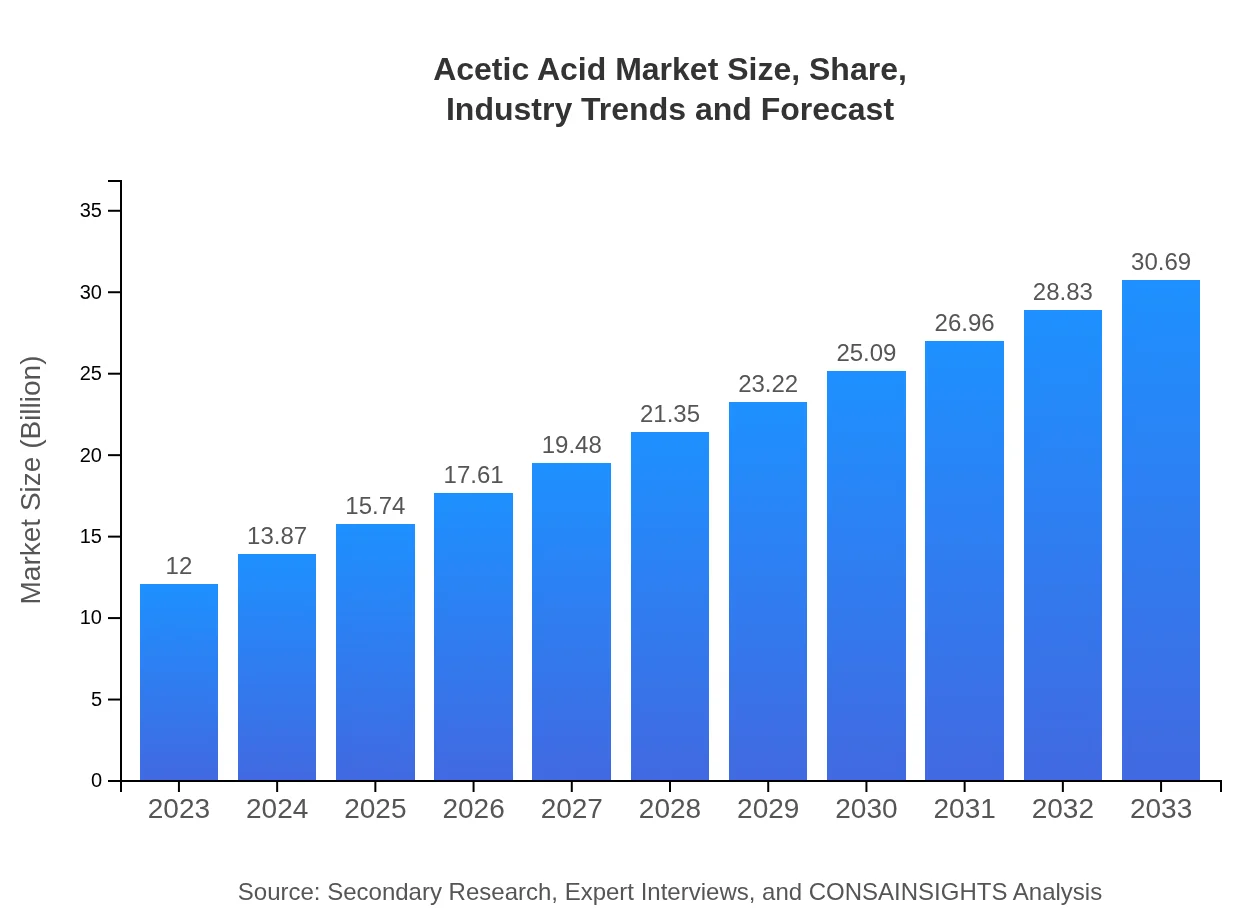

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | BASF SE, SABIC, LyondellBasell Industries, Eastman Chemical Company |

| Last Modified Date | 02 February 2026 |

Acetic Acid Market Overview

Customize Acetic Acid Market Report market research report

- ✔ Get in-depth analysis of Acetic Acid market size, growth, and forecasts.

- ✔ Understand Acetic Acid's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Acetic Acid

What is the Market Size & CAGR of Acetic Acid market in 2023?

Acetic Acid Industry Analysis

Acetic Acid Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Acetic Acid Market Analysis Report by Region

Europe Acetic Acid Market Report:

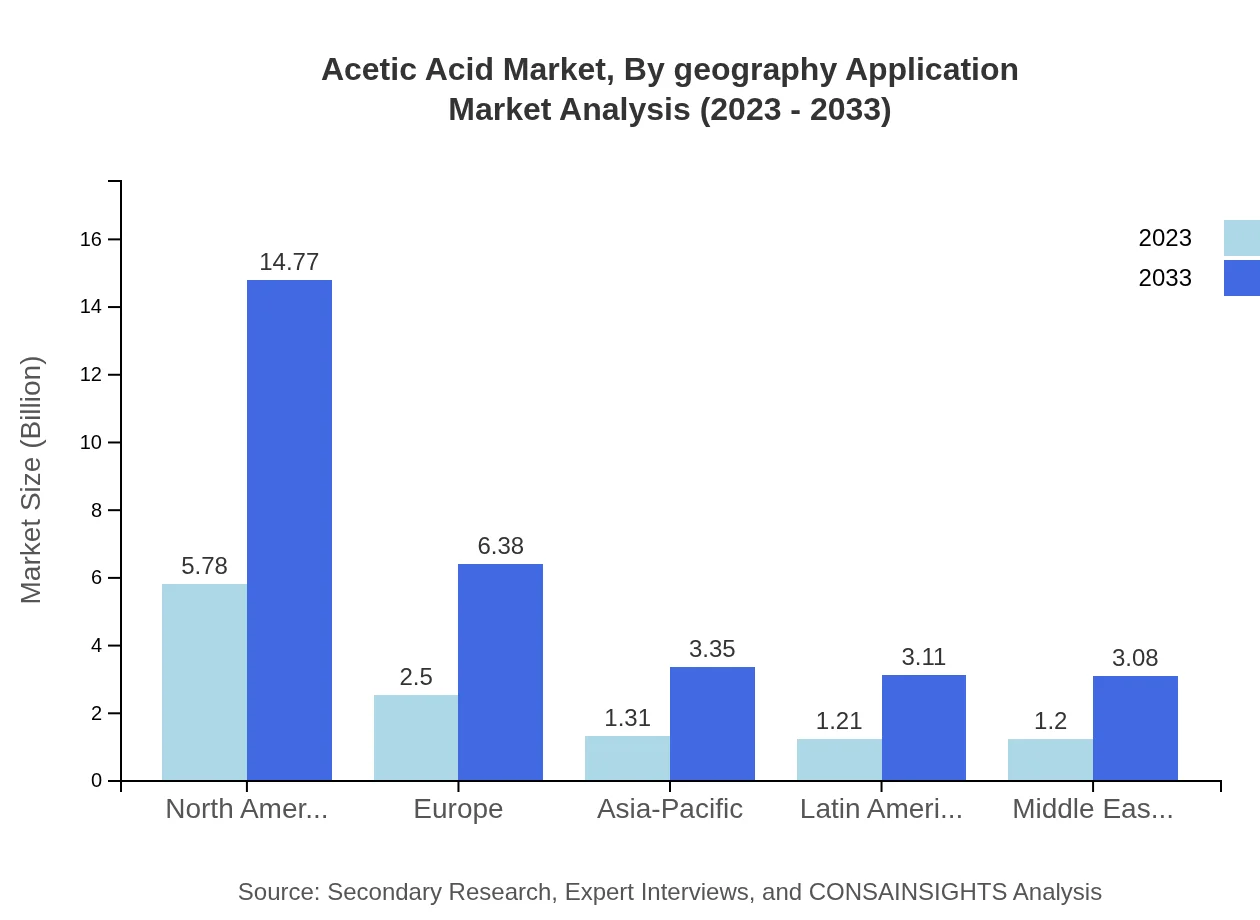

Europe's Acetic Acid market was valued at $3.74 billion in 2023, expected to reach $9.58 billion by 2033. The region's focus on developing sustainable industrial practices drives significant demand.Asia Pacific Acetic Acid Market Report:

The Asia-Pacific region is a significant player in the Acetic Acid market, valued at $2.33 billion in 2023. By 2033, it is expected to reach $5.95 billion. Countries like China and India are major consumers, driven by expanding manufacturing sectors and an increasing focus on chemical production.North America Acetic Acid Market Report:

North America is a robust market for Acetic Acid, with a market size of $4.07 billion in 2023, anticipating growth to $10.40 billion by 2033. The United States is the primary market leader due to its advanced chemical manufacturing infrastructure.South America Acetic Acid Market Report:

In South America, the Acetic Acid market was valued at $0.43 billion in 2023, with projections to grow to $1.10 billion by 2033. The growth is encouraged by rising industrial activities and the demand for food preservatives.Middle East & Africa Acetic Acid Market Report:

Middle East and Africa's market is valued at $1.44 billion in 2023, anticipated to grow to $3.67 billion by 2033. Increased chemical manufacturing activities are a primary growth driver in this region.Tell us your focus area and get a customized research report.

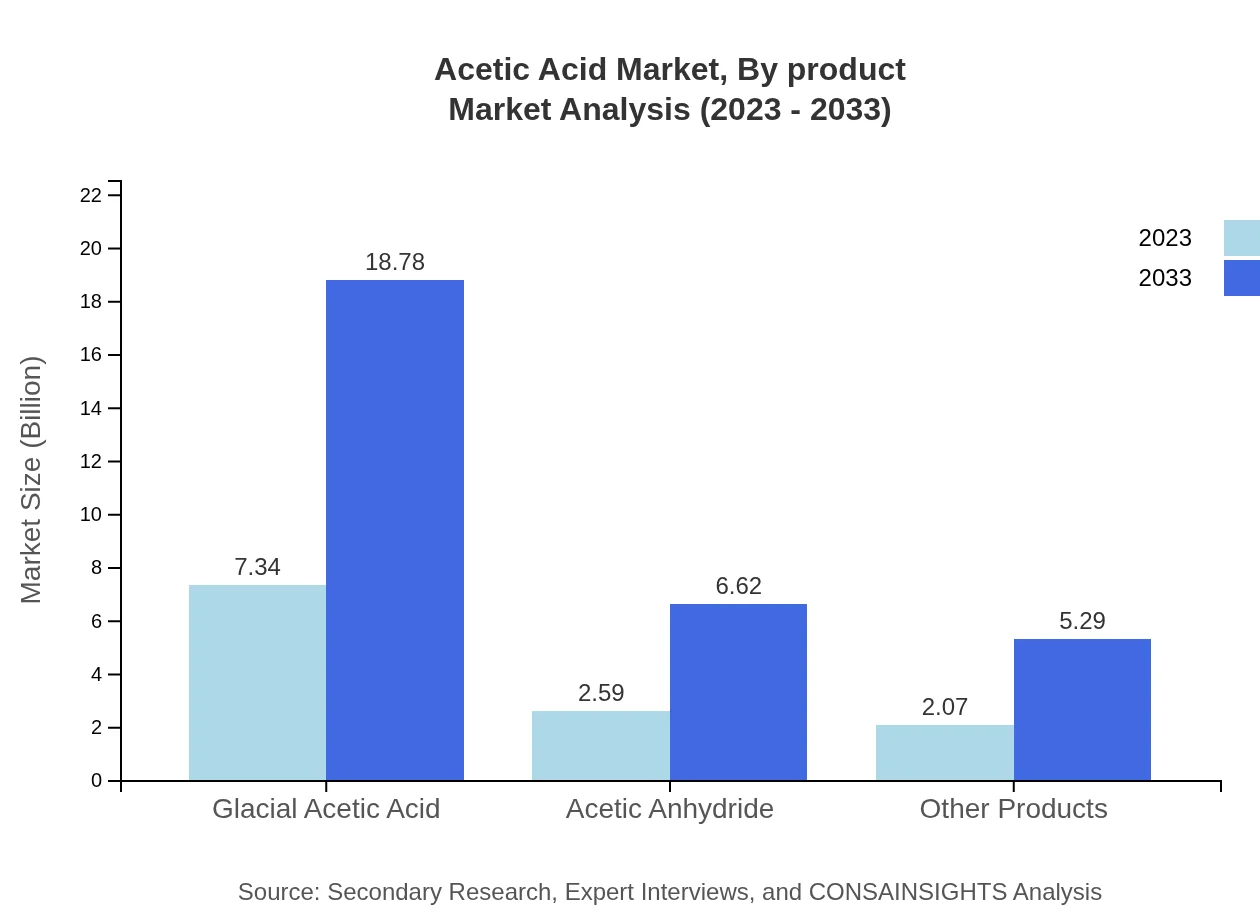

Acetic Acid Market Analysis By Product

Glacial Acetic Acid leads with a market size of $7.34 billion in 2023, estimated to grow to $18.78 billion by 2033, holding a 61.18% share. Acetic Anhydride follows with a value of $2.59 billion in 2023, projected at $6.62 billion by 2033 and a 21.57% share. Other products comprise $2.07 billion in 2023, growing to $5.29 billion by 2033.

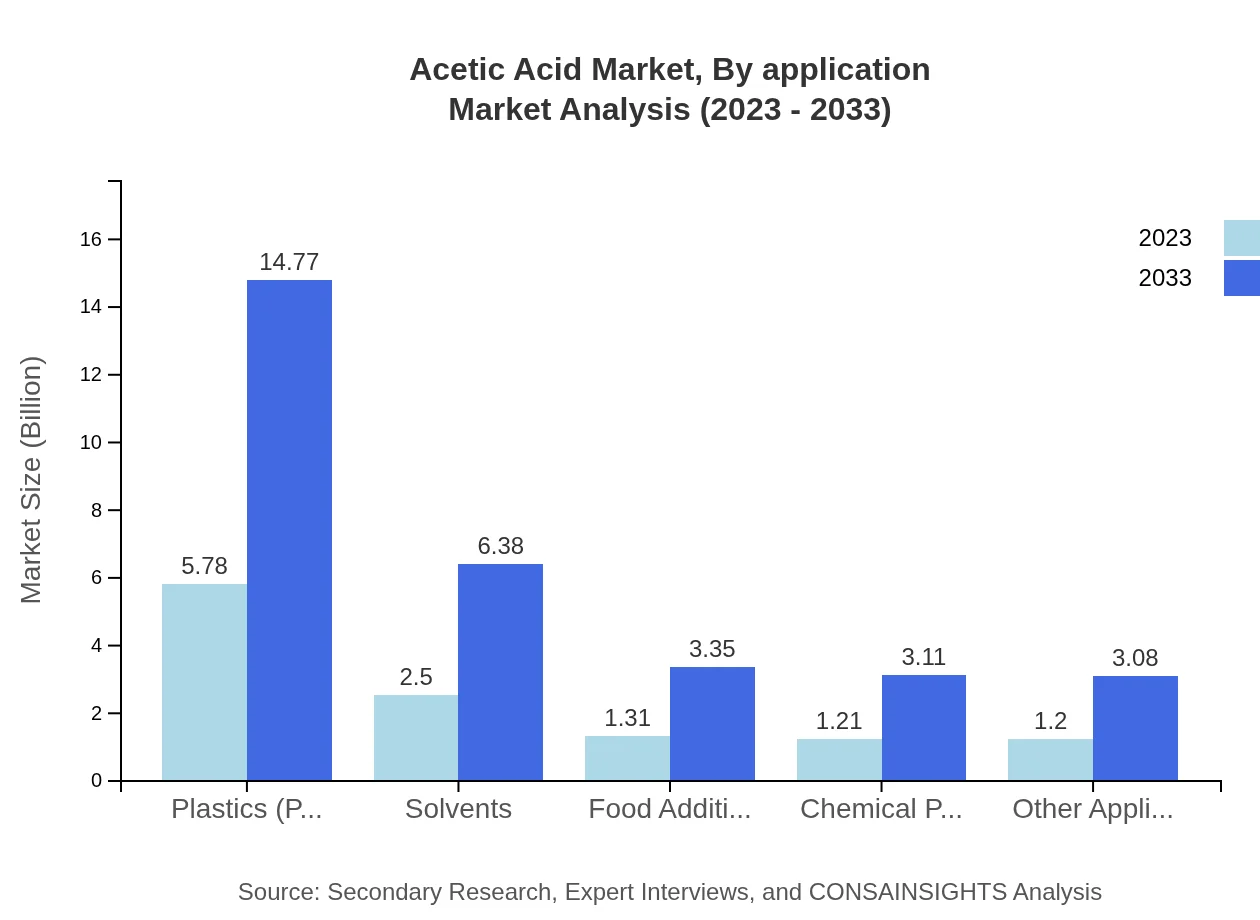

Acetic Acid Market Analysis By Application

In applications, packaging takes a lead with a market size of $5.78 billion in 2023, growing to $14.77 billion by 2033 and a 48.13% share, followed by automotive at $2.50 billion in 2023, projected to $6.38 billion by 2033. Chemicals and food additives show robust growth prospects too.

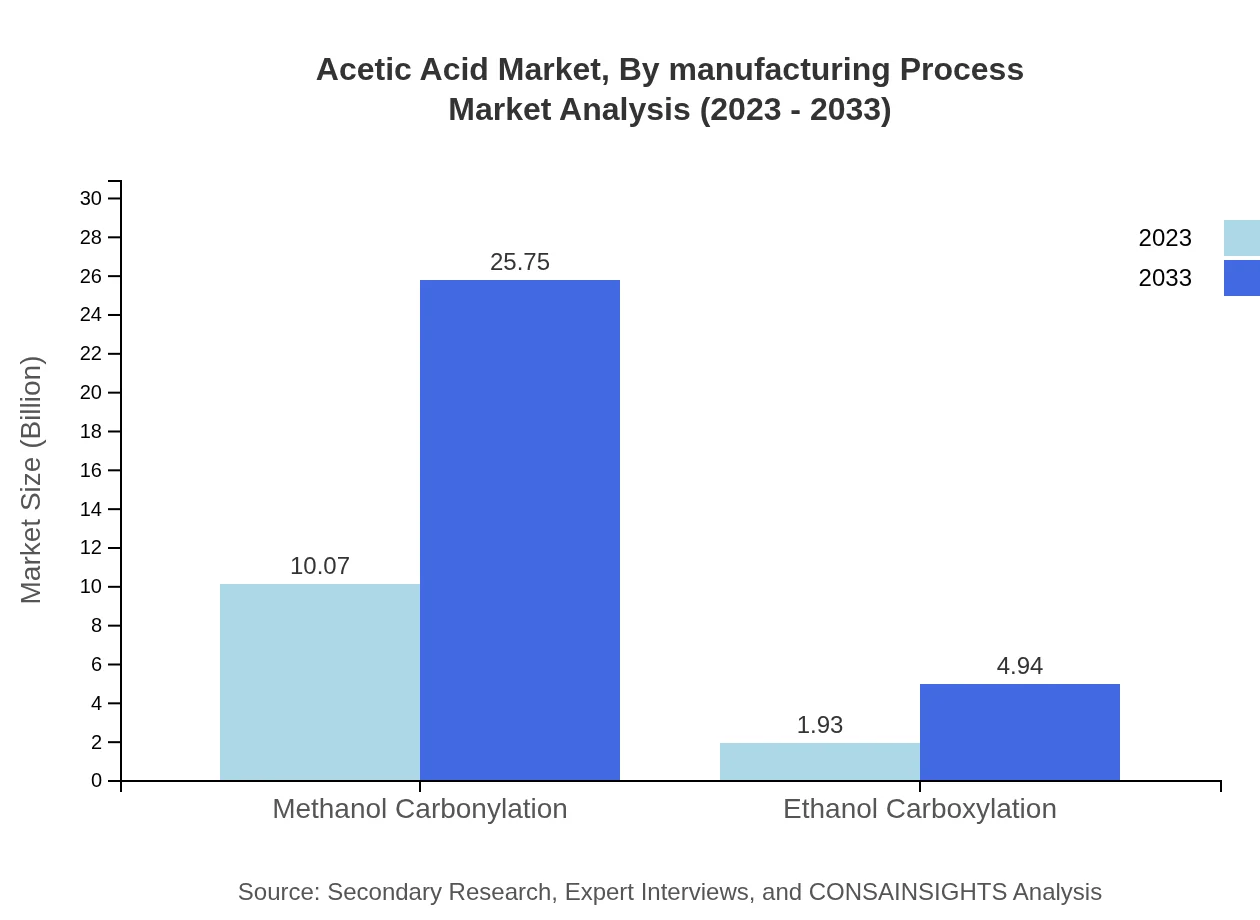

Acetic Acid Market Analysis By Manufacturing Process

The Methanol Carbonylation process is predominant in the Acetic Acid market, claiming a size of $10.07 billion in 2023, anticipated to rise to $25.75 billion by 2033 with an 83.89% share, while Ethanol Carboxylation, with a 16.11% share, presents significant but smaller contributions.

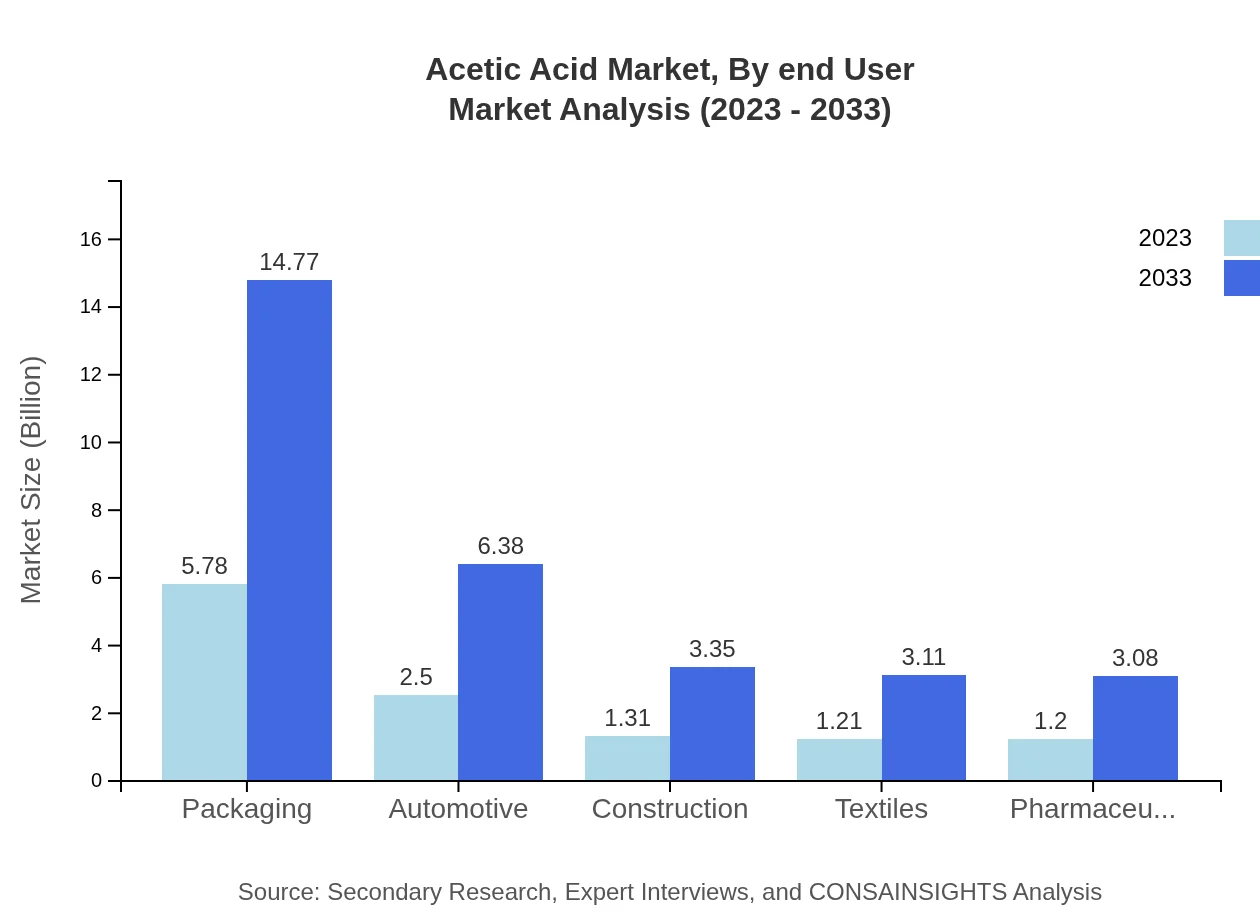

Acetic Acid Market Analysis By End User

By end-user, the major consumers include the plastics sector with $5.78 billion in 2023, expected to grow to $14.77 billion by 2033, and the pharmaceuticals sector accounting for $1.20 billion in 2023, projected to $3.08 billion by 2033.

Acetic Acid Market Analysis By Geography Application

Geographical demand for Acetic Acid varies, with Europe dominating at a market size of $3.74 billion in 2023, expected to reach $9.58 billion by 2033, driven by stringent regulations demanding eco-friendly chemicals. North America's demand is similarly strong, bolstered by its advanced chemical technologies.

Acetic Acid Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Acetic Acid Industry

BASF SE:

BASF is a leading global chemical company that plays a crucial role in the Acetic Acid market through its massive production capabilities and a commitment to sustainable practices.SABIC:

SABIC is a major global player in the chemical industry, known for its large-scale production of Acetic Acid which is utilised in various applications including packaging and textiles.LyondellBasell Industries:

LyondellBasell is recognized for its innovative approach to chemical manufacturing, significantly contributing to the global supply of Acetic Acid through efficient processes.Eastman Chemical Company:

Eastman is a leading manufacturer of specialty chemicals which includes a substantial portfolio of Acetic Acid products tailored for diverse end-use applications.We're grateful to work with incredible clients.

FAQs

What is the market size of acetic acid?

The global acetic acid market is projected to reach approximately $12 billion by 2033, growing at a CAGR of 9.5%. This growth reflects an increasing demand across various applications, including food additives and chemical production.

Who are the key market players in the acetic acid industry?

Key players in the acetic acid market include major chemical manufacturers and suppliers such as BASF, Celanese Corporation, and Mitsubishi Gas Chemical Company, among others. Their investments in innovation and capacity expansion contribute significantly to the market dynamics.

What are the primary factors driving growth in the acetic acid industry?

The growth of the acetic acid industry is driven by increasing applications in textiles, food additives, and establishment of manufacturing capabilities in emerging markets. Additionally, the rising demand for glacial acetic acid in various sectors supports its expansion.

Which region is the fastest Growing in the acetic acid market?

Asia Pacific is currently the fastest-growing region in the acetic acid market, with a projected market increase from $2.33 billion in 2023 to approximately $5.95 billion by 2033. This growth is driven by rising industrialization and consumer demand.

Does ConsaInsights provide customized market report data for the acetic acid industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the acetic acid industry. Clients can request data segmentation, regional insights, or detailed analyses based on unique business requirements.

What deliverables can I expect from this acetic acid market research project?

Expect comprehensive deliverables, including market size analysis, segment and regional data breakdowns, competitive landscape insights, trend analysis, and forecasts. This holistic approach provides actionable intelligence for strategic decisions.

What are the market trends of acetic acid?

Current market trends in acetic acid indicate a growing focus on sustainable production processes, increased investments in bio-based feedstocks, and expansion of applications across industries such as automotive and construction, reflecting a diversified market landscape.