Air Defense Systems Market Report

Published Date: 03 February 2026 | Report Code: air-defense-systems

Air Defense Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of air defense systems, including market size, regional insights, industry trends, and future forecasts for the period 2023 to 2033. It aims to equip stakeholders with vital information to make informed decisions.

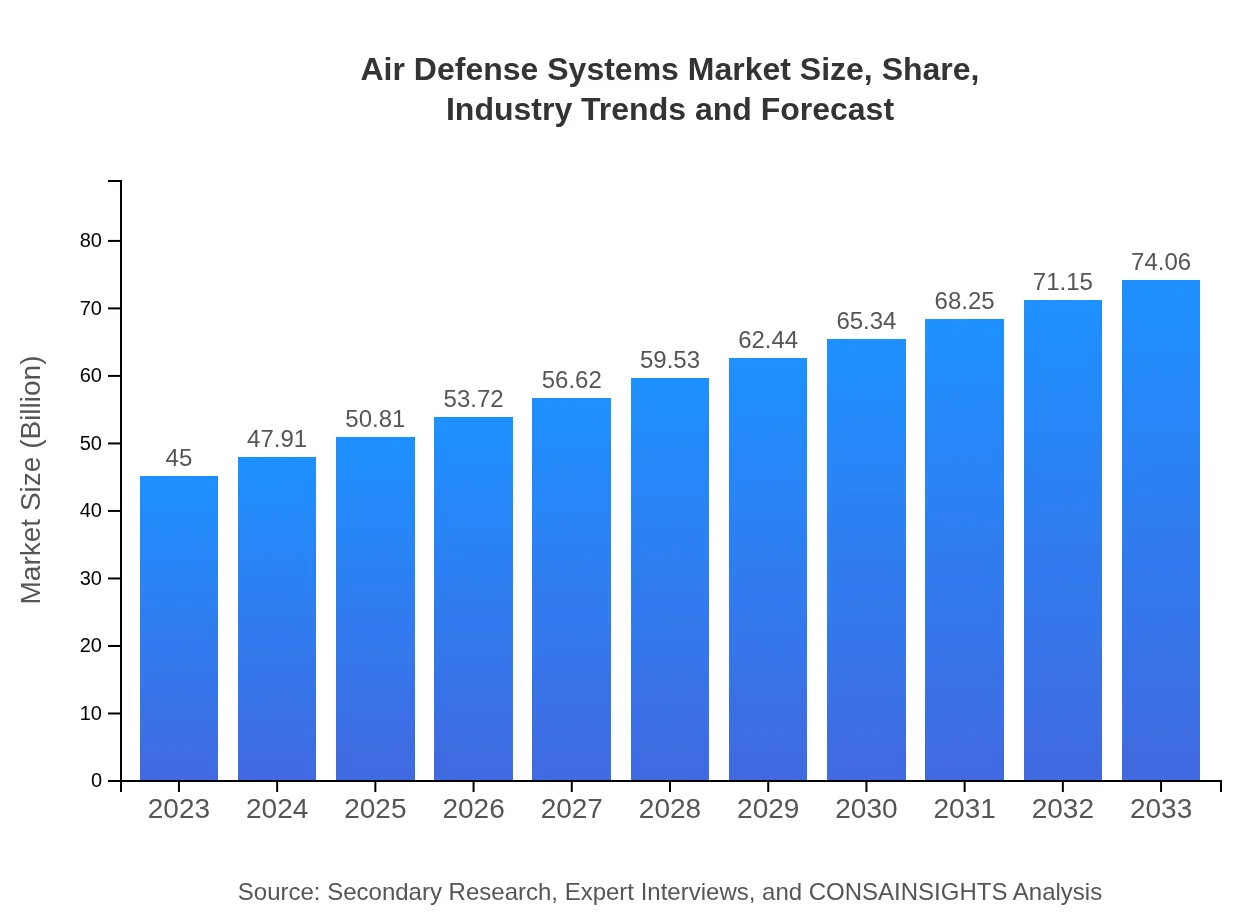

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $74.06 Billion |

| Top Companies | Lockheed Martin, Raytheon Technologies, BAE Systems, Northrop Grumman |

| Last Modified Date | 03 February 2026 |

Air Defense Systems Market Overview

Customize Air Defense Systems Market Report market research report

- ✔ Get in-depth analysis of Air Defense Systems market size, growth, and forecasts.

- ✔ Understand Air Defense Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Air Defense Systems

What is the Market Size & CAGR of Air Defense Systems market in 2023?

Air Defense Systems Industry Analysis

Air Defense Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Air Defense Systems Market Analysis Report by Region

Europe Air Defense Systems Market Report:

Europe's air defense market is forecasted to grow from $13.61 billion in 2023 to $22.40 billion by 2033. Ongoing geopolitical tensions, especially concerning Russia and Eastern Europe, are influencing nations to enhance their defense capabilities.Asia Pacific Air Defense Systems Market Report:

In the Asia Pacific region, the air defense systems market was valued at $8.51 billion in 2023 and is projected to reach $14.00 billion by 2033, driven by increasing military budgets and advancements in technology. Countries like China and India are emphasizing homegrown defense manufacturing, prompting substantial growth.North America Air Defense Systems Market Report:

North America leads the market with a valuation of $16.56 billion in 2023, expected to grow to $27.25 billion by 2033. The U.S. dominates the market due to its advanced defense technology and significant investments in military infrastructure.South America Air Defense Systems Market Report:

The South American market, valued at $1.63 billion in 2023, is expected to grow to $2.69 billion by 2033. Regional tensions and the need for enhanced security measures are driving investments in air defense systems.Middle East & Africa Air Defense Systems Market Report:

The Middle East and Africa region's market is forecasted to grow from $4.69 billion in 2023 to $7.72 billion by 2033. Regional conflicts and a focus on strengthening defense mechanisms are leading to increased investments.Tell us your focus area and get a customized research report.

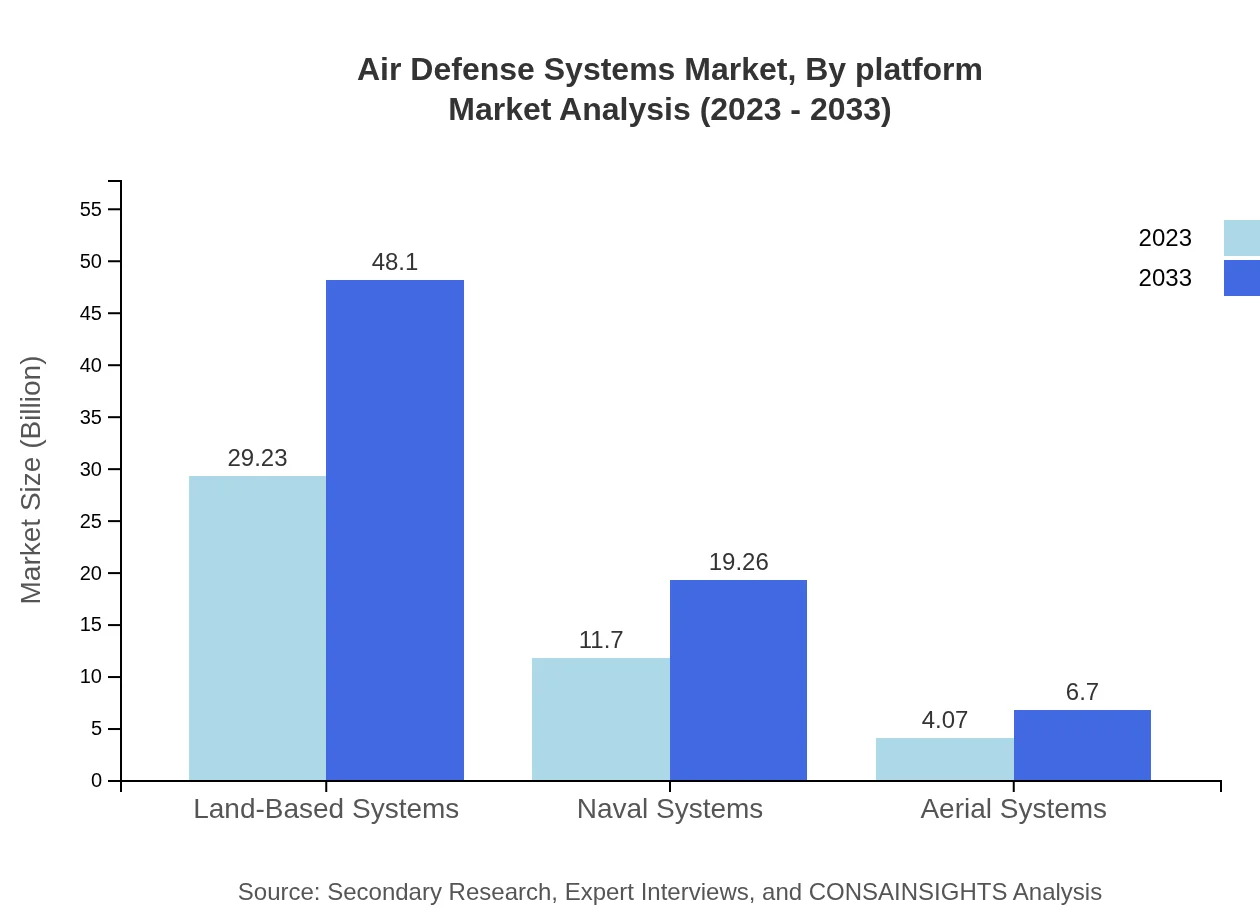

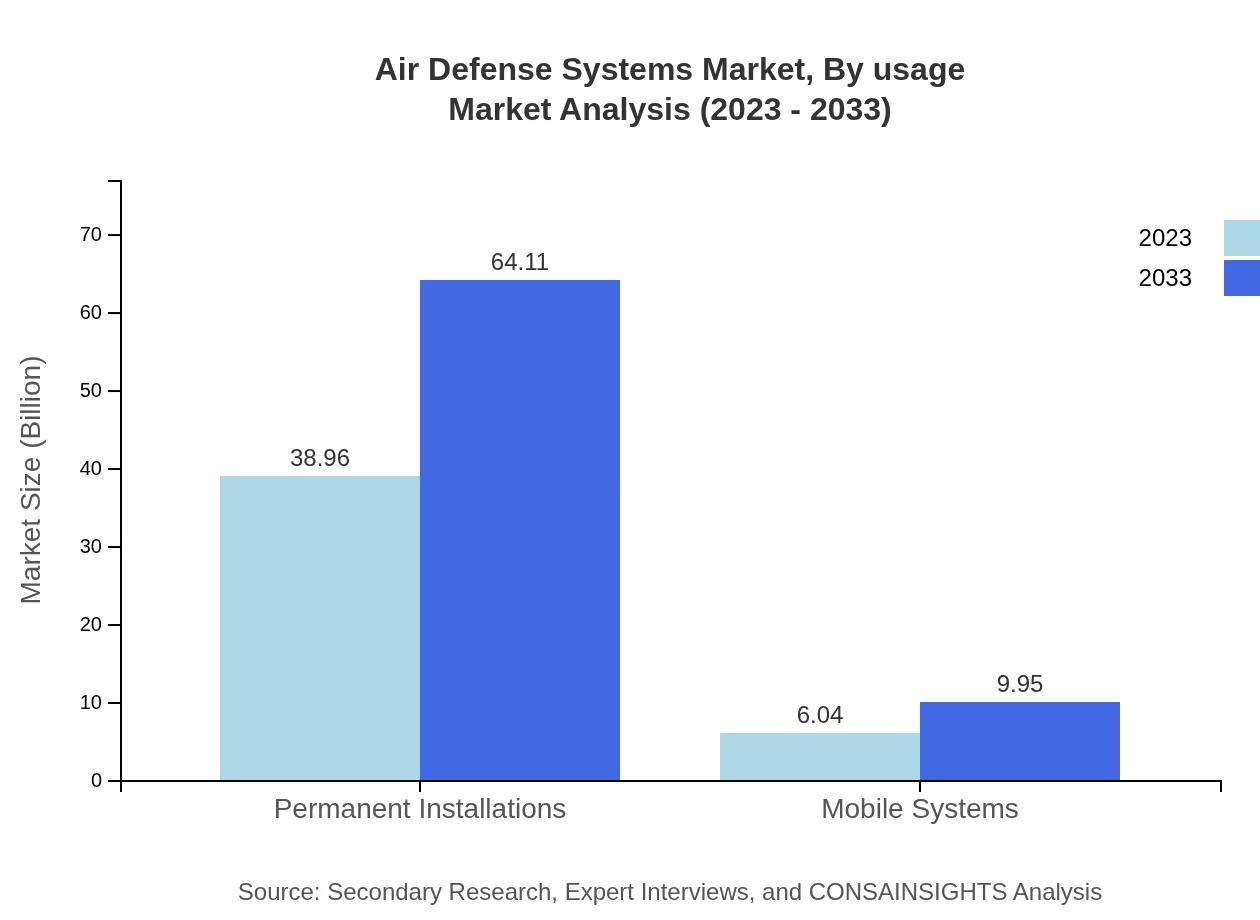

Air Defense Systems Market Analysis By Platform

The air defense market can be examined in terms of platform usage. Permanent Installations dominate with a market size of $38.96 billion in 2023, increasing to $64.11 billion by 2033. Mobile Systems account for $6.04 billion in 2023, growing to $9.95 billion. Land-Based Systems show significant growth from $29.23 billion to $48.10 billion over the forecast period. Naval and Aerial Systems also reflect positive growth trends, underscoring the diverse applications across various military domains.

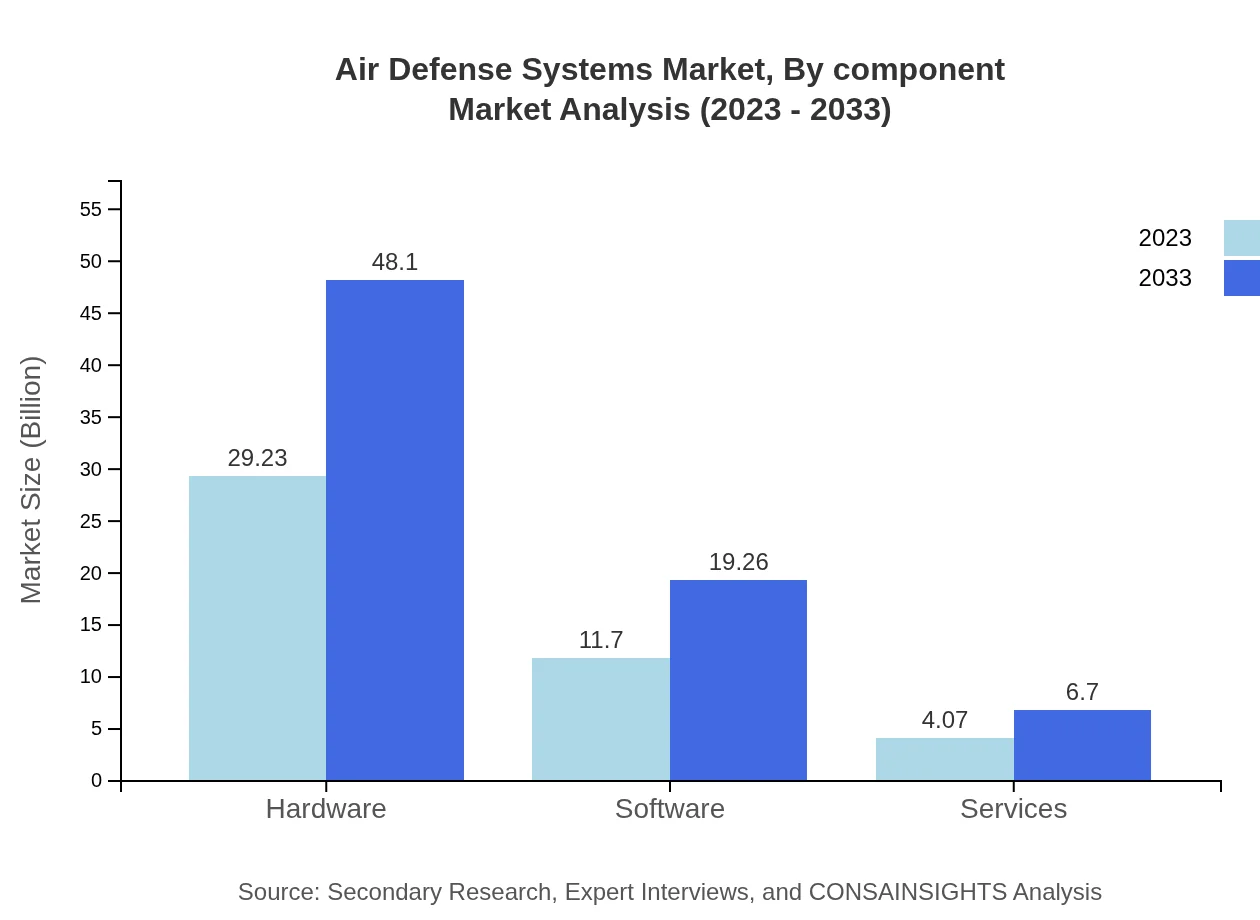

Air Defense Systems Market Analysis By Technology

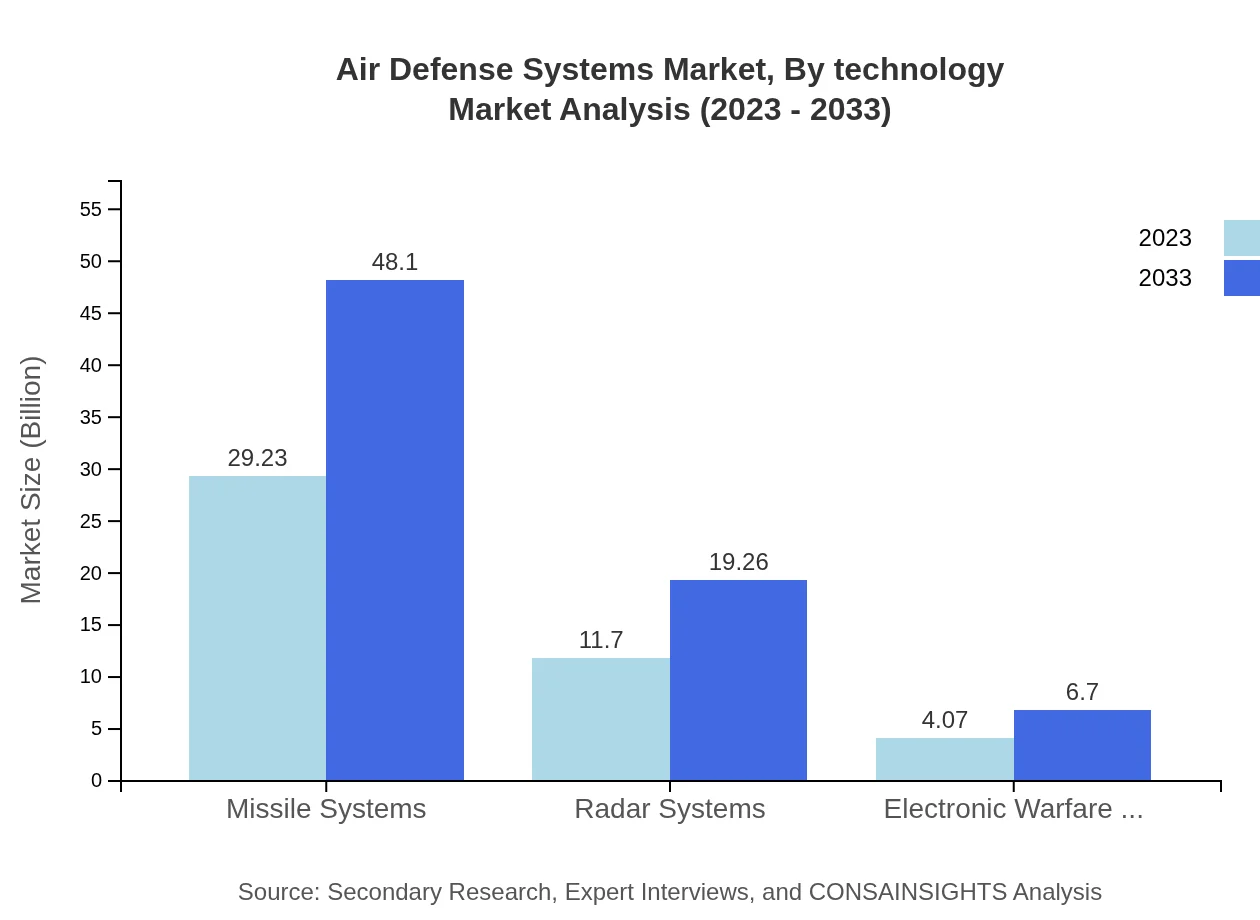

The market segmentation by technology reveals substantial investment in hardware, which holds a market share of 64.95% in 2023, expected to remain stable. Software and services, accounting for 26% and 9.05% respectively, are projected to experience marked growth as systems become increasingly integrated and reliant on sophisticated software solutions.

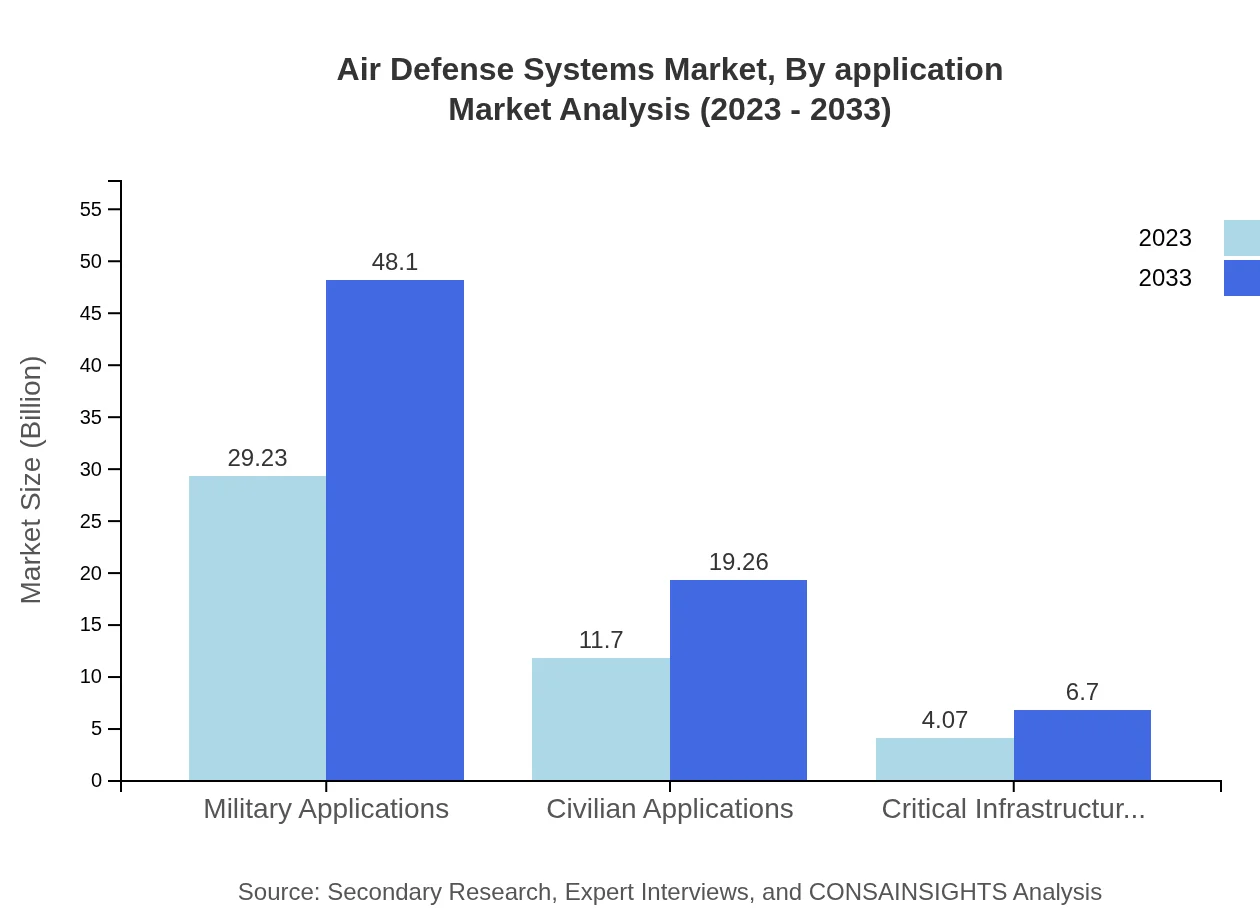

Air Defense Systems Market Analysis By Application

Military Applications hold a majority market share of 64.95% in 2023, driven by defense spending and geopolitical pressures. Civilian Applications and Critical Infrastructure Protection are also vital, growing steadily from $11.70 billion to $19.26 billion and from $4.07 billion to $6.70 billion respectively, as security needs broaden beyond military domains.

Air Defense Systems Market Analysis By Usage

Market usage segmentation shows military operations dominate, while emerging trends indicate increased focus on civilian protection and critical infrastructure safeguarding. The growing threat landscape necessitates a balanced approach to both military and non-military applications, reflecting shifting priorities in air defense strategies.

Air Defense Systems Market Analysis By Component

Analysis by component illustrates the rise of missile systems and radar technologies, representing crucial parts of air defense architectures. Despite hardware comprising over 64% of the market share, investments in software and services are rapidly increasing as combat strategies evolve towards more integrated solutions.

Air Defense Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Air Defense Systems Industry

Lockheed Martin:

A major player in the defense sector, Lockheed Martin specializes in air defense systems, offering advanced technologies such as the Aegis Combat System and THAAD (Terminal High Altitude Area Defense).Raytheon Technologies:

Raytheon is a leader in radar and missile defense systems, including the Patriot missile system and various electronic warfare solutions, catering to both military and civilian applications.BAE Systems:

BAE Systems is known for its innovative air defense solutions, focusing on integrated systems that enhance situational awareness and operational effectiveness in air defense.Northrop Grumman:

Northrop Grumman offers a range of defense systems, including advanced radar and electronic warfare technologies that support air defense operations globally.We're grateful to work with incredible clients.

FAQs

What is the market size of air Defense Systems?

As of 2023, the Air Defense Systems market is valued at approximately $45 billion, with a projected growth at a CAGR of 5% leading to substantial expansions by 2033. This indicates strong ongoing investment and development in defense technologies globally.

What are the key market players or companies in this air Defense Systems industry?

Key players in the Air Defense Systems industry include Lockheed Martin, Raytheon Technologies, Northrop Grumman, BAE Systems, and Thales Group, among others. Their strategic innovations drive market dynamics and sets competitive benchmarks across various segments.

What are the primary factors driving the growth in the air Defense Systems industry?

Driving factors include increasing geopolitical tensions, advancements in technology, a rise in defense budgets among nations, and a growing focus on national security. These elements are shaping the future landscape of air defense systems worldwide.

Which region is the fastest Growing in the air Defense Systems?

North America remains the fastest-growing region, with market projections expanding from $16.56 billion in 2023 to $27.25 billion by 2033. This growth is driven by strong military investments and technological advancements in defense systems.

Does ConsaInsights provide customized market report data for the air Defense Systems industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the air-defense-systems sector, allowing businesses to gain unique insights and strategic advantages tailored to their specific needs.

What deliverables can I expect from this air Defense Systems market research project?

Deliverables typically include a comprehensive market analysis report, segmentation data, regional insights, competitive landscape overviews, and growth forecasts, providing a thorough understanding of market dynamics and trends.

What are the market trends of air Defense Systems?

Current trends signal an uptick in the adoption of advanced technologies, integration of AI and machine learning for operational efficiency, increased focus on mobile systems, and the rising importance of cybersecurity within air defense frameworks.