Algorithmic Trading Market Report

Published Date: 24 January 2026 | Report Code: algorithmic-trading

Algorithmic Trading Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Algorithmic Trading market, covering current trends, market segmentation, regional analysis, leading players, and forecasts up to 2033. Insights into market dynamics, innovations, and growth strategies are also provided.

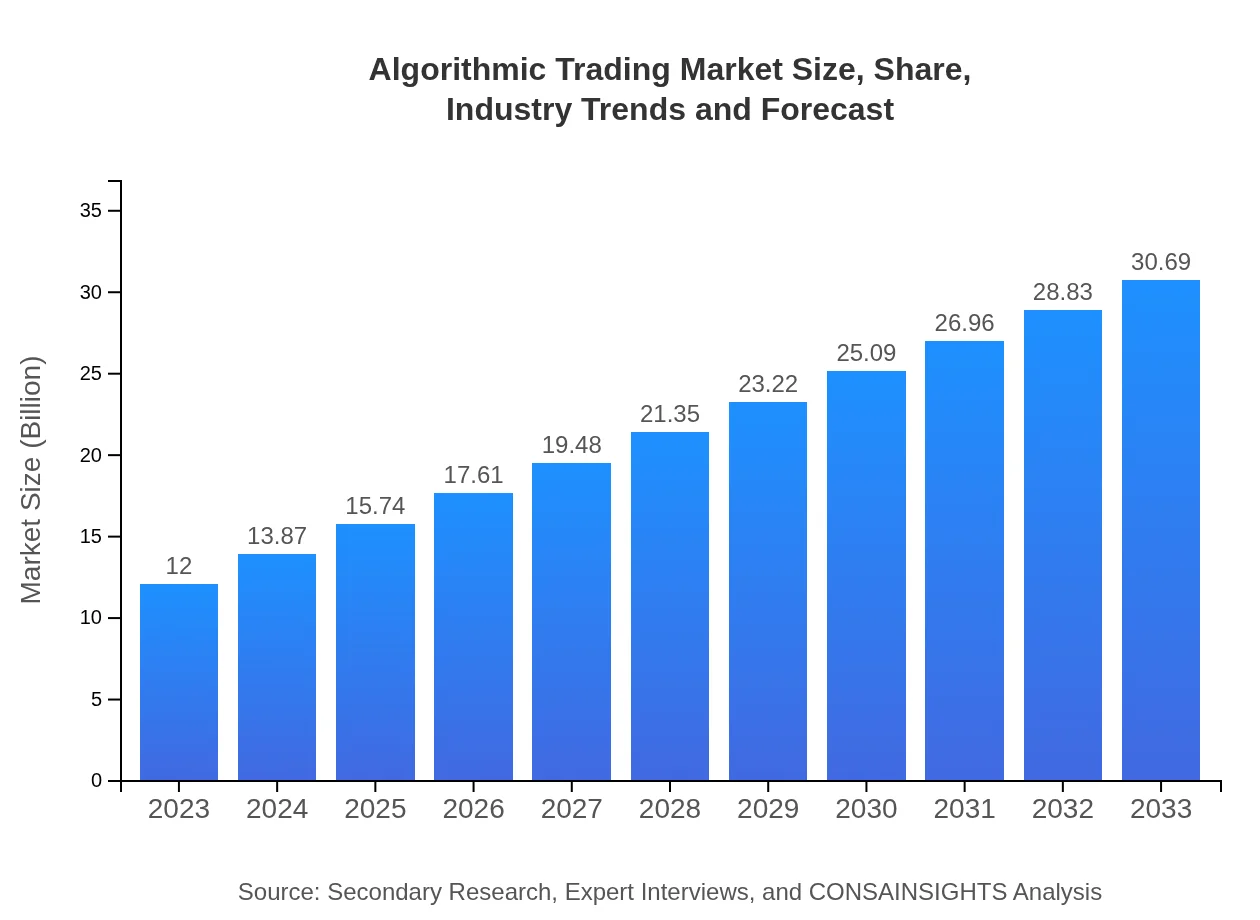

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | Bloomberg LP, TradeStation, MetaQuotes Software, Interactive Brokers, QuantConnect |

| Last Modified Date | 24 January 2026 |

Algorithmic Trading Market Overview

Customize Algorithmic Trading Market Report market research report

- ✔ Get in-depth analysis of Algorithmic Trading market size, growth, and forecasts.

- ✔ Understand Algorithmic Trading's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Algorithmic Trading

What is the Market Size & CAGR of Algorithmic Trading market in 2023?

Algorithmic Trading Industry Analysis

Algorithmic Trading Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Algorithmic Trading Market Analysis Report by Region

Europe Algorithmic Trading Market Report:

The European market is projected to grow from $3.28 billion in 2023 to $8.39 billion by 2033. The region’s stringent regulations and compliance requirements are compelling traders to adopt algorithmic solutions for enhanced efficiency.Asia Pacific Algorithmic Trading Market Report:

The Asia Pacific market was valued at $2.30 billion in 2023 and is forecasted to grow to $5.88 billion by 2033, representing robust expansion within the region. Increasing trading volumes and the adoption of advanced trading technologies among institutional investors are key drivers of growth.North America Algorithmic Trading Market Report:

North America holds the largest share of the Algorithmic Trading market, estimated at $4.34 billion in 2023 and projected to expand to $11.11 billion by 2033. The dominance in this region is attributed to the presence of major financial institutions and technological advancements.South America Algorithmic Trading Market Report:

In South America, the Algorithmic Trading market is valued at $1.16 billion in 2023, expected to reach $2.96 billion by 2033. The market is benefiting from a growing number of investment funds and greater access to technological innovations.Middle East & Africa Algorithmic Trading Market Report:

The Middle East and Africa region is valued at $0.92 billion in 2023 and is anticipated to reach $2.35 billion by 2033. Growth is fueled by an increase in investments and developments in financial market infrastructures.Tell us your focus area and get a customized research report.

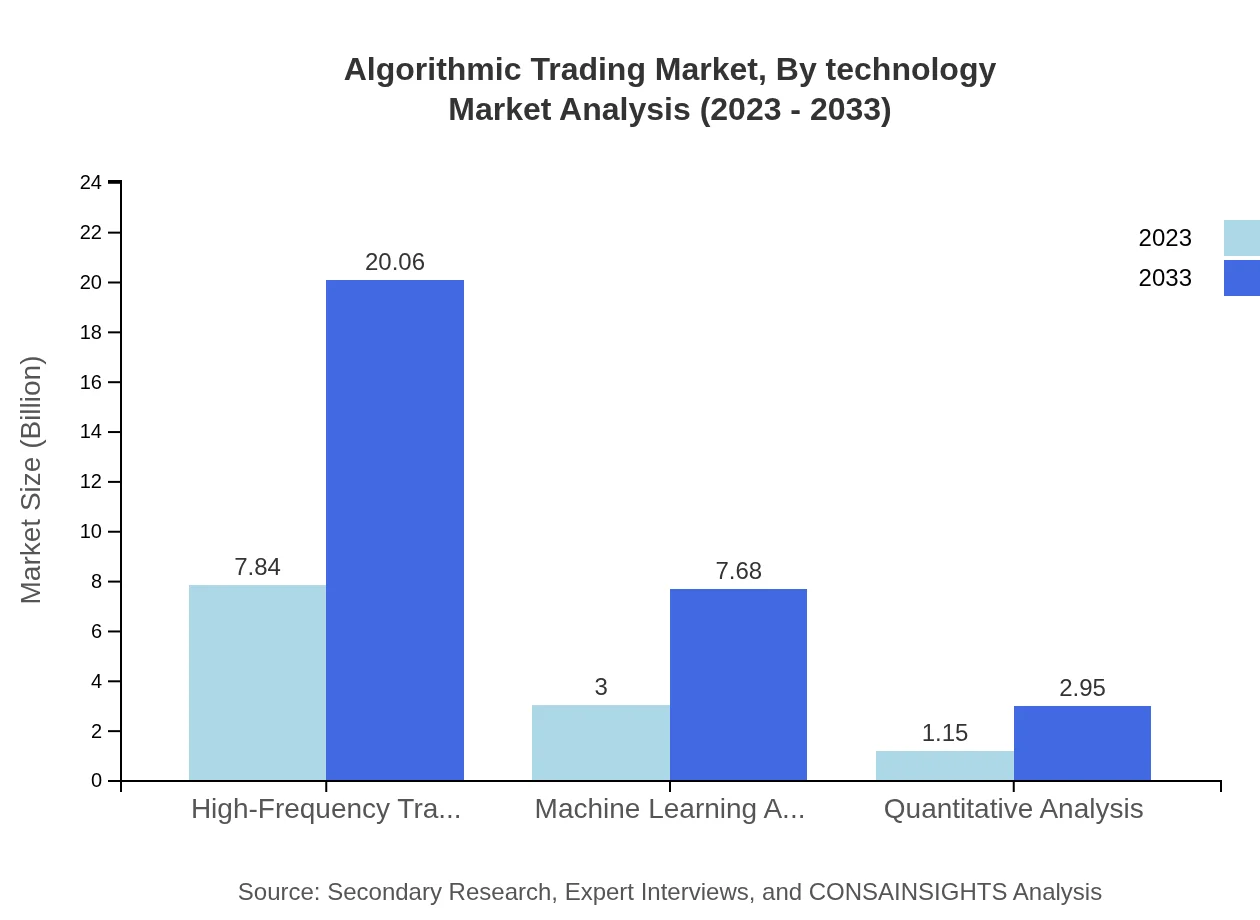

Algorithmic Trading Market Analysis By Technology

The technology segment of Algorithmic Trading includes High-Frequency Trading, Machine Learning Algorithms, and Quantitative Analysis. High-Frequency Trading commands the largest market share, accounting for approximately 65.36% of the market in 2023, with a size of $7.84 billion, projected to grow to $20.06 billion by 2033. Machine Learning Algorithms and Quantitative Analysis are gaining traction due to their ability to analyze vast amounts of data and improve trading strategies. Machine Learning’s share is pegged at 25.03% in 2023.

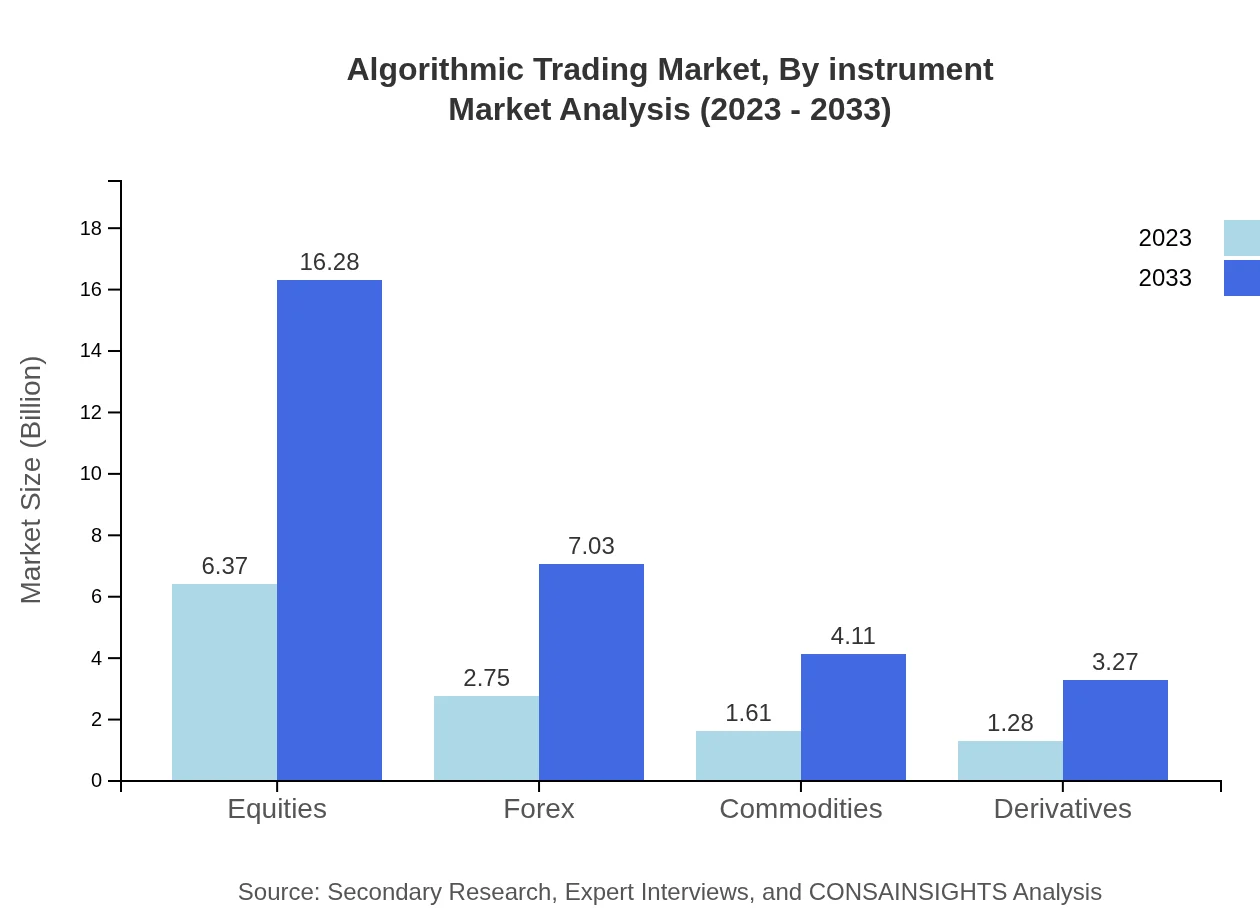

Algorithmic Trading Market Analysis By Instrument

The financial instrument market in Algorithmic Trading focuses primarily on Equities, Forex, Commodities, and Derivatives. Equities dominate the market with a size valuation of $6.37 billion in 2023, projected to rise to $16.28 billion by 2033. Forex follows with a size of $2.75 billion in 2023 and projected at $7.03 billion in 2033, highlighting the popularity of currency trading in automated platforms.

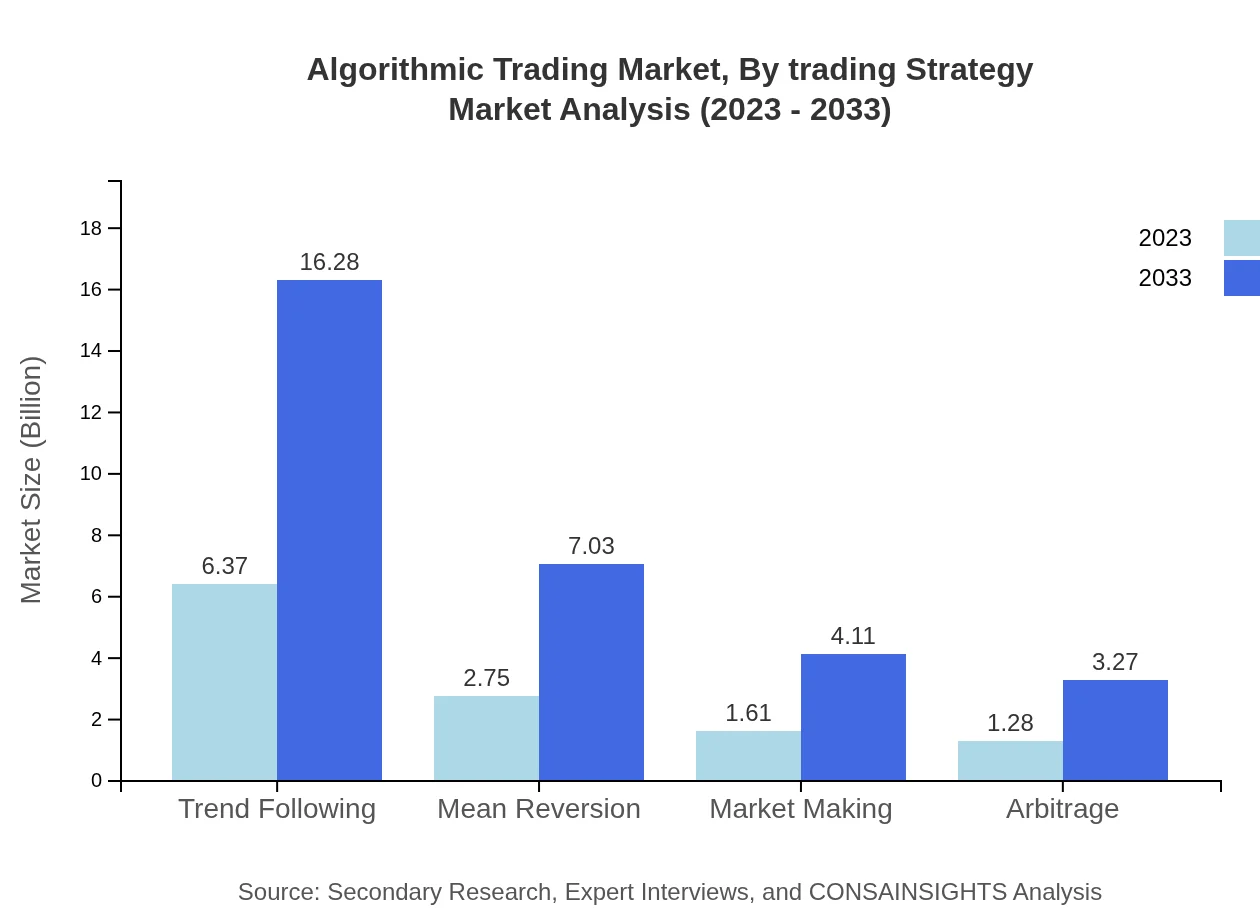

Algorithmic Trading Market Analysis By Trading Strategy

In terms of trading strategies, Trend Following leads with a significant share of 53.05% in 2023, growing in value from $6.37 billion to $16.28 billion by 2033. Strategies like Mean Reversion and Arbitrage also retain notable market positions, illustrating their essential roles in automated trading frameworks.

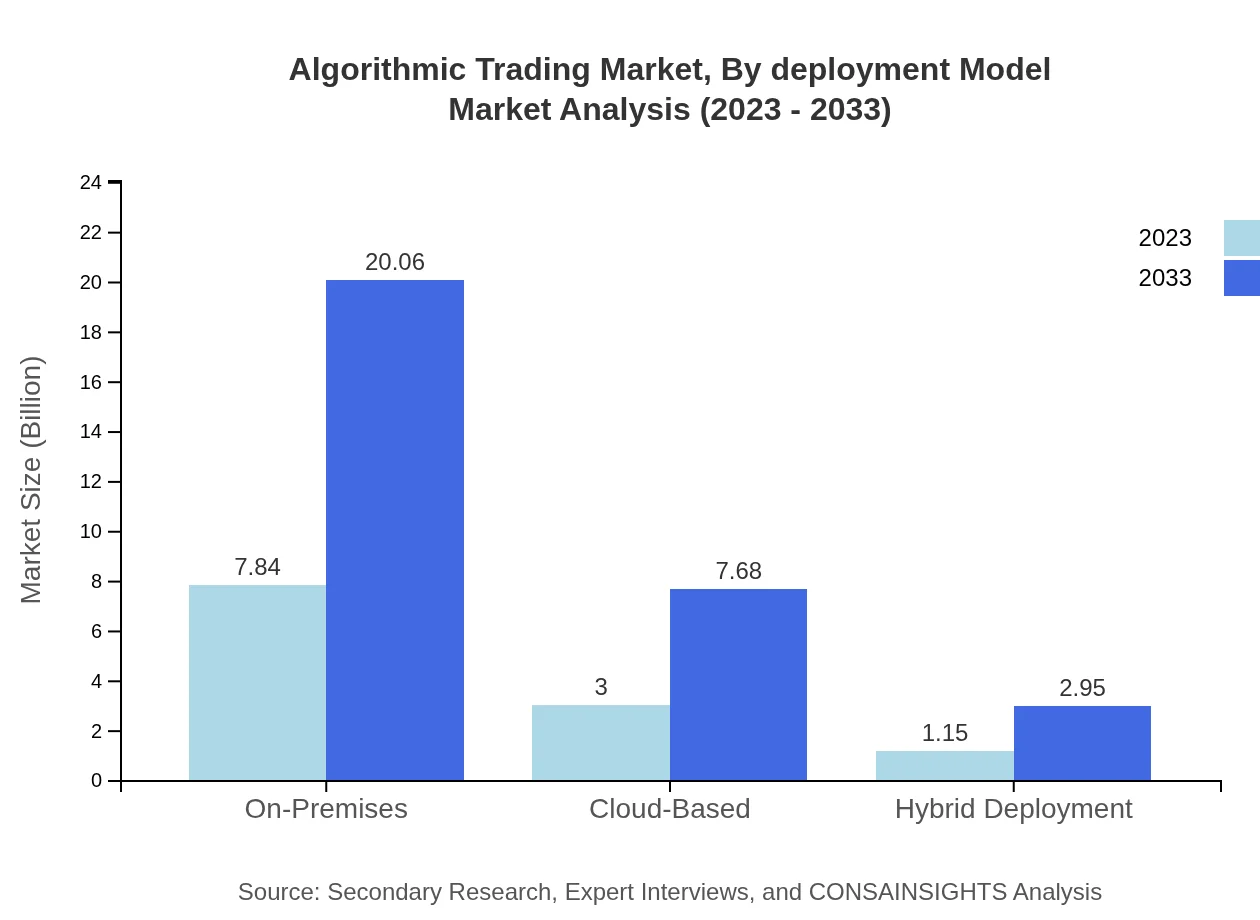

Algorithmic Trading Market Analysis By Deployment Model

In deployment models, On-Premises solutions dominate, accounting for a 65.36% market share in 2023, worth $7.84 billion, and are expected to grow to $20.06 billion by 2033. Cloud-based solutions are increasingly gaining traction owing to lower infrastructure costs and enhanced flexibility, reflecting evolving preferences among traders.

Algorithmic Trading Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Algorithmic Trading Industry

Bloomberg LP:

Bloomberg LP is a leader in financial information and analytics, offering sophisticated tools for algorithmic trading that integrate real-time data and analytics.TradeStation:

TradeStation provides technology-driven trading solutions, empowering individual traders with algorithmic trading capabilities through its advanced platforms.MetaQuotes Software:

MetaQuotes Software is renowned for its trading platforms like MetaTrader, which facilitates algorithmic trading for retail and institutional traders globally.Interactive Brokers:

Known for its low-cost trading options, Interactive Brokers also offers state-of-the-art algorithmic trading tools aimed at institutional and retail clients alike.QuantConnect:

QuantConnect is an open-source platform that provides algorithmic trading tools to developers, enabling back-testing and deployment of trading strategies.We're grateful to work with incredible clients.

FAQs

What is the market size of algorithmic trading?

The global algorithmic trading market was valued at approximately $12 billion in 2023 and is projected to grow at a CAGR of 9.5% over the next decade, indicating robust demand and expansion within this innovative financial sector.

What are the key market players or companies in this algorithmic trading industry?

Key players in the algorithmic trading industry include major financial institutions such as Goldman Sachs, JP Morgan, and Citadel, alongside tech firms like Bloomberg and Trading Technologies, all contributing to advancements in trading algorithms.

What are the primary factors driving the growth in the algorithmic trading industry?

Growth in the algorithmic trading market is driven by increased demand for efficient trading strategies, advancements in technology like machine learning, and the rising volume of transactions across electronic trading platforms.

Which region is the fastest Growing in the algorithmic trading?

North America emerges as the fastest-growing region in the algorithmic trading market, with market size projected to increase from $4.34 billion in 2023 to $11.11 billion by 2033, supported by technological innovations and investment activities.

Does ConsaInsights provide customized market report data for the algorithmic trading industry?

Yes, ConsaInsights offers customized market report data for the algorithmic trading sector, enabling clients to obtain tailored insights and analytics suited to their specific needs and strategic goals.

What deliverables can I expect from this algorithmic trading market research project?

Expected deliverables from the algorithmic trading market research project include comprehensive market analysis reports, trend forecasts, competitive landscape assessments, and insights into market segments and regional demographics.

What are the market trends of algorithmic trading?

Current trends in algorithmic trading include the integration of AI and machine learning technologies, a shift towards cloud-based solutions, and increased usage of high-frequency trading strategies enhancing market efficiency.