Amines Market Report

Published Date: 02 February 2026 | Report Code: amines

Amines Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Amines market, analyzing trends, growth projections, and key insights from 2023 to 2033. It includes detailed segments and regional analyses that highlight market dynamics and opportunities.

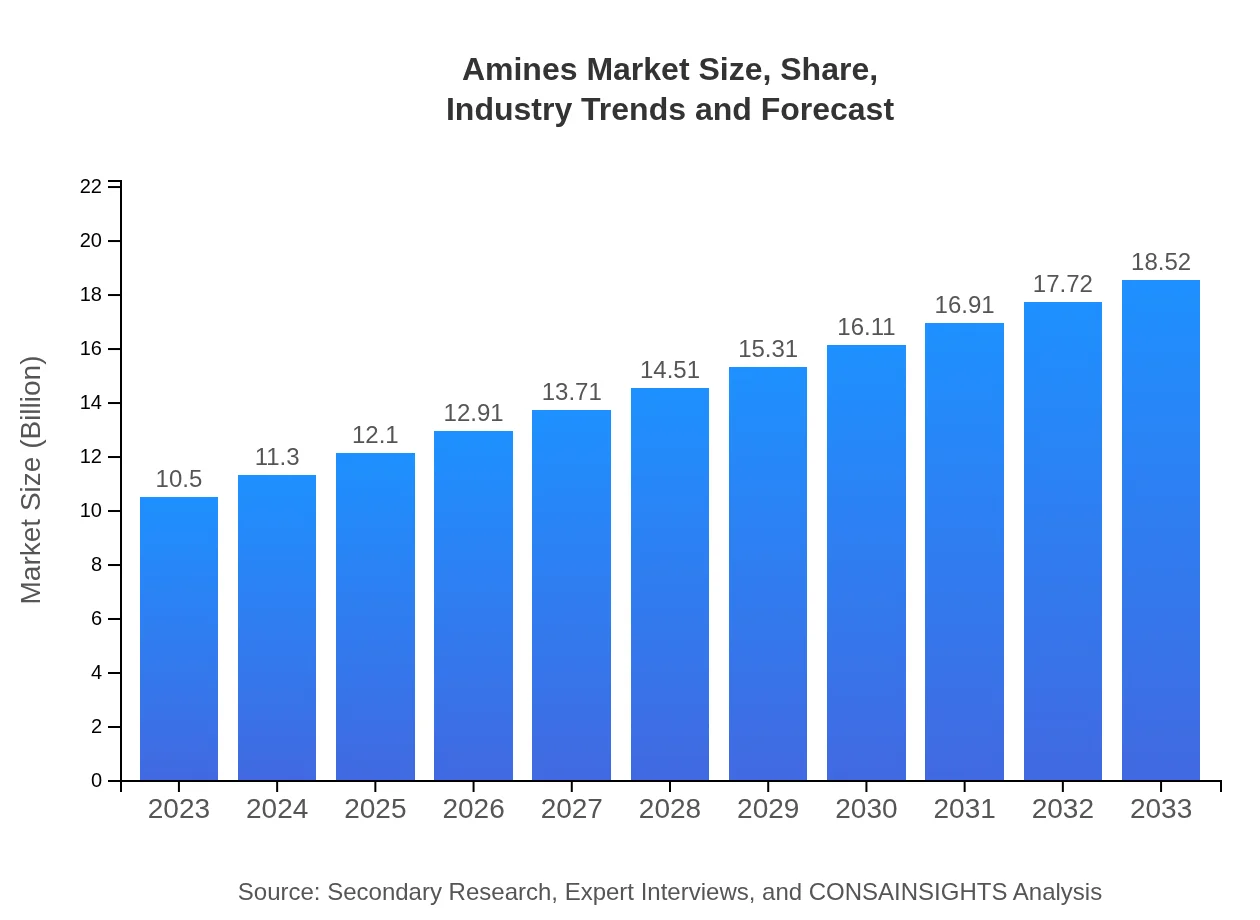

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $18.52 Billion |

| Top Companies | BASF SE, Evonik Industries AG, Huntsman Corporation |

| Last Modified Date | 02 February 2026 |

Amines Market Overview

Customize Amines Market Report market research report

- ✔ Get in-depth analysis of Amines market size, growth, and forecasts.

- ✔ Understand Amines's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Amines

What is the Market Size & CAGR of Amines market in 2023?

Amines Industry Analysis

Amines Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Amines Market Analysis Report by Region

Europe Amines Market Report:

The European market for amines is set to expand from $2.57 billion in 2023 to $4.53 billion in 2033, thanks to strict regulations encouraging the use of sustainable chemicals and a strong automotive sector driving demand for specialty amines.Asia Pacific Amines Market Report:

The Asia Pacific region is expected to see robust growth from $2.08 billion in 2023 to $3.67 billion in 2033, driven by increased industrialization and demand in sectors like agriculture and personal care. Countries like China and India are leading contributors.North America Amines Market Report:

North America, with a market size of $3.38 billion in 2023, is anticipated to rise to $5.97 billion by 2033. The growth is largely driven by advancements in the pharmaceutical and personal care industries.South America Amines Market Report:

In South America, the amines market is projected to grow from $1.03 billion in 2023 to $1.82 billion in 2033. This growth is attributed to the rising awareness in agricultural applications and demand for innovative pharmaceuticals.Middle East & Africa Amines Market Report:

The market in the Middle East and Africa is estimated to grow from $1.43 billion in 2023 to $2.53 billion by 2033, supported by improvements in agricultural productivity and the expansion of the industrial sector.Tell us your focus area and get a customized research report.

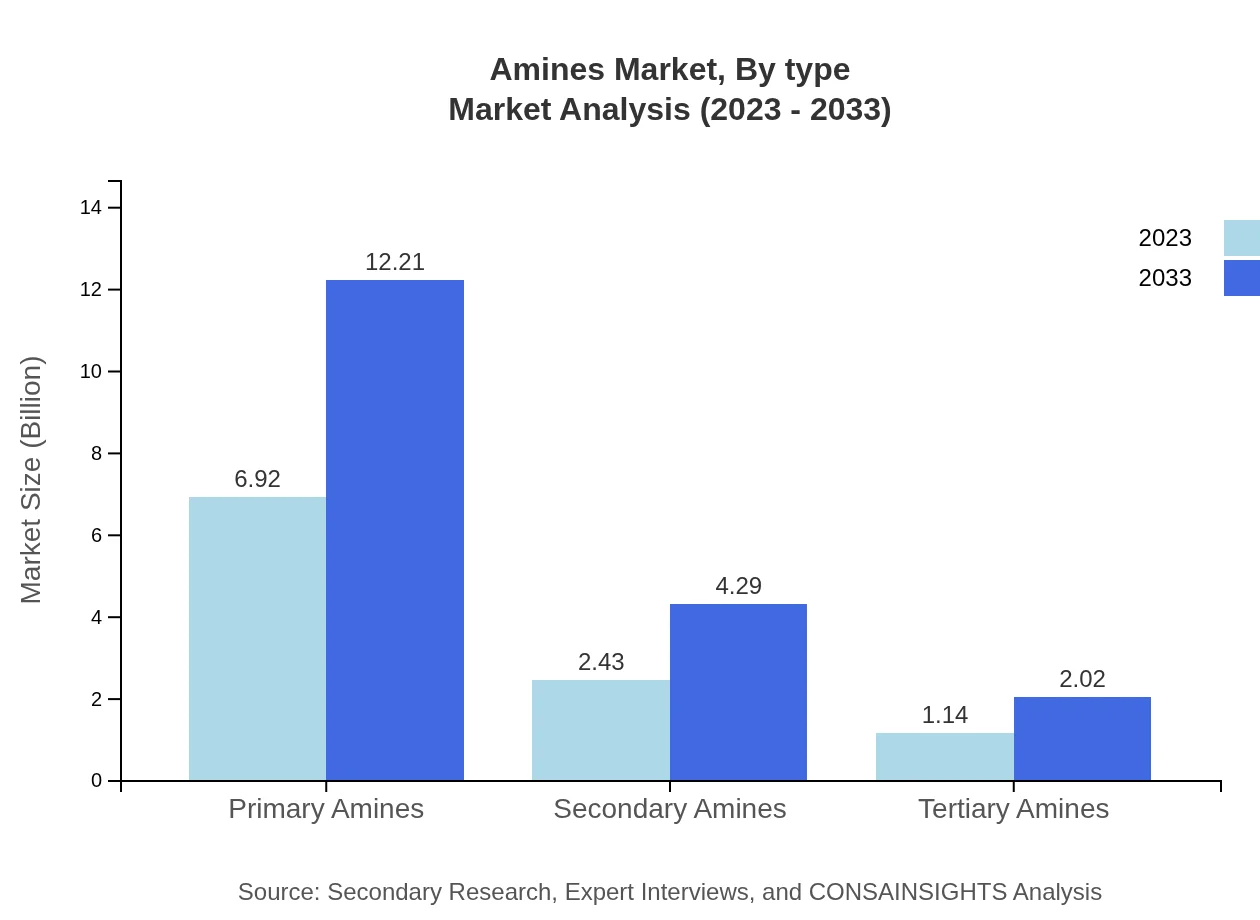

Amines Market Analysis By Type

In 2023, the market for Primary Amines stands at $6.92 billion, expected to reach $12.21 billion by 2033, holding a significant share of 65.92%. Secondary Amines and Tertiary Amines have market sizes of $2.43 billion and $1.14 billion in 2023, expected to grow to $4.29 billion and $2.02 billion respectively by 2033.

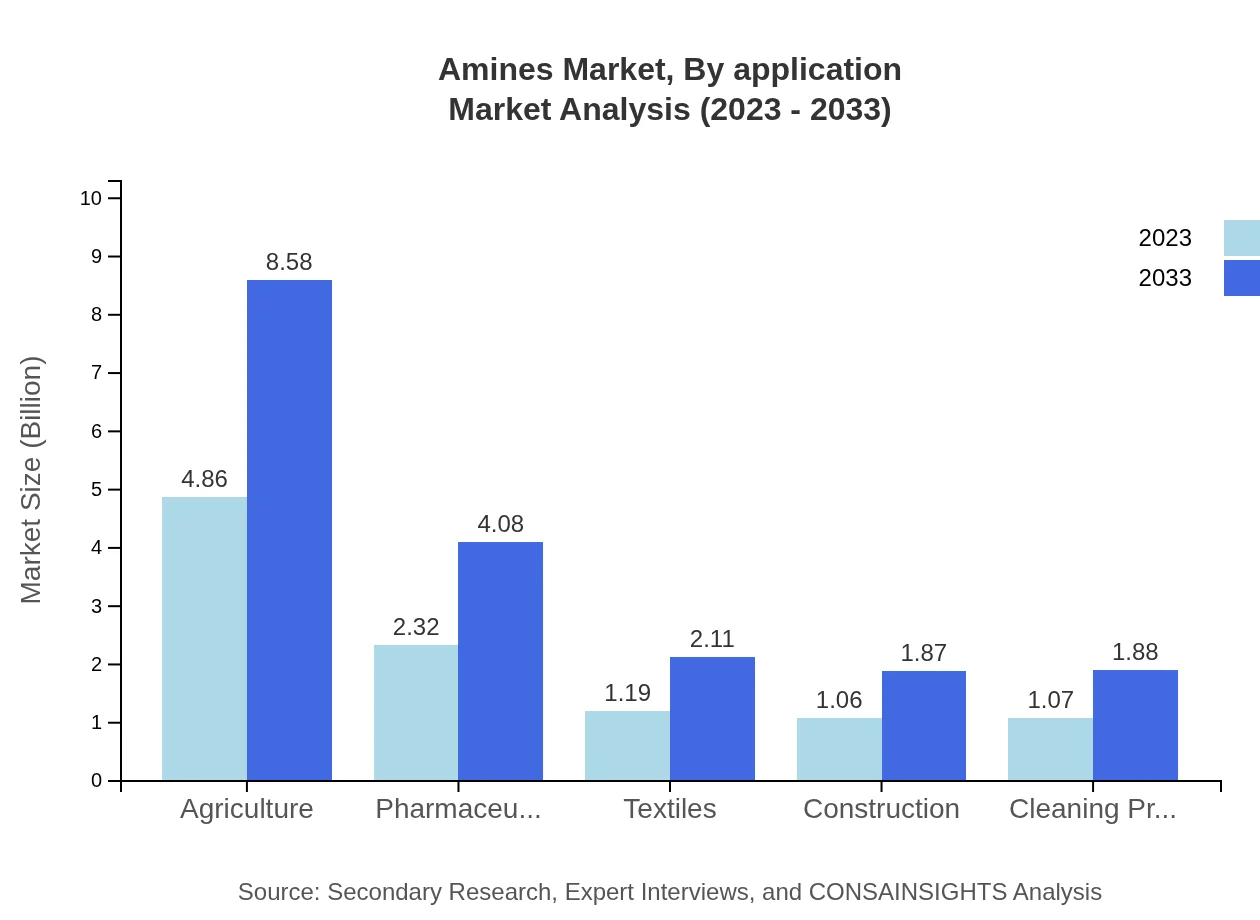

Amines Market Analysis By Application

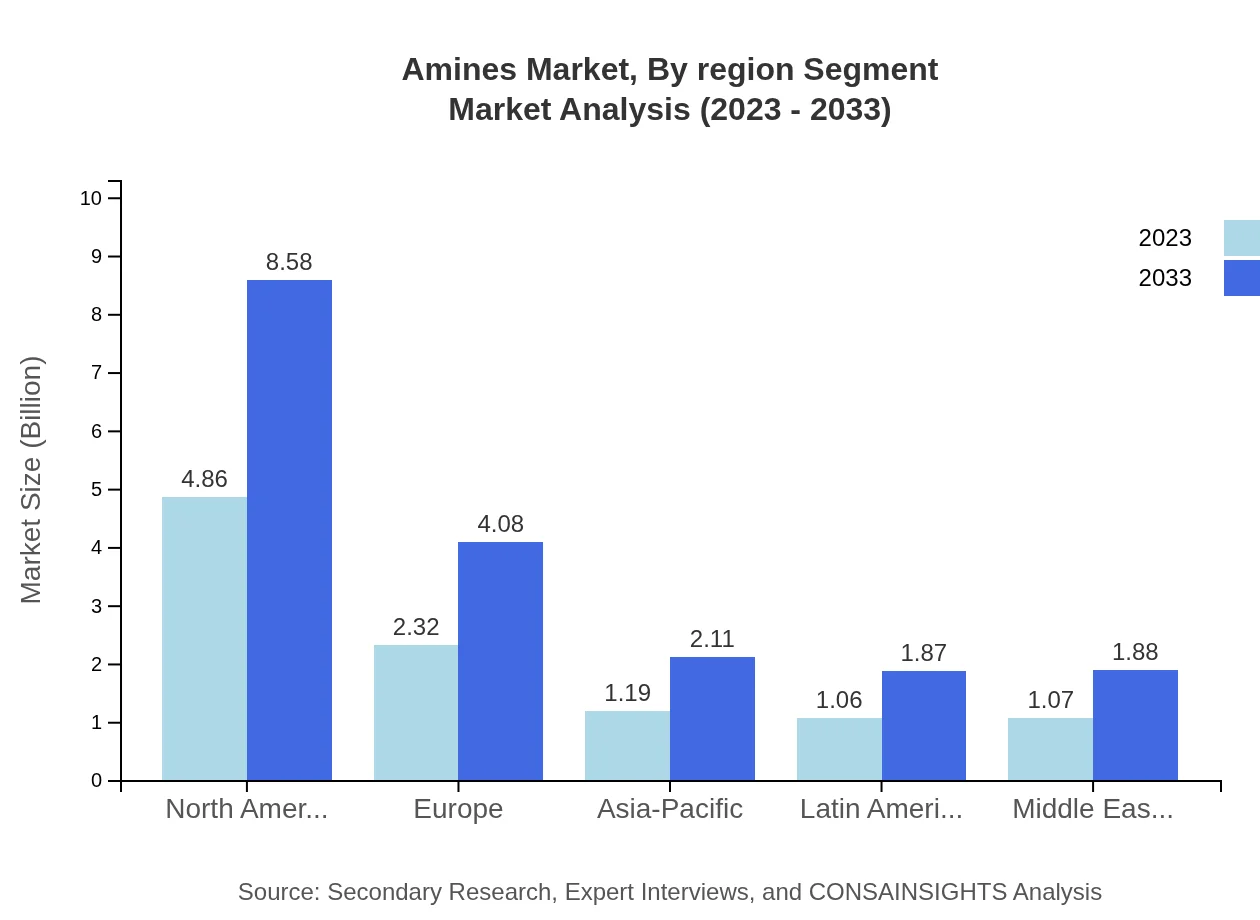

Major applications for amines include Agriculture, Pharmaceuticals, and Textiles. Agriculture accounts for the largest share with $4.86 billion in 2023, projected to increase to $8.58 billion by 2033. Pharmaceuticals and Textiles contribute significantly with sizes of $2.32 billion and $1.19 billion respectively.

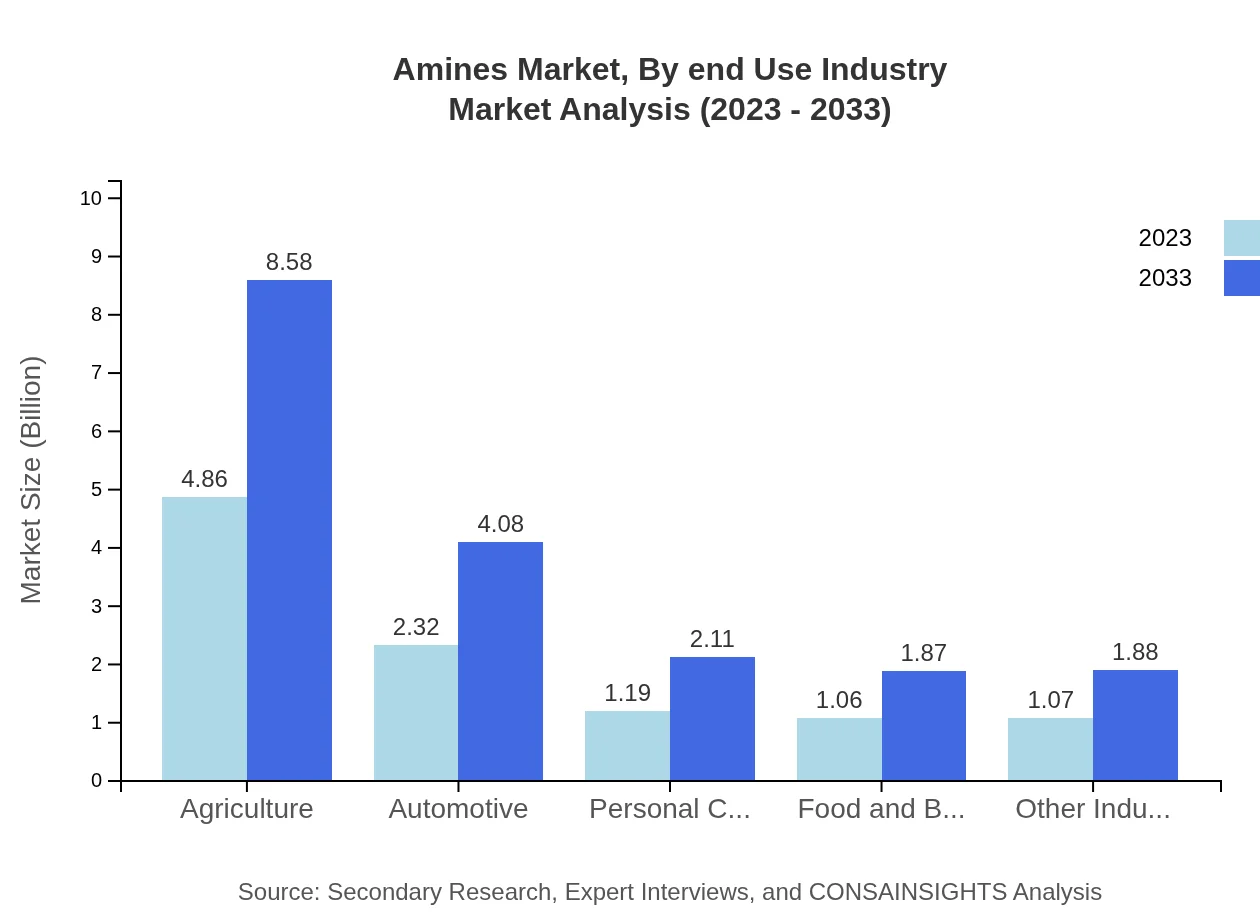

Amines Market Analysis By End Use Industry

Key end-use industries for amines encompass automotive, personal care, and cleaning products. The automotive sector is projected to maintain strong growth, moving from $2.32 billion in 2023 to $4.08 billion by 2033, driven by increased demand for automotive lubricants and coatings.

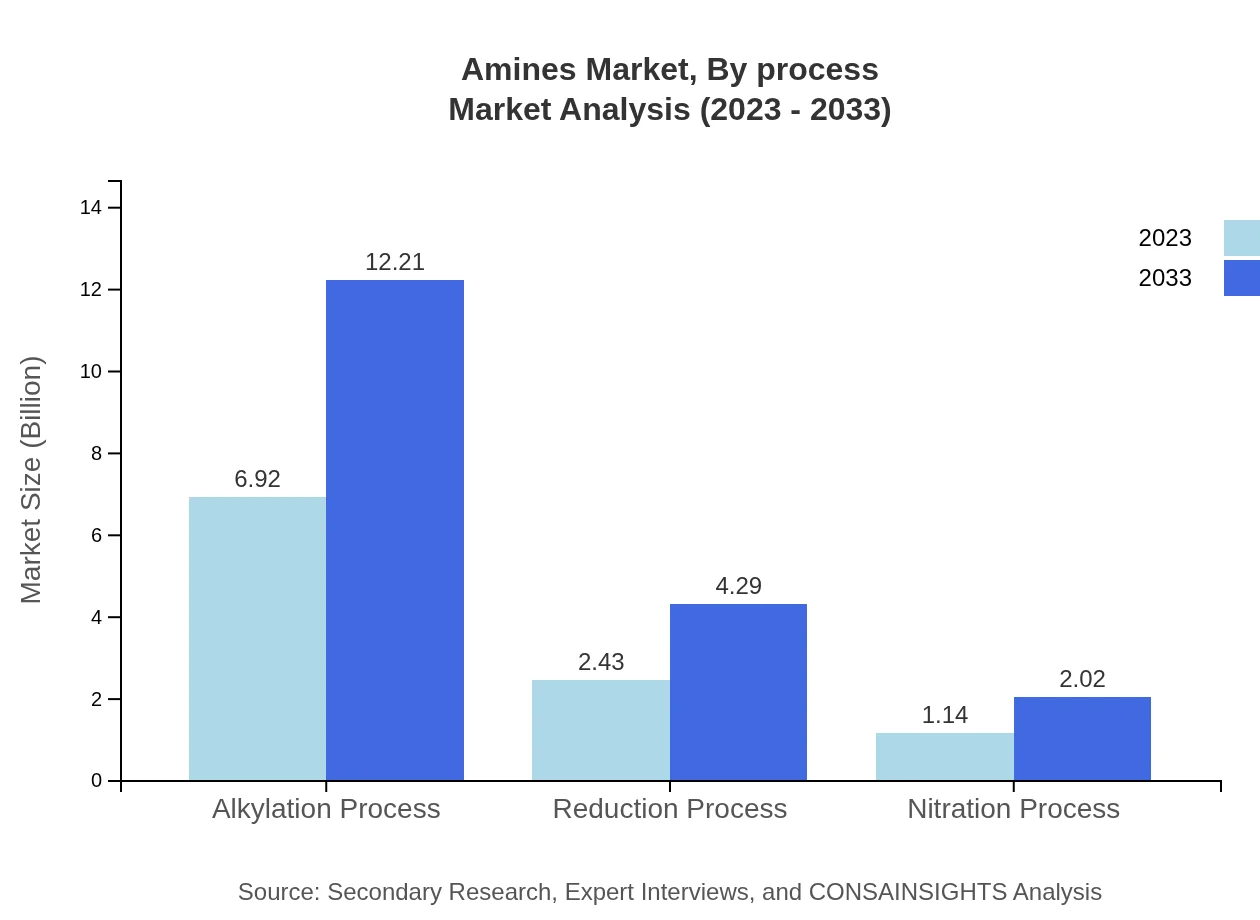

Amines Market Analysis By Process

The Alkylation Process dominates the market with a size of $6.92 billion in 2023, set to increase to $12.21 billion. In contrast, the Reduction and Nitration Processes maintain smaller roles with market sizes of $2.43 billion and $1.14 billion in 2023 respectively.

Amines Market Analysis By Region Segment

Regionally, North America and Europe lead the market with substantial shares, while Asia Pacific shows the fastest growth. Latin America and the Middle East and Africa are emerging markets with increasing significance in the global context.

Amines Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Amines Industry

BASF SE:

As one of the world's leading chemical companies, BASF produces a wide range of amines used across various applications including agriculture, automotive, and personal care.Evonik Industries AG:

Evonik is recognized for its high-performance amines that serve the pharmaceutical and agriculture sectors, focusing on innovation and eco-friendly processes.Huntsman Corporation:

Huntsman manufactures a broad selection of amines, highlighting their importance in the textile and automotive industries.We're grateful to work with incredible clients.

FAQs

What is the market size of amines?

The global amines market is valued at approximately $10.5 billion in 2023, projected to grow at a CAGR of 5.7%, reaching significant milestones by 2033.

What are the key market players or companies in the amines industry?

Leading companies in the amines market include BASF, Dow Chemical, AkzoNobel, Huntsman Corporation, and Eastman Chemical, who collectively dominate various segments and drive innovation.

What are the primary factors driving the growth in the amines industry?

Key drivers of the amines market growth include increasing demand in agriculture and pharmaceuticals, expanding applications in various industries, and the rising need for specialty chemicals.

Which region is the fastest Growing in the amines?

The Asia-Pacific region is the fastest-growing market for amines, projected to expand from $2.08 billion in 2023 to $3.67 billion by 2033, driven by industrial growth.

Does ConsaInsights provide customized market report data for the amines industry?

Yes, ConsaInsights offers tailored market report data for the amines industry to meet specific client research needs and detailed market insights.

What deliverables can I expect from this amines market research project?

Deliverables include comprehensive market analysis, segment performance insights, regional trends, detailed data reports, and strategic recommendations for stakeholders.

What are the market trends of amines?

Current trends in the amines market include a surge in eco-friendly production methods, increasing penetration in the personal care sector, and advancements in chemical applications.