Aquatic Herbicides Market Report

Published Date: 02 February 2026 | Report Code: aquatic-herbicides

Aquatic Herbicides Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aquatic Herbicides market, detailing insights on market dynamics, growth forecasts, and key trends from 2023 to 2033.

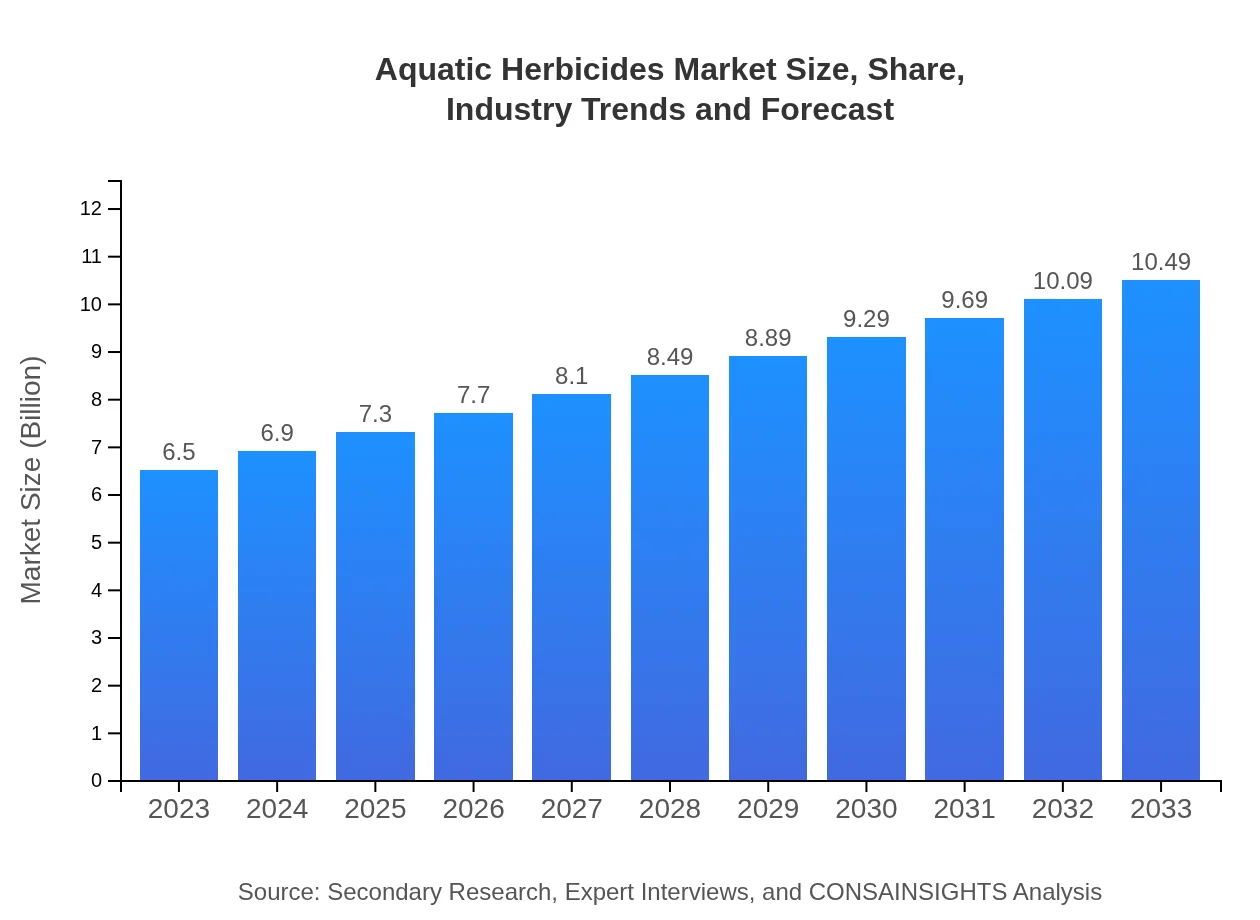

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.50 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $10.49 Billion |

| Top Companies | BASF SE, Syngenta AG, Dow AgroSciences LLC, Nufarm Limited, United Phosphorus Limited |

| Last Modified Date | 02 February 2026 |

Aquatic Herbicides Market Overview

Customize Aquatic Herbicides Market Report market research report

- ✔ Get in-depth analysis of Aquatic Herbicides market size, growth, and forecasts.

- ✔ Understand Aquatic Herbicides's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aquatic Herbicides

What is the Market Size & CAGR of Aquatic Herbicides market in 2023?

Aquatic Herbicides Industry Analysis

Aquatic Herbicides Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aquatic Herbicides Market Analysis Report by Region

Europe Aquatic Herbicides Market Report:

Europe's market, valued at $1.68 billion in 2023, is set to expand to $2.72 billion by 2033. The region is embracing eco-friendly formulations, influenced by stringent regulations on chemical usage.Asia Pacific Aquatic Herbicides Market Report:

The Asia Pacific region, with a market value of $1.28 billion in 2023, is expected to grow to $2.07 billion by 2033, driven by increasing agricultural output and expanding recreational water bodies. Countries like India and China are adopting advanced herbicide solutions to combat aquatic vegetation.North America Aquatic Herbicides Market Report:

North America shows robust growth, with a market size of $2.47 billion in 2023, forecasted to grow to $3.99 billion by 2033, due to the significant use of aquatic herbicides in maintaining recreational lakes and managing invasive species.South America Aquatic Herbicides Market Report:

In South America, the market was valued at $0.51 billion in 2023, projected to reach $0.82 billion by 2033. Regional growth is fueled by agricultural expansions and a rising awareness of aquatic ecosystem management.Middle East & Africa Aquatic Herbicides Market Report:

In the Middle East and Africa, the market's valuation is at $0.55 billion in 2023, expected to increase to $0.88 billion by 2033, driven by improved agricultural practices and increasing investment in water management systems.Tell us your focus area and get a customized research report.

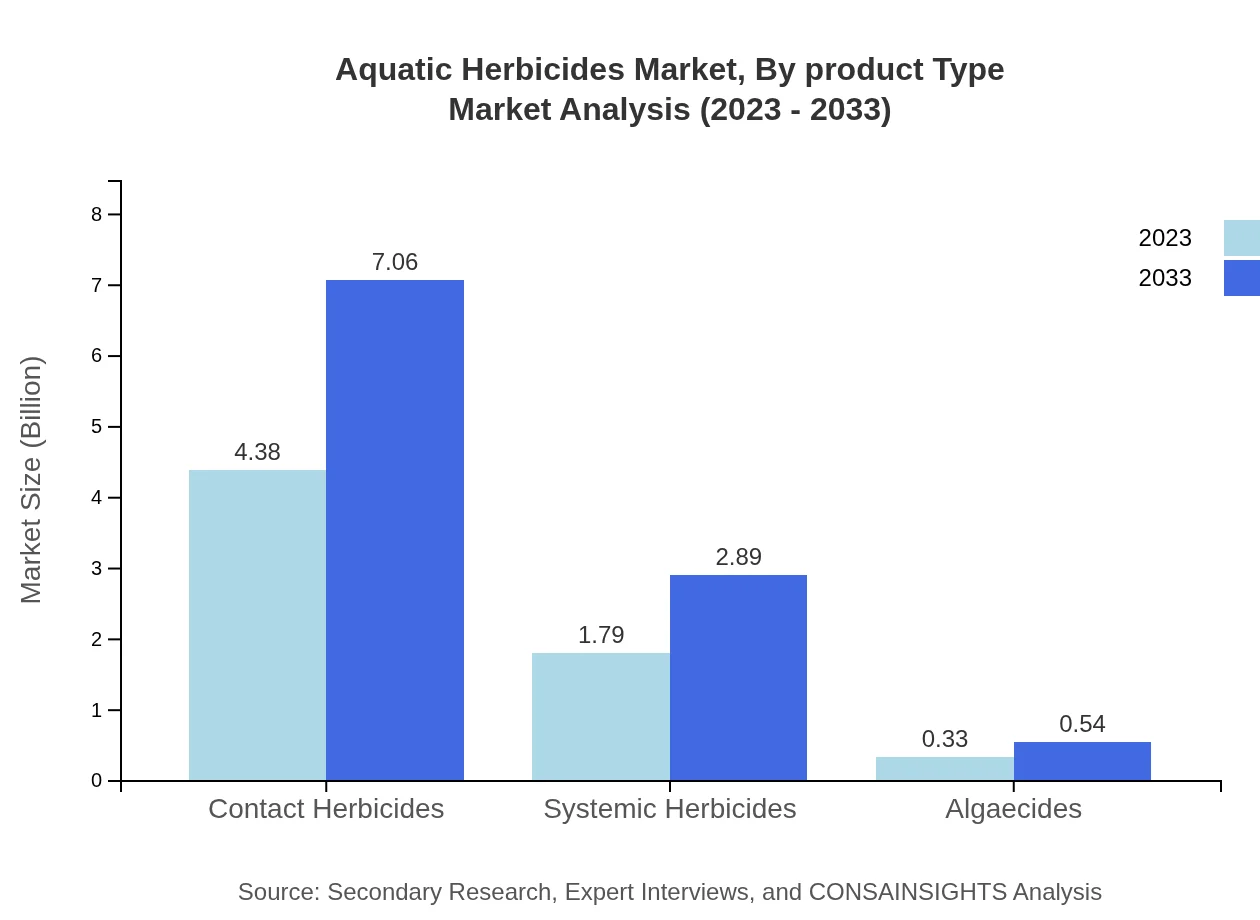

Aquatic Herbicides Market Analysis By Product Type

The product type segment includes significant categories such as contact herbicides, which dominate with a market size of $4.38 billion in 2023, projected to rise to $7.06 billion by 2033. Systemic herbicides hold a market share reflecting $1.79 billion in 2023 and expected to reach $2.89 billion in 2033.

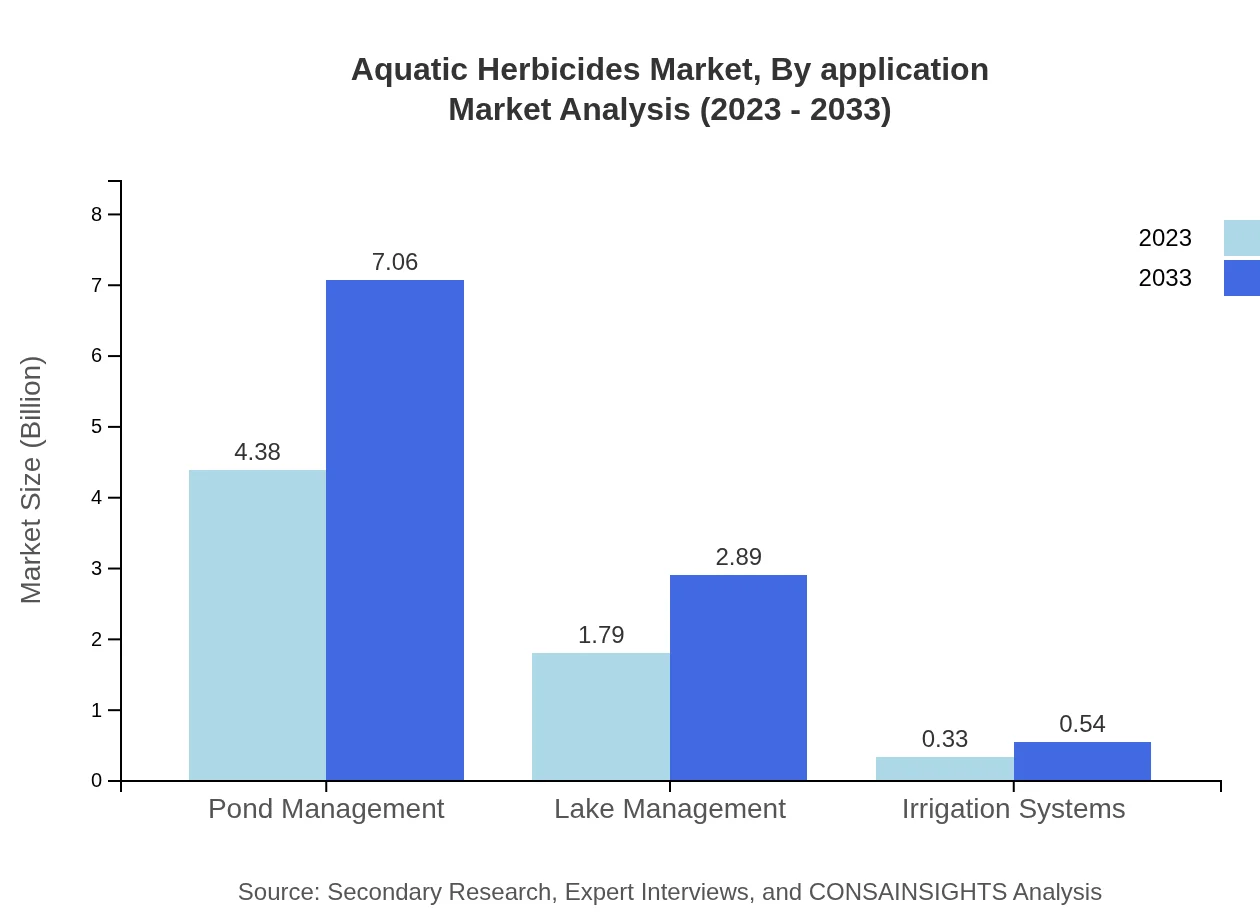

Aquatic Herbicides Market Analysis By Application

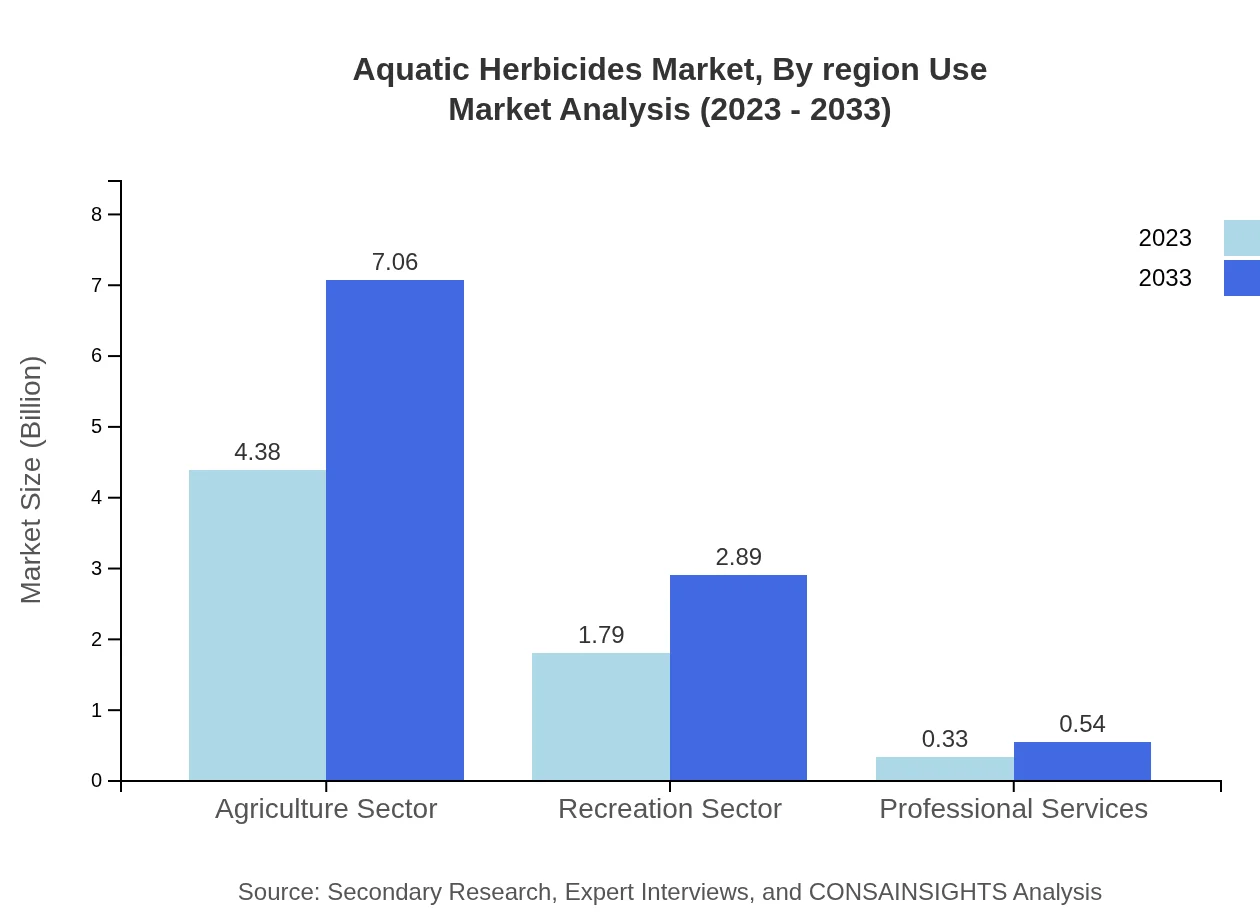

The primary applications of aquatic herbicides are in agriculture and recreation sectors. The agriculture sector's market size is $4.38 billion in 2023, expected to grow to $7.06 billion by 2033, while the recreation sector is anticipated to increase from $1.79 billion in 2023 to $2.89 billion by 2033.

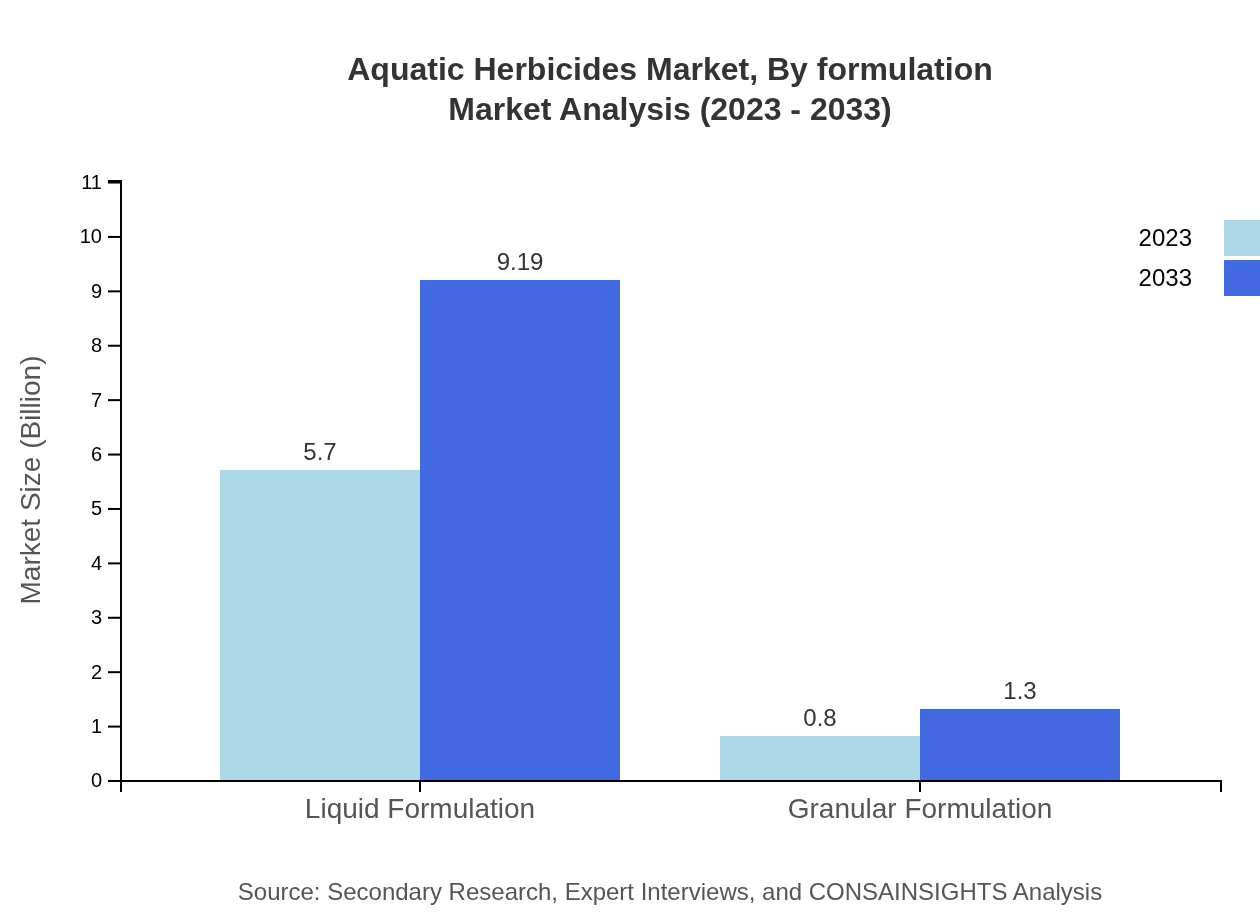

Aquatic Herbicides Market Analysis By Formulation

The formulation segment shows liquid formulations leading the market at $5.70 billion in 2023, projected to grow to $9.19 billion by 2033. Granular formulations, although smaller, are also growing from $0.80 billion in 2023 to $1.30 billion in 2033.

Aquatic Herbicides Market Analysis By Region Use

The market is driven predominantly by end-users in agriculture and recreational sectors. The agriculture sector commands over 67% of the market share, with other applications like irrigation systems and professional services contributing to the market dynamics.

Aquatic Herbicides Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aquatic Herbicides Industry

BASF SE:

BASF SE is a global leader in chemical manufacturing and provides innovative aquatic herbicides aimed at sustainable agriculture.Syngenta AG:

Syngenta specializes in crop protection products, including aquatic herbicides, focused on enhancing safety and efficacy in aquatic environments.Dow AgroSciences LLC:

A leader in agriculture, Dow offers a range of herbicides targeting aquatic applications, emphasizing environmental health.Nufarm Limited:

Nufarm manufactures a variety of herbicides and is known for its contribution to improving water quality through aquatic herbicide solutions.United Phosphorus Limited:

United Phosphorus provides a speedy range of aquatic herbicides with a focus on integrated weed management solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of aquatic Herbicides?

The global aquatic herbicides market is valued at approximately $6.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 4.8%, reaching $9.9 billion by 2033. This growth reflects increasing demand for effective aquatic weed management solutions.

What are the key market players or companies in the aquatic Herbicides industry?

Key players in the aquatic herbicides market include multinational corporations and specialized agriculture companies. These organizations drive innovation and product development, competing on effectiveness, sustainability, and regulatory compliance.

What are the primary factors driving the growth in the aquatic herbicides industry?

Growth in the aquatic herbicides market is primarily driven by increased agricultural production and the necessity to control aquatic vegetation in lakes and ponds. Environmental regulations and the push for sustainable practices further enhance market demand.

Which region is the fastest Growing in the aquatic herbicides market?

The Asia Pacific region is the fastest-growing segment of the aquatic herbicides market, with growth anticipated from $1.28 billion in 2023 to $2.07 billion by 2033. This growth is fueled by rising aquaculture and agricultural activities.

Does ConsaInsights provide customized market report data for the aquatic herbicides industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the aquatic herbicides industry, providing detailed insights tailored to specific sectors, regions, and product types to meet diverse business needs.

What deliverables can I expect from this aquatic herbicides market research project?

Deliverables from the aquatic herbicides market research include comprehensive market analysis reports, forecasts, competitive landscape evaluations, segment insights, and actionable strategies tailored based on your specific business objectives.

What are the market trends of aquatic herbicides?

Current trends in the aquatic herbicides market include a shift towards eco-friendly formulations, integration of technology for application precision, and rising awareness of water quality management within agricultural and recreational sectors.