Automotive Hud Market Report

Published Date: 02 February 2026 | Report Code: automotive-hud

Automotive Hud Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive HUD market, covering key insights, market dynamics, and forecasts from 2023 to 2033. It explores trends, regional performances, and competitive landscapes within the industry.

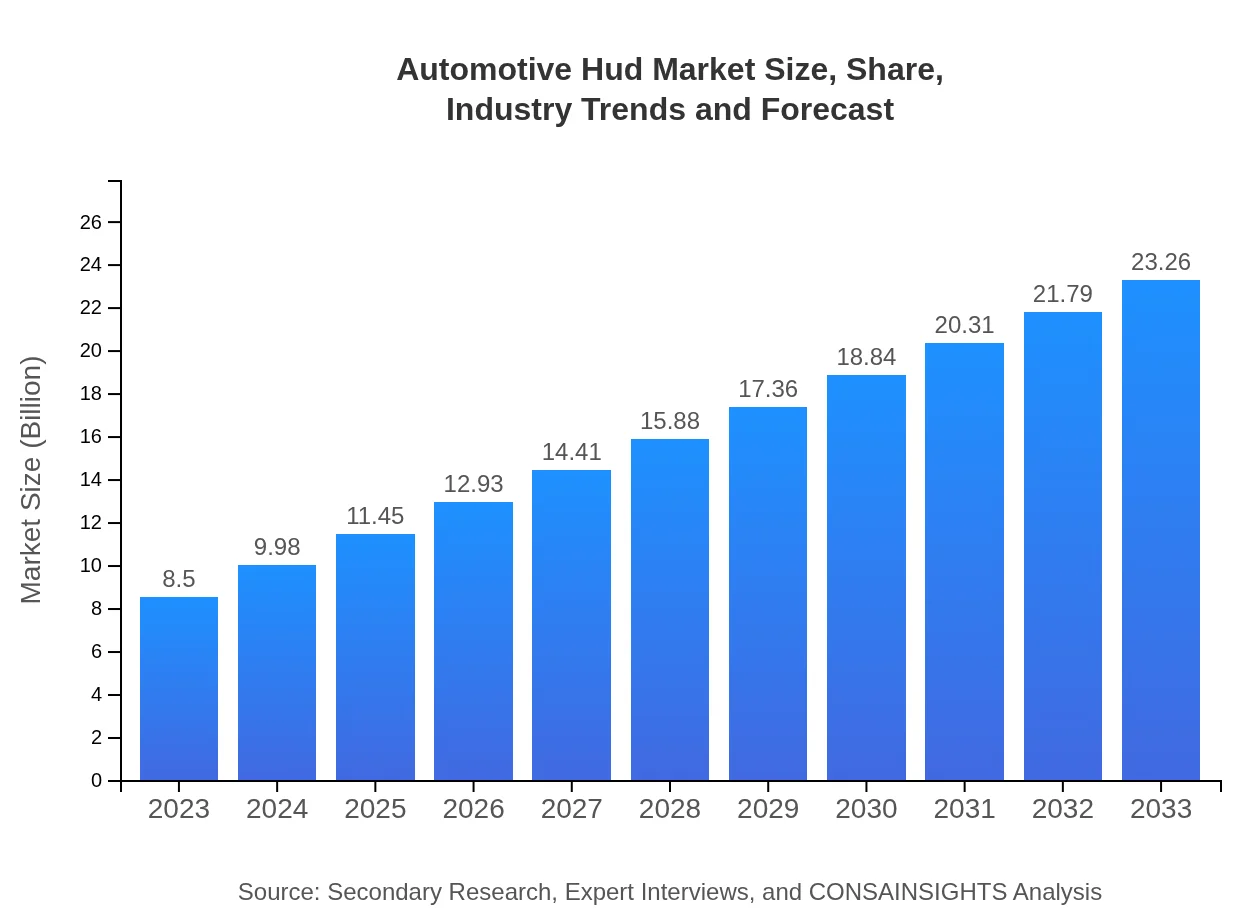

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $23.26 Billion |

| Top Companies | Bosch, Denso Corporation, Continental AG, Visteon Corporation, Gentex Corporation |

| Last Modified Date | 02 February 2026 |

Automotive Hud Market Overview

Customize Automotive Hud Market Report market research report

- ✔ Get in-depth analysis of Automotive Hud market size, growth, and forecasts.

- ✔ Understand Automotive Hud's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Hud

What is the Market Size & CAGR of Automotive Hud market in 2023?

Automotive Hud Industry Analysis

Automotive Hud Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Hud Market Analysis Report by Region

Europe Automotive Hud Market Report:

In Europe, the market is expected to expand from $2.82 billion in 2023 to $7.71 billion by 2033. The European market is driven by stringent regulations focusing on vehicle safety standards and the growing trend of digitization in automobiles.Asia Pacific Automotive Hud Market Report:

The Asia Pacific region is anticipated to exhibit strong growth, with the Automotive HUD market projected to reach approximately $4.25 billion by 2033, up from $1.55 billion in 2023. The increased production of vehicles, coupled with rising disposable incomes and tech-savvy consumers, is driving the demand for HUD systems in this region.North America Automotive Hud Market Report:

The North American market is projected to climb from $3.03 billion in 2023 to $8.29 billion by 2033. Fueled by strong demand in both the luxury and mainstream segments, advancements in data connectivity, and increasing regulatory measures for driver safety, North America remains a vital region for the HUD market.South America Automotive Hud Market Report:

In South America, the Automotive HUD market is set to grow from $0.64 billion in 2023 to $1.76 billion by 2033. While consumer adoption rates are currently moderate, the perceived safety benefits of HUDs are encouraging manufacturers to integrate these technologies into their vehicles.Middle East & Africa Automotive Hud Market Report:

The Middle East and Africa region is forecasted to grow from $0.46 billion in 2023 to $1.26 billion by 2033. Although still emerging, advancements in luxury automotive features and a shift towards electric vehicles are anticipated to spur growth in the HUD market.Tell us your focus area and get a customized research report.

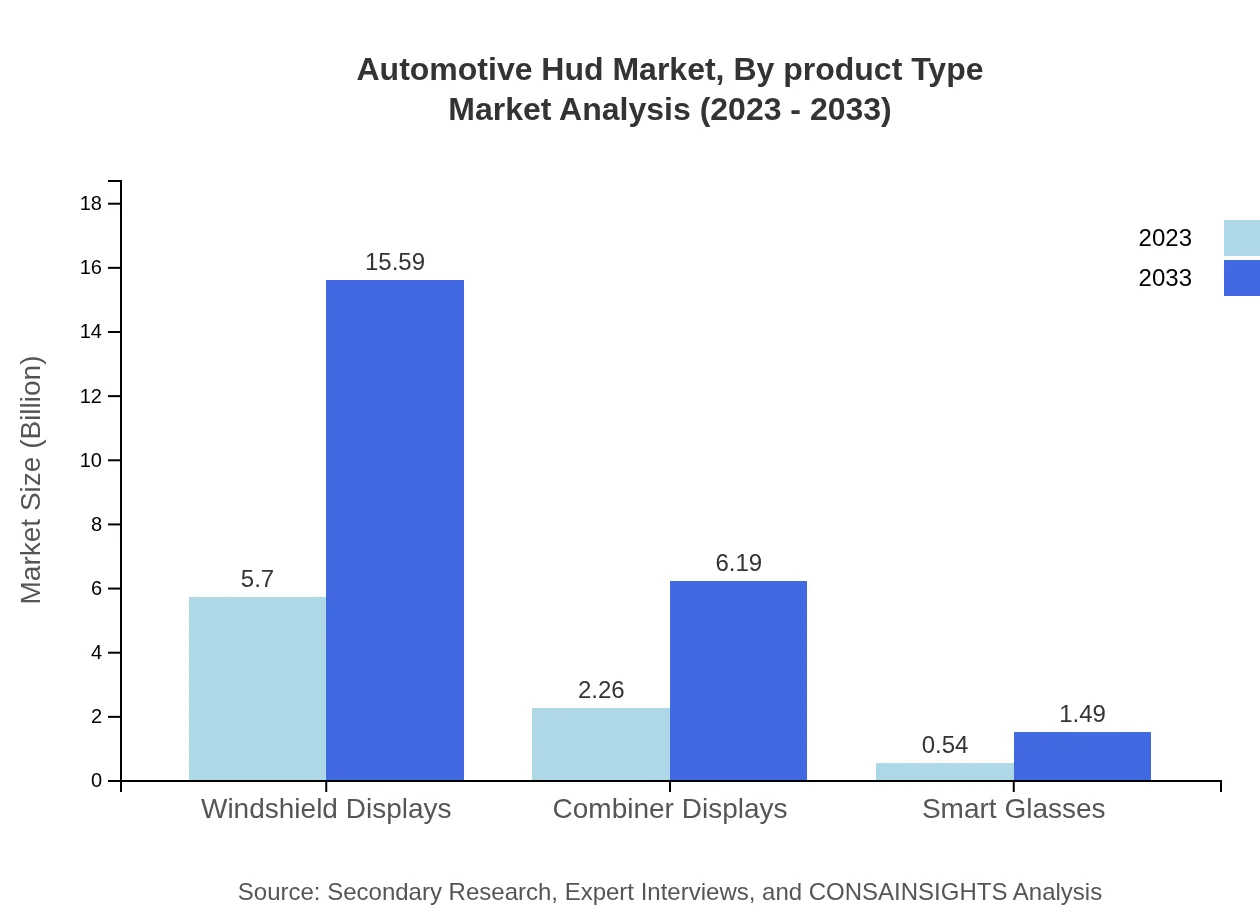

Automotive Hud Market Analysis By Product Type

The market by product type highlights the performance and projected growth of various HUD technologies. The LASER projection segment leads the market, anticipated to rise from $5.70 billion in 2023 to $15.59 billion in 2033, capturing a dominant market share of 67.01%. Combiner displays hold a significant share too, growing from $2.26 billion to $6.19 billion in the same timeframe.

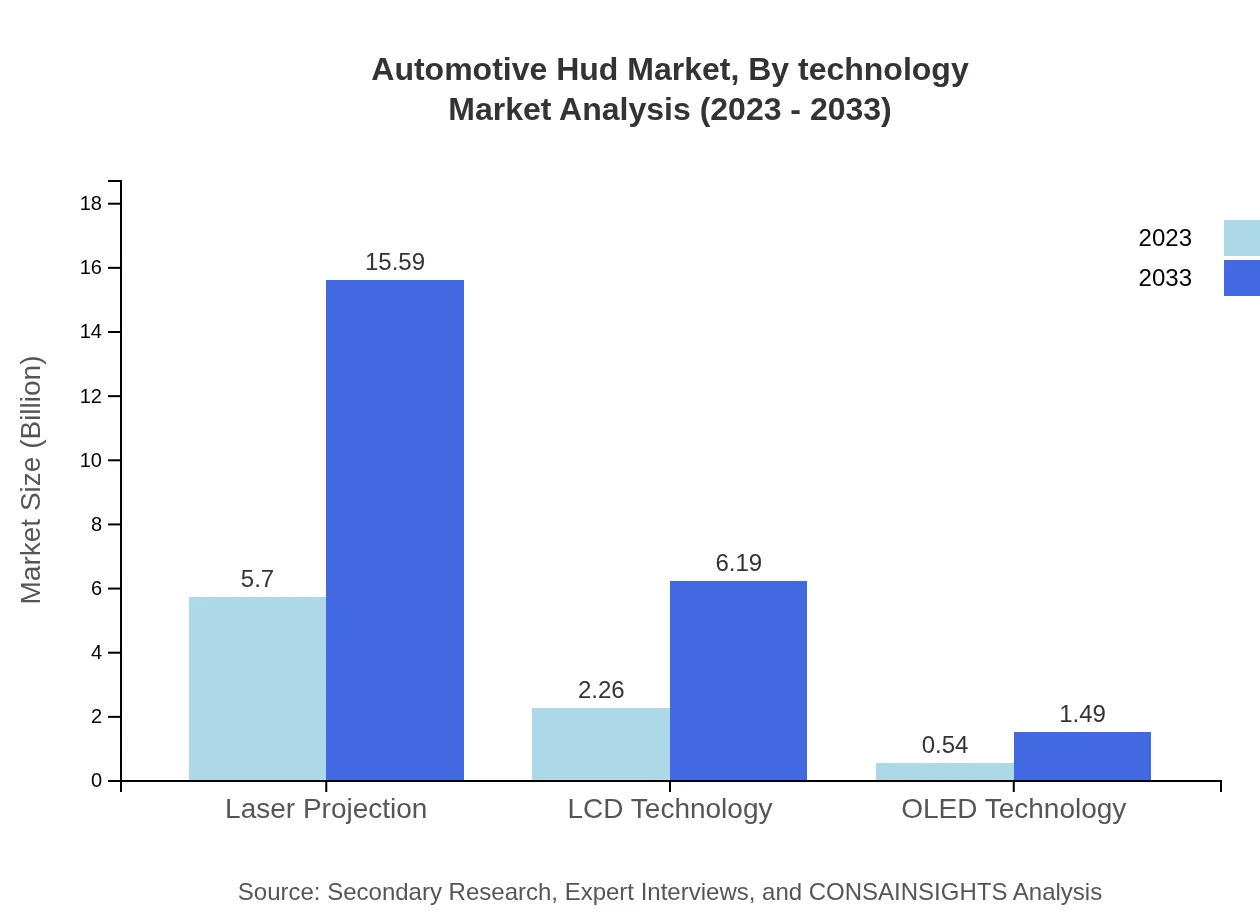

Automotive Hud Market Analysis By Technology

Underlining technologies such as LCD and OLED, the HUD market is transitioning towards more dynamic platforms. OLED technology will see substantial growth, moving from $0.54 billion in 2023 to $1.49 billion in 2033, indicating a trend towards higher-quality displays and functionality.

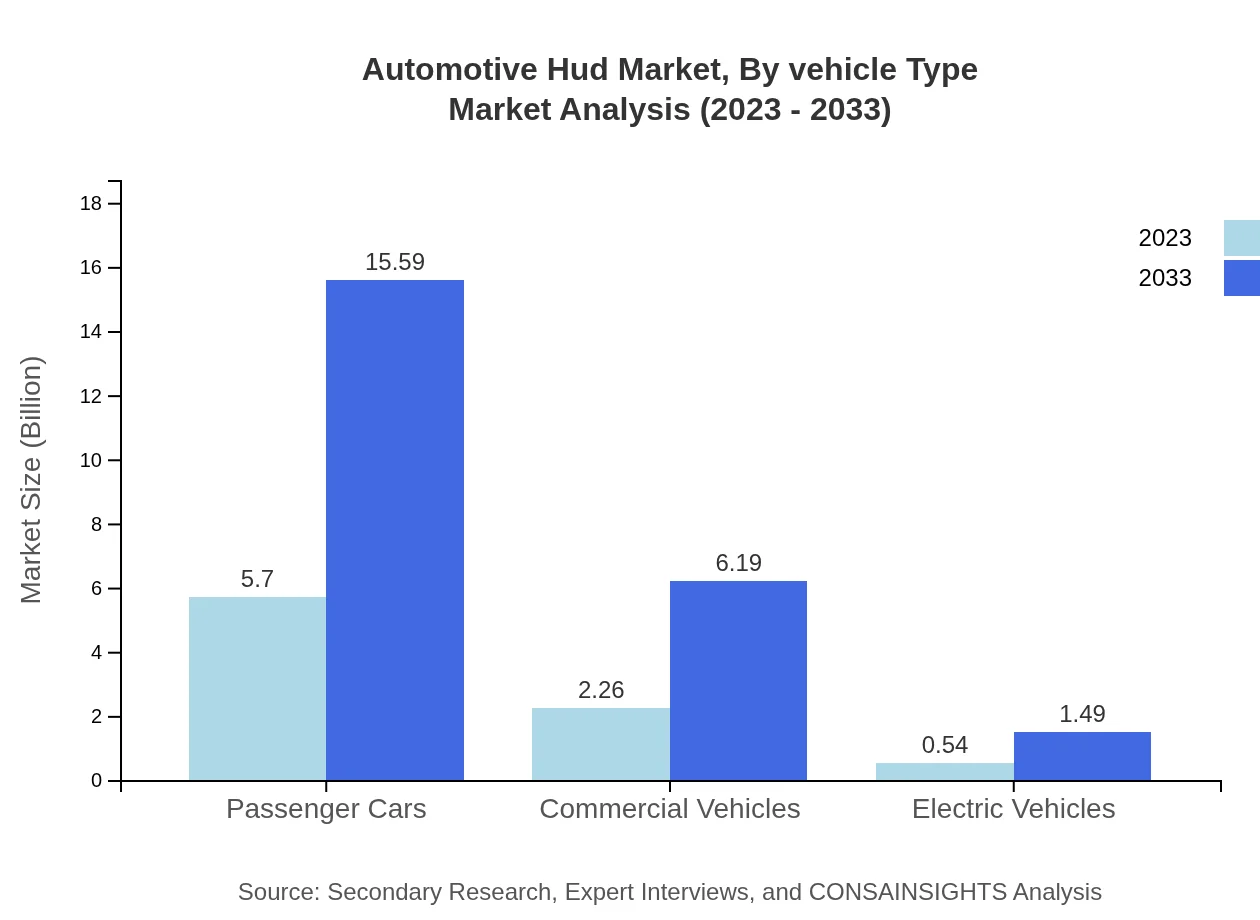

Automotive Hud Market Analysis By Vehicle Type

Passenger cars dominate the market, with expectations to increase from $5.70 billion in 2023 to $15.59 billion by 2033. Commercial vehicles are also witnessing growth potential, projected to climb from $2.26 billion to $6.19 billion due to the rising demand for fleet management technology.

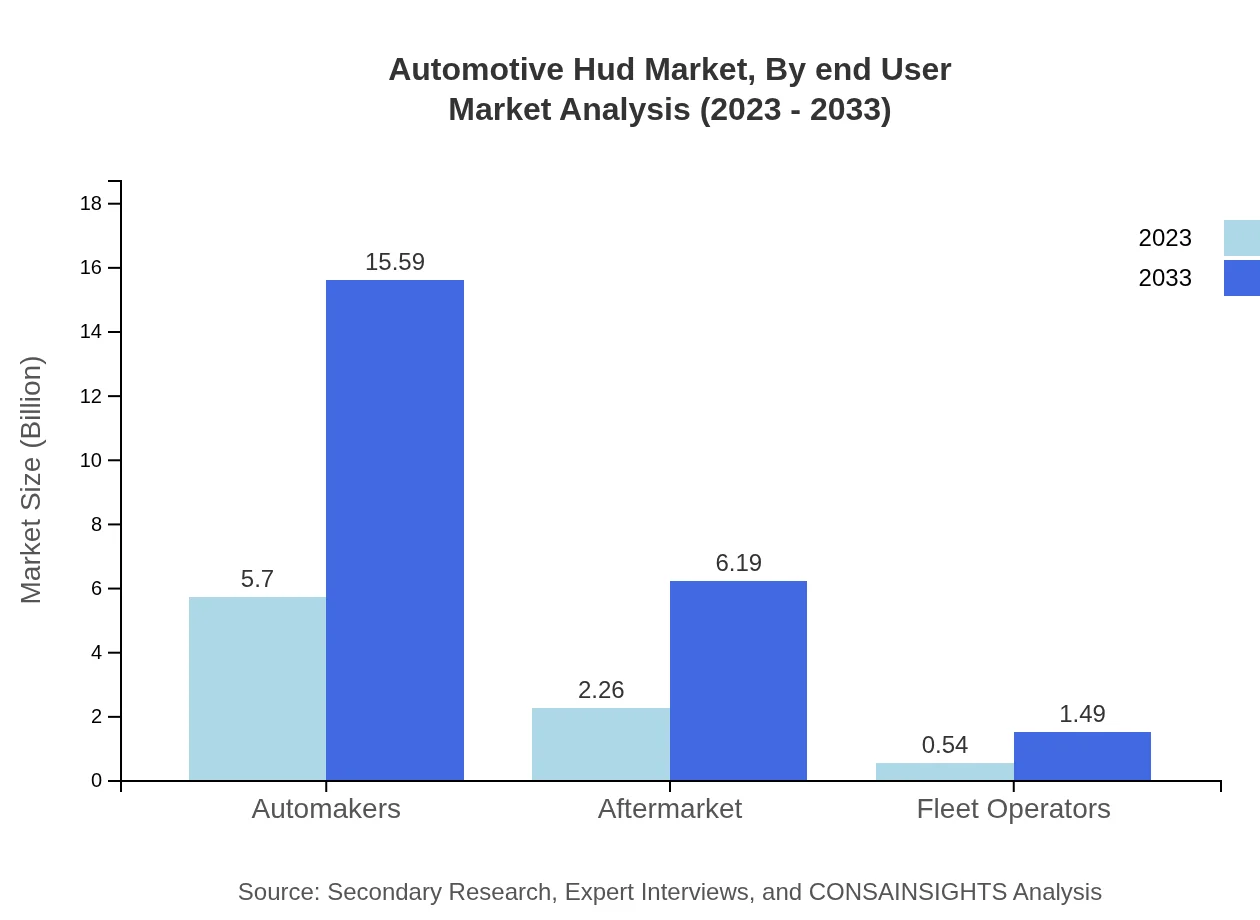

Automotive Hud Market Analysis By End User

The end user segmentation reveals a growing inclination of fleet operators and everyday consumers for advanced HUD systems. The aftermarket segment is predicted to experience a substantial rise driven by the demand for retrofitting vehicles with modern safety features.

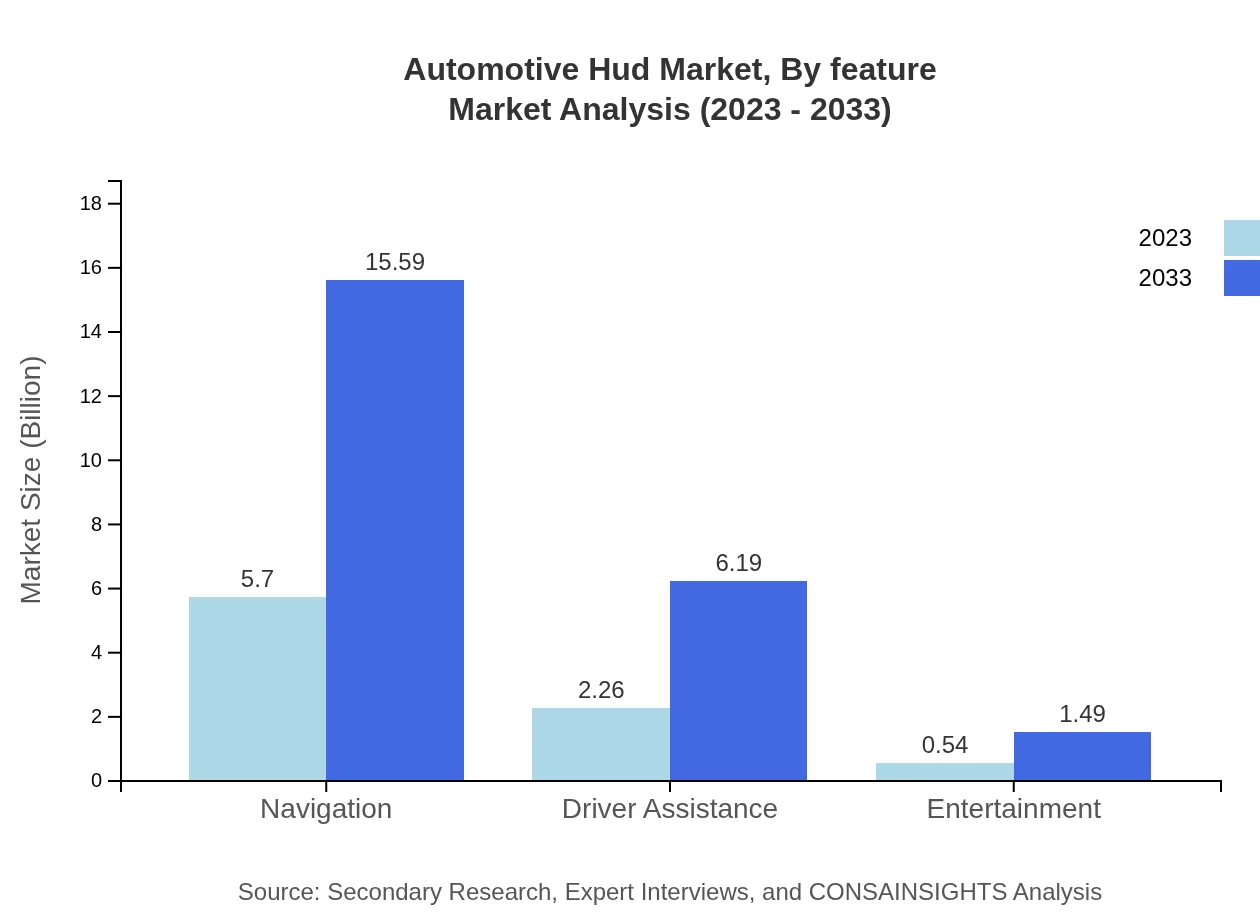

Automotive Hud Market Analysis By Feature

Instrumentation paths including navigation and driver assistance emerge as critical features in HUD systems. The navigation segment alone is projected to grow from $5.70 billion in 2023 to $15.59 billion by 2033, underlining its strategic importance in enhancing user experience.

Automotive Hud Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Hud Industry

Bosch:

Bosch is a leading technology and services company with a strong foothold in the automotive electronics sector, pioneering innovative HUD technologies that enhance vehicle safety and driving comfort.Denso Corporation:

Denso is a global manufacturer of advanced automotive technology, and its HUD systems are integral components of modern vehicle designs, focusing on integrated connectivity and driver assistance.Continental AG:

Continental specializes in automotive technology and has made significant contributions to the HUD market, prioritizing intuitive designs and safety features.Visteon Corporation:

Visteon remains at the forefront of automotive electronics, offering comprehensive HUD solutions that align with the latest technological advancements.Gentex Corporation:

Gentex is known for its innovation in automotive mirrors and smart displays, with HUD systems that enhance the driving experience by providing real-time feedback and information.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Hud?

The automotive head-up display (HUD) market is currently valued at approximately $8.5 billion and is projected to grow at a CAGR of 10.2% from 2023 to 2033.

What are the key market players or companies in the automotive Hud industry?

Key players in the automotive HUD market include companies such as Continental AG, Bosch, DENSO Corporation, Garmin, and Visteon Corporation, which lead the market in terms of technology and product innovation.

What are the primary factors driving the growth in the automotive Hud industry?

Factors driving growth include increasing consumer demand for advanced driver assistance systems, enhanced safety features, and the rise in electric vehicles. Furthermore, technology advancements in display interfaces and integration with smart devices also contribute significantly.

Which region is the fastest Growing in the automotive Hud?

North America is the fastest-growing region in the automotive HUD market, with a market size projected to rise from $3.03 billion in 2023 to $8.29 billion by 2033, highlighting a significant growth trajectory.

Does ConsaInsights provide customized market report data for the automotive Hud industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the automotive HUD industry, providing detailed insights and analyses based on various parameters.

What deliverables can I expect from this automotive Hud market research project?

Deliverables from the automotive HUD market research project include comprehensive reports, market forecasts, regional analysis, competitive landscape summaries, and insights on consumer trends and preferences in the industry.

What are the market trends of automotive Hud?

Current trends in the automotive HUD market include increasing use of OLED technology, a shift towards windshield displays, and a growing focus on driver assistance and navigation functionalities, catering to both passenger and commercial vehicles.