Avionics Systems Market Report

Published Date: 03 February 2026 | Report Code: avionics-systems

Avionics Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Avionics Systems market, covering analysis from 2023 to 2033. It includes market trends, segmentation, regional insights, and forecasted growth to aid industry stakeholders in strategic decision-making.

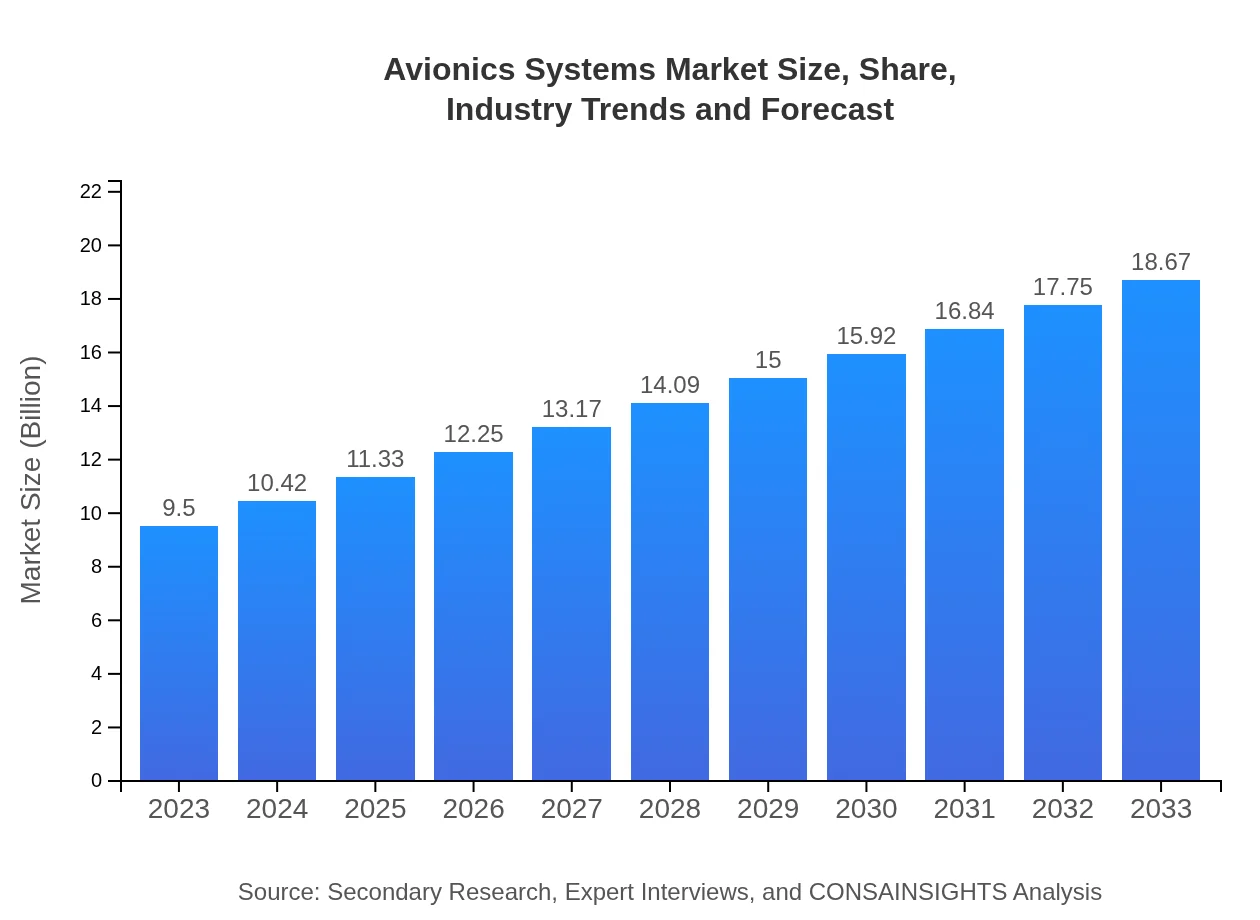

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $18.67 Billion |

| Top Companies | Honeywell International Inc., Rockwell Collins (now part of Collins Aerospace), Garmin Ltd., Thales Group, BAE Systems |

| Last Modified Date | 03 February 2026 |

Avionics Systems Market Overview

Customize Avionics Systems Market Report market research report

- ✔ Get in-depth analysis of Avionics Systems market size, growth, and forecasts.

- ✔ Understand Avionics Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Avionics Systems

What is the Market Size & CAGR of Avionics Systems market in 2023?

Avionics Systems Industry Analysis

Avionics Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Avionics Systems Market Analysis Report by Region

Europe Avionics Systems Market Report:

In Europe, the avionics market is valued at $3.08 billion in 2023, projected to grow to $6.06 billion by 2033. Factors such as stringent regulatory requirements and a strong aviation industry base drive this region's growth, with increasing emphasis on green technology.Asia Pacific Avionics Systems Market Report:

In 2023, the Asia Pacific region holds a market size of $1.76 billion and is expected to grow to $3.46 billion by 2033. This growth is fueled by increasing air travel demands, ongoing military modernization efforts, and significant investments in aerospace infrastructure. China and India are leading the charge in aviation expansion within this region.North America Avionics Systems Market Report:

North America leads the avionics market with a size of $3.35 billion in 2023, expected to increase to $6.58 billion by 2033. The presence of major aviation manufacturers and extensive defense budgets in the U.S. significantly contribute to market growth, alongside innovations in avionics technology.South America Avionics Systems Market Report:

The South American avionics systems market is projected to grow from $0.30 billion in 2023 to $0.59 billion by 2033, attributed to rising aviation activities and government initiatives to boost regional air transportation. However, economic challenges may pose growth restrictions.Middle East & Africa Avionics Systems Market Report:

The Middle East and Africa market is estimated to grow from $1.01 billion in 2023 to $1.98 billion by 2033. Rising investments in aviation infrastructure and a growing tourism sector in this region are pivotal to the market's growth trajectory.Tell us your focus area and get a customized research report.

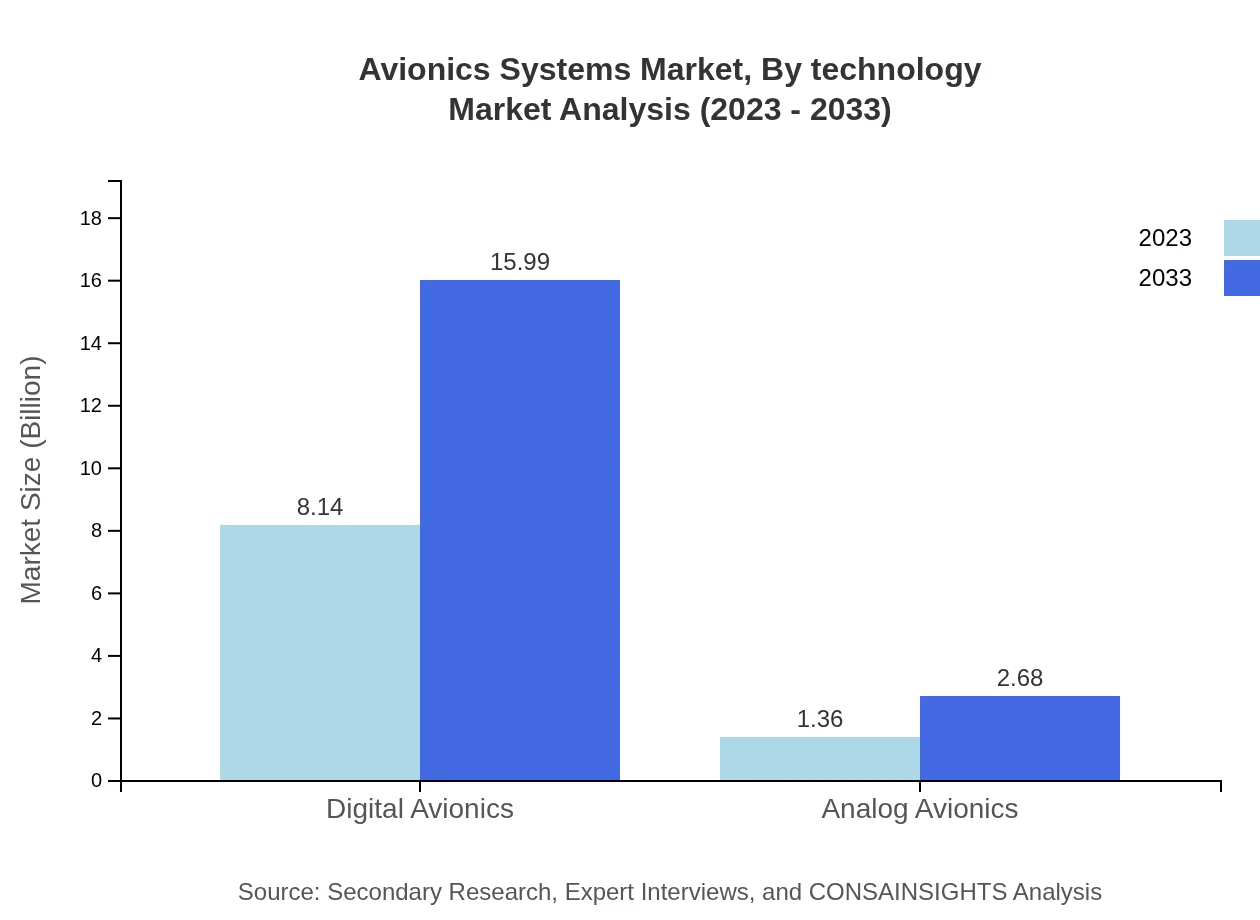

Avionics Systems Market Analysis By Product Type

Digital avionics dominate the product type segment, estimated at $8.14 billion in 2023 and expected to grow to $15.99 billion by 2033, holding an 85.66% market share. Analog avionics constitute a smaller segment with a 14.34% share, projected to grow from $1.36 billion to $2.68 billion over the same period.

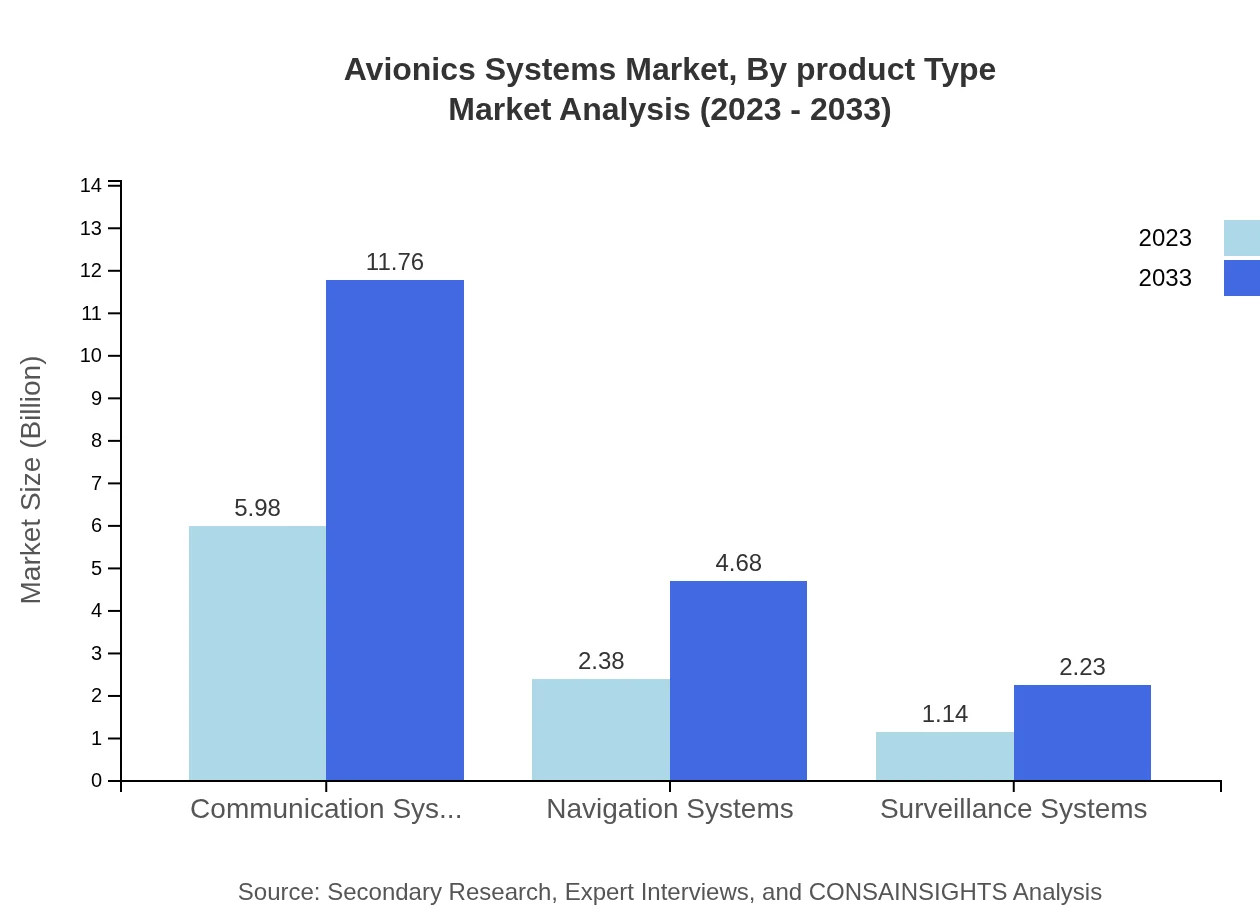

Avionics Systems Market Analysis By Technology

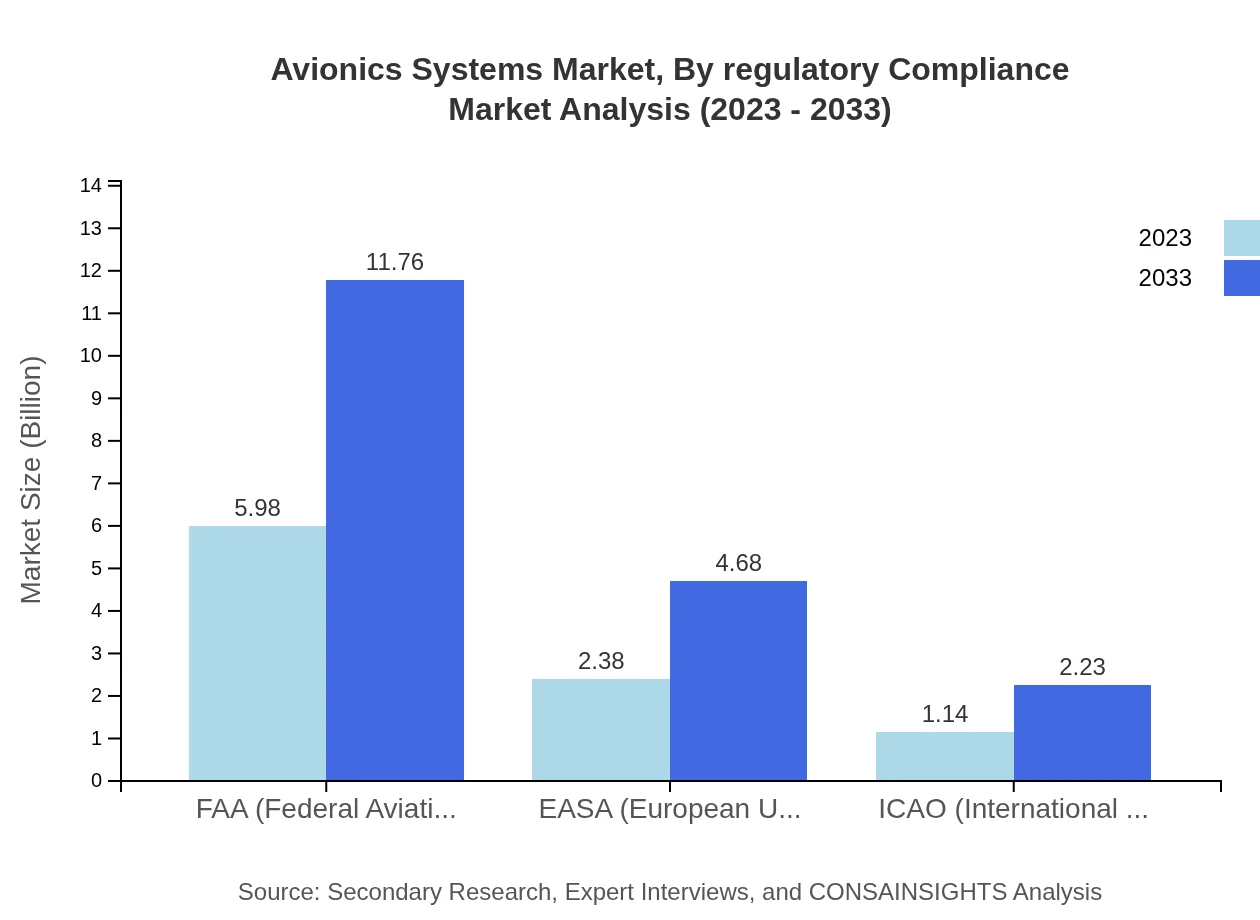

The technology segment is marked by advancements in communication and navigation systems. Communication systems are projected to grow from $5.98 billion to $11.76 billion, while navigation systems are anticipated to rise from $2.38 billion to $4.68 billion by 2033, driven by increasing demand for efficient and reliable operations.

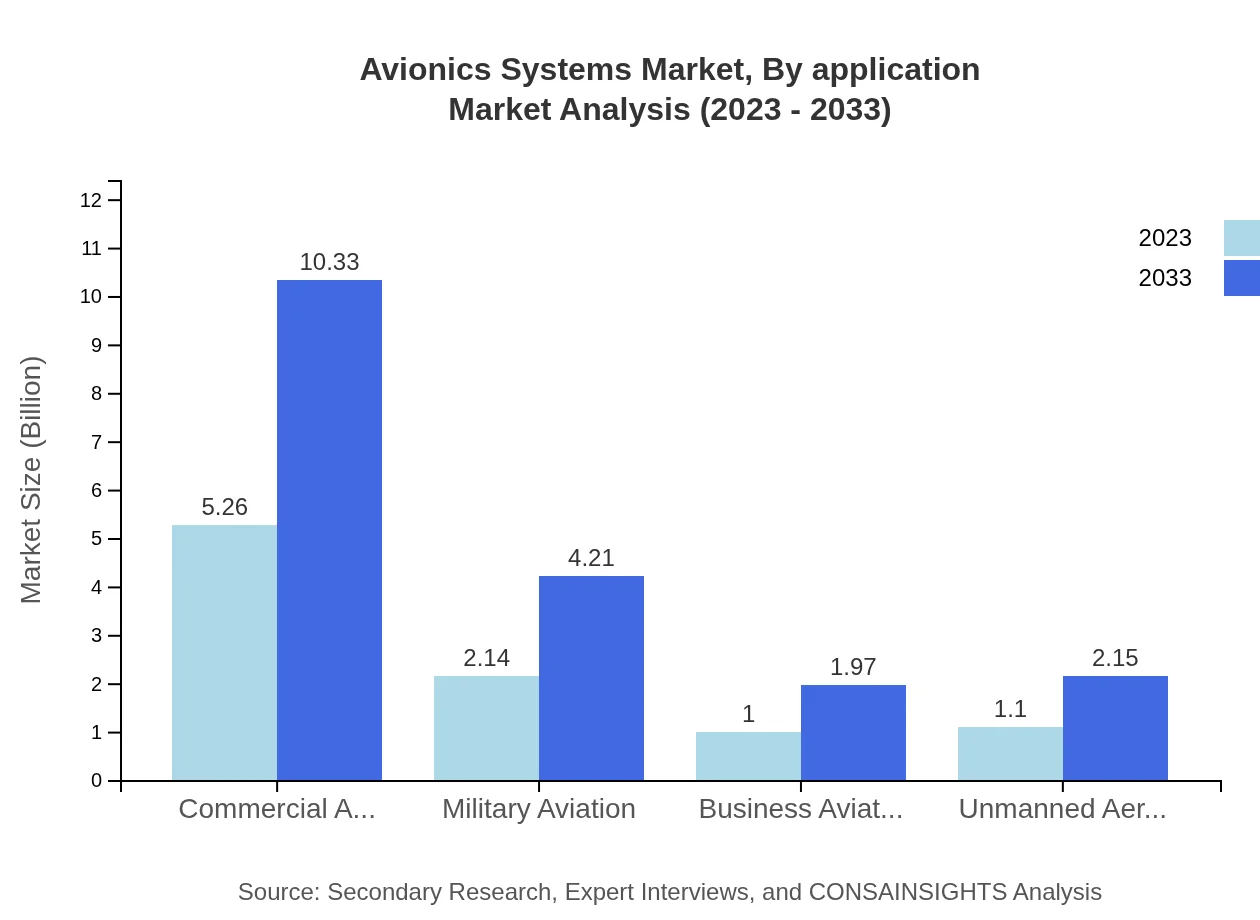

Avionics Systems Market Analysis By Application

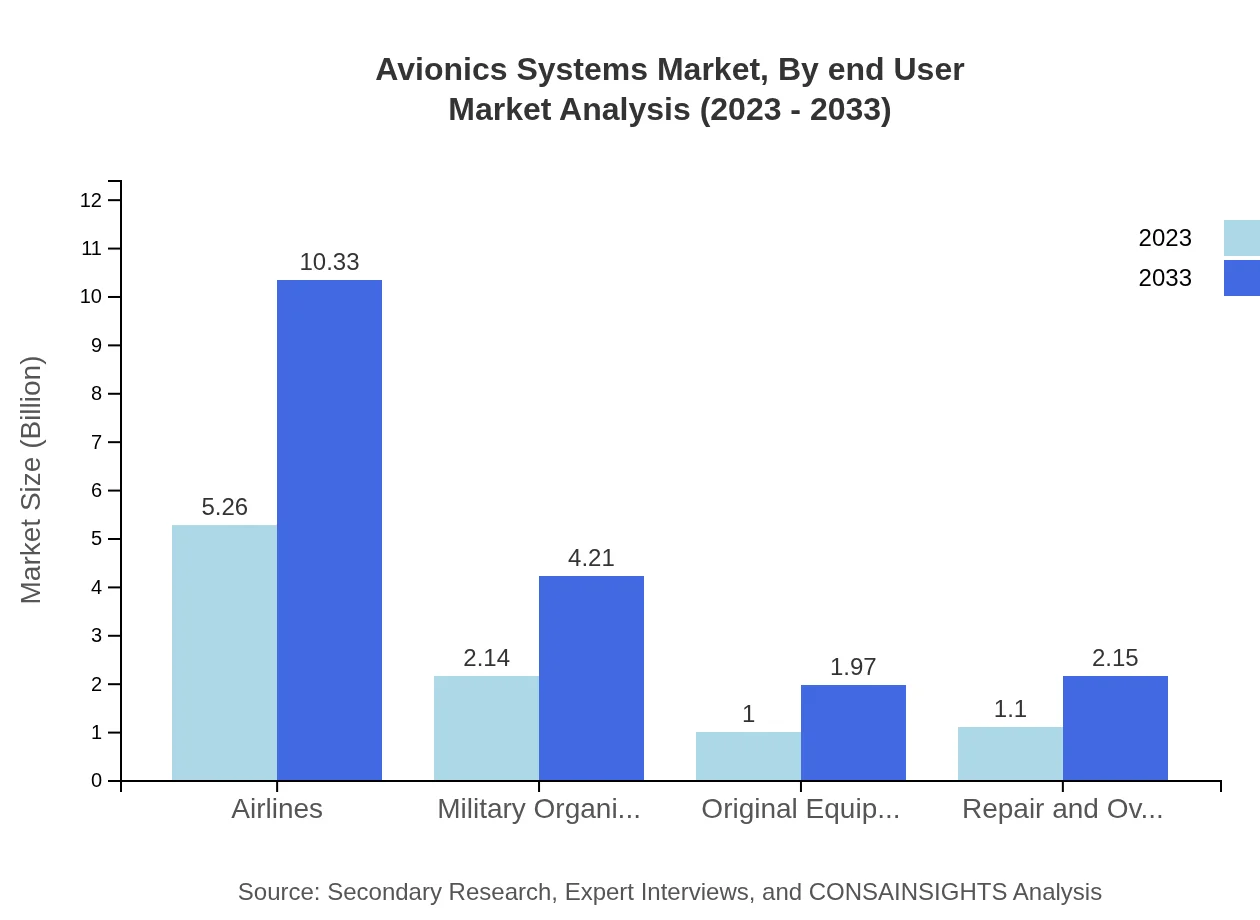

The commercial aviation segment continues to dominate the application area, forecasted to maintain a 55.32% market share by growing from $5.26 billion to $10.33 billion by 2033. Military applications are also significant, expanding from $2.14 billion to $4.21 billion, reflecting increased defense spending.

Avionics Systems Market Analysis By End User

End-users of avionics include airlines, military organizations, OEMs, and MRO service providers. While airlines account for most of the market with a 55.32% share, military organizations hold 22.57%, and OEMs represent 10.57% of the sector, each driving innovation and demand for advanced avionics.

Avionics Systems Market Analysis By Regulatory Compliance

Regulatory compliance is crucial in the avionics market, dictated by organizations like the FAA, EASA, and ICAO. The market size for FAA-compliant avionics is expected to rise to $11.76 billion by 2033 from $5.98 billion, highlighting the importance of meeting safety and operational standards.

Avionics Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Avionics Systems Industry

Honeywell International Inc.:

Honeywell is a leading aerospace manufacturer specializing in avionics, flight safety, and navigation systems. The company is recognized for its innovative solutions and extensive product portfolio catering to commercial and military aviation.Rockwell Collins (now part of Collins Aerospace):

Rockwell Collins has a rich history in providing advanced avionics systems, helping to improve safety and operational performance in both commercial and military aircraft. Their integrated cockpit solutions are particularly prominent in the market.Garmin Ltd.:

Garmin is renowned for its GPS technology and aviation products, building a reputation for reliability and cutting-edge technology. They focus on innovation in cockpit systems and integrated avionics.Thales Group:

Thales Group is a prominent player in the avionics market, providing advanced solutions in navigation and communication systems. Their focus on digital transformation and security solutions positions them as a market leader.BAE Systems:

BAE Systems is a key player in military avionics, providing advanced electronic systems and solutions for defense applications, playing a significant role in enhancing aviation safety and operational capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of avionics systems?

The global avionics systems market has a size of approximately $9.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8%, indicating robust growth and expansion through 2033.

What are the key market players or companies in the avionics systems industry?

Key players in the avionics systems market include major aerospace firms and technology providers such as Honeywell, Rockwell Collins, and Thales. These companies lead the innovation and development of avionics technologies that are shaping the industry.

What are the primary factors driving the growth in the avionics systems industry?

Several factors contribute to growth in the avionics systems market, including increasing global air traffic, advancements in technology such as digital avionics, and a rising demand for upgraded safety and navigation systems in both commercial and military aviation.

Which region is the fastest Growing in the avionics systems?

The fastest-growing region for avionics systems is North America, projected to increase from $3.35 billion in 2023 to $6.58 billion by 2033. This is driven by the high presence of aviation manufacturers and technology innovators.

Does ConsaInsights provide customized market report data for the avionics systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the avionics systems industry. This includes detailed insights, forecasts, and competitive analysis for stakeholders looking to navigate the market effectively.

What deliverables can I expect from this avionics systems market research project?

Deliverables from the avionics systems market research project typically include comprehensive reports, market forecasts, competitive landscape analysis, and actionable insights tailored to your organization's strategic goals.

What are the market trends of avionics systems?

Market trends in the avionics systems space include a shift towards automation, increased integration of AI technologies in navigation systems, and a growing emphasis on cybersecurity measures for aviation systems to ensure safety and reliability.