Biometric System Market Report

Published Date: 31 January 2026 | Report Code: biometric-system

Biometric System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Biometric System market from 2023 to 2033, covering market size, growth trends, industry analyses, segmentation, and regional insights. It aims to offer valuable forecasts and data to stakeholders in this rapidly evolving field.

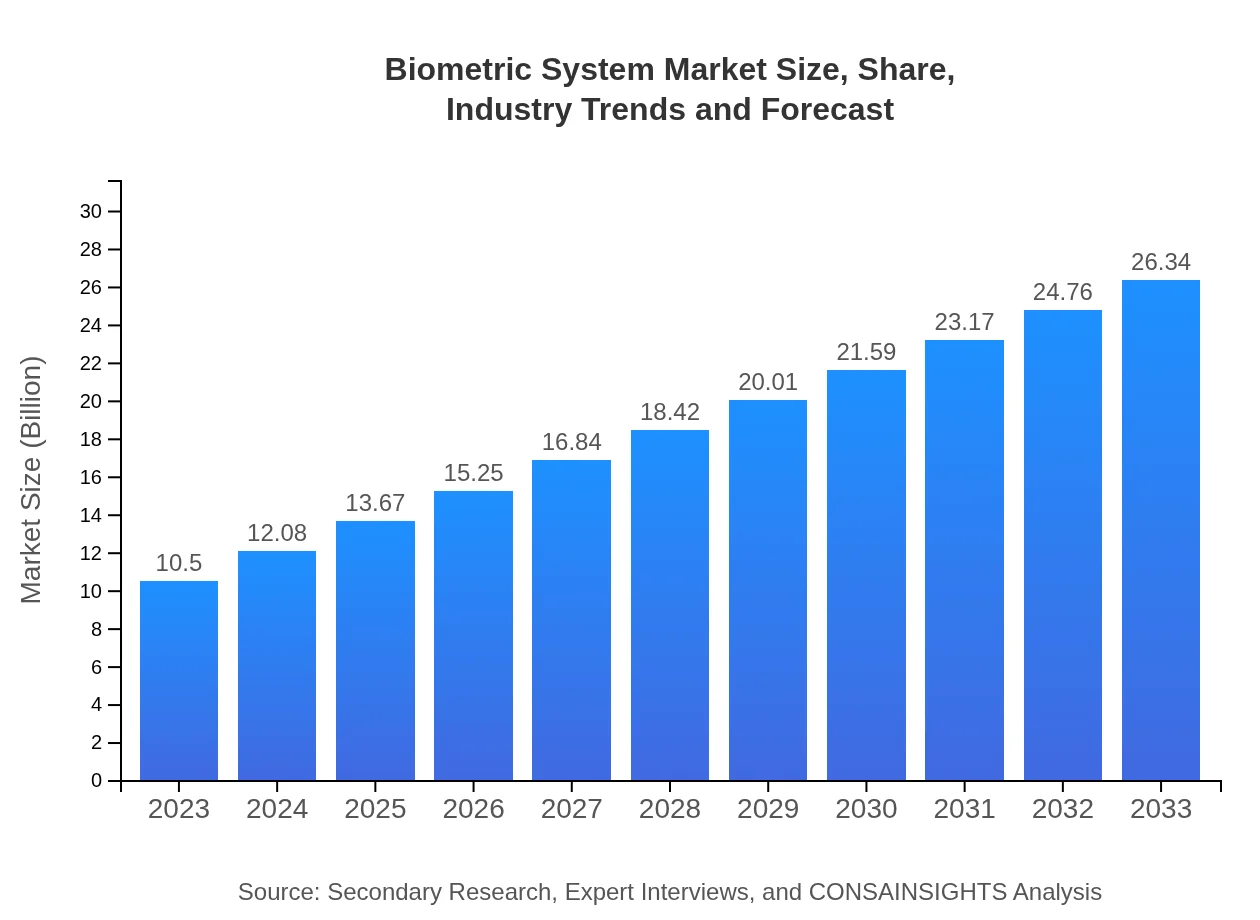

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 9.3% |

| 2033 Market Size | $26.34 Billion |

| Top Companies | Thales Group, Gemalto NV, FaceTec, NEC Corporation |

| Last Modified Date | 31 January 2026 |

Biometric System Market Overview

Customize Biometric System Market Report market research report

- ✔ Get in-depth analysis of Biometric System market size, growth, and forecasts.

- ✔ Understand Biometric System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biometric System

What is the Market Size & CAGR of Biometric System market in 2033?

Biometric System Industry Analysis

Biometric System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biometric System Market Analysis Report by Region

Europe Biometric System Market Report:

In Europe, the market is anticipated to rise from $3.33 billion in 2023 to $8.36 billion by 2033. The emphasis on data protection regulations such as GDPR is driving the adoption of biometric systems across various sectors, including government and private enterprises.Asia Pacific Biometric System Market Report:

In the Asia Pacific region, the Biometric System market is expected to grow from $1.86 billion in 2023 to $4.67 billion by 2033. This growth is driven by increased urbanization, rising security concerns, and government initiatives to enhance safety protocols. Countries like China and India are leading the adoption of biometric technologies.North America Biometric System Market Report:

North America stands as a leader, with the market expected to grow from $3.98 billion in 2023 to $9.99 billion by 2033. The region's focus on smart technologies and stringent regulatory frameworks underscore the demand for advanced biometric systems, especially in sectors like banking and healthcare.South America Biometric System Market Report:

The Biometric System market in South America is projected to expand from $0.46 billion in 2023 to $1.14 billion in 2033. Increasing internet penetration and smartphone usage are key factors facilitating growth, alongside rising investments in security infrastructure.Middle East & Africa Biometric System Market Report:

The Biometric System market in the Middle East and Africa will increase from $0.87 billion in 2023 to $2.18 billion by 2033, driven by growing investments in security and public safety across countries in this region.Tell us your focus area and get a customized research report.

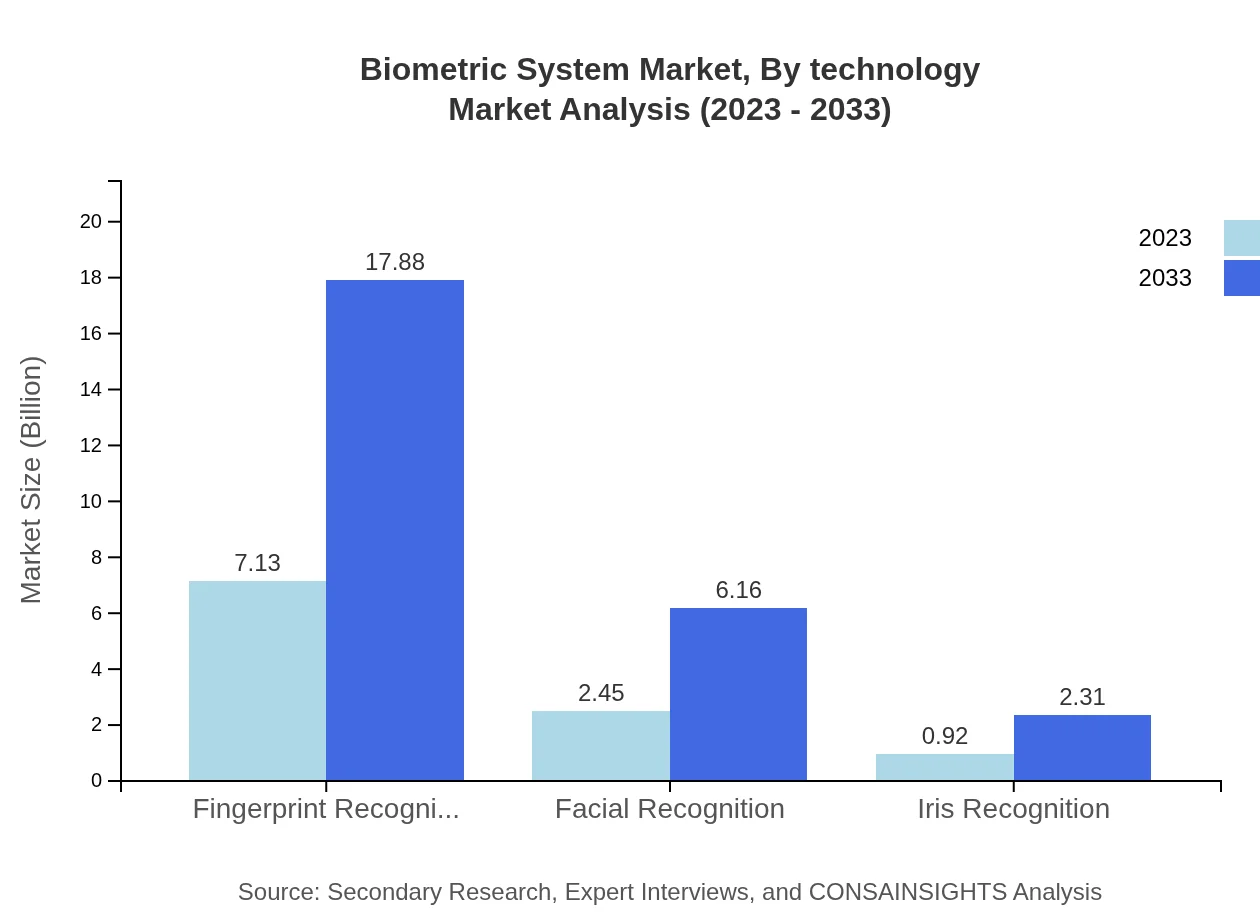

Biometric System Market Analysis By Technology

The technology segment is pivotal in defining market performance. Fingerprint recognition dominates with an expected size growth from $7.13 billion in 2023 to $17.88 billion by 2033, making up 67.86% of the market share. Facial recognition follows, projected to grow from $2.45 billion to $6.16 billion, capturing 23.37% share, while iris recognition, although smaller, grows from $0.92 billion to $2.31 billion, contributing significantly to overall trends.

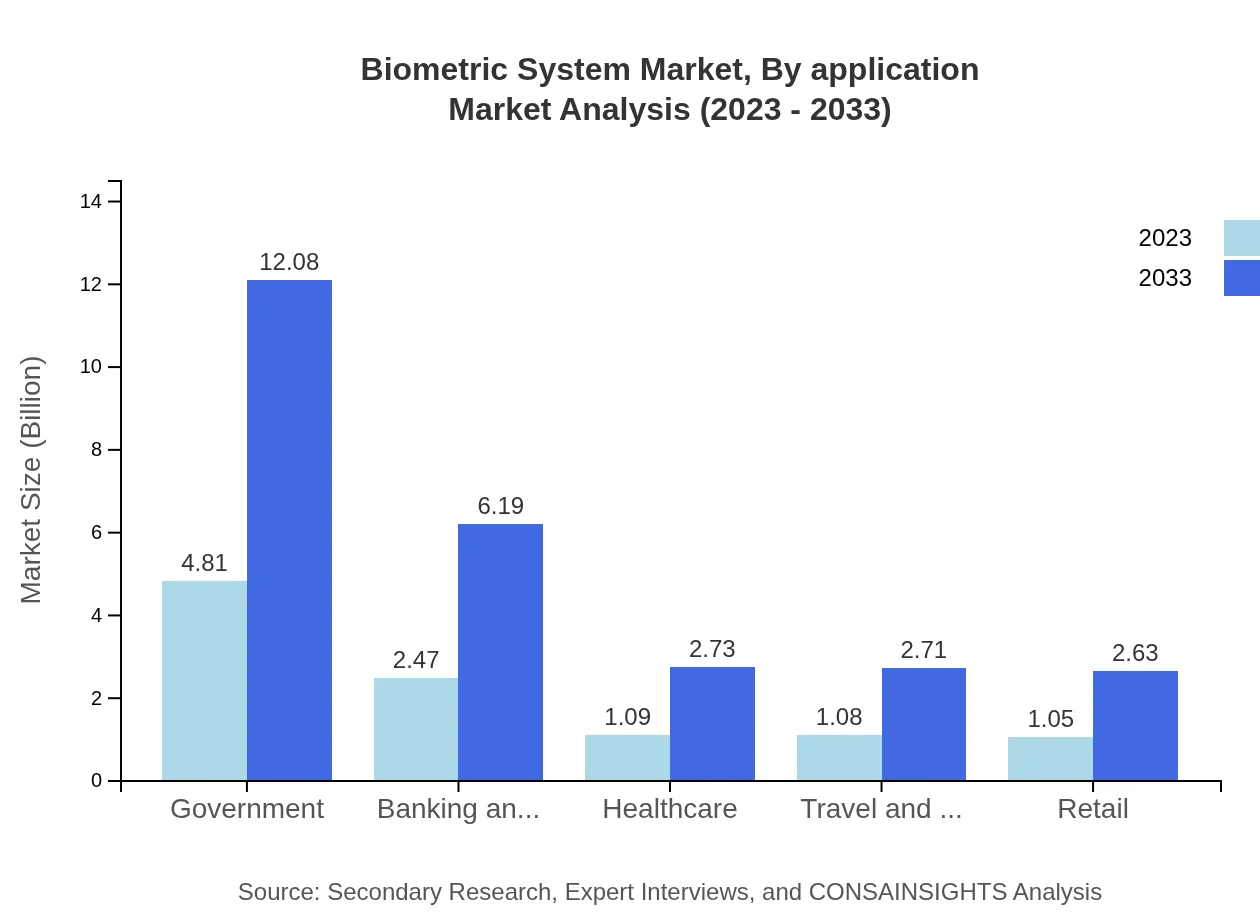

Biometric System Market Analysis By Application

Key applications include government agencies, which will expand from $4.81 billion in 2023 to $12.08 billion by 2033, holding 45.84% share. Banking and financial institutions follow with a growth from $2.47 billion to $6.19 billion, while healthcare facilities and retail sectors also demonstrate potential for growth within the industry.

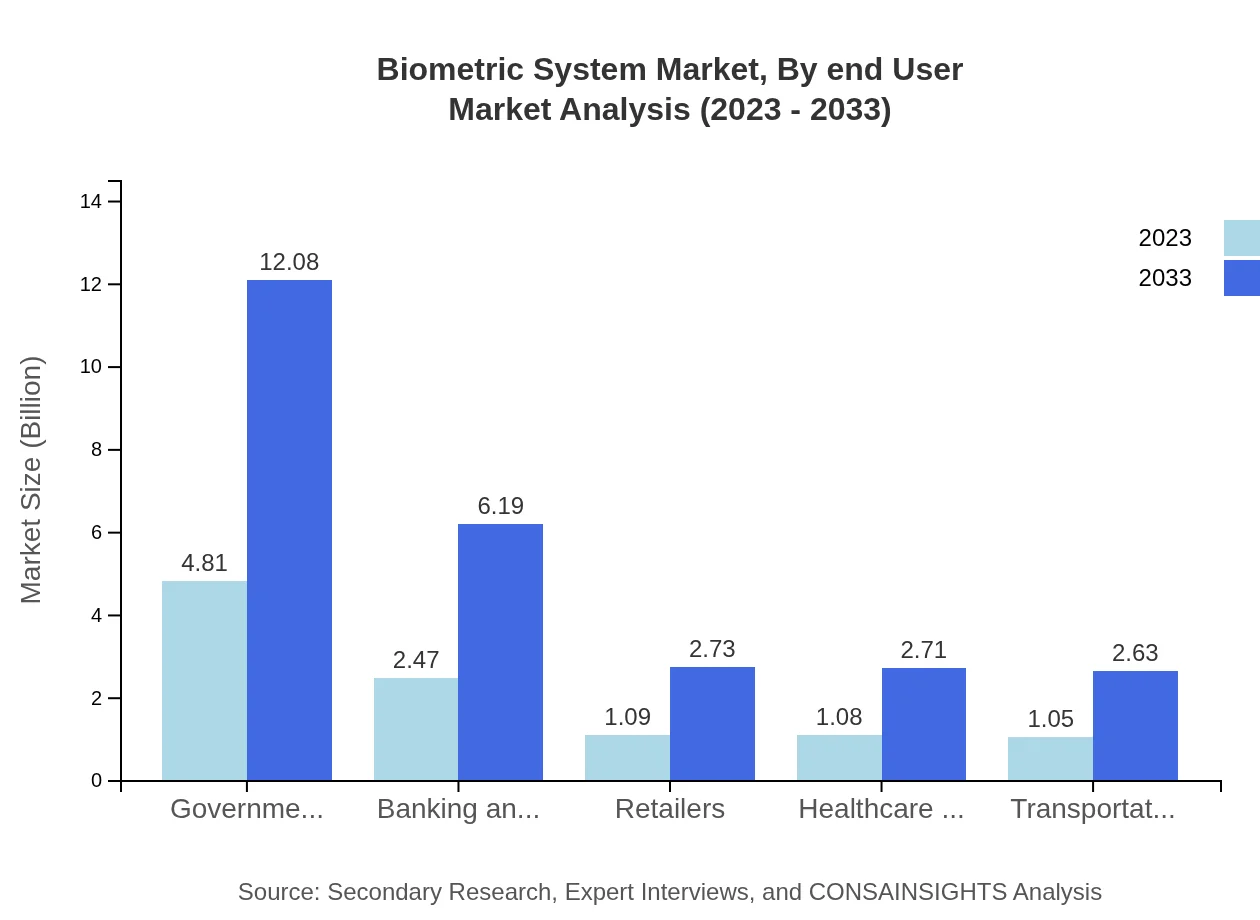

Biometric System Market Analysis By End User

The government sector remains the leading end-user, with a projected size increase from $4.81 billion to $12.08 billion (45.84% market share). Banking and financial services maintain significant traction, particularly given the rising trends in mobile banking and online fraud prevention. Healthcare and retail also present substantial growth opportunities due to increasing security demands.

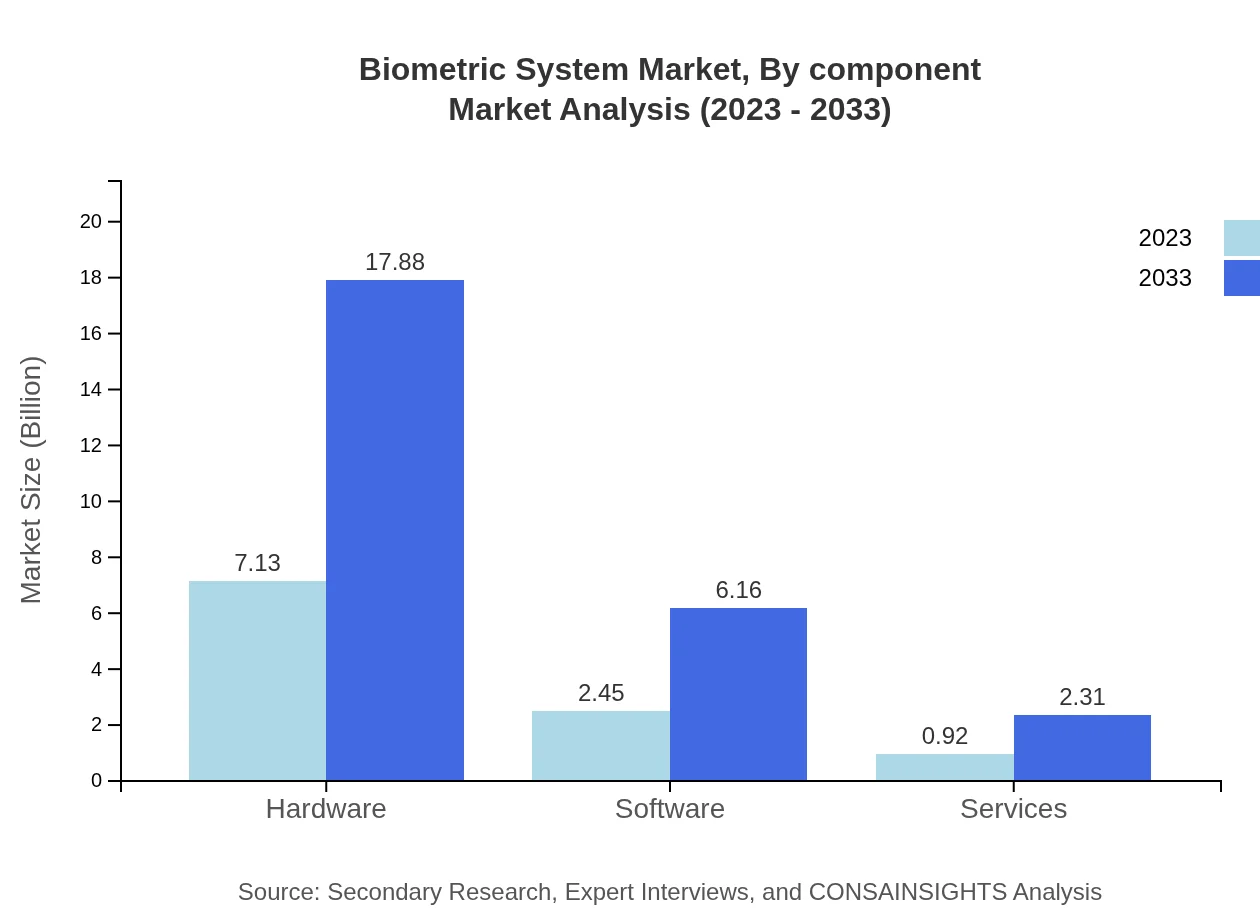

Biometric System Market Analysis By Component

The component breakdown illustrates that hardware currently leads the segment with a market size from $7.13 billion to $17.88 billion by 2033 (67.86% share). Software and services represent vital support systems, accounting for 23.37% and 8.77%, respectively, highlighting the growing importance of integrated solutions in the biometric landscape.

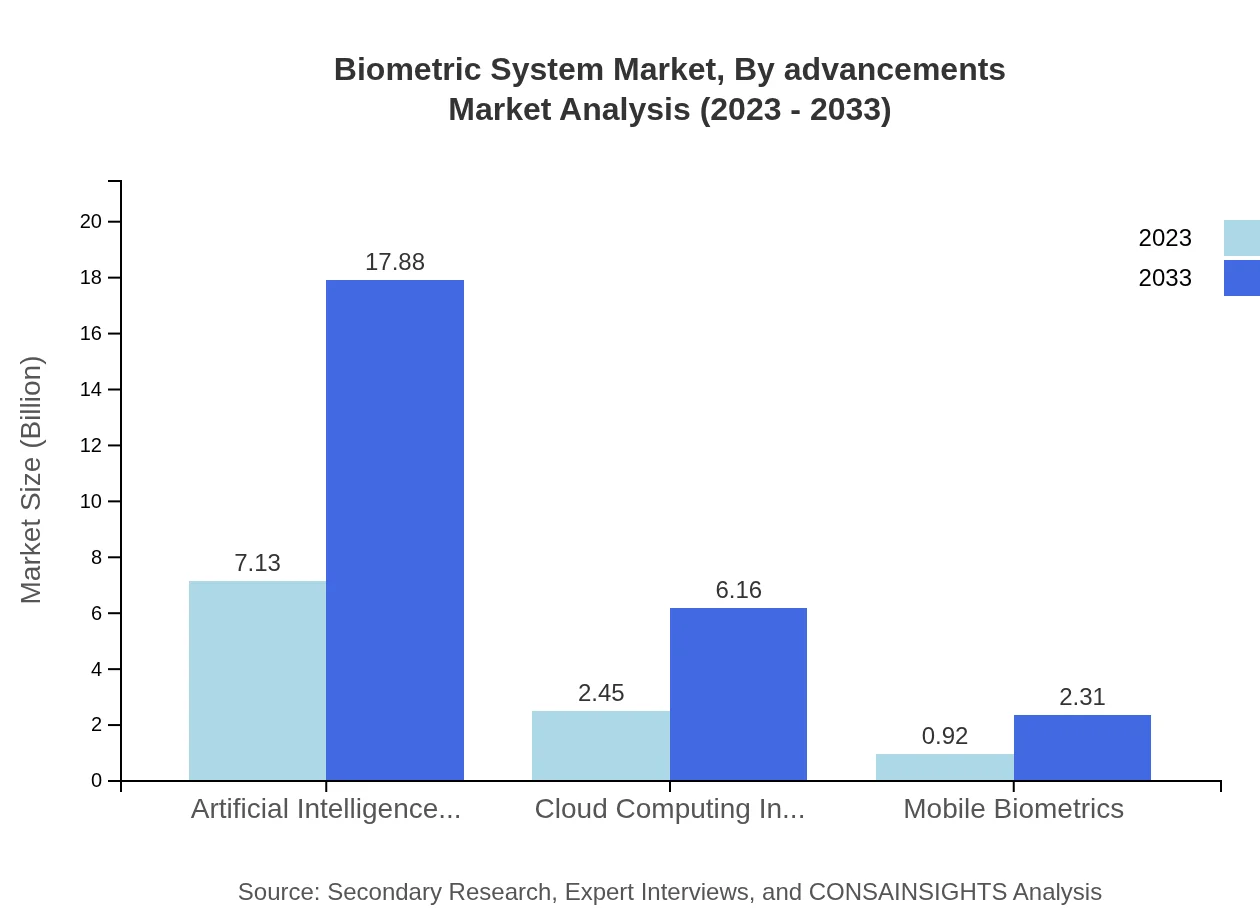

Biometric System Market Analysis By Advancements

Advancements like artificial intelligence integration significantly enhance biometric systems, expected to grow from $7.13 billion to $17.88 billion by 2033, asserting a 67.86% market share. Cloud computing integration is also notable, expected growth from $2.45 billion to $6.16 billion emphasizes the trend toward remote and scalable solutions in the biometric market.

Biometric System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biometric System Industry

Thales Group:

A key player in biometric solutions providing innovative security technologies across various sectors. Thales is known for its reliable identification systems and robust cybersecurity solutions.Gemalto NV:

Specializes in digital security and biometric technologies, helping organizations secure identities while enhancing user experiences through intelligent biometrics.FaceTec:

Recognized for its advanced facial recognition technology, FaceTec offers secure 3D authentication solutions that meet both usability and security needs for various industries.NEC Corporation:

Utilizes AI and advanced biometric recognition systems to deliver high-security solutions for government, enterprise, and social sectors, making it a front runner in the industry.We're grateful to work with incredible clients.

FAQs

What is the market size of biometric System?

The biometric system market is valued at approximately $10.5 billion in 2023, with a compound annual growth rate (CAGR) of 9.3%. Projections indicate robust growth leading to a significantly larger market by 2033.

What are the key market players or companies in this biometric systems industry?

Key players in the biometric system industry include prominent technology companies and specialized biometric firms, which are continuously innovating to enhance security solutions and expand their market share in this rapidly growing field.

What are the primary factors driving the growth in the biometric system industry?

Factors such as increasing security threats, technological advancements in biometric recognition technologies, and a growing demand for secure authentication methods are major drivers propelling the growth of the biometric system market.

Which region is the fastest Growing in the biometric system market?

The Asia-Pacific region is the fastest-growing market, with a market size projected to grow from $1.86 billion in 2023 to $4.67 billion by 2033, reflecting a significant increase in adoption and investment in biometric solutions.

Does Consainsights provide customized market report data for the biometric system industry?

Yes, Consainsights offers tailored market research reports in the biometric system industry, enabling businesses to access data that aligns with their specific needs and provides insights into niche segments and regional markets.

What deliverables can I expect from this biometric system market research project?

Deliverables from this market research project include comprehensive market analysis reports, forecasts, competitive landscape assessments, and strategic recommendations tailored to your organization’s goals and market positioning.

What are the market trends of biometric system?

Current trends in the biometric system market include the integration of artificial intelligence for enhanced authentication, increasing mobile biometric applications, and rising adoption in sectors such as healthcare and finance for improved security.