Certificate Authority Market Report

Published Date: 31 January 2026 | Report Code: certificate-authority

Certificate Authority Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Certificate Authority market, including market size, trends, regional insights, and forecasts from 2023 to 2033.

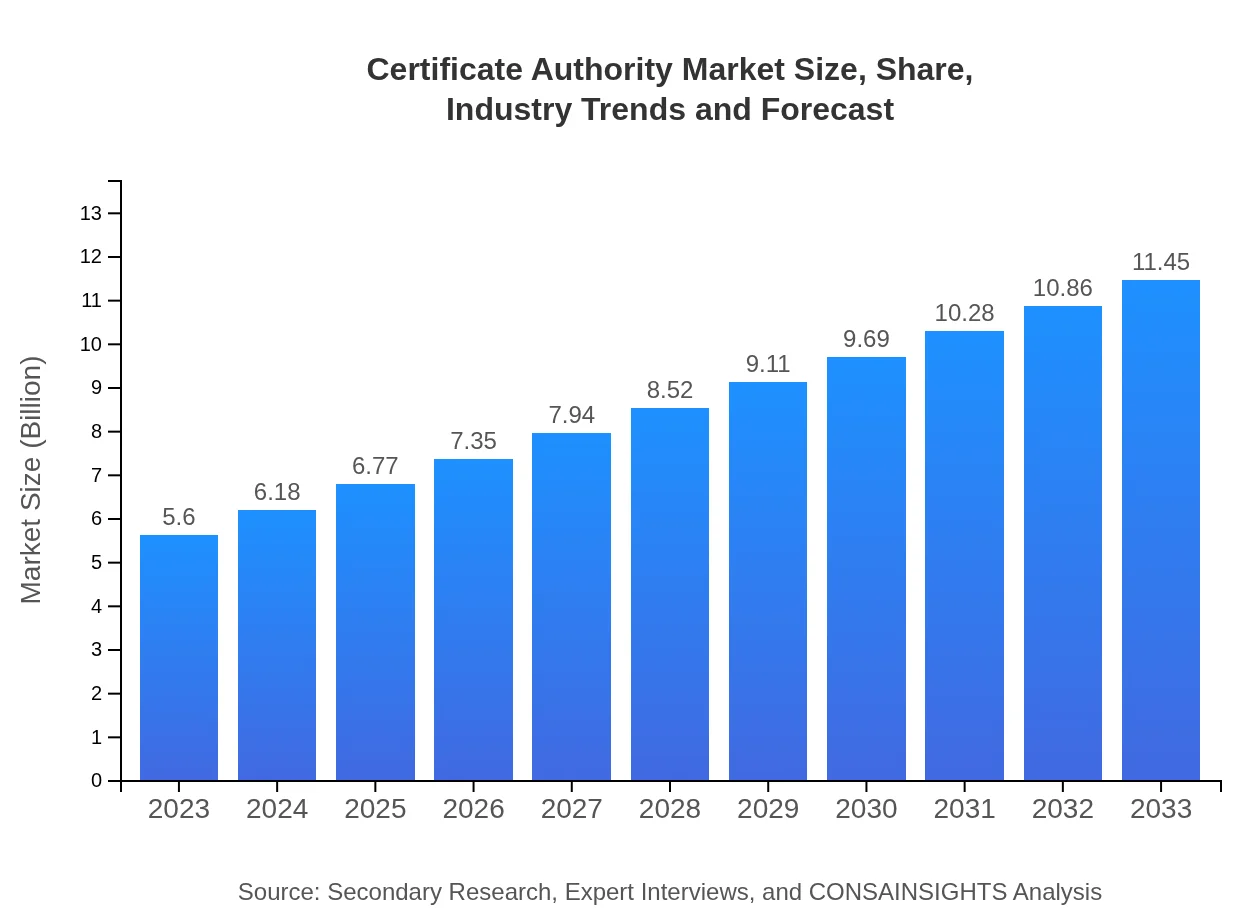

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | DigiCert, GlobalSign, Entrust, GoDaddy |

| Last Modified Date | 31 January 2026 |

Certificate Authority Market Overview

Customize Certificate Authority Market Report market research report

- ✔ Get in-depth analysis of Certificate Authority market size, growth, and forecasts.

- ✔ Understand Certificate Authority's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Certificate Authority

What is the Market Size & CAGR of Certificate Authority market in 2023?

Certificate Authority Industry Analysis

Certificate Authority Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Certificate Authority Market Analysis Report by Region

Europe Certificate Authority Market Report:

The European market is anticipated to increase from $1.48 billion in 2023 to $3.03 billion by 2033. The enforcement of GDPR and other data protection regulations is driving the adoption of trusted CA services among businesses, catalyzing market growth.Asia Pacific Certificate Authority Market Report:

The Asia-Pacific region is expected to witness significant growth, from $1.11 billion in 2023 to $2.28 billion in 2033. The expanding digital economy and rising cybersecurity threats are driving investments in CA services, as businesses seek to enhance their security posture against increasing online risks.North America Certificate Authority Market Report:

North America remains the largest market for Certificate Authorities, with growth projected from $1.94 billion in 2023 to $3.96 billion in 2033. High levels of digital adoption in the region, coupled with stringent regulatory frameworks, are catalyzing demand.South America Certificate Authority Market Report:

In South America, the market is projected to grow from $0.43 billion in 2023 to $0.89 billion by 2033. The growing adoption of digital payment systems and the need for secure online transactions are key factors contributing to the market's expansion in this region.Middle East & Africa Certificate Authority Market Report:

The Middle East and Africa market is set to grow from $0.63 billion in 2023 to $1.29 billion in 2033, fueled by increasing investments in cybersecurity infrastructure and the growing need for secure digital environments.Tell us your focus area and get a customized research report.

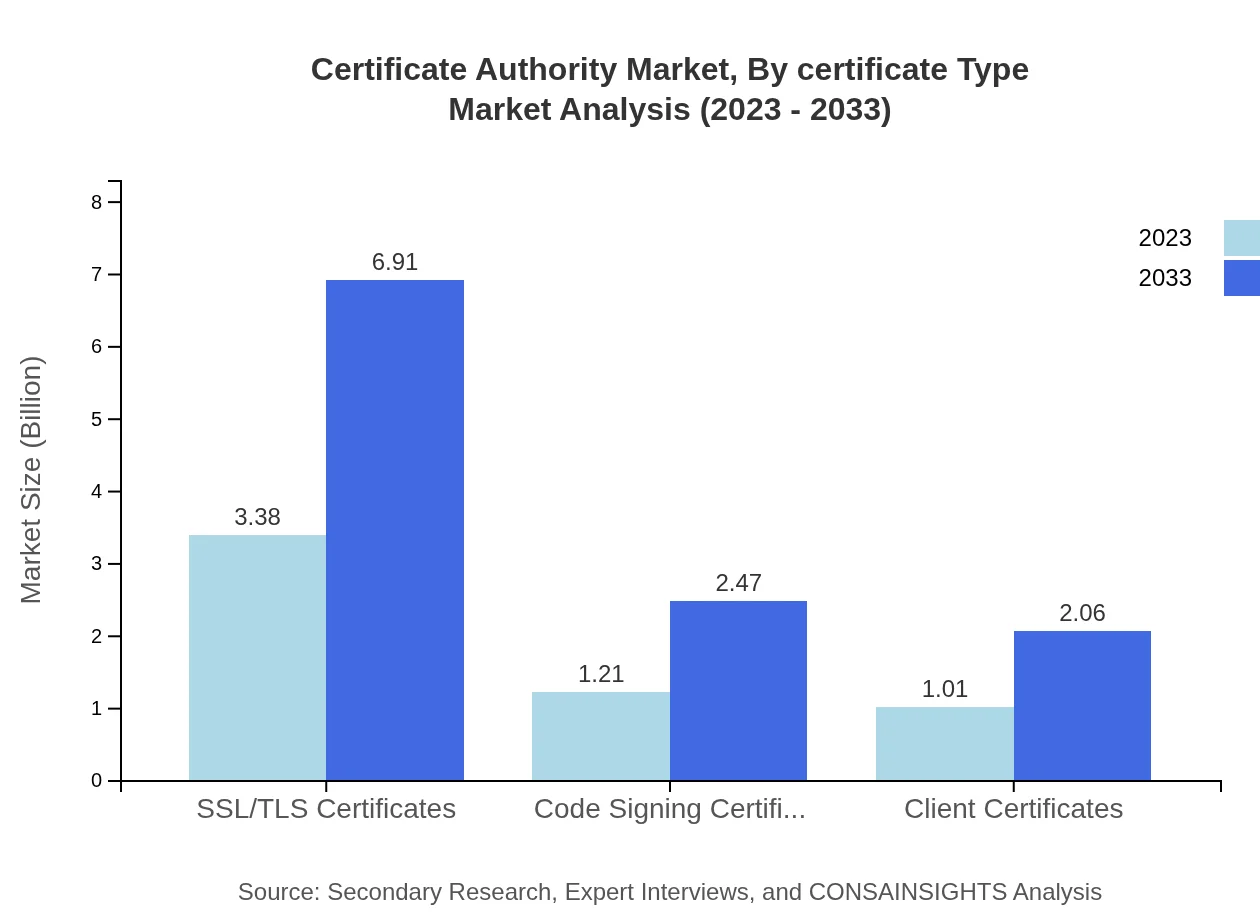

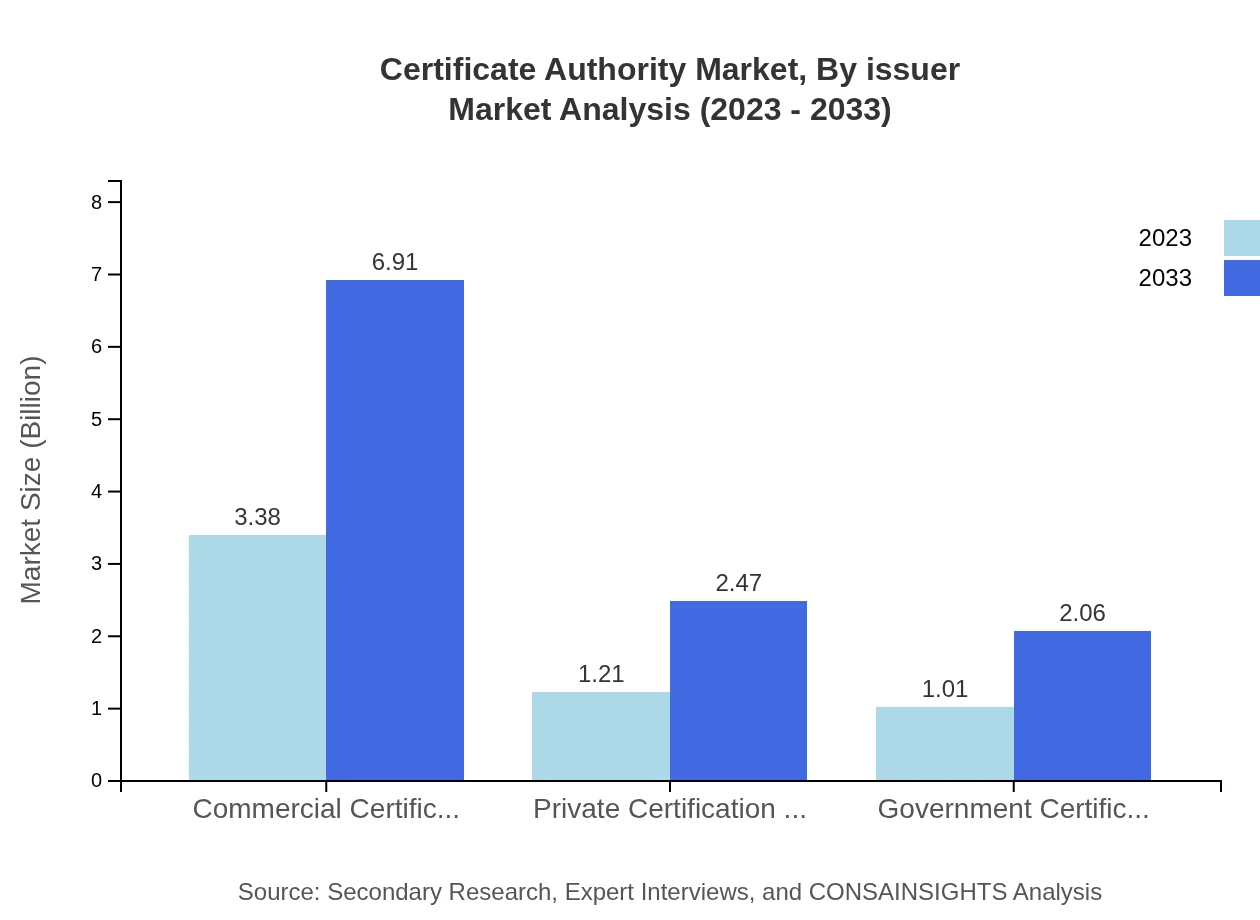

Certificate Authority Market Analysis By Certificate Type

In 2023, the Commercial Certification Authorities segment accounts for a significant share, valued at $3.38 billion and expected to reach $6.91 billion by 2033. The Private Certification Authorities segment is projected to grow from $1.21 billion to $2.47 billion, while Government Certification Authorities are forecasted to increase from $1.01 billion to $2.06 billion. SSL/TLS certificates dominate with a 60.36% market share, highlighting their critical role in web security.

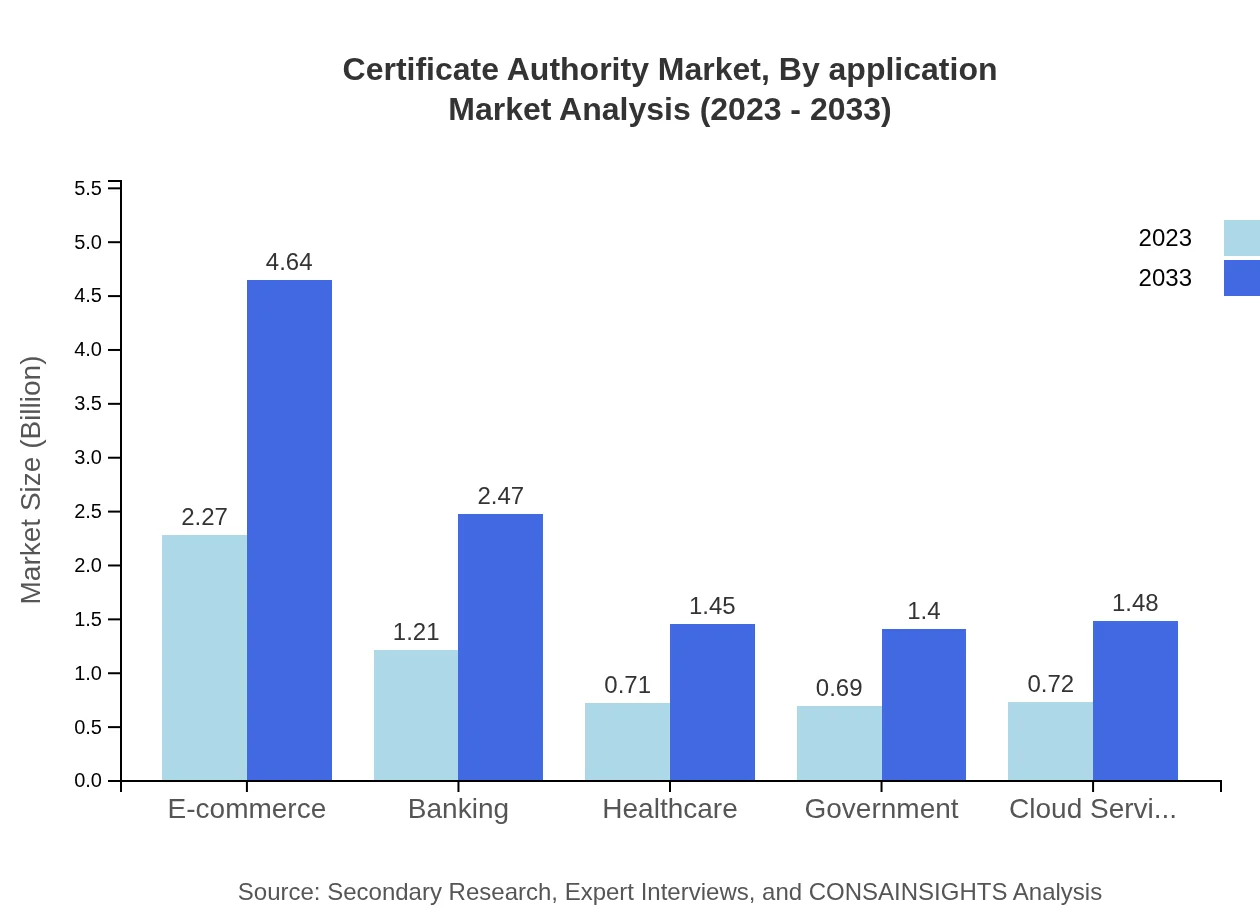

Certificate Authority Market Analysis By Application

The healthcare and e-commerce sectors are prominent application areas, with the healthcare segment valued at $2.27 billion in 2023 and expected to touch $4.64 billion by 2033, driven by strict compliance requirements. Similarly, the e-commerce segment accounts for $2.27 billion in 2023 and projects a significant growth, aligning with the digital transformation trends.

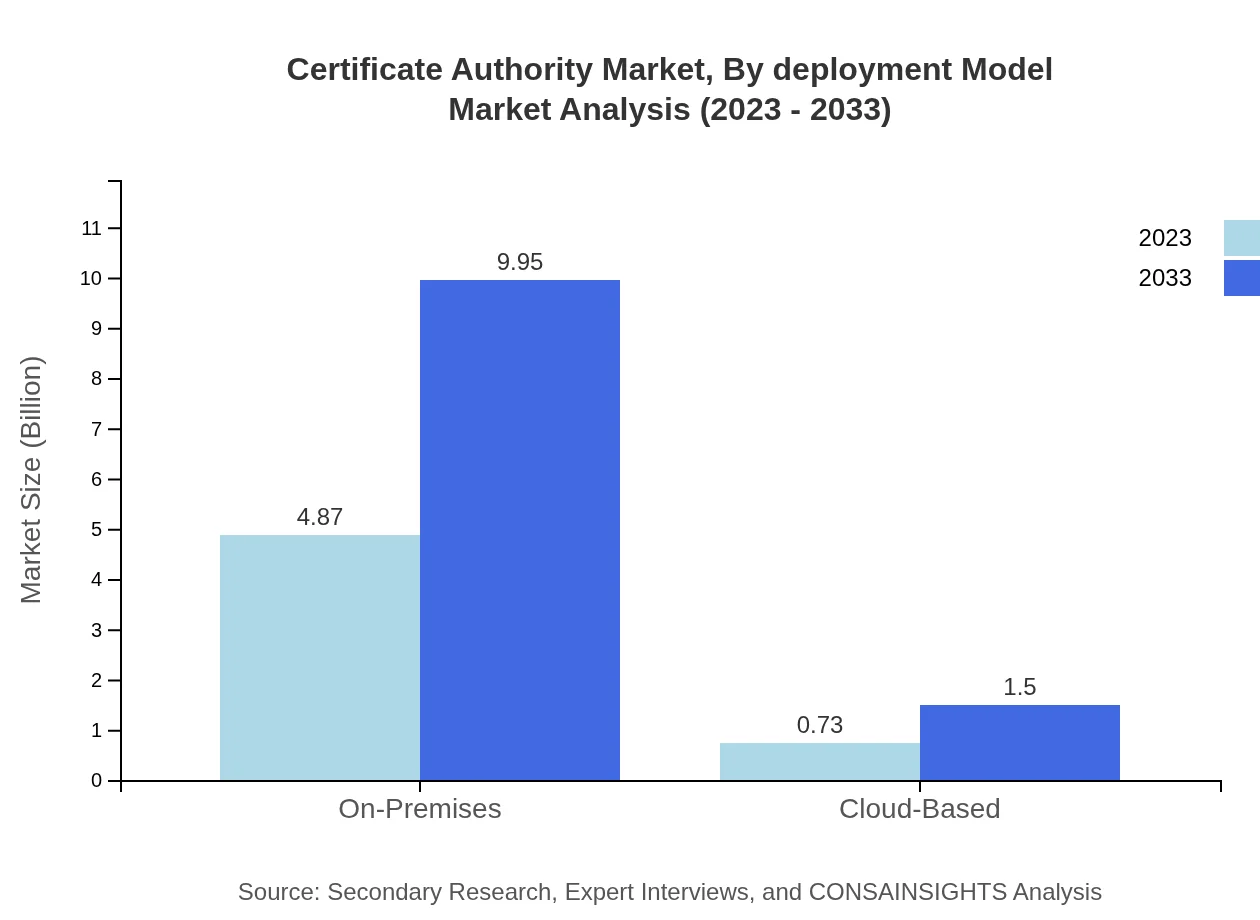

Certificate Authority Market Analysis By Deployment Model

The deployment model is split between On-Premises and Cloud-Based solutions. In 2023, the market size for On-Premises CA services stands at $4.87 billion, while Cloud-Based solutions account for $0.73 billion. Forecasts indicate On-Premises will grow to $9.95 billion and Cloud-Based to $1.50 billion by 2033, reflecting a robust shift towards cloud solutions.

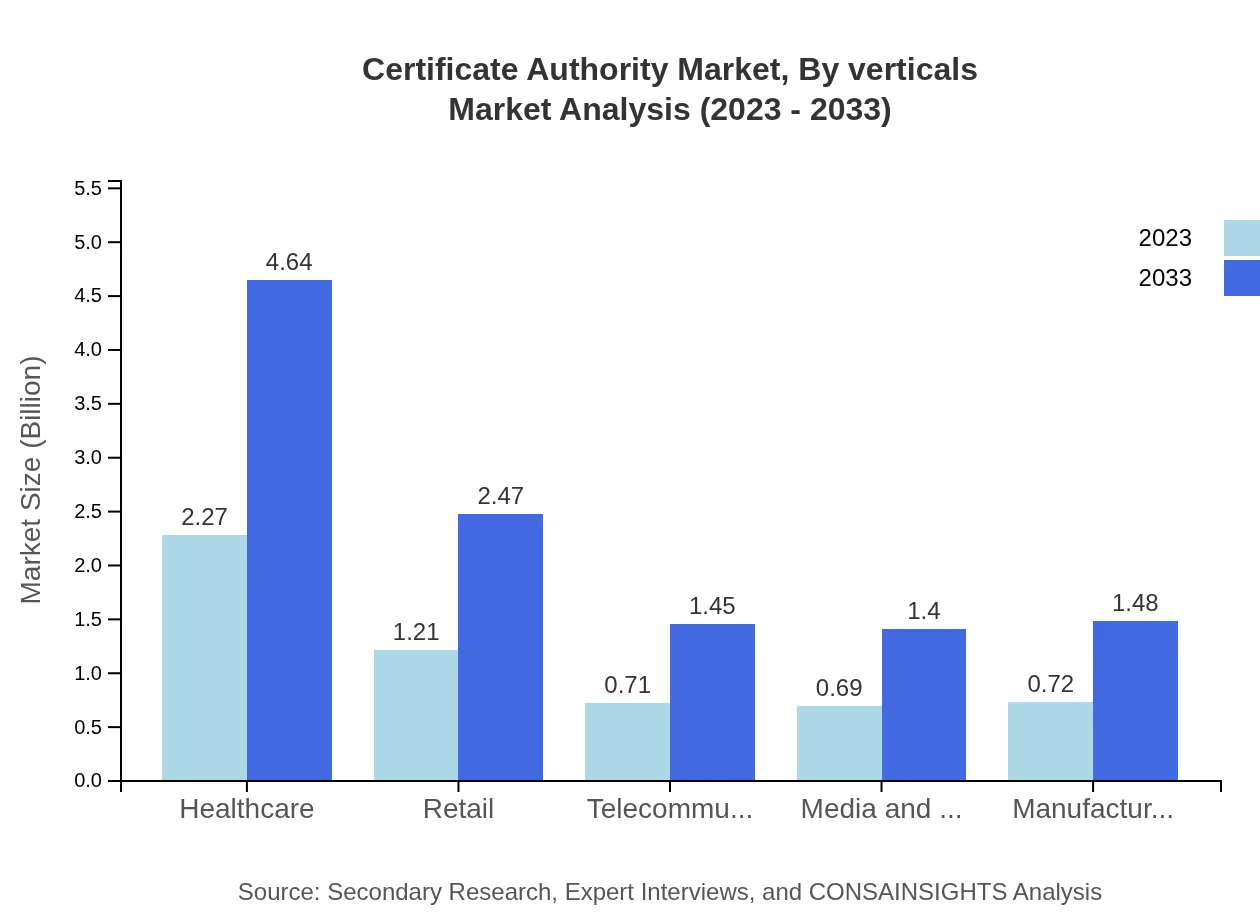

Certificate Authority Market Analysis By Verticals

Various industry verticals are increasingly adopting Certificate Authorities. The telecommunications segment, for instance, is valued at $0.71 billion in 2023, projecting to reach $1.45 billion by 2033. Meanwhile, sectors like media and entertainment, banking, and retail are similarly engaging CA services to enhance security protocols and protect consumer data.

Certificate Authority Market Analysis By Issuer

The segment by issuer is split across Commercial, Private, and Government CAs. Commercial CAs not only hold the largest market share but also see steady growth from $3.38 billion in 2023 to $6.91 billion in 2033. Private and Government CAs also continue to expand in alignment with increased digital security needs.

Certificate Authority Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Certificate Authority Industry

DigiCert:

A leading provider of TLS/SSL certificates and PKI solutions, DigiCert is known for its extensive portfolio of identity and security products.GlobalSign:

GlobalSign offers a broad range of security services including SSL certificates and identity management solutions, catering predominantly to enterprise-level clients.Entrust:

Entrust specializes in identity and secure transaction solutions, providing a wide array of digital certificates to enhance online security across various sectors.GoDaddy:

Known primarily as a domain registrar, GoDaddy also provides trusted SSL certificates aimed at small businesses to secure their sites.We're grateful to work with incredible clients.

FAQs

What is the market size of certificate authority?

The global certificate authority market is projected to grow from USD 5.6 billion in 2023 to a significant value by 2033, with a CAGR of 7.2% during the forecast period, driven by increasing cybersecurity concerns and digital transformation.

What are the key market players or companies in this certificate authority industry?

Key players in the certificate authority industry include companies like DigiCert, GlobalSign, Entrust, Comodo, and SIgNify, which significantly influence market trends through innovation and competitive service offerings.

What are the primary factors driving the growth in the certificate authority industry?

Growth in the certificate authority industry is driven by factors such as rising cybersecurity threats, increased adoption of SSL certificates, regulatory compliance requirements, and the growing need for secure online transactions and communications.

Which region is the fastest Growing in the certificate authority?

The region witnessing the fastest growth in the certificate authority market is North America, expanding from USD 1.94 billion in 2023 to USD 3.96 billion in 2033, followed closely by Europe and Asia Pacific.

Does ConsaInsights provide customized market report data for the certificate authority industry?

Yes, ConsaInsights offers customized market report data tailored to the certificate authority industry, helping clients gain precise insights based on specific requirements and market dynamics.

What deliverables can I expect from this certificate authority market research project?

Expect comprehensive deliverables, including market size analysis, growth projections, segment breakdown, competitive landscape, and strategic recommendations tailored to the certificate authority industry.

What are the market trends of certificate authority?

Key trends in the certificate authority market include the shift towards cloud-based solutions, increased adoption of automated certificate management systems, and rising demand for IoT security solutions.