Cockpit Electronics Market Report

Published Date: 02 February 2026 | Report Code: cockpit-electronics

Cockpit Electronics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Cockpit Electronics market from 2023 to 2033, presenting valuable insights into market size, trends, and forecasts. It explores regions, segments, technology advancements, and key players shaping the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

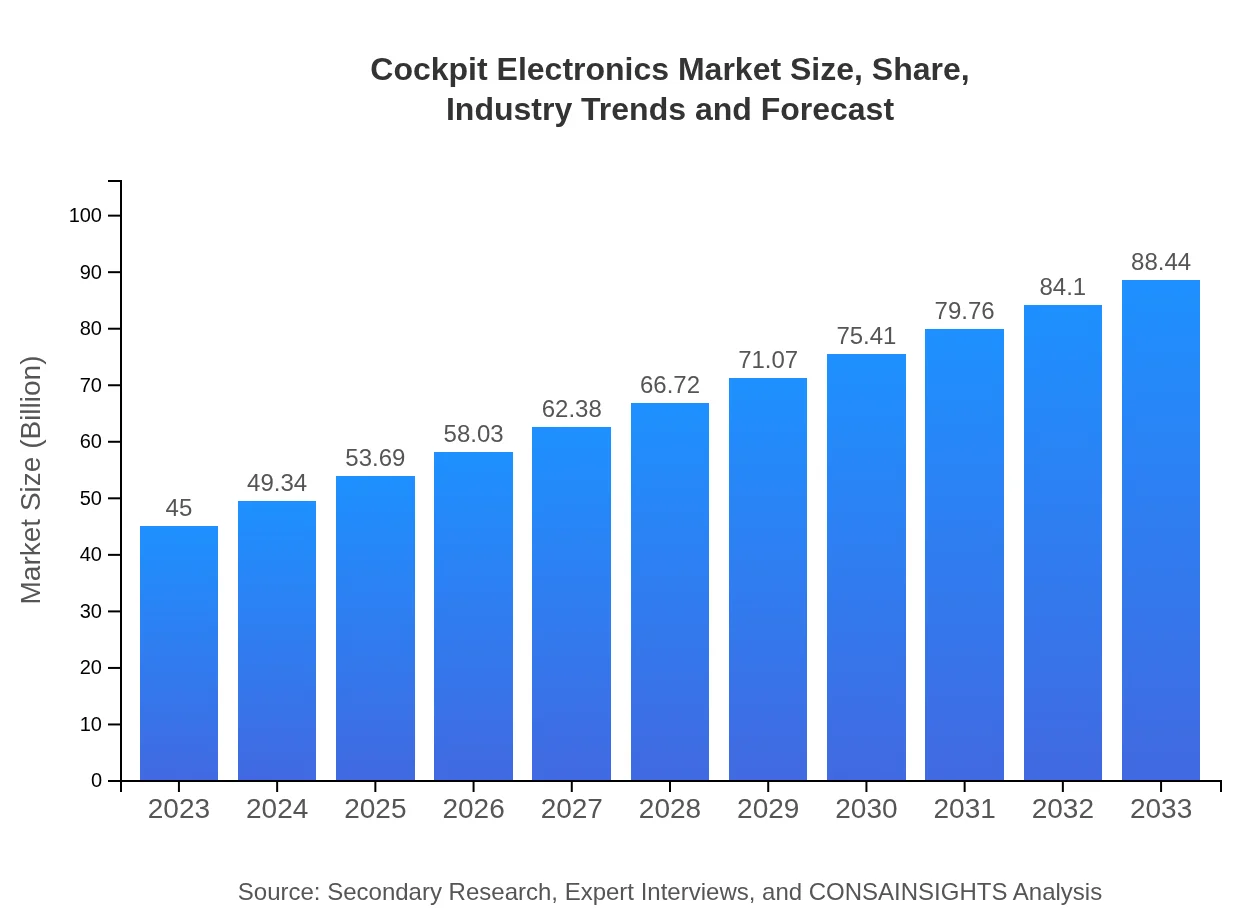

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $88.44 Billion |

| Top Companies | Bosch, Continental AG, Denso Corporation, Harman International, Valeo |

| Last Modified Date | 02 February 2026 |

Cockpit Electronics Market Overview

Customize Cockpit Electronics Market Report market research report

- ✔ Get in-depth analysis of Cockpit Electronics market size, growth, and forecasts.

- ✔ Understand Cockpit Electronics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cockpit Electronics

What is the Market Size & CAGR of Cockpit Electronics market in 2023?

Cockpit Electronics Industry Analysis

Cockpit Electronics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cockpit Electronics Market Analysis Report by Region

Europe Cockpit Electronics Market Report:

Europe, with a market size growth from $14.09 billion in 2023 to $27.70 billion in 2033, is keenly focused on smart and autonomous driving technologies. Stringent regulations regarding vehicle safety and efficiency are pushing OEMs to innovate, making this region a crucial market for cockpit electronics.Asia Pacific Cockpit Electronics Market Report:

The Asia Pacific region is projected to witness significant growth, with a market size of $16.42 billion expected by 2033, up from $8.36 billion in 2023. Leading automotive manufacturing countries like China, Japan, and South Korea are driving innovations and demand for advanced cockpit electronics as they ramp up production of EVs, affecting the overall growth trajectory positively.North America Cockpit Electronics Market Report:

North America leads the market size with an estimated value of $32.56 billion by 2033, up from $16.56 billion in 2023. The US automotive market’s focus on integrating advanced driver assistance systems and enhancing user experience through high-tech cockpit features drives this growth extensively.South America Cockpit Electronics Market Report:

In South America, the cockpit electronics market is expected to grow from $0.81 billion in 2023 to $1.59 billion by 2033. An increase in vehicle production and rising consumer disposable income in key markets such as Brazil and Argentina are expected to contribute positively to the growth of the market in this region.Middle East & Africa Cockpit Electronics Market Report:

The Middle East and Africa region is also set for growth, with the market expanding from $5.17 billion in 2023 to $10.17 billion by 2033. Increased investments in infrastructure and a growing automotive sector, particularly in the UAE and South Africa, are key contributors to this anticipated growth.Tell us your focus area and get a customized research report.

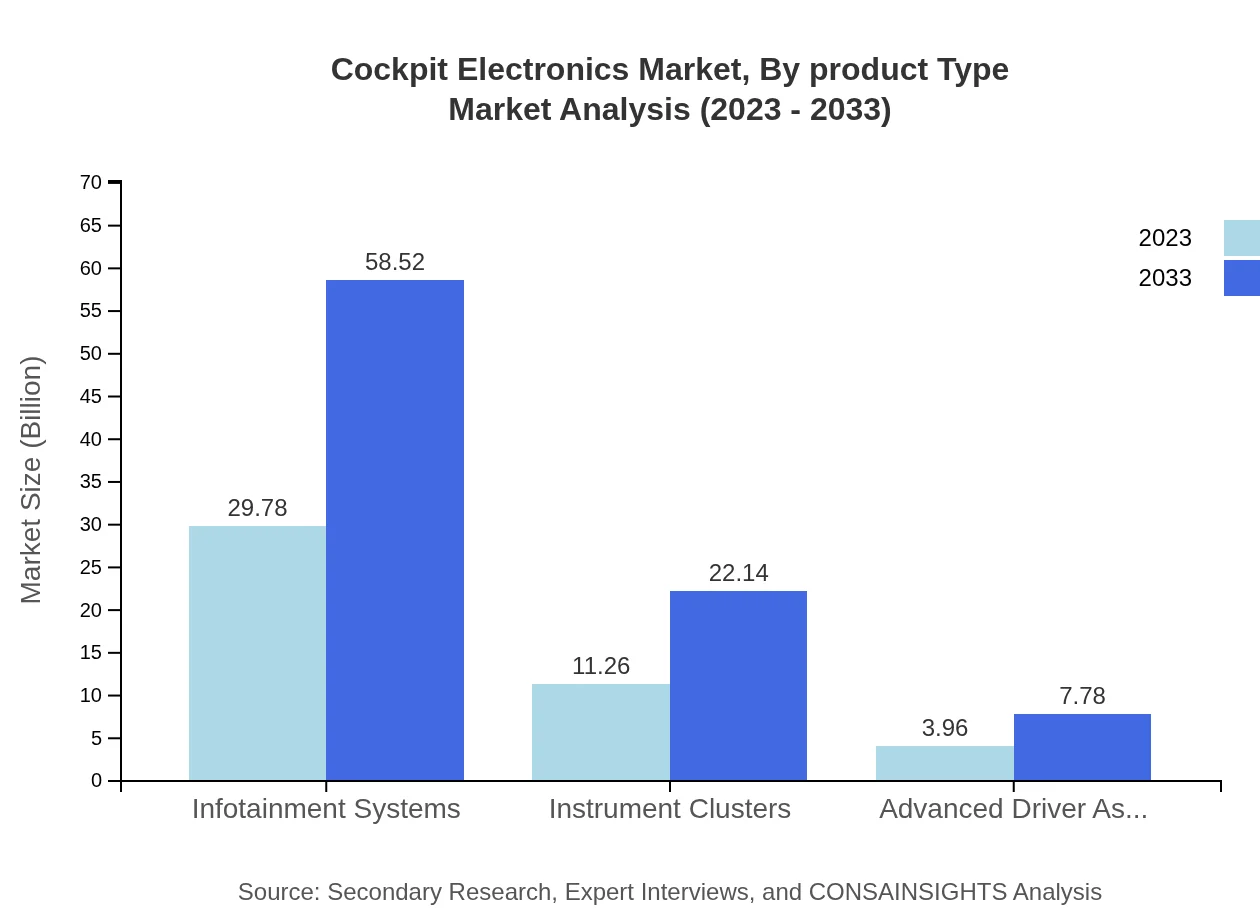

Cockpit Electronics Market Analysis By Product Type

The cockpit electronics market by product type indicates significant performance by infotainment systems, anticipated to grow from $29.78 billion in 2023 to $58.52 billion by 2033. Instrument clusters and advanced driver assistance systems also mark substantial market sizes of $11.26 billion, highlighting their importance in modern automotive design. The demand for these products stems from a consumer inclination towards enhanced interactivity and safety features in vehicles.

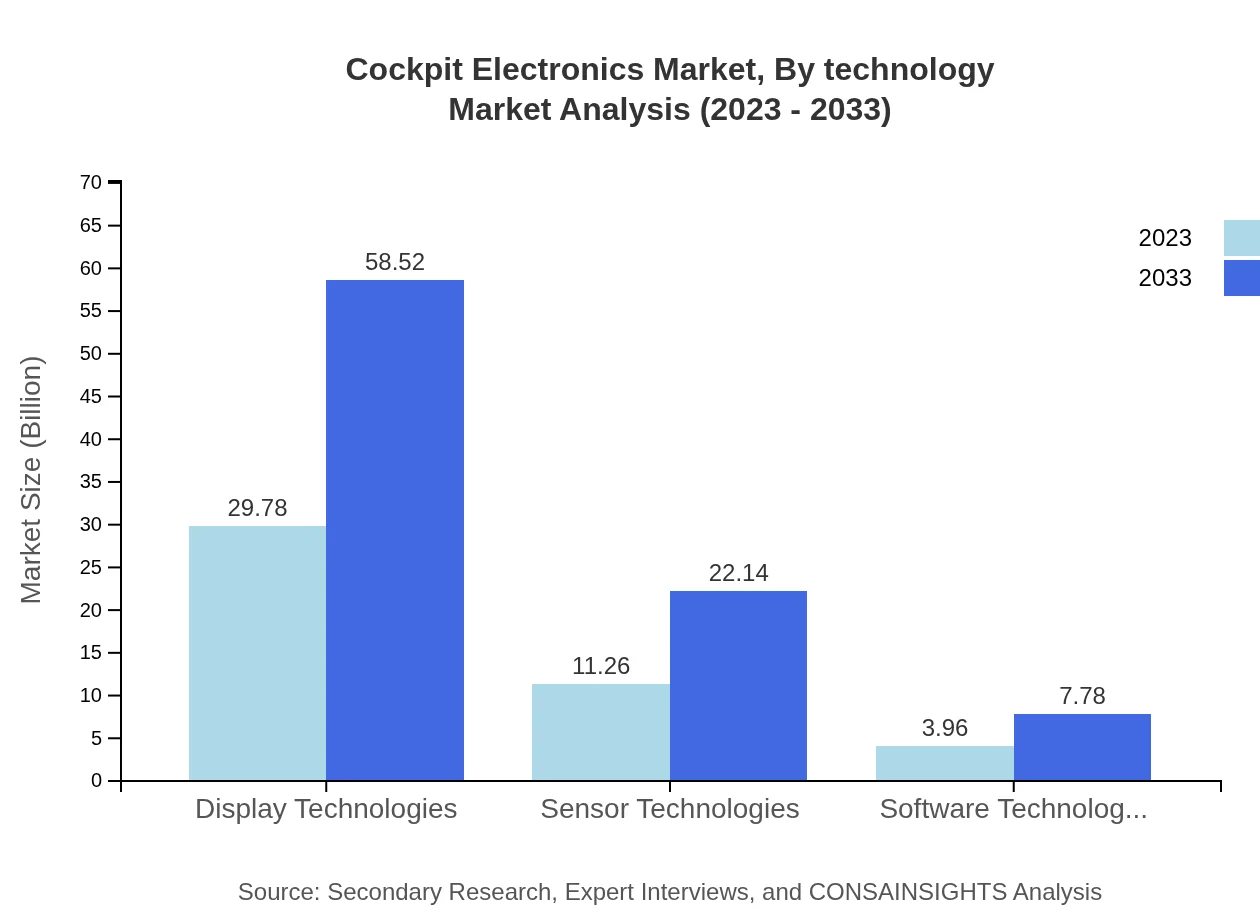

Cockpit Electronics Market Analysis By Technology

Technology segments in cockpit electronics feature notable growth patterns, particularly in display technologies which demonstrate a forecast growth from $29.78 billion to $58.52 billion over the same period. Sensor technologies are poised to expand significantly, capturing value from enhanced user interactions and safety initiatives, expanding from $11.26 billion to $22.14 billion by 2033.

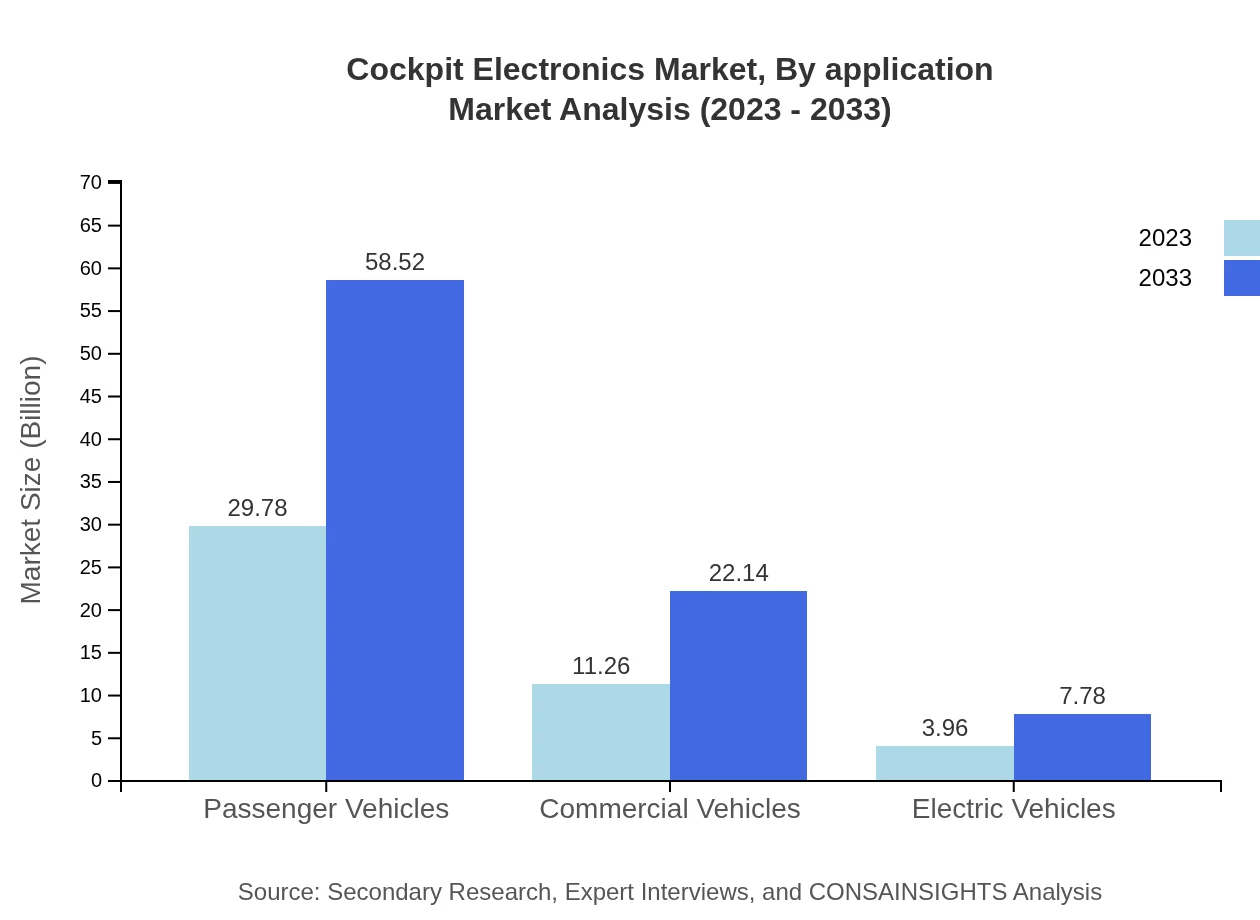

Cockpit Electronics Market Analysis By Application

Passenger vehicles dominate the cockpit electronics application segment, with a size expanding from $29.78 billion to $58.52 billion in the coming decade, indicating robust consumer preferences. Commercial vehicles also represent a growing market, signifying increased deployment of advanced technologies aimed at enhancing safety and operational efficiency.

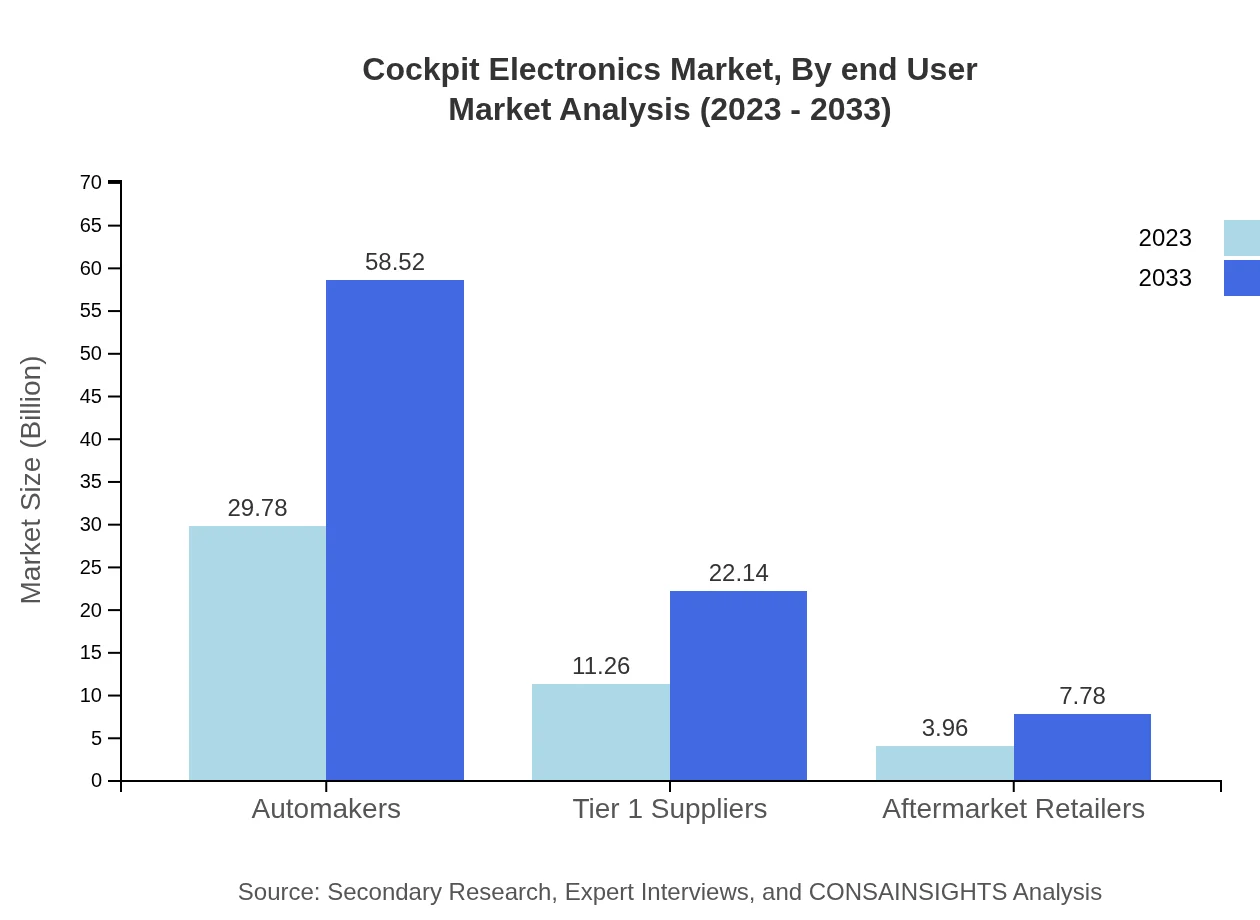

Cockpit Electronics Market Analysis By End User

The end-user segment reveals substantial engagement from automakers, accounting for a significant share of the market alongside tier 1 suppliers creating a competitive landscape. As automakers integrate technology for user-centric experiences, demand from aftermarket retailers also continues to show promising growth.

Cockpit Electronics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cockpit Electronics Industry

Bosch:

Bosch is a leading global supplier of technology and services, providing advanced cockpit electronics solutions that enhance automotive safety and user experience.Continental AG:

Continental AG is known for its innovative solutions in vehicle electronics, focusing heavily on driver assistance systems and infotainment technologies.Denso Corporation:

Denso specializes in advanced automotive technology, contributing significantly to cockpit electronics through cutting-edge infotainment and climate control systems.Harman International:

Harman focuses on connected technologies and infotainment solutions, leading in both innovation and market share within the cockpit electronics space.Valeo:

Valeo is a global automotive supplier that develops smart mobility solutions and cockpit electronics, especially in power management and driver assistance technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of cockpit electronics?

The cockpit electronics market is valued at approximately $45 billion in 2023, with a compound annual growth rate (CAGR) of 6.8%. It is projected to experience significant growth over the next decade, reaching new heights by 2033.

What are the key market players or companies in the cockpit electronics industry?

Key players in the cockpit electronics market include major automakers and Tier 1 suppliers. These companies dominate with a combined market share, collectively shaping innovation and competitiveness across the industry, particularly in advanced technologies and infotainment systems.

What are the primary factors driving the growth in the cockpit electronics industry?

Growth in the cockpit electronics industry is primarily driven by advancements in technology, increasing demand for safety features, and the rise of electric vehicles. Additionally, consumer preferences for enhanced infotainment experiences further stimulate market expansion and innovation.

Which region is the fastest Growing in the cockpit electronics market?

The fastest-growing region in the cockpit electronics market is projected to be North America, expanding from $16.56 billion in 2023 to $32.56 billion by 2033. Europe and Asia Pacific also show robust growth, signaling increasing investments in automotive technologies.

Does ConsaInsights provide customized market report data for the cockpit electronics industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the cockpit electronics industry. This includes segmented information and detailed analyses to support informed business strategies and decision-making.

What deliverables can I expect from this cockpit electronics market research project?

Deliverables from the cockpit electronics market research project typically include comprehensive market analysis reports, regional and segment data, growth forecasts, competitor analysis, and insights into emerging trends to guide strategic planning and investment decisions.

What are the market trends of cockpit electronics?

Market trends in cockpit electronics indicate a shift towards advanced driver assistance systems, integration of AI in infotainment, and increased focus on user-centric designs. The rise of electric vehicles also propels innovations in technology and user experiences.