Commercial Aircraft Fadec Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft-fadec

Commercial Aircraft Fadec Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Commercial Aircraft Fadec market from 2023 to 2033, highlighting market trends, size, growth drivers, technological advancements, and regional insights.

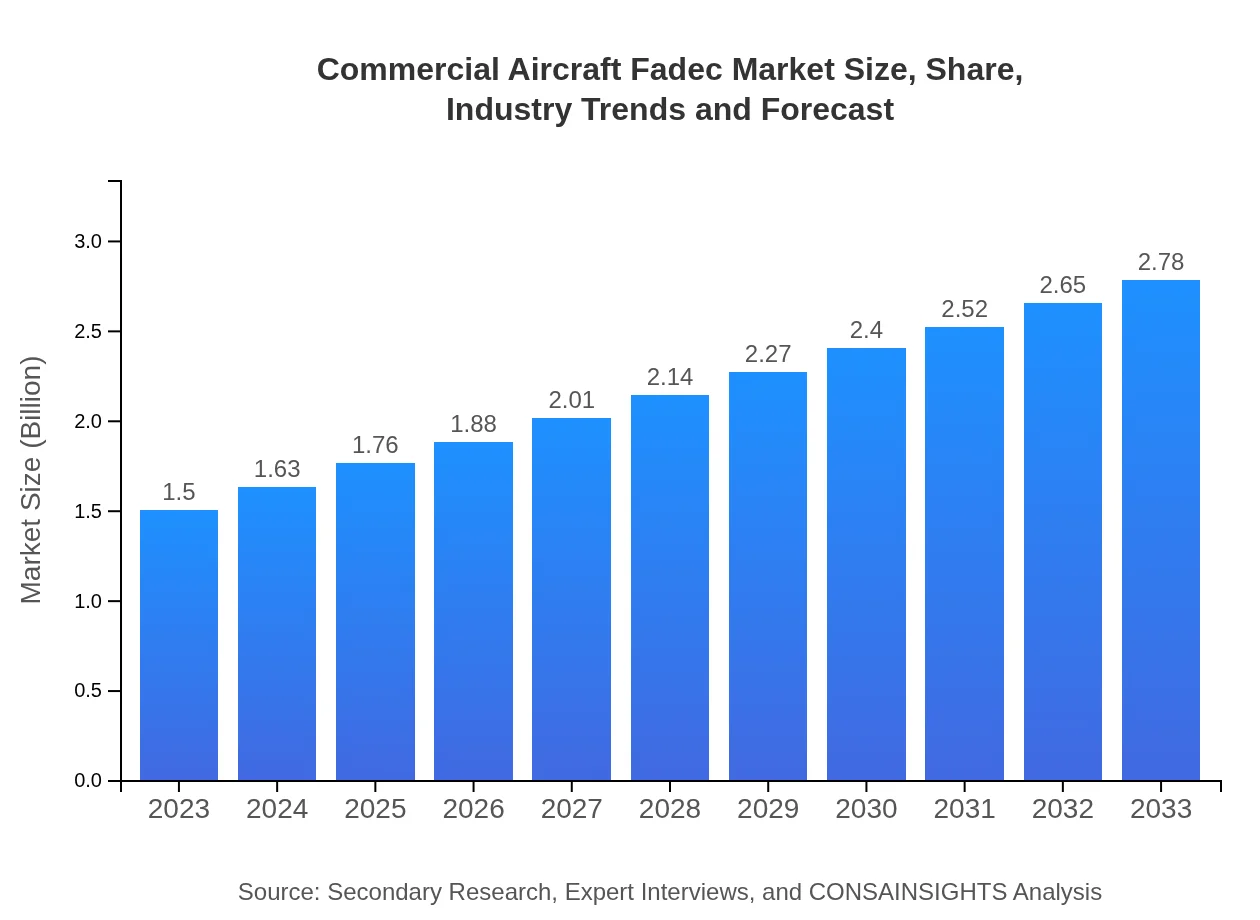

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Honeywell International Inc., General Electric Company, Safran SA, Rockwell Collins |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft Fadec Market Overview

Customize Commercial Aircraft Fadec Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft Fadec market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft Fadec's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft Fadec

What is the Market Size & CAGR of Commercial Aircraft Fadec market in 2023?

Commercial Aircraft Fadec Industry Analysis

Commercial Aircraft Fadec Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft Fadec Market Analysis Report by Region

Europe Commercial Aircraft Fadec Market Report:

Valued at $0.39 billion in 2023, the European market is projected to expand to $0.72 billion by 2033. European countries are focusing on sustainable aviation technologies, enhancing the demand for efficient FADEC systems, amidst rigorous environmental regulations.Asia Pacific Commercial Aircraft Fadec Market Report:

In 2023, the Asia-Pacific market for Commercial Aircraft Fadec is valued at approximately $0.29 billion, expected to grow to $0.55 billion by 2033. The region is experiencing a surge in air travel and aircraft procurements, particularly in countries like China and India, driving demand for advanced FADEC systems.North America Commercial Aircraft Fadec Market Report:

North America holds a significant share of the market, with a value of $0.58 billion in 2023, estimated to increase to $1.07 billion by 2033. The region is a leader in aviation technology, with major manufacturers driving innovations in FADEC solutions. The strong demand from commercial and military aviation sectors is a key growth factor.South America Commercial Aircraft Fadec Market Report:

The South American market is relatively smaller, with a market size of $0.05 billion in 2023, projected to reach $0.08 billion by 2033. The growth is hampered by economic fluctuations, but increasing regional airlines and investments in aviation infrastructure are expected to enhance FADEC adoption moving forward.Middle East & Africa Commercial Aircraft Fadec Market Report:

The Middle East and Africa market is forecasted to grow from $0.19 billion in 2023 to $0.35 billion by 2033. Rapidly developing aviation sectors in the Middle East, fueled by increasing air traffic and tourism, are likely to drive the adoption of sophisticated FADEC systems.Tell us your focus area and get a customized research report.

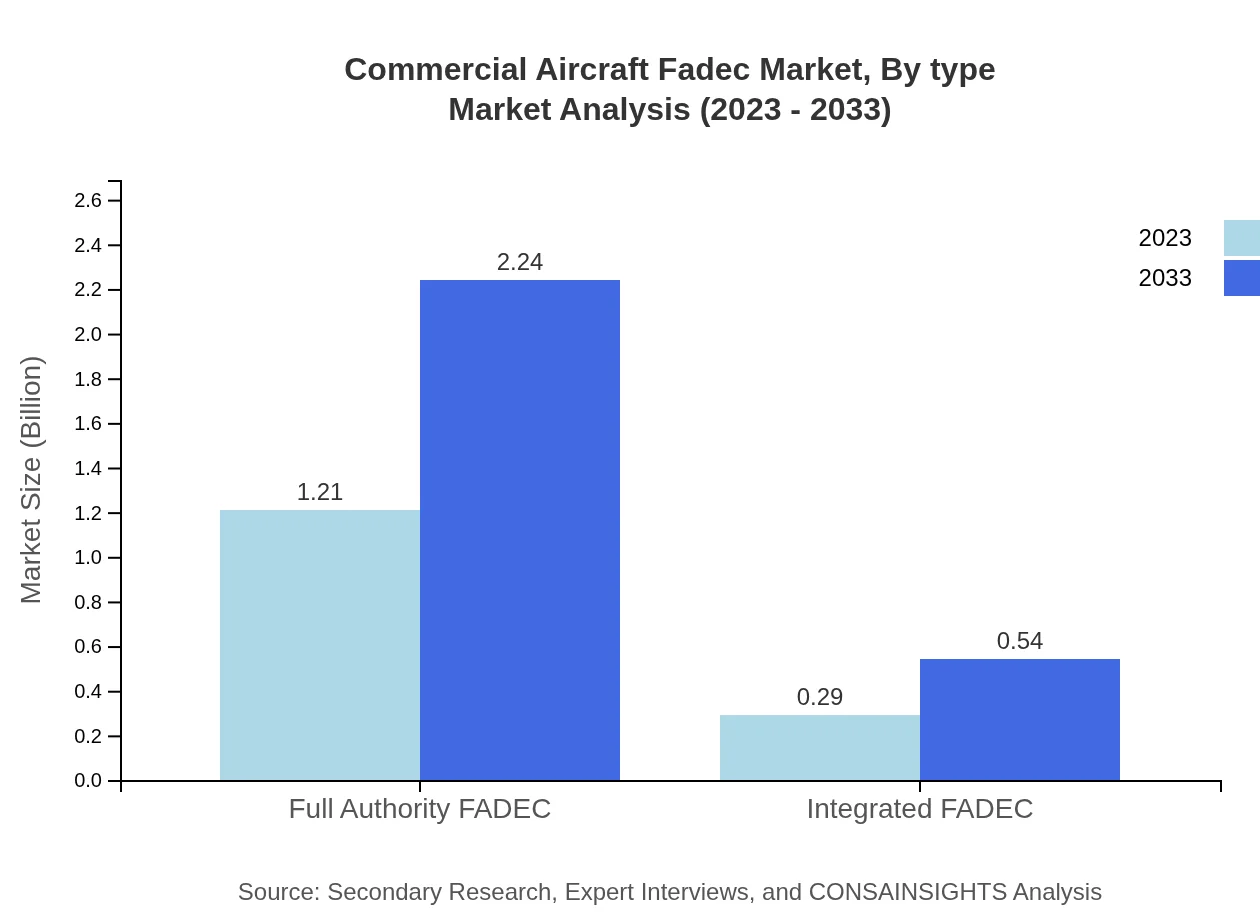

Commercial Aircraft Fadec Market Analysis By Type

The market segmentation by type includes Full Authority FADEC, Integrated FADEC, Electronic FADEC, Hybrid FADEC, and Advanced Control Systems. Full Authority FADEC dominates the market with a size of $1.21 billion in 2023 and is expected to reach $2.24 billion by 2033, driven by its comprehensive functionalities and reliability. Integrated FADEC is also gaining traction, recording a size of $0.29 billion in 2023, growing to $0.54 billion by 2033, as manufacturers aim for optimized engine performance.

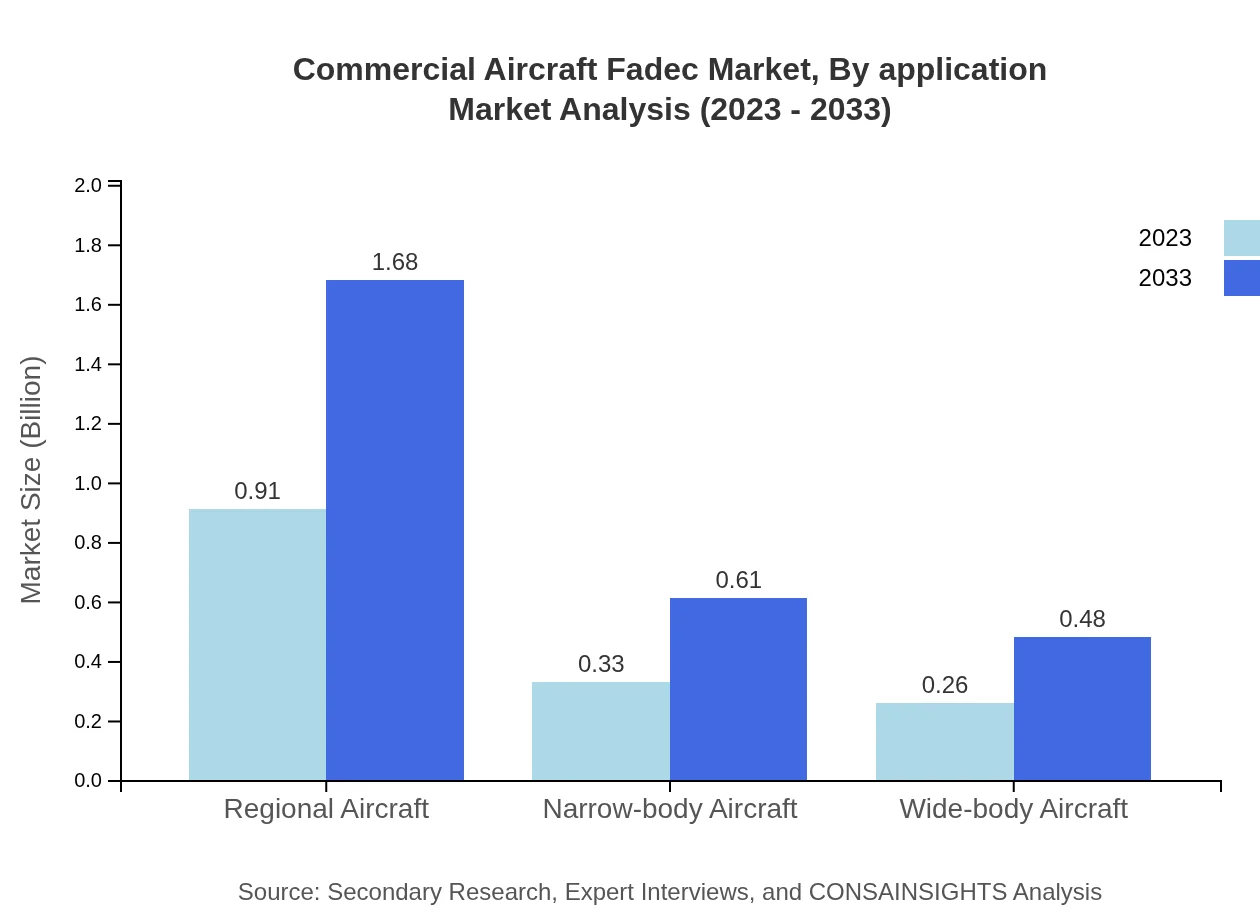

Commercial Aircraft Fadec Market Analysis By Application

This segmentation includes commercial and private applications, with commercial aircraft holding the majority share due to the increasing demand for air travel. The market for commercial application is expected to grow significantly as airlines focus on operational efficiency and safety.

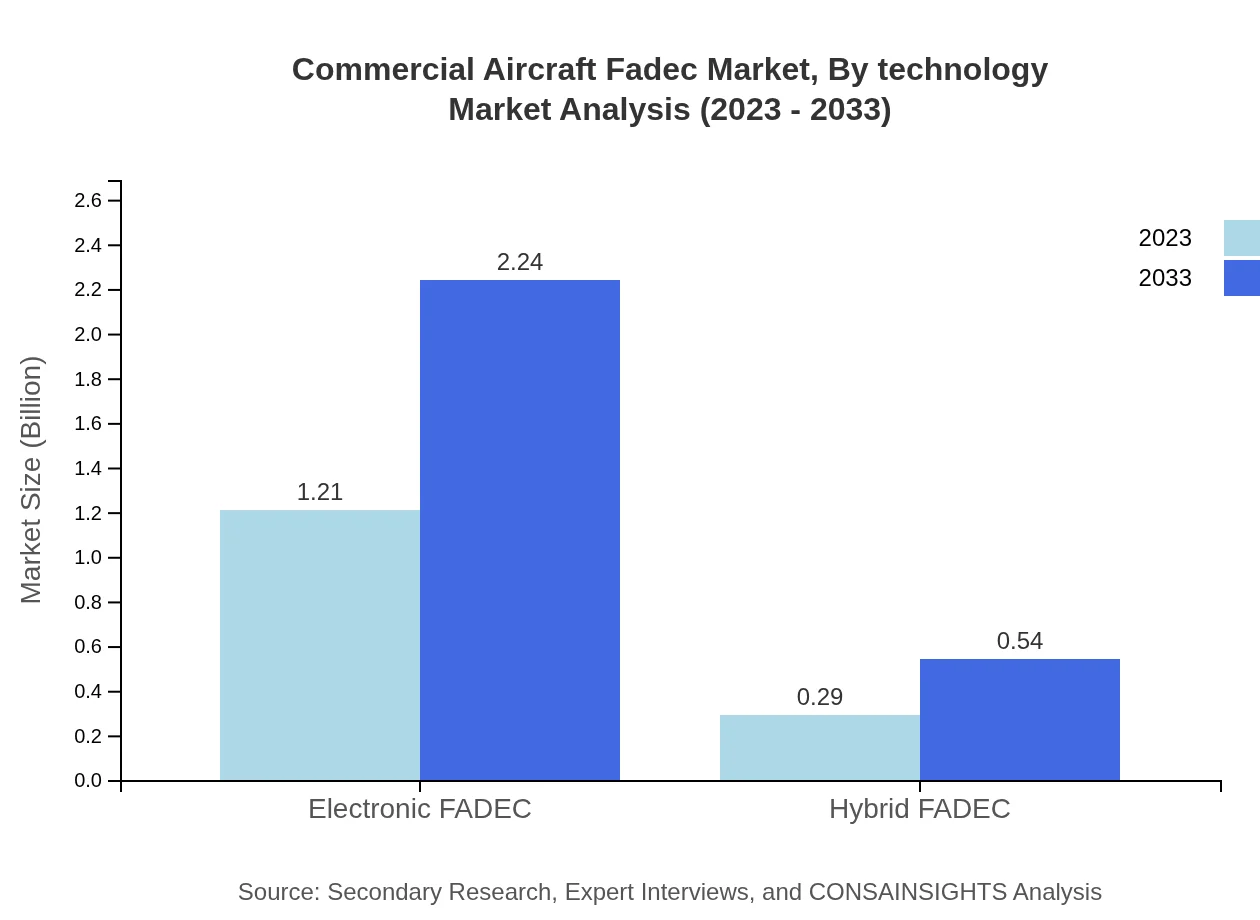

Commercial Aircraft Fadec Market Analysis By Technology

Technological advancements play a crucial role in the FADEC market. The implementation of cutting-edge technologies such as advanced algorithms, machine learning, and AI in FADEC systems enhances their functionality and performance. Electronic FADEC systems show robust growth prospects with anticipated market values increasing from $1.21 billion in 2023 to $2.24 billion by 2033.

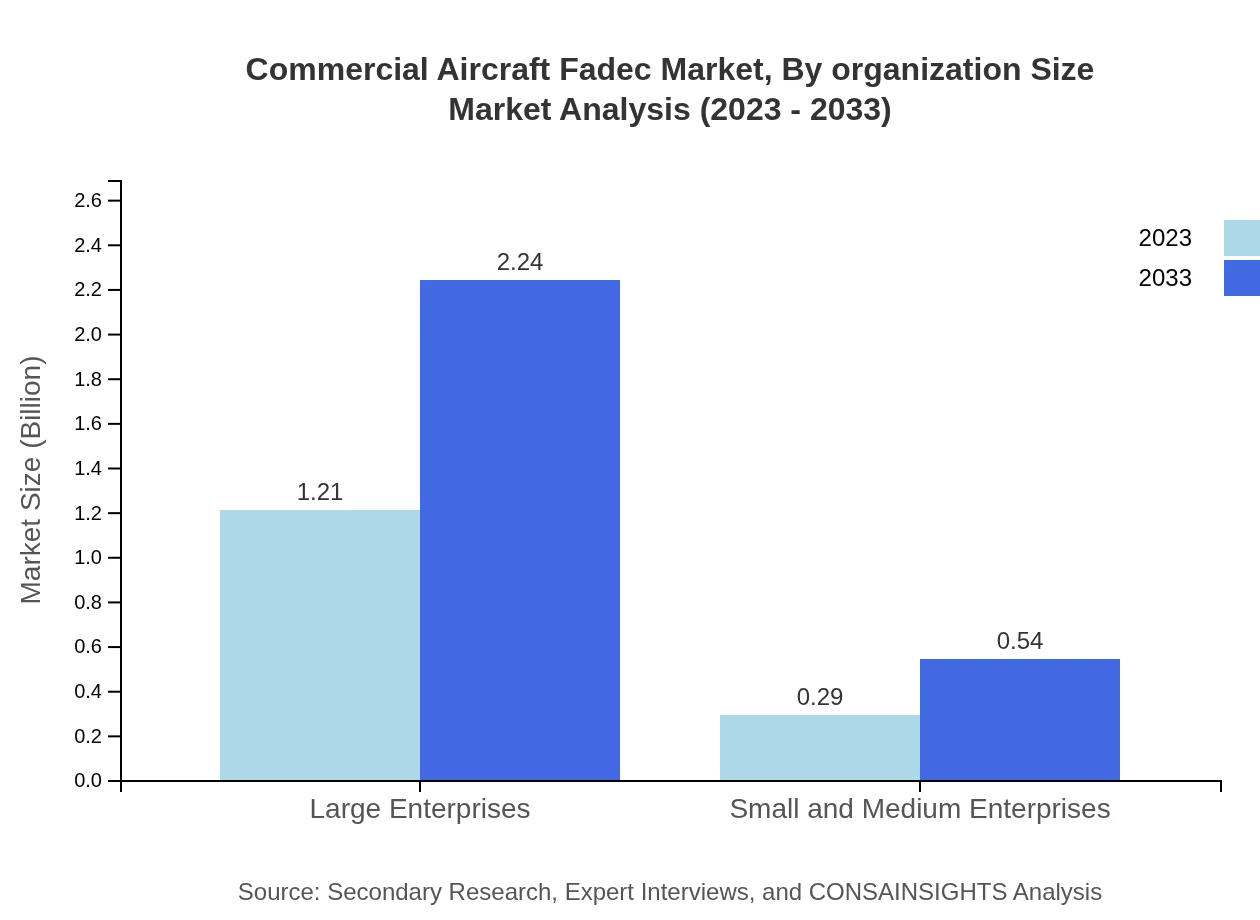

Commercial Aircraft Fadec Market Analysis By Organization Size

The market can also be segmented based on organization size into large enterprises and small and medium enterprises (SMEs). Large enterprises occupy the larger share of the market, acknowledged for their capacity to invest in advanced technology, as seen with a market value of $1.21 billion in 2023. However, SMEs are gradually adopting FADEC owing to the rising availability of affordable options.

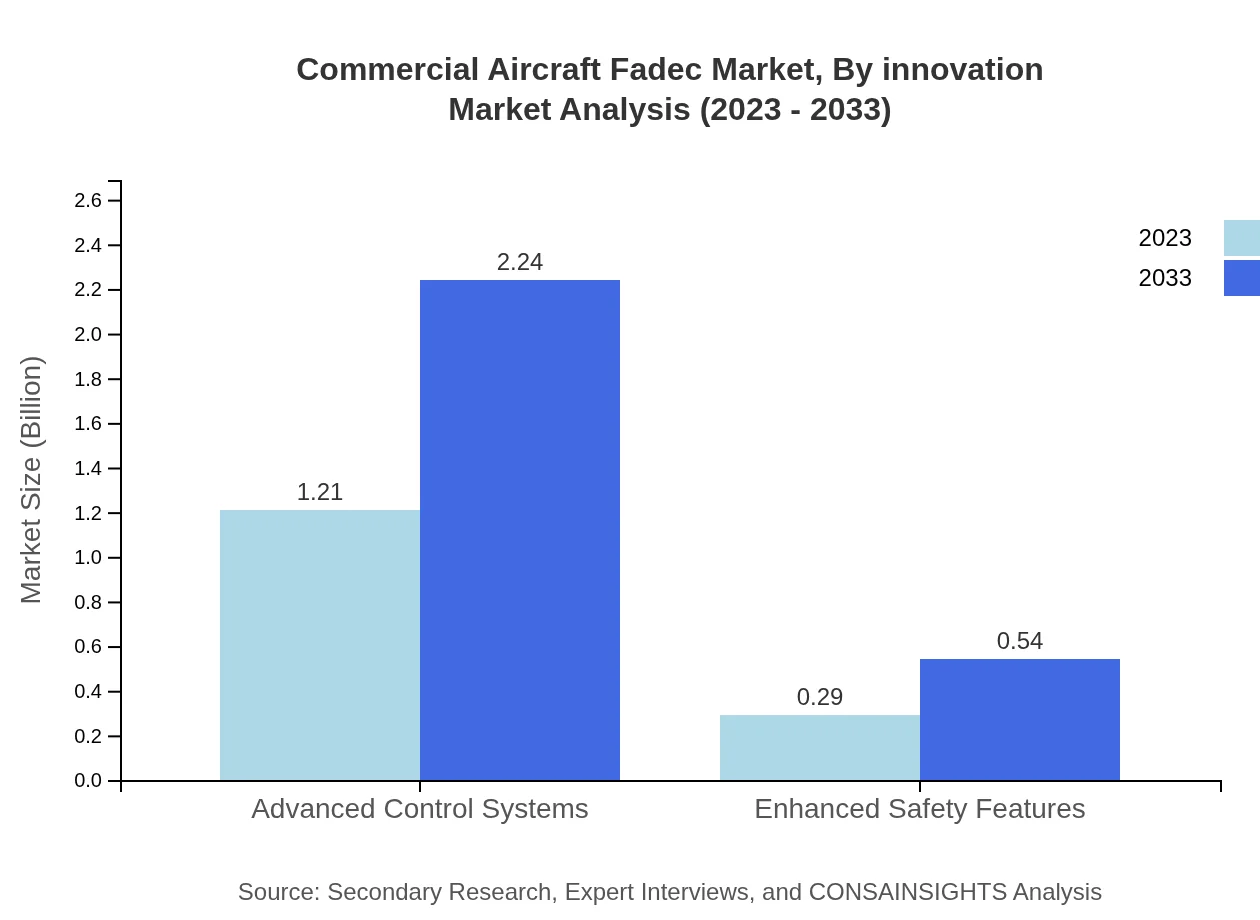

Commercial Aircraft Fadec Market Analysis By Innovation

Innovation in the FADEC sector includes the development of more efficient systems that enhance operational control and safety features. Systems integrating enhanced safety features represent a growing segment of the market, showing increasing viability in both commercial and private aviation applications.

Commercial Aircraft Fadec Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Aircraft Fadec Industry

Honeywell International Inc.:

A leading player in the aerospace industry specializing in advanced avionics and control systems, contributing significantly to the development of FADEC technologies.General Electric Company:

A key innovator in the aviation sector, GE focuses on developing state-of-the-art engines and control systems, including advanced FADEC solutions.Safran SA:

A prominent aircraft equipment manufacturer known for producing advanced FADEC systems for various commercial aircraft engines.Rockwell Collins:

A major player in avionics systems providing reliable FADEC solutions to enhance engine management and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial Aircraft Fadec?

The commercial aircraft FADEC market is projected to reach $1.5 billion by 2033, growing at a CAGR of 6.2%. This growth signifies the increasing demand for integrated and advanced control systems in aviation.

What are the key market players or companies in this commercial Aircraft Fadec industry?

Key players in the commercial aircraft FADEC industry include major aerospace manufacturers and technology firms focusing on enhancing aircraft engine performance and safety, ensuring robust competition and innovation.

What are the primary factors driving the growth in the commercial Aircraft Fadec industry?

The growth in the commercial aircraft FADEC industry is driven by advancements in aeronautical technology, increased fuel efficiency, safety regulations, and the rising demand for air travel, leading to greater aircraft production.

Which region is the fastest Growing in the commercial Aircraft Fadec?

The North America region is the fastest-growing in the commercial aircraft FADEC market, anticipated to increase from $0.58 billion in 2023 to $1.07 billion by 2033, driven by high investments in aviation technology.

Does ConsaInsights provide customized market report data for the commercial Aircraft Fadec industry?

Yes, ConsaInsights provides customized market report data for the commercial aircraft FADEC industry, tailored to meet specific client needs, ensuring comprehensive and relevant insights for informed decision-making.

What deliverables can I expect from this commercial Aircraft Fadec market research project?

From the commercial aircraft FADEC market research project, expect detailed reports, market forecasts, competitive analysis, and insights about market trends, segments, and regional performance to guide strategic initiatives.

What are the market trends of commercial Aircraft Fadec?

Current trends in the commercial aircraft FADEC market include the integration of enhanced safety features and advanced control systems, along with a shift towards eco-friendly technologies to optimize performance and reduce emissions.