Copper Alloy Wire Market Report

Published Date: 31 January 2026 | Report Code: copper-alloy-wire

Copper Alloy Wire Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Copper Alloy Wire market, including insights into current trends, market size, forecasts through 2033, and regional breakdowns.

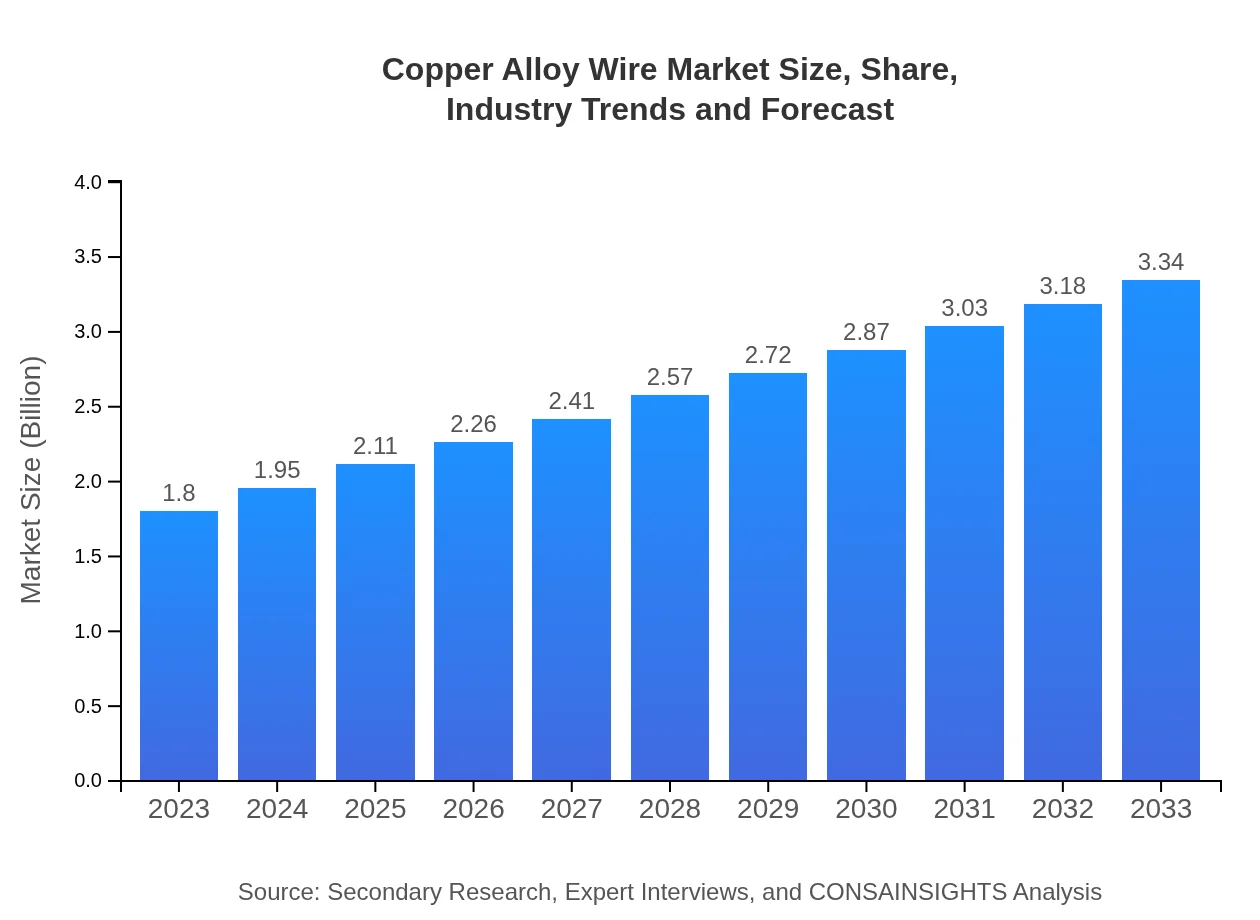

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | AURUBIS AG, KME Group, Southwire Company, LLC, Mitsubishi Materials |

| Last Modified Date | 31 January 2026 |

Copper Alloy Wire Market Overview

Customize Copper Alloy Wire Market Report market research report

- ✔ Get in-depth analysis of Copper Alloy Wire market size, growth, and forecasts.

- ✔ Understand Copper Alloy Wire's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Copper Alloy Wire

What is the Market Size & CAGR of Copper Alloy Wire market in 2023?

Copper Alloy Wire Industry Analysis

Copper Alloy Wire Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Copper Alloy Wire Market Analysis Report by Region

Europe Copper Alloy Wire Market Report:

Europe shows steady growth potential, with market values anticipated to grow from USD 0.52 billion in 2023 to USD 0.97 billion by 2033, influenced by increasing environmental regulations and a shift towards greener technologies.Asia Pacific Copper Alloy Wire Market Report:

Asia-Pacific is forecast to experience robust growth, expanding from a market size of USD 0.35 billion in 2023 to approximately USD 0.64 billion by 2033, driven by rapid industrialization and urbanization.North America Copper Alloy Wire Market Report:

North America leads the market with an expected growth from USD 0.65 billion in 2023 to USD 1.20 billion in 2033, largely due to advanced manufacturing capabilities and high consumption in the automotive and aerospace sectors.South America Copper Alloy Wire Market Report:

The South America region is projected to grow from USD 0.17 billion in 2023 to USD 0.31 billion by 2033, aided by improving economic conditions and infrastructure development.Middle East & Africa Copper Alloy Wire Market Report:

The Middle East and Africa are expected to witness moderate growth, with market size increasing from USD 0.12 billion in 2023 to USD 0.22 billion by 2033, primarily due to infrastructural investments and resource-rich economies.Tell us your focus area and get a customized research report.

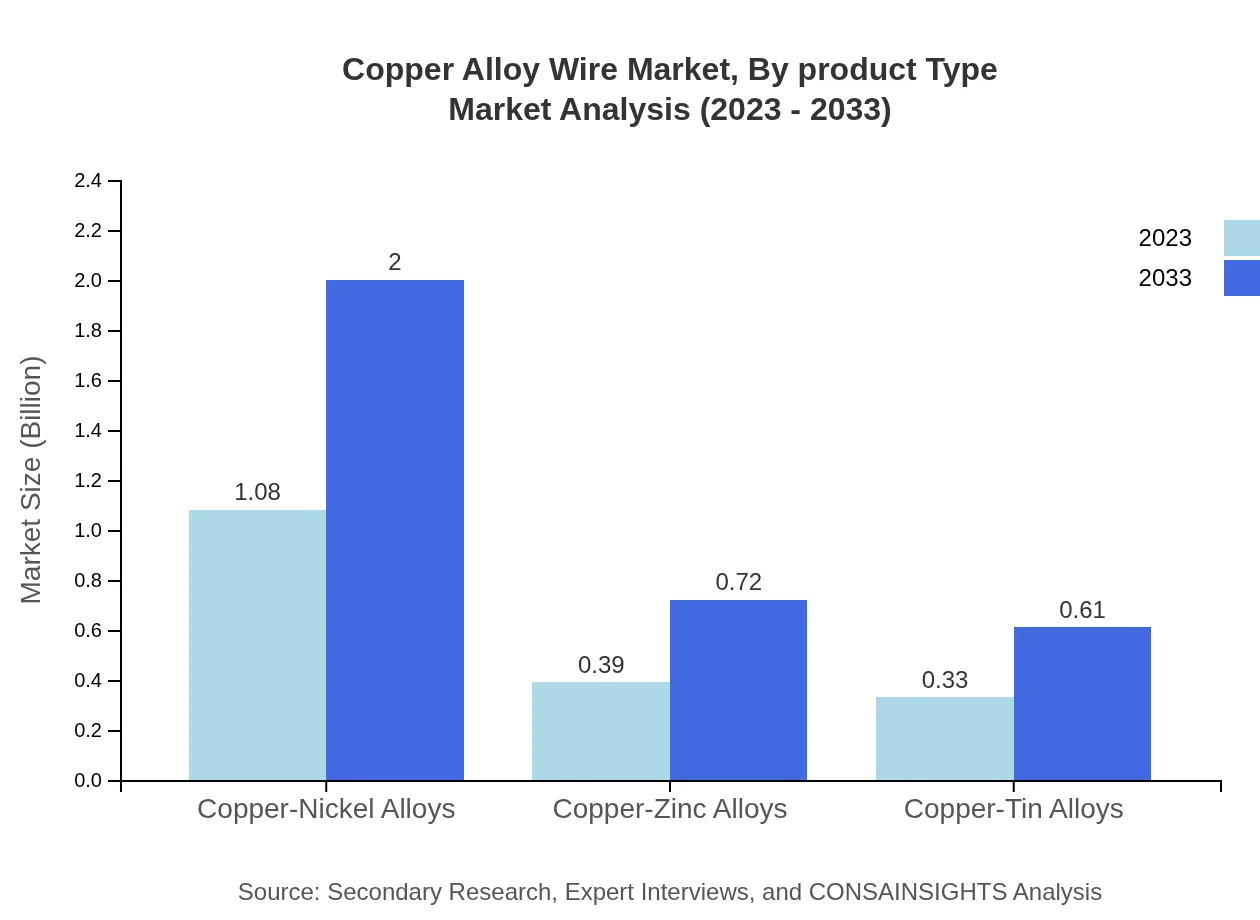

Copper Alloy Wire Market Analysis By Product Type

In 2023, the copper-nickel alloys segment leads the market with USD 1.08 billion, contributing to 60.05% market share, and is projected to maintain this position up to 2033. Copper-zinc alloys and copper-tin alloys follow with significant shares of 21.65% and 18.3%, respectively, reflecting their essential roles in various applications.

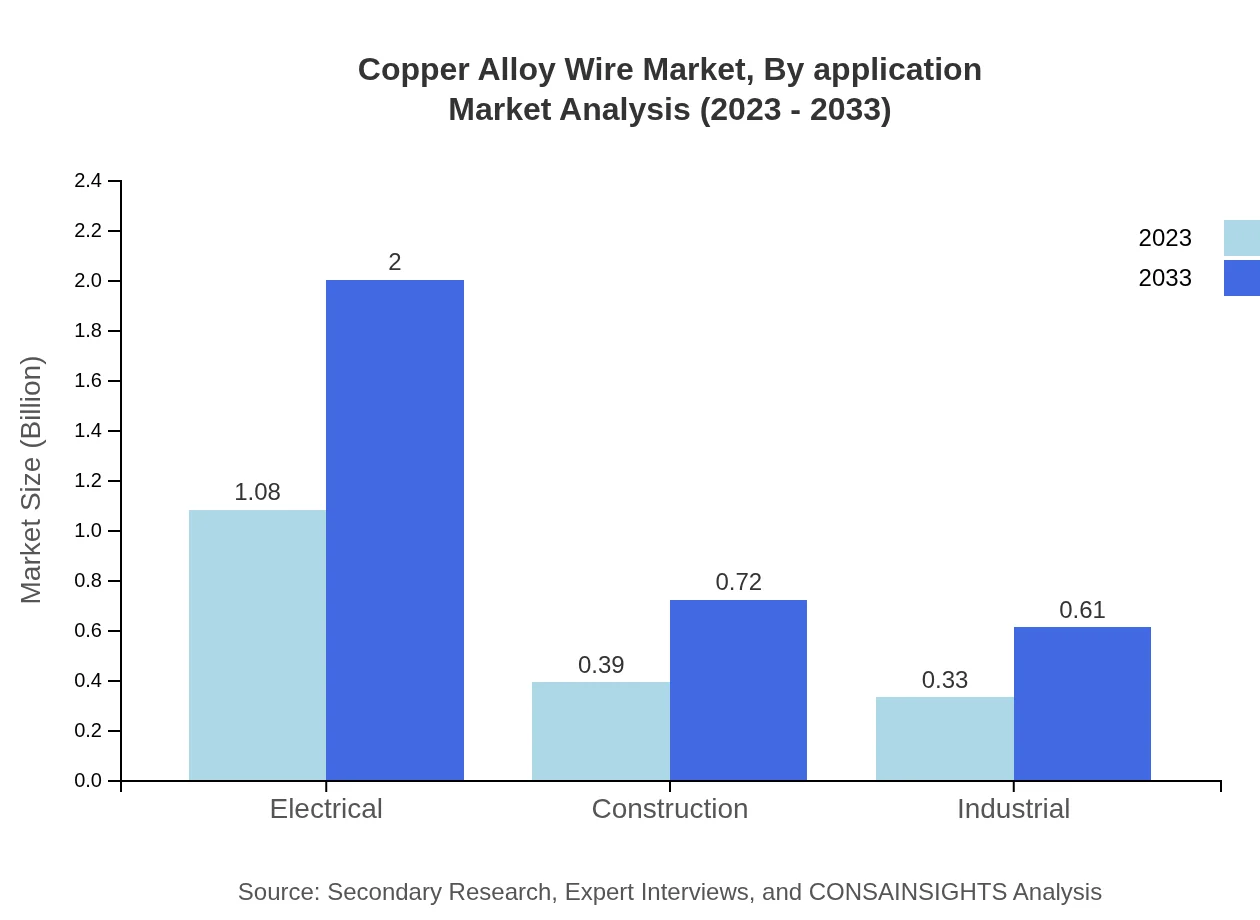

Copper Alloy Wire Market Analysis By Application

The construction industry takes the lead with a size of USD 1.08 billion in 2023, sharing 60.05% of the market, growing to USD 2.00 billion by 2033. The automotive industry significantly contributes as well, with a market of USD 0.39 billion in 2023, expected to grow alongside increasing automotive electrification.

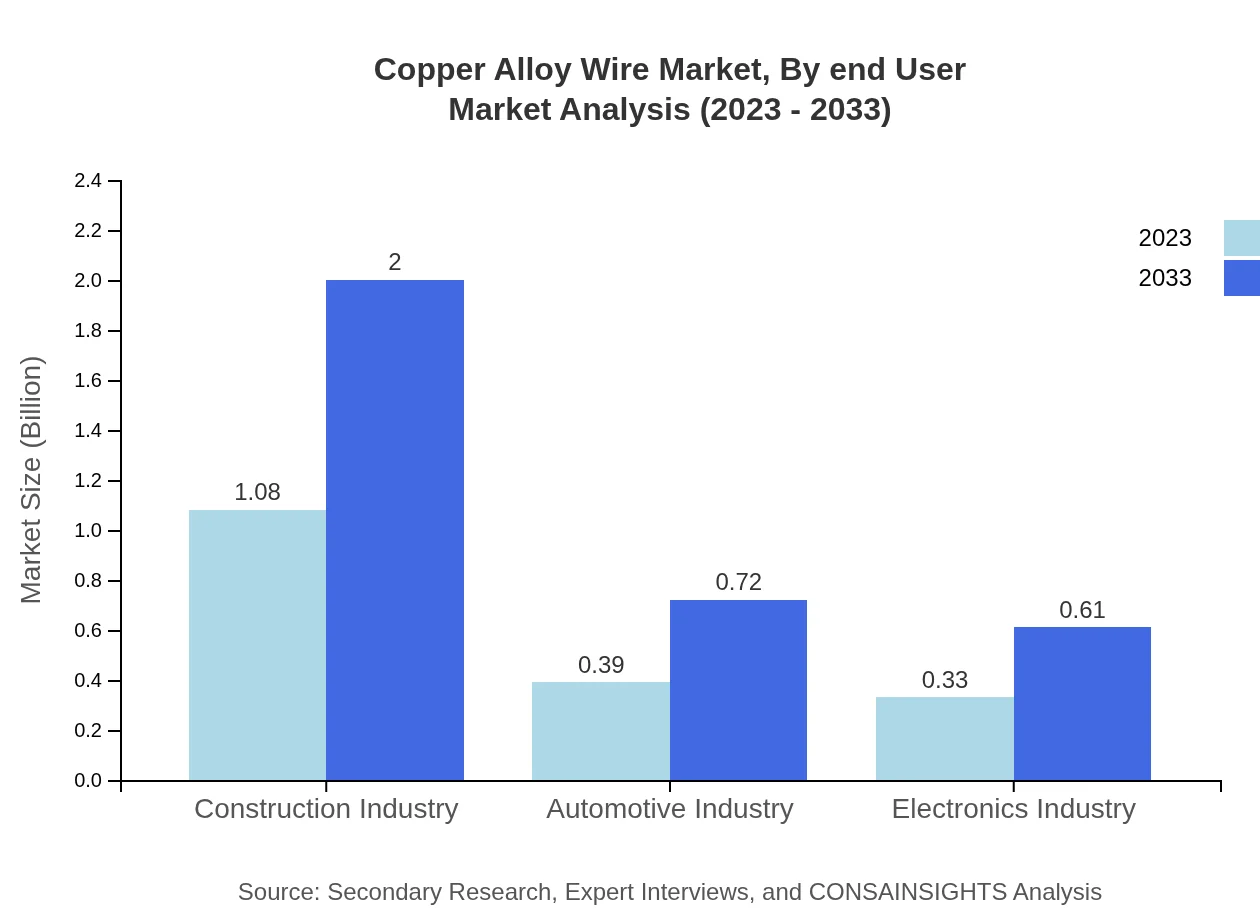

Copper Alloy Wire Market Analysis By End User

With a focus on the electrical sector, which enjoys a market size of USD 1.08 billion in 2023 and growing in importance, the industrial and construction sectors follow closely, showcasing their relevance in driving demand.

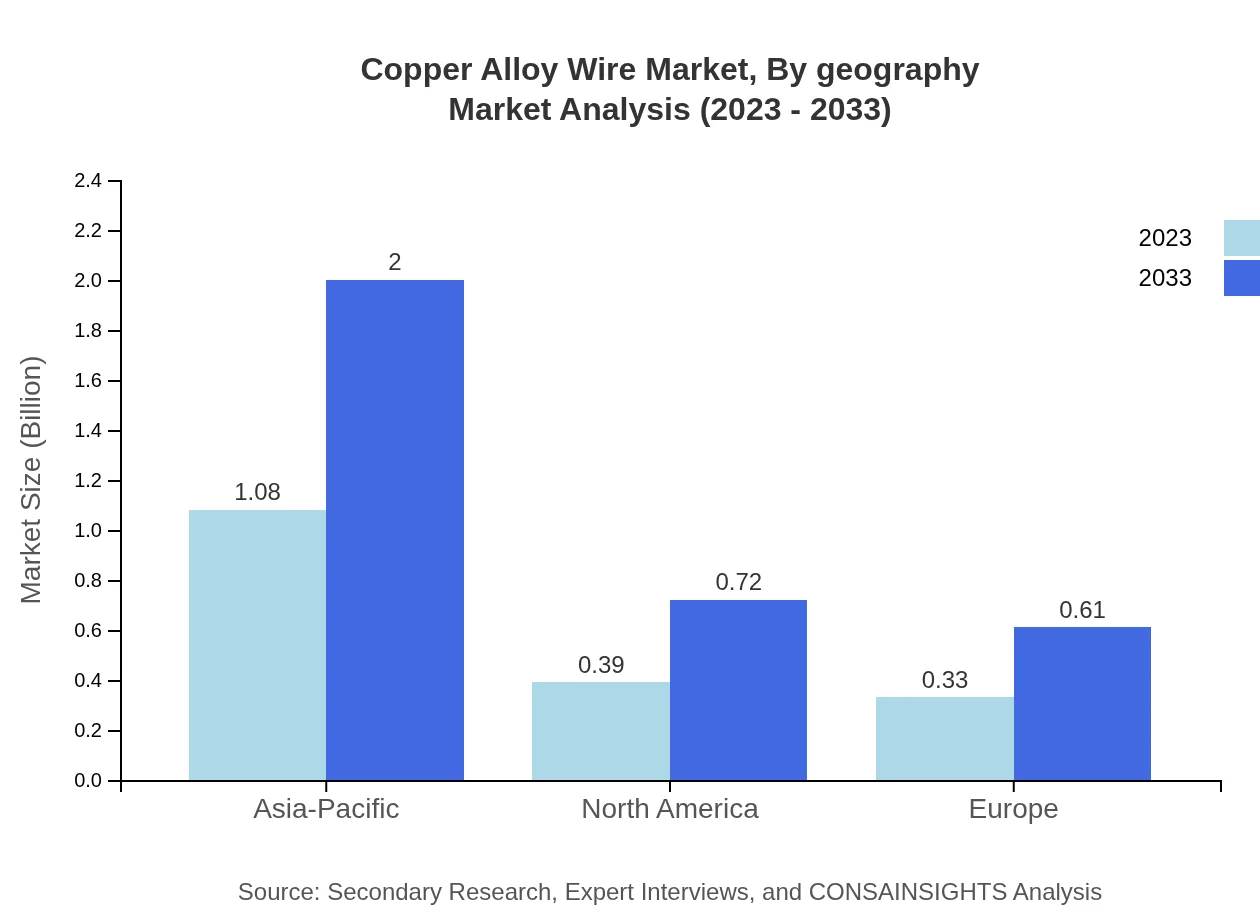

Copper Alloy Wire Market Analysis By Geography

Asia-Pacific (USD 0.35 billion), North America (USD 0.65 billion), and Europe (USD 0.52 billion) demonstrate significant growth trajectories, driven primarily by infrastructural demands and technological advancements in their respective regions.

Copper Alloy Wire Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Copper Alloy Wire Industry

AURUBIS AG:

AURUBIS is a leading global provider of non-ferrous metals, and its investment in state-of-the-art production facilities ensures a strong position in the copper alloy wire segment.KME Group:

KME is known for its innovative solutions in copper and copper alloy production, actively contributing to the automotive and electronics sectors.Southwire Company, LLC:

Southwire is a prominent manufacturer of copper wire and cable products and continues expanding its portfolio with high-quality copper alloy wires.Mitsubishi Materials:

Mitsubishi Materials is a player in the copper alloy wire market, leveraging its expertise in material technology to offer superior products.We're grateful to work with incredible clients.

FAQs

What is the market size of copper Alloy Wire?

The copper-alloy-wire market is projected to reach $1.8 billion by 2033, with an impressive CAGR of 6.2% from 2023. This growth reflects the increasing demand across various sectors, contributing to a promising market outlook.

What are the key market players or companies in the copper Alloy Wire industry?

The copper-alloy-wire industry comprises key players like Southwire Company, LLC, and The Furukawa Electric Co., Ltd. These companies are recognized for their innovative products and strong market presence, leading advancements in alloy technology and applications.

What are the primary factors driving the growth in the copper Alloy Wire industry?

Significant factors for growth include the surging demand from construction and automotive sectors. Moreover, technological advancements in manufacturing processes and the increasing adoption of copper alloys for electrical applications fuel further expansion in the market.

Which region is the fastest Growing in the copper Alloy Wire market?

North America is the fastest-growing region in the copper-alloy-wire market. With a projected growth from $0.65 billion in 2023 to $1.20 billion by 2033, it showcases robust industrial advancements and growing infrastructure investments.

Does ConsaInsights provide customized market report data for the copper Alloy Wire industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the copper-alloy-wire industry. Clients can obtain detailed insights, including segmented data and forecasts aligning with their business goals.

What deliverables can I expect from this copper Alloy Wire market research project?

Deliverables from the copper-alloy-wire market research will include comprehensive reports detailing market size, growth forecasts, competitive analysis, and regional breakdowns. Clients will receive actionable insights to support strategic decision-making.

What are the market trends of copper Alloy Wire?

Market trends for copper-alloy-wire indicate increased usage in the electrical and construction sectors, with segments like copper-nickel alloys leading in demand. Focus on sustainability and recycling also drives innovation and growth prospects in the industry.