Diesel Power Engine Market Report

Published Date: 02 February 2026 | Report Code: diesel-power-engine

Diesel Power Engine Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Diesel Power Engine market, covering market trends, size forecasts, and technological advancements from 2023 to 2033. Key insights on industry segmentation, regional performance, and major players are included to guide stakeholders in strategic decision-making.

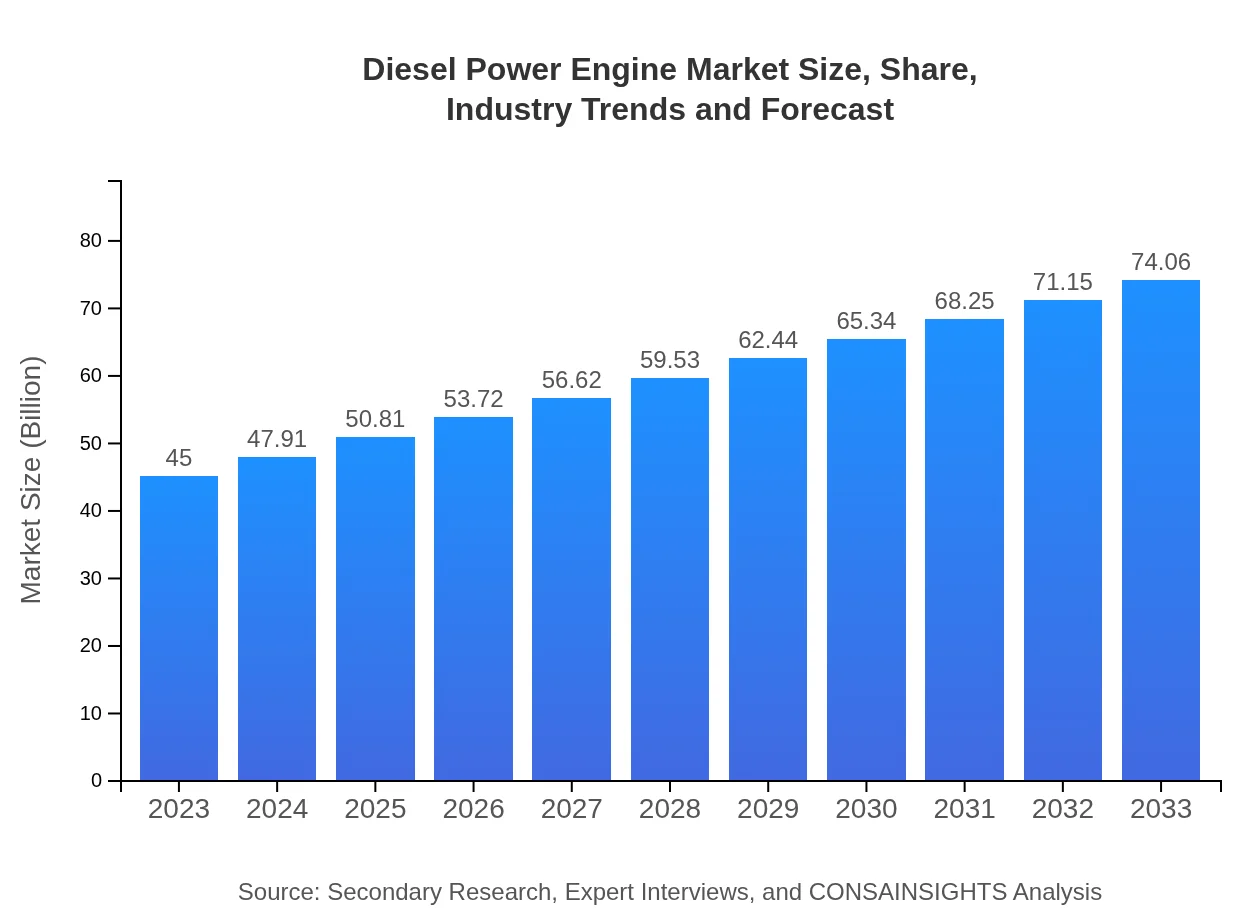

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $74.06 Billion |

| Top Companies | Caterpillar Inc., Cummins Inc., Volvo Penta, John Deere |

| Last Modified Date | 02 February 2026 |

Diesel Power Engine Market Overview

Customize Diesel Power Engine Market Report market research report

- ✔ Get in-depth analysis of Diesel Power Engine market size, growth, and forecasts.

- ✔ Understand Diesel Power Engine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Diesel Power Engine

What is the Market Size & CAGR of Diesel Power Engine market in 2023?

Diesel Power Engine Industry Analysis

Diesel Power Engine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Diesel Power Engine Market Analysis Report by Region

Europe Diesel Power Engine Market Report:

Europe's market is expected to grow from $11.06 billion in 2023 to $18.20 billion by 2033. The stringent environmental regulations leading to demand for cleaner technology are shaping the future of diesel engines in the region.Asia Pacific Diesel Power Engine Market Report:

The Asia Pacific region is projected to see substantial growth in the Diesel Power Engine market, with a market size expected to grow from $9.63 billion in 2023 to $15.85 billion by 2033, driven by rapid industrialization and infrastructural development in countries like China and India.North America Diesel Power Engine Market Report:

North America is a dominant market with an estimated growth from $17.42 billion in 2023 to $28.68 billion by 2033. The strong presence of established manufacturers and technologically advanced industries fuels this growth.South America Diesel Power Engine Market Report:

The South American market is set to grow from $3.68 billion in 2023 to $6.06 billion by 2033. The focus on agricultural improvements and energy production in Brazil and Argentina plays a vital role in market expansion in this region.Middle East & Africa Diesel Power Engine Market Report:

The Middle East and Africa region will see a gradual increase from $3.20 billion in 2023 to $5.27 billion by 2033. The demand for diesel engines in construction and oil extraction activities significantly drives this market.Tell us your focus area and get a customized research report.

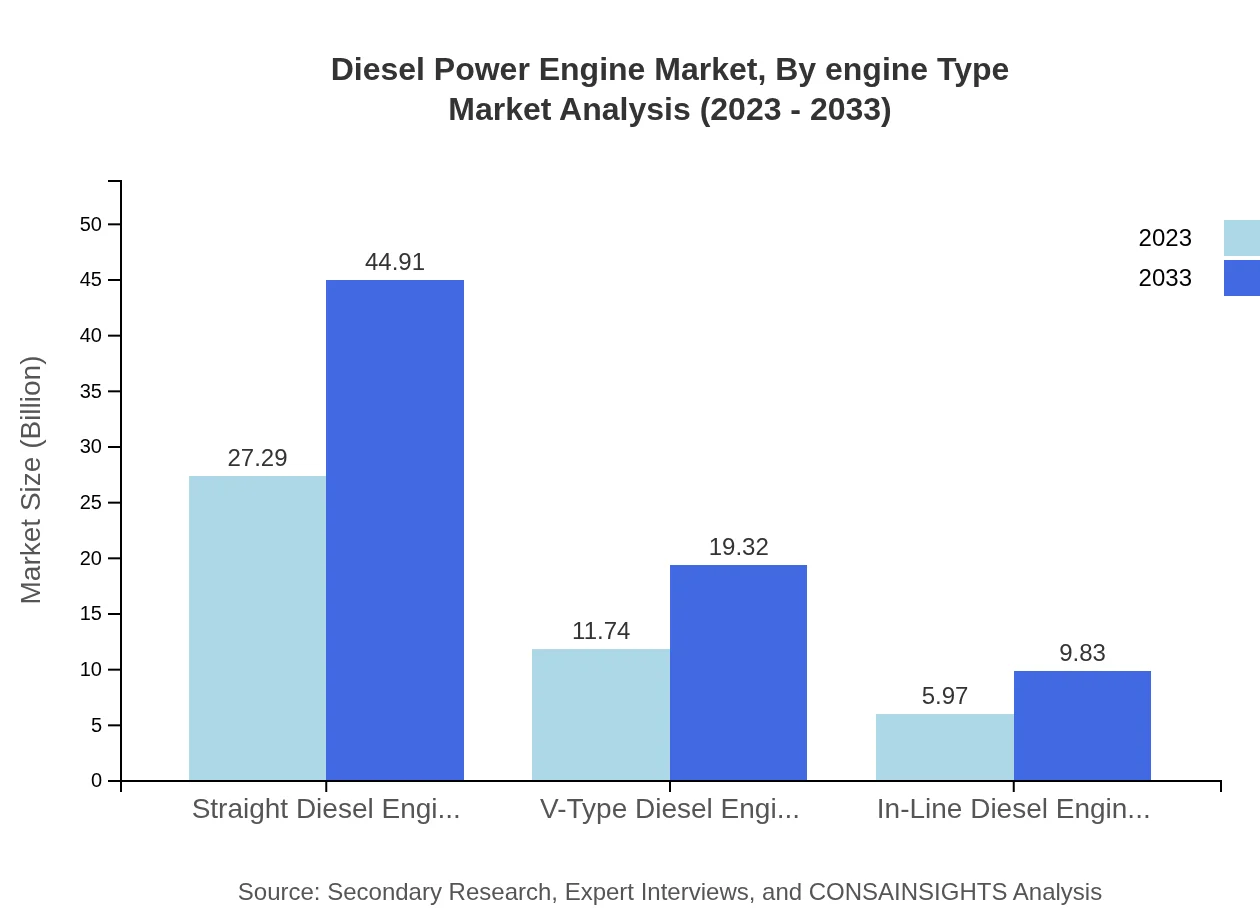

Diesel Power Engine Market Analysis By Engine Type

The Diesel Power Engine market is significantly influenced by the type of engine utilized. In 2023, straight diesel engines dominate the market with $27.29 billion, projected to rise to $44.91 billion by 2033. Innovations in V-type and in-line diesel engines showcase potential growth too, with the former expected to grow from $11.74 billion to $19.32 billion, and the latter from $5.97 billion to $9.83 billion during the same period.

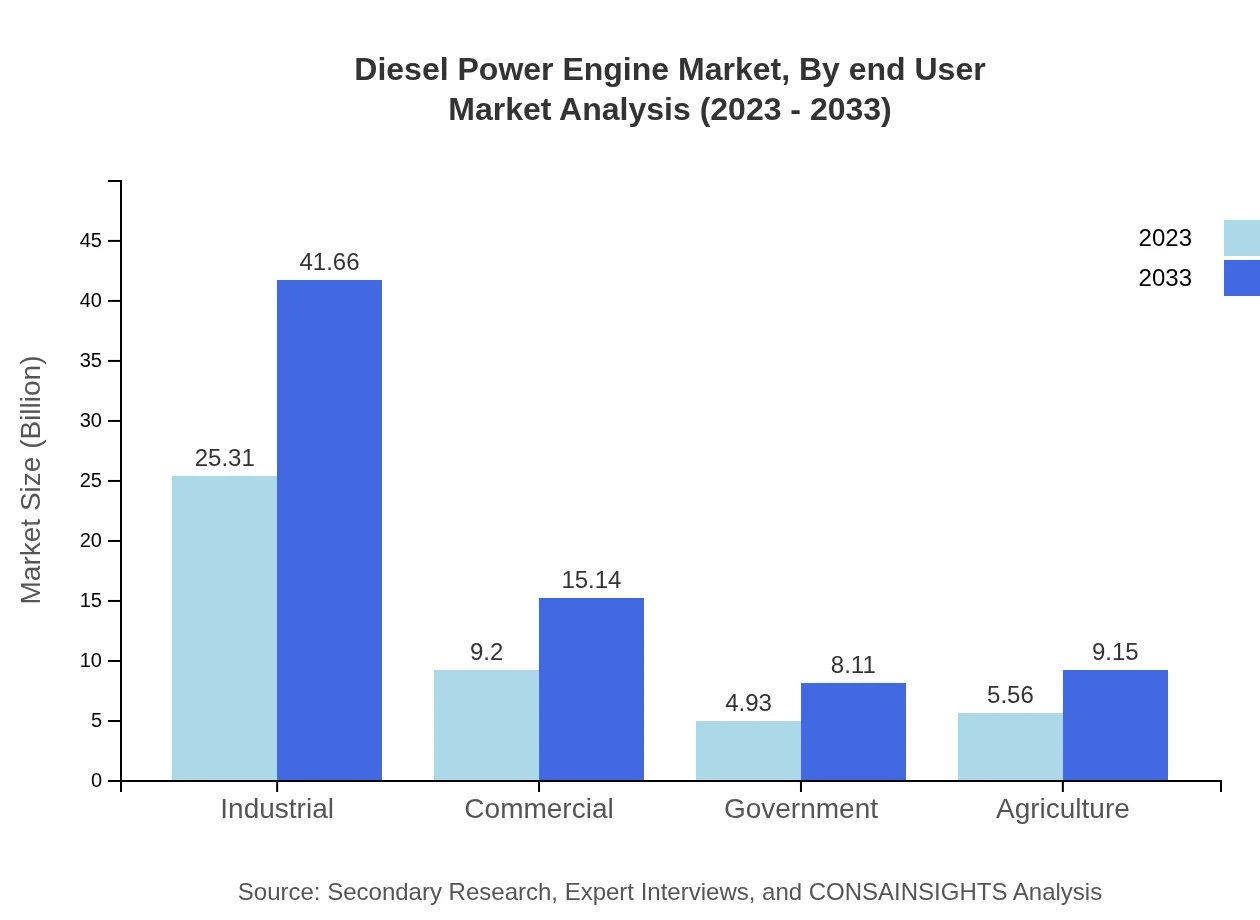

Diesel Power Engine Market Analysis By Application

In terms of application, the industrial sector leads the market by size, valued at $25.31 billion in 2023, projected to reach $41.66 billion by 2033. Other sectors like marine and construction also contribute significantly, with marine applications holding $19.17 billion and expected to grow to $31.56 billion, reflecting an increasing demand for diesel engines in transportation and logistics.

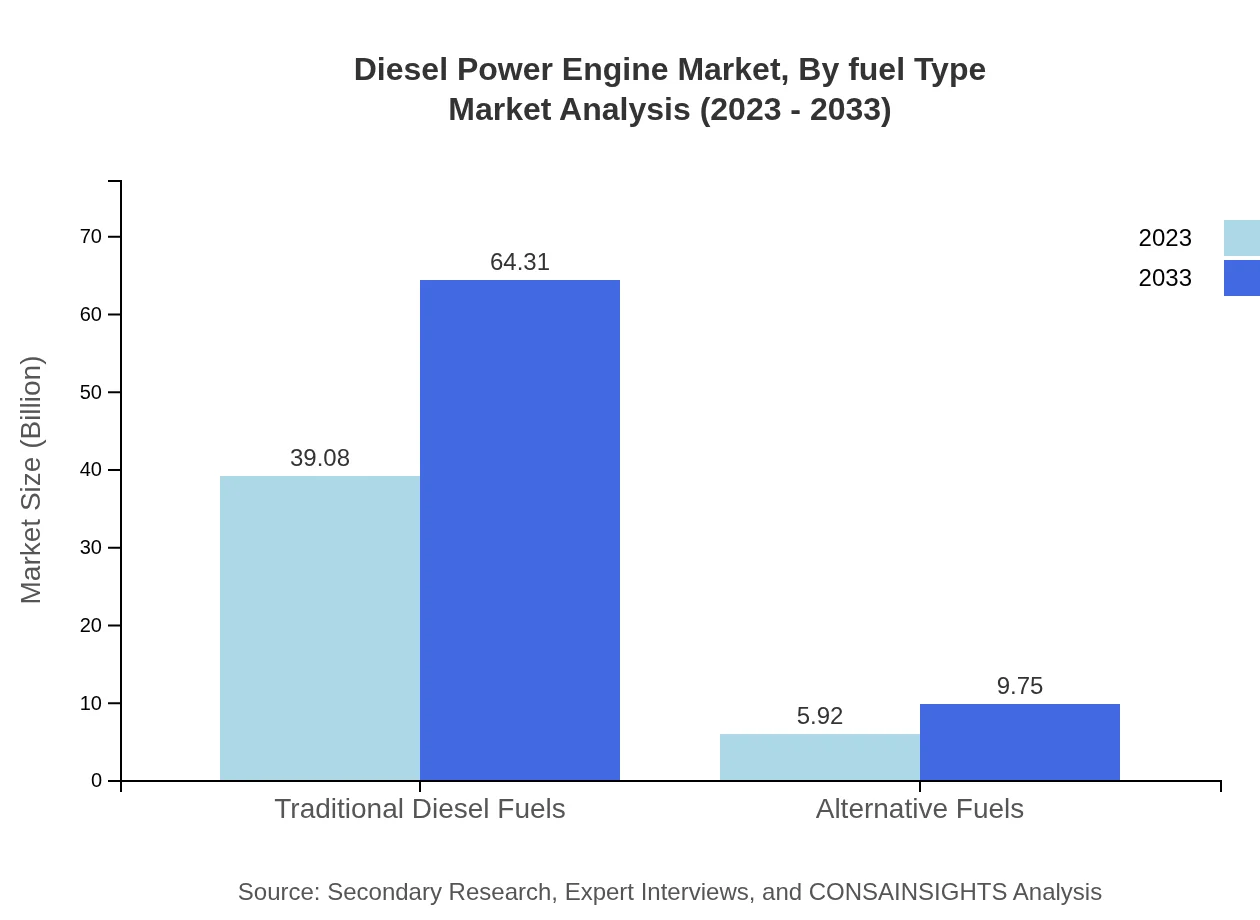

Diesel Power Engine Market Analysis By Fuel Type

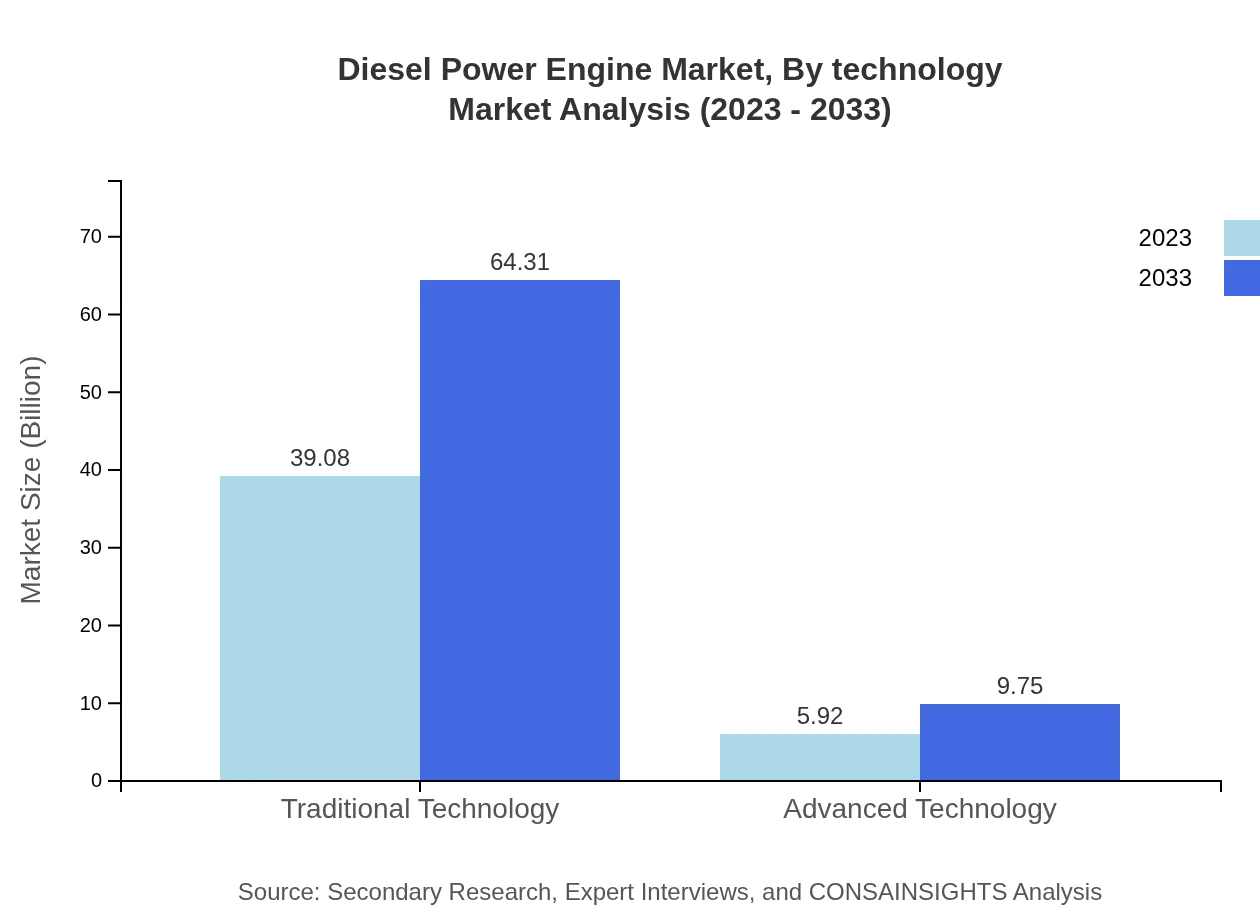

The analysis of fuel types reveals traditional diesel fuels leading the market with $39.08 billion in 2023, expanding to $64.31 billion by 2033. Alternative fuels are also gaining traction, projected to grow from $5.92 billion in 2023 to $9.75 billion by 2033, due to an increasing shift toward environmentally friendly options.

Diesel Power Engine Market Analysis By End User

From an end-user perspective, the industrial segment accounts for $25.31 billion in 2023 and is expected to reach $41.66 billion by 2033, demonstrating the significance of diesel engines in manufacturing processes. The government and commercial sectors also contribute notably, driven by infrastructure projects and transportation needs.

Diesel Power Engine Market Analysis By Technology

Technologically, traditional diesel engines still dominate the market with a substantial share, but advanced technologies are gradually capturing attention, particularly due to environmental concerns. Traditional technologies are expected to hold $39.08 billion in 2023, while advanced technologies grow from $5.92 billion to $9.75 billion, reflecting a slow but steady shift in adoption.

Diesel Power Engine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Diesel Power Engine Industry

Caterpillar Inc.:

A leading manufacturer of diesel engines and machinery, Caterpillar focuses on sustainability and efficiency in operations across various sectors including agriculture and construction.Cummins Inc.:

Cummins is recognized for its advanced diesel engine technologies and innovative solutions that enhance fuel economy and reduce emissions, playing a crucial role in global diesel engine markets.Volvo Penta:

Part of the Volvo Group, Volvo Penta specializes in diesel engines for marine applications, providing efficient, durable solutions for various marine engineering needs.John Deere:

John Deere is well-known in the agricultural sector for its robust diesel engine offerings, enhancing productivity in farming and implementing innovative technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of diesel Power Engine?

The diesel power engine market is valued at approximately $45 billion in 2023, with a projected CAGR of 5%, indicating steady growth through 2033. This expansion reflects the increasing demand across various sectors globally.

What are the key market players or companies in the diesel Power Engine industry?

Key players in the diesel power engine market include industry giants involved in manufacturing and technology advancements, significantly affecting market trends and competitive dynamics.

What are the primary factors driving the growth in the diesel Power Engine industry?

The growth in the diesel power engine industry is primarily driven by increasing demand for industrial applications, infrastructure development, and the transition to alternative fuels for sustainability, fueling innovation and investment.

Which region is the fastest Growing in the diesel Power Engine?

The North America region is projected to be the fastest-growing, with the market size expected to rise from $17.42 billion in 2023 to $28.68 billion by 2033, highlighting ongoing industrial and transportation demands.

Does ConsaInsights provide customized market report data for the diesel Power Engine industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the diesel power engine industry, ensuring comprehensive insights aligned with enterprise objectives.

What deliverables can I expect from this diesel Power Engine market research project?

Deliverables from the diesel power engine market research project may include detailed reports, market forecasts, regional analysis, competitive landscape insights, and tailored recommendations for strategic decision-making.

What are the market trends of diesel Power Engine?

Current market trends in the diesel power engine sector include a shift towards eco-friendly technologies, increasing integration of advanced diesel systems, and buoyant demand in industrial and agricultural segments.