Exhaust Systems Market Report

Published Date: 02 February 2026 | Report Code: exhaust-systems

Exhaust Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Exhaust Systems market from 2023 to 2033, covering key insights, trends, regional performance, and future growth expectations.

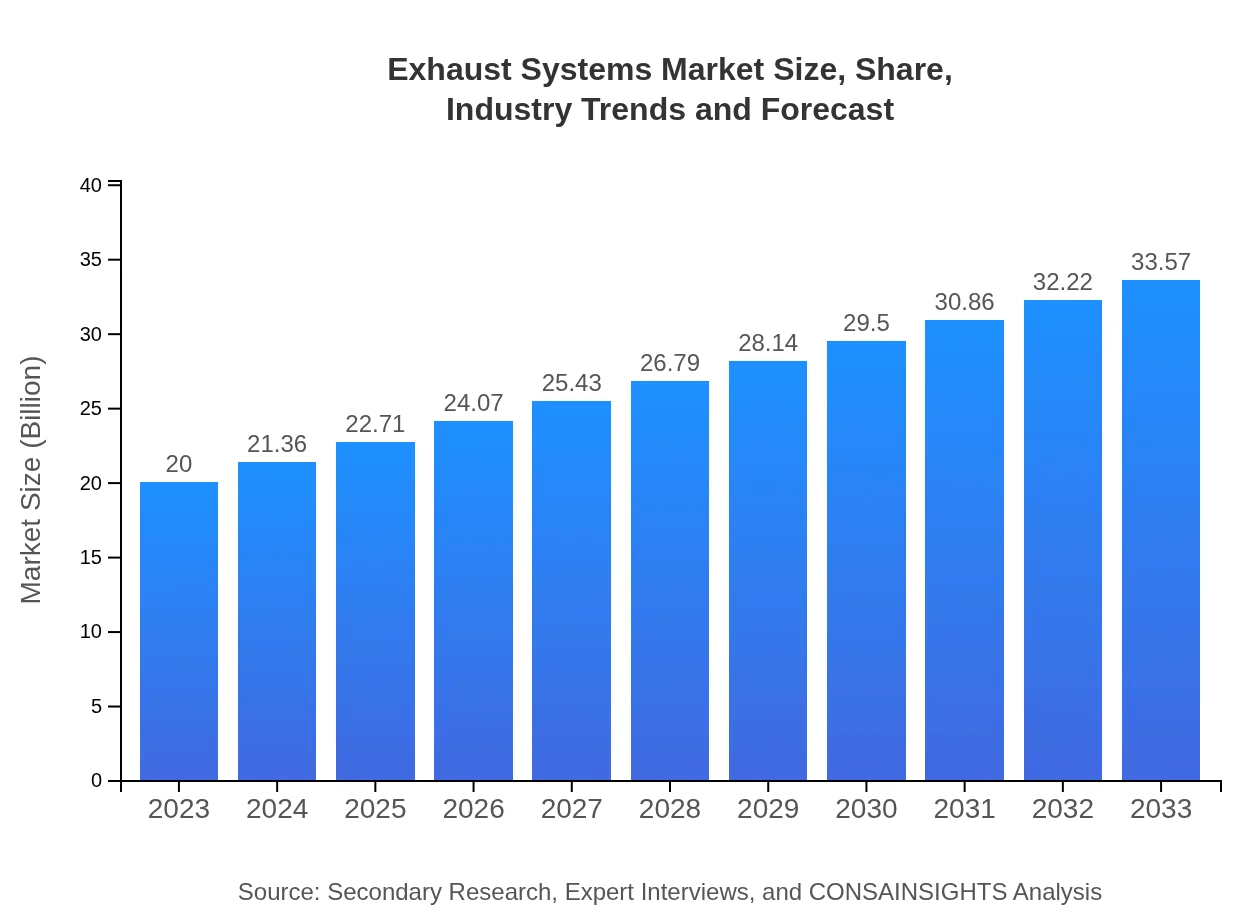

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $33.57 Billion |

| Top Companies | Magna International Inc., Tenneco Inc., Faurecia S.E., Eberspächer Group |

| Last Modified Date | 02 February 2026 |

Exhaust Systems Market Overview

Customize Exhaust Systems Market Report market research report

- ✔ Get in-depth analysis of Exhaust Systems market size, growth, and forecasts.

- ✔ Understand Exhaust Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Exhaust Systems

What is the Market Size & CAGR of Exhaust Systems market in 2023?

Exhaust Systems Industry Analysis

Exhaust Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Exhaust Systems Market Analysis Report by Region

Europe Exhaust Systems Market Report:

Europe's Exhaust Systems market was valued at $5.24 billion in 2023 and is projected to reach $8.79 billion by 2033. The region leads in the adoption of innovative technologies that promote lower emissions, influenced by strict EU regulations. The transition towards electric vehicles further accelerates the growth of exhaust systems that meet new regulatory standards.Asia Pacific Exhaust Systems Market Report:

The Asia Pacific region is projected to witness significant growth in the Exhaust Systems market, with a market size of $3.97 billion in 2023, expected to reach $6.67 billion by 2033. The expansion of automotive manufacturing, particularly in countries like China and India, alongside increasing consumer demand for vehicles, is propelling market growth. Moreover, regulatory frameworks encouraging emissions reduction are bolstering innovations in exhaust technologies.North America Exhaust Systems Market Report:

North America remains one of the key markets for Exhaust Systems, showing a robust growth trajectory from $7.66 billion in 2023 to $12.87 billion by 2033. The region's stringent regulations regarding emissions and environmental impact, alongside a well-established automotive industry, are key drivers of this market. Increased investments in R&D for advanced exhaust technologies also play a critical role.South America Exhaust Systems Market Report:

In South America, the Exhaust Systems market is relatively smaller, valued at $0.53 billion in 2023 and expected to grow to $0.90 billion by 2033. Market growth is primarily driven by the increasing penetration of automobile manufacturers in the region and rising disposable income, leading to higher vehicle ownership rates. However, fluctuating economic conditions could pose challenges to staggering growth.Middle East & Africa Exhaust Systems Market Report:

The Middle East and Africa present a burgeoning market for Exhaust Systems, with an estimated market size of $2.59 billion in 2023, growing to $4.35 billion by 2033. Key drivers include the ongoing expansion of the automotive sector, coupled with enhancing awareness of environmental issues. However, the market faces challenges due to varying regulatory frameworks across the region.Tell us your focus area and get a customized research report.

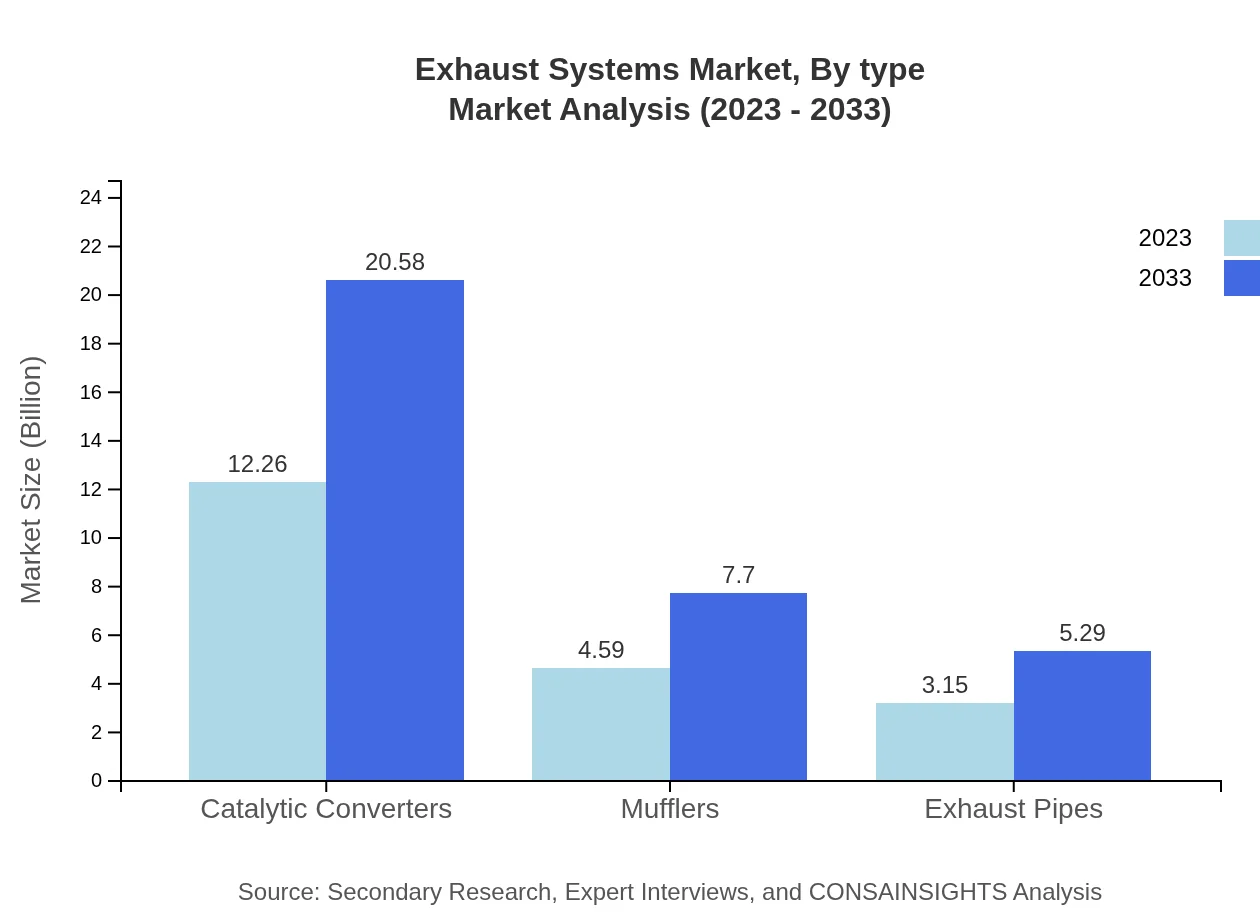

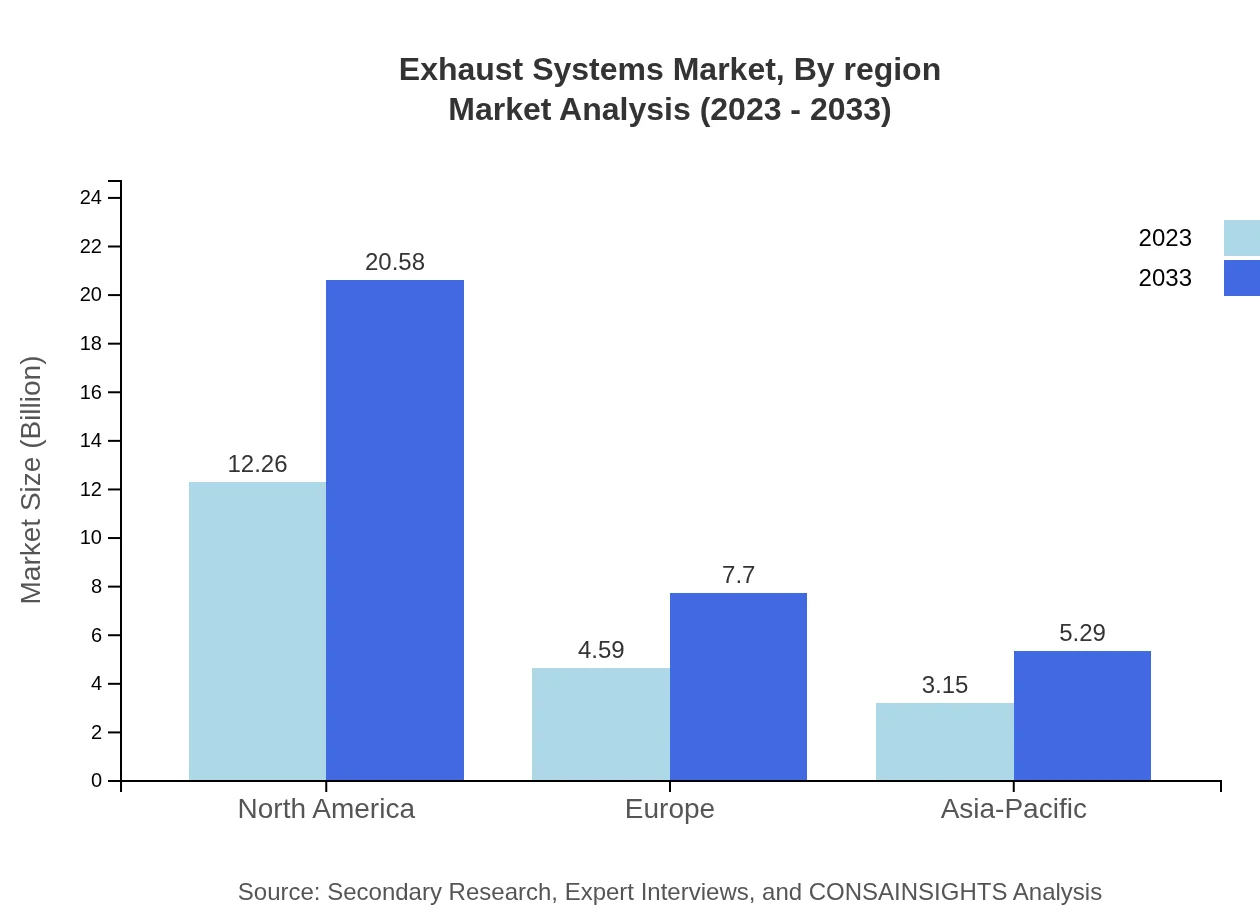

Exhaust Systems Market Analysis By Type

The Exhaust Systems market is prominently driven by three key segments: Catalytic Converters, Mufflers, and Exhaust Pipes. In 2023, the market for Catalytic Converters is $12.26 billion, expected to grow significantly to $20.58 billion by 2033. This segment holds a market share of 61.3%. Mufflers, valued at $4.59 billion in 2023, are projected to reach $7.70 billion by 2033, maintaining a share of 22.94%. Exhaust Pipes are estimated at $3.15 billion in 2023, with a projected increase to $5.29 billion by 2033, representing a 15.76% share.

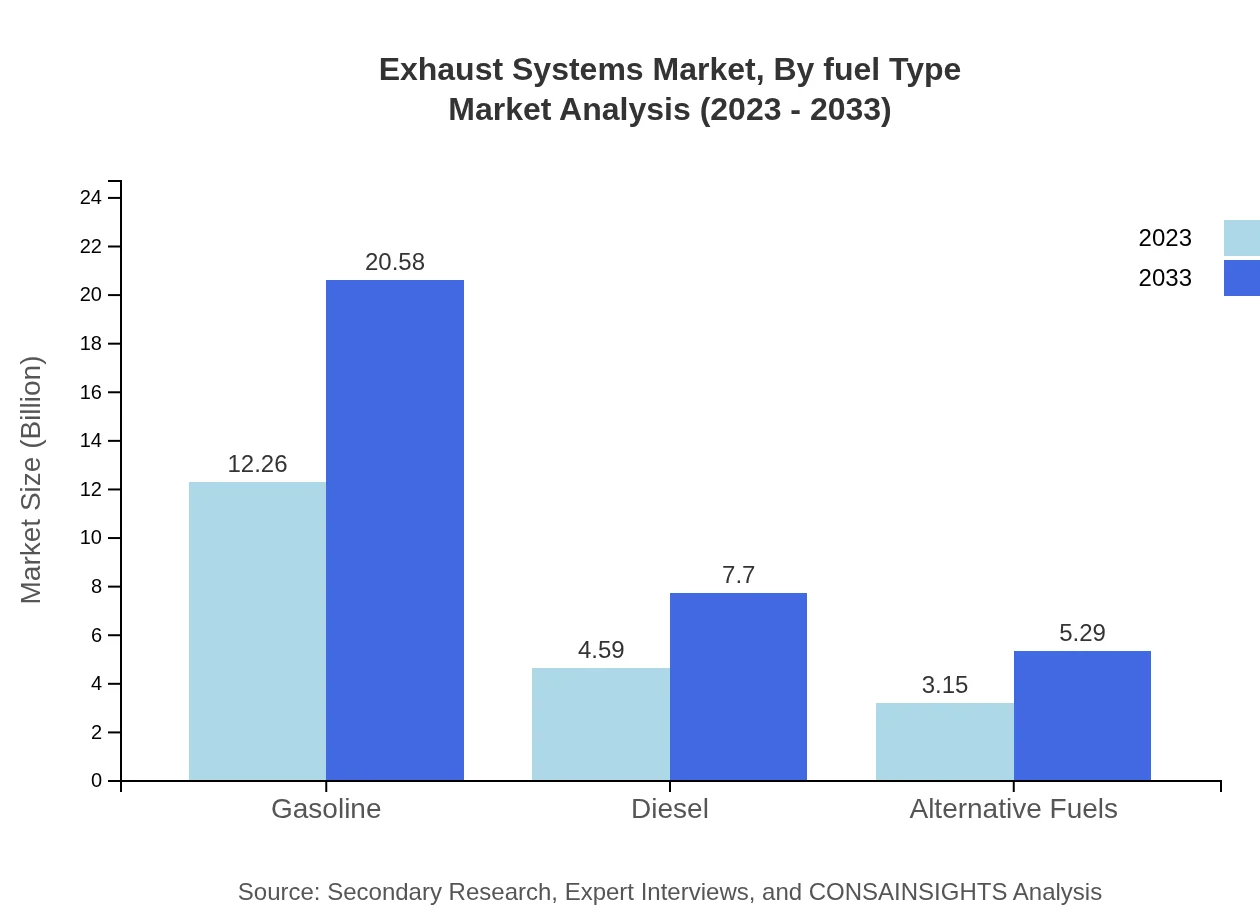

Exhaust Systems Market Analysis By Fuel Type

Analyzing the fuel type segments, gasoline exhaust systems dominate with a size of $12.26 billion in 2023, set to grow to $20.58 billion by 2033, maintaining a noteworthy market share of 61.3%. Diesel exhaust systems are valued at $4.59 billion in 2023, projected to grow to $7.70 billion by 2033, securing a 22.94% share. Alternative fuel systems, currently valued at $3.15 billion, are expected to increase to $5.29 billion over the next decade, representing a 15.76% share.

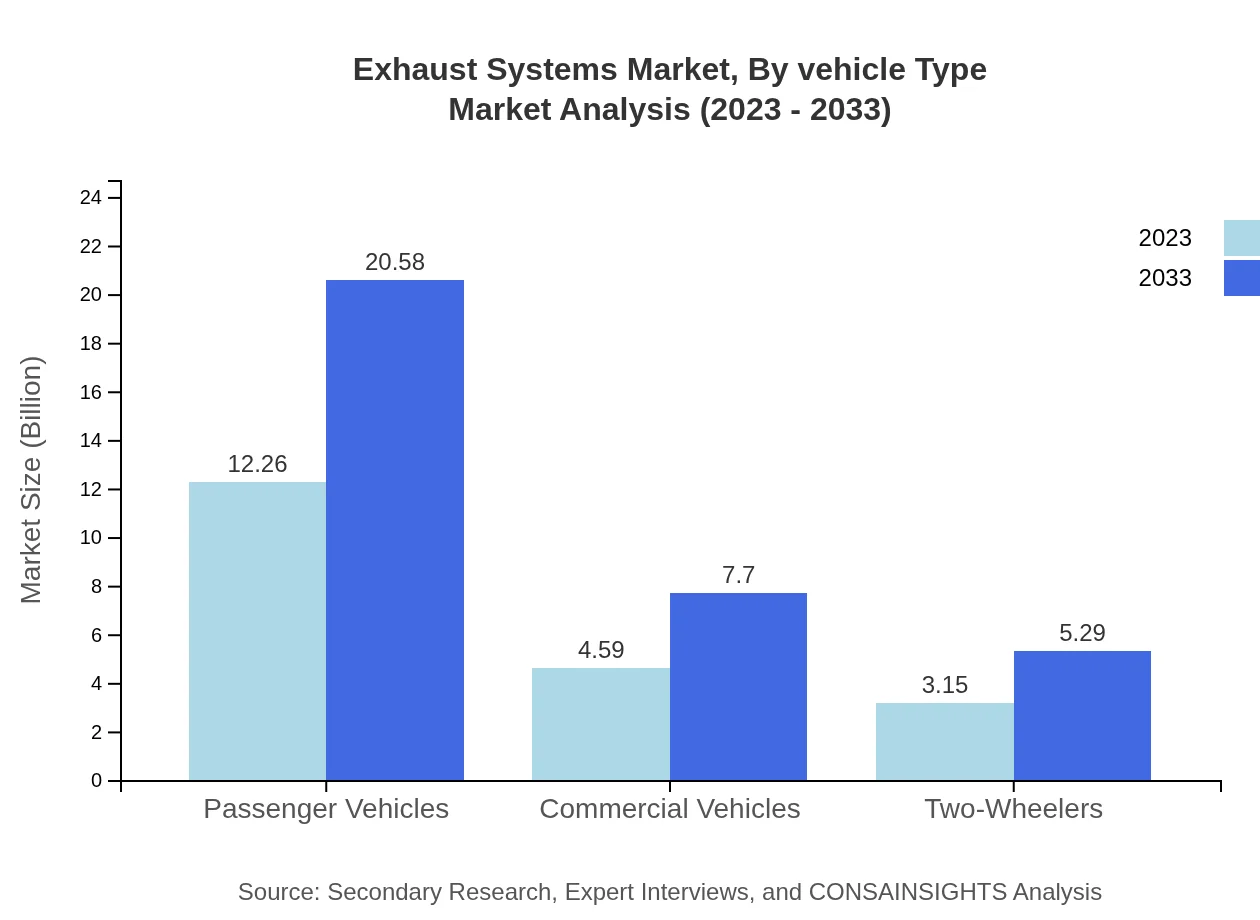

Exhaust Systems Market Analysis By Vehicle Type

The segmentation by vehicle type shows passenger vehicles leading with a market size of $12.26 billion in 2023, expected to rise to $20.58 billion by 2033, capturing a significant 61.3% share. Commercial vehicles follow, with a size of $4.59 billion expected to grow to $7.70 billion by 2033, while two-wheelers represent a growing segment currently valued at $3.15 billion, projected to reach $5.29 billion by the end of the forecast period.

Exhaust Systems Market Analysis By Region

The market analysis by region indicates significant growth in North America, with a current size of $7.66 billion projected to grow to $12.87 billion by 2033. Europe follows closely, transitioning from $5.24 billion to $8.79 billion, while Asia Pacific shows fast growth potential going from $3.97 billion to $6.67 billion. The markets in South America and the Middle East and Africa, though smaller, are poised for growth despite their current market sizes of $0.53 billion and $2.59 billion, respectively.

Exhaust Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Exhaust Systems Industry

Magna International Inc.:

Magna International is one of the largest suppliers of automotive systems and components worldwide, heavily involved in the development and manufacture of advanced exhaust systems that align with global emissions standards.Tenneco Inc.:

Tenneco is a leading global automotive parts manufacturer focused on clean air and ride performance products, including exhaust systems. They are known for innovation in catalytic convertors and other exhaust technologies.Faurecia S.E.:

Faurecia specializes in sustainable mobility solutions, offering advanced exhaust systems that enhance vehicle efficiency while minimizing environmental impact. They invest significantly in R&D for exhaust technologies.Eberspächer Group:

Eberspächer is an international supplier of exhaust technology, renowned for its pioneering work in exhaust systems and catalytic converters for a wide range of vehicles.We're grateful to work with incredible clients.

FAQs

What is the market size of exhaust systems?

The global exhaust systems market is valued at approximately $20 billion in 2023 and is projected to grow at a CAGR of 5.2%, reaching significant growth by 2033.

What are the key market players or companies in the exhaust systems industry?

Prominent players in the exhaust systems market include manufacturers like Faurecia, Tenneco, and Eberspächer, which offer a variety of products to meet both passenger and commercial vehicle demands.

What are the primary factors driving the growth in the exhaust systems industry?

Growth in the exhaust systems industry is driven by increasing demand for fuel-efficient vehicles, tightening emission regulations, and technological advancements in exhaust treatment systems aimed at improving performance and compliance.

Which region is the fastest Growing in the exhaust systems?

The North American region is currently the fastest-growing market segment for exhaust systems, anticipated to increase from $7.66 billion in 2023 to $12.87 billion by 2033, reflecting strong growth prospects.

Does ConsaInsights provide customized market report data for the exhaust systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the exhaust systems industry, enabling clients to access detailed insights relevant to their strategic objectives.

What deliverables can I expect from this exhaust systems market research project?

From the exhaust systems market research project, you can expect comprehensive reports, data analytics, segment analysis, regional insights, and strategic recommendations tailored to market dynamics.

What are the market trends of exhaust systems?

Key trends in the exhaust systems market include the integration of lightweight materials, advancements in electric vehicle technologies, and a shift towards sustainable practices, driving innovation and competitive dynamics.