Financial Services Desktop Virtualization Market Report

Published Date: 31 January 2026 | Report Code: financial-services-desktop-virtualization

Financial Services Desktop Virtualization Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Financial Services Desktop Virtualization market, offering insights into its size, trends, and competitive landscape from 2023 to 2033. It provides detailed regional analysis, industry segmentation, and forecasts that empower stakeholders to make informed decisions.

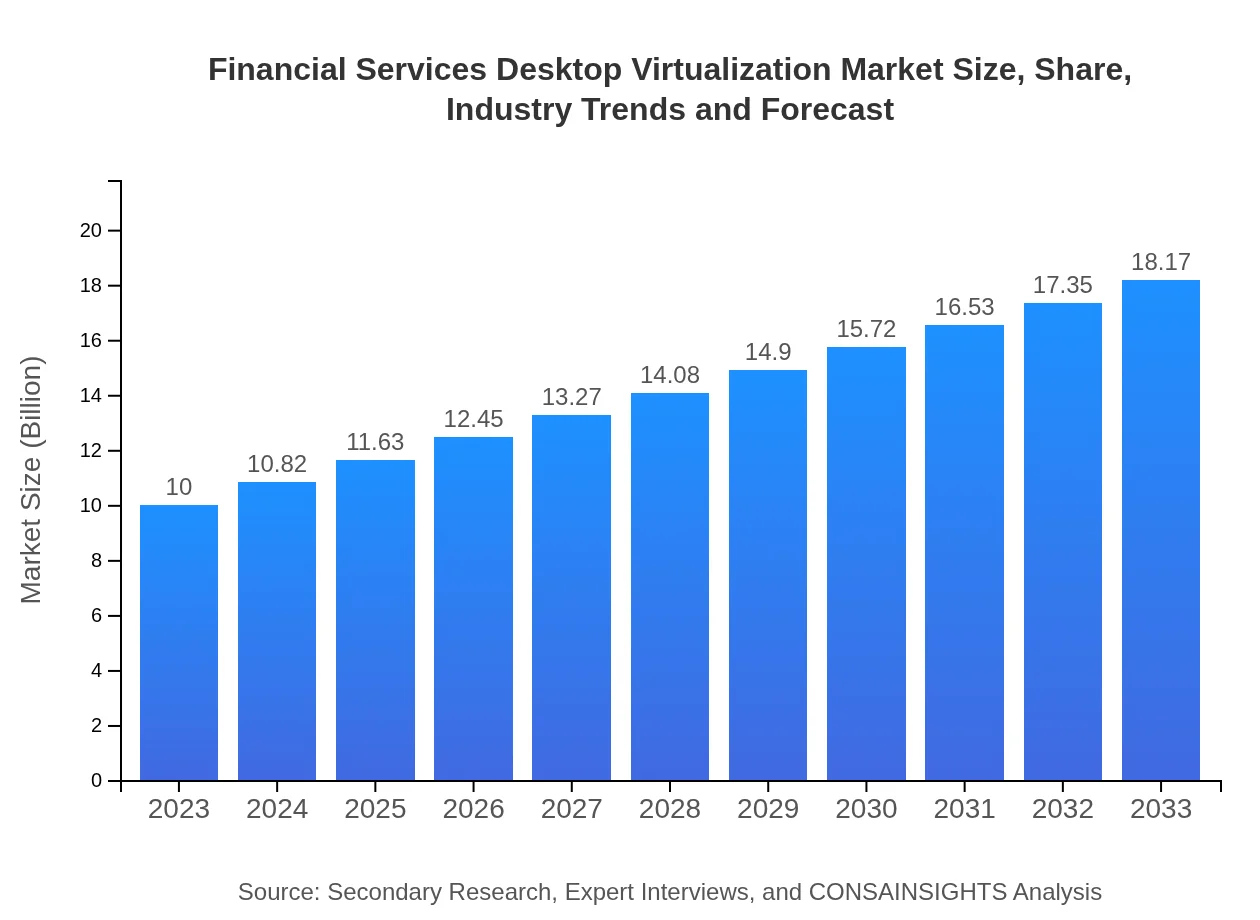

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $18.17 Billion |

| Top Companies | VMware, Inc., Citrix Systems, Inc., Microsoft Corporation, Amazon Web Services, Inc. |

| Last Modified Date | 31 January 2026 |

Financial Services Desktop Virtualization Market Overview

Customize Financial Services Desktop Virtualization Market Report market research report

- ✔ Get in-depth analysis of Financial Services Desktop Virtualization market size, growth, and forecasts.

- ✔ Understand Financial Services Desktop Virtualization's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Financial Services Desktop Virtualization

What is the Market Size & CAGR of Financial Services Desktop Virtualization market in 2023?

Financial Services Desktop Virtualization Industry Analysis

Financial Services Desktop Virtualization Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Financial Services Desktop Virtualization Market Analysis Report by Region

Europe Financial Services Desktop Virtualization Market Report:

In Europe, the market is expected to increase from $2.51 billion in 2023 to $4.56 billion by 2033, supported by an emphasis on regulatory compliance and evolving data security protocols. The adoption of innovative virtualization technologies is becoming a vital strategy for European financial firms to remain competitive.Asia Pacific Financial Services Desktop Virtualization Market Report:

The Asia-Pacific market for Financial Services Desktop Virtualization is projected to grow from $1.90 billion in 2023 to $3.46 billion by 2033, driven by digital banking initiatives and increasing adoption of cloud solutions among institutions. The region sees rising investments in advanced technologies and a growing emphasis on enhancing customer experiences through efficient virtual platforms.North America Financial Services Desktop Virtualization Market Report:

North America holds the largest market share, with revenues projected to increase from $3.59 billion in 2023 to $6.53 billion by 2033. This growth is attributed to the presence of major financial institutions investing heavily in virtualization to enhance operational efficiency and compliance with regulatory requirements.South America Financial Services Desktop Virtualization Market Report:

In South America, the Financial Services Desktop Virtualization market is anticipated to grow from $1.00 billion in 2023 to $1.81 billion by 2033. This growth is primarily fueled by an increase in mobile banking and demand for improved customer support solutions in financial services, helping institutions adapt to technological changes.Middle East & Africa Financial Services Desktop Virtualization Market Report:

The Middle East and Africa market is projected to grow from $0.99 billion in 2023 to $1.81 billion by 2033, driven by an increase in digital transformation across financial services, along with rising demand for secure and reliable desktop solutions amid changing workforce dynamics.Tell us your focus area and get a customized research report.

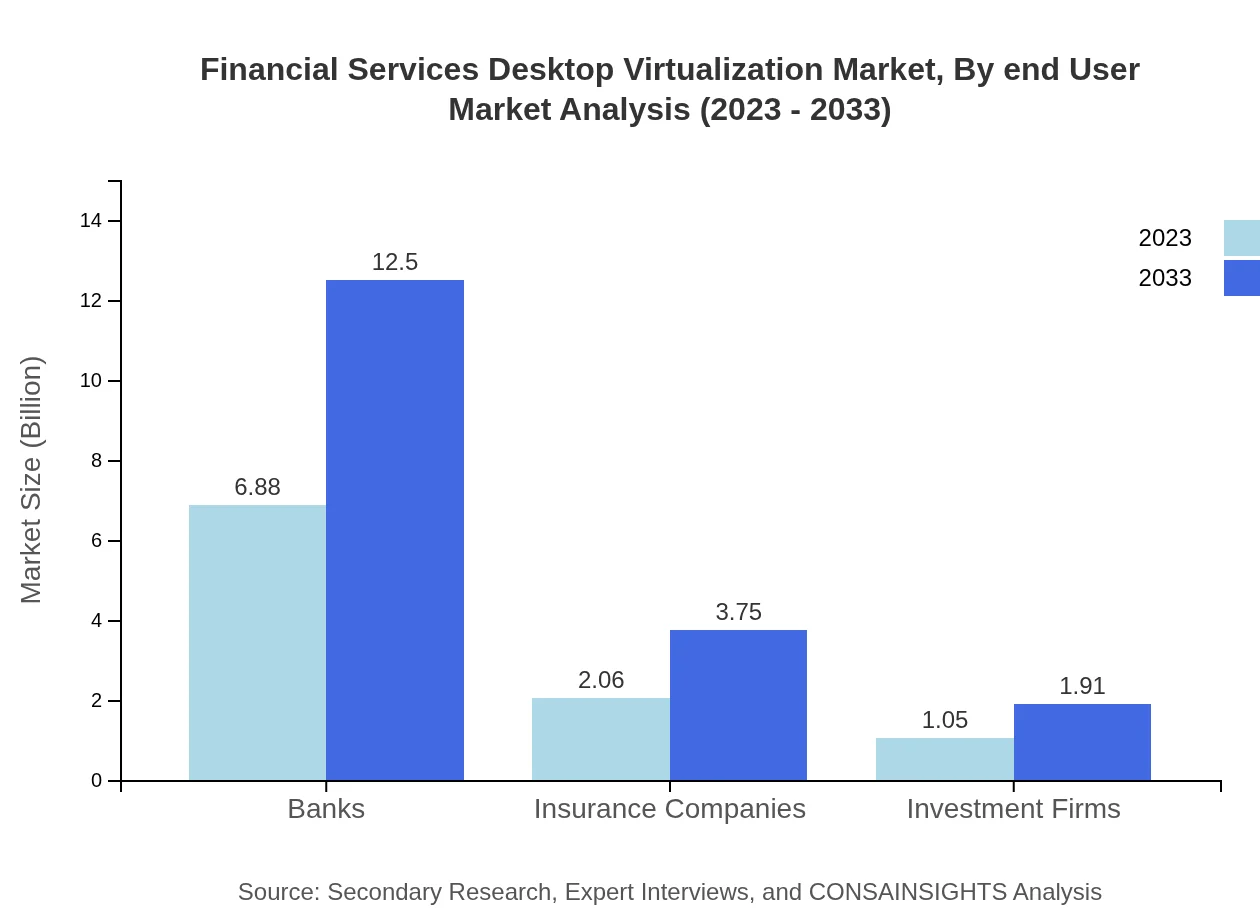

Financial Services Desktop Virtualization Market Analysis By End User

The segment analysis reveals that banks dominate the market, accounting for approximately $6.88 billion in 2023 and expected to grow to $12.50 billion by 2033. Insurance companies and investment firms follow with respective market sizes of $2.06 billion and $1.05 billion in 2023, reflecting the growing importance of virtualization in enhancing efficiency and security across financial transactions.

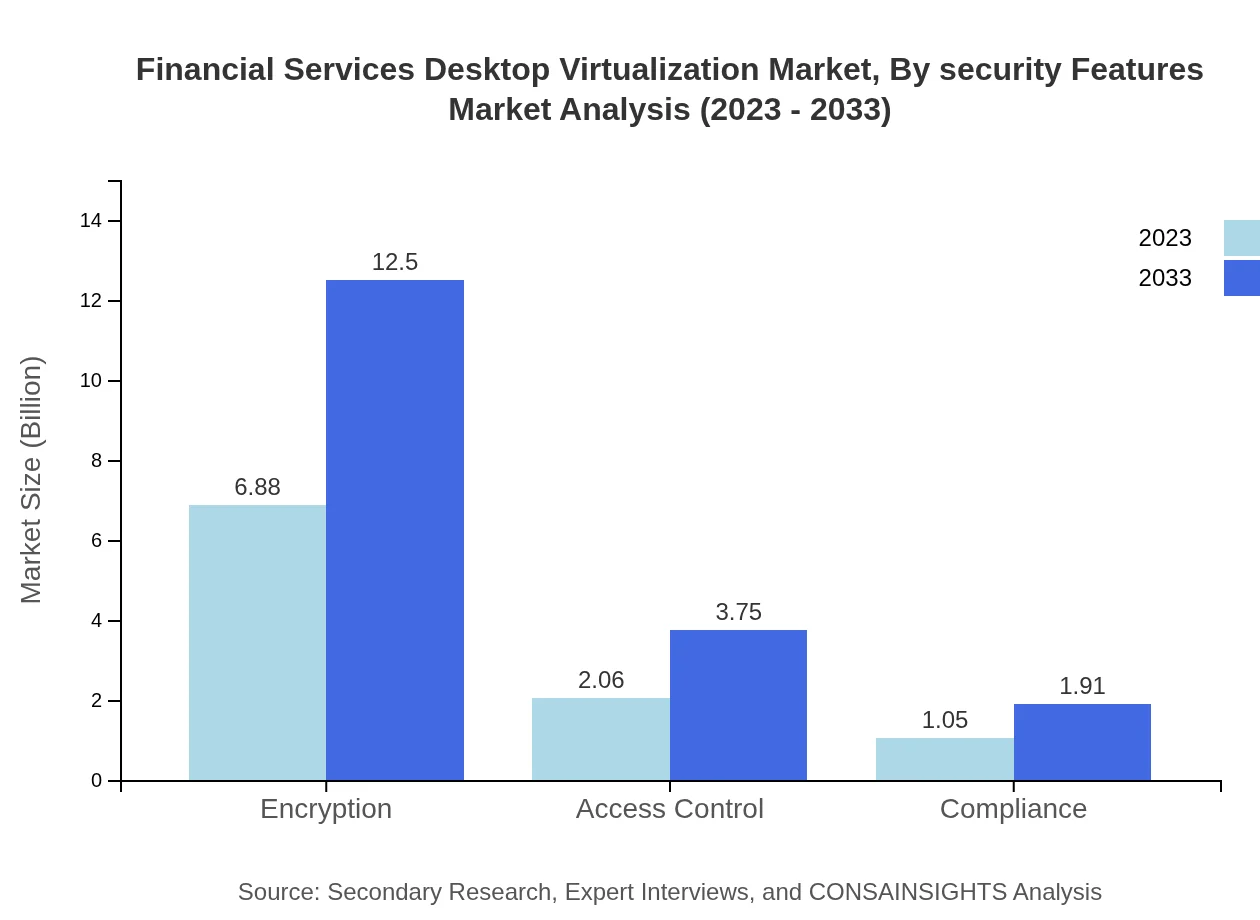

Financial Services Desktop Virtualization Market Analysis By Security Features

Key security features driving market growth include encryption, access control, and compliance measures. Encryption contributes significantly, with a market size of $6.88 billion in 2023, expected to reach $12.50 billion by 2033. Compliance assurance remains critical, reflecting the need for stringent data protection in financial services.

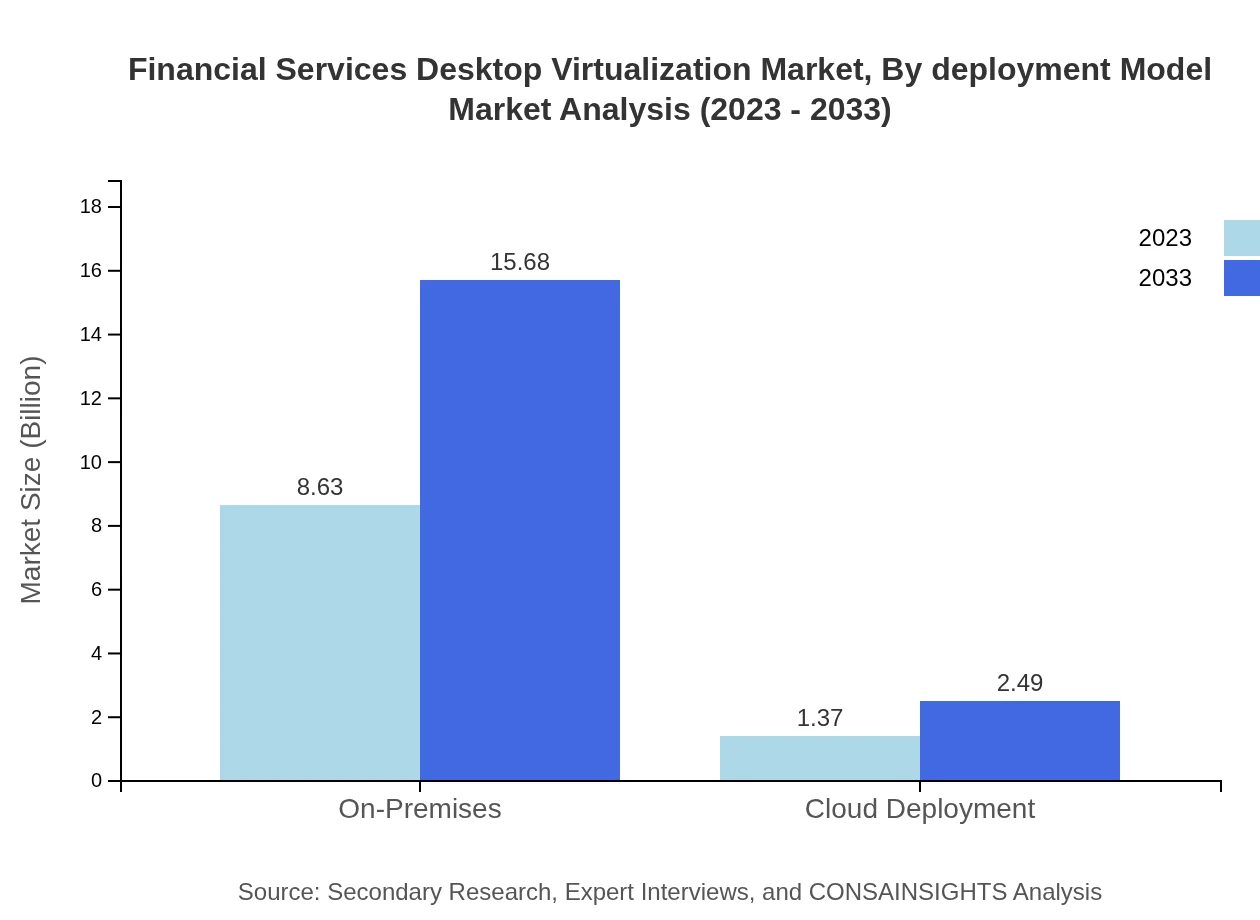

Financial Services Desktop Virtualization Market Analysis By Deployment Model

On-premises deployments currently dominate the market at $8.63 billion in 2023 and are anticipated to reach $15.68 billion by 2033. Cloud-based solutions are also gaining traction, with market values estimated at $1.37 billion in 2023, expected to grow to $2.49 billion driven by demand for flexibility and remote access among financial institutions.

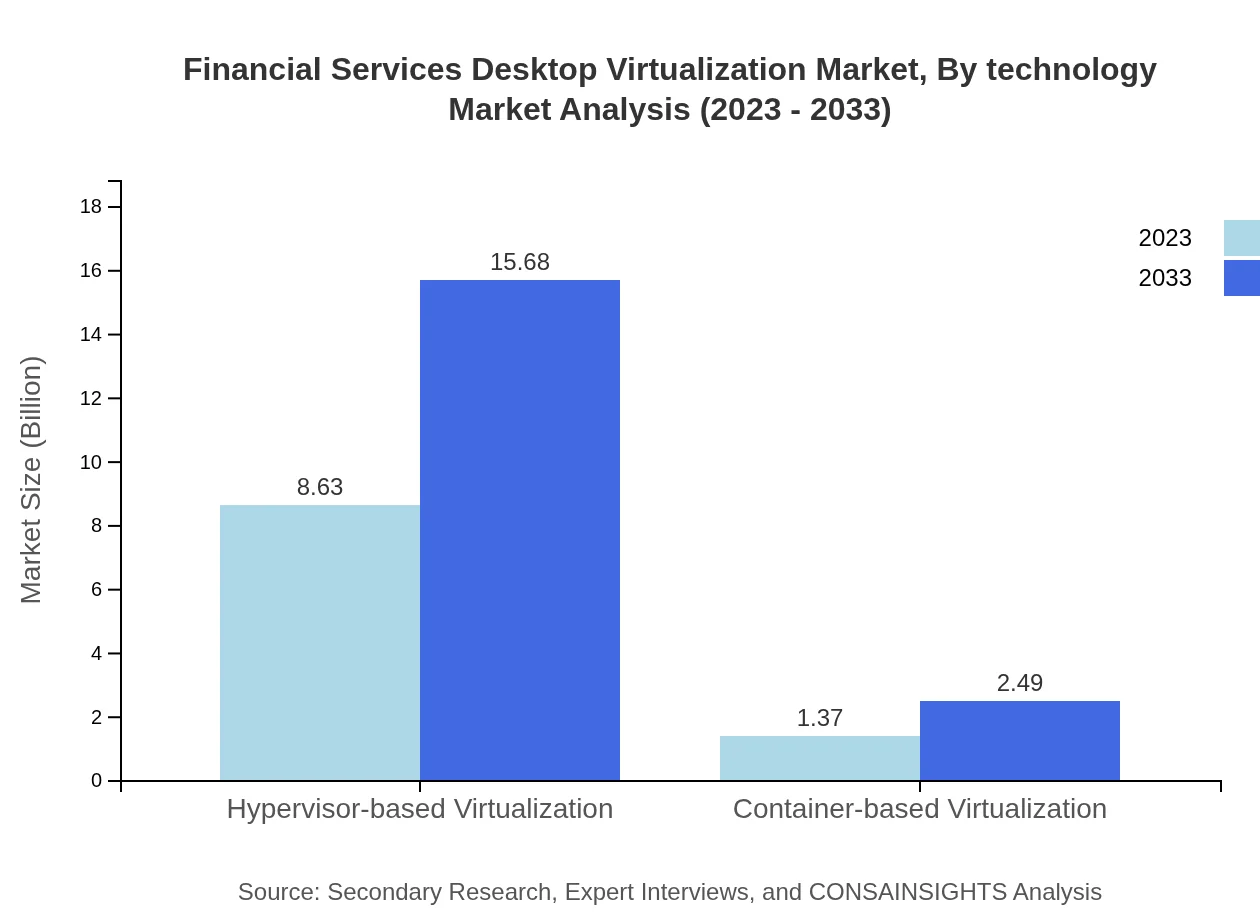

Financial Services Desktop Virtualization Market Analysis By Technology

Hypervisor-based virtualization holds the largest share in the market, with a size of $8.63 billion in 2023, projected to reach $15.68 billion by 2033. Meanwhile, container-based virtualization is emerging as a significant player with growth anticipated from $1.37 billion to $2.49 billion, driven by advancements in application deployment.

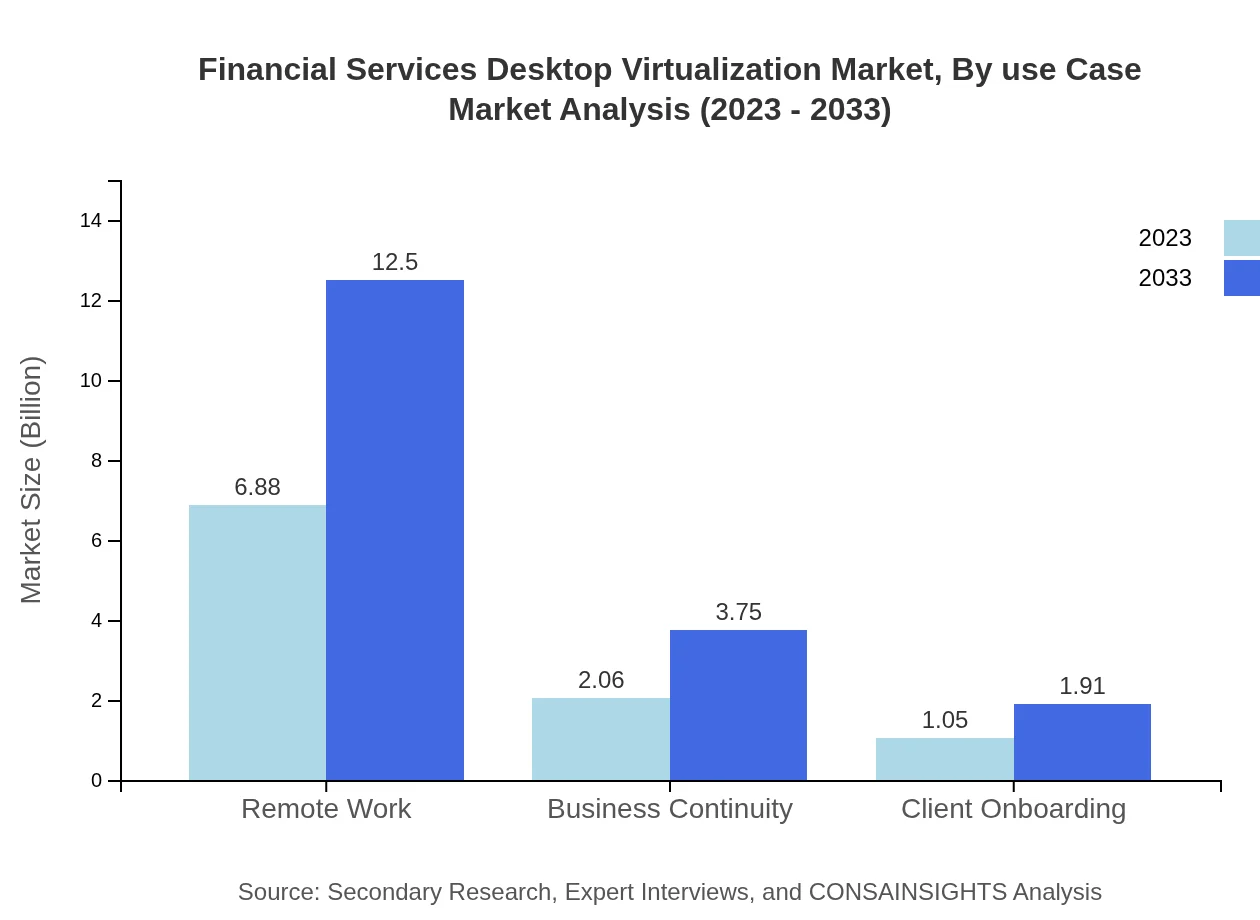

Financial Services Desktop Virtualization Market Analysis By Use Case

Remote work solutions account for the most substantial share at $6.88 billion in 2023 and are forecasted to grow to $12.50 billion by 2033. Business continuity also plays a vital role, with expected growth reflecting increased demand for reliable operations amidst unforeseen disruptions.

Financial Services Desktop Virtualization Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Financial Services Desktop Virtualization Industry

VMware, Inc.:

VMware is a prominent player in virtualization technology, known for its comprehensive solutions that enhance cloud infrastructure and enable robust desktop virtualization environments for financial services.Citrix Systems, Inc.:

Citrix is a well-known provider of virtual solutions, focusing on providing secure and efficient desktop delivery technologies for the financial sector, helping firms maintain productivity with optimal security.Microsoft Corporation:

Microsoft's Azure Virtual Desktop and related products play a vital role in the financial services sector by offering scalable and secure desktop virtualization solutions that integrate seamlessly with existing enterprise environments.Amazon Web Services, Inc.:

AWS provides a wide range of solutions, including WorkSpaces, aimed at facilitating secure desktop delivery and management for financial institutions, driving efficiency and cloud adoption.We're grateful to work with incredible clients.

FAQs

What is the market size of Financial Services Desktop Virtualization?

The Financial Services Desktop Virtualization market is projected to reach approximately $10 billion by 2033, growing at a CAGR of 6% from its current valuation. In 2023, the market is estimated to be about $10 billion.

What are the key market players or companies in this Financial Services Desktop Virtualization industry?

Key market players in the Financial Services Desktop Virtualization industry include global technology firms that specialize in virtualization solutions, such as VMware, Citrix, and Microsoft, as well as emerging startups focusing on innovative cloud solutions.

What are the primary factors driving the growth in the Financial Services Desktop Virtualization industry?

Growth in the Financial Services Desktop Virtualization industry is driven by increased demand for remote work solutions, enhanced security requirements, regulatory compliance needs, and the necessity for business continuity, as financial institutions adapt to digital transformation.

Which region is the fastest Growing in the Financial Services Desktop Virtualization?

The fastest-growing region in the Financial Services Desktop Virtualization market is projected to be North America, with the market size expected to grow from $3.59 billion in 2023 to $6.53 billion by 2033, reflecting significant investment and adoption of virtualization technologies.

Does ConsaInsights provide customized market report data for the Financial Services Desktop Virtualization industry?

Yes, ConsaInsights offers customized market report data tailored to the Financial Services Desktop Virtualization industry, allowing businesses to receive specific insights based on their requirements and market dynamics.

What deliverables can I expect from this Financial Services Desktop Virtualization market research project?

Deliverables from the Financial Services Desktop Virtualization market research project typically include comprehensive market analysis reports, data on market size and growth, competitive landscape assessments, and insights into regional trends and customer preferences.

What are the market trends of Financial Services Desktop Virtualization?

Market trends in Financial Services Desktop Virtualization include a shift towards hybrid cloud solutions, increased focus on security and compliance, growth in remote work infrastructure, investment in advanced technologies, and a rise in demand for data encryption and access control features.