Flow Sensors Market Report

Published Date: 31 January 2026 | Report Code: flow-sensors

Flow Sensors Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report covers the Flow Sensors industry, providing insights into current market conditions, size, forecasts, and segmentation from 2023 to 2033, including regional analyses and key market players.

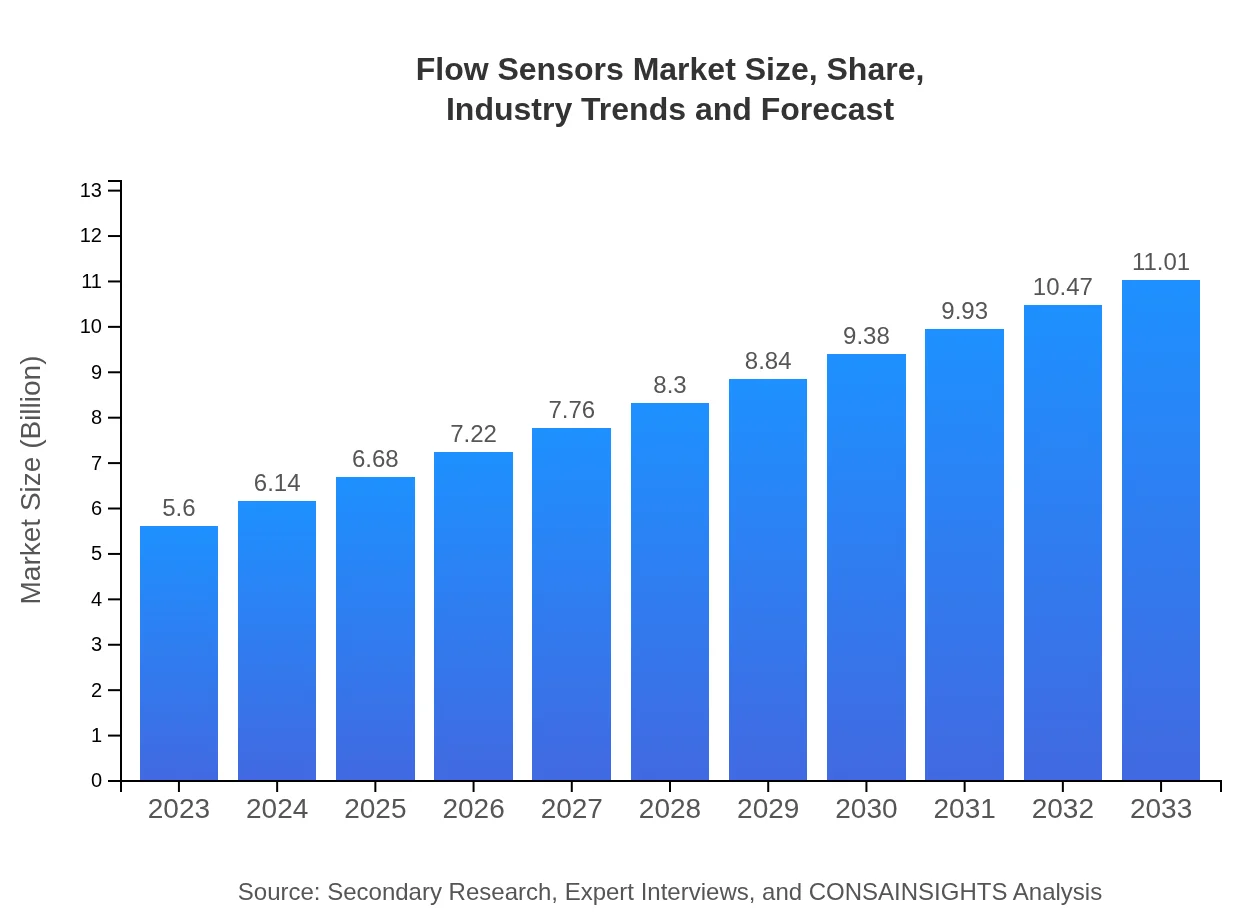

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Emerson Electric Co., Siemens AG, Honeywell International Inc., Endress+Hauser, Yokogawa Electric Corporation |

| Last Modified Date | 31 January 2026 |

Flow Sensors Market Overview

Customize Flow Sensors Market Report market research report

- ✔ Get in-depth analysis of Flow Sensors market size, growth, and forecasts.

- ✔ Understand Flow Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Flow Sensors

What is the Market Size & CAGR of Flow Sensors market in 2033?

Flow Sensors Industry Analysis

Flow Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Flow Sensors Market Analysis Report by Region

Europe Flow Sensors Market Report:

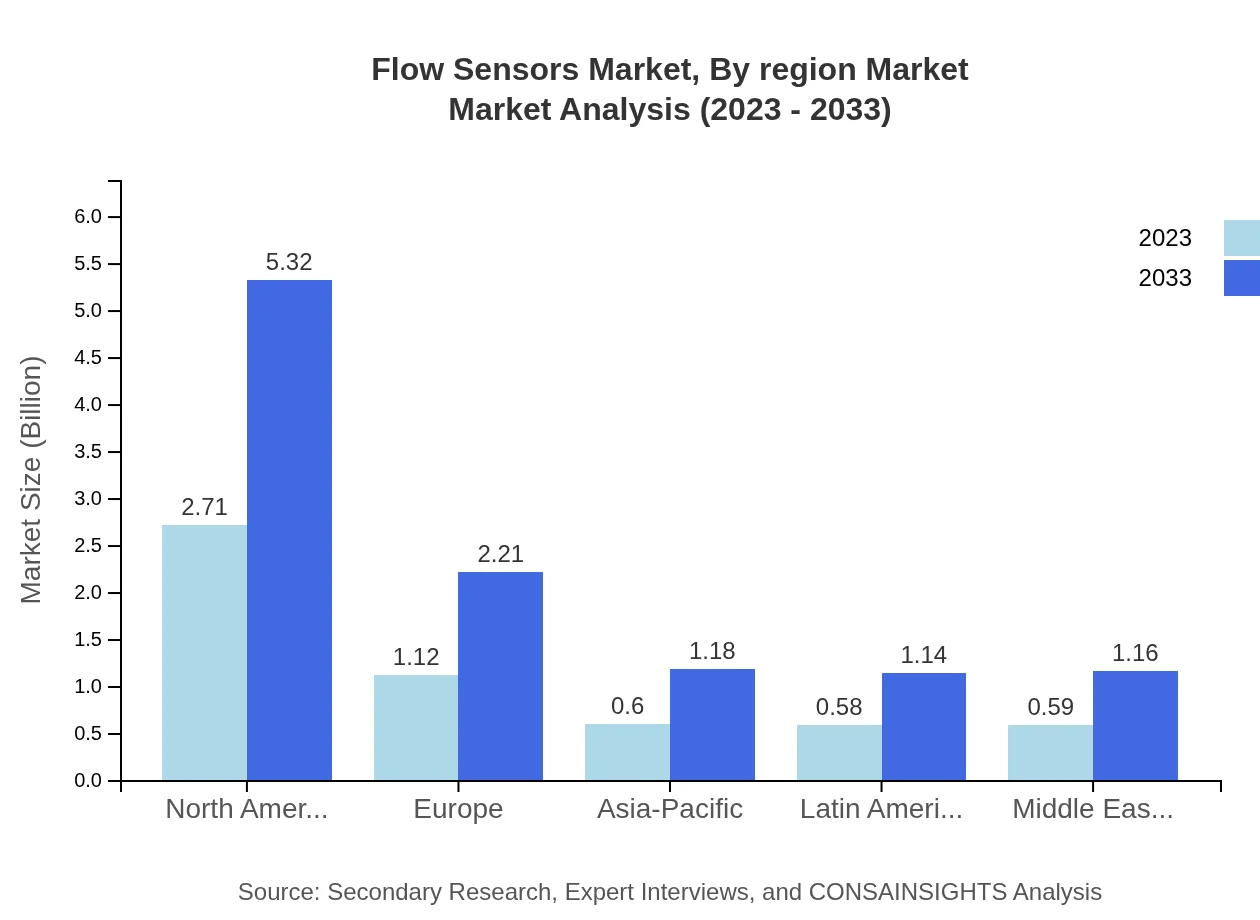

Europe's flow sensors market is set for growth from $1.80 billion in 2023 to $3.54 billion by 2033. The region’s focus on sustainability and strict environmental regulations are driving the demand for efficient flow monitoring solutions.Asia Pacific Flow Sensors Market Report:

The Asia-Pacific region holds a significant share of the flow sensors market, projected to grow from $1.04 billion in 2023 to $2.05 billion by 2033. Key growth drivers include rapid industrialization, urbanization, and increasing investments in smart infrastructure.North America Flow Sensors Market Report:

North America is expected to dominance, with the market size growing from $1.92 billion in 2023 to $3.78 billion in 2033. The U.S. is a major contributor due to its technological advancements and significant investments in energy and industrial sectors.South America Flow Sensors Market Report:

The South American market is anticipated to grow steadily, with a rise from $0.32 billion in 2023 to $0.64 billion in 2033. The demand for flow sensors in water management and agricultural applications underpins the market's growth.Middle East & Africa Flow Sensors Market Report:

The Middle Eastern and African market is forecasted to grow from $0.51 billion in 2023 to $1.00 billion by 2033, driven by increasing investments in oil and gas as well as infrastructural development projects.Tell us your focus area and get a customized research report.

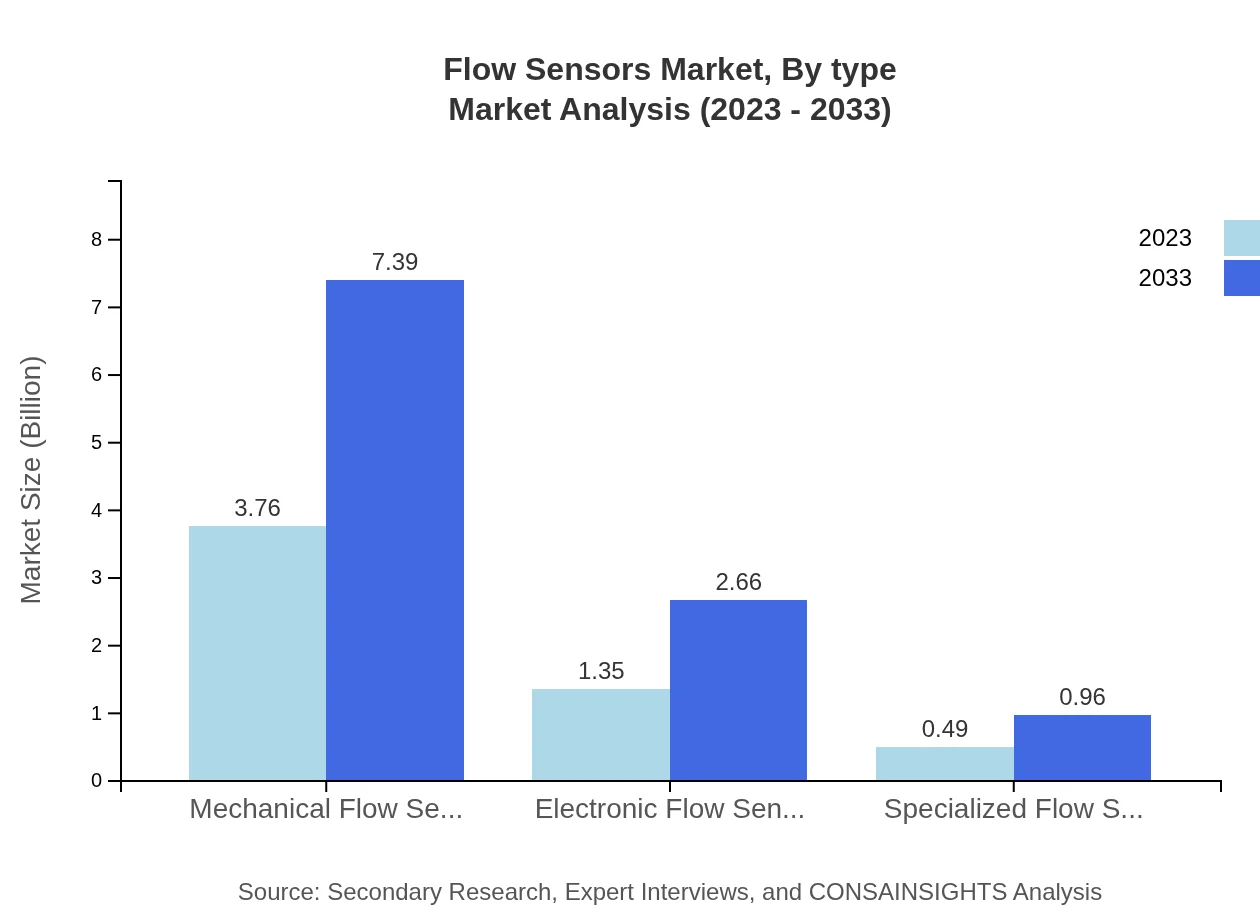

Flow Sensors Market Analysis By Type

Mechanical Flow Sensors dominate the market, projected to increase from $3.76 billion in 2023 to $7.39 billion in 2033, holding a 67.12% market share. Electronic Flow Sensors are expected to rise from $1.35 billion to $2.66 billion, maintaining a 24.13% share. Specialized Flow Sensors will grow from $0.49 billion to $0.96 billion, representing an 8.75% share.

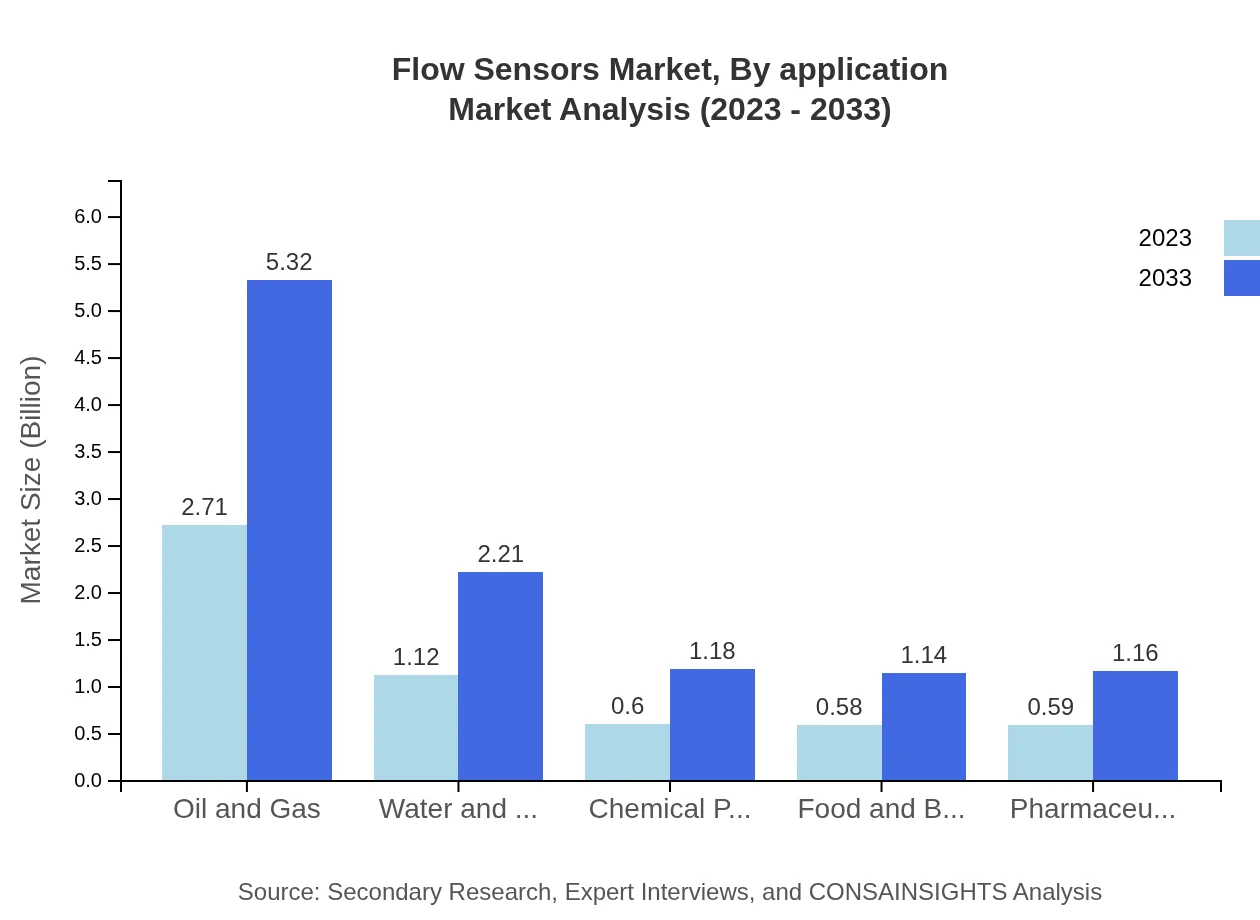

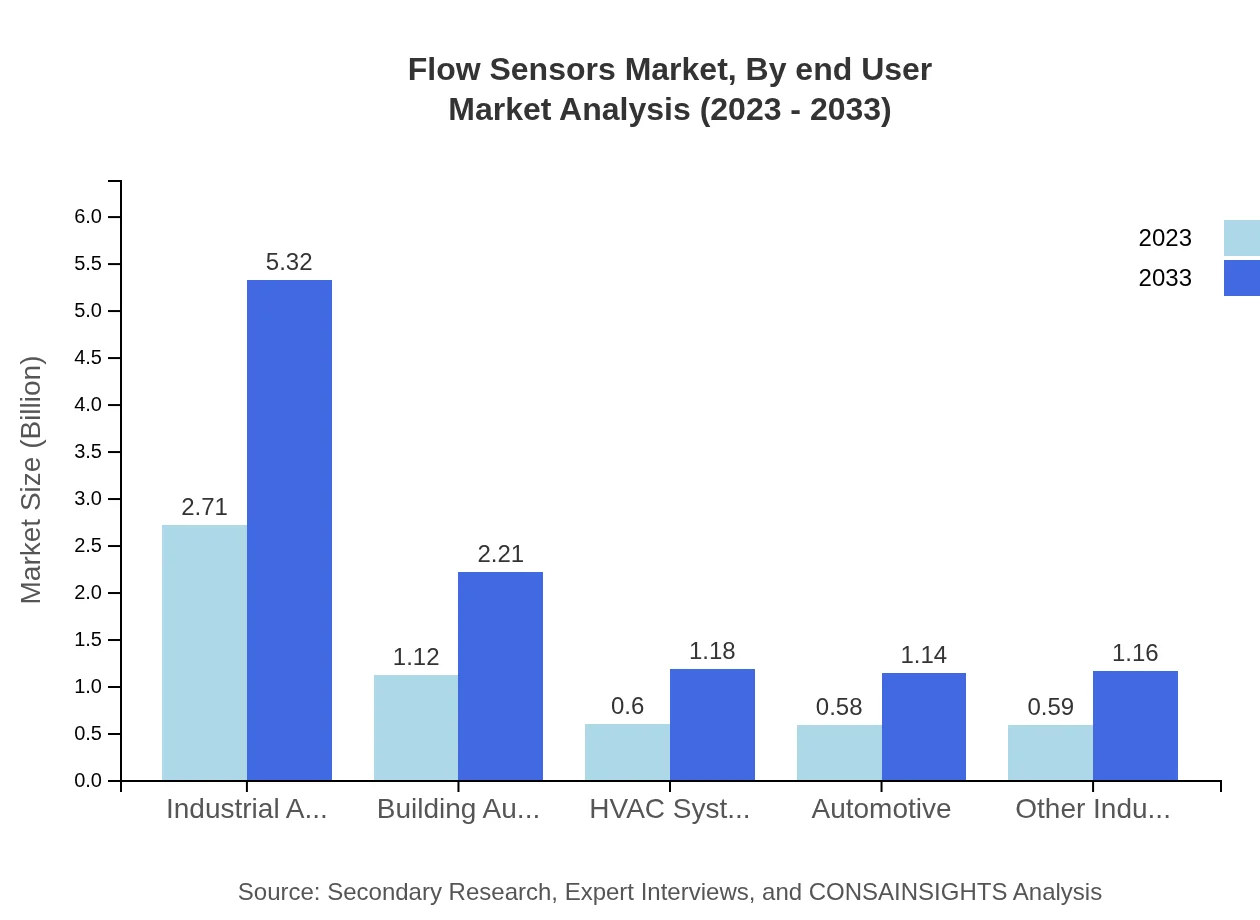

Flow Sensors Market Analysis By Application

The Industrial Automation application segment is poised to grow significantly, from $2.71 billion in 2023 to $5.32 billion by 2033, capturing a 48.35% market share. Building Automation is also notable, growing from $1.12 billion to $2.21 billion (20.05% share). HVAC Systems and Automotive applications are expected to hold shares of 10.72% and 10.37%, respectively.

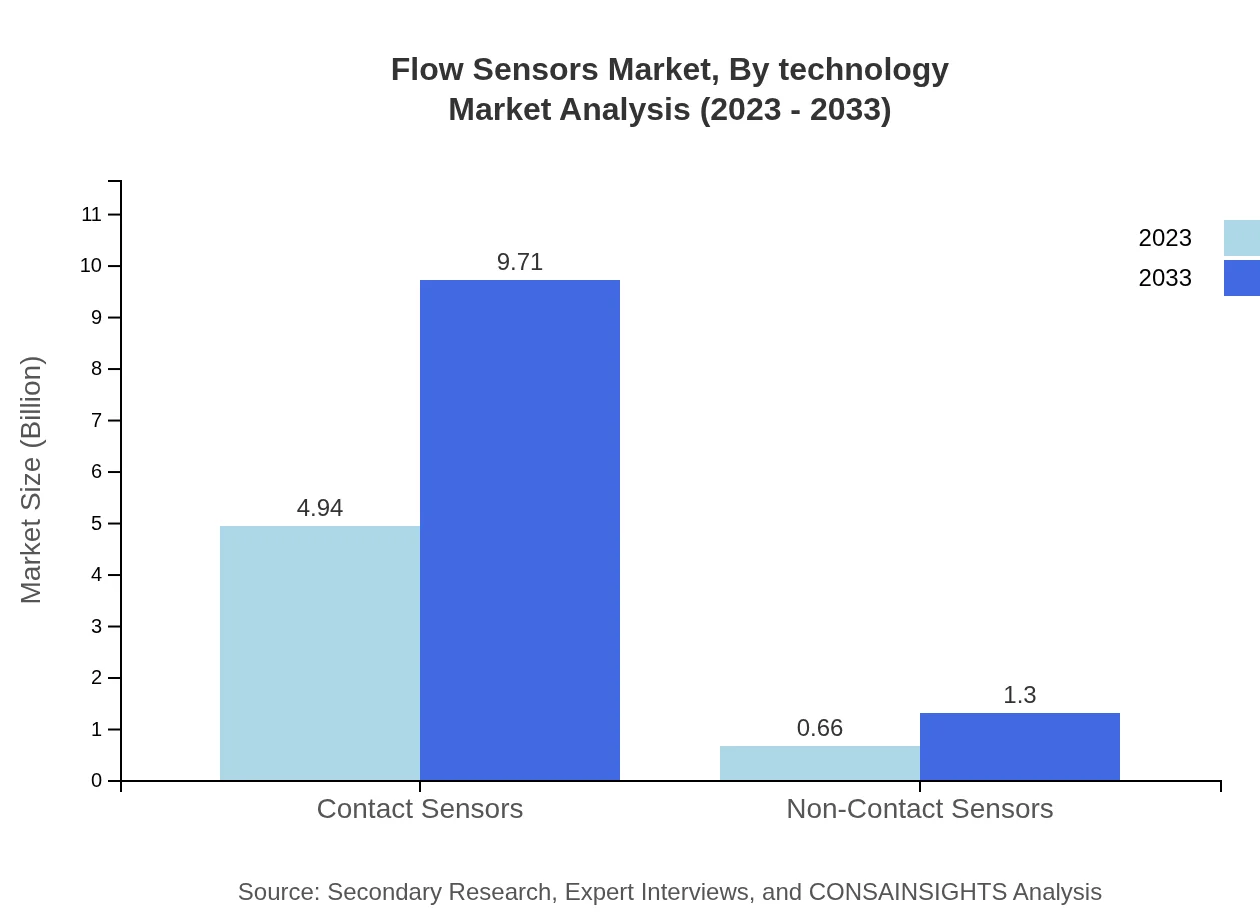

Flow Sensors Market Analysis By Technology

The Flow Sensors market is increasingly characterized by advancements in both contact and non-contact sensor technologies. Contact Sensors dominate with an 88.21% share ($4.94 billion in 2023 to $9.71 billion in 2033), while non-contact sensors are projected to grow modestly from $0.66 billion to $1.30 billion (11.79%).

Flow Sensors Market Analysis By End User

Key end-user sectors include oil and gas (growing from $2.71 billion to $5.32 billion), water and wastewater, which will rise from $1.12 billion to $2.21 billion, and food and beverage, increasing from $0.58 billion to $1.14 billion. Each sector represents a growing application for flow sensors with considerable market shares.

Flow Sensors Market Analysis By Region Market

The comprehensive regional analysis indicates varying growth trends: North America leads with the highest market share, followed closely by Europe and Asia-Pacific, each contributing significantly based on industrial demands, technological advancements, and environmental regulations.

Flow Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Flow Sensors Industry

Emerson Electric Co.:

A leader in automation solutions, Emerson designs flow sensors and instruments that enhance process efficiency and compliance.Siemens AG:

Siemens offers a wide array of flow measurement technologies that are pivotal for industrial applications, focusing on enhancing energy efficiency.Honeywell International Inc.:

Known for its innovative sensor technologies, Honeywell delivers advanced flow measurement solutions to various industries.Endress+Hauser:

A key player in the flow sensors market, Endress+Hauser offers comprehensive instrumentation and analytics to optimize process management.Yokogawa Electric Corporation:

Yokogawa specializes in industrial automation and control, providing flow sensors known for their accuracy and reliability.We're grateful to work with incredible clients.

FAQs

What is the market size of Flow Sensors?

The global flow sensors market is valued at approximately $5.6 billion in 2023, with a projected CAGR of 6.8%. By 2033, the market is expected to experience significant growth, driven by advancing technologies and increasing demand from various sectors.

What are the key market players or companies in this Flow Sensors industry?

Key players in the flow sensors market include industry leaders like Siemens, Honeywell, and Endress+Hauser. These companies are known for their innovative solutions and advanced sensor technologies catering to various applications including industrial automation and HVAC systems.

What are the primary factors driving the growth in the Flow Sensor industry?

The growth of the flow sensors market is primarily driven by increasing demand for automation in industries, advancements in sensor technology, and the rising need for efficient water and energy management systems. Additionally, regulatory standards for environmental compliance further contribute to market expansion.

Which region is the fastest Growing in the Flow Sensors market?

Among various regions, North America is currently the fastest-growing market for flow sensors, with an estimated size of $2.71 billion in 2023, projected to reach $5.32 billion by 2033. This growth is attributed to the high adoption of automation across industries.

Does ConsaInsights provide customized market report data for the Flow Sensor industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements in the flow sensor industry. Clients can obtain detailed insights regarding market trends, segmentation, and forecasts to meet their unique business needs.

What deliverables can I expect from this Flow Sensor market research project?

From the flow sensor market research project, you can expect comprehensive reports including market size estimates, growth forecasts, competitive landscape analysis, and insights into regional markets and key segments within the industry.

What are the market trends of Flow Sensors?

Current market trends in the flow sensors industry include increasing integration of smart technologies, enhanced accuracy in measurement, and greater focus on sustainable practices. Moreover, there is a rise in demand for wireless and IoT-enabled flow sensors in various applications.