Food Fibers Market Report

Published Date: 31 January 2026 | Report Code: food-fibers

Food Fibers Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Food Fibers market, covering key insights, market size, growth forecasts, and trends from 2023 to 2033. It examines the industry's economic conditions, segmentation, and geographical dynamics, offering a holistic view of future opportunities and challenges.

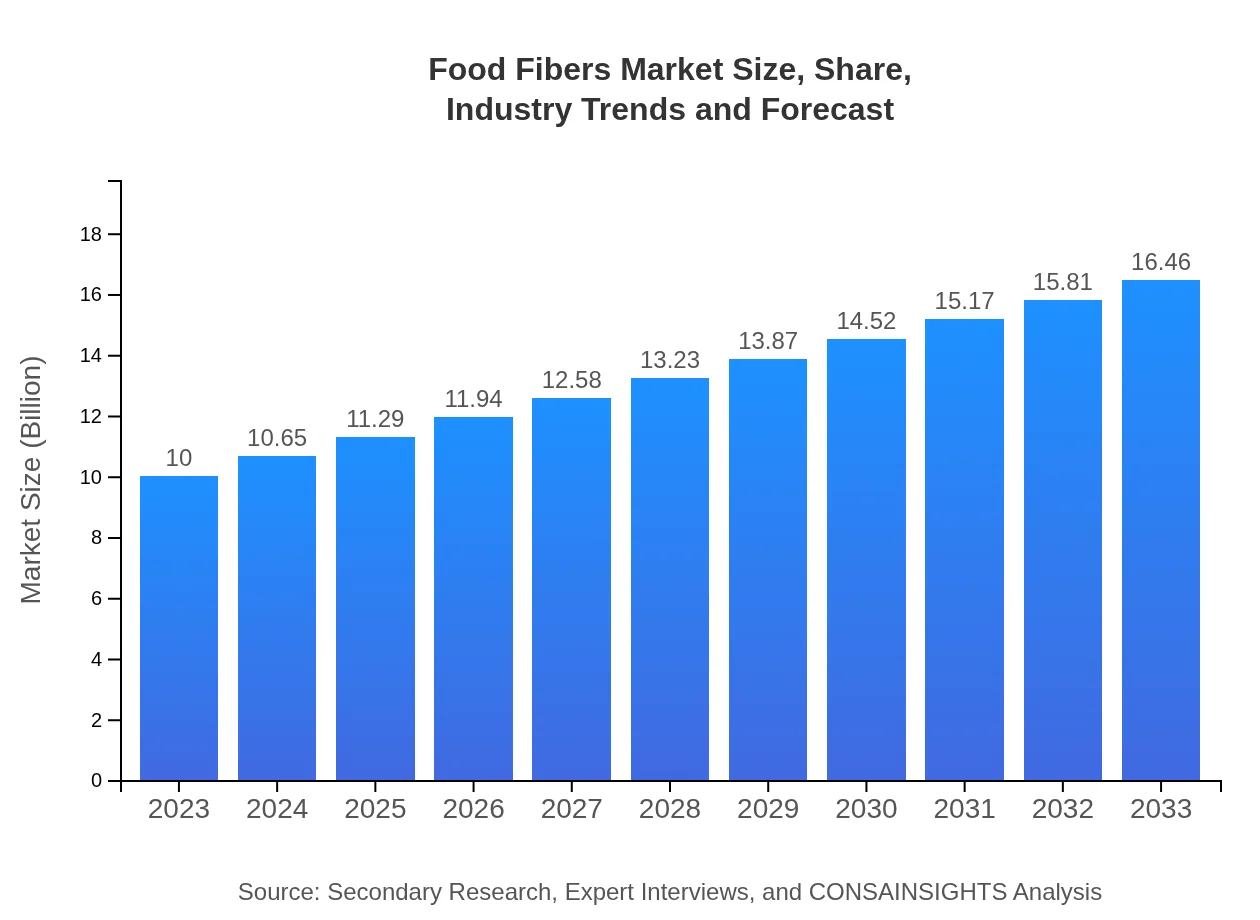

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Tate & Lyle PLC, DuPont Nutrition & Biosciences, Cargill, Inc., Archer Daniels Midland Company (ADM), Benefiber (Kellogg's) |

| Last Modified Date | 31 January 2026 |

Food Fibers Market Overview

Customize Food Fibers Market Report market research report

- ✔ Get in-depth analysis of Food Fibers market size, growth, and forecasts.

- ✔ Understand Food Fibers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Fibers

What is the Market Size & CAGR of Food Fibers market in 2023?

Food Fibers Industry Analysis

Food Fibers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Fibers Market Analysis Report by Region

Europe Food Fibers Market Report:

In Europe, the Food Fibers market was valued at $2.52 billion in 2023 and is anticipated to reach $4.14 billion by 2033. The growth in this region is largely due to stringent regulations on food quality and safety, along with increased consumer awareness about nutrition and the benefits of plant-based diets, leading to higher demand for natural food fibers.Asia Pacific Food Fibers Market Report:

In 2023, the Asia Pacific Food Fibers market size is estimated at $1.98 billion, projected to reach $3.27 billion by 2033, driven by increasing health awareness and rising disposable incomes in developing countries. The growth of the functional food sector and emphasis on preventive healthcare are key contributing factors, along with a robust demand for dietary fibers in traditional diets.North America Food Fibers Market Report:

The North American market for Food Fibers is projected to grow from $3.72 billion in 2023 to $6.12 billion by 2033. This robust growth is attributed to high per capita consumption, the prevalence of fiber-related health issues, and a shift towards healthier food options among consumers who prioritize gut health and overall wellness.South America Food Fibers Market Report:

The South American Food Fibers market, valued at $0.41 billion in 2023, is expected to grow to $0.68 billion by 2033. The region is experiencing growing acceptance of dietary supplements and functional foods, propelled by rising healthcare expenditures and a focus on health and wellness, fostering significant market growth.Middle East & Africa Food Fibers Market Report:

The Middle East & Africa Food Fibers market, estimated at $1.37 billion in 2023, is projected to grow to $2.25 billion by 2033. Factors driving growth include increased health awareness, rising urbanization, and an expanding consumer base seeking dietary solutions to combat health issues like obesity and diabetes.Tell us your focus area and get a customized research report.

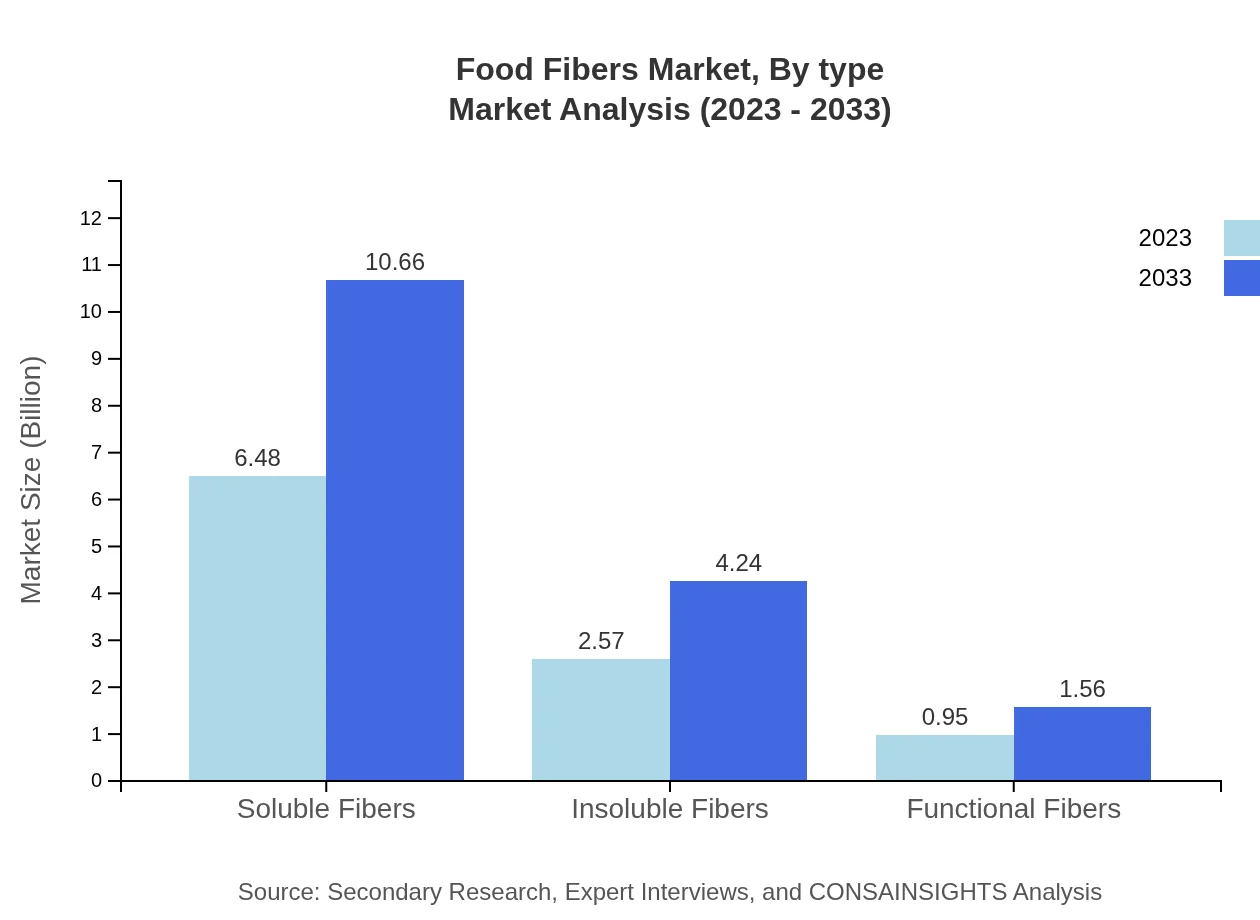

Food Fibers Market Analysis By Type

In 2023, the market share of soluble fibers is significant, with a size of $6.48 billion (64.78%) and expected to grow to $10.66 billion (64.78%) by 2033. Insoluble fibers account for $2.57 billion (25.74%) in 2023, growing to $4.24 billion (25.74%) by 2033. Functional fibers, while smaller, show significant growth potential, rising from $0.95 billion (9.48%) to $1.56 billion (9.48%) during the same period.

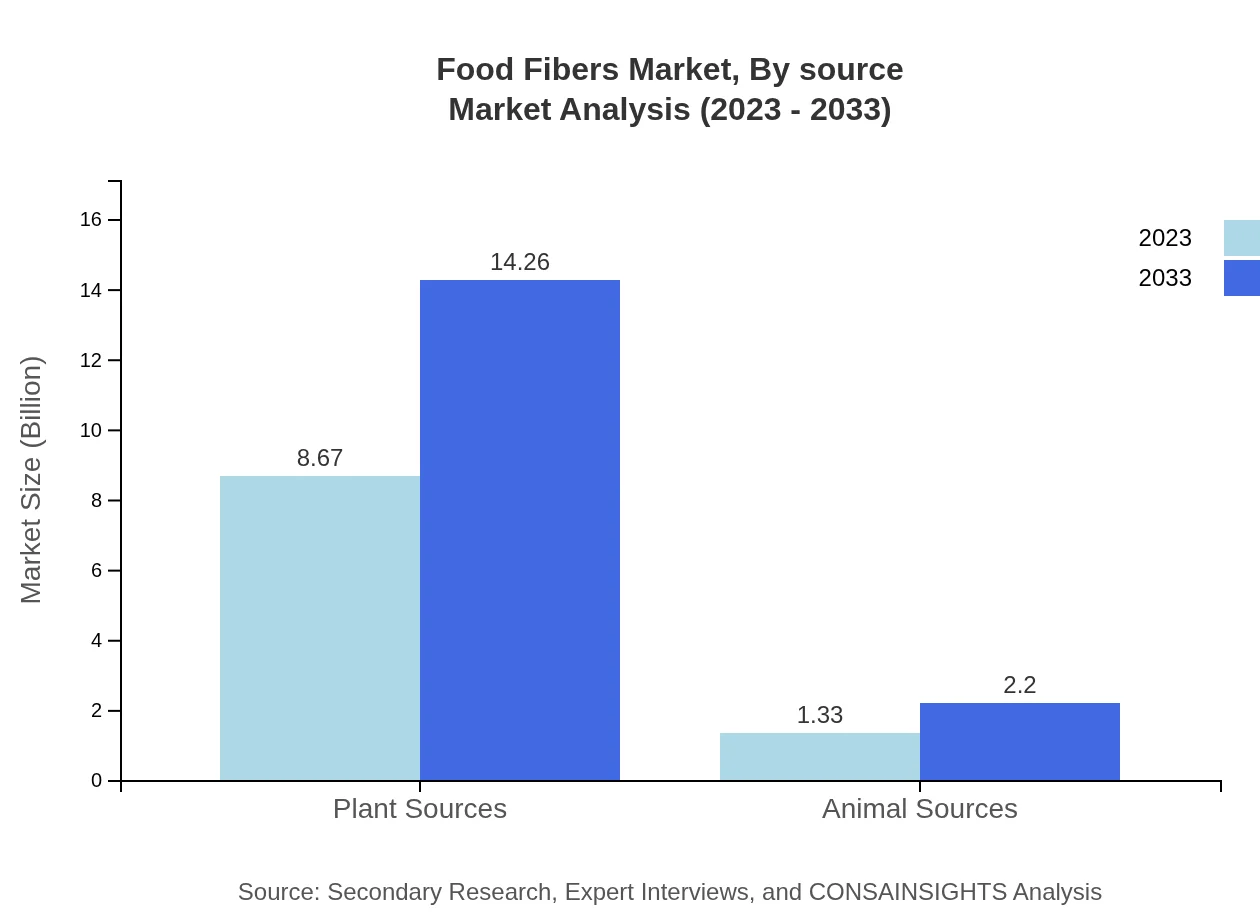

Food Fibers Market Analysis By Source

The source of food fibers is predominantly plant-based, representing an 86.66% share in 2023, valued at $8.67 billion, anticipated to reach $14.26 billion by 2033. In contrast, animal sources make up 13.34%, increasing from $1.33 billion in 2023 to $2.20 billion in 2033, as the market adapts to rising consumer interest in protein-rich diets that incorporate animal-derived fibers.

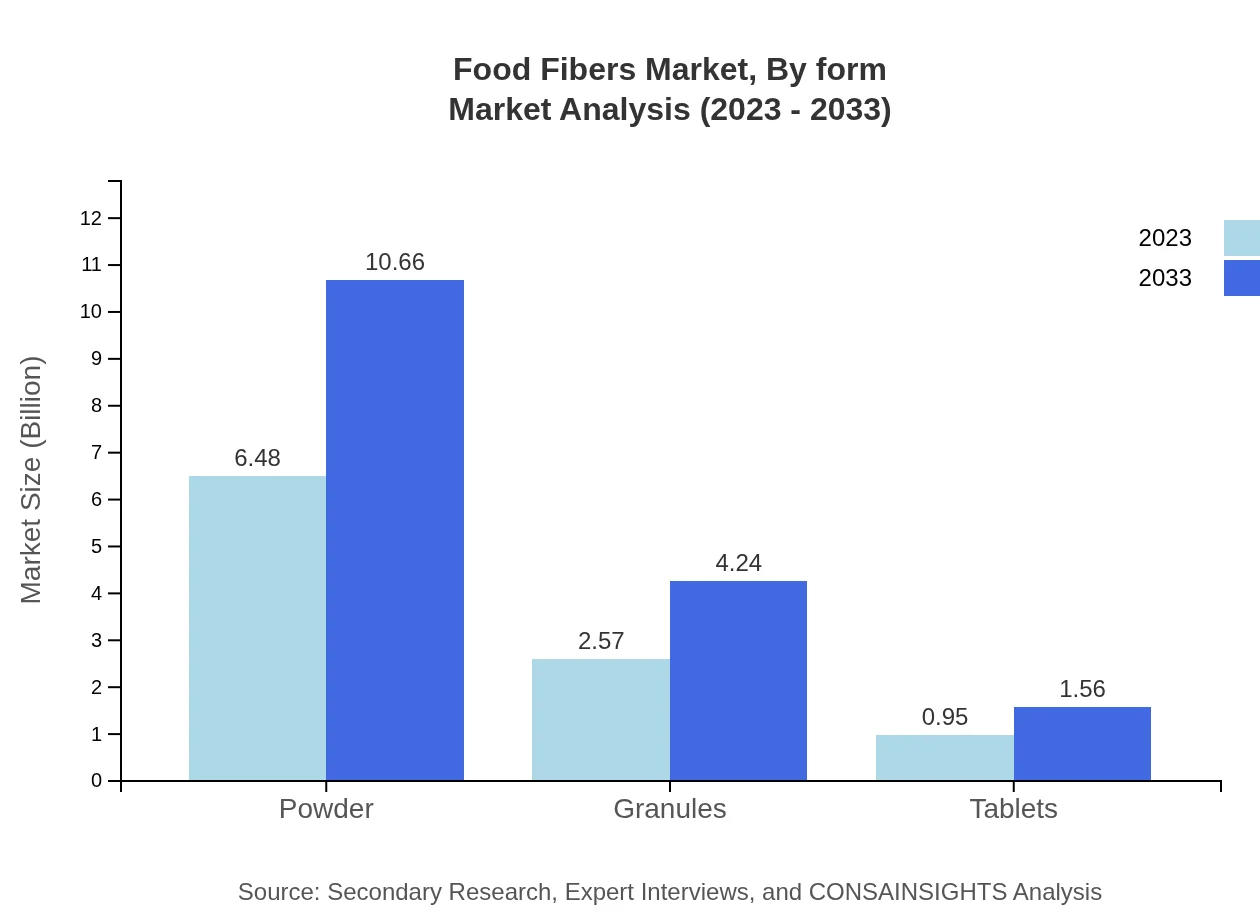

Food Fibers Market Analysis By Form

In terms of form, powders dominate the market with a 64.78% share ($6.48 billion) in 2023, rising to $10.66 billion by 2033. Granules follow with $2.57 billion (25.74%) in 2023, growing to $4.24 billion by 2033. Tablets account for a smaller market share ($0.95 billion in 2023), increasing to $1.56 billion by 2033.

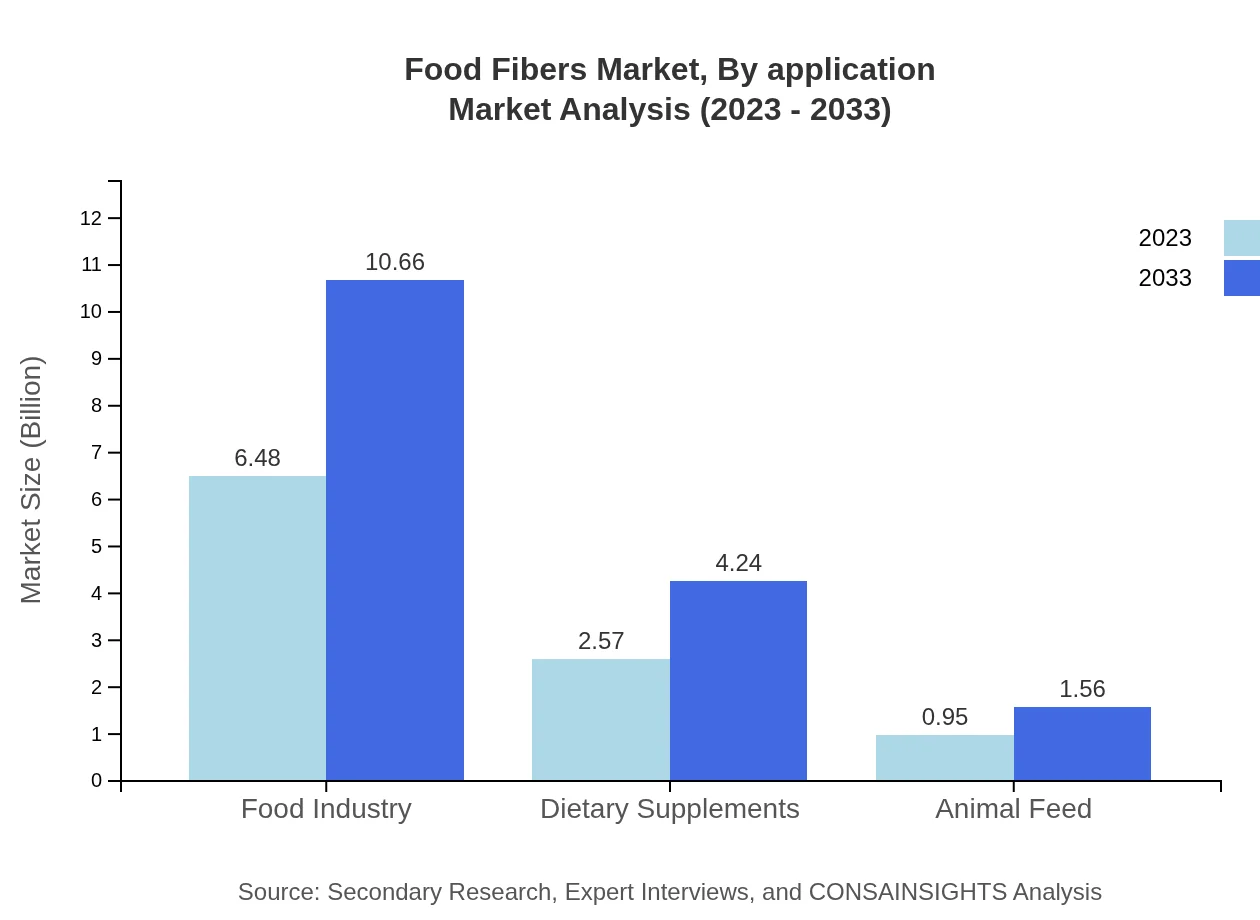

Food Fibers Market Analysis By Application

The food industry is the leading application for food fibers, representing 64.78% of the market, valued at $6.48 billion in 2023, poised to grow to $10.66 billion by 2033. Dietary supplements hold a 25.74% share ($2.57 billion in 2023), expected to reach $4.24 billion by 2033, while animal feed occupies 9.48% share, rising from $0.95 billion to $1.56 billion.

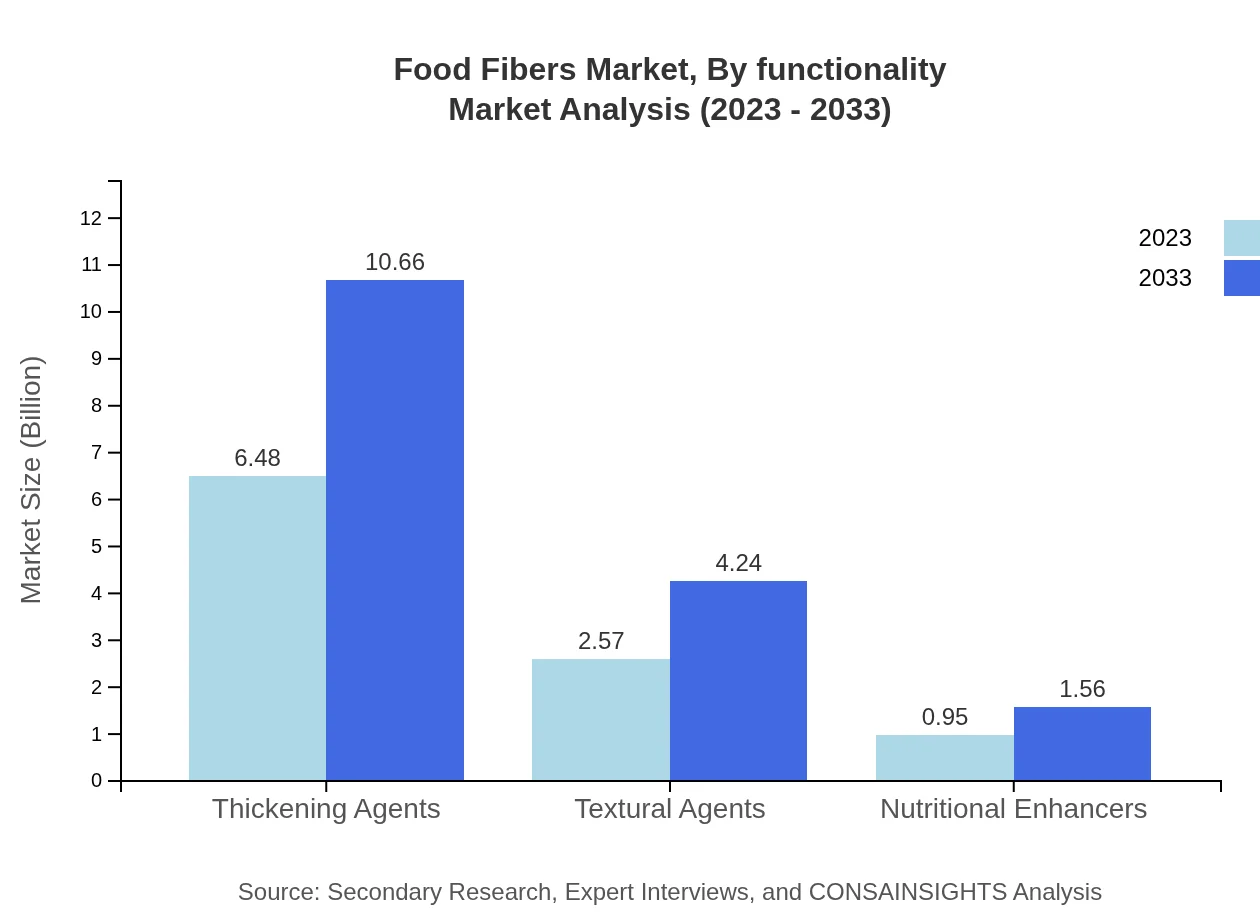

Food Fibers Market Analysis By Functionality

Thickening agents hold a substantial share of the Food Fibers market, with a size of $6.48 billion (64.78%) in 2023, projected to reach $10.66 billion by 2033. Textural agents and nutritional enhancers follow closely, with shares of $2.57 billion (25.74%) and $0.95 billion (9.48%) in 2023 respectively, each showing steady growth in their respective applications.

Food Fibers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Fibers Industry

Tate & Lyle PLC:

A leading global provider of specialty food ingredients and solutions known for its innovative fiber products that enhance nutrition.DuPont Nutrition & Biosciences:

A major player in the food ingredients sector, DuPont offers a wide range of food fibers derived from both natural and synthetic sources.Cargill, Inc.:

Cargill is a multinational provider of food, agricultural, financial, and industrial products, including a diverse portfolio of fibers.Archer Daniels Midland Company (ADM):

ADM is a global leader in human and animal nutrition, providing various fiber solutions for dietary applications.Benefiber (Kellogg's):

A well-known brand offering soluble fiber supplements to promote digestive health.We're grateful to work with incredible clients.

FAQs

What is the market size of Food Fibers?

The global food fibers market is currently valued at approximately $10 billion, with a projected CAGR of 5% from 2023 to 2033. This growth reflects increasing consumer awareness of health and nutrition.

What are the key market players or companies in the Food Fibers industry?

Key players in the food fibers industry include large corporations specializing in health foods and nutritional products. Specific major companies often vary, but they typically include brands recognized in dietary supplements and functional food markets.

What are the primary factors driving the growth in the Food Fibers industry?

The growth of the food fibers market is driven by rising health consciousness among consumers, increasing demand for dietary supplements, and enhancements in food product formulations catering to health benefits.

Which region is the fastest Growing in the Food Fibers market?

The fastest-growing region in the food fibers market is North America, projected to grow from $3.72 billion in 2023 to $6.12 billion by 2033, reflecting a significant increase in health-oriented product consumption.

Does Consainsights provide customized market report data for the Food Fibers industry?

Yes, Consainsights offers tailored market report data for the food fibers industry, allowing clients to obtain insights specific to their business needs and strategic goals.

What deliverables can I expect from this Food Fibers market research project?

Deliverables from the food fibers market research project include detailed market analysis reports, segmentation data, growth forecasts, competitive landscape insights, and actionable strategies based on the findings.

What are the market trends of Food Fibers?

Current market trends indicate a strong shift towards plant-based fibers, with increased consumer preference for sustainable sources. Innovations in food technology and functional foods are also shaping the landscape of the food fibers market.