Gan Power Devices Market Report

Published Date: 31 January 2026 | Report Code: gan-power-devices

Gan Power Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a complete analysis of the Gan Power Devices market, focusing on trends, growth potential, and forecasts from 2023 to 2033, providing insights into various segments, regions, and key market players.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

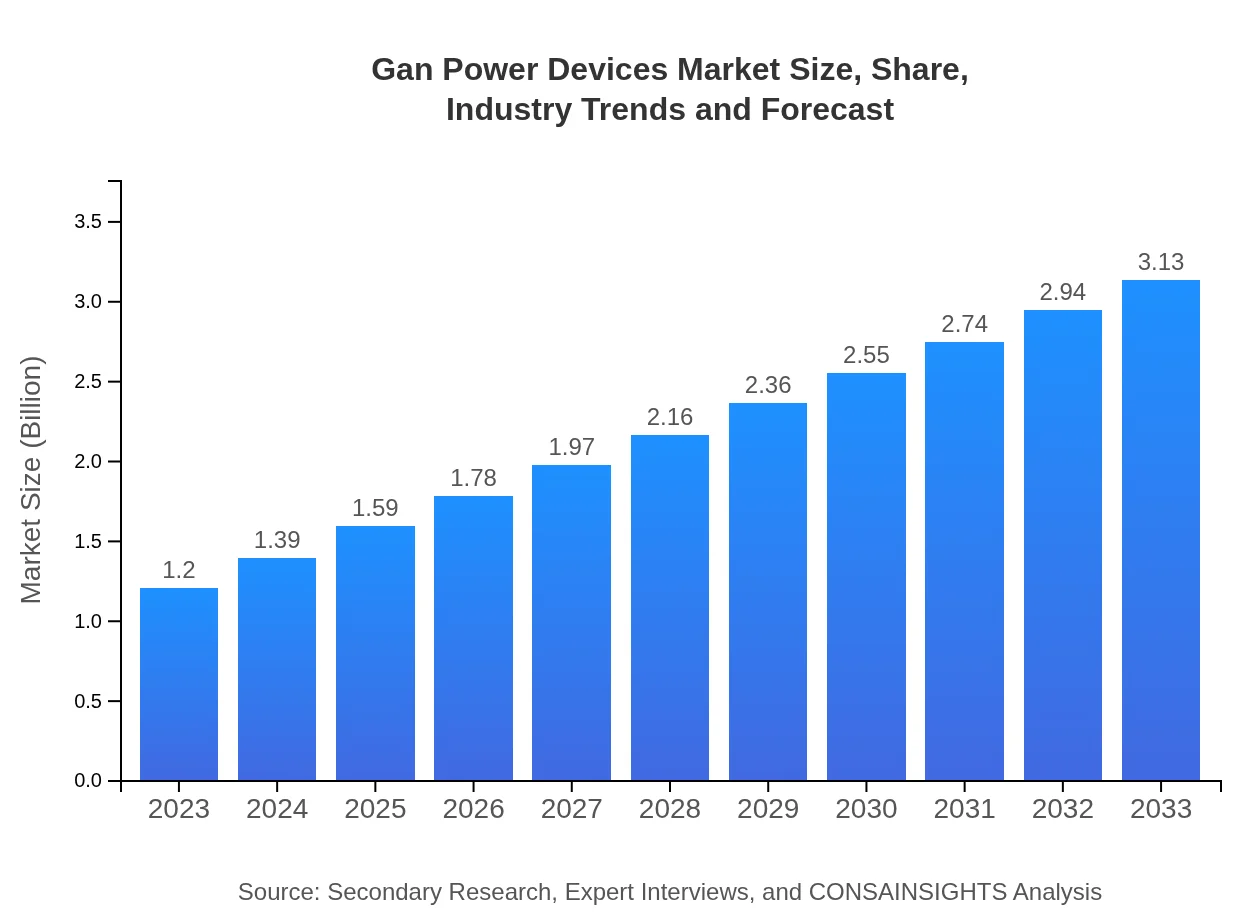

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 9.7% |

| 2033 Market Size | $3.13 Billion |

| Top Companies | Navitas Semiconductor, Efficient Power Conversion (EPC), ON Semiconductor, Infineon Technologies, GaN Systems |

| Last Modified Date | 31 January 2026 |

Gan Power Devices Market Overview

Customize Gan Power Devices Market Report market research report

- ✔ Get in-depth analysis of Gan Power Devices market size, growth, and forecasts.

- ✔ Understand Gan Power Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gan Power Devices

What is the Market Size & CAGR of Gan Power Devices market in 2023?

Gan Power Devices Industry Analysis

Gan Power Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gan Power Devices Market Analysis Report by Region

Europe Gan Power Devices Market Report:

Europe's market is expected to rise from $0.30 billion in 2023 to $0.79 billion by 2033. Regulatory push for energy efficiency and the need for cutting-edge technologies in renewable energy initiatives significantly drive this growth.Asia Pacific Gan Power Devices Market Report:

Asia Pacific is poised for significant growth, expected to expand from $0.24 billion in 2023 to approximately $0.62 billion by 2033. The region boasts a robust electronics manufacturing ecosystem, increased demand for energy-efficient solutions, and expanding electric vehicle markets.North America Gan Power Devices Market Report:

North America sees a substantial market increase, forecasting growth from $0.41 billion in 2023 to about $1.06 billion by 2033. The region benefits from technological advancements, a considerable focus on R&D, and high adoption rates of electric vehicles.South America Gan Power Devices Market Report:

In South America, the market is anticipated to grow from $0.12 billion in 2023 to $0.30 billion by 2033. Economic growth, rising consumer electronics demand, and increasing investments in renewable energy sources contribute to this trend.Middle East & Africa Gan Power Devices Market Report:

The Middle East and Africa market is forecasted to expand from $0.14 billion in 2023 to roughly $0.36 billion by 2033, aided by increased infrastructure projects and focus on sustainable energy solutions.Tell us your focus area and get a customized research report.

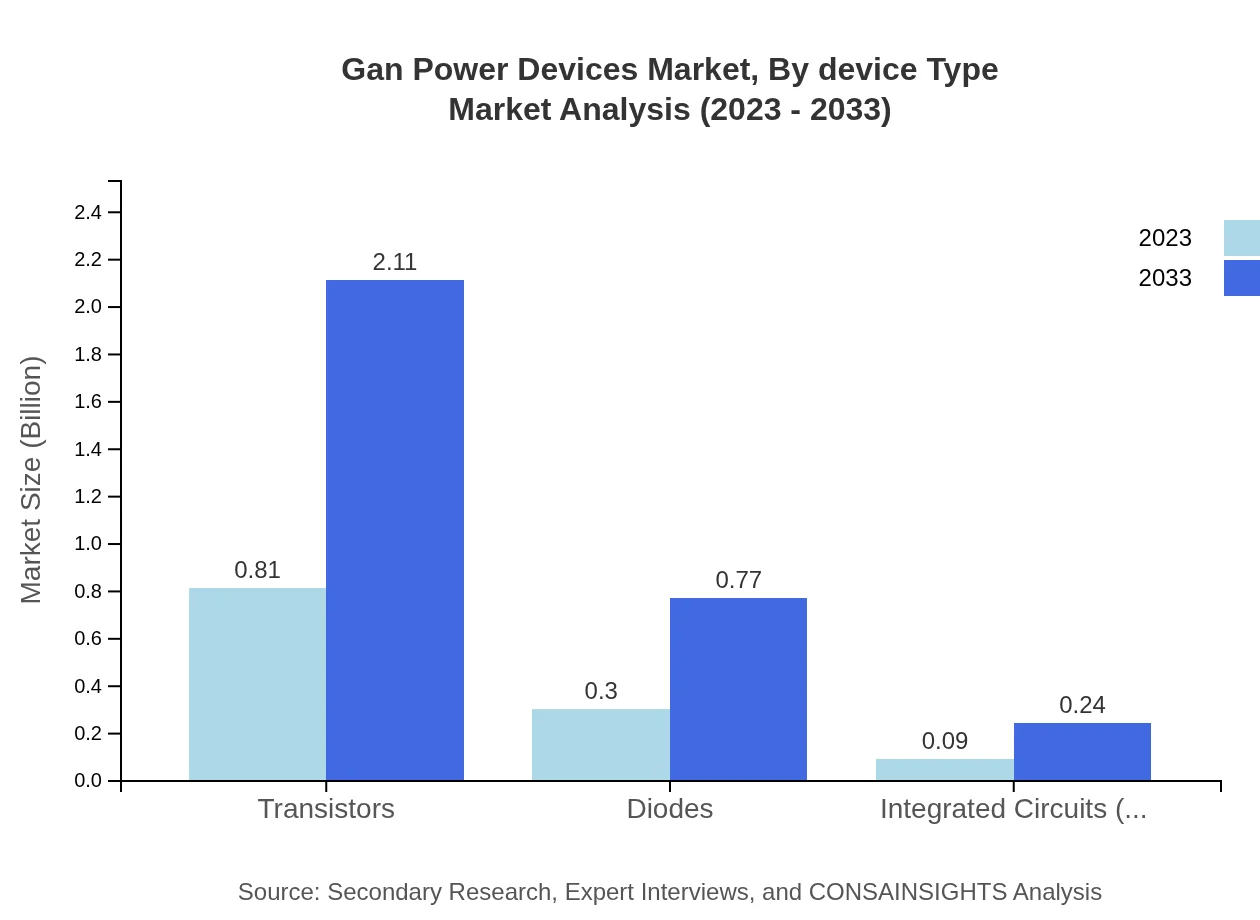

Gan Power Devices Market Analysis By Device Type

The analysis indicates that Transistors hold the largest share, estimated at $0.81 billion in 2023 with expectations to grow to around $2.11 billion by 2033. The Monolithic devices join as a pioneer segment, emphasizing energy efficiency and compact design. Other types include Diodes, Integrated Circuits (ICs), and Hybrid devices reflecting diverse applications critical for industrial and electronic sectors.

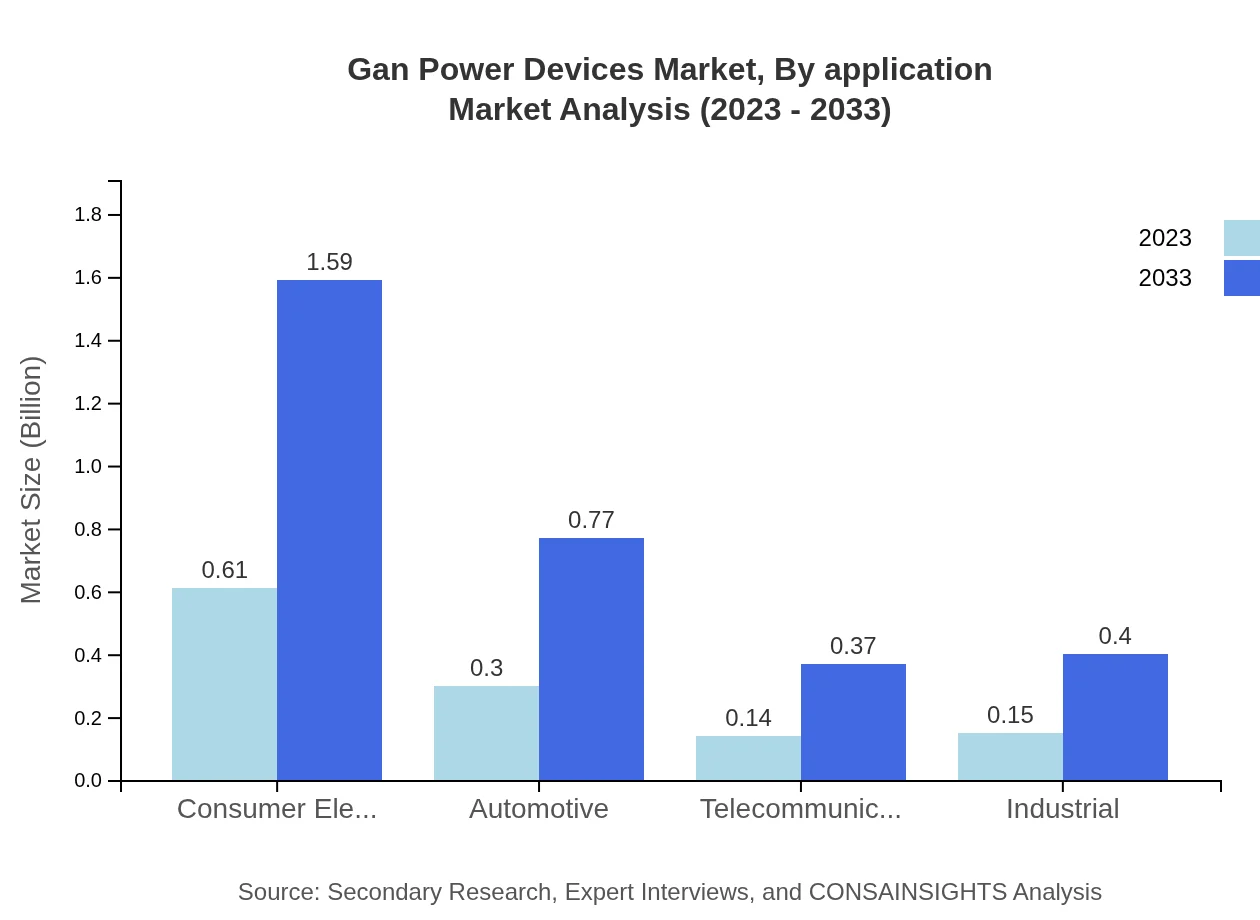

Gan Power Devices Market Analysis By Application

Applications in consumer electronics and automotive sectors currently dominate the market. The electronics manufacturers’ share remains notable, accounting for approximately 50.77% in 2023, growing with technological advancements and increased adoption of sophisticated devices.

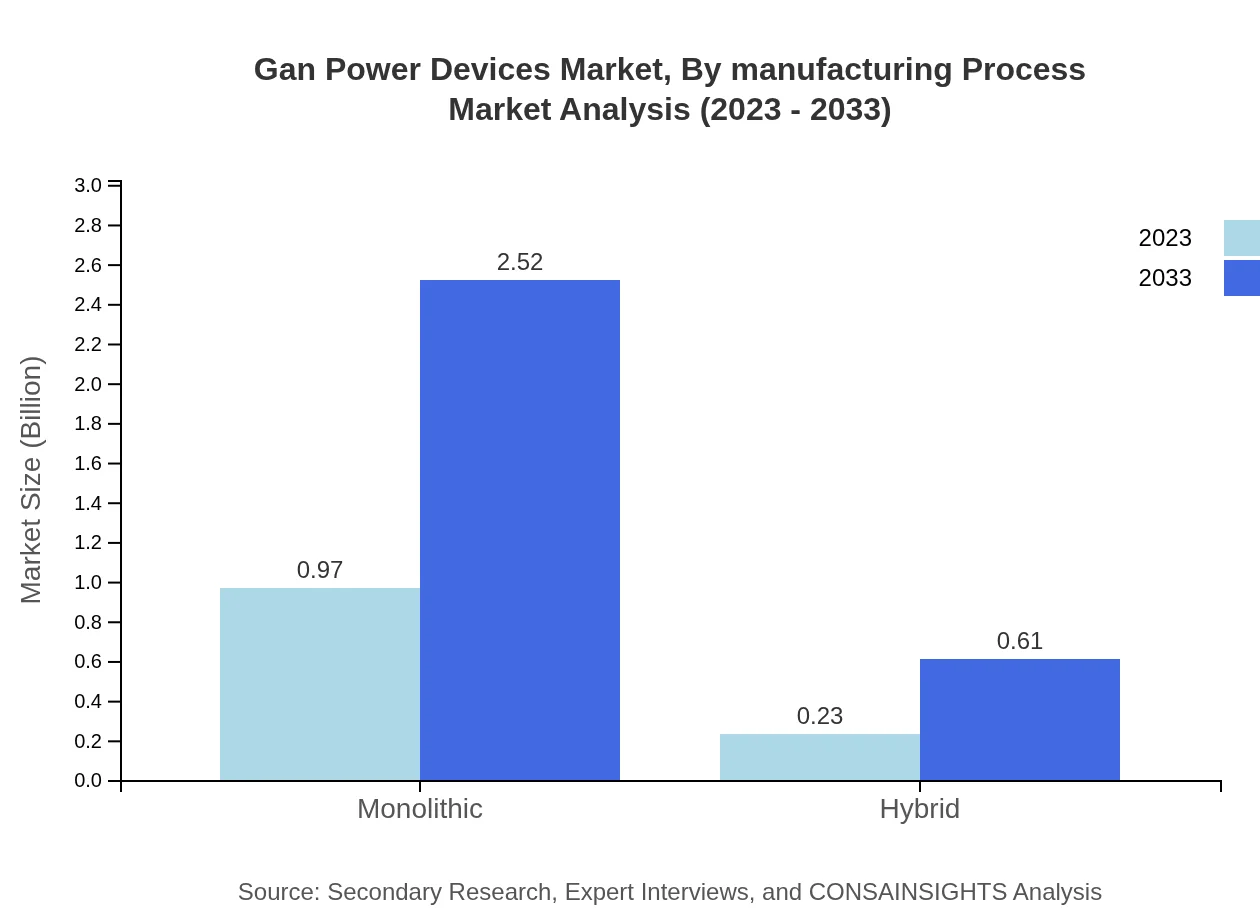

Gan Power Devices Market Analysis By Manufacturing Process

The manufacturing landscape predominantly utilizes the epitaxial process, enhancing purity and performance of GaN devices. This method plays a crucial role in producing high-quality power devices, while yielding reduced defect rates in production batches

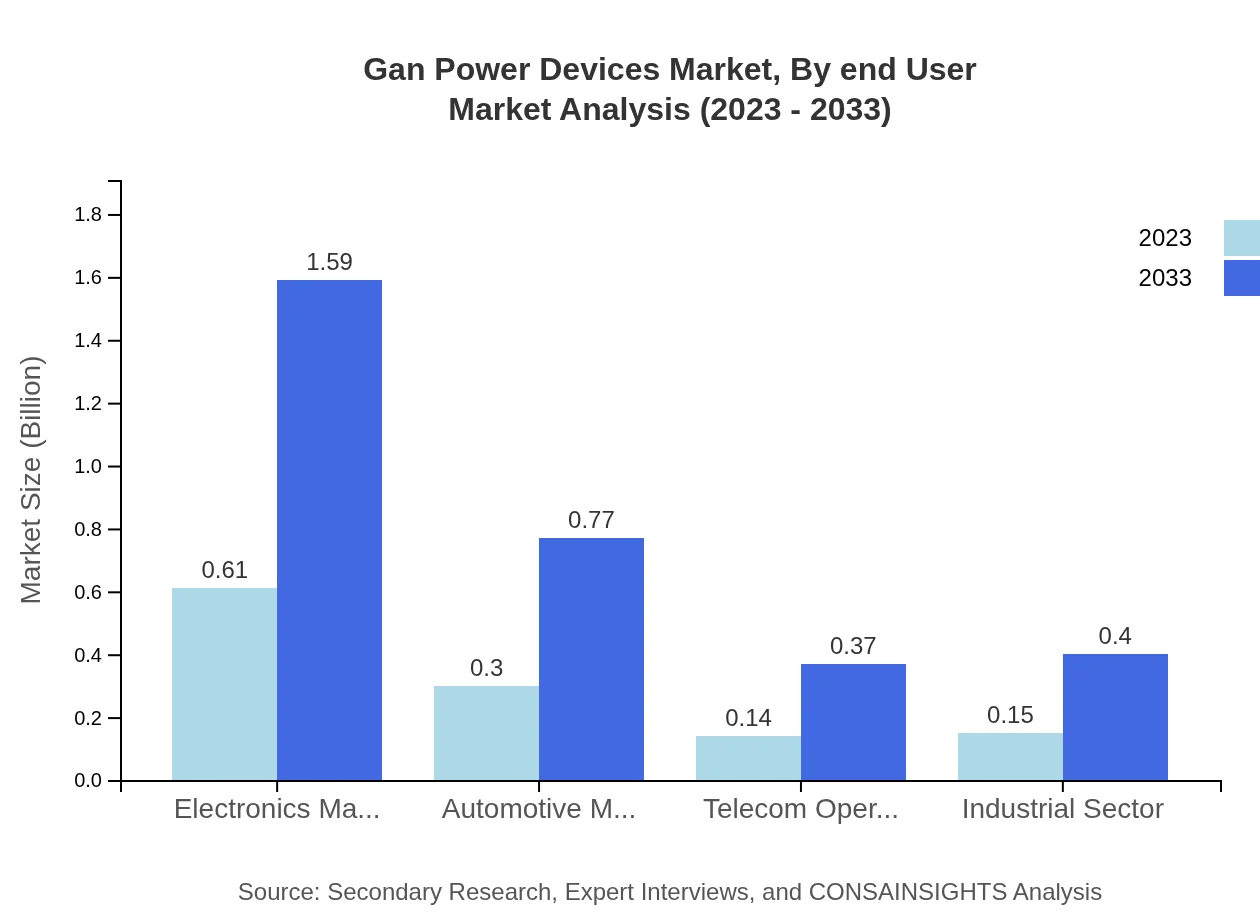

Gan Power Devices Market Analysis By End User

The automotive sector shows evolving trends with growth from $ extbf{0.30}$ billion in 2023 to approximately $ extbf{0.77}$ billion by 2033. Telecommunications maintaining a steady market share due to increasing connectivity demands highlights the significance of GaN devices across multiple end-user industries.

Gan Power Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gan Power Devices Industry

Navitas Semiconductor:

A leading provider of GaN power ICs, Navitas focuses on fast-charging technology and energy-efficient solutions for consumer electronics and electric vehicles.Efficient Power Conversion (EPC):

EPC specializes in producing high-performance GaN power devices and is at the forefront of developing products that enable more efficient power conversion across a variety of applications.ON Semiconductor:

A major player in the semiconductor industry, ON Semiconductor contributes significantly to GaN technology, developing innovative solutions for automotive and industrial applications.Infineon Technologies:

Infineon offers a wide portfolio of GaN technologies that enhance system efficiency in automotive, industrial, and consumer applications, driving innovation within the power device sector.GaN Systems:

GaN Systems leads in the manufacturing of GaN transistors, providing high-performance solutions for power applications ranging from consumer electronics to industrial systems.We're grateful to work with incredible clients.

FAQs

What is the market size of gan Power Devices?

The global GaN power devices market was valued at approximately $1.2 billion in 2023 and is projected to grow at a CAGR of 9.7% through 2033, indicating a robust demand for these advanced semiconductor technologies.

What are the key market players or companies in this gan Power Devices industry?

Key players in the GaN power devices market include renowned companies such as Cree, Infineon Technologies, Texas Instruments, and EPC. These organizations lead the market, innovating and developing new power solutions that leverage GaN technology.

What are the primary factors driving the growth in the gan Power Devices industry?

The growth of the GaN power devices market is driven by the increasing demand for efficient power management, advancements in technology, and the proliferation of electric vehicles and renewable energy solutions. These devices enable higher performance and lower energy consumption.

Which region is the fastest Growing in the gan Power Devices?

The fastest-growing region for GaN power devices is North America, where the market is expected to expand from $0.41 billion in 2023 to $1.06 billion by 2033. This growth is fueled by technological innovations and strong industrial demand.

Does ConsaInsights provide customized market report data for the gan Power Devices industry?

Yes, Consainsights provides tailored market report data for the GaN power devices industry, allowing clients to obtain specific insights, trends, and forecasts that align with their business needs and strategic goals.

What deliverables can I expect from this gan Power Devices market research project?

From the GaN power devices market research project, clients can expect comprehensive market analyses, segmentations, competitive landscape evaluations, region-specific reports, and actionable insights to inform their decision-making processes.

What are the market trends of gan Power Devices?

Key trends in the GaN power devices market include a shift towards electric vehicles, a growing emphasis on energy efficiency, and the integration of GaN technology in consumer electronics, telecommunications, and industrial applications, reflecting rising global energy concerns.