Gcc Chemical Logistics Market Report

Published Date: 02 February 2026 | Report Code: gcc-chemical-logistics

Gcc Chemical Logistics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Gcc Chemical Logistics market, focusing on key insights, market size, trends, and forecasts from 2023 to 2033. It covers various segments, regional analyses, and leading players in the industry.

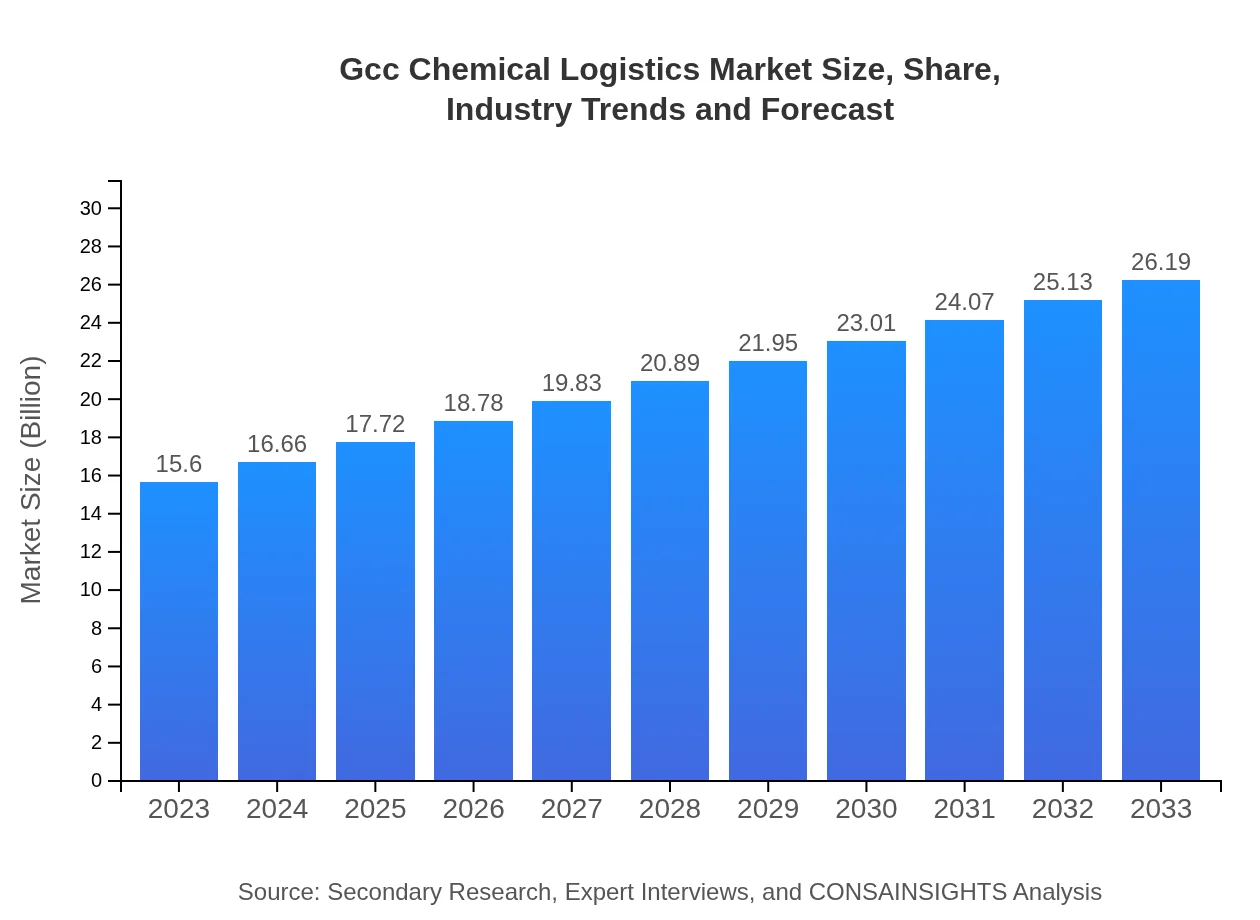

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $26.19 Billion |

| Top Companies | DB Schenker, Kuehne + Nagel, DHL Supply Chain, Expeditors |

| Last Modified Date | 02 February 2026 |

Gcc Chemical Logistics Market Overview

Customize Gcc Chemical Logistics Market Report market research report

- ✔ Get in-depth analysis of Gcc Chemical Logistics market size, growth, and forecasts.

- ✔ Understand Gcc Chemical Logistics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gcc Chemical Logistics

What is the Market Size & CAGR of Gcc Chemical Logistics market in 2023?

Gcc Chemical Logistics Industry Analysis

Gcc Chemical Logistics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gcc Chemical Logistics Market Analysis Report by Region

Europe Gcc Chemical Logistics Market Report:

Europe's Gcc Chemical Logistics market is expected to grow from $3.92 billion in 2023 to $6.58 billion by 2033. The region has stringent regulations, promoting safer logistics practices and increased investments in technology.Asia Pacific Gcc Chemical Logistics Market Report:

The Asia Pacific region showcases robust growth, driven by increasing manufacturing activities and a rising demand for petrochemicals. The market is valued at $3.26 billion in 2023, expected to grow to $5.47 billion by 2033, reflecting a strong CAGR.North America Gcc Chemical Logistics Market Report:

North America stands as a significant market with a valuation of $6.04 billion in 2023, anticipated to reach $10.15 billion by 2033. The region is characterized by advanced logistics infrastructure and high demand for specialty chemicals.South America Gcc Chemical Logistics Market Report:

In South America, the Gcc Chemical Logistics is valued at $1.34 billion in 2023, with projections rising to $2.26 billion by 2033. The growth is attributed to emerging markets and a growing industrial base.Middle East & Africa Gcc Chemical Logistics Market Report:

The Middle East and Africa region's market is valued at $1.04 billion in 2023 and projected to grow to $1.74 billion by 2033. The growth is influenced by increasing oil and gas exploration activities.Tell us your focus area and get a customized research report.

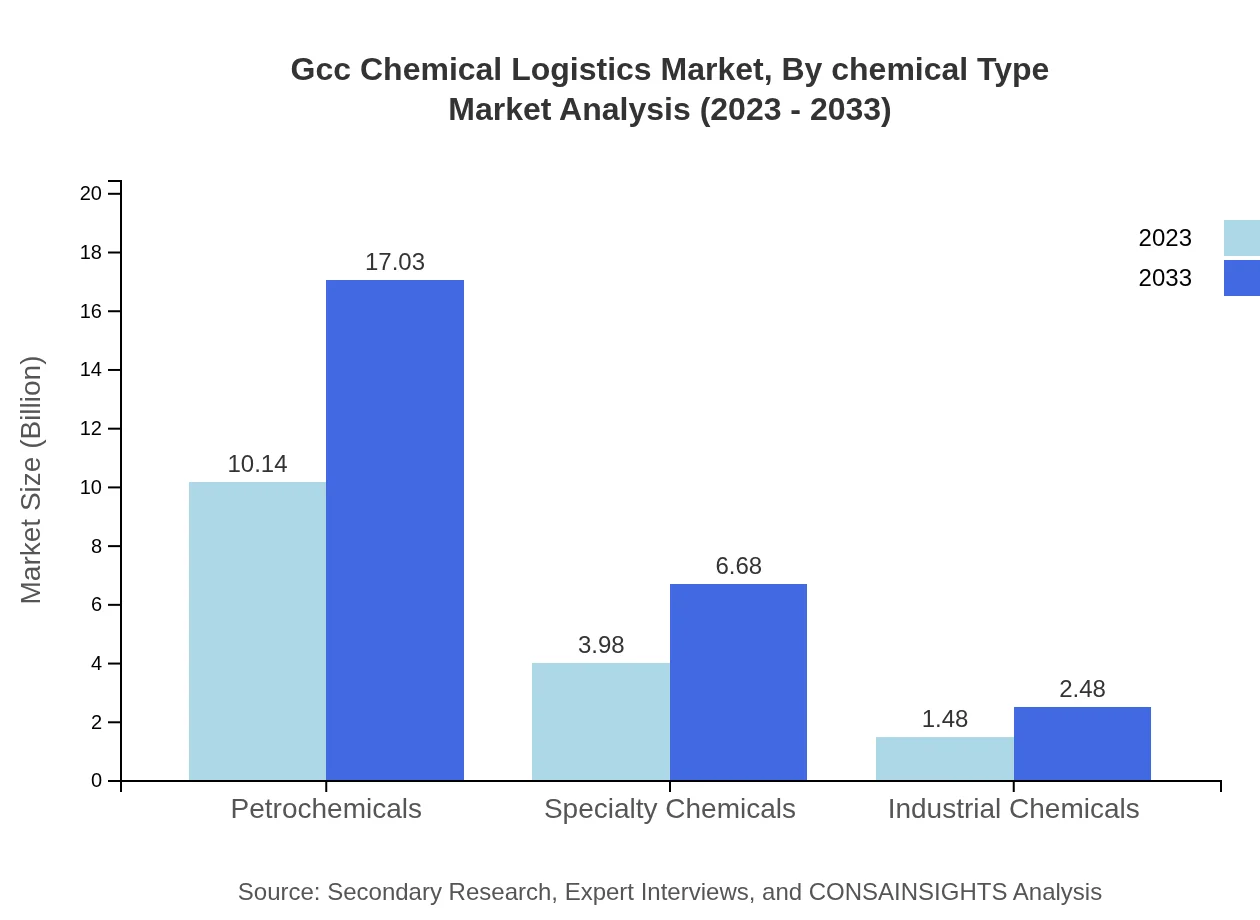

Gcc Chemical Logistics Market Analysis By Chemical Type

The segment of Petrochemicals leads the Gcc Chemical Logistics market with a size of $10.14 billion in 2023, expected to reach $17.03 billion by 2033, representing a substantial 65.03% market share. Specialty Chemicals follow with a market size of $3.98 billion in 2023, projected to increase to $6.68 billion, accounting for 25.49% share. Industrial Chemicals also contribute with a market size of $1.48 billion in 2023, anticipated to grow to $2.48 billion.

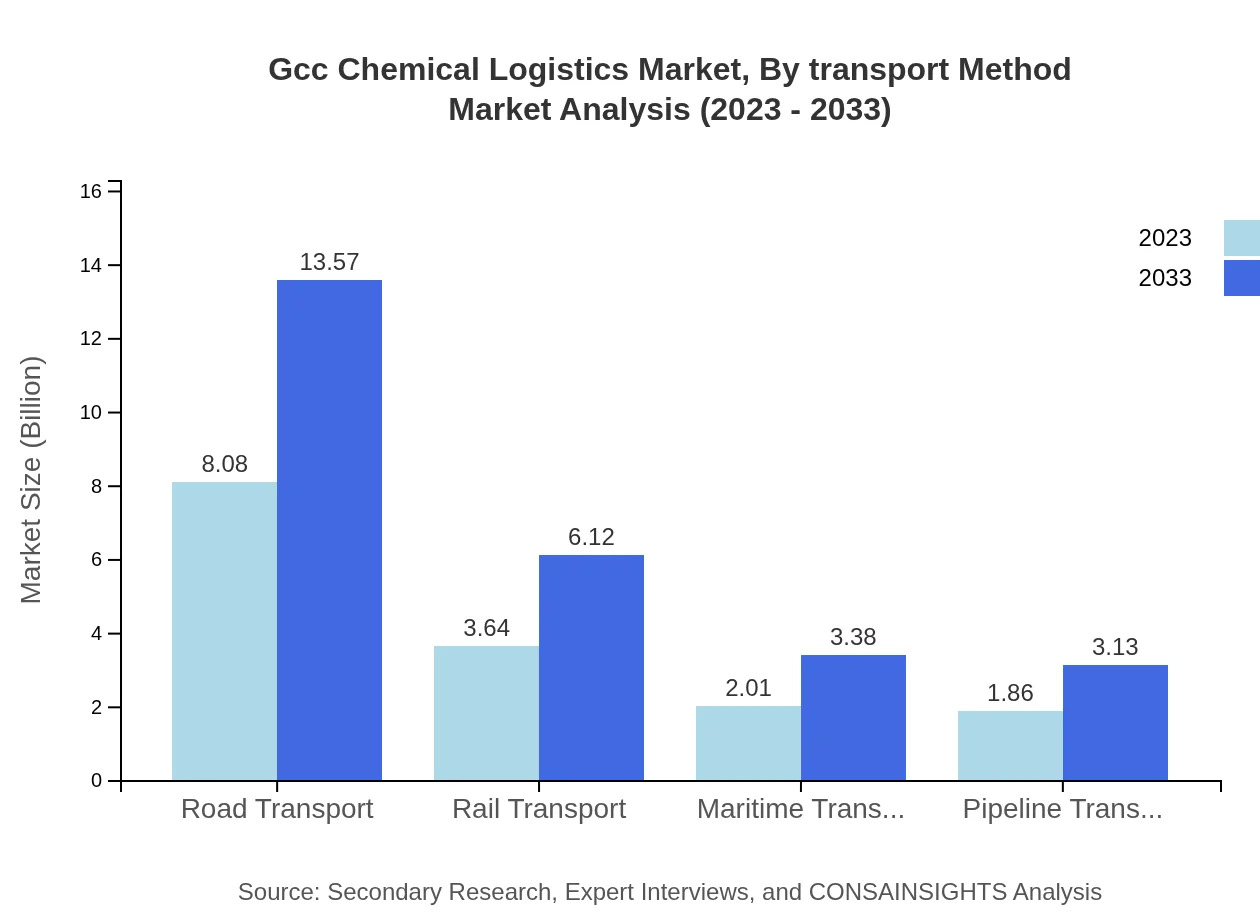

Gcc Chemical Logistics Market Analysis By Transport Method

Road Transport dominates the logistics space, currently at $8.08 billion, heading towards $13.57 billion with a 51.81% market share. Rail Transport shows promising growth from $3.64 billion to $6.12 billion, while Maritime Transport reflects a market size increase from $2.01 billion to $3.38 billion. Pipeline transport is also noteworthy, expected to grow from $1.86 billion to $3.13 billion.

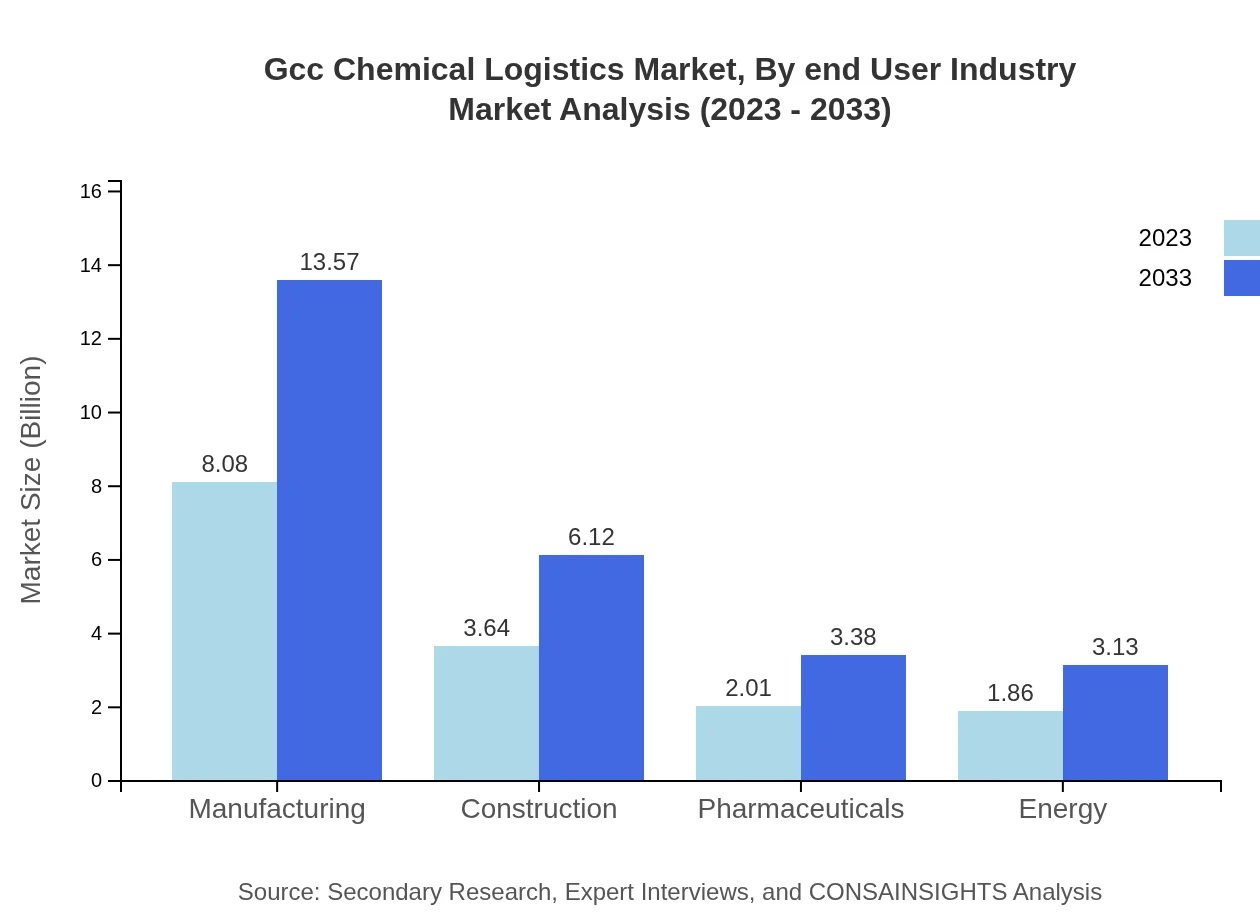

Gcc Chemical Logistics Market Analysis By End User Industry

The Manufacturing sector leads the Gcc Chemical Logistics market at $8.08 billion with significant growth expected. The Construction industry follows at $3.64 billion, gaining traction in logistics services. The Pharmaceuticals hold a solid market presence at $2.01 billion, and the Energy sector, equally vital, reaches $1.86 billion.

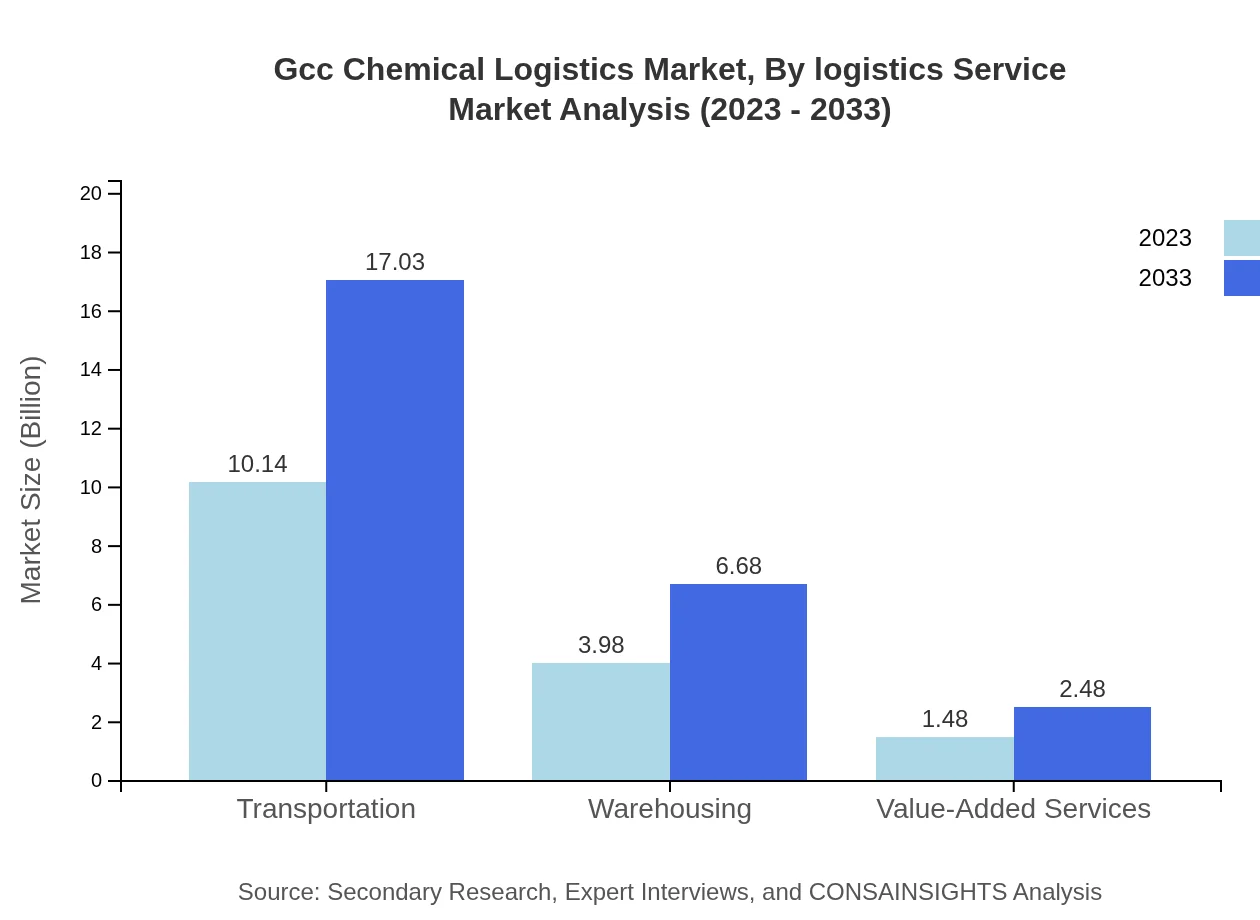

Gcc Chemical Logistics Market Analysis By Logistics Service

The Transportation segment commands a substantial $10.14 billion share, driven by increasing demand. Warehousing contributes $3.98 billion, and the Value-Added Services sector represents $1.48 billion. As logistics providers focus on integrating value-added services, this segment is projected to see continuous growth.

Gcc Chemical Logistics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gcc Chemical Logistics Industry

DB Schenker:

A market leader in logistics and supply chain management, offering advanced solutions tailored for the chemical industry, focused on safety and regulatory compliance.Kuehne + Nagel:

One of the world’s leading logistics companies known for its state-of-the-art chemical logistics services, providing innovative and sustainable solutions.DHL Supply Chain:

A key player in the logistics sector, specializing in comprehensive supply chain solutions catering to the chemical industry, emphasizing efficiency.Expeditors:

Provides integrated logistics solutions with a strong focus on chemical handling, leveraging technology to optimize the supply chain.We're grateful to work with incredible clients.

FAQs

What is the market size of gcc Chemical Logistics?

The GCC Chemical Logistics market is valued at $15.6 billion in 2023, with an anticipated growth rate of 5.2% CAGR. By 2033, the market is expected to expand significantly, driven by increasing demand across sectors.

What are the key market players or companies in this gcc Chemical Logistics industry?

Key players in the GCC Chemical Logistics market include major logistics companies and chemical manufacturing firms that specialize in efficient transportation and storage solutions tailored for chemicals.

What are the primary factors driving the growth in the gcc Chemical Logistics industry?

The growth of the GCC Chemical Logistics industry is primarily driven by the rising demand for petrochemicals, expansions in manufacturing capacities, and increased international trade activities, necessitating improved logistics solutions.

Which region is the fastest Growing in the gcc Chemical Logistics?

The fastest-growing region in the GCC Chemical Logistics market is North America, projected to grow from $6.04 billion in 2023 to $10.15 billion by 2033, supported by robust industrial activity and infrastructural investments.

Does ConsaInsights provide customized market report data for the gcc Chemical Logistics industry?

Yes, ConsaInsights offers customized market report data for the GCC Chemical Logistics industry, allowing clients to access tailored insights and analytics that meet their specific research needs.

What deliverables can I expect from this gcc Chemical Logistics market research project?

Clients of the GCC Chemical Logistics market research project can expect comprehensive reports, data analysis, market trends, and strategic recommendations designed to support informed decision-making.

What are the market trends of gcc Chemical Logistics?

Current market trends in the GCC Chemical Logistics sector indicate a shift towards increased automation, efficiency in supply chain management, and a greater focus on sustainability practices.