Ghee Market Report

Published Date: 31 January 2026 | Report Code: ghee

Ghee Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report on Ghee covers insights, trends, and forecasts from 2023 to 2033, addressing market size, segmentation, regional analysis, and the competitive landscape of key players in the industry.

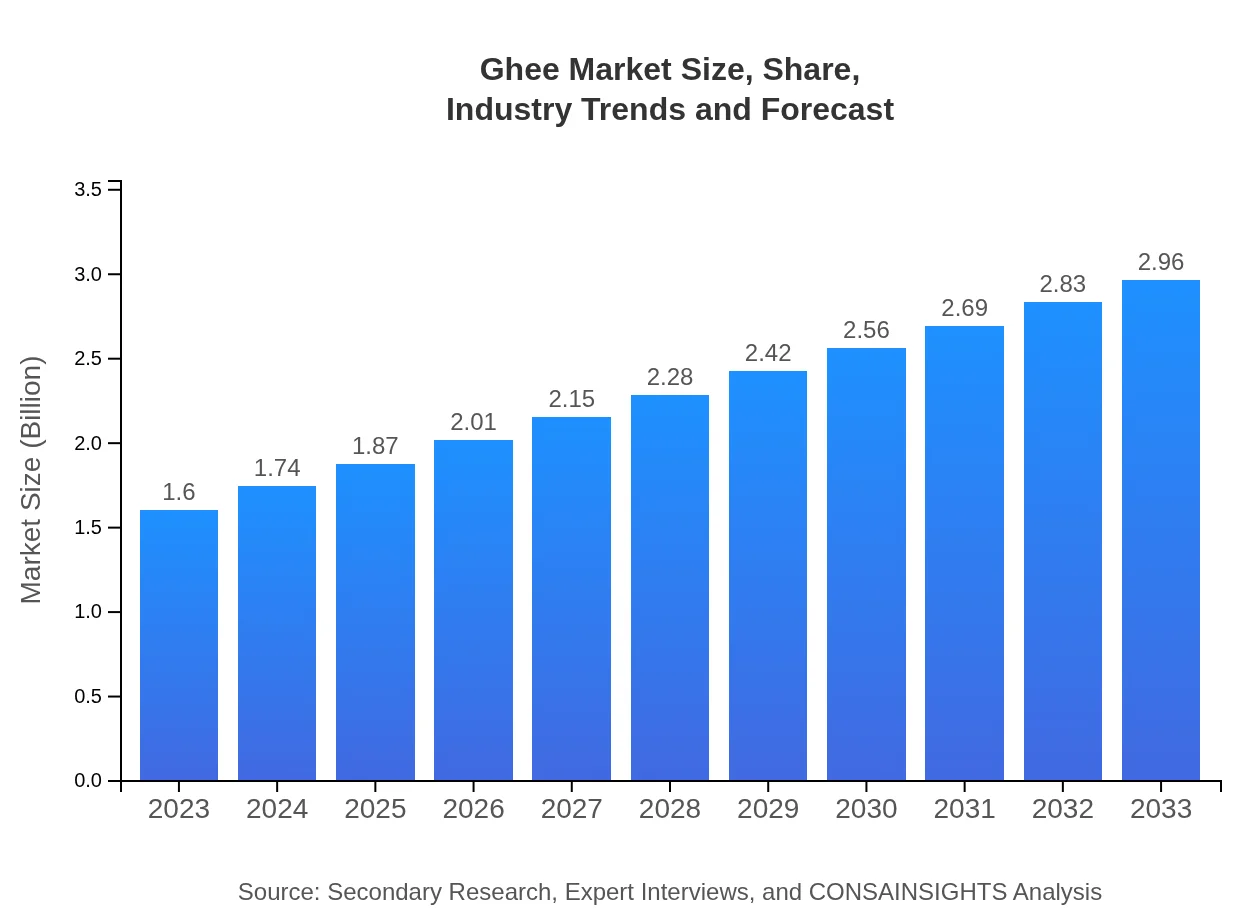

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.60 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.96 Billion |

| Top Companies | Amul, Nestlé, Patanjali, Mother Dairy, Dairy Craft |

| Last Modified Date | 31 January 2026 |

Ghee Market Overview

Customize Ghee Market Report market research report

- ✔ Get in-depth analysis of Ghee market size, growth, and forecasts.

- ✔ Understand Ghee's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ghee

What is the Market Size & CAGR of Ghee market in 2023?

Ghee Industry Analysis

Ghee Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ghee Market Analysis Report by Region

Europe Ghee Market Report:

Europe shows promising growth in the Ghee market, with a projected market size growth from $0.44 billion in 2023 to $0.82 billion by 2033. Awareness of the health benefits and culinary versatility of Ghee is enhancing its popularity.Asia Pacific Ghee Market Report:

The Asia Pacific region holds a substantial share of the Ghee market, valued at $0.30 billion in 2023, and is expected to reach $0.56 billion by 2033. The strong cultural preference for Ghee and its incorporation into traditional cuisines are driving factors in this region.North America Ghee Market Report:

North America's Ghee market size is valued at $0.62 billion in 2023, expected to increase to $1.15 billion by 2033. The increasing health trends and the popularity of ethnic cuisines significantly boost market demand.South America Ghee Market Report:

In South America, the Ghee market is emerging slowly with a current value of $0.01 billion in 2023, projected to grow to $0.03 billion by 2033. The growth can be attributed to rising health-conscious consumers exploring global cooking practices.Middle East & Africa Ghee Market Report:

The Middle East and Africa market stands at $0.22 billion in 2023, anticipated to grow to $0.41 billion by 2033. Traditional dietary practices in the region favor the use of Ghee, contributing to its steady growth.Tell us your focus area and get a customized research report.

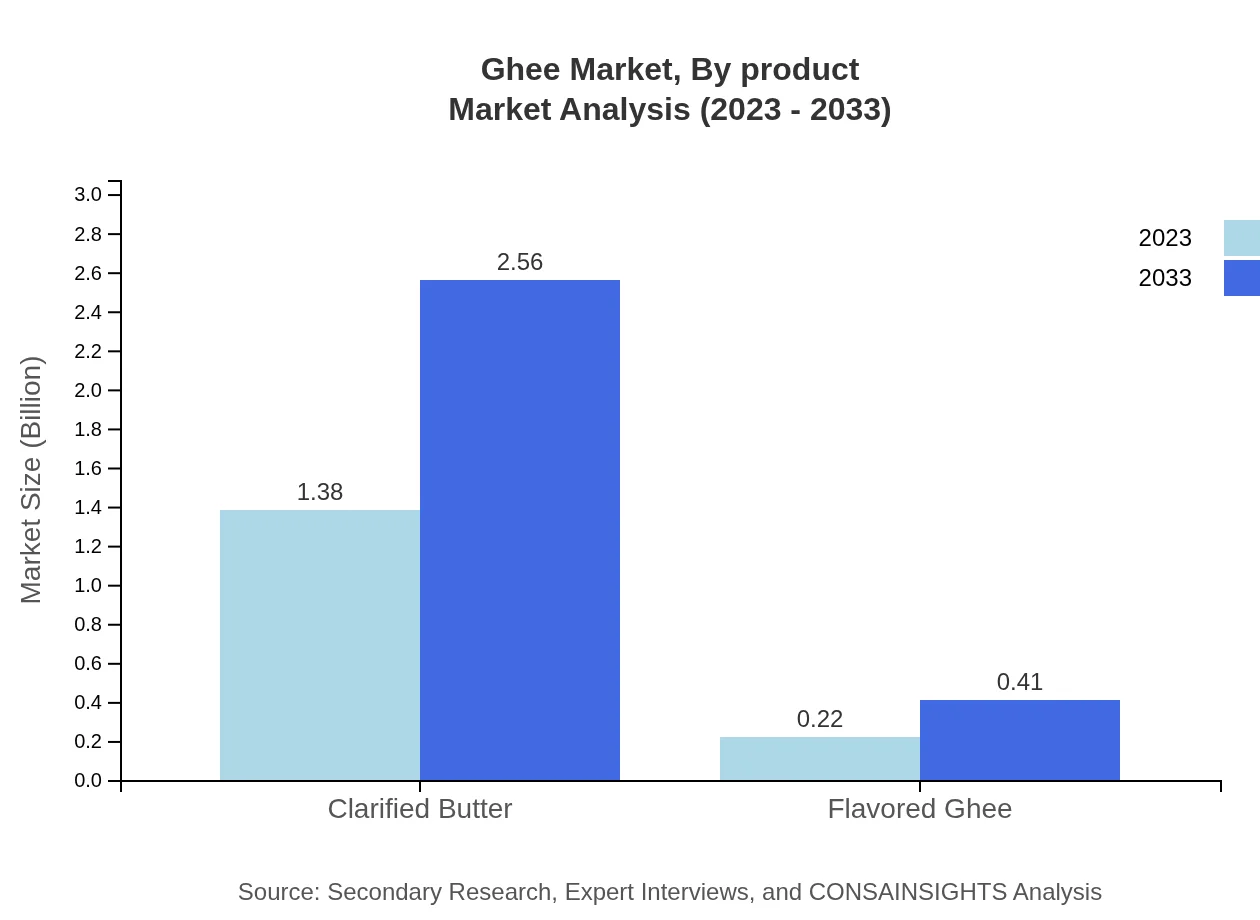

Ghee Market Analysis By Product

The Ghee market, by product type, includes Clarified Butter and Flavored Ghee. Clarified Butter dominates the market, valued at $1.38 billion in 2023 and projected to reach $2.56 billion by 2033, holding a market share of 86.32%. Flavored Ghee, while smaller, shows growth potential, with a market size projected to grow from $0.22 billion in 2023 to $0.41 billion by 2033.

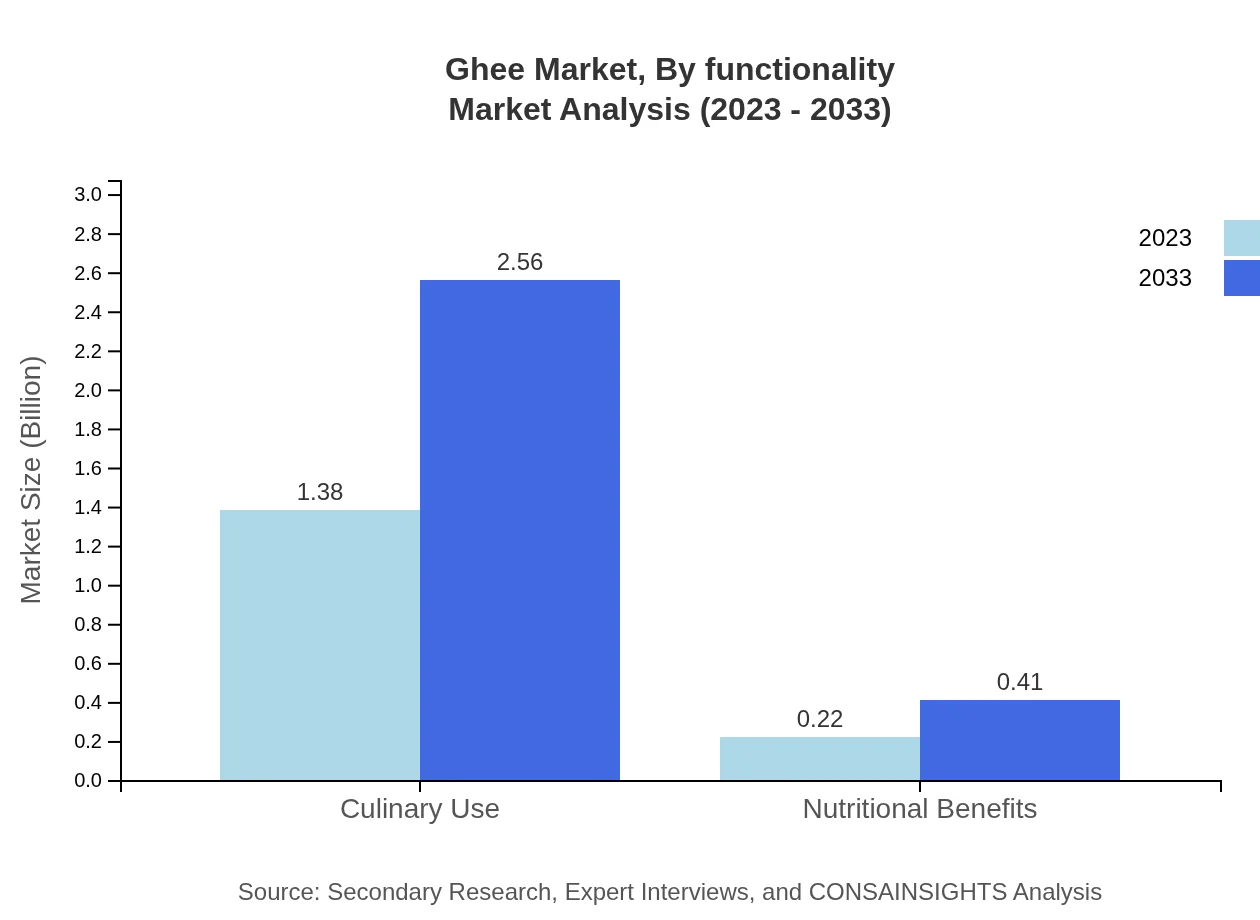

Ghee Market Analysis By Functionality

The Ghee market can be analyzed based on functionality, which includes Culinary Use and Nutritional Benefits. Culinary Use encompasses traditional cooking methods, holding a significant 86.32% market share at $1.38 billion in 2023, projected to grow to $2.56 billion by 2033. Nutritional Benefits, a growing segment, demonstrates a market size growth from $0.22 billion in 2023 to $0.41 billion by 2033, indicating rising awareness regarding Ghee's health advantages.

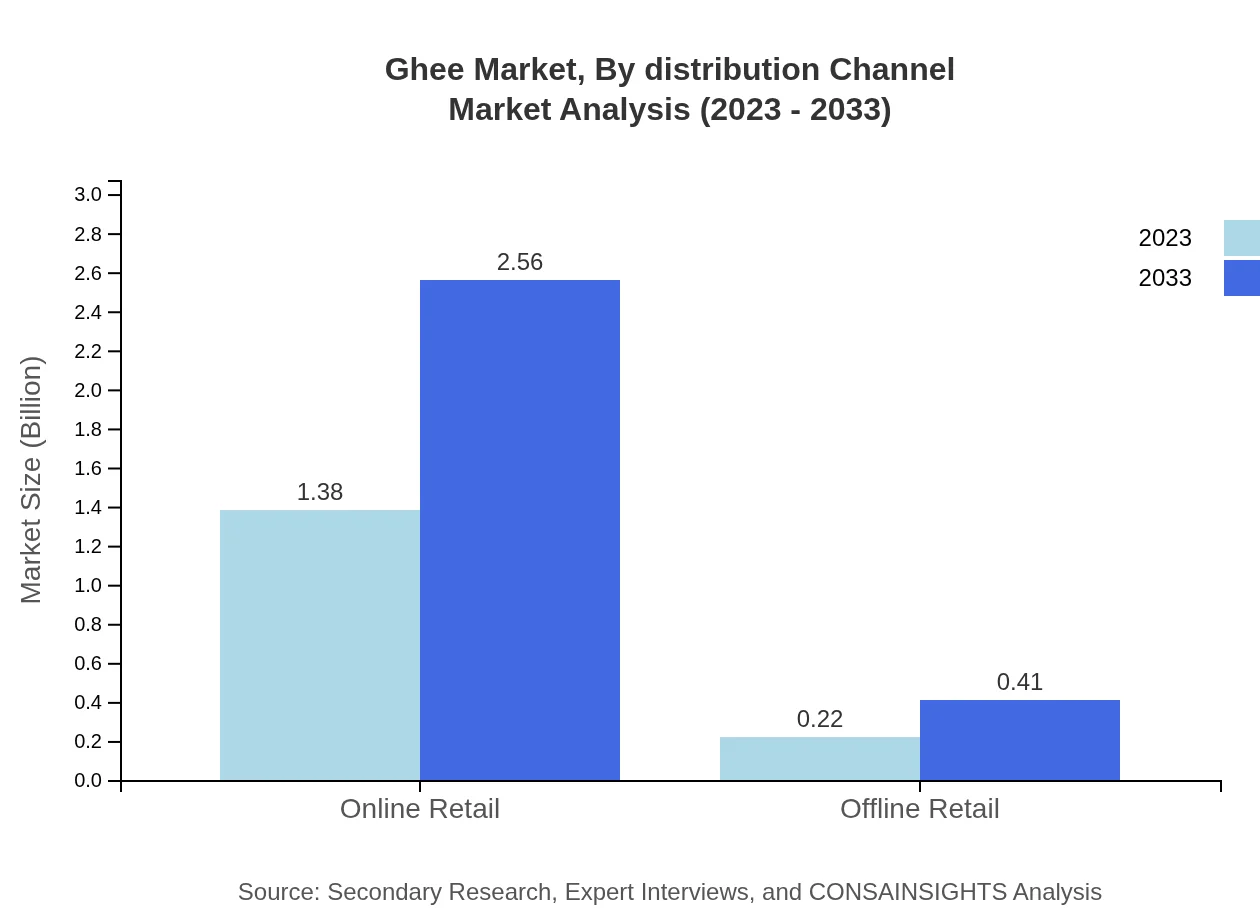

Ghee Market Analysis By Distribution Channel

In terms of distribution channels, Ghee products are sold through Online and Offline Retail. Online Retail leads with a significant market size of $1.38 billion in 2023 and a projected growth to $2.56 billion by 2033, representing 86.32% market share. Offline Retail, while smaller, is expected to see growth from $0.22 billion in 2023 to $0.41 billion by 2033, capturing 13.68% share.

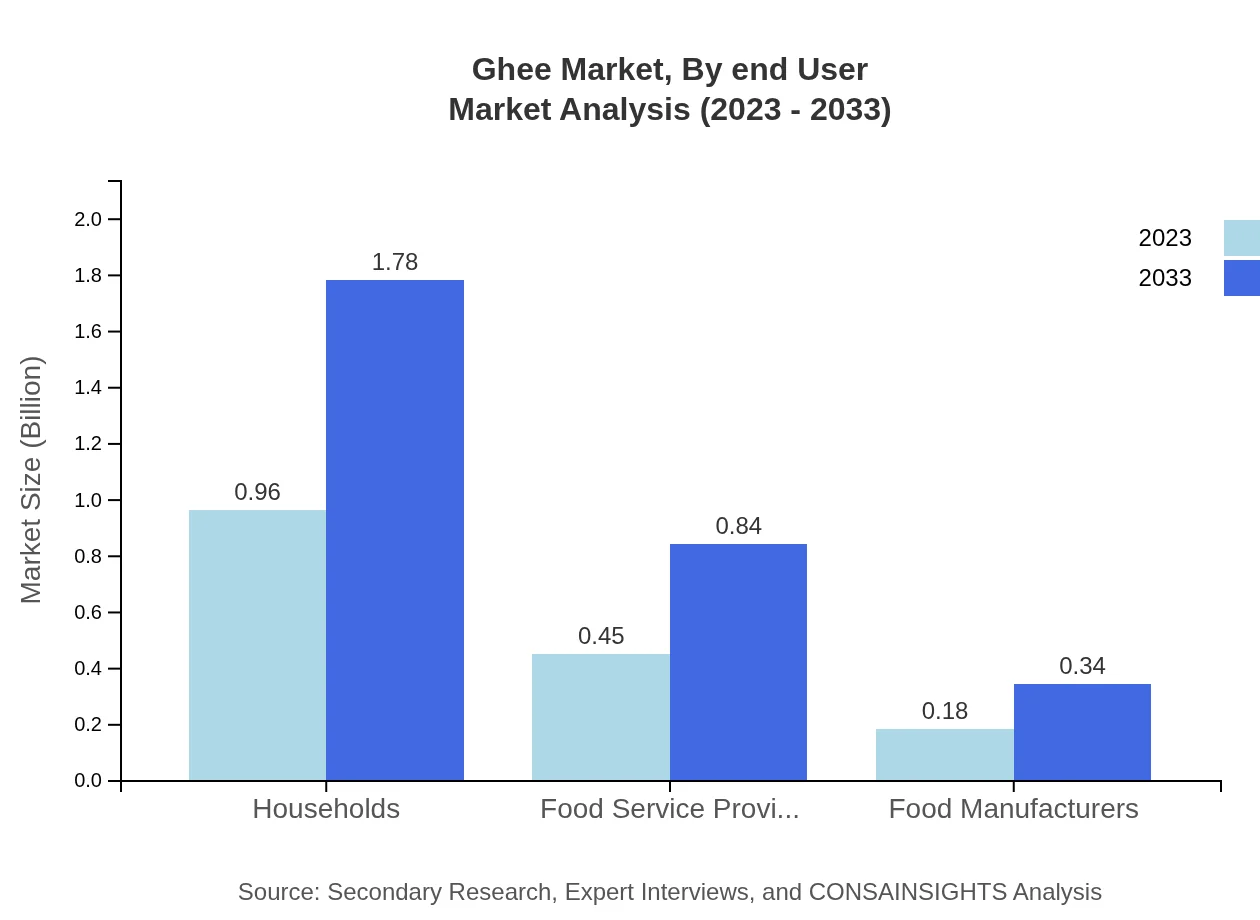

Ghee Market Analysis By End User

The Ghee market is segmented by end-user into Households, Food Service Providers, and Food Manufacturers. Households dominate with a market size of $0.96 billion in 2023, projected to rise to $1.78 billion by 2033, commanding 60.21% market share. Food Service Providers follow at $0.45 billion, growing to $0.84 billion by 2033, while Food Manufacturers represent a small segment at $0.18 billion currently, growing to $0.34 billion by 2033.

Ghee Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ghee Industry

Amul:

Amul is a leading dairy brand in India, renowned for its high-quality Ghee products, contributing significantly to the global Ghee market.Nestlé:

Nestlé offers a wide variety of dairy products, including Ghee, and is a prominent player in the global market, focusing on innovation and health.Patanjali:

Patanjali, an Indian consumer goods company, has rapidly captured market share with its range of natural Ghee products, emphasizing health and wellness.Mother Dairy:

Mother Dairy, part of the National Dairy Development Board in India, is dedicated to providing high-quality Ghee, contributing to local and international markets.Dairy Craft:

Dairy Craft specializes in various dairy products, including organic Ghee, catering to health-conscious consumers globally.We're grateful to work with incredible clients.

FAQs

What is the market size of ghee?

The global ghee market size is estimated at $1.6 billion in 2023, with a projected CAGR of 6.2% from 2023 to 2033. It reflects a significant growth momentum driven by increasing demand for natural and healthy cooking oils.

What are the key market players or companies in the ghee industry?

Key market players include Amul, Britannia, and Nestlé, among others. These companies significantly influence market trends and product innovations, contributing to the overall expansion of the ghee segment by catering to diverse consumer preferences.

What are the primary factors driving the growth in the ghee industry?

Primary growth drivers include rising health consciousness, increased awareness of ghee's nutritional benefits, and the growing trend of natural and organic products in culinary applications, which are attracting a wider consumer base.

Which region is the fastest Growing in the ghee market?

The fastest-growing region in the ghee market is North America, with market size projections increasing from $0.62 billion in 2023 to $1.15 billion by 2033, driven by higher consumer adoption and increased availability of ghee in retail channels.

Does ConsaInsights provide customized market report data for the ghee industry?

Yes, ConsaInsights offers tailored market report data for the ghee industry, enabling clients to access specific insights that reflect their unique business needs, ensuring informed decision-making and strategic planning.

What deliverables can I expect from this ghee market research project?

Typical deliverables include a detailed market analysis, growth forecasts, competitive landscape profiles, regional market insights, and segment data that highlight trends within the ghee industry, facilitating comprehensive market understanding.

What are the market trends of ghee?

Current trends in the ghee market include an increasing preference for clarified butter, a shift toward online retail channels, and a growing interest in flavored ghee, each fostering innovation and consumer engagement in the culinary space.