Gluten Free Prepared Food Market Report

Published Date: 31 January 2026 | Report Code: gluten-free-prepared-food

Gluten Free Prepared Food Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Gluten Free Prepared Food market, providing insights into market trends, size forecasts, regional analyses, and industry dynamics for the years 2023 to 2033.

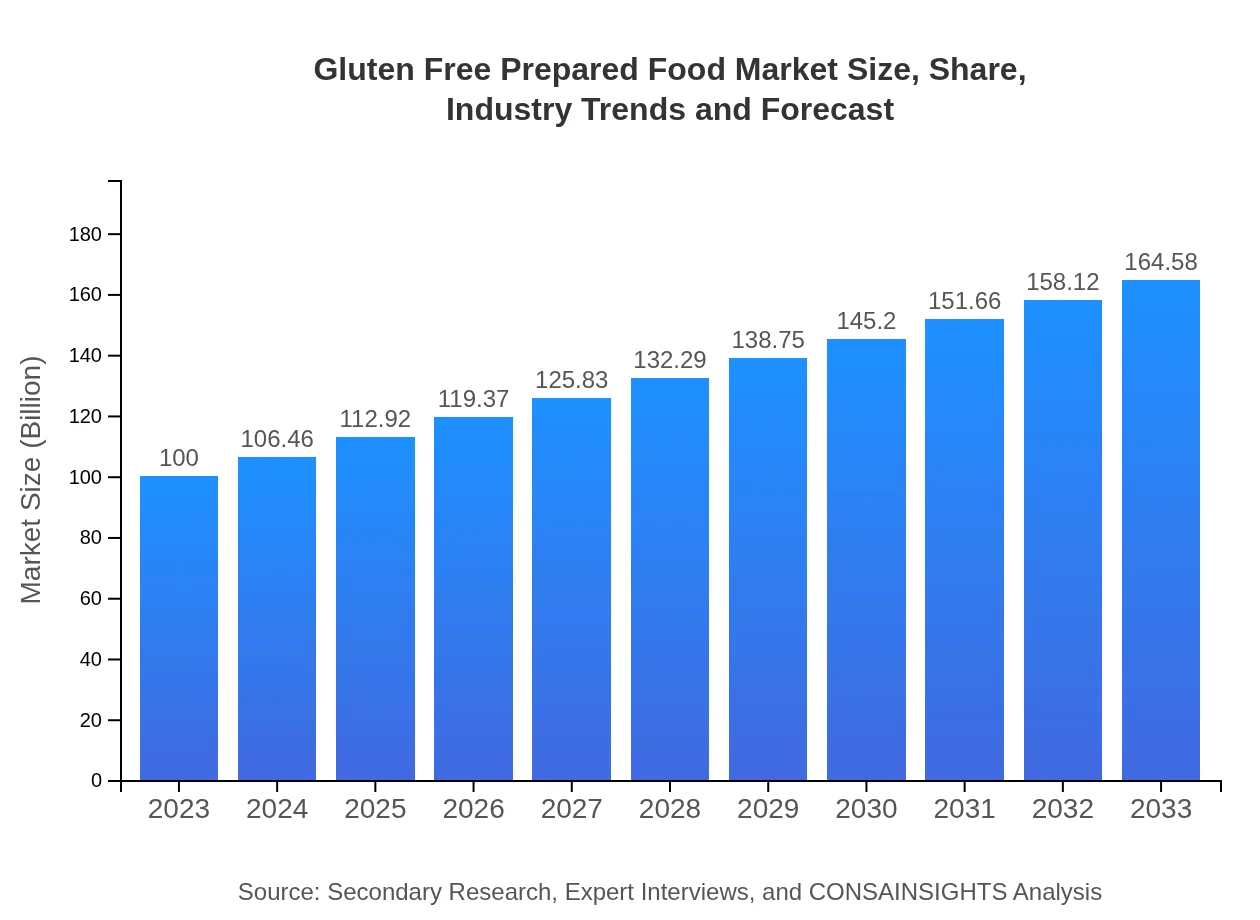

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | General Mills, Kraft Heinz Company, Mondelez International, Nestlé, Bob's Red Mill |

| Last Modified Date | 31 January 2026 |

Gluten Free Prepared Food Market Overview

Customize Gluten Free Prepared Food Market Report market research report

- ✔ Get in-depth analysis of Gluten Free Prepared Food market size, growth, and forecasts.

- ✔ Understand Gluten Free Prepared Food's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gluten Free Prepared Food

What is the Market Size & CAGR of Gluten Free Prepared Food market in 2033?

Gluten Free Prepared Food Industry Analysis

Gluten Free Prepared Food Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gluten Free Prepared Food Market Analysis Report by Region

Europe Gluten Free Prepared Food Market Report:

Europe's Gluten Free Prepared Food market is valued at $24.38 billion in 2023, projected to expand to $40.12 billion by 2033. The United Kingdom and Germany are at the forefront, spurred by legislation promoting gluten-free diet compliance and a rich heritage of gluten-free product development.Asia Pacific Gluten Free Prepared Food Market Report:

In the Asia Pacific region, the Gluten Free Prepared Food market is valued at $21.17 billion in 2023, expected to grow to $34.84 billion by 2033, driven by rising consumer awareness and lifestyle changes. Countries like Japan and Australia lead in demand due to a higher prevalence of celiac disease and dietary preferences.North America Gluten Free Prepared Food Market Report:

In North America, the market stands at $37.95 billion in 2023 and is expected to reach $62.46 billion by 2033. The United States leads in market share, driven by high consumer awareness and the growing availability of gluten-free products across supermarkets and health food stores.South America Gluten Free Prepared Food Market Report:

The South American market, valued at $8.77 billion in 2023 with growth projected to $14.43 billion by 2033, is primarily influenced by increasing health consciousness among consumers. Brazil and Argentina are notable contributors to this growth as they explore gluten-free options for traditional cuisines.Middle East & Africa Gluten Free Prepared Food Market Report:

The Middle East and Africa region shows substantial growth potential, with the market at $7.73 billion in 2023 and anticipated to grow to $12.72 billion by 2033. The region is gradually embracing gluten-free food products driven by urbanization and increasing disposable incomes.Tell us your focus area and get a customized research report.

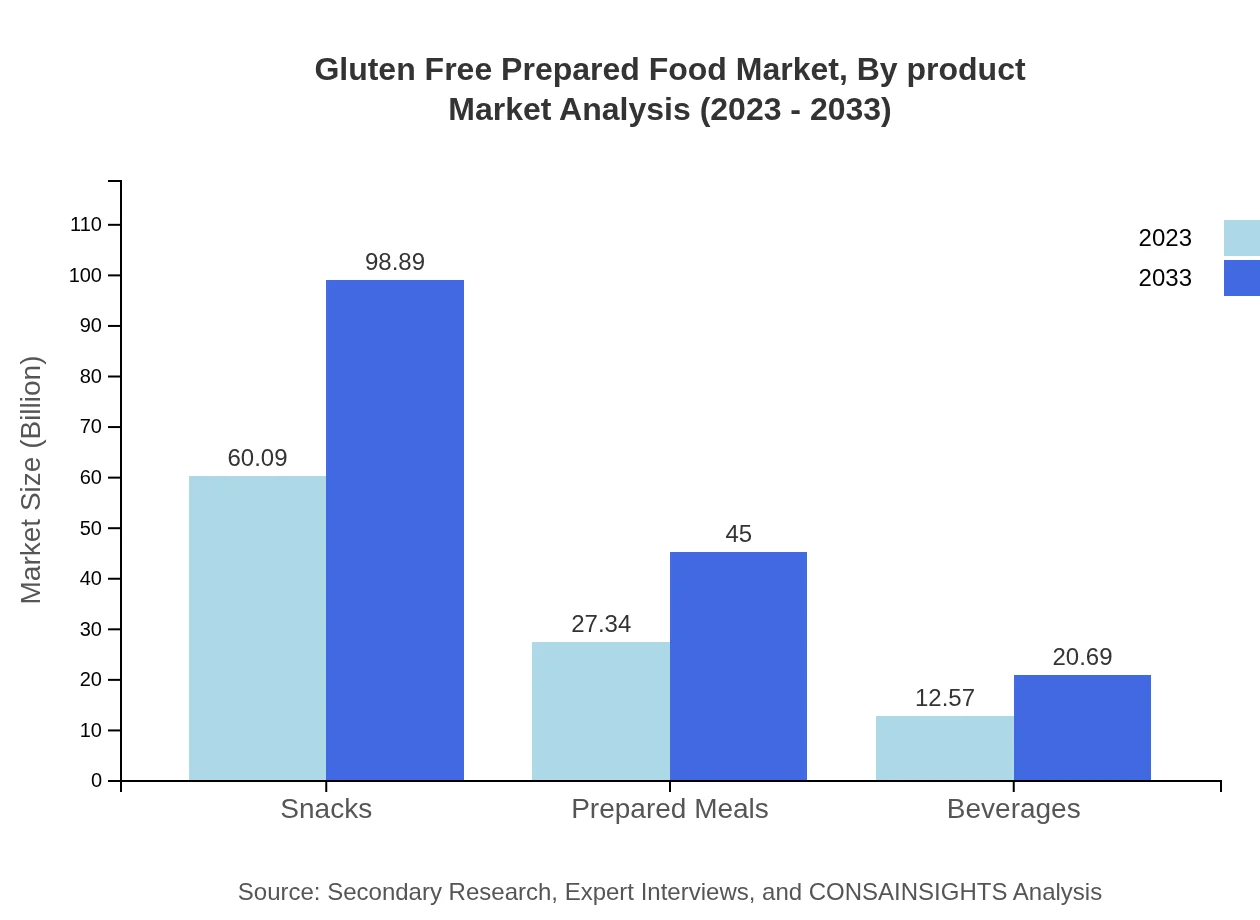

Gluten Free Prepared Food Market Analysis By Product

In terms of product segmentation, snacks dominate the market with a size of $60.09 billion in 2023, expanding to $98.89 billion by 2033. Prepared meals and beverages follow, valued at $27.34 billion and $12.57 billion respectively in 2023, with prepared meals expected to reach $45.00 billion.

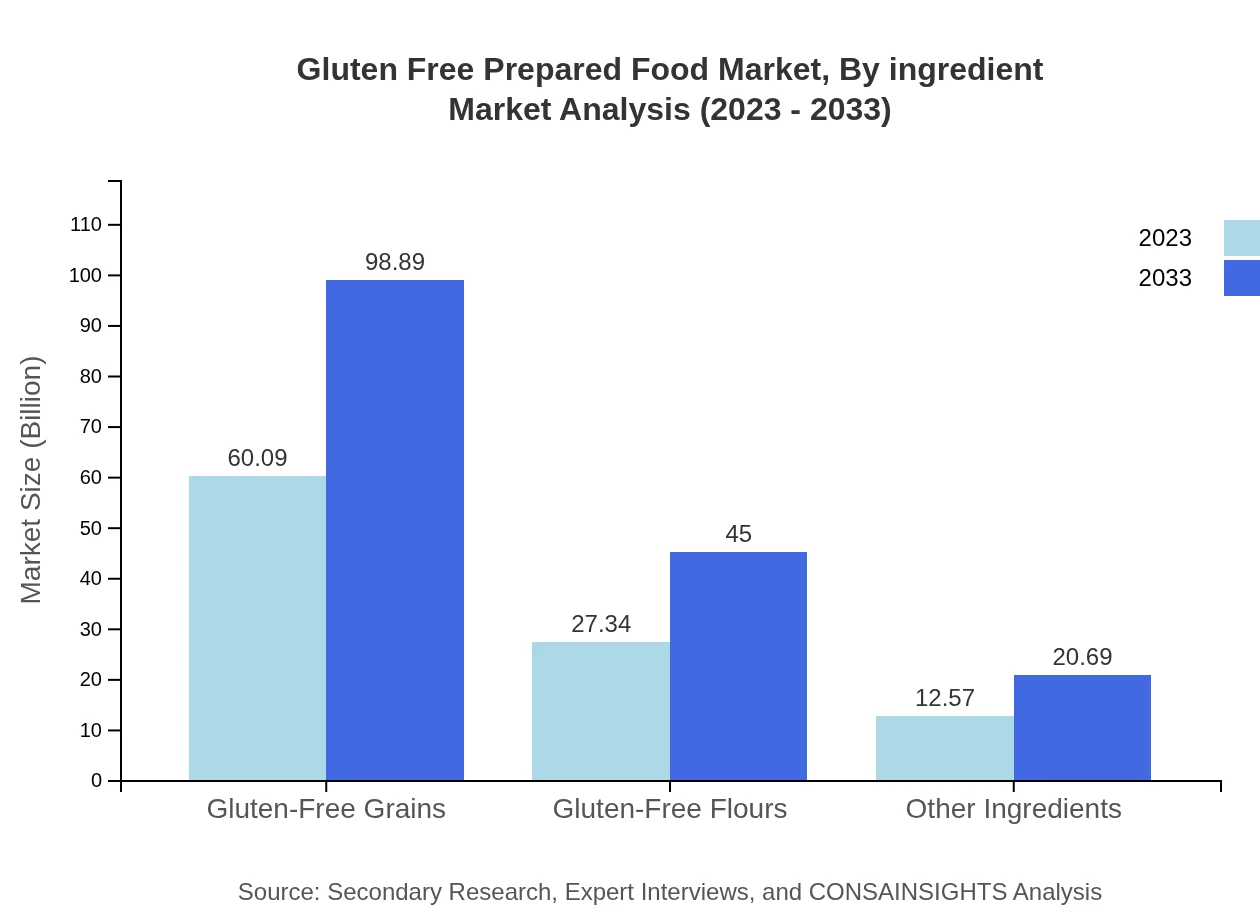

Gluten Free Prepared Food Market Analysis By Ingredient

Key ingredients contributing to the gluten-free prepared food market include gluten-free grains, flours, and other components. Gluten-free grains market is projected to grow from $60.09 billion in 2023 to $98.89 billion by 2033, while gluten-free flours are expected to increase from $27.34 billion to $45.00 billion.

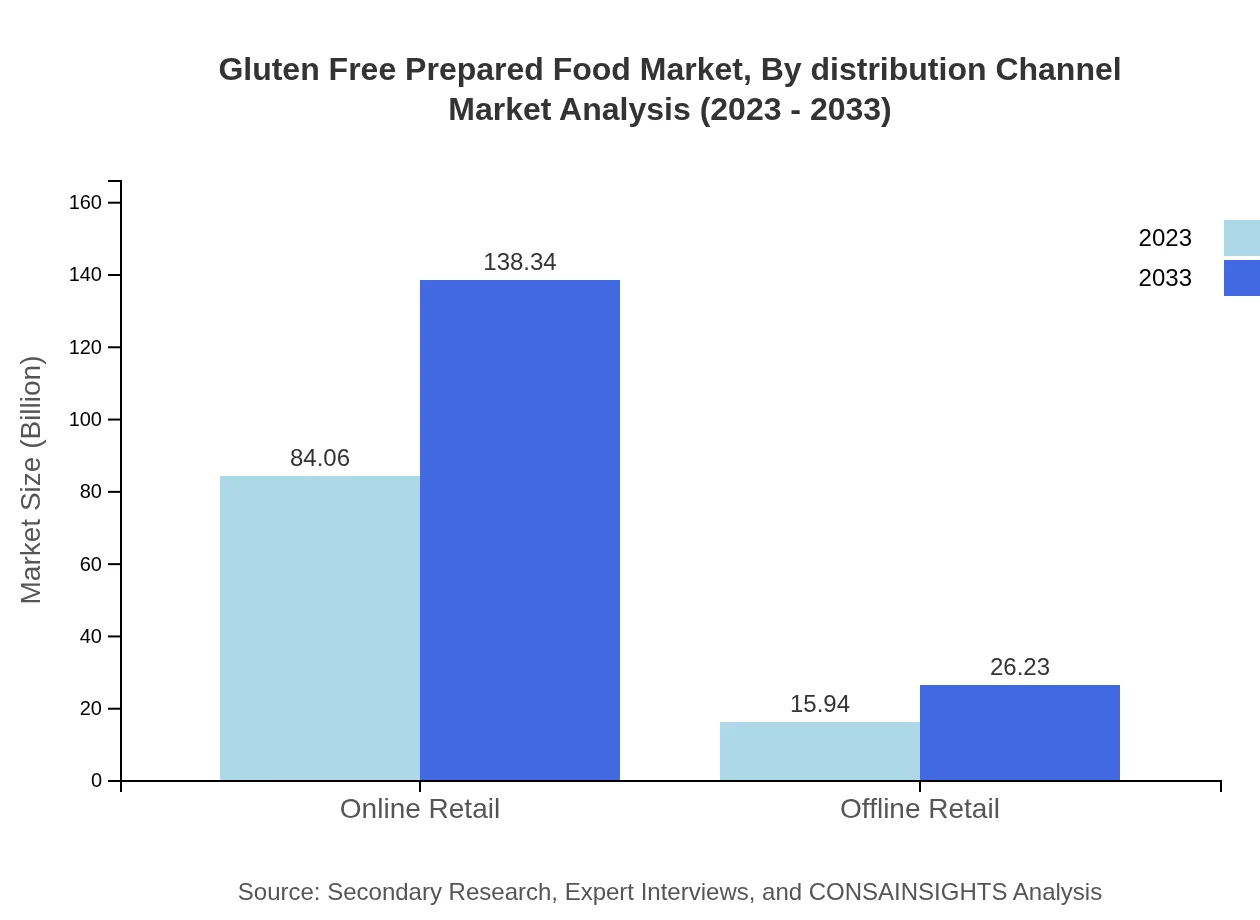

Gluten Free Prepared Food Market Analysis By Distribution Channel

The distribution of gluten-free products is primarily through online retail, representing a market size of $84.06 billion in 2023 and expected growth to $138.34 billion by 2033. Offline retail channels also play a significant role but are comparatively smaller, starting from $15.94 billion to $26.23 billion.

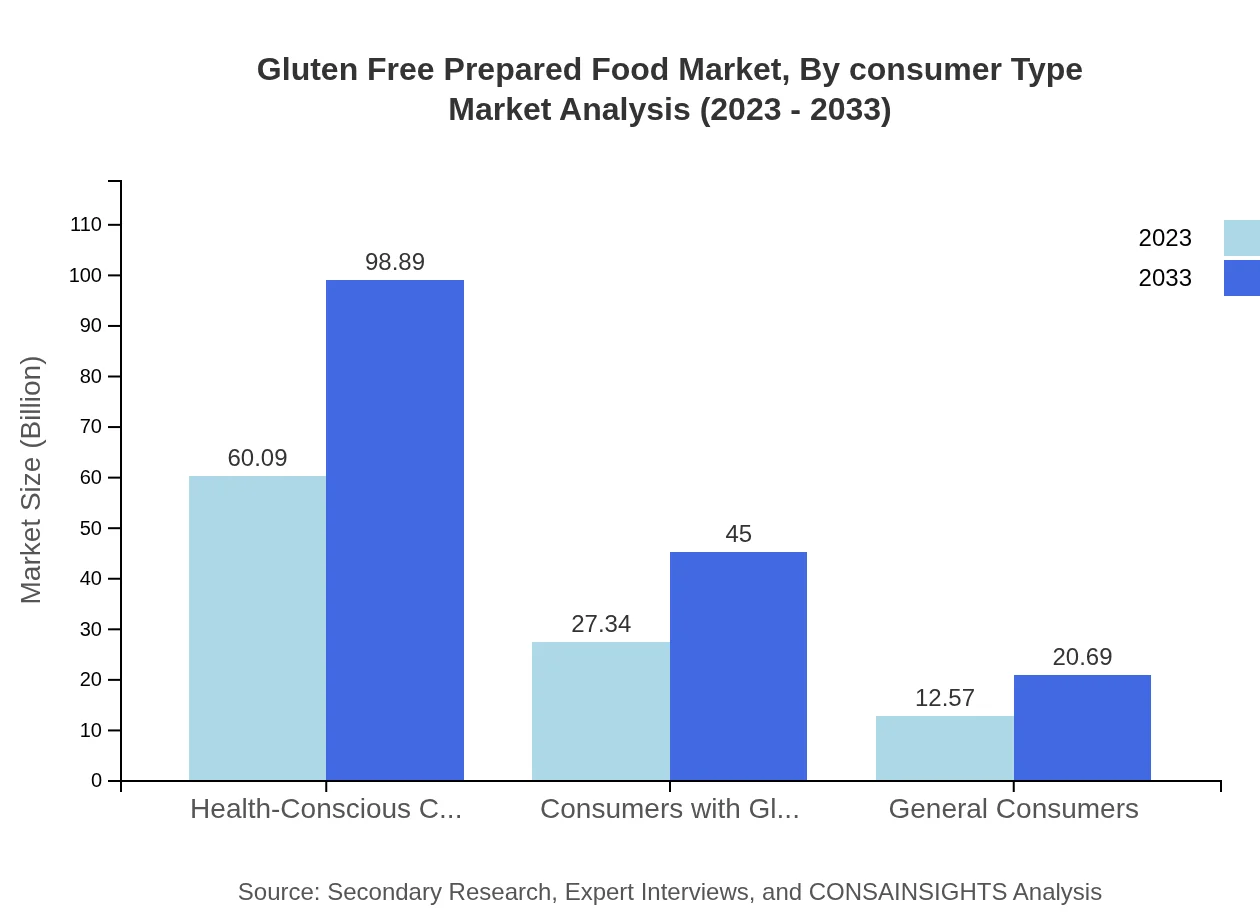

Gluten Free Prepared Food Market Analysis By Consumer Type

The largest segment of the gluten-free market is health-conscious consumers, who accounted for $60.09 billion in value in 2023, poised to grow to $98.89 billion. Consumers with gluten allergies also represent a significant consumer base with an expected growth from $27.34 billion to $45.00 billion.

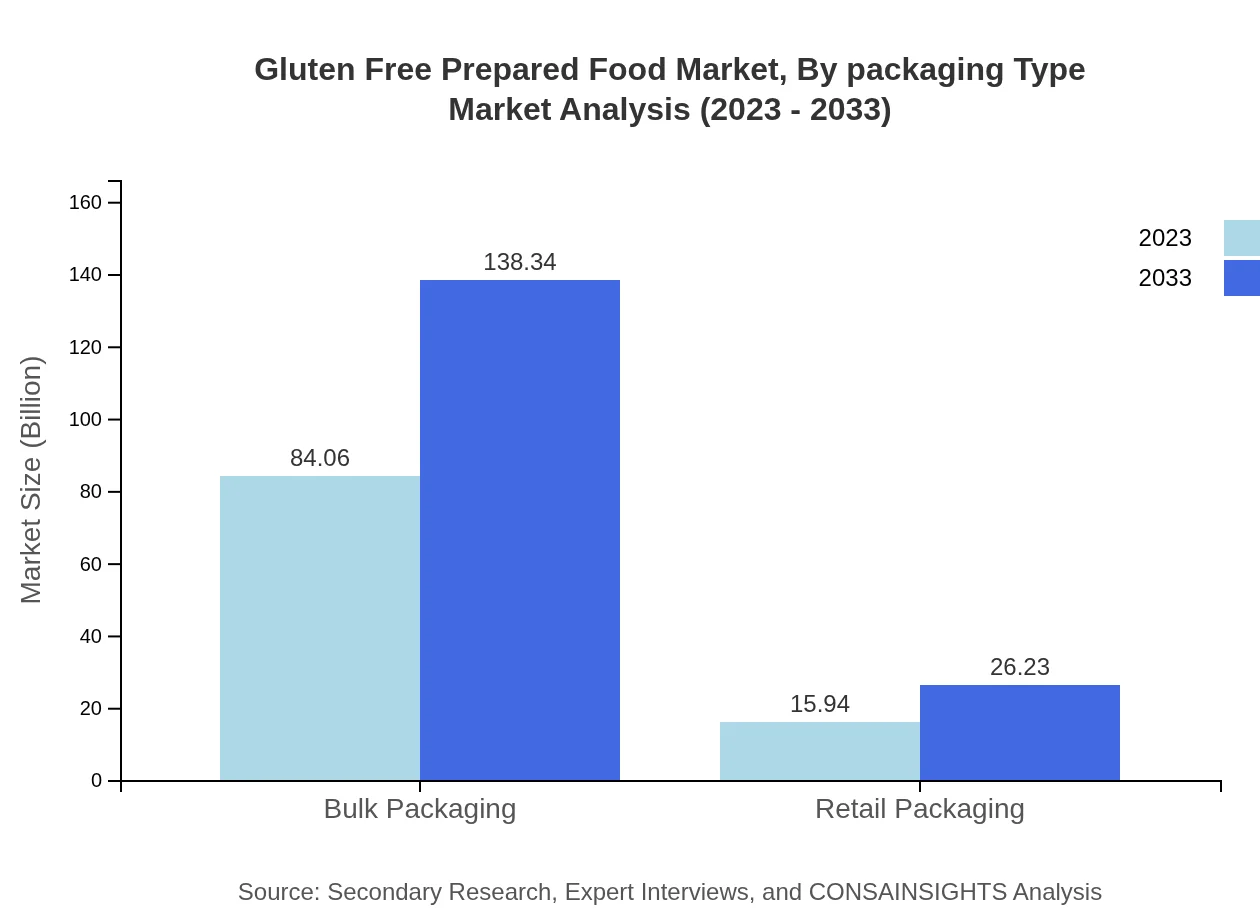

Gluten Free Prepared Food Market Analysis By Packaging Type

Bulk packaging plays a dominant role in the gluten-free prepared food market, with a steady valuation from $84.06 billion in 2023 to $138.34 billion by 2033, while retail packaging is expected to grow from $15.94 billion to $26.23 billion.

Gluten Free Prepared Food Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gluten Free Prepared Food Industry

General Mills:

A key player in the gluten-free prepared food segment, General Mills offers a variety of gluten-free products, particularly in the snacks and baking mixes category, contributing significantly to market growth.Kraft Heinz Company:

This company produces an extensive range of gluten-free options across different product categories, focusing on innovative product development to meet consumer trends.Mondelez International:

With a strong portfolio of gluten-free snacks, Mondelez is committed to health and wellness, driving consumer demand in various regions.Nestlé:

Renowned for its comprehensive assortment of gluten-free prepared foods, Nestlé leads advancements in product formulations that cater to dietary restrictions.Bob's Red Mill:

Specializing in gluten-free grains and flours, Bob's Red Mill is a leader in the gluten-free movement, offering health-conscious consumers quality products.We're grateful to work with incredible clients.

FAQs

What is the market size of gluten Free prepared food?

The gluten-free prepared food market is projected to reach approximately $100 million by 2033, growing at a CAGR of 5%. This growth trend reflects the increasing consumer demand for gluten-free products in the food sector.

What are the key market players or companies in the gluten Free prepared food industry?

Key players include large corporations and specialized brands focusing on gluten-free options, which enhance their market positioning through innovation and high-quality product offerings.

What are the primary factors driving the growth in the gluten Free prepared food industry?

Factors include rising awareness of gluten allergies, an increasing number of health-conscious consumers, and the growing trend toward healthier lifestyle choices, influencing market expansion significantly.

Which region is the fastest Growing in the gluten Free prepared food market?

North America is expected to be the fastest-growing region, with a market size projected to increase from $37.95 million in 2023 to $62.46 million by 2033.

Does ConsaInsights provide customized market report data for the gluten Free prepared food industry?

Yes, ConsaInsights offers tailored market reports and insights specifically designed to meet unique business requirements within the gluten-free prepared food industry.

What deliverables can I expect from this gluten Free prepared food market research project?

Expect comprehensive market analysis reports, segment data, trends, forecasts, and actionable insights tailored to your strategic needs in the gluten-free food market.

What are the market trends of gluten Free prepared food?

Notable trends include increased popularity of gluten-free snacks, the rise of health-conscious brands, and enhanced product distribution through online and bulk retail channels.