Grain Processing Equipment Market Report

Published Date: 31 January 2026 | Report Code: grain-processing-equipment

Grain Processing Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Grain Processing Equipment market, focusing on key trends, segments, regional insights, and future forecasts covering the period from 2023 to 2033.

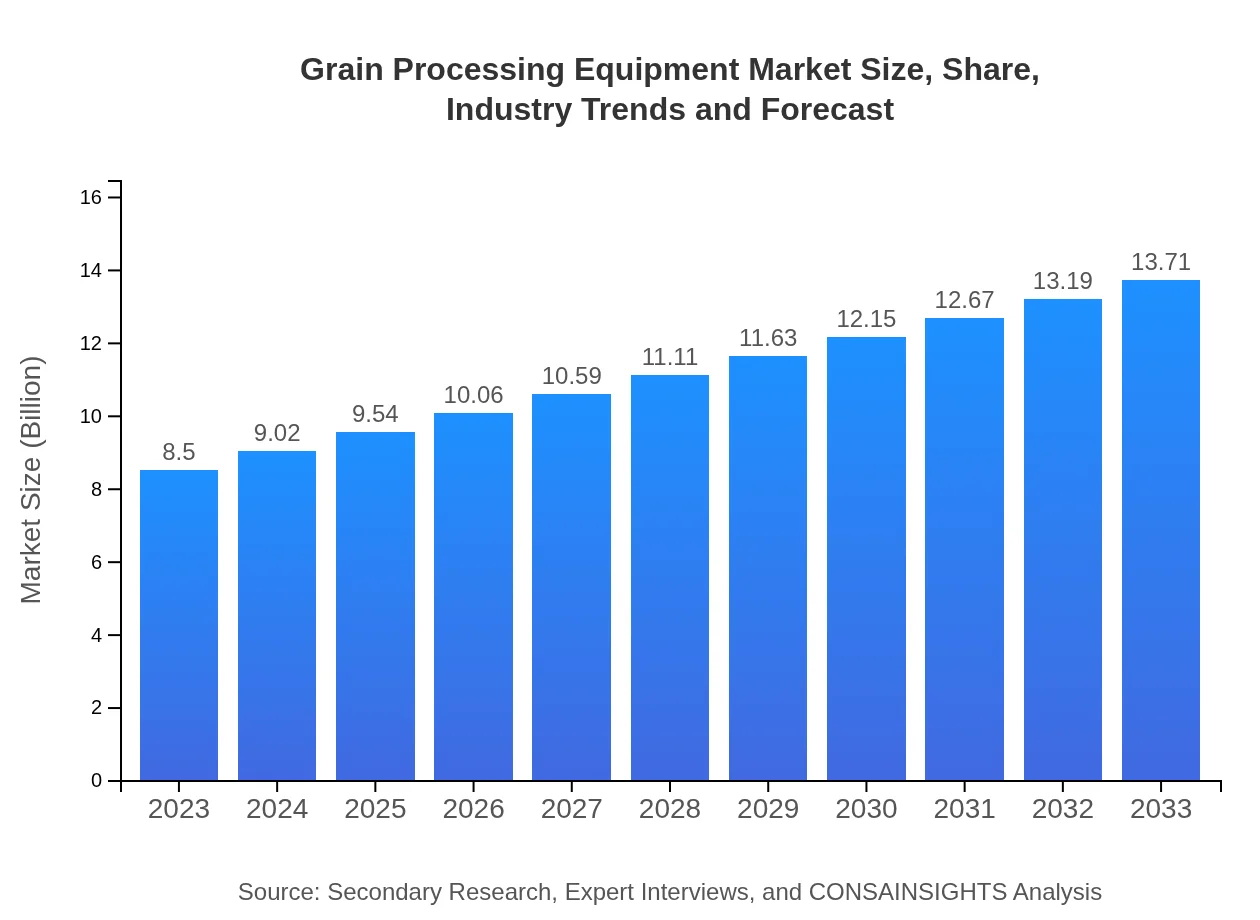

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $13.71 Billion |

| Top Companies | Bühler Group, AGCO Corporation, CPM Holdings, Inc. |

| Last Modified Date | 31 January 2026 |

Grain Processing Equipment Market Overview

Customize Grain Processing Equipment Market Report market research report

- ✔ Get in-depth analysis of Grain Processing Equipment market size, growth, and forecasts.

- ✔ Understand Grain Processing Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Grain Processing Equipment

What is the Market Size & CAGR of Grain Processing Equipment market in 2023?

Grain Processing Equipment Industry Analysis

Grain Processing Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Grain Processing Equipment Market Analysis Report by Region

Europe Grain Processing Equipment Market Report:

Europe's Grain Processing Equipment market is anticipated to increase from USD 2.85 billion in 2023 to USD 4.59 billion by 2033. The European Union's stringent food safety regulations and sustainable agricultural practices significantly influence equipment demands, emphasizing high-quality, efficient processing solutions.Asia Pacific Grain Processing Equipment Market Report:

The Asia Pacific region held a market value of USD 1.40 billion in 2023, projected to grow to USD 2.27 billion by 2033. The rise in population and food consumption, coupled with increased agricultural output, plays a pivotal role in this growth. Countries like China and India are major contributors, emphasizing modernization and increased mechanization in farming practices.North America Grain Processing Equipment Market Report:

The North American market, valued at USD 3.08 billion in 2023, is forecasted to expand to USD 4.97 billion by 2033. The primary drivers include technological innovations and a strong focus on efficiency in large-scale grain production. The United States and Canada are leading in grain processing due to their advanced agricultural practices.South America Grain Processing Equipment Market Report:

In South America, the Grain Processing Equipment market stood at USD 0.62 billion in 2023, expected to reach USD 1.00 billion by 2033. The region's agricultural landscape is rapidly evolving, with a growing focus on exports and production efficiency, particularly in Brazil and Argentina's grain sectors.Middle East & Africa Grain Processing Equipment Market Report:

The Middle East and Africa market was valued at USD 0.55 billion in 2023 and is projected to grow to USD 0.89 billion by 2033. Investment in agricultural technology and efforts to improve food security are key factors driving growth in this region, alongside an expanding population and increasing grain imports.Tell us your focus area and get a customized research report.

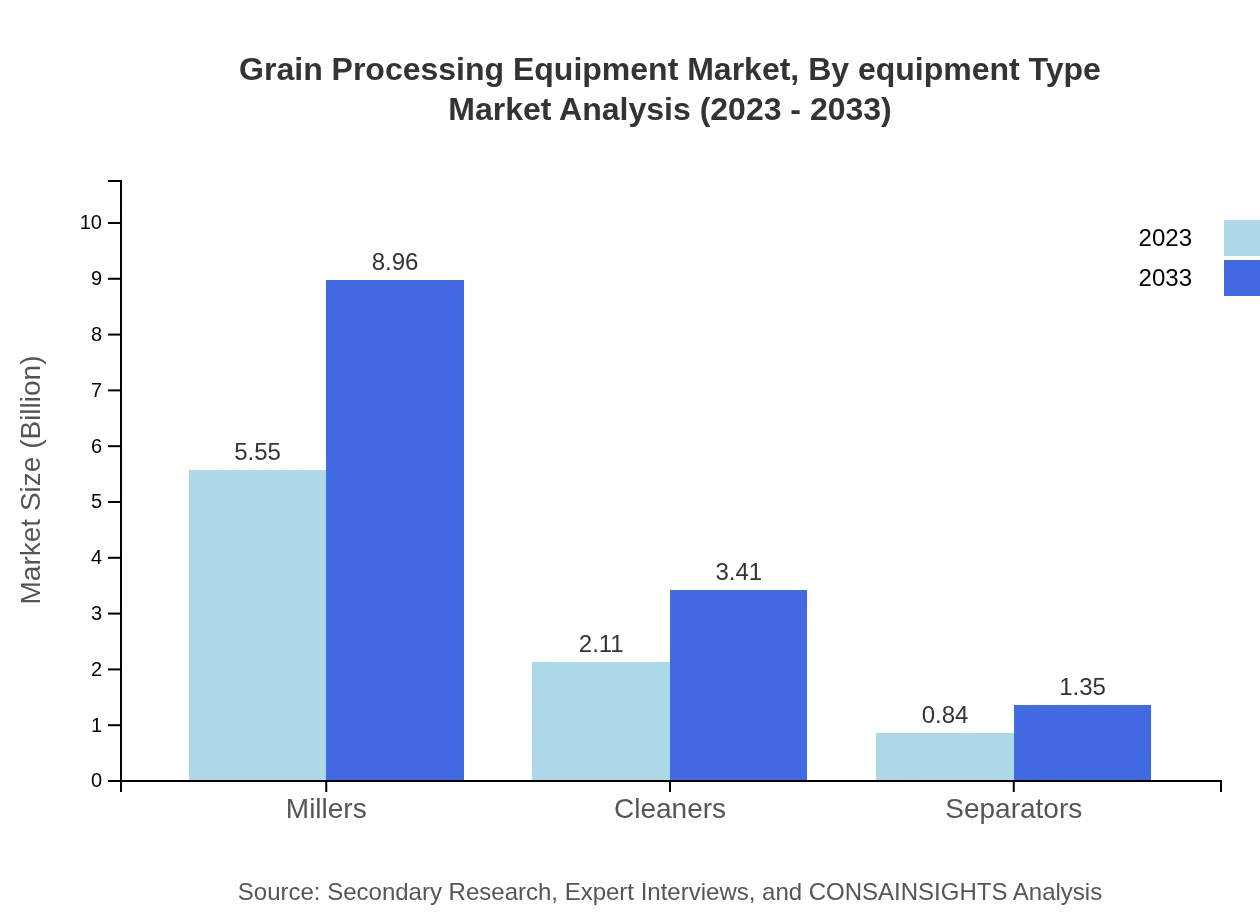

Grain Processing Equipment Market Analysis By Equipment Type

In 2023, traditional technology accounted for 65.3% of the market share in terms of size at USD 5.55 billion, while automated technology and smart technology held 24.87% (USD 2.11 billion) and 9.83% (USD 0.84 billion) respectively. This trend indicates a gradual shift towards more sophisticated processing technologies, with expectations to reach USD 8.96 billion (65.3%) for traditional, USD 3.41 billion (24.87%) for automated, and USD 1.35 billion (9.83%) for smart technology by 2033.

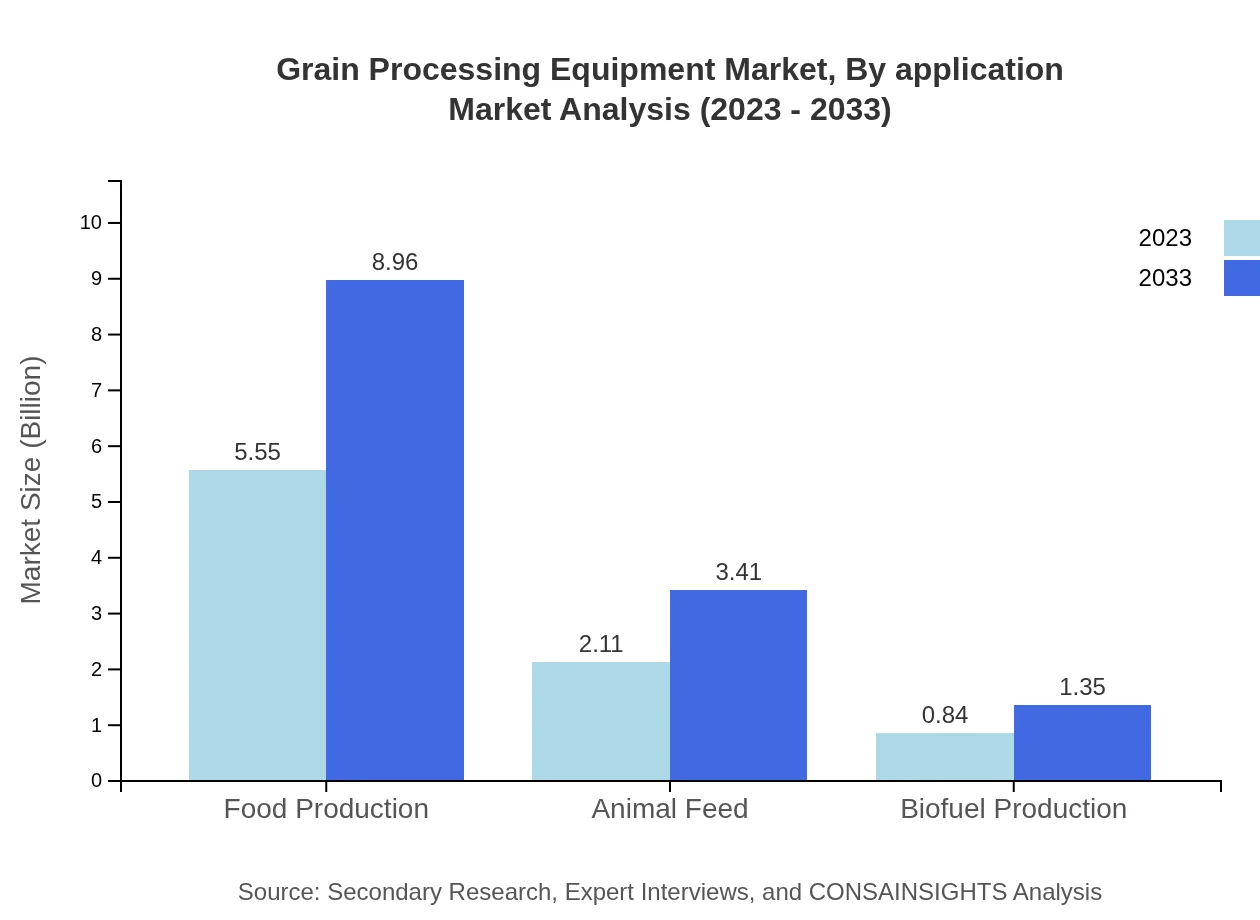

Grain Processing Equipment Market Analysis By Application

This market can be segmented further into food production, animal feed, and biofuel production. Food production takes a dominant share, representing 65.3% of the market in 2023 at USD 5.55 billion, expected to grow to USD 8.96 billion by 2033. In contrast, the animal feed application was valued at USD 2.11 billion (24.87%) in 2023 and projected to reach USD 3.41 billion by 2033.

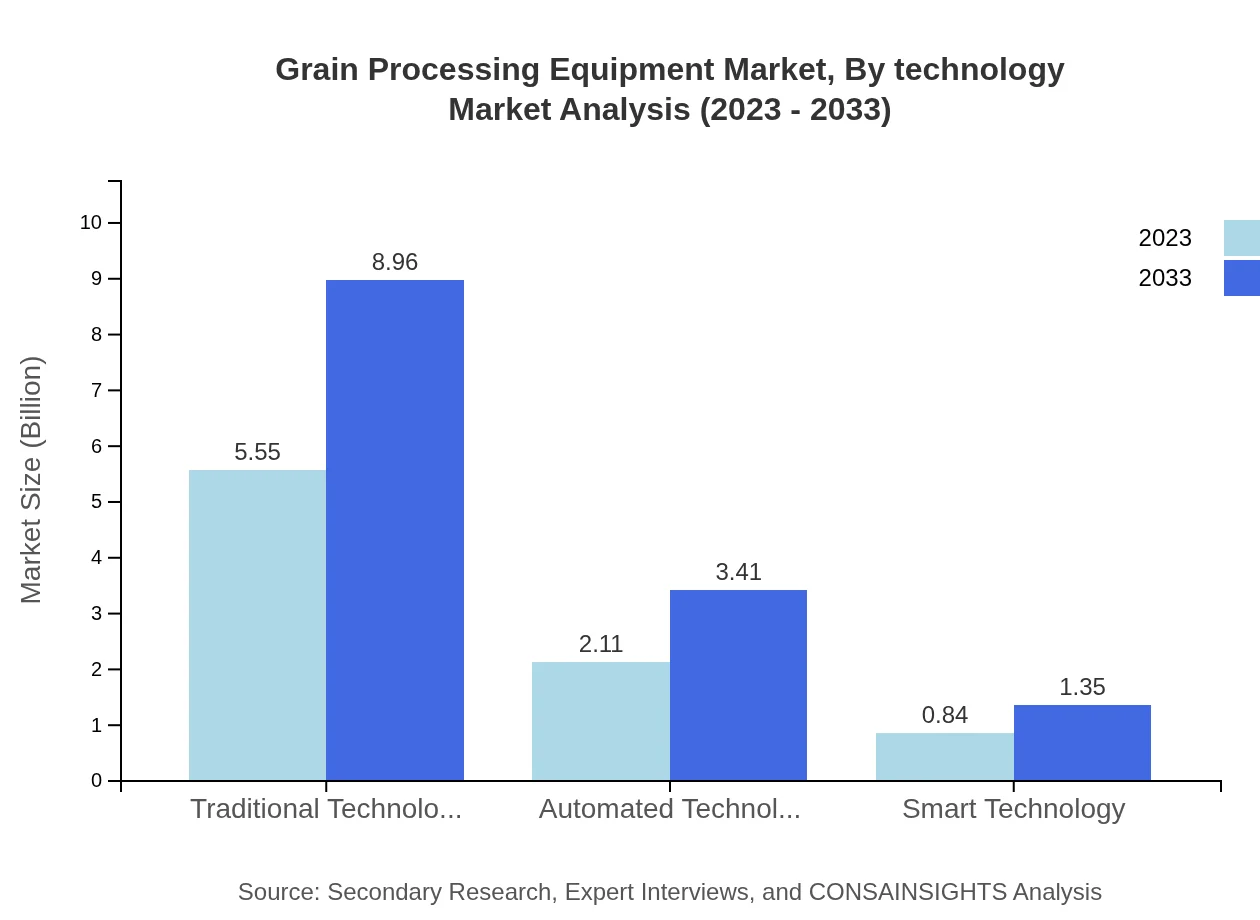

Grain Processing Equipment Market Analysis By Technology

Traditional technology remains prevalent in the market, constituting 65.3% in 2023, whereas automated and smart technologies are growing rapidly. The expected values for 2033 indicate a transformation with more investments focused on innovation, reflecting the trend toward automation and advanced processing technologies.

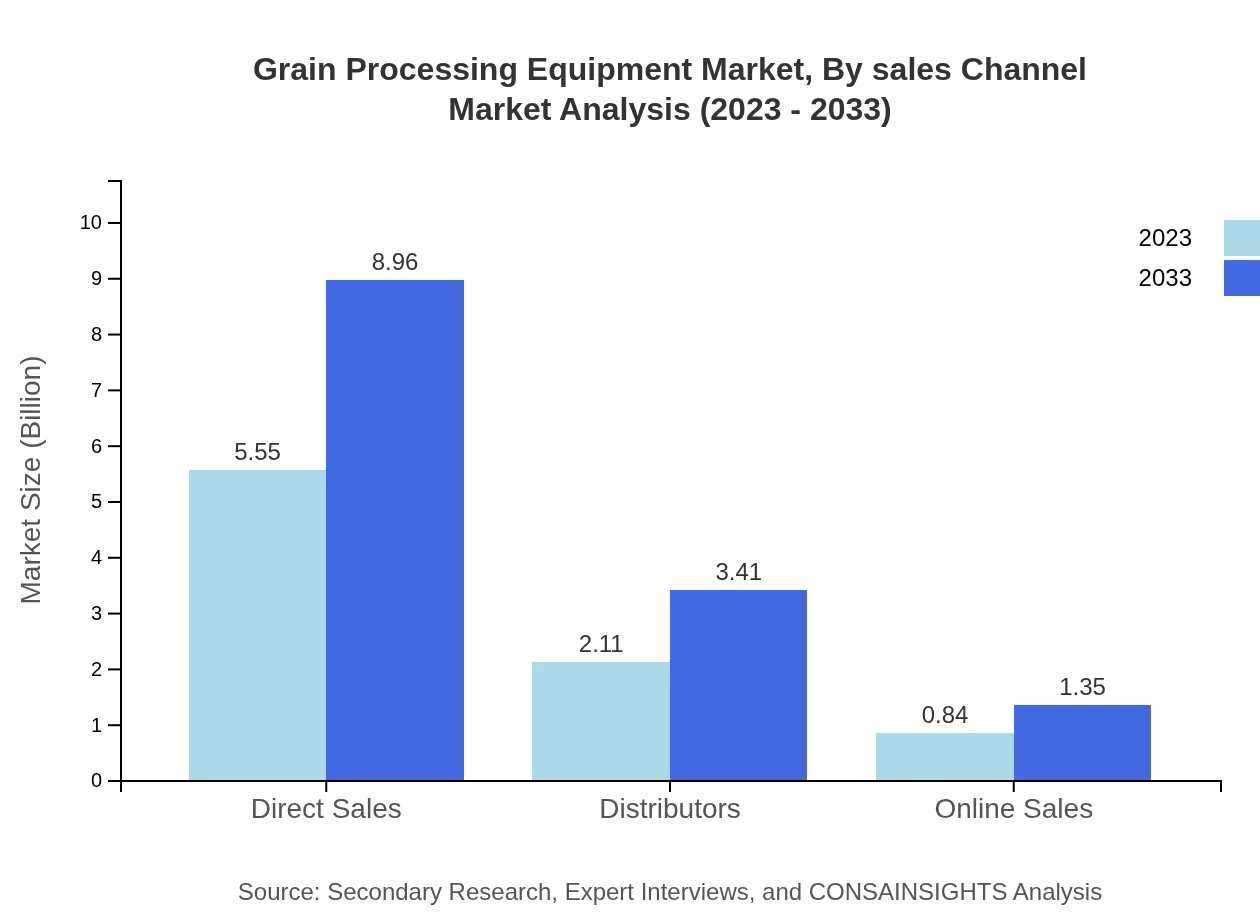

Grain Processing Equipment Market Analysis By Sales Channel

Direct sales account for 65.3% of the market share in 2023. Distributors and online sales follow, contributing to enhanced product reach and customer engagement. As markets evolve, online sales are expected to grow, indicating a shifting preference for digital purchasing avenues among consumers.

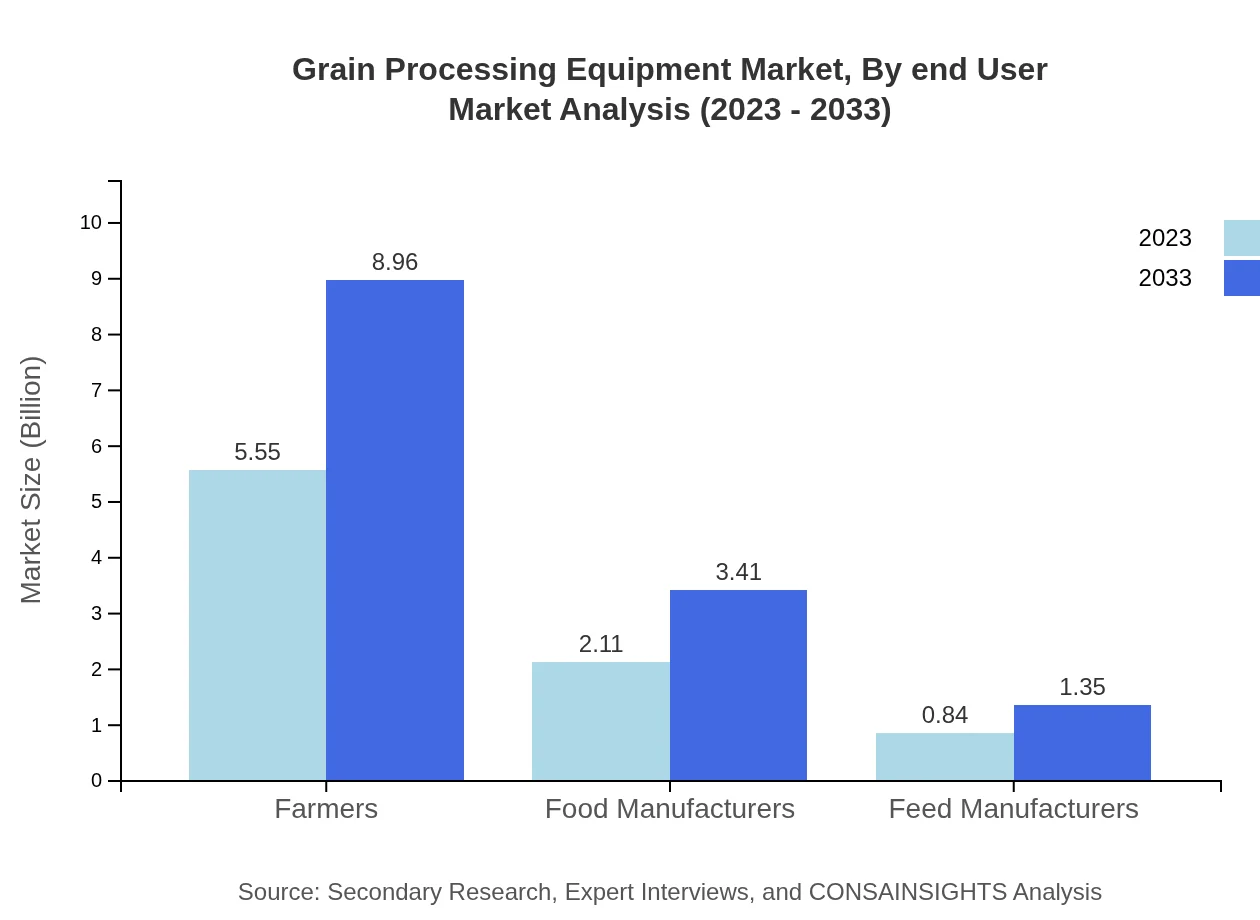

Grain Processing Equipment Market Analysis By End User

Farmers represent the primary end-users of grain processing equipment, making up 65.3% of the market in 2023. The growing demand for efficiency in harvest and post-harvest processing among farmers drives innovation and investment in higher-capacity and labor-saving equipment.

Grain Processing Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Grain Processing Equipment Industry

Bühler Group:

Bühler Group is a leading supplier of grain processing equipment, renowned for its innovative technology and a wide portfolio covering everything from milling to grain handling and processing solutions.AGCO Corporation:

AGCO Corporation specializes in providing agricultural equipment and solutions, including advanced grain handling and storage systems, contributing significantly to enhancing grain processing efficiency.CPM Holdings, Inc.:

CPM Holdings is a major player in providing high-quality equipment and technologies for the grain and feed milling industry, focusing on process improvement and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of grain Processing Equipment?

The grain processing equipment market is valued at $8.5 billion in 2023, with an expected CAGR of 4.8% through 2033. The market's growth is driven by increasing demand for processed grains and efficiency in production methods.

What are the key market players or companies in the grain Processing Equipment industry?

Key players in the grain processing equipment market include companies such as Bühler AG, AGI, Scherer, and GEA Group, which offer diverse equipment solutions for grain processing and innovation in technology.

What are the primary factors driving the growth in the grain processing equipment industry?

Growth in the grain processing equipment industry is driven by rising global food demand, advancements in processing technologies, and increased investments in agricultural infrastructure to enhance production efficiency.

Which region is the fastest Growing in the grain processing equipment market?

The fastest-growing region in the grain processing equipment market is projected to be Europe, with market growth from $2.85 billion in 2023 to $4.59 billion by 2033, indicating a robust increase over the decade.

Does ConsaInsights provide customized market report data for the grain processing equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the grain processing equipment industry, allowing clients to focus on particular segments, regions, or technologies.

What deliverables can I expect from this grain processing equipment market research project?

Deliverables from the grain processing equipment market research project typically include comprehensive reports, market analyses, competitive landscape insights, regional dynamics, and future trend forecasting.

What are the market trends of grain processing equipment?

Current trends in the grain processing equipment market include increased automation, smart technology integration, and a focus on sustainable practices aimed at reducing waste and energy consumption.