Indian Isotonic Drinks Market Report

Published Date: 31 January 2026 | Report Code: indian-isotonic-drinks

Indian Isotonic Drinks Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Indian Isotonic Drinks market, covering key insights, market dynamics, trends, and forecast data from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

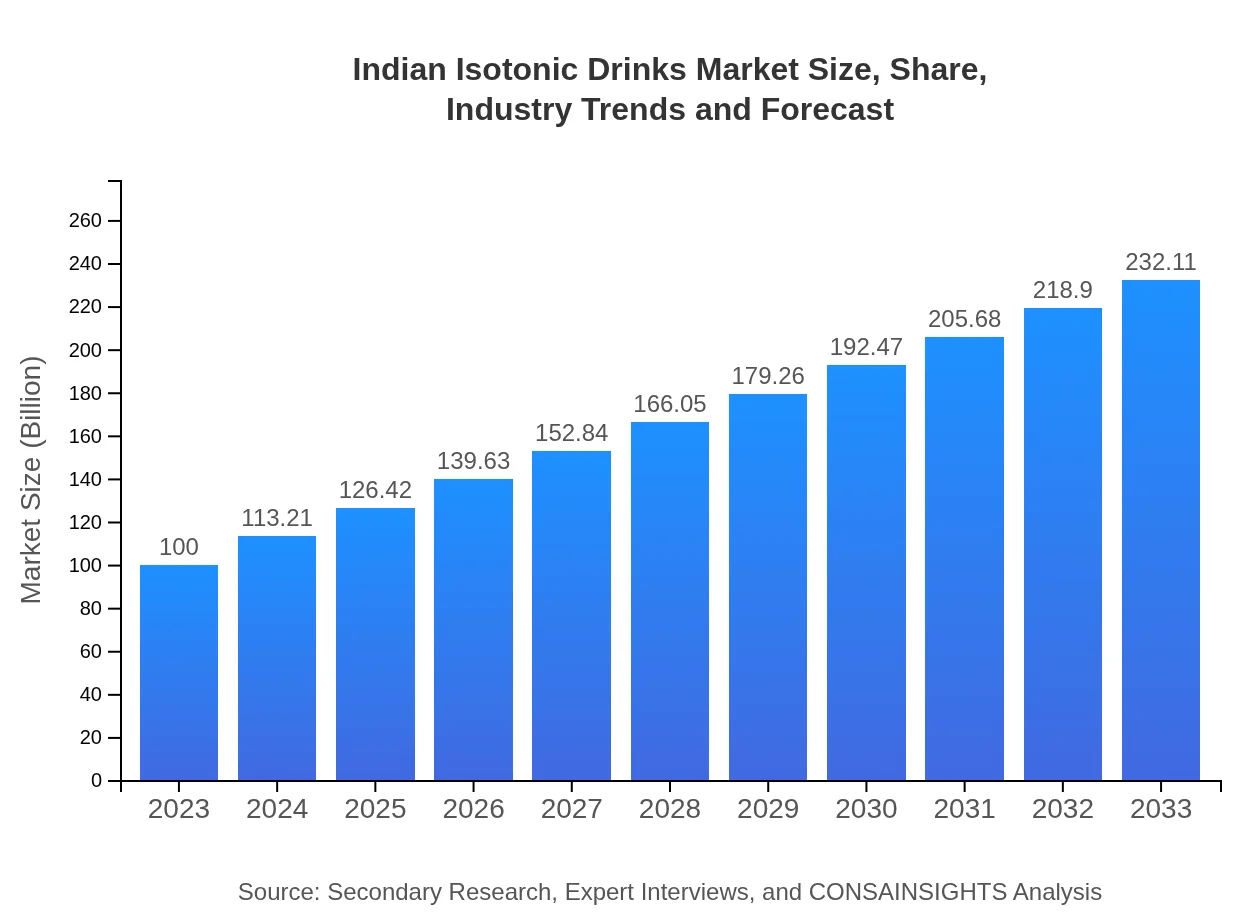

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 8.5% |

| 2033 Market Size | $232.11 Million |

| Top Companies | Coca-Cola Company, PepsiCo, Britvic, Nestlé |

| Last Modified Date | 31 January 2026 |

Indian Isotonic Drinks Market Overview

Customize Indian Isotonic Drinks Market Report market research report

- ✔ Get in-depth analysis of Indian Isotonic Drinks market size, growth, and forecasts.

- ✔ Understand Indian Isotonic Drinks's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Indian Isotonic Drinks

What is the Market Size & CAGR of Indian Isotonic Drinks market in 2023?

Indian Isotonic Drinks Industry Analysis

Indian Isotonic Drinks Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Indian Isotonic Drinks Market Analysis Report by Region

Europe Indian Isotonic Drinks Market Report:

In Europe, the market valuation is anticipated to grow from INR 28.05 billion in 2023 to INR 65.11 billion in 2033 due to the popularity of active lifestyles among consumers.Asia Pacific Indian Isotonic Drinks Market Report:

The Asia Pacific region's isotonic drinks market is valued at INR 19.03 billion in 2023, projected to reach INR 44.17 billion by 2033. This growth is fueled by increasing fitness awareness and a rising population of sports enthusiasts.North America Indian Isotonic Drinks Market Report:

North America holds a significant market share, with values expected to escalate from INR 37.55 billion in 2023 to INR 87.16 billion by 2033, driven by high health consciousness.South America Indian Isotonic Drinks Market Report:

In South America, the market is expected to grow from INR 2.05 billion in 2023 to INR 4.76 billion in 2033, benefiting from a growing health and wellness trend.Middle East & Africa Indian Isotonic Drinks Market Report:

The Middle East and Africa market is projected to grow from INR 13.32 billion in 2023 to INR 30.92 billion in 2033, as interest in sports nutrition and hydration rises.Tell us your focus area and get a customized research report.

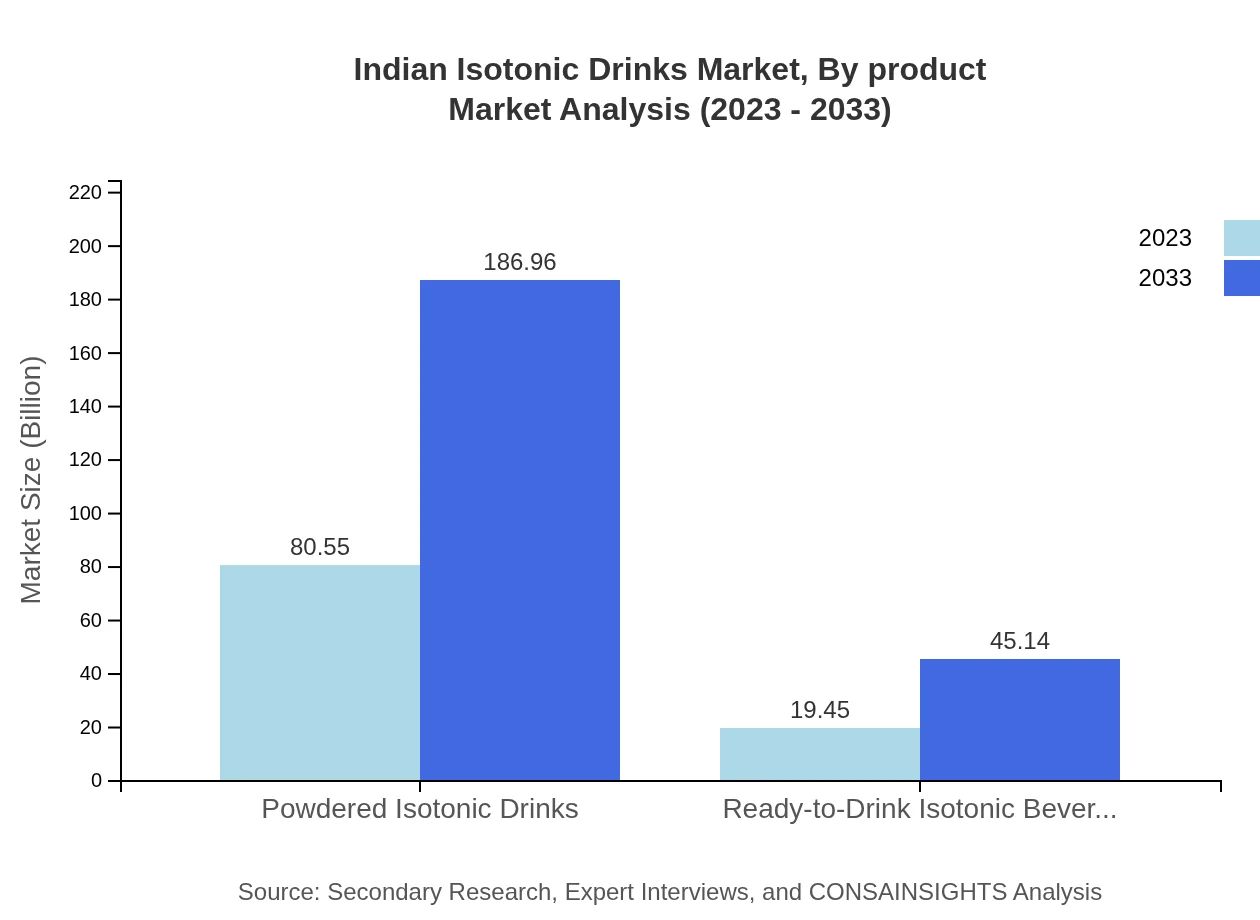

Indian Isotonic Drinks Market Analysis By Product

The product segmentation of the Indian isotonic drinks market includes powdered and ready-to-drink beverages. In 2023, powdered isotonic drinks dominate the market with a value of INR 80.55 billion, expected to reach INR 186.96 billion by 2033. Ready-to-drink isotonic beverages are also significant, starting at INR 19.45 billion in 2023 and expected to grow to INR 45.14 billion by 2033.

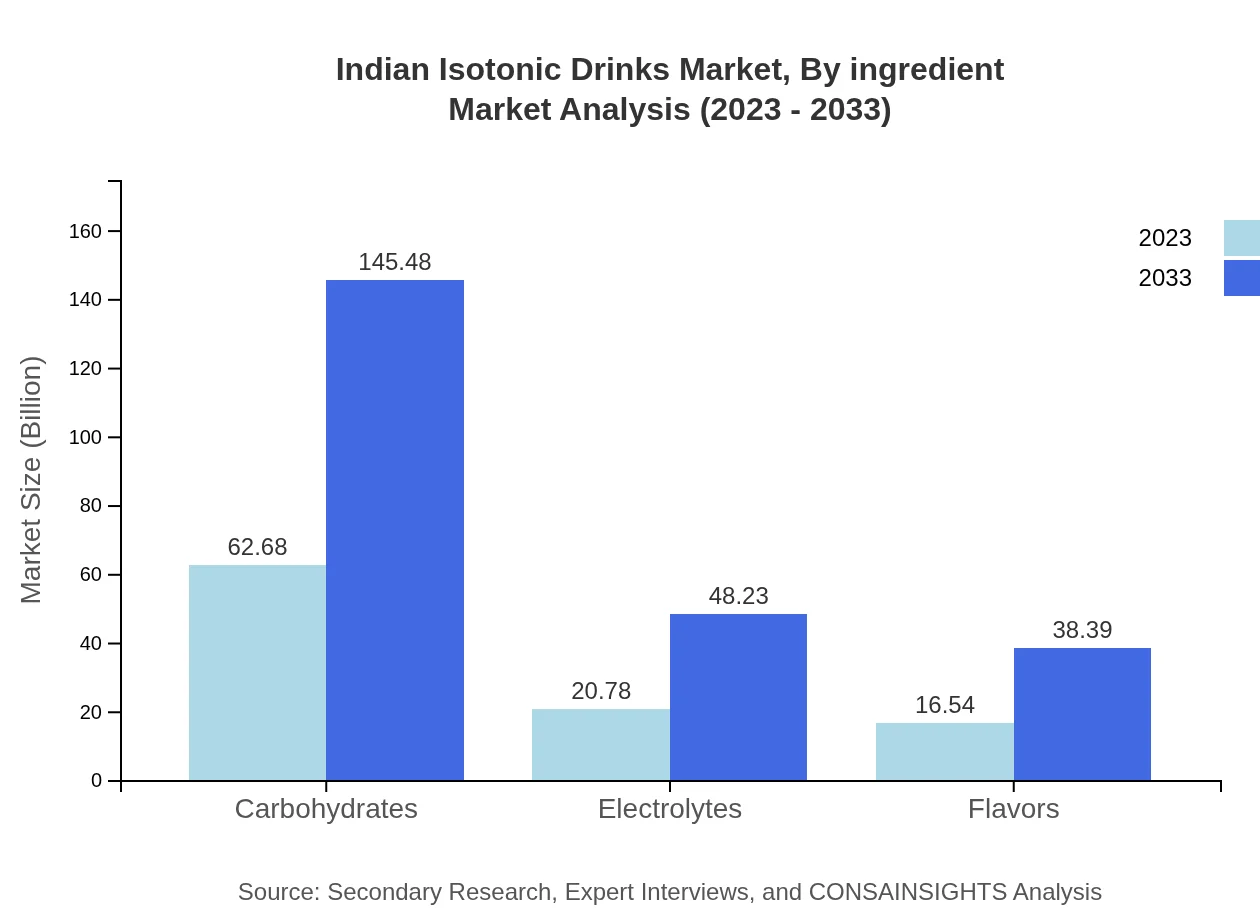

Indian Isotonic Drinks Market Analysis By Ingredient

The primary ingredients in isotonic drinks include carbohydrates, electrolytes, and various flavors. In 2023, carbohydrates dominate the market with INR 62.68 billion, and are projected to reach INR 145.48 billion by 2033, indicating their crucial role in hydration. Electrolyte-based isotonic drinks start at INR 20.78 billion, with projections up to INR 48.23 billion.

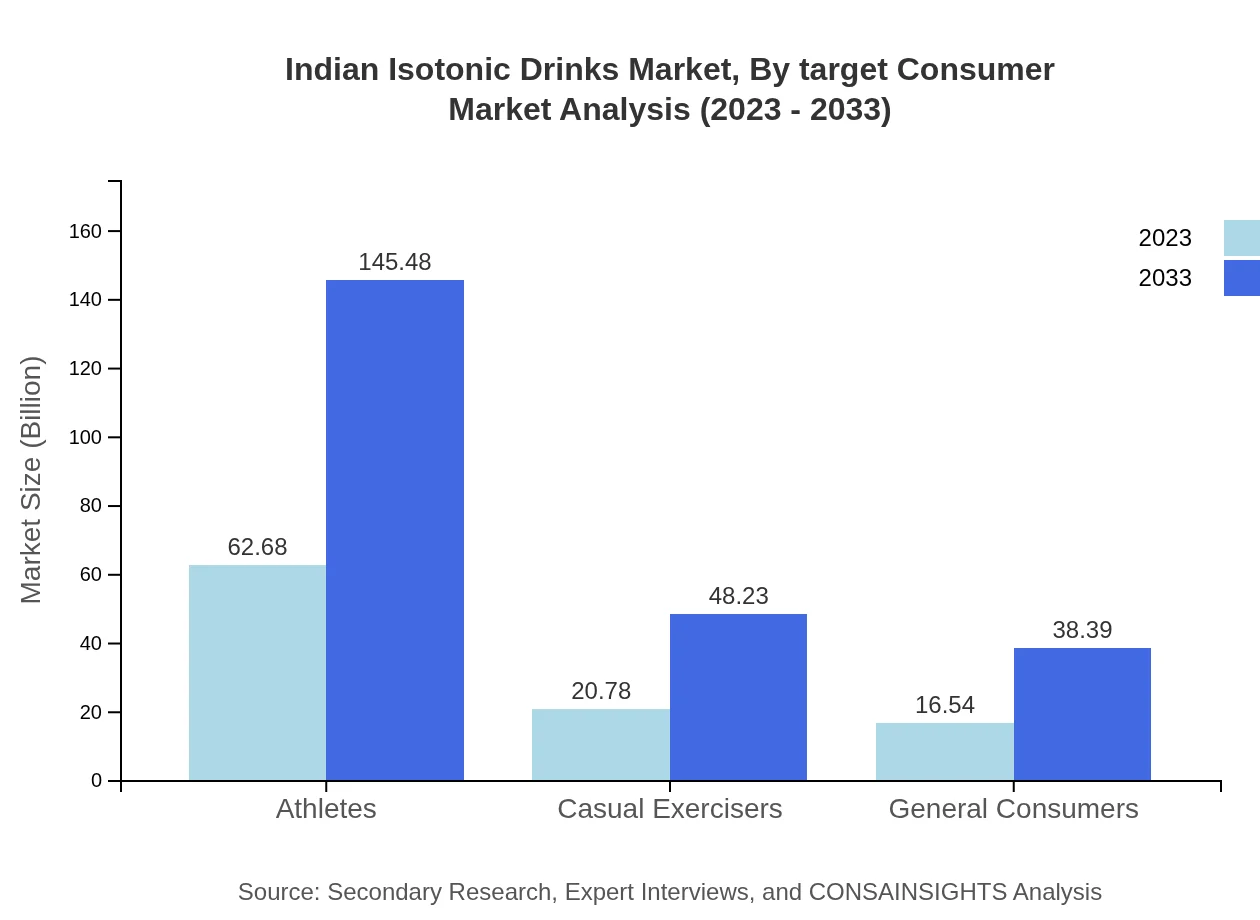

Indian Isotonic Drinks Market Analysis By Target Consumer

The target consumer segments include athletes, casual exercisers, and general consumers. Athletes are a key demographic, with a market size of INR 62.68 billion in 2023, expected to rise to INR 145.48 billion by 2033. Casual exercisers and general consumers are also important segments, with respective market sizes of INR 20.78 billion and INR 16.54 billion as of 2023.

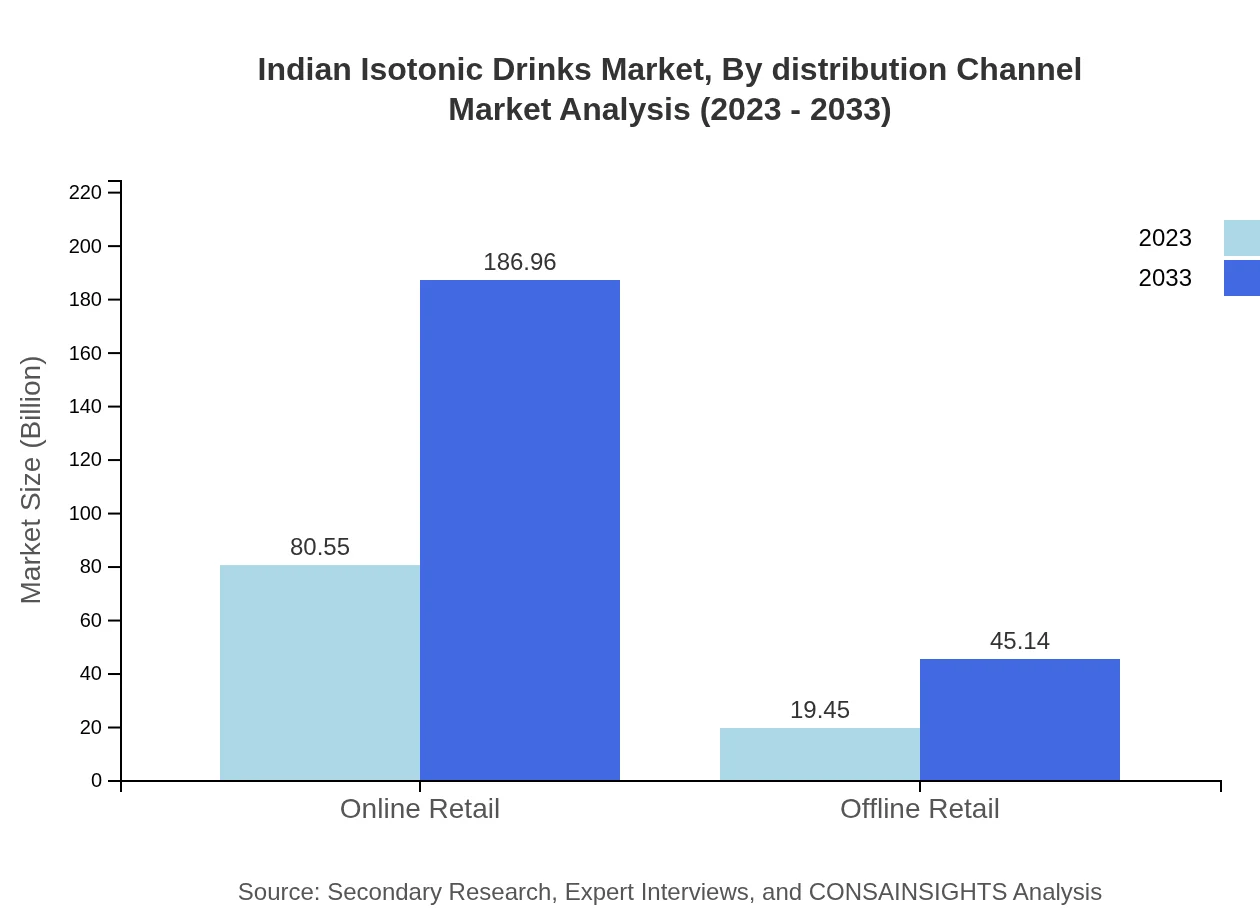

Indian Isotonic Drinks Market Analysis By Distribution Channel

The distribution channels are primarily divided into online and offline retail. Online retailing is a dominant channel, valued at INR 80.55 billion in 2023 and anticipated to grow to INR 186.96 billion by 2033. Offline retail, while smaller, is also lucrative, with a projected increase from INR 19.45 billion in 2023 to INR 45.14 billion.

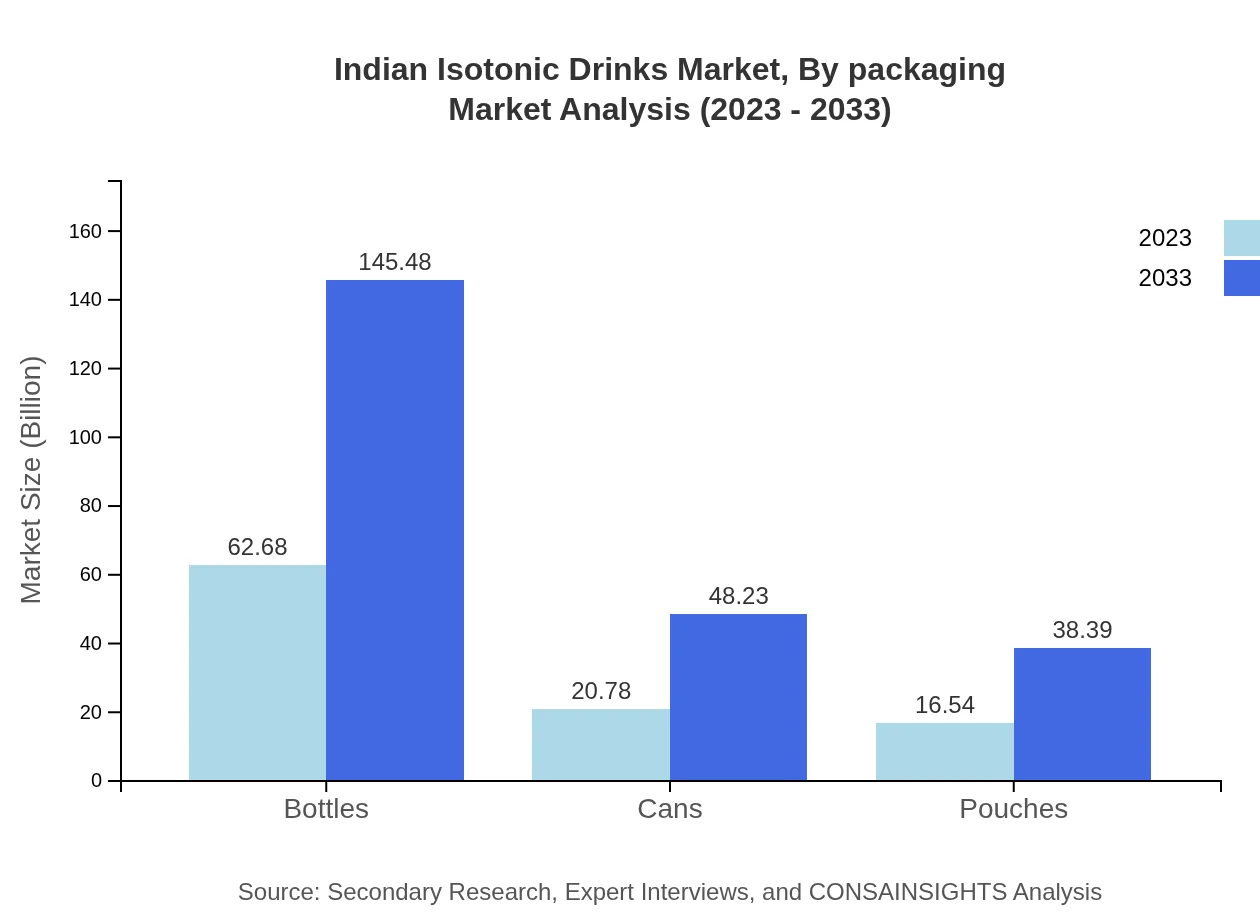

Indian Isotonic Drinks Market Analysis By Packaging

The packaging types include bottles, cans, and pouches. Bottled isotonic drinks will reach INR 145.48 billion by 2033 from INR 62.68 billion, while can-packaged drinks grow from INR 20.78 billion to INR 48.23 billion.

Indian Isotonic Drinks Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Indian Isotonic Drinks Industry

Coca-Cola Company:

A leading beverage corporation that offers a range of isotonic drinks under brands like Powerade and is known for its extensive distribution network.PepsiCo:

Owner of Gatorade and various sports beverages, PepsiCo plays a significant role in the isotonic drink market with innovation in flavors and formulations.Britvic:

Britvic is known for its fruit-flavored isotonic drinks and has a strong presence in the UK market as well as emerging markets.Nestlé:

Nestlé has diversified offerings in the hydration category, including isotonic beverages, focusing on health and wellness.We're grateful to work with incredible clients.

FAQs

What is the market size of Indian Isotonic Drinks?

The Indian Isotonic Drinks market is valued at approximately $100 million in 2023, with a projected CAGR of 8.5% through to 2033, indicating significant growth potential in health-conscious consumer segments.

What are the key market players or companies in the Indian Isotonic Drinks industry?

Key market players include major beverage companies known for isotonic drinks, which focus on innovative product development and robust distribution networks to capitalize on evolving consumer preferences for health-centric beverages.

What are the primary factors driving the growth in the Indian Isotonic Drinks industry?

The growth is driven by increased health awareness among consumers, rising sports participation rates, and the popularity of fitness regimens, leading to higher demand for isotonic drinks that aid hydration and recovery.

Which region is the fastest Growing in the Indian Isotonic Drinks market?

North America is the fastest-growing region, projected to grow from $37.55 million in 2023 to $87.16 million by 2033, driven by a surge in health and fitness trends among the population.

Does ConsaInsights provide customized market report data for the Indian Isotonic Drinks industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs and interests, allowing businesses to gain insights that are specifically relevant to their market strategies and operational requirements.

What deliverables can I expect from this Indian Isotonic Drinks market research project?

Expect comprehensive reports including market size analysis, trend assessments, competitive landscape overviews, segmented data insights, and strategic recommendations based on market research findings.

What are the market trends of Indian Isotonic Drinks?

Key trends include the rising preference for organic and natural ingredients, innovative packaging solutions, and the growing popularity of online retail channels, reflecting changing consumer purchasing behaviors and preferences.