Industrial Access Control Market Report

Published Date: 31 January 2026 | Report Code: industrial-access-control

Industrial Access Control Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Industrial Access Control market, covering current market trends, size, forecasts for 2023-2033, and insightful data on regional performance, segmentation, and industry leaders.

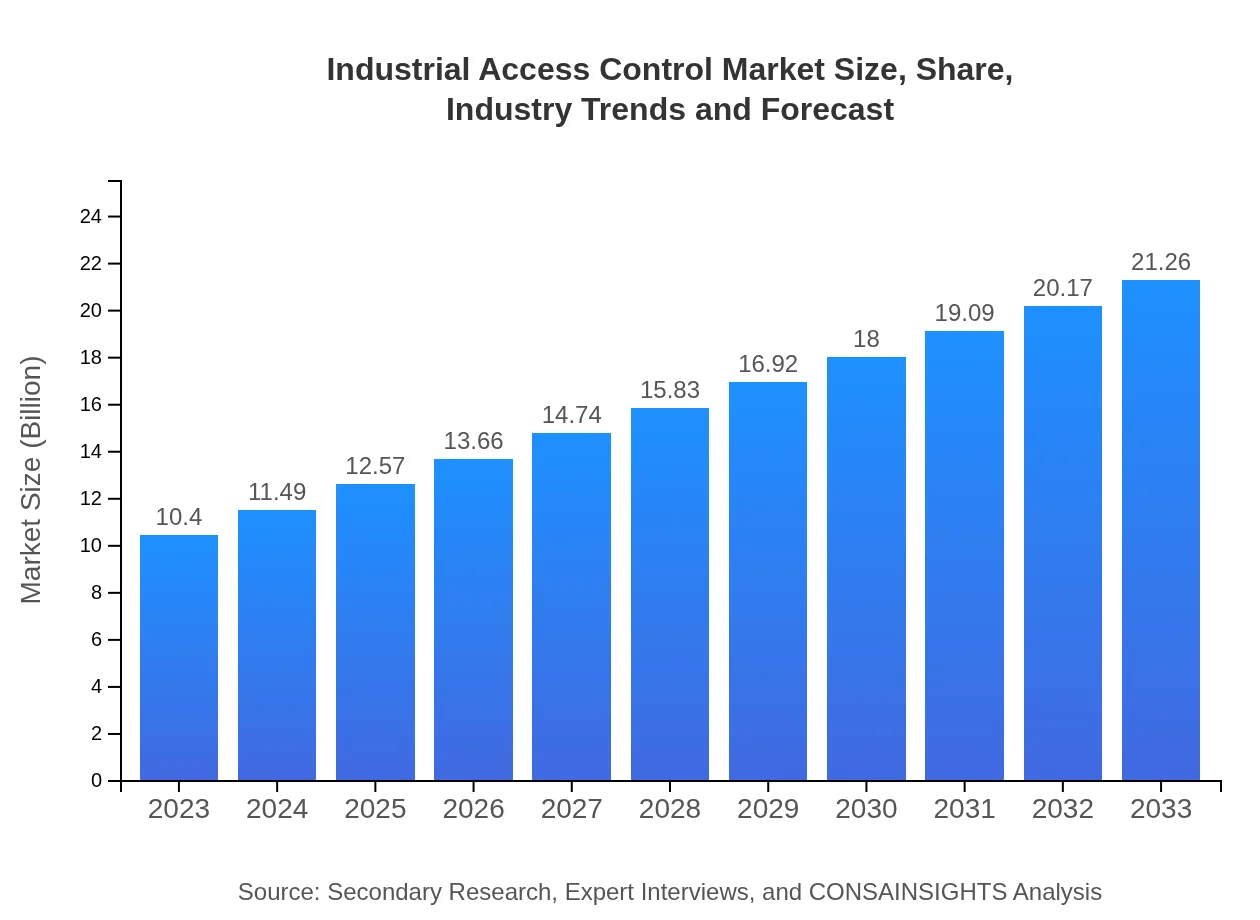

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.40 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.26 Billion |

| Top Companies | Honeywell International Inc., Johnson Controls International, ASSA ABLOY, ZKTeco |

| Last Modified Date | 31 January 2026 |

Industrial Access Control Market Overview

Customize Industrial Access Control Market Report market research report

- ✔ Get in-depth analysis of Industrial Access Control market size, growth, and forecasts.

- ✔ Understand Industrial Access Control's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Access Control

What is the Market Size & CAGR of Industrial Access Control market in 2023?

Industrial Access Control Industry Analysis

Industrial Access Control Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Access Control Market Analysis Report by Region

Europe Industrial Access Control Market Report:

Europe's market is anticipated to grow from $3.86 billion in 2023 to $7.89 billion by 2033, propelled by stringent data protection laws and a growing focus on enhancing security measures in both commercial and governmental settings.Asia Pacific Industrial Access Control Market Report:

In 2023, the Industrial Access Control market in the Asia Pacific region is valued at $1.95 billion and is expected to grow to $3.99 billion by 2033. This growth is fueled by rapid industrialization, urbanization, and the increasing emphasis on security systems due to rising crime rates.North America Industrial Access Control Market Report:

North America holds a substantial portion of the market, with a valuation of $3.39 billion in 2023 that will likely grow to $6.94 billion by 2033. Markets in the U.S. and Canada are driven by high technology adoption rates and stringent regulatory requirements pertaining to security.South America Industrial Access Control Market Report:

The South American Industrial Access Control market is estimated at $0.38 billion in 2023, with projections reaching $0.78 billion by 2033. Key factors include increased infrastructure development and the adoption of advanced security technologies in commercial sectors.Middle East & Africa Industrial Access Control Market Report:

The Middle East and Africa market is forecasted to increase from $0.81 billion in 2023 to approximately $1.65 billion by 2033. The growth is attributed to increasing investments in infrastructure and government initiatives for enhanced public safety.Tell us your focus area and get a customized research report.

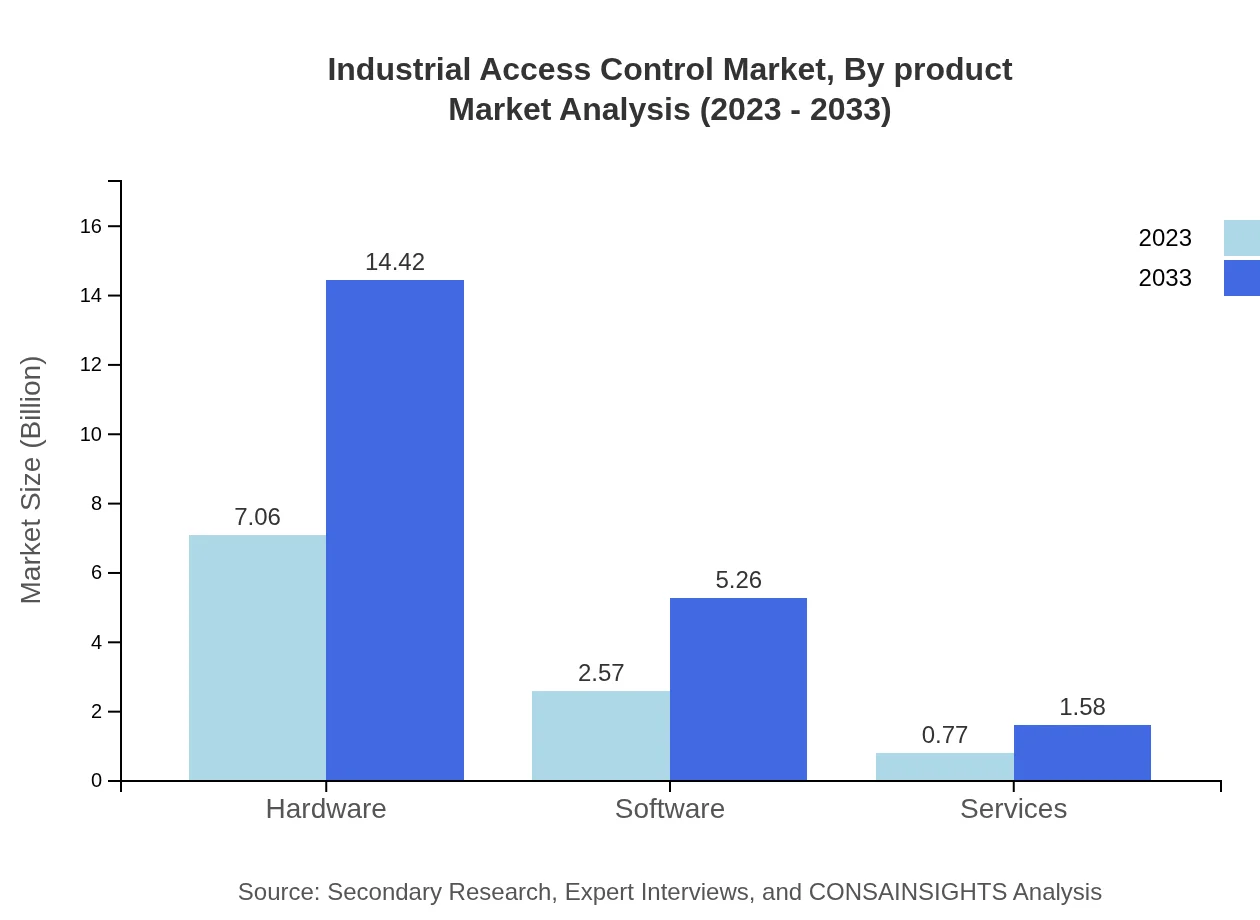

Industrial Access Control Market Analysis By Product

The hardware segment dominates the Industrial Access Control market, with an estimated value of $7.06 billion in 2023 and projected to grow to $14.42 billion by 2033. Software solutions follow with an estimated $2.57 billion in 2023, expected to increase to $5.26 billion. Services comprise the smallest segment but are expected to grow from $0.77 billion in 2023 to $1.58 billion.

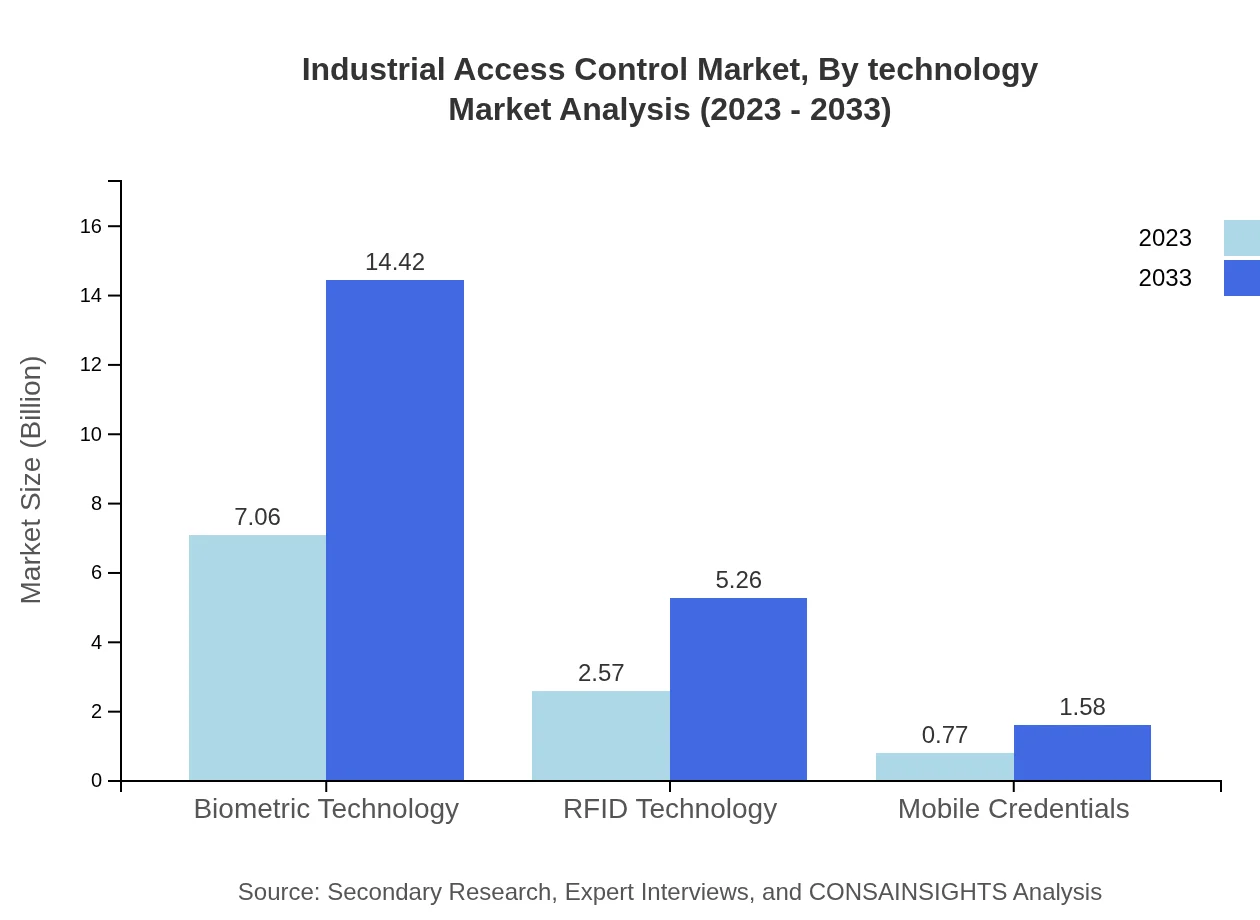

Industrial Access Control Market Analysis By Technology

The market is significantly influenced by Biometric Technology, which is expected to grow consistently from $7.06 billion in 2023 to $14.42 billion by 2033. RFID Technology and Mobile Credentials are also crucial, with projected market sizes growing from $2.57 billion and $0.77 billion respectively in 2023.

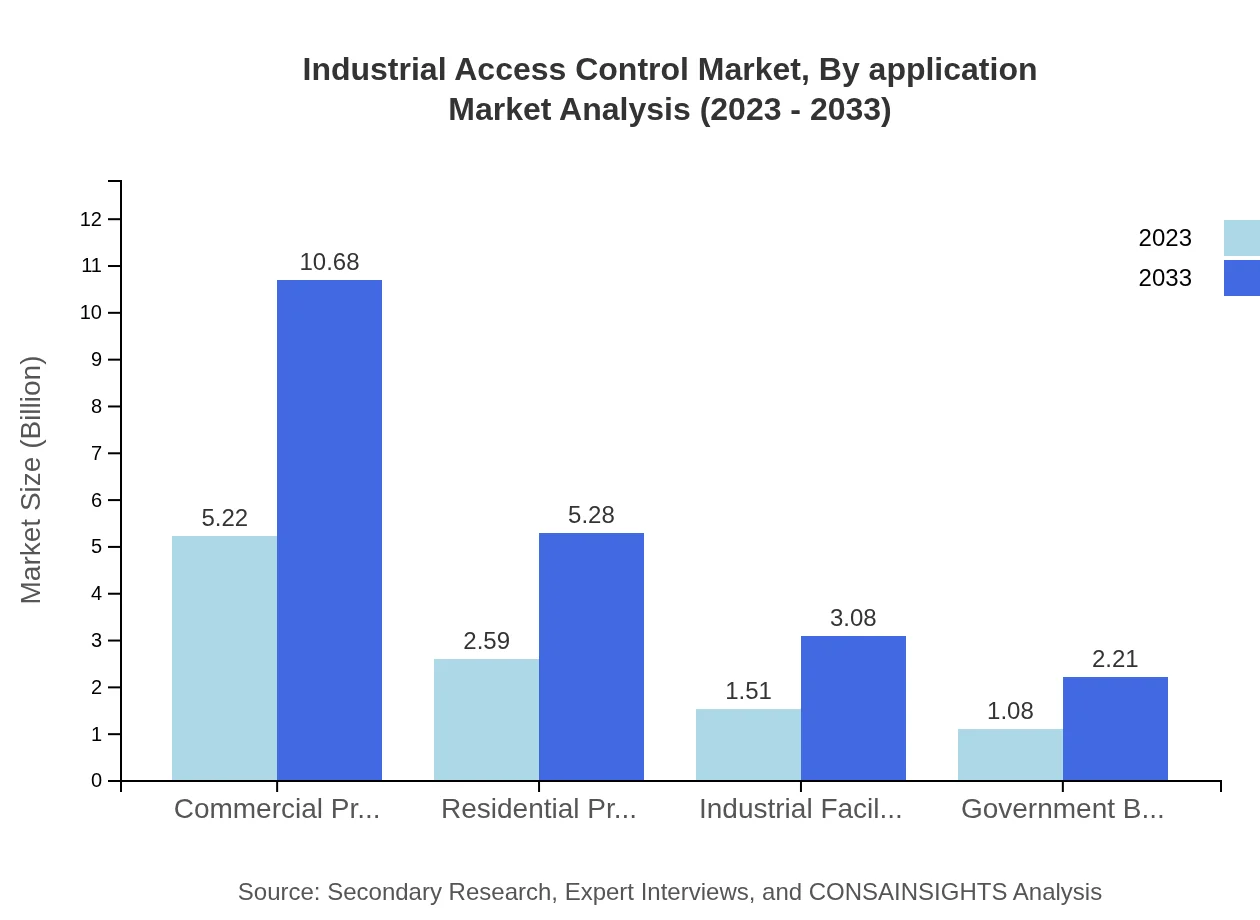

Industrial Access Control Market Analysis By Application

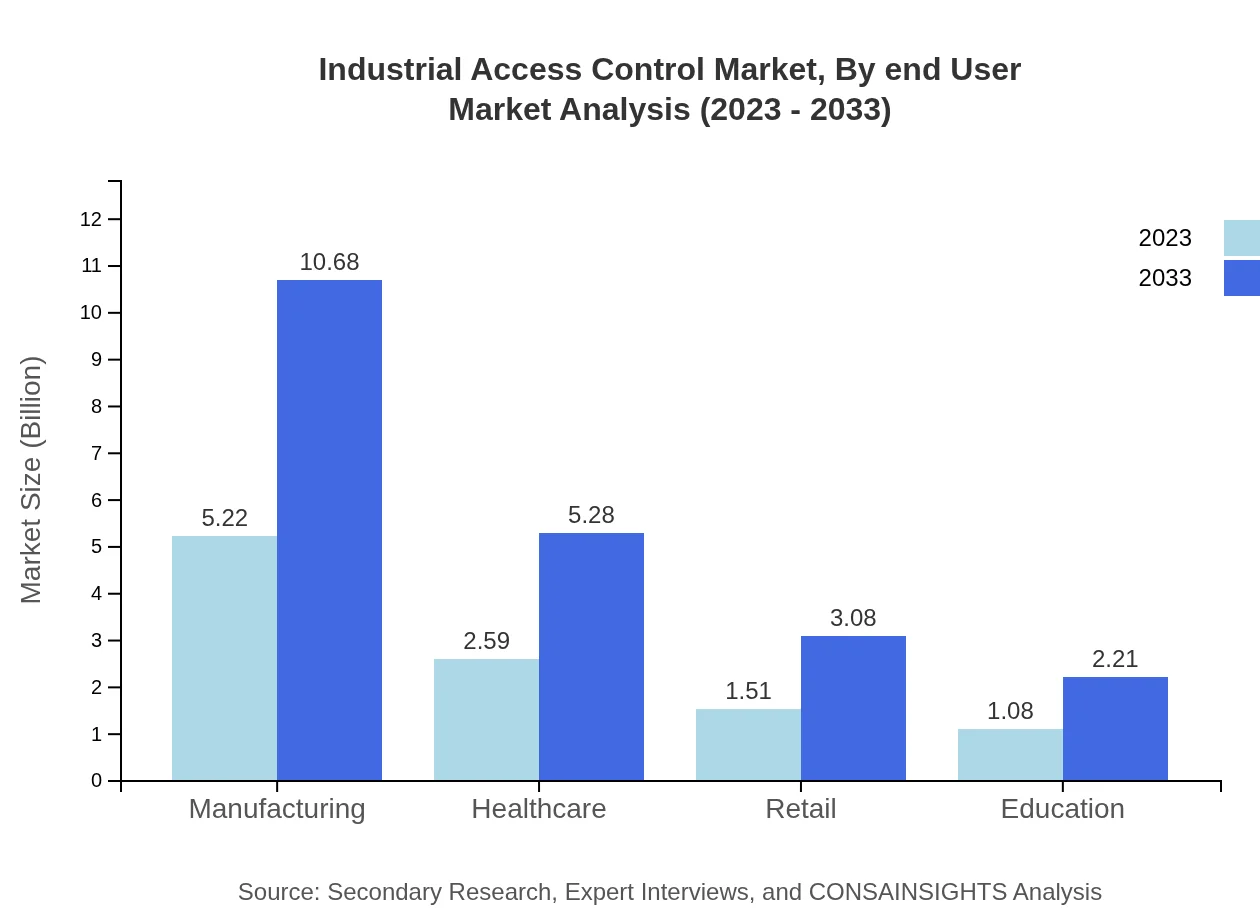

Significant applications of Industrial Access Control include Manufacturing, Healthcare, and Retail sectors. The Manufacturing segment leads the application market with an estimated value of $5.22 billion in 2023, growing to $10.68 billion by 2033.

Industrial Access Control Market Analysis By End User

The Industrial Access Control market is witnessing robust growth across various end-user industries. Manufacturing holds the largest share, accounting for approximately 50.23% in 2023, followed by Healthcare at 24.86%. Emerging sectors such as Retail and Education are also expanding their footprint within this market.

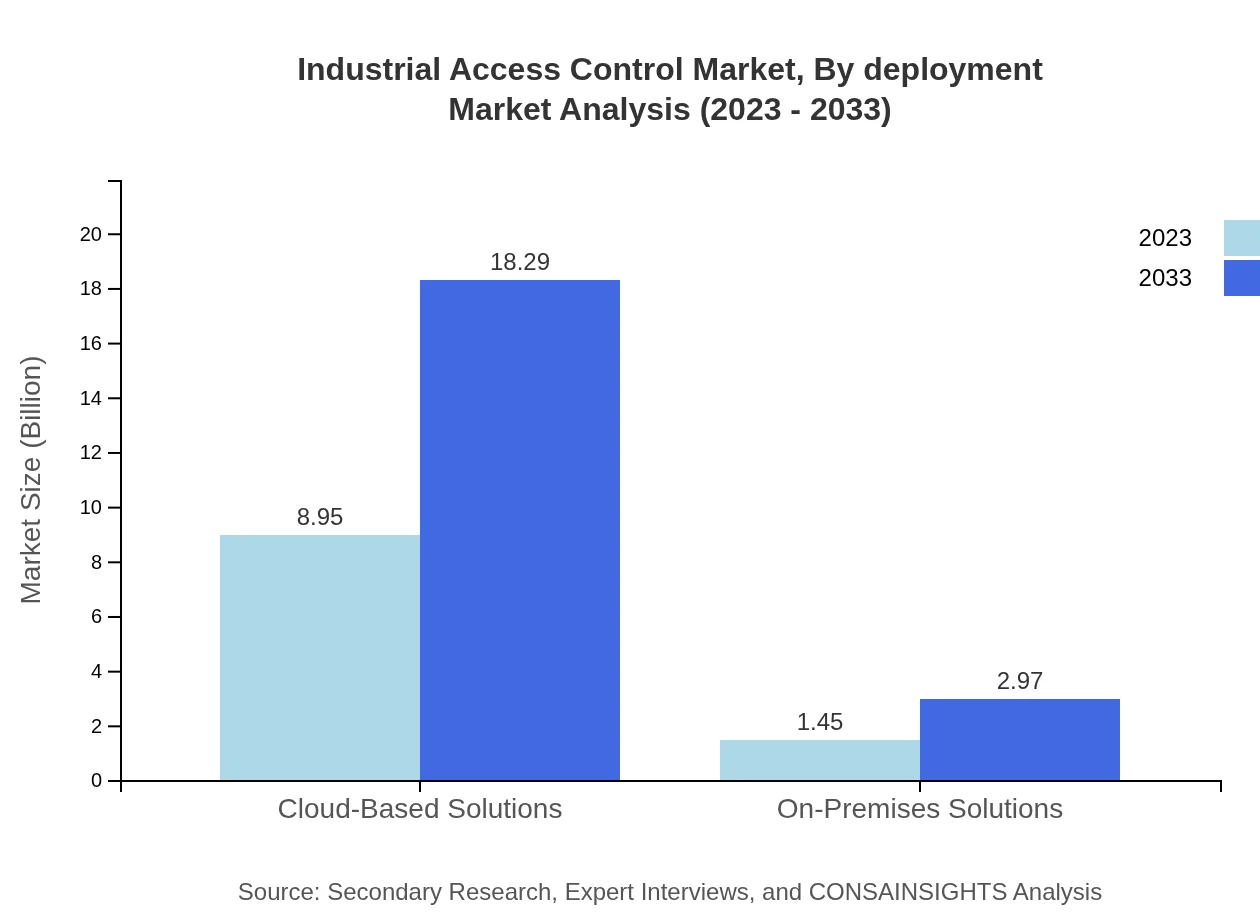

Industrial Access Control Market Analysis By Deployment

Cloud-based solutions dominate the deployment mode segment, representing a significant share of 86.05% in 2023 and expected to grow to 18.29 billion by 2033. On-Premises solutions continue to be relevant but represent a smaller segment of the market.

Industrial Access Control Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Access Control Industry

Honeywell International Inc.:

A global leader in commercial and consumer industrial access control solutions, Honeywell provides state-of-the-art technologies that integrate seamlessly with building management systems.Johnson Controls International:

Johnson Controls specializes in delivering innovative security solutions, focusing on streamlined and effective access control systems for various industries.ASSA ABLOY:

ASSA ABLOY offers a broad spectrum of access control products, renowned for their high levels of security and technological advancements including biometrics and mobile access.ZKTeco:

ZKTeco is a prominent provider of advanced biometric verification solutions, offering a comprehensive portfolio ranging from fingerprint to facial recognition technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Access Control?

The industrial access control market is currently valued at $10.4 billion and is expected to grow at a CAGR of 7.2% over the next decade, reflecting the rising demand for security solutions.

What are the key market players or companies in this industrial Access Control industry?

Key players in the industrial access control market include Honeywell, ASSA ABLOY, Johnson Controls, and Bosch Security Systems, all of whom contribute significantly to technological innovations and market expansion.

What are the primary factors driving the growth in the industrial Access Control industry?

Growth in the industrial access control market is driven by increasing security concerns, adoption of advanced technologies, stringent regulatory requirements, and a growing trend towards automation in industrial environments.

Which region is the fastest Growing in the industrial Access Control?

The fastest-growing region in the industrial access control market is Europe, projected to grow from $3.86 billion in 2023 to $7.89 billion by 2033, supporting technological advancements in security solutions.

Does ConsaInsights provide customized market report data for the industrial Access Control industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, providing in-depth insights into market dynamics, trends, and competitive landscapes in the industrial access control sector.

What deliverables can I expect from this industrial Access Control market research project?

Deliverables from the industrial access control market research project include detailed market analyses, trend forecasting, competitive assessments, and segmented insights into various hardware, software, and services categories.

What are the market trends of industrial Access Control?

Market trends in industrial access control include increasing use of biometric and RFID technologies, growth in cloud-based solutions, and rising adoption of integrated security systems across various industries.