Industrial Nitrogen Market Report

Published Date: 02 February 2026 | Report Code: industrial-nitrogen

Industrial Nitrogen Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Industrial Nitrogen market from 2023 to 2033, featuring market size, trends, and insights into industry segmentation, regional performance, and key competitors.

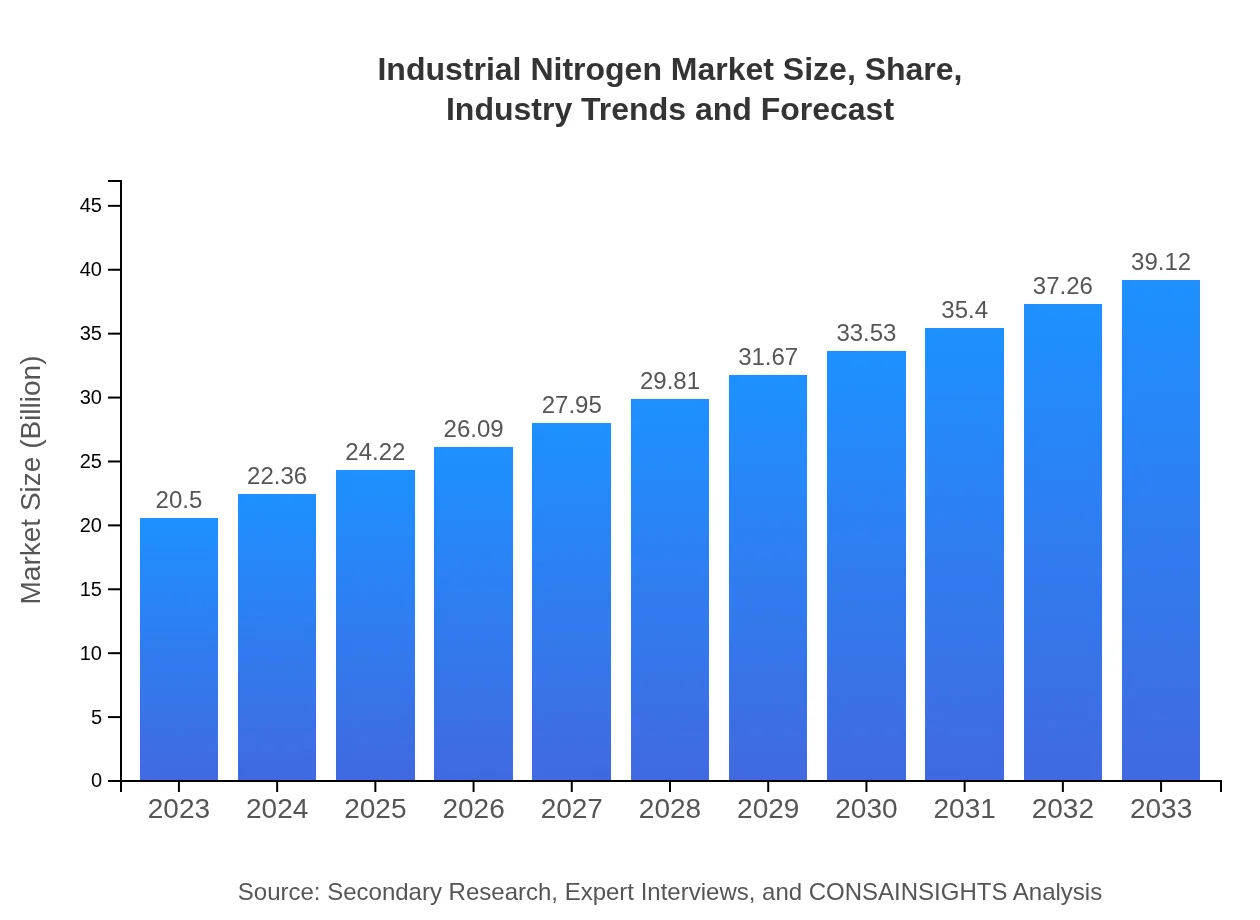

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.50 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $39.12 Billion |

| Top Companies | Linde plc, Air Products and Chemicals, Inc., CryoGas International, Praxair Technologies, Inc. |

| Last Modified Date | 02 February 2026 |

Industrial Nitrogen Market Overview

Customize Industrial Nitrogen Market Report market research report

- ✔ Get in-depth analysis of Industrial Nitrogen market size, growth, and forecasts.

- ✔ Understand Industrial Nitrogen's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Nitrogen

What is the Market Size & CAGR of the Industrial Nitrogen market in 2023?

Industrial Nitrogen Industry Analysis

Industrial Nitrogen Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Nitrogen Market Analysis Report by Region

Europe Industrial Nitrogen Market Report:

In Europe, the Industrial Nitrogen market is set to grow from $5.51 billion in 2023 to $10.52 billion by 2033. The region is witnessing a surge in demand for nitrogen-rich fertilizers and packaged foods, prompting growth in agricultural and food sectors. Innovations in nitrogen production technologies are also driving sustainability initiatives.Asia Pacific Industrial Nitrogen Market Report:

The Asia Pacific market for Industrial Nitrogen is estimated to grow from $3.99 billion in 2023 to $7.61 billion by 2033. Rapid industrialization and an increase in manufacturing activities, particularly in countries like China and India, drive this growth. The growing demand from sectors such as electronics and pharmaceuticals further solidifies the region's pivotal role in the nitrogen market.North America Industrial Nitrogen Market Report:

North America holds a significant share of the Industrial Nitrogen market, expected to increase from $7.05 billion in 2023 to $13.46 billion by 2033. The presence of major industrial players and stringent safety regulations contribute to higher demand for nitrogen products in healthcare, food and beverage, and manufacturing sectors.South America Industrial Nitrogen Market Report:

South America's Industrial Nitrogen market is projected to grow from $1.56 billion in 2023 to $2.97 billion by 2033. The burgeoning construction and agricultural industries in countries like Brazil and Argentina are primary growth drivers. Potential investments in infrastructure are expected to intensify the demand for nitrogen applications in construction activities.Middle East & Africa Industrial Nitrogen Market Report:

The Industrial Nitrogen market in the Middle East and Africa is forecasted to grow from $2.39 billion in 2023 to $4.56 billion by 2033. Increasing investments in oil and gas sectors and the emphasis on petrochemical production are key contributors to market growth. Additionally, the rising adoption of nitrogen in the healthcare industry is expected to augment demand.Tell us your focus area and get a customized research report.

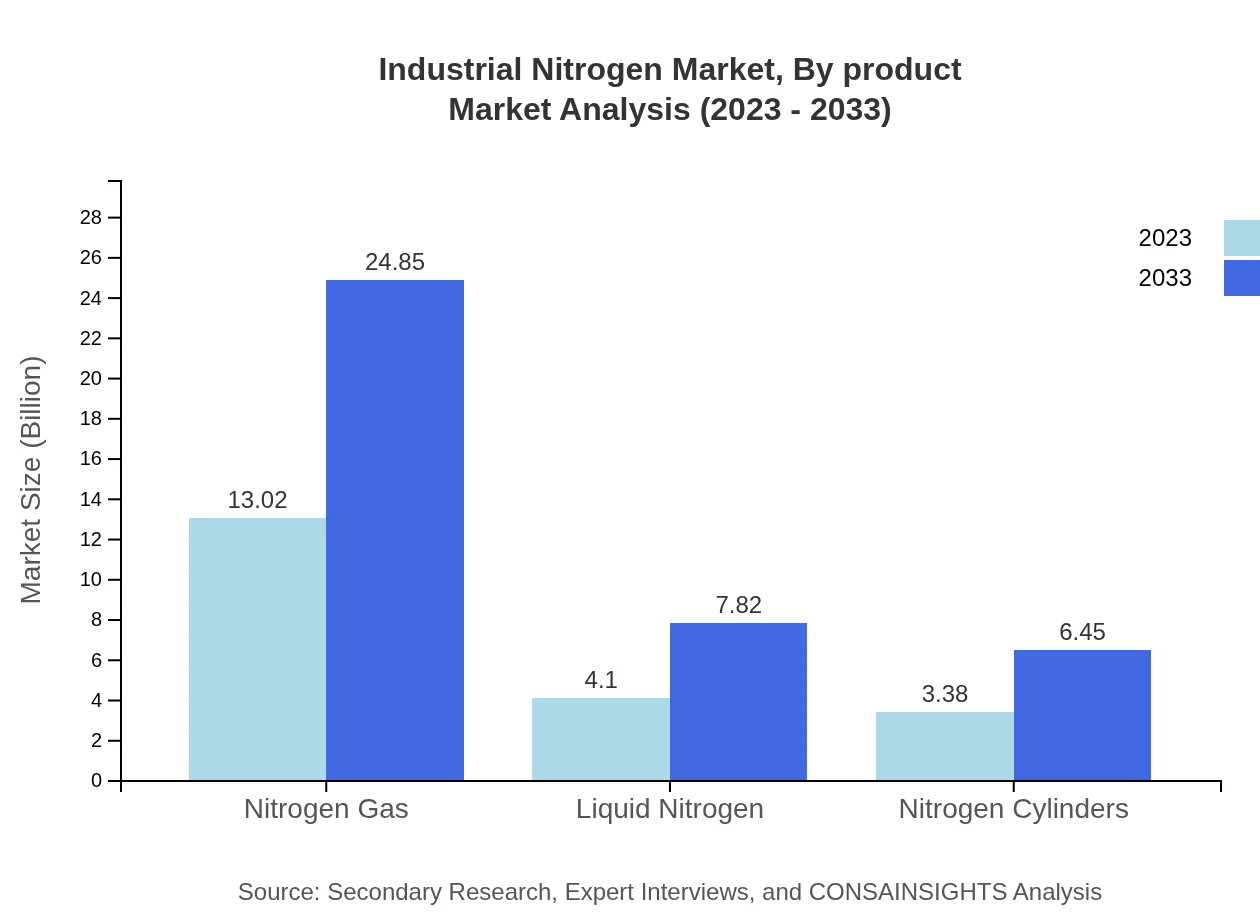

Industrial Nitrogen Market Analysis By Product

The Industrial Nitrogen market is primarily categorized into nitrogen gas, liquid nitrogen, and nitrogen cylinders. In 2023, nitrogen gas dominates the market with a size of $13.02 billion, projected to grow to $24.85 billion by 2033, holding a 63.52% market share. Liquid nitrogen is also significant, with a market size of $4.10 billion in 2023, growing to $7.82 billion by 2033. Nitrogen cylinders, while smaller, show steady growth from $3.38 billion to $6.45 billion during the same period.

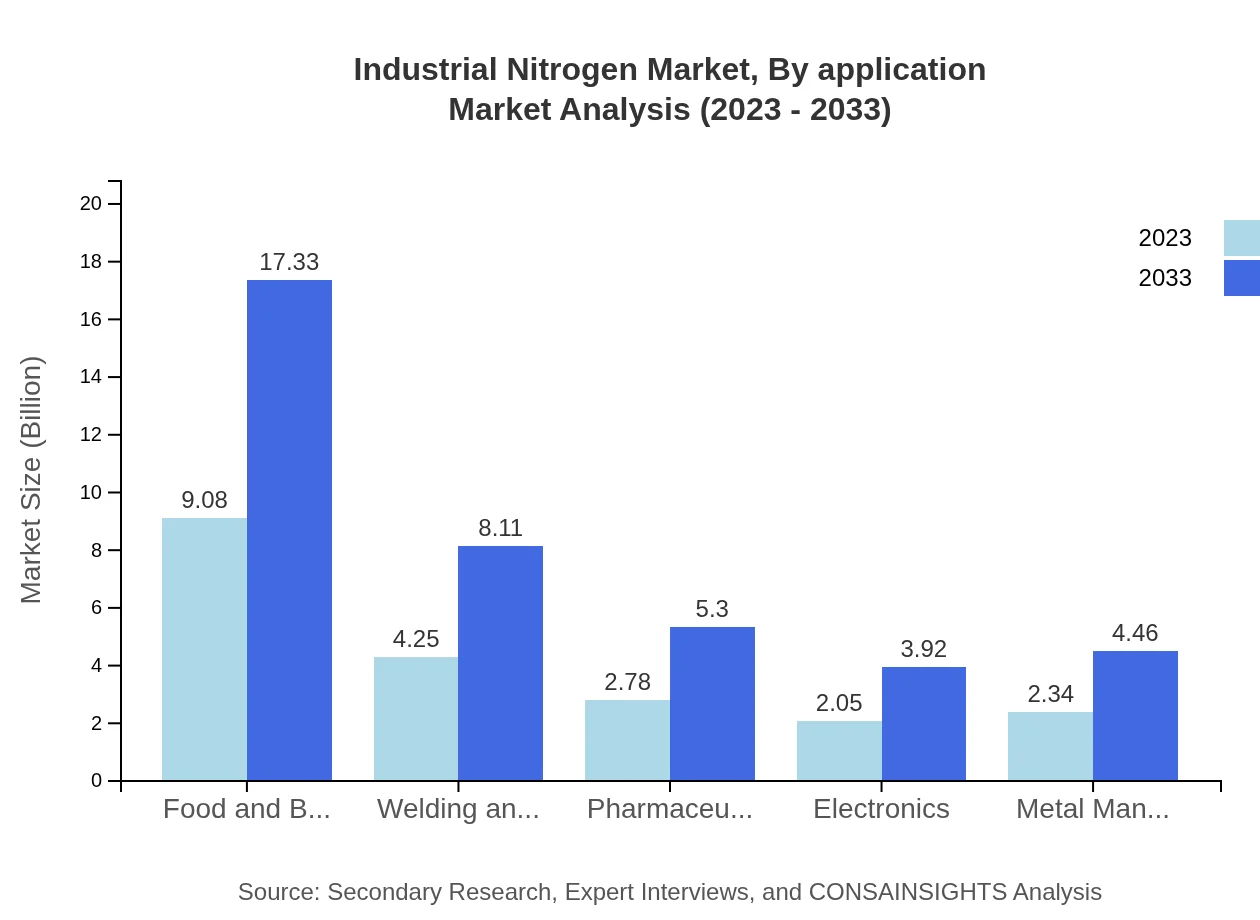

Industrial Nitrogen Market Analysis By Application

Application-based segmentation reveals diverse uses of nitrogen across industries. Manufacturing holds the largest share at $9.08 billion in 2023, expected to reach $17.33 billion by 2033. The healthcare sector follows closely, with growth from $4.25 billion to $8.11 billion, accounting for 20.73% of the market share. Other areas such as energy and food and beverage show steady growth as nitrogen applications expand...

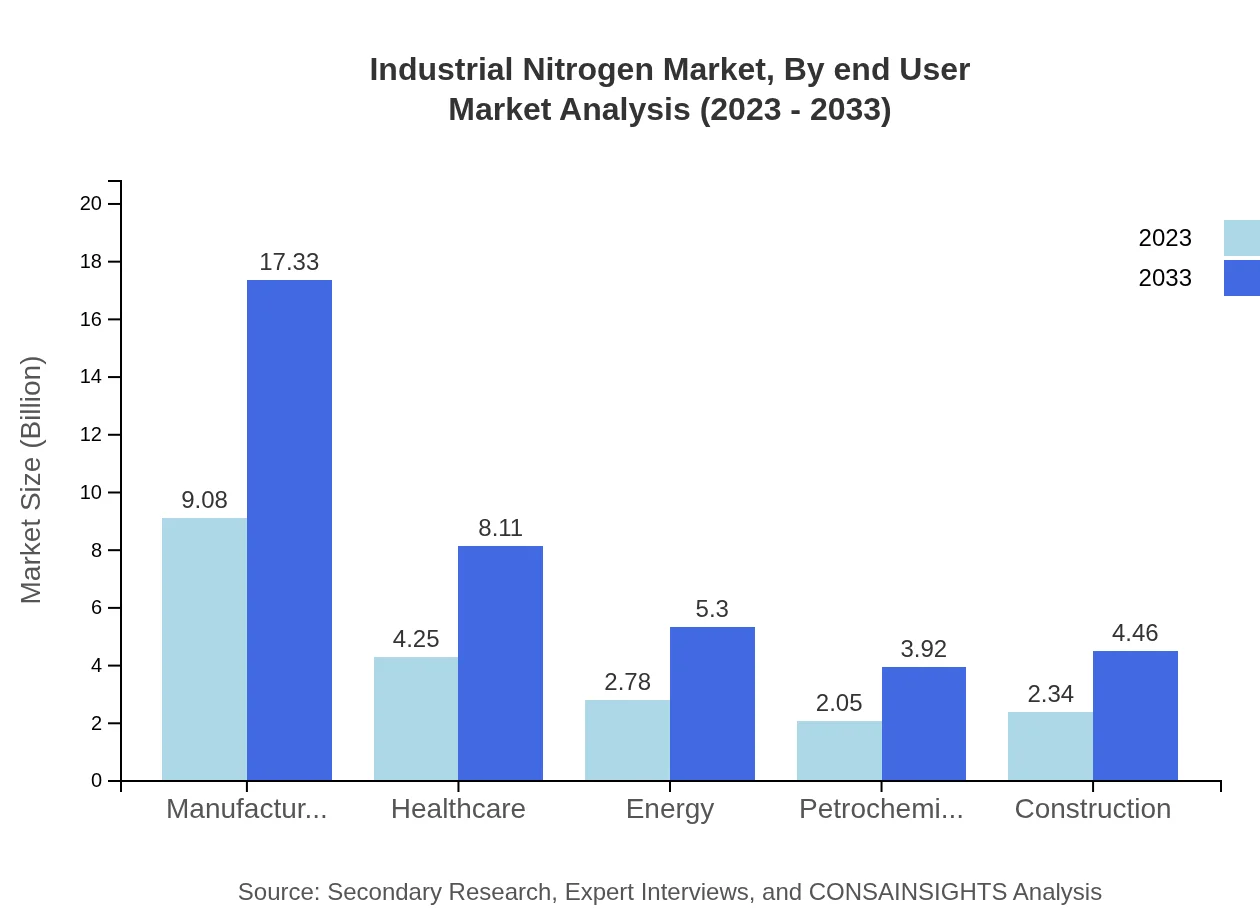

Industrial Nitrogen Market Analysis By End User

End-user segmentation indicates significant demand from various sectors. The manufacturing industry, utilizing nitrogen in processes like welding and cutting, dominates with a market size of $9.08 billion in 2023, projected to reach $17.33 billion by 2033. Other prominent users include healthcare and food and beverage, both crucial for product quality and safety.

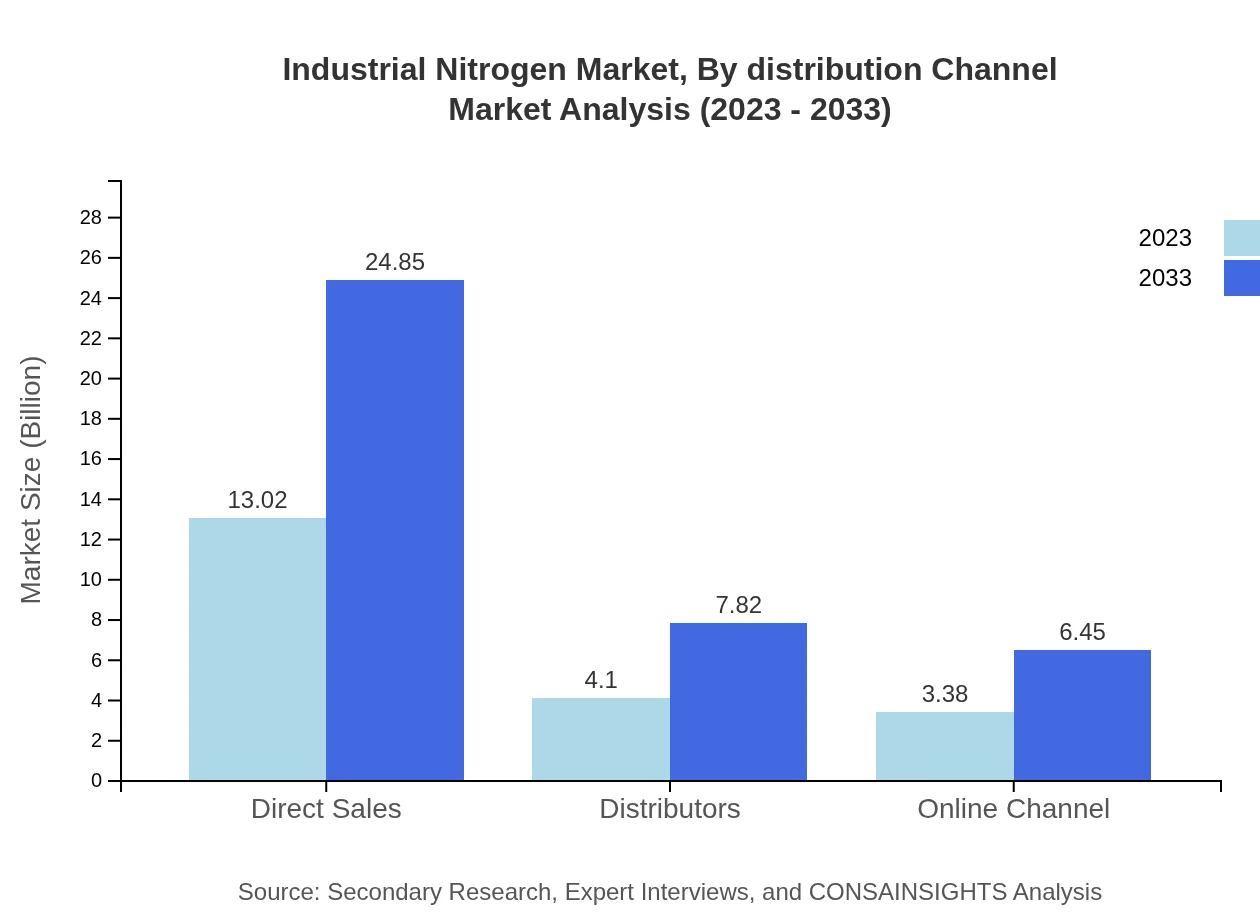

Industrial Nitrogen Market Analysis By Distribution Channel

Distribution channels for Industrial Nitrogen are emerging as critical factors in market dynamics. Direct sales dominate this sector with $13.02 billion in 2023, expected to grow to $24.85 billion by 2033. Distributors and online channels are also essential, showing varying growth trajectories aimed at enhancing accessibility and consumer engagement.

Industrial Nitrogen Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Industrial Nitrogen Industry

Linde plc:

A leading global industrial gas company, Linde provides comprehensive nitrogen production solutions including gas and liquefied nitrogen for various applications.Air Products and Chemicals, Inc.:

Air Products specializes in nitrogen and other industrial gases, focusing on innovative solutions and technologies for improving efficiency in applications.CryoGas International:

CryoGas provides a range of nitrogen products and services, leveraging advanced technology to meet the needs of industries such as healthcare and food processing.Praxair Technologies, Inc.:

Part of the Linde Group, Praxair is a major player in the nitrogen market, supplying products tailored for energy, food, and manufacturing sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Nitrogen?

The industrial nitrogen market is projected to reach $20.5 billion by 2033, growing at a CAGR of 6.5% from its current size in 2023. This growth is driven by increasing demand across various industries, including healthcare and food and beverage.

What are the key market players or companies in the industrial Nitrogen industry?

Key players in the industrial nitrogen market include major global companies that dominate production and distribution. These include Air Products and Chemicals, Linde PLC, and Praxair Inc., who provide high-quality nitrogen solutions across multiple sectors.

What are the primary factors driving the growth in the industrial Nitrogen industry?

Key drivers of growth in the industrial nitrogen sector include rising demand for nitrogen in food preservation, healthcare applications, and the increasing use of nitrogen in manufacturing processes, thereby enhancing production efficiency and product safety.

Which region is the fastest Growing in the industrial Nitrogen?

North America is the fastest-growing region in the industrial nitrogen market, with its market size projected to grow from $7.05 billion in 2023 to $13.46 billion by 2033, supported by strong industrial activity and high consumption rates.

Does ConsaInsights provide customized market report data for the industrial Nitrogen industry?

Yes, ConsaInsights provides tailored market reports for the industrial nitrogen industry. Clients can request specific data and insights, allowing them to make informed strategic decisions based on their unique business needs.

What deliverables can I expect from this industrial Nitrogen market research project?

From the industrial nitrogen market research project, clients can expect comprehensive reports detailing market trends, competitive analysis, regional insights, growth forecasts, and segment-specific data to aid in strategic planning.

What are the market trends of industrial Nitrogen?

Current trends in the industrial nitrogen market include a growing shift towards environmentally sustainable practices, increased automation in production processes, and the rising use of nitrogen in renewable energy applications, which are collectively driving market expansion.