Lte And-5g Broadcast Market Report

Published Date: 31 January 2026 | Report Code: lte-and-5g-broadcast

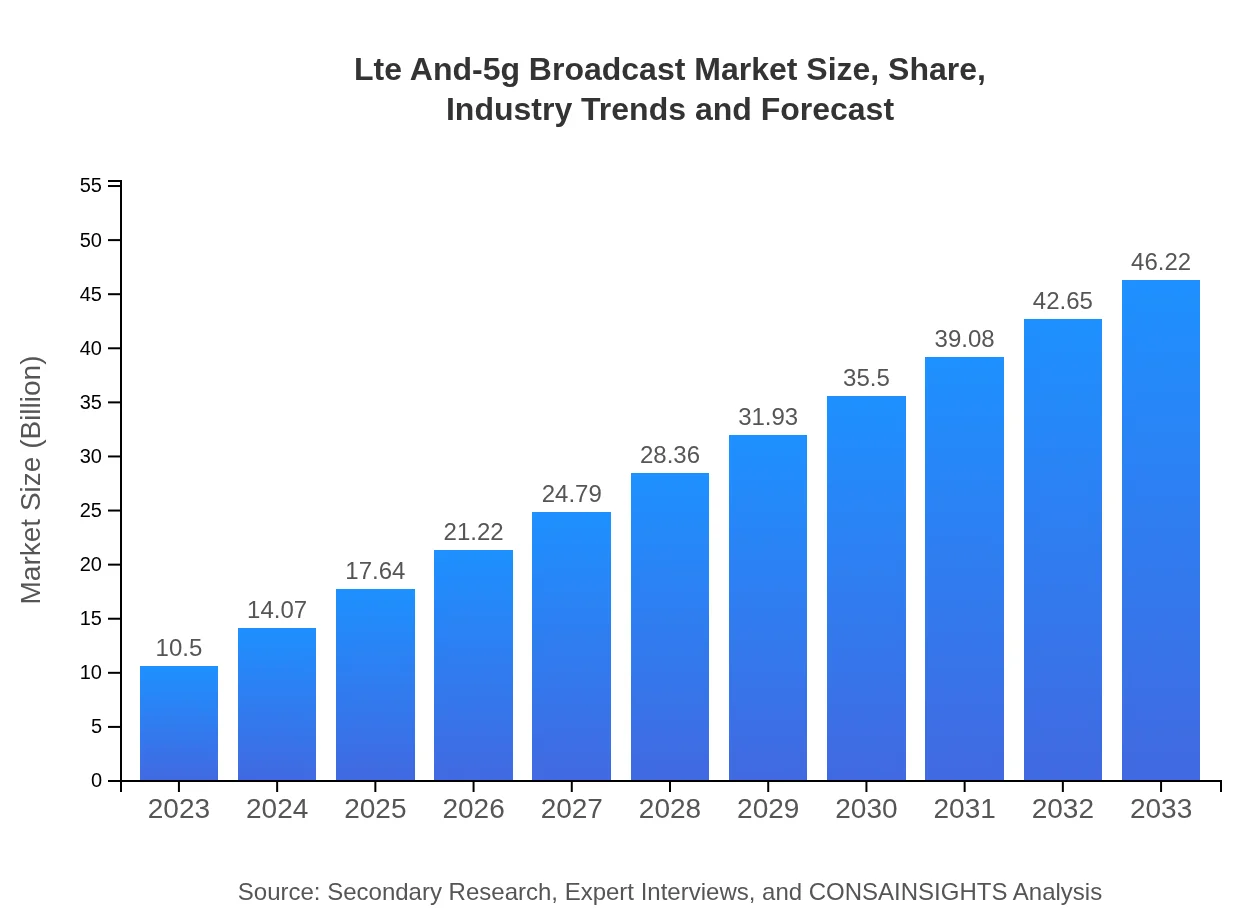

Lte And-5g Broadcast Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Lte And-5g Broadcast market, exploring market trends, growth forecasts from 2023 to 2033, and breakdowns by region and segment. Key insights into competitive dynamics and technological advancements are also provided.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 15.2% |

| 2033 Market Size | $46.22 Billion |

| Top Companies | Ericsson , Nokia , Qualcomm , Huawei , Samsung Electronics |

| Last Modified Date | 31 January 2026 |

Lte And-5g Broadcast Market Overview

Customize Lte And-5g Broadcast Market Report market research report

- ✔ Get in-depth analysis of Lte And-5g Broadcast market size, growth, and forecasts.

- ✔ Understand Lte And-5g Broadcast's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Lte And-5g Broadcast

What is the Market Size & CAGR of Lte And-5g Broadcast market in 2023?

Lte And-5g Broadcast Industry Analysis

Lte And-5g Broadcast Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Lte And-5g Broadcast Market Analysis Report by Region

Europe Lte And-5g Broadcast Market Report:

Europe's market is projected to expand from $3.21 billion in 2023 to $14.14 billion by 2033. The region is characterized by a high adoption rate of 5G technology and robust regulatory support for digital broadcasting initiatives, making it a leader in Lte And-5g Broadcast advancements.Asia Pacific Lte And-5g Broadcast Market Report:

The Asia Pacific region is forecast to grow from $1.98 billion in 2023 to $8.74 billion by 2033, marking a substantial opportunity for telecom operators. Rapid urbanization and rising mobile internet penetration are key factors contributing to the region's growth, notably in countries like China and India where demand for streaming services is surging.North America Lte And-5g Broadcast Market Report:

North America boasts a strong Lte And-5g Broadcast market, expected to escalate from $3.82 billion in 2023 to $16.83 billion by 2033. The presence of major telecom operators and continuous advancements in broadcasting technologies significantly drive this region's market expansion.South America Lte And-5g Broadcast Market Report:

In South America, the Lte And-5g Broadcast market is expected to grow from $0.54 billion in 2023 to $2.38 billion by 2033. This growth is primarily fueled by increasing investments in telecommunications infrastructure, especially in Brazil and Argentina, as countries work to enhance mobile broadcasting capabilities.Middle East & Africa Lte And-5g Broadcast Market Report:

The Middle East and Africa region is set to grow from $0.94 billion in 2023 to $4.13 billion by 2033 as countries enhance their digital broadcasting infrastructure amid rising mobile device usage and demand for wireless services.Tell us your focus area and get a customized research report.

Lte And-5g Broadcast Market Analysis Broadcasters

Global Lte And-5g Broadcast Market, By Broadcasters Segment (2023 - 2033)

The broadcasters segment represents a significant portion of the Lte And-5g Broadcast market, expanding from $5.31 billion in 2023 to $23.36 billion by 2033. Broadcasters are adopting these technologies to deliver high-quality content, thus enhancing viewer experiences. As the market evolves, we expect broadcasters to increasingly rely on integrated solutions to provide seamless transitions between traditional and digital broadcasting platforms.

Lte And-5g Broadcast Market Analysis Telecom_operators

Global Lte And-5g Broadcast Market, By Telecom Operators Segment (2023 - 2033)

Telecom operators are crucial players in the Lte And-5g Broadcast market, with this segment growing from $2.59 billion in 2023 to $11.41 billion by 2033. Their role in expanding infrastructure and improving service delivery is vital for the overall market growth, particularly as businesses and consumers shift their viewing habits to more mobile-centric platforms.

Lte And-5g Broadcast Market Analysis Content_providers

Global Lte And-5g Broadcast Market, By Content Providers Segment (2023 - 2033)

Content providers are catalyzing the growth of the Lte And-5g Broadcast market, which is set to rise from $1.52 billion in 2023 to $6.70 billion by 2033. Their focus on delivering high-quality streaming experiences directly impacts consumer satisfaction and market dynamics, guiding the evolution of broadcasting services towards better user engagement and accessibility.

Lte And-5g Broadcast Market Analysis Government_agencies

Global Lte And-5g Broadcast Market, By Government Agencies Segment (2023 - 2033)

The government agencies segment is projected to grow from $1.08 billion in 2023 to $4.75 billion by 2033. Governments globally are acknowledging the importance of enhanced broadcast systems in public safety and information dissemination, thus increasing investments in Lte And-5g technologies.

Lte And-5g Broadcast Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Lte And-5g Broadcast Industry

Ericsson :

Ericsson is a leading telecommunications equipment provider specializing in 5G and LTE technologies, offering advanced broadcasting solutions to enhance mobile connectivity.Nokia :

Nokia focuses on delivering innovative network solutions and services for the telecommunications industry, playing a critical role in the rollout of Lte And-5g Broadcast across different regions.Qualcomm :

Qualcomm develops cutting-edge semiconductor technologies that power devices and networks for LTE and 5G broadcasting, aiding in seamless content delivery.Huawei :

Huawei provides comprehensive telecommunications solutions, including broadcasting technologies that support the advancement of LTE and 5G services globally.Samsung Electronics:

Samsung Electronics invests significantly in R&D to refine its broadcasting technology, contributing substantially to the Lte And-5g Broadcast market through innovative devices and services.We're grateful to work with incredible clients.

FAQs

What is the market size of LTE and 5G broadcast?

The LTE and 5G broadcast market is projected to grow from $10.5 billion in 2023 to a significantly larger size by 2033, with a compound annual growth rate (CAGR) of 15.2%. This growth reflects increasing demand for high-quality broadcasting services.

What are the key market players or companies in the LTE and 5G broadcast industry?

Key players in the LTE and 5G broadcast industry include major telecommunications companies, broadcasting agencies, and content providers, who are pivotal in driving innovation and expansion in broadcasting technologies that support high-speed data transmission.

What are the primary factors driving the growth in the LTE and 5G broadcast industry?

Factors driving growth include advancements in telecommunications infrastructure, increasing consumer demand for high-quality media content, the rise of IoT devices, and enhanced mobile broadband experiences fostering new applications and use cases.

Which region is the fastest Growing in the LTE and 5G broadcast?

The fastest-growing region for LTE and 5G broadcast is North America, with market growth projected from $3.82 billion in 2023 to $16.83 billion by 2033. Europe also sees significant growth, rising from $3.21 billion to $14.14 billion in the same period.

Does ConsaInsights provide customized market report data for the LTE and 5G broadcast industry?

Yes, ConsaInsights specializes in providing customized market research data tailored to the specific needs of clients in the LTE and 5G broadcast industry, ensuring relevant insights to support strategic decision-making.

What deliverables can I expect from this LTE and 5G broadcast market research project?

Deliverables from this market research project typically include detailed market analysis reports, segmentation data, regional forecasts, competitive landscape assessments, and insights on emerging trends in the LTE and 5G broadcast field.

What are the market trends of LTE and 5G broadcast?

Current trends include an increasing shift toward 5G technology adoption, the integration of broadcasting services with telecommunications networks, and a growing focus on interactive and real-time media applications powered by LTE and 5G capabilities.