Lubricant Additives Market Report

Published Date: 02 February 2026 | Report Code: lubricant-additives

Lubricant Additives Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Lubricant Additives market, including market trends, size projections, regional insights, and key players. The forecast period extends from 2023 to 2033, delivering comprehensive data for informed decision-making.

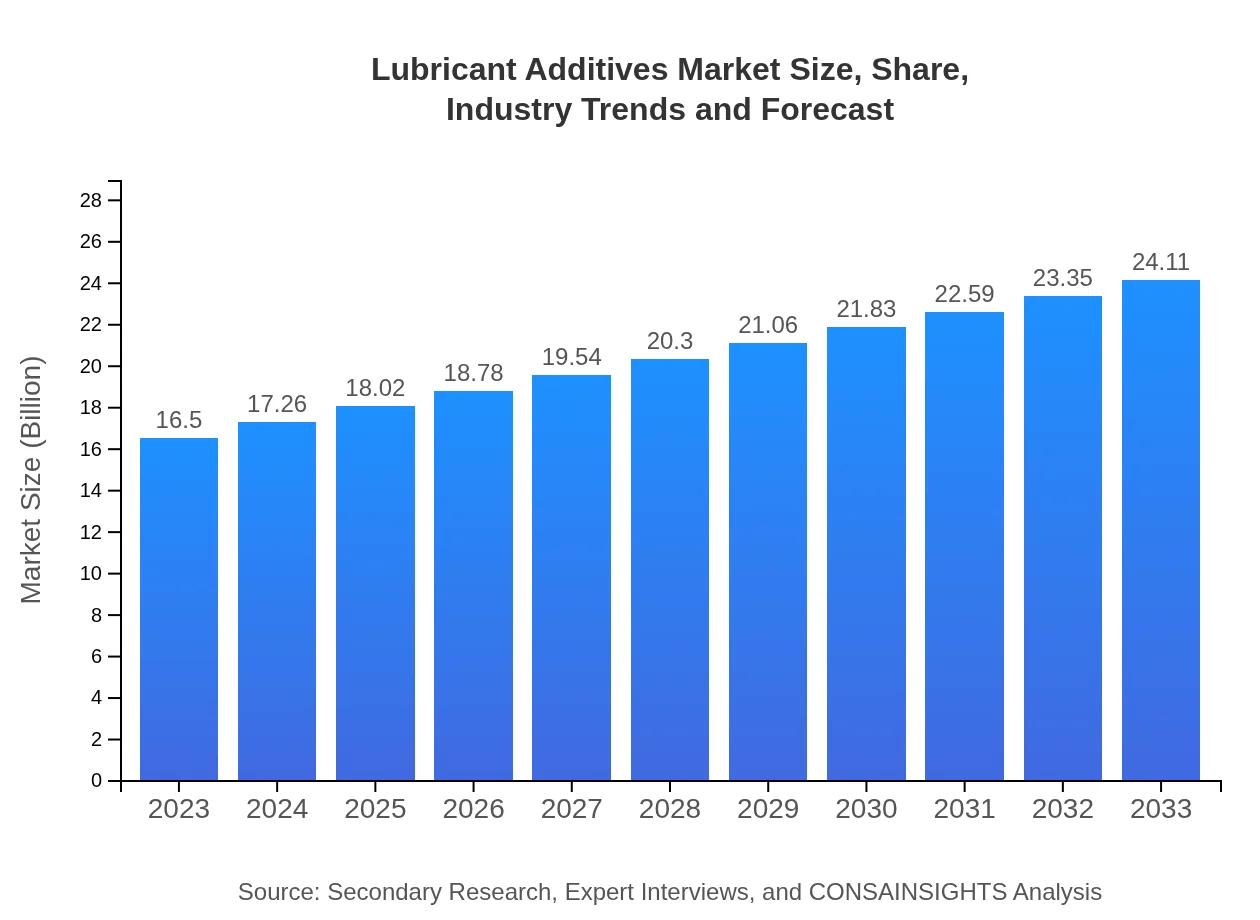

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $16.50 Billion |

| CAGR (2023-2033) | 3.8% |

| 2033 Market Size | $24.11 Billion |

| Top Companies | BASF SE, Chevron Oronite Company, LLC, Evonik Industries AG, Afton Chemical Corporation, Lubrizol Corporation |

| Last Modified Date | 02 February 2026 |

Lubricant Additives Market Overview

Customize Lubricant Additives Market Report market research report

- ✔ Get in-depth analysis of Lubricant Additives market size, growth, and forecasts.

- ✔ Understand Lubricant Additives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Lubricant Additives

What is the Market Size & CAGR of the Lubricant Additives market in 2023?

Lubricant Additives Industry Analysis

Lubricant Additives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Lubricant Additives Market Analysis Report by Region

Europe Lubricant Additives Market Report:

Europe, valued at $3.98 billion in 2023, is forecasted to reach $5.82 billion by 2033. The region is seeing an emphasis on environmentally friendly products and innovations coupled with stringent environmental regulations promoting the use of advanced lubricant additives.Asia Pacific Lubricant Additives Market Report:

The Asia Pacific region is witnessing significant growth in the lubricant additives market with a size of $3.51 billion in 2023 projected to reach $5.14 billion by 2033. The burgeoning automotive sector, particularly in countries like China and India, is a major driver. Additionally, rising industrialization and the demand for high-quality lubricants are contributing to this growth.North America Lubricant Additives Market Report:

North America leads the lubricant additives market, with a valuation of $6.32 billion in 2023, projected to rise to $9.23 billion by 2033. The region is characterized by advanced automotive technology and stringent regulations demanding high-performance products, fostering an environment for growth.South America Lubricant Additives Market Report:

The South American market for lubricant additives is relatively small, valued at $0.53 billion in 2023 and expected to grow to $0.77 billion by 2033. This growth is mainly driven by increased investment in infrastructure and the oil and gas industry, which demands high-performance lubricants.Middle East & Africa Lubricant Additives Market Report:

The Middle East and Africa's lubricant additives market, standing at $2.15 billion in 2023, is expected to grow to $3.15 billion by 2033. The increasing oil and gas activities, coupled with rising automotive sales, are pivotal factors driving market growth in this region.Tell us your focus area and get a customized research report.

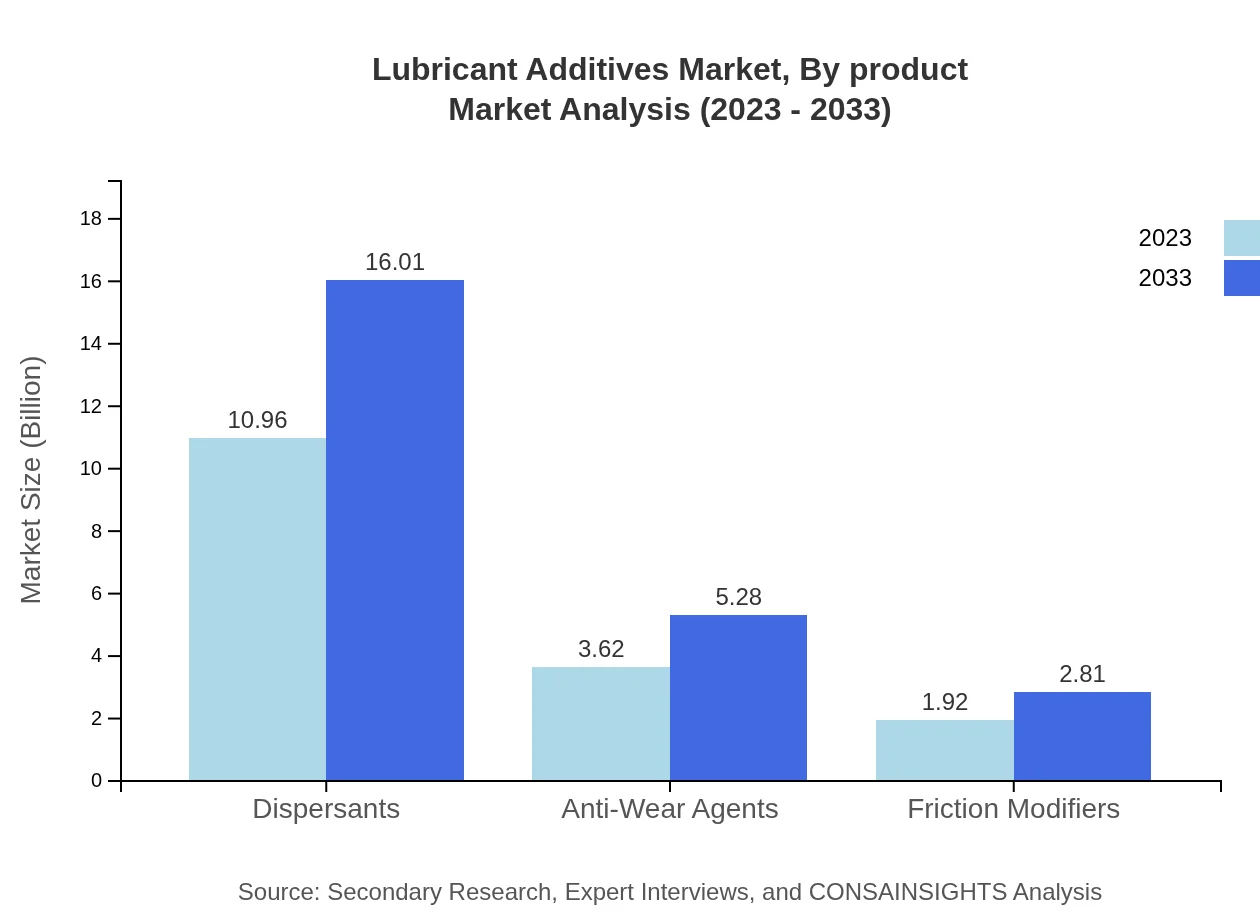

Lubricant Additives Market Analysis By Product

The product segmentation highlights dispersants, anti-wear agents, friction modifiers, and viscosity index improvers as significant players. For instance, dispersants accounted for a market size of $10.96 billion in 2023, projected to grow to $16.01 billion by 2033, signifying their critical role in maintaining lubricant cleanliness and performance.

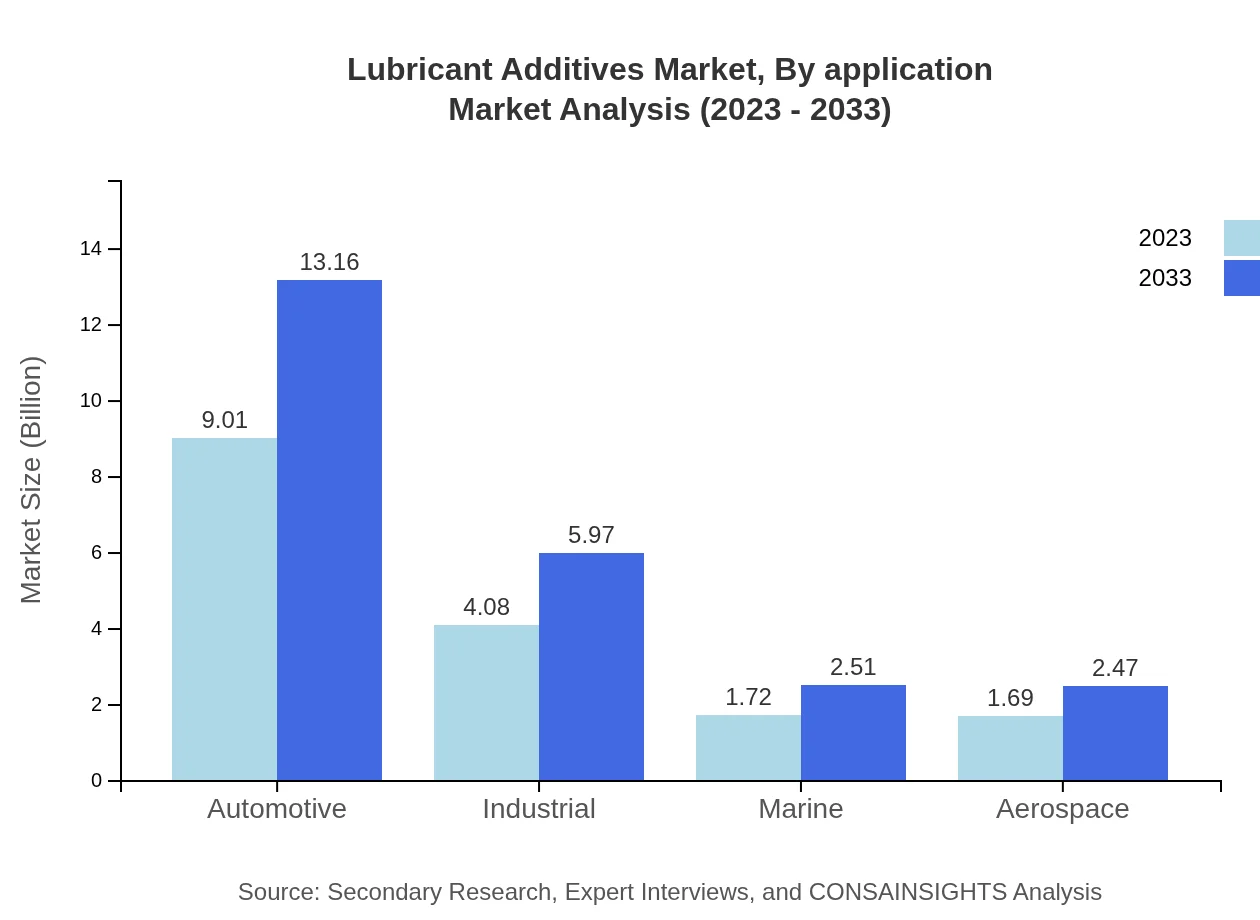

Lubricant Additives Market Analysis By Application

The market is applied extensively in automotive, industrial, marine, and aerospace applications. Automotive applications alone dominate the market with a share of approximately 54.6% in 2023, driven by increasing vehicle production and the demand for improved fuel efficiency.

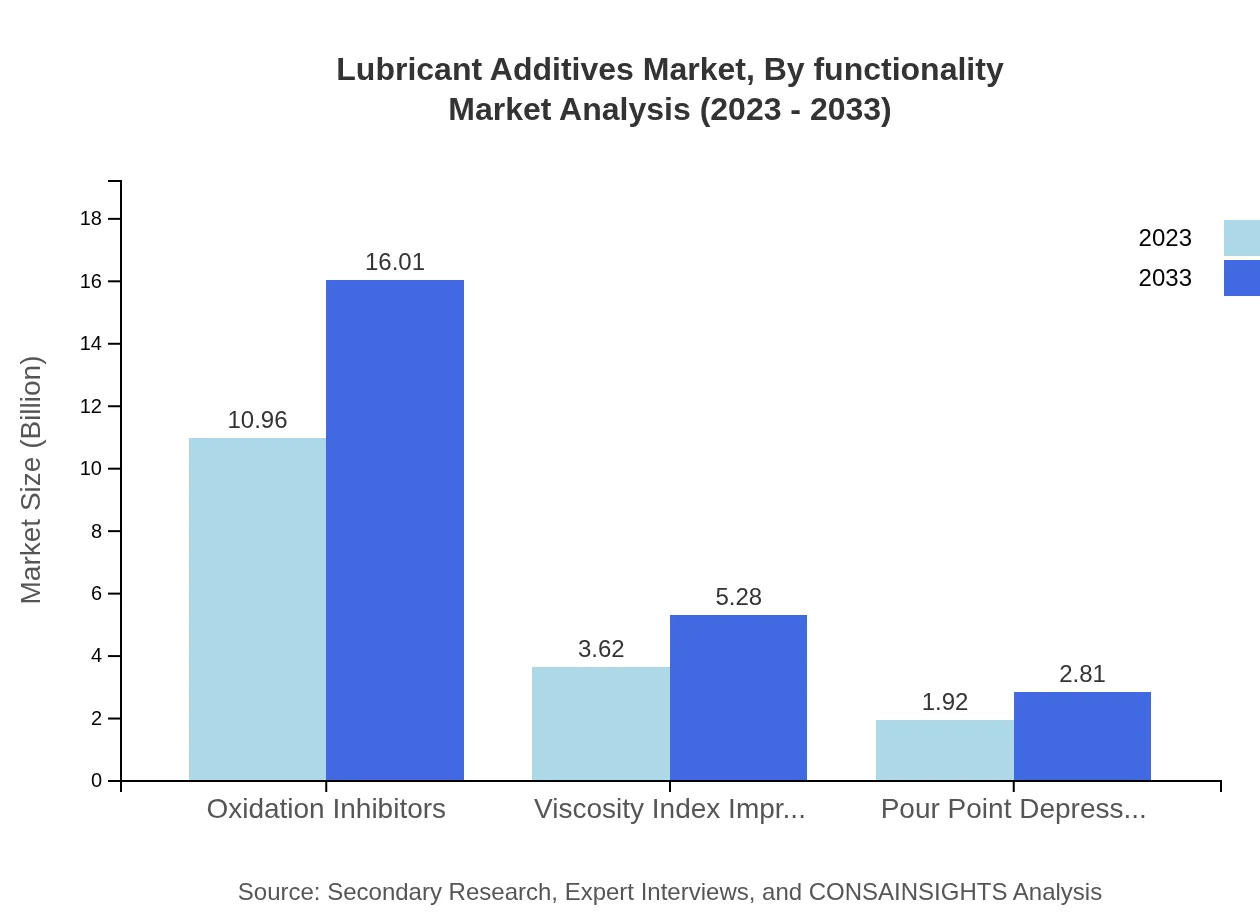

Lubricant Additives Market Analysis By Functionality

Functionality-wise, the market includes categories such as anti-wear agents, friction modifiers, and oxidation inhibitors. Anti-wear agents are particularly essential, with a market share of 21.92% in 2023, assisting in prolonging engine life and enhancing overall performance.

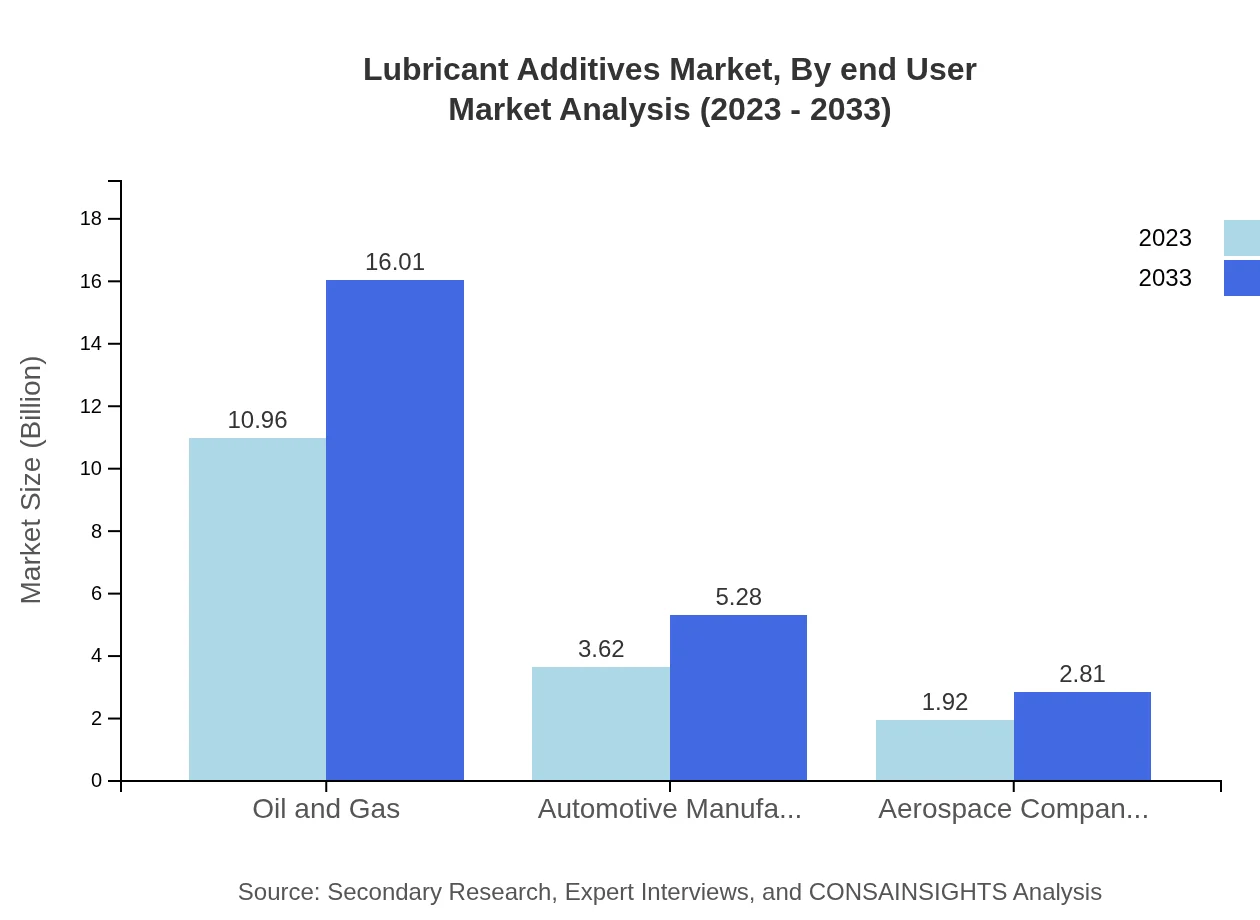

Lubricant Additives Market Analysis By End User

The automotive industry remains the predominant end-user of lubricant additives, representing a significant proportion of market demand. Industrial sectors, aerospace, and marine applications also show considerable growth, reflecting a trend towards specialized lubricants tailored for specific conditions.

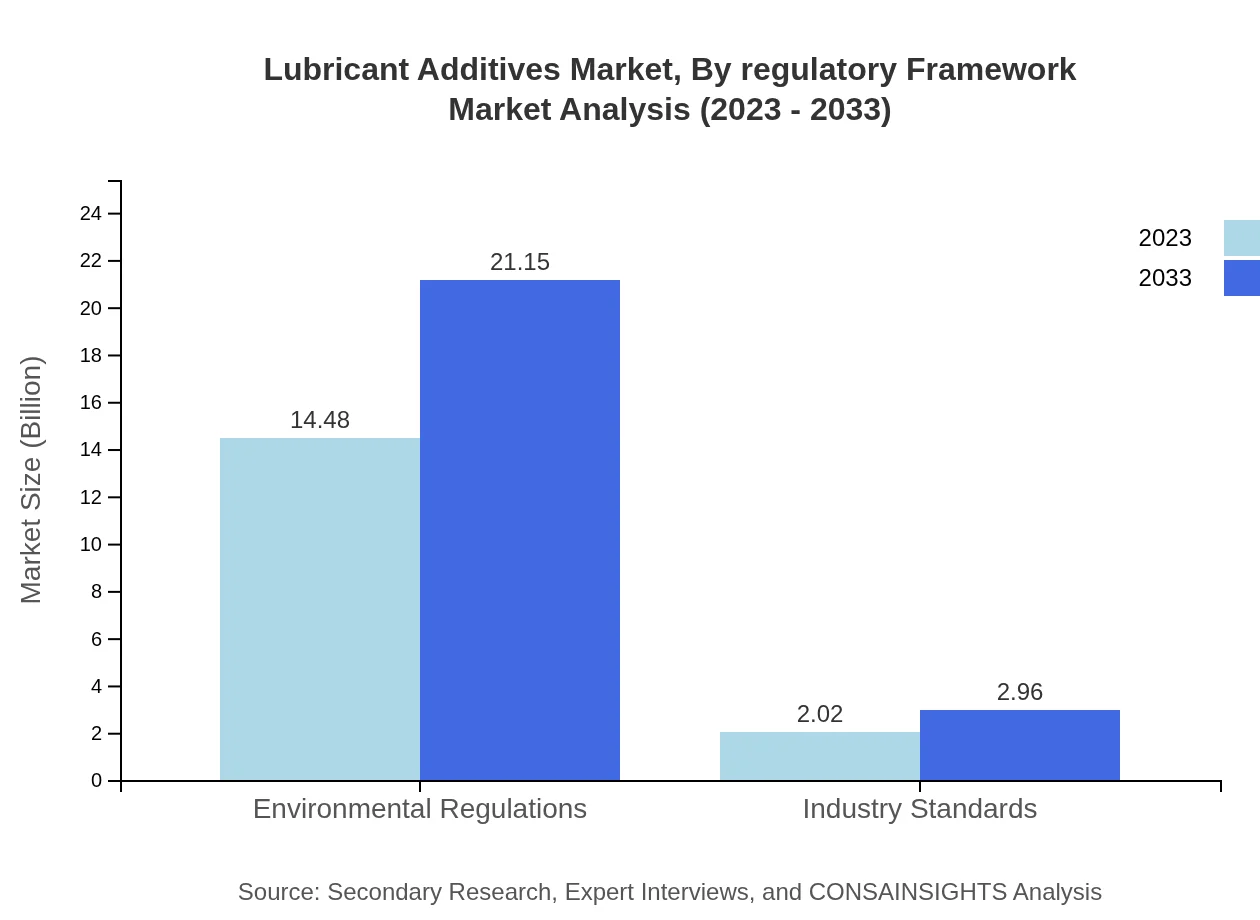

Lubricant Additives Market Analysis By Regulatory Framework

The lubricant additives market must navigate strict regulatory environments, particularly concerning environmental standards. This regulatory framework influences product development, with a focus on sustainable additives gaining traction, ensuring manufacturers comply while meeting market demands.

Lubricant Additives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Lubricant Additives Industry

BASF SE:

BASF SE is a global leader in chemical production, developing a broad range of lubricant additives designed for enhancing performance across automotive and industrial applications.Chevron Oronite Company, LLC:

Chevron Oronite specializes in the development and manufacturing of high-performance additive solutions for lubricants, contributing significantly to the industry's advancement.Evonik Industries AG:

Evonik is a specialty chemicals company known for its innovative lubricant additives that cater to various industrial and automotive needs.Afton Chemical Corporation:

Afton Chemical provides tailored additive solutions that improve the efficiency and performance of lubricants across multiple sectors.Lubrizol Corporation:

Lubrizol is dedicated to formulating and producing high-performance lubricant additives focused on sustainability and industrial efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of lubricant Additives?

The lubricant additives market is valued at approximately $16.5 billion in 2023, with a projected CAGR of 3.8%. This growth reflects increasing demand across various industries including automotive, marine, and industrial applications.

What are the key market players or companies in this lubricant Additives industry?

Key players in the lubricant additives market include major chemical companies such as BASF, Lubrizol Corporation, and Afton Chemical. These companies focus on innovative solutions that enhance performance and meet consumer requirements.

What are the primary factors driving the growth in the lubricant Additives industry?

Growth in the lubricant additives industry is primarily driven by increasing automotive production, stringent environmental regulations, and the demand for high-performance lubricants in industrial applications. Additionally, technological advancements in formulation play a pivotal role.

Which region is the fastest Growing in the lubricant Additives market?

The fastest-growing region in the lubricant additives market is Europe, projected to grow from $3.98 billion in 2023 to $5.82 billion by 2033, reflecting strong automotive and industrial sectors actively adopting advanced lubricants.

Does ConsaInsights provide customized market report data for the lubricant Additives industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the lubricant additives sector, enabling stakeholders to access relevant insights and forecasts suited to their business objectives.

What deliverables can I expect from this lubricant Additives market research project?

From the lubricant additives market research project, you can expect comprehensive reports, data analysis, market trends, growth forecasts, competitive landscape assessments, and tailored recommendations based on segment insights.

What are the market trends of lubricant Additives?

Key trends in the lubricant additives market include increasing demand for environmentally friendly products, rising usage of synthetic lubricants, and a growing focus on technological innovations in additive formulations to enhance performance.