Medium And Heavy Duty Commercial Vehicles Market Report

Published Date: 02 February 2026 | Report Code: medium-and-heavy-duty-commercial-vehicles

Medium And Heavy Duty Commercial Vehicles Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Medium and Heavy Duty Commercial Vehicles market, encompassing market size, trends, technology, and regional insights spanning from 2023 to 2033.

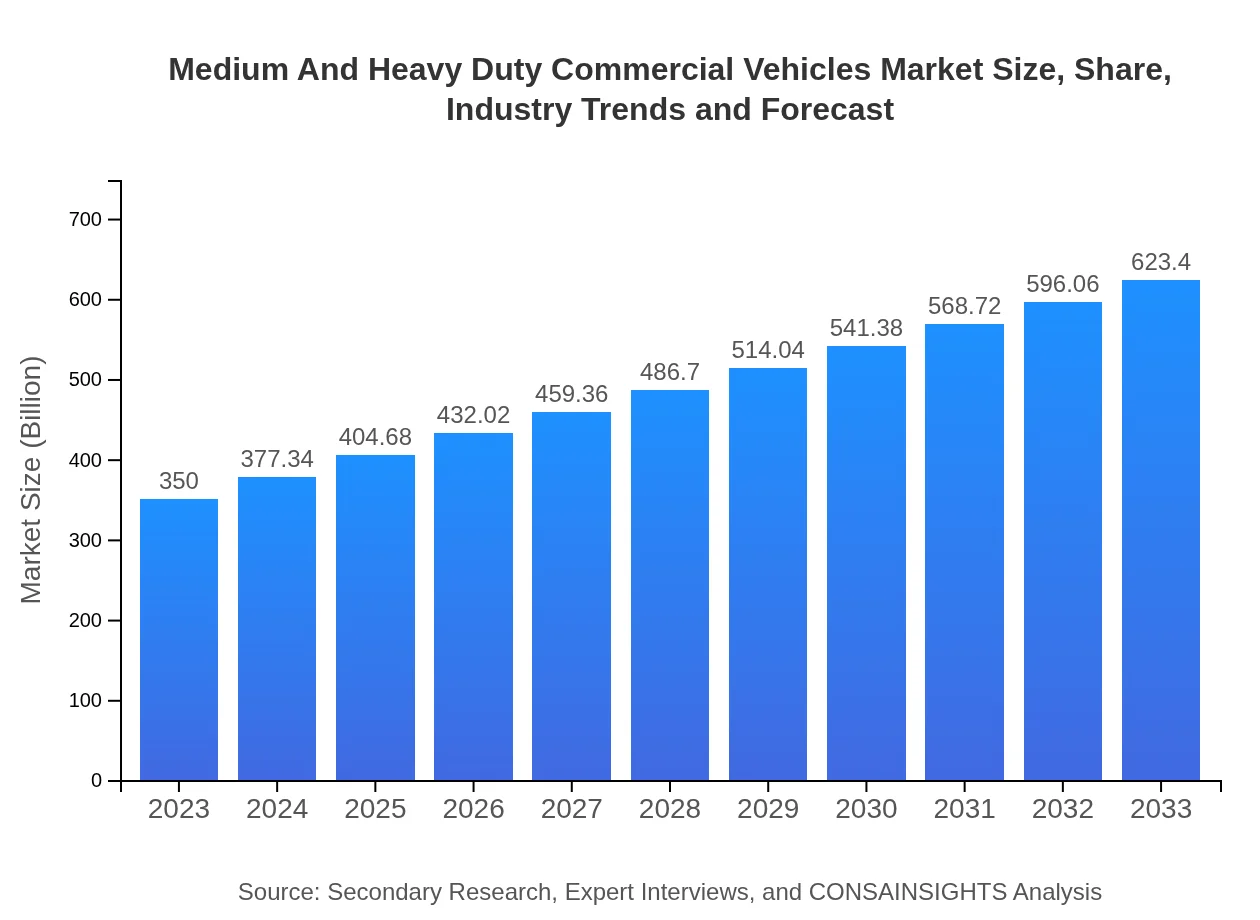

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $350.00 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $623.40 Billion |

| Top Companies | Daimler AG, Volvo Group, PACCAR Inc., MAN SE, Scania AB |

| Last Modified Date | 02 February 2026 |

Medium And Heavy Duty Commercial Vehicles Market Overview

Customize Medium And Heavy Duty Commercial Vehicles Market Report market research report

- ✔ Get in-depth analysis of Medium And Heavy Duty Commercial Vehicles market size, growth, and forecasts.

- ✔ Understand Medium And Heavy Duty Commercial Vehicles's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Medium And Heavy Duty Commercial Vehicles

What is the Market Size & CAGR of Medium And Heavy Duty Commercial Vehicles market in 2023?

Medium And Heavy Duty Commercial Vehicles Industry Analysis

Medium And Heavy Duty Commercial Vehicles Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Medium And Heavy Duty Commercial Vehicles Market Analysis Report by Region

Europe Medium And Heavy Duty Commercial Vehicles Market Report:

The European market for MHDCV is expected to grow from USD 117.14 billion in 2023 to USD 208.65 billion by 2033. Stringent emission regulations and an emphasis on sustainability are prompting a shift towards electric and hybrid vehicles.Asia Pacific Medium And Heavy Duty Commercial Vehicles Market Report:

In 2023, the Asia Pacific market is valued at approximately USD 66.88 billion, projected to grow to USD 119.13 billion by 2033. This growth is driven by rapid urbanization and infrastructure development in countries like China and India, leading to increased demand for commercial vehicles in various industries.North America Medium And Heavy Duty Commercial Vehicles Market Report:

In North America, the MHDCV market is valued at USD 112.91 billion in 2023, projected to reach USD 201.11 billion by 2033. The region's growth is fueled by the booming e-commerce industry, increasing demand for freight transport, and technological advancements in vehicle performance.South America Medium And Heavy Duty Commercial Vehicles Market Report:

The South American market for MHDCV is valued at USD 20.89 billion in 2023, expected to expand to USD 37.22 billion by 2033. Brazil and Argentina dominate this market, influenced by the growing logistics sector and infrastructure investments.Middle East & Africa Medium And Heavy Duty Commercial Vehicles Market Report:

The market in the Middle East and Africa stands at USD 32.16 billion in 2023, with a forecasted growth to USD 57.29 billion by 2033. Investments in infrastructure projects across the region are expected to boost demand for commercial vehicles, despite geopolitical challenges.Tell us your focus area and get a customized research report.

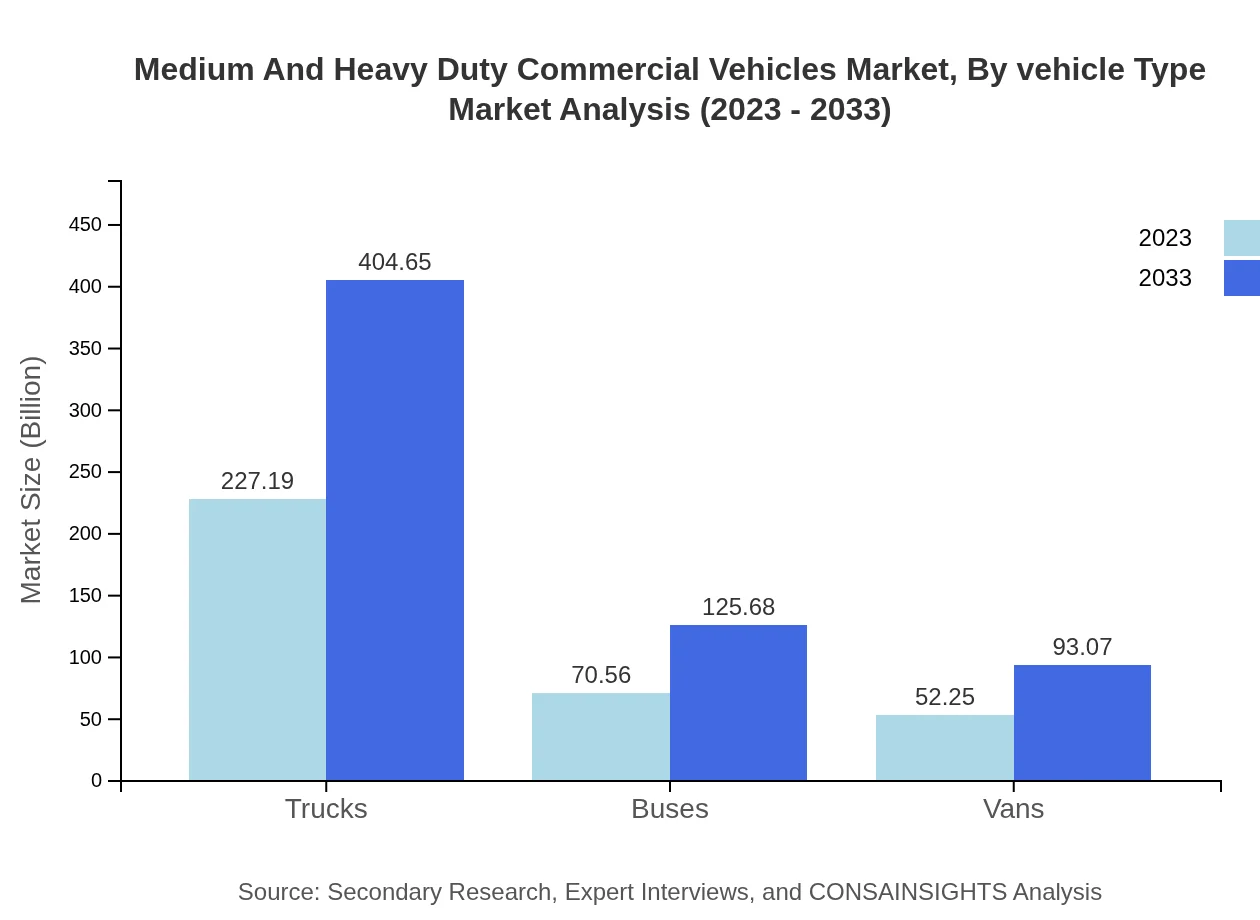

Medium And Heavy Duty Commercial Vehicles Market Analysis By Vehicle Type

The truck segment dominates the MHDCV market, contributing to approximately 64.91% of the total revenue in 2023, valued at USD 227.19 billion, expected to reach USD 404.65 billion by 2033. Buses and vans also hold significant market shares, mainly driven by urban transportation needs.

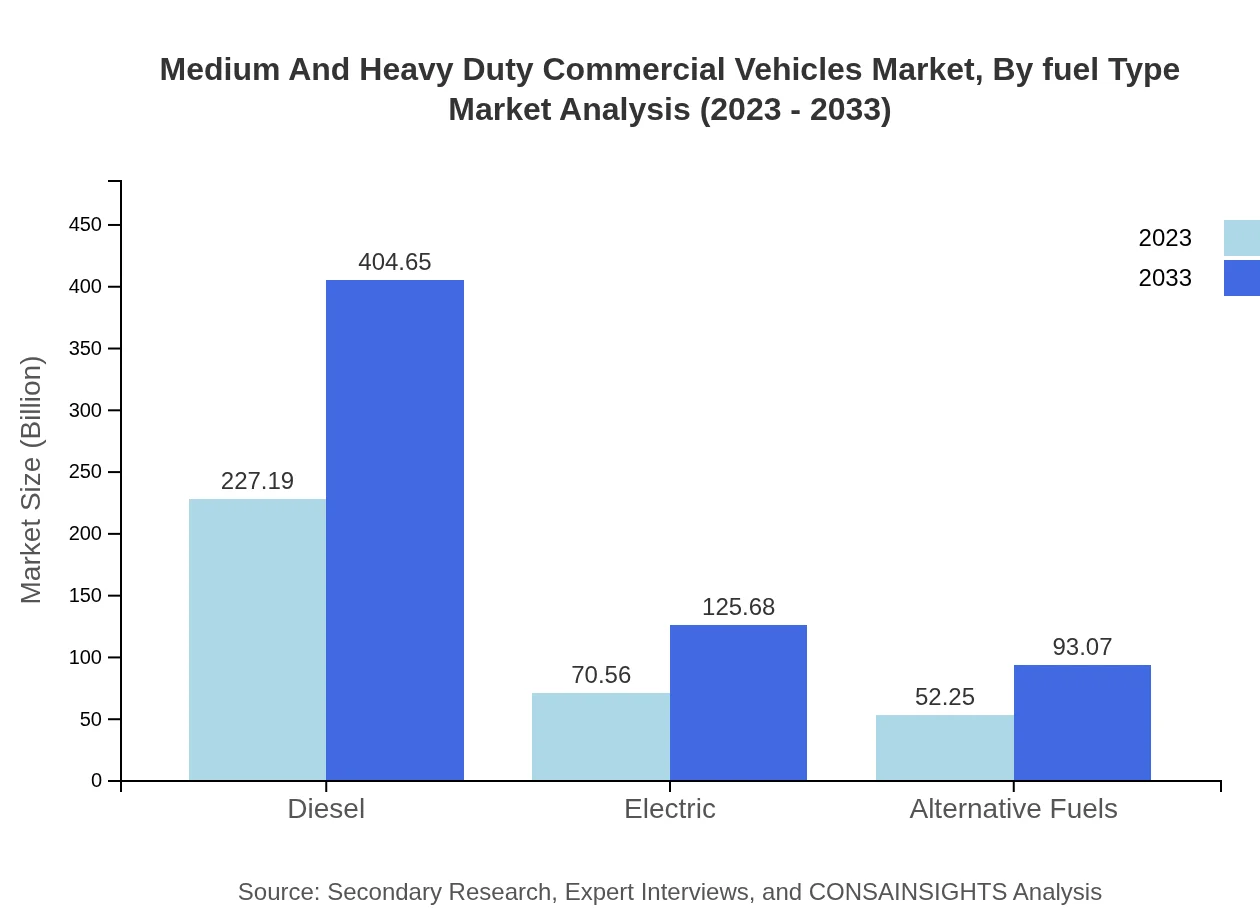

Medium And Heavy Duty Commercial Vehicles Market Analysis By Fuel Type

Diesel remains the leading fuel type for MHDCVs, accounting for 64.91% of the market share in 2023. However, the electric and alternative fuel segments are witnessing rapid growth, with forecasts indicating that electric vehicles will grow from a market size of USD 70.56 billion in 2023 to USD 125.68 billion by 2033.

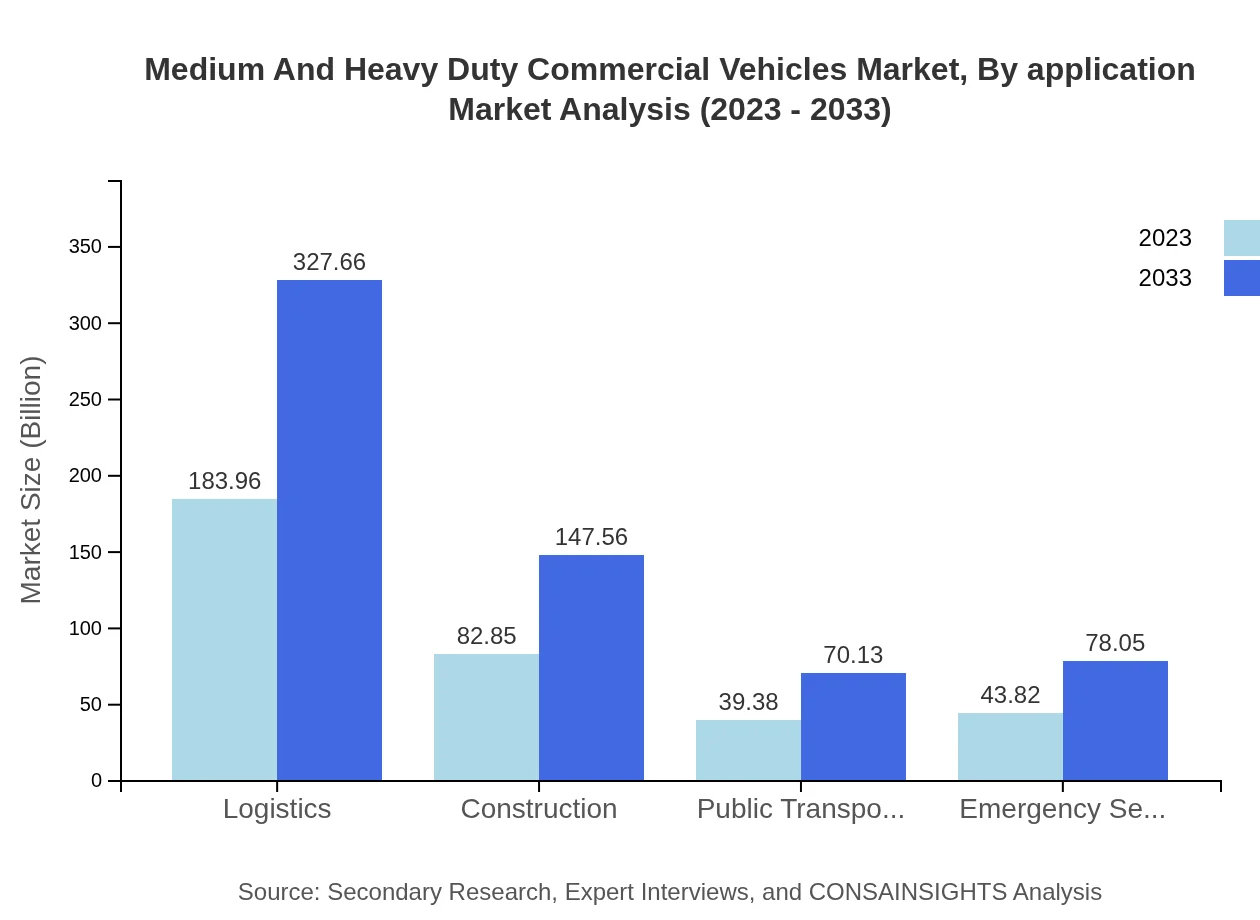

Medium And Heavy Duty Commercial Vehicles Market Analysis By Application

Key applications include logistics, construction, and public transportation. The logistics sector is projected to hold a significant market share of 52.56% in 2023, valued at USD 183.96 billion, growing to USD 327.66 billion by 2033, driven by the surge in e-commerce activities.

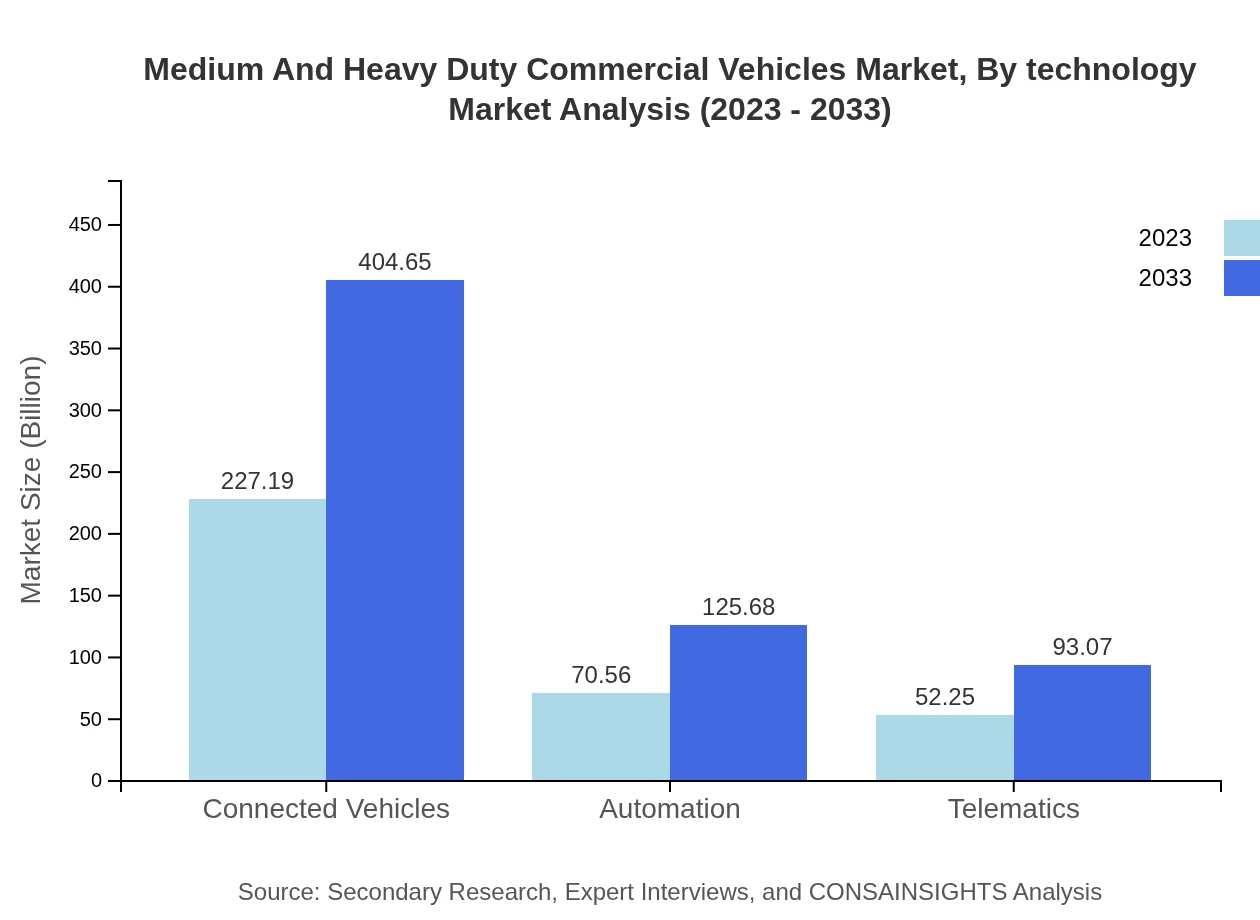

Medium And Heavy Duty Commercial Vehicles Market Analysis By Technology

Technological advancements such as automation, telematics, and connectivity are shaping the MHDCV market. Automation and telematics segments are expected to grow significantly, with telematics alone projected to rise from USD 52.25 billion in 2023 to USD 93.07 billion by 2033.

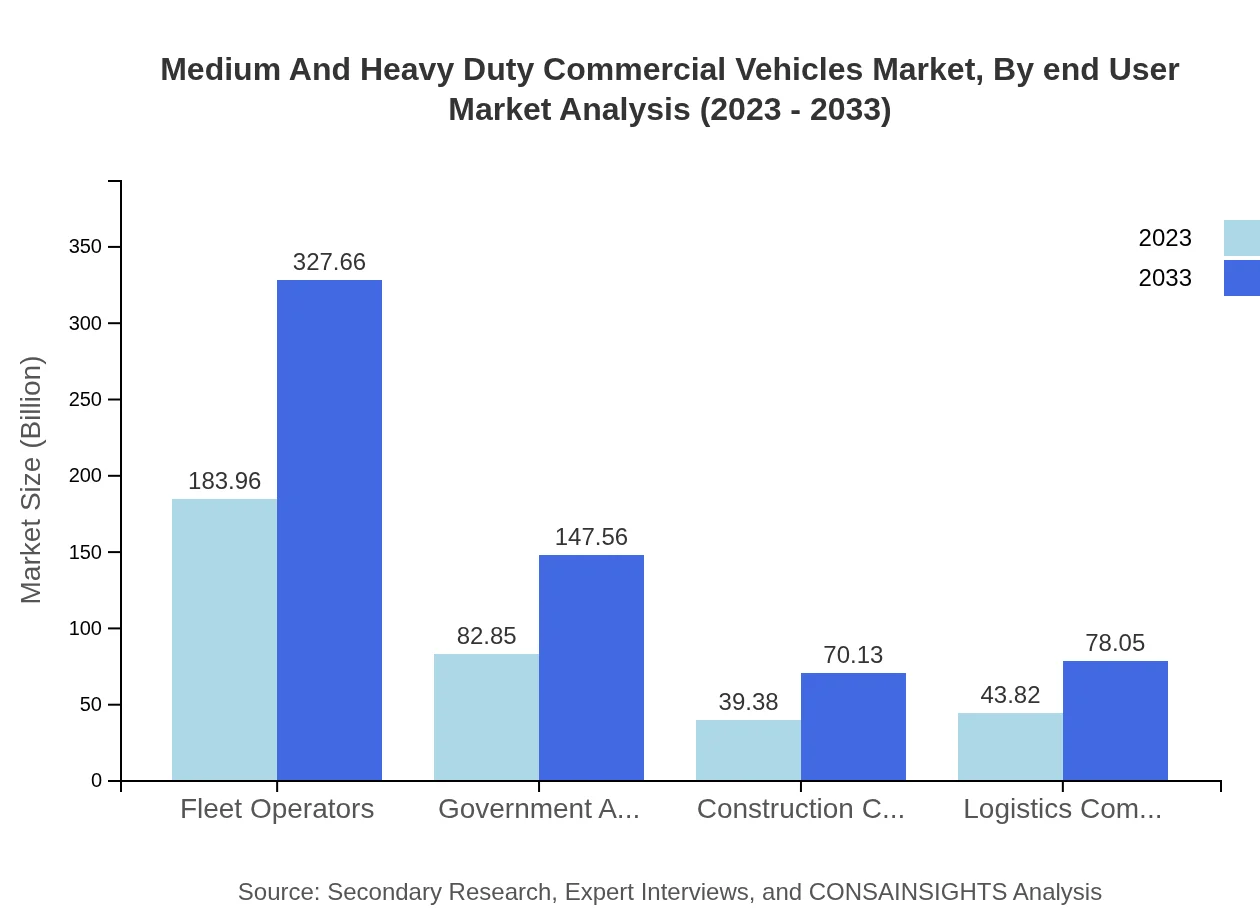

Medium And Heavy Duty Commercial Vehicles Market Analysis By End User

The market serves various end-users, including fleet operators, government agencies, and logistics companies. Fleet operators hold a substantial market share of 52.56% in 2023, valued at USD 183.96 billion, which is expected to grow as demand for logistics services increases.

Medium And Heavy Duty Commercial Vehicles Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Medium And Heavy Duty Commercial Vehicles Industry

Daimler AG:

A leading global manufacturer of commercial vehicles, Daimler AG is known for its innovation in sustainable transport technologies, including electric and hybrid solutions.Volvo Group:

Volvo Group is recognized for its high-quality trucks and commitment to sustainability, with ongoing developments in electric vehicle technology.PACCAR Inc.:

PACCAR specializes in manufacturing premium trucks and engines and is focused on technology advancements for enhanced operational efficiency.MAN SE:

A prominent manufacturer with a strong presence in Europe, MAN SE is advancing its offerings in electric vehicles and automation.Scania AB:

Scania is a pioneer in sustainable transportation solutions, offering a wide range of vehicles that prioritize fuel efficiency and lower emissions.We're grateful to work with incredible clients.

FAQs

What is the market size of medium And Heavy Duty Commercial Vehicles?

The medium and heavy-duty commercial vehicles market is valued at approximately $350 billion as of 2023, with a projected CAGR of 5.8% through 2033. This growth reflects increasing demand and technological advancements in the sector.

What are the key market players or companies in this medium And Heavy Duty Commercial Vehicles industry?

Key market players in the medium and heavy-duty commercial vehicles industry include manufacturers such as Daimler AG, Volvo Group, PACCAR Inc., and Navistar International. These companies play a significant role in innovating vehicle technologies and meeting growing customer needs.

What are the primary factors driving the growth in the medium And Heavy Duty Commercial Vehicles industry?

Significant factors driving growth include increasing freight demand, advancements in electric and autonomous vehicles, rising infrastructure investments, and stringent emission regulations. These elements combine to enhance the market landscape and boost commercial vehicle utilization.

Which region is the fastest Growing in the medium And Heavy Duty Commercial Vehicles market?

The Asia Pacific region is the fastest-growing market for medium and heavy-duty commercial vehicles. It is expected to grow from $66.88 billion in 2023 to approximately $119.13 billion by 2033, reflecting substantial infrastructure development and urbanization.

Does ConsaInsights provide customized market report data for the medium And Heavy Duty Commercial Vehicles industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the medium and heavy-duty commercial vehicles industry. Clients can request focused insights on segments, regions, and emerging trends.

What deliverables can I expect from this medium And Heavy Duty Commercial Vehicles market research project?

Deliverables from this market research project include comprehensive market analysis reports, segmentation insights, competitive landscape overviews, forecasted trends, and actionable recommendations based on current industry data.

What are the market trends of medium And Heavy Duty Commercial Vehicles?

Current market trends include a shift towards electric vehicles, the rise of connected technologies, and increased focus on automation and telematics. These trends align with global sustainability goals and evolving consumer demands.