Metal Recycling Market Report

Published Date: 02 February 2026 | Report Code: metal-recycling

Metal Recycling Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Metal Recycling market, offering insights into market size, trends, and forecasts for the period 2023 to 2033. It includes detailed regional analyses, industry segments, and key players, aiming to inform stakeholders about opportunities and challenges in this dynamic sector.

| Metric | Value |

|---|---|

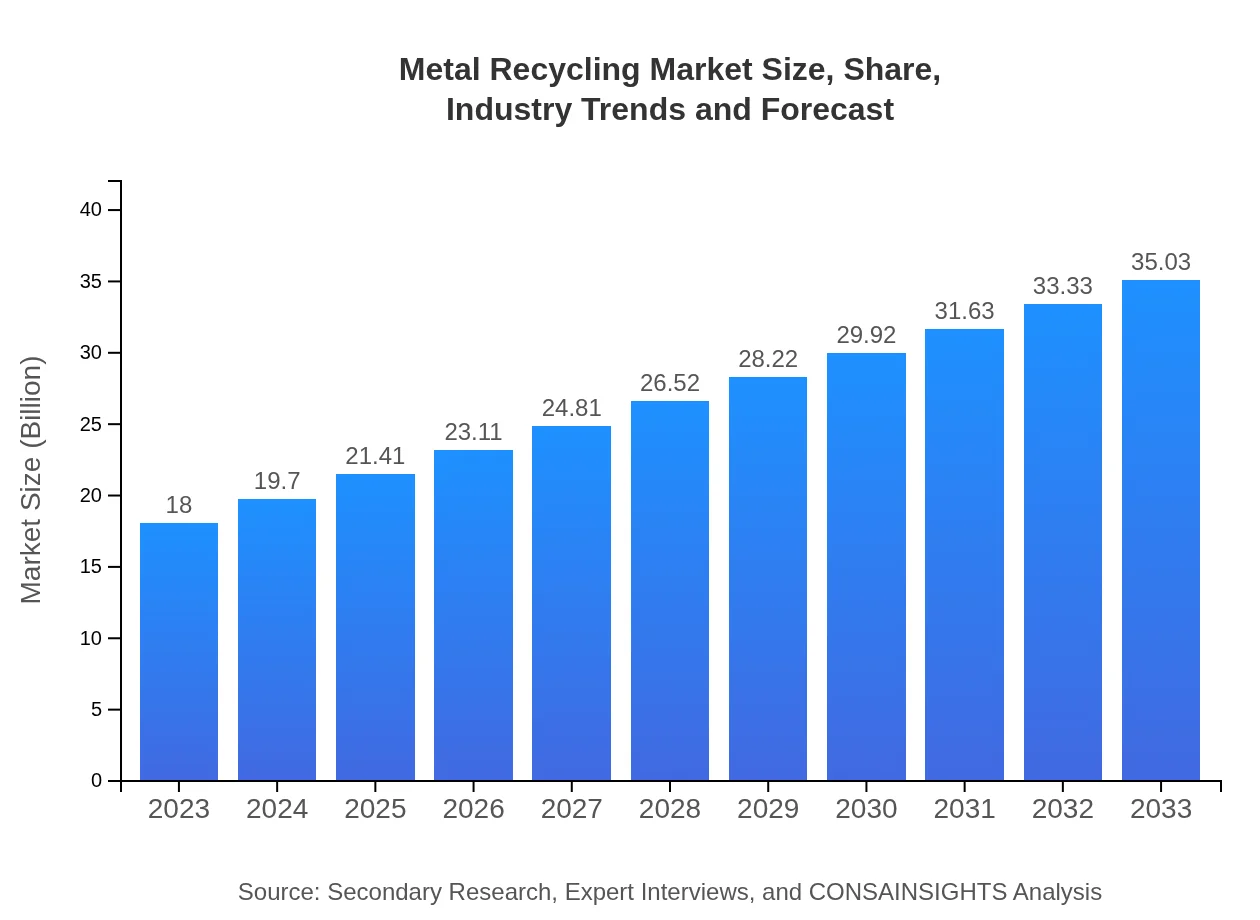

| Study Period | 2023 - 2033 |

| 2023 Market Size | $18.00 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $35.03 Billion |

| Top Companies | Schnitzer Steel Industries Inc., Commercial Metals Company (CMC), Nucor Corporation, ArcelorMittal |

| Last Modified Date | 02 February 2026 |

Metal Recycling Market Overview

Customize Metal Recycling Market Report market research report

- ✔ Get in-depth analysis of Metal Recycling market size, growth, and forecasts.

- ✔ Understand Metal Recycling's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Metal Recycling

What is the Market Size & CAGR of Metal Recycling market in 2023?

Metal Recycling Industry Analysis

Metal Recycling Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Metal Recycling Market Analysis Report by Region

Europe Metal Recycling Market Report:

The European Metal Recycling market is anticipated to rise from $6.03 billion in 2023 to $11.74 billion by 2033. European countries are leading the charge in recycling initiatives due to stringent regulations and a strong focus on reducing the carbon footprint. The demand for recycled metals in automotive and construction sectors significantly influences this region's market.Asia Pacific Metal Recycling Market Report:

In the Asia-Pacific region, the Metal Recycling market is expected to see growth from $2.94 billion in 2023 to $5.72 billion by 2033. This growth is driven by rapid industrialization, urbanization, and increasing metal consumption in countries like China and India. Moreover, supportive government policies focused on promoting recycling and sustainability add to this growth trajectory.North America Metal Recycling Market Report:

North America is a significant market for Metal Recycling, with projections indicating growth from $6.44 billion in 2023 to $12.53 billion by 2033. The presence of well-established recycling infrastructures and strict environmental regulations support this growth, particularly in the United States, where recycling initiatives are at the forefront of sustainability efforts.South America Metal Recycling Market Report:

The South American Metal Recycling market is projected to expand from $0.58 billion in 2023 to $1.14 billion by 2033. The region's growth is highly influenced by the mining industry, with countries like Brazil and Argentina leading the demand for recycling as a means to sustain resources and minimize waste.Middle East & Africa Metal Recycling Market Report:

In the Middle East and Africa, the Metal Recycling market is expected to grow from $2.00 billion in 2023 to $3.90 billion by 2033. The region's market development is tied to increasing awareness of the need for sustainable practices, with various nations investing in recycling technologies and industry standards to enhance their metal recovery capabilities.Tell us your focus area and get a customized research report.

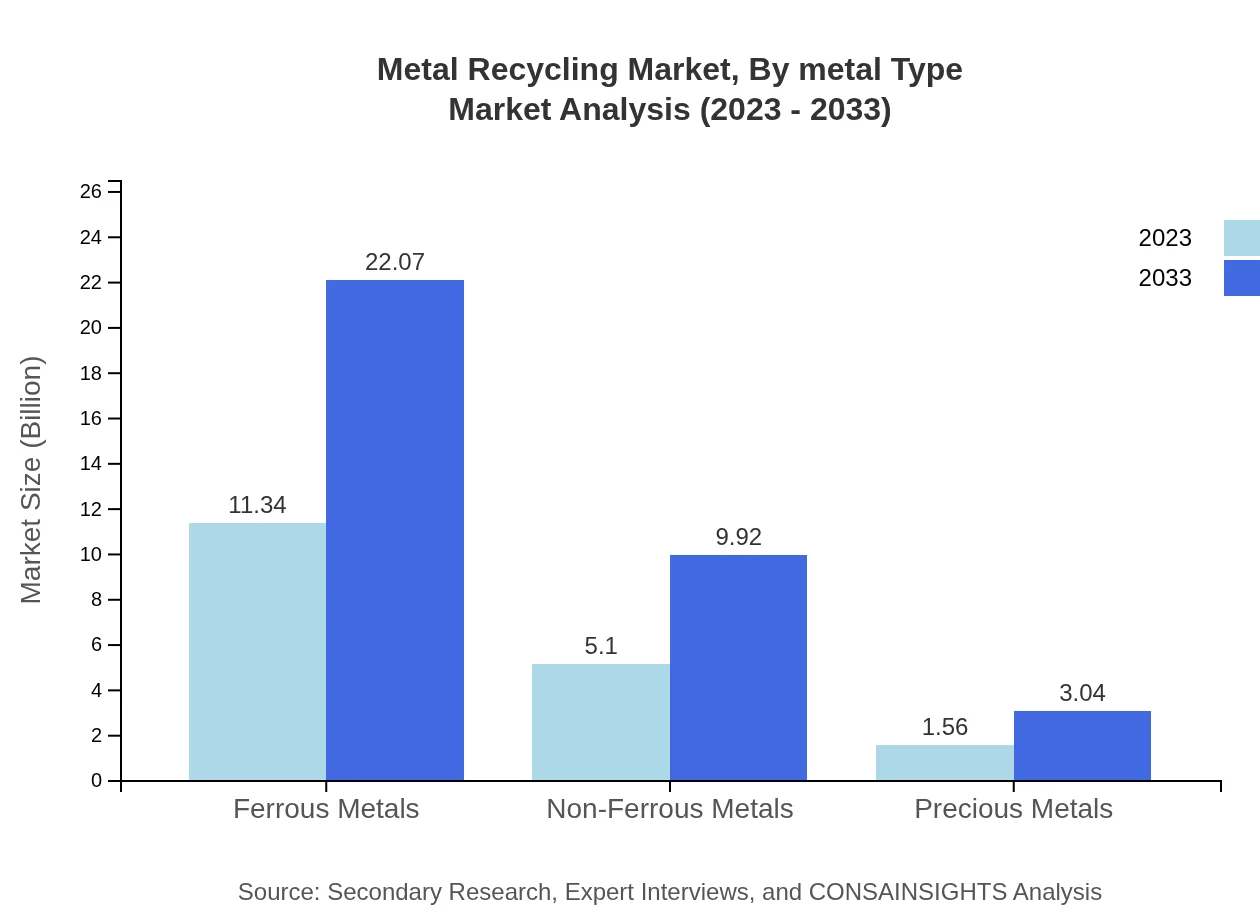

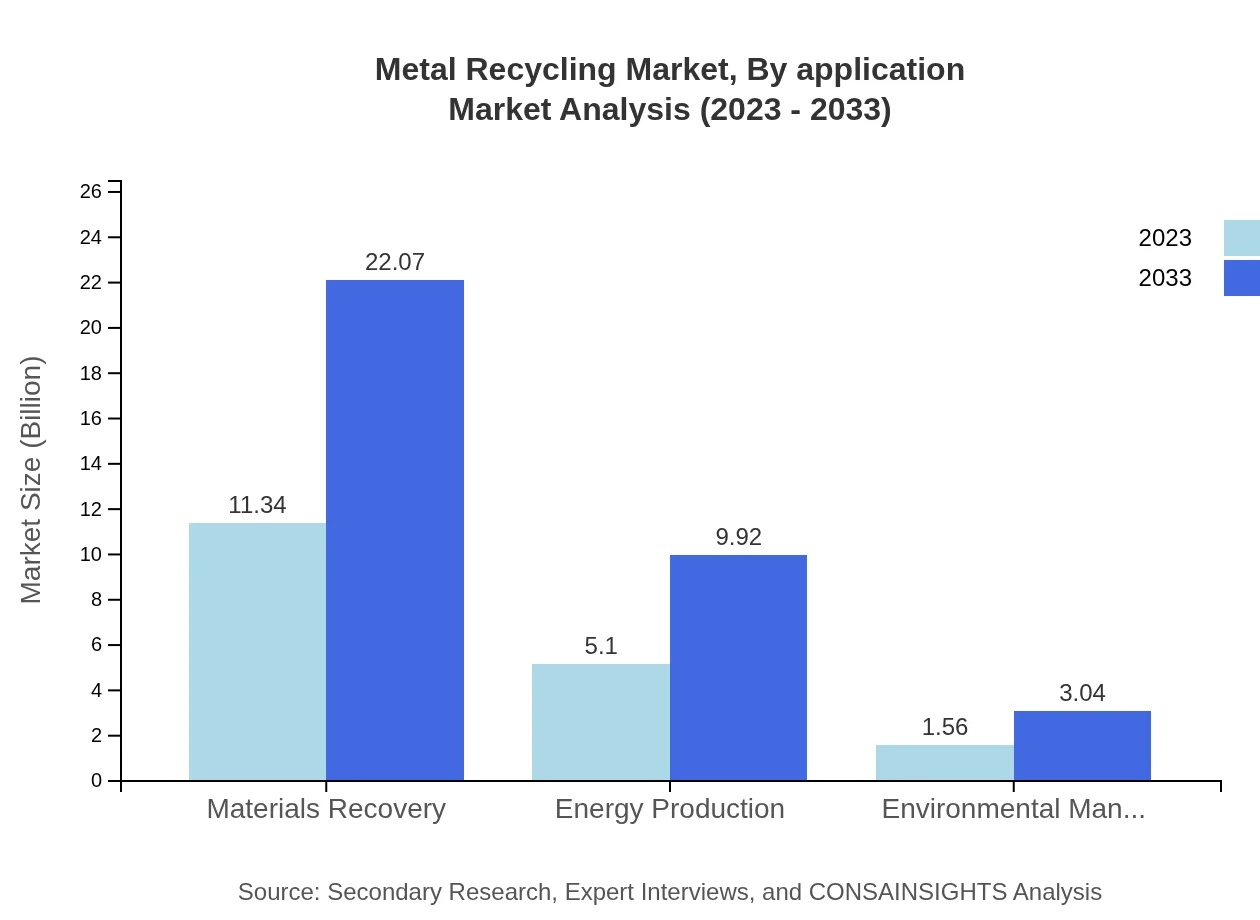

Metal Recycling Market Analysis By Metal Type

The market for Ferrous Metals is projected to grow from $11.34 billion in 2023 to $22.07 billion in 2033, maintaining a market share of 63%. Non-Ferrous Metals are expected to grow from $5.10 billion to $9.92 billion, sustaining a 28.32% market share. Precious Metals will see growth from $1.56 billion to $3.04 billion, while retaining an 8.68% share. Together, these segments reflect the diverse applications and demands of recycled metals in various industries.

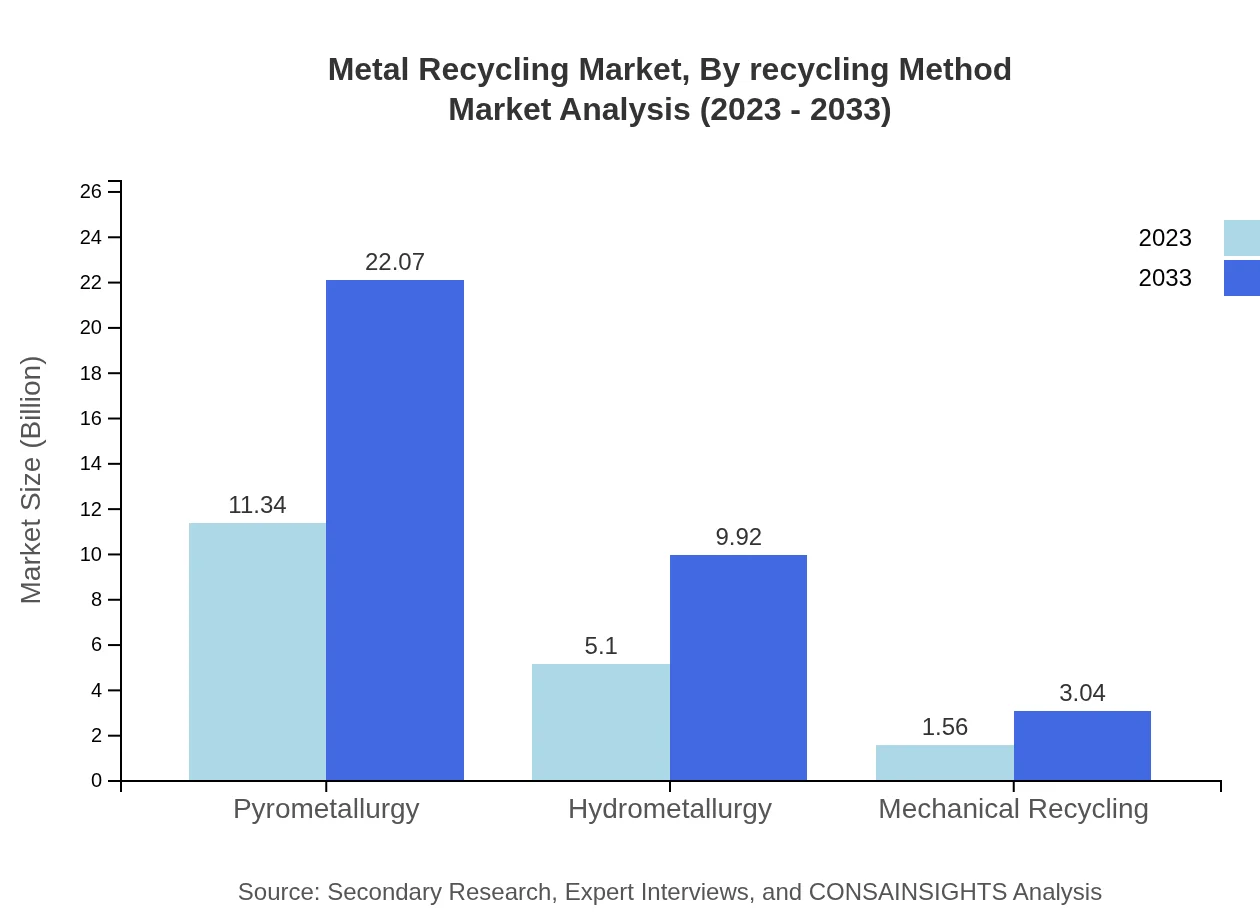

Metal Recycling Market Analysis By Recycling Method

In terms of recycling methods, Pyrometallurgy dominates the market size, growing from $11.34 billion in 2023 to $22.07 billion by 2033. Hydrometallurgy and Mechanical Recycling show promising growth, with sizes projected at $5.10 billion and $1.56 billion respectively in 2023, expected to rise to $9.92 billion and $3.04 billion by 2033. These segments are vital in shaping metal recycling processes effectively and sustainably.

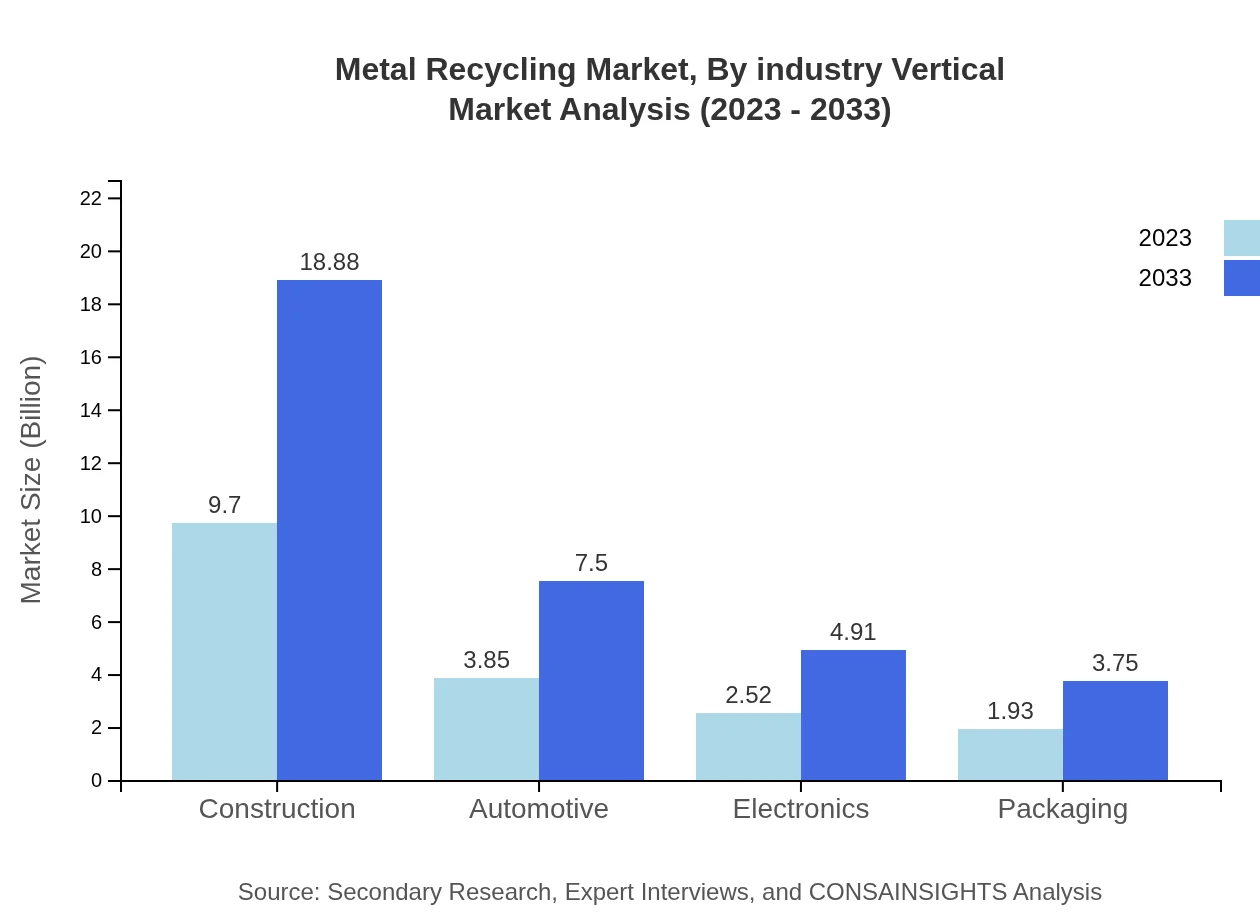

Metal Recycling Market Analysis By Industry Vertical

The Construction industry remains the largest vertical, expected to expand from $9.70 billion to $18.88 billion by 2033, capturing a market share of 53.88%. The Automotive sector follows closely, growing from $3.85 billion to $7.50 billion, with a 21.41% share. Electronics and Packaging also show significant numbers, reflecting the broad utilization of recycled metals across sectors.

Metal Recycling Market Analysis By Application

The increasing applications of recycled metals are evident across sectors. In the construction sector, recycled materials enhance structural integrity while being eco-friendly. Automotive applications benefit from cost savings and improved vehicle recyclability, while electronics recycling focuses on extracting valuable metals for reuse. The packaging industry increasingly adopts recycled metals to meet sustainable practices, contributing to overall market growth and efficiency.

Metal Recycling Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Metal Recycling Industry

Schnitzer Steel Industries Inc.:

Schnitzer Steel is one of the largest providers of recycled metals, operating numerous recycling facilities across the United States and underlining its commitment to environmentally friendly practices.Commercial Metals Company (CMC):

CMC operates a vertically integrated metals recycling business, processing ferrous and non-ferrous metals, with a focus on technological innovation to maximize recovery and efficiency.Nucor Corporation:

Nucor is a leading steel producer that plays a crucial role in metal recycling, promoting sustainable practices and operations that prioritize resource conservation while producing quality steel.ArcelorMittal:

As a global leader, ArcelorMittal emphasizes recycling and sustainability in its operations, focusing on reducing carbon emissions and promoting the circular economy within the steel industry.We're grateful to work with incredible clients.

FAQs

What is the market size of metal Recycling?

The global metal recycling market is currently valued at approximately $18 billion and is projected to grow at a CAGR of 6.7% from 2023 to 2033, reflecting a robust demand for recycled materials.

What are the key market players or companies in the metal Recycling industry?

Key players include well-established companies such as Sims Metal Management, European Metal Recycling Ltd., and OmniSource Corporation. These firms dominate the sector through extensive operations and innovative recycling technologies.

What are the primary factors driving the growth in the metal Recycling industry?

Growth in the metal recycling industry is primarily driven by increasing environmental concerns, government regulations promoting recycling, and the rising demand for sustainable materials in manufacturing processes.

Which region is the fastest Growing in the metal Recycling?

Asia Pacific is the fastest-growing region within the metal recycling market, with a projected market increase from $2.94 billion in 2023 to $5.72 billion by 2033, showcasing a growing emphasis on recycling in manufacturing.

Does ConsaInsights provide customized market report data for the metal Recycling industry?

Yes, ConsaInsights offers tailored market report data specific to the metal-recycling industry, allowing clients to obtain insights that cater to their unique business needs and market focuses.

What deliverables can I expect from this metal Recycling market research project?

Deliverables include comprehensive market analysis reports, growth forecasts, competitive landscape assessments, key trends, and segment-specific insights, enabling informed decision-making.

What are the market trends of metal Recycling?

Current trends include a growing emphasis on zero-waste initiatives, advancements in recycling technologies, and collaboration between sectors to enhance material recovery processes, driving sustainable practices.