Military Aviation Maintenance Repair And Overhaul Market Report

Published Date: 03 February 2026 | Report Code: military-aviation-maintenance-repair-and-overhaul

Military Aviation Maintenance Repair And Overhaul Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Military Aviation Maintenance Repair and Overhaul (MRO) market from 2023 to 2033, examining the trends, growth opportunities, and regional developments impacting the sector.

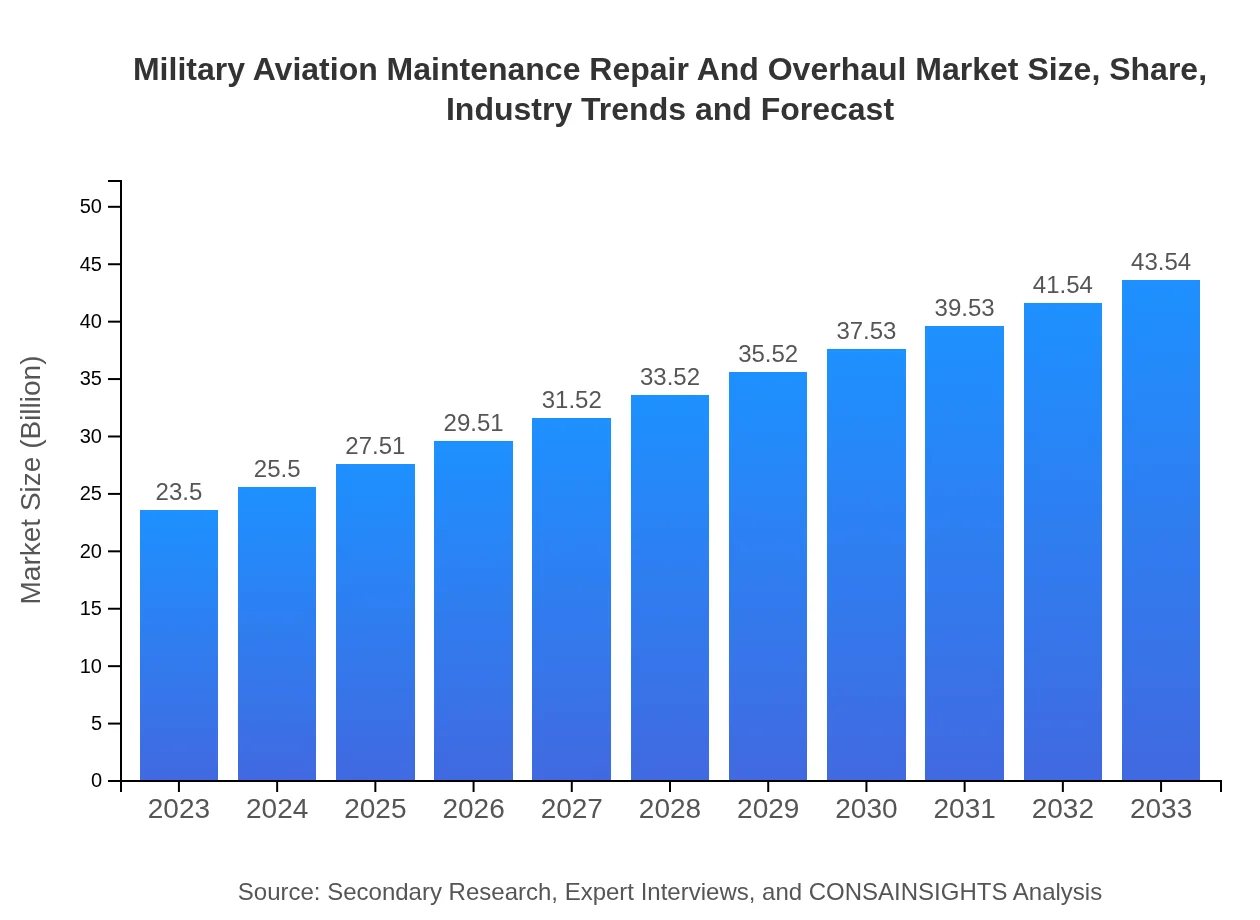

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $23.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $43.54 Billion |

| Top Companies | Lockheed Martin, Boeing , Northrop Grumman, BAE Systems |

| Last Modified Date | 03 February 2026 |

Military Aviation Maintenance Repair And Overhaul Market Overview

Customize Military Aviation Maintenance Repair And Overhaul Market Report market research report

- ✔ Get in-depth analysis of Military Aviation Maintenance Repair And Overhaul market size, growth, and forecasts.

- ✔ Understand Military Aviation Maintenance Repair And Overhaul's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Military Aviation Maintenance Repair And Overhaul

What is the Market Size & CAGR of Military Aviation Maintenance Repair And Overhaul market in 2023?

Military Aviation Maintenance Repair And Overhaul Industry Analysis

Military Aviation Maintenance Repair And Overhaul Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Military Aviation Maintenance Repair And Overhaul Market Analysis Report by Region

Europe Military Aviation Maintenance Repair And Overhaul Market Report:

Europe's Military Aviation MRO market is projected to grow from $6.26 billion in 2023 to $11.59 billion by 2033. The increasing focus on NATO commitments, enhanced defense budgets, and advanced training regarding MRO practices are shaping the European market’s landscape.Asia Pacific Military Aviation Maintenance Repair And Overhaul Market Report:

The Asia-Pacific Military Aviation MRO market is experiencing rapid growth, driven by increased defense spending and modernization initiatives. In 2023, it was valued at $4.48 billion, projected to reach $8.30 billion by 2033. The key drivers include geopolitical tensions and collaborations among countries for joint defense capabilities.North America Military Aviation Maintenance Repair And Overhaul Market Report:

North America holds a significant share of the Military Aviation MRO market, valued at $8.93 billion in 2023 and expected to reach $16.55 billion by 2033. The presence of key industry players, along with substantial investments from the U.S. military in modernization and readiness programs, are essential factors driving market growth.South America Military Aviation Maintenance Repair And Overhaul Market Report:

In South America, the Military Aviation MRO market has seen modest growth primarily due to budget constraints in defense spending. Valued at $0.66 billion in 2023, it is expected to grow to $1.21 billion by 2033 as countries prioritize some modernization efforts to enhance their military capabilities.Middle East & Africa Military Aviation Maintenance Repair And Overhaul Market Report:

The Middle East and Africa region is witnessing shifts in military aviation focus, with a market size of $3.18 billion in 2023 projected to grow to $5.89 billion by 2033. Rising tensions and increased military expenditures are attributed to the growing demand for MRO services.Tell us your focus area and get a customized research report.

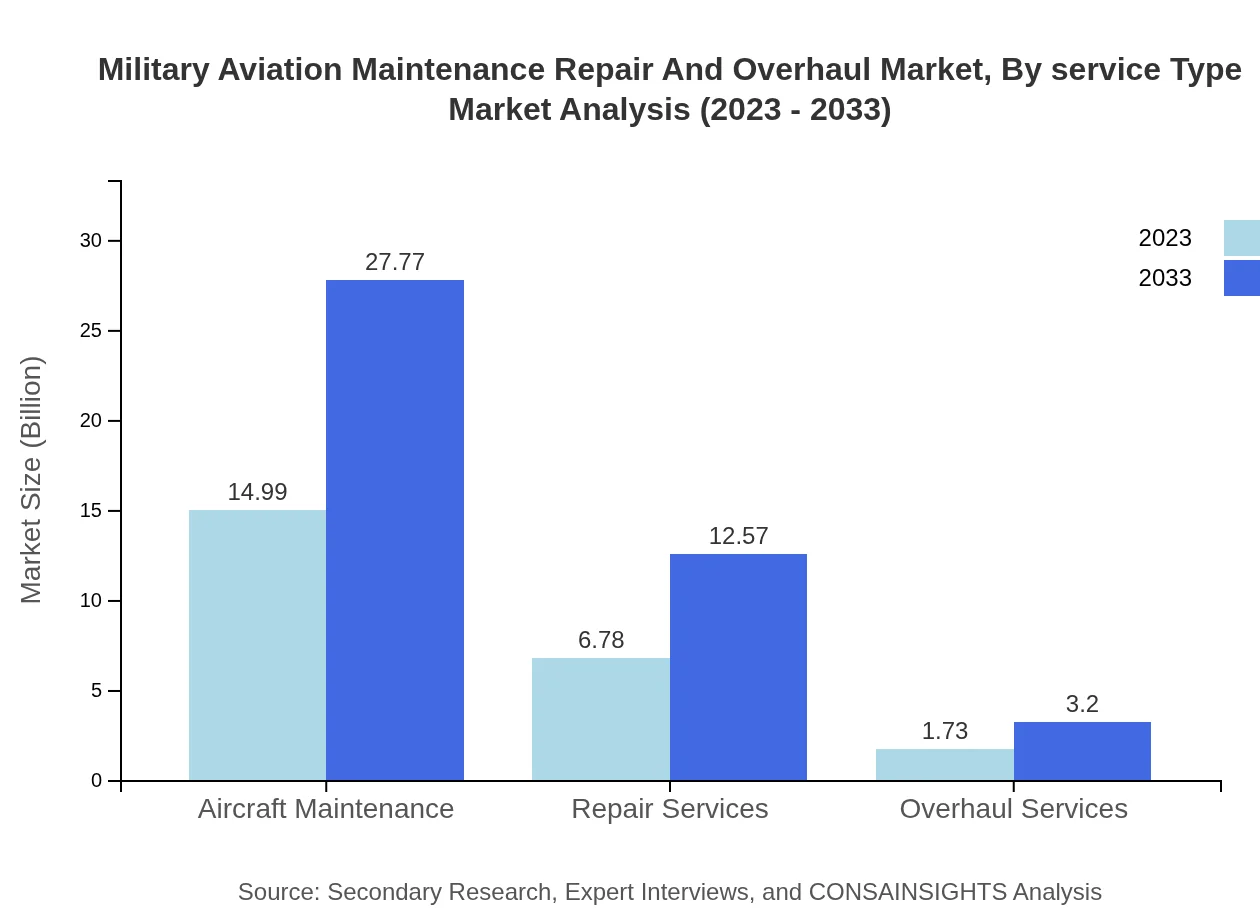

Military Aviation Maintenance Repair And Overhaul Market Analysis By Service Type

The service type segment is dominated by MRO software, with a significant market size of $19.89 billion in 2023, projected to increase to $36.85 billion by 2033. Aircraft maintenance and repair services are crucial, accounting for substantial shares in the overall market. Emerging trends include predictive maintenance and use of diagnostic tools that enhance efficiency.

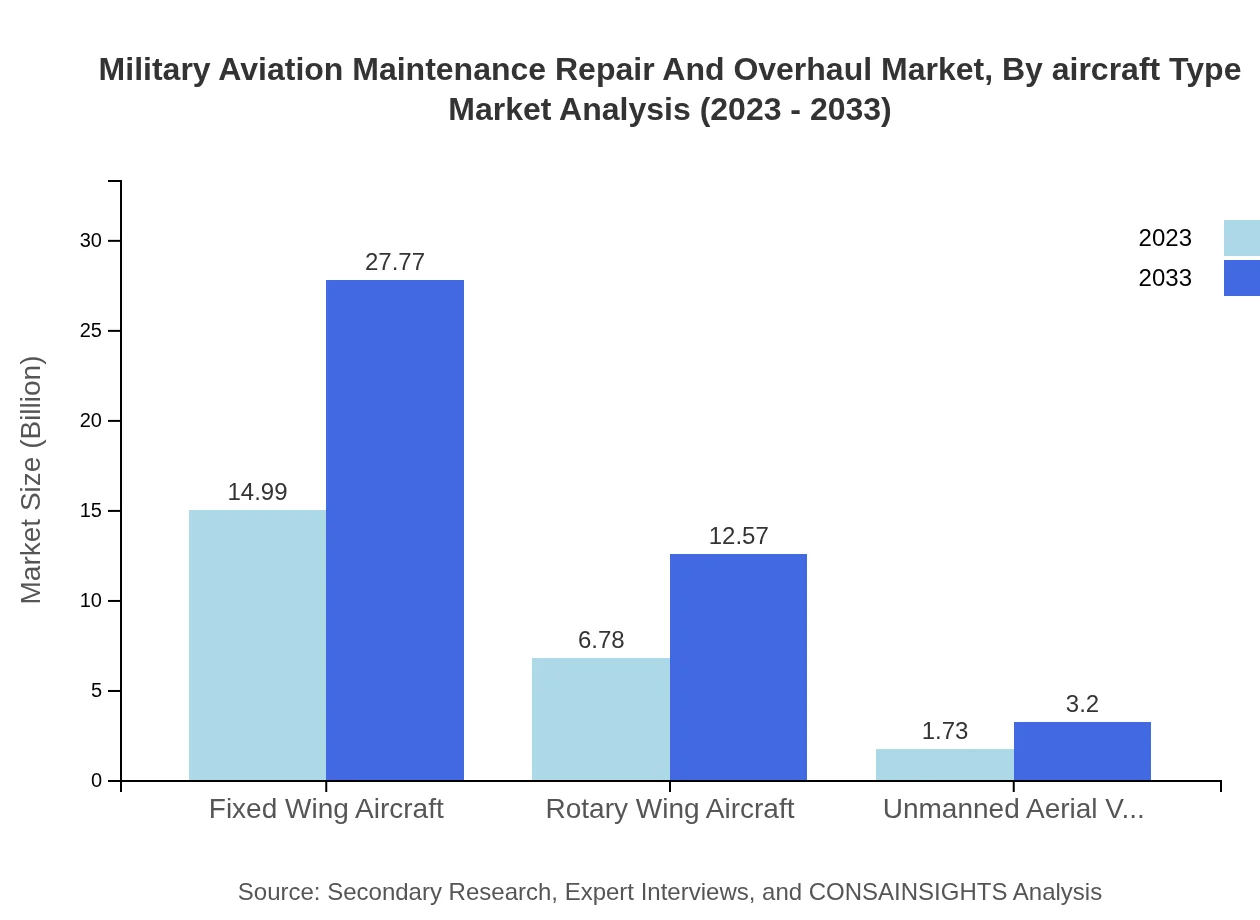

Military Aviation Maintenance Repair And Overhaul Market Analysis By Aircraft Type

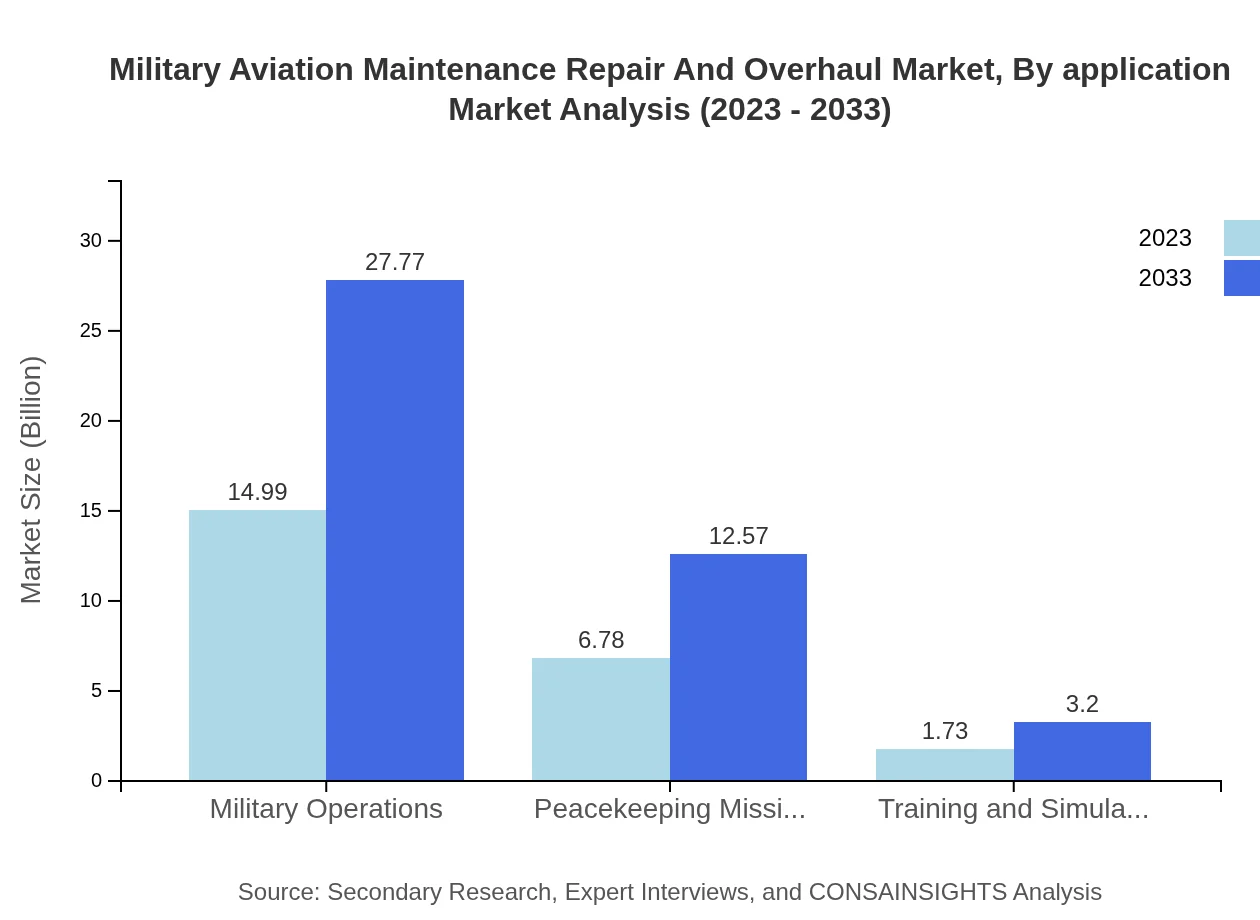

The aircraft type segment highlights a notable focus on fixed-wing aircraft, which represented $14.99 billion in 2023 and will reach $27.77 billion by 2033. Rotary wing and UAVs follow suit, showcasing a growing segment with significant shares due to enhanced capabilities for modern military operations.

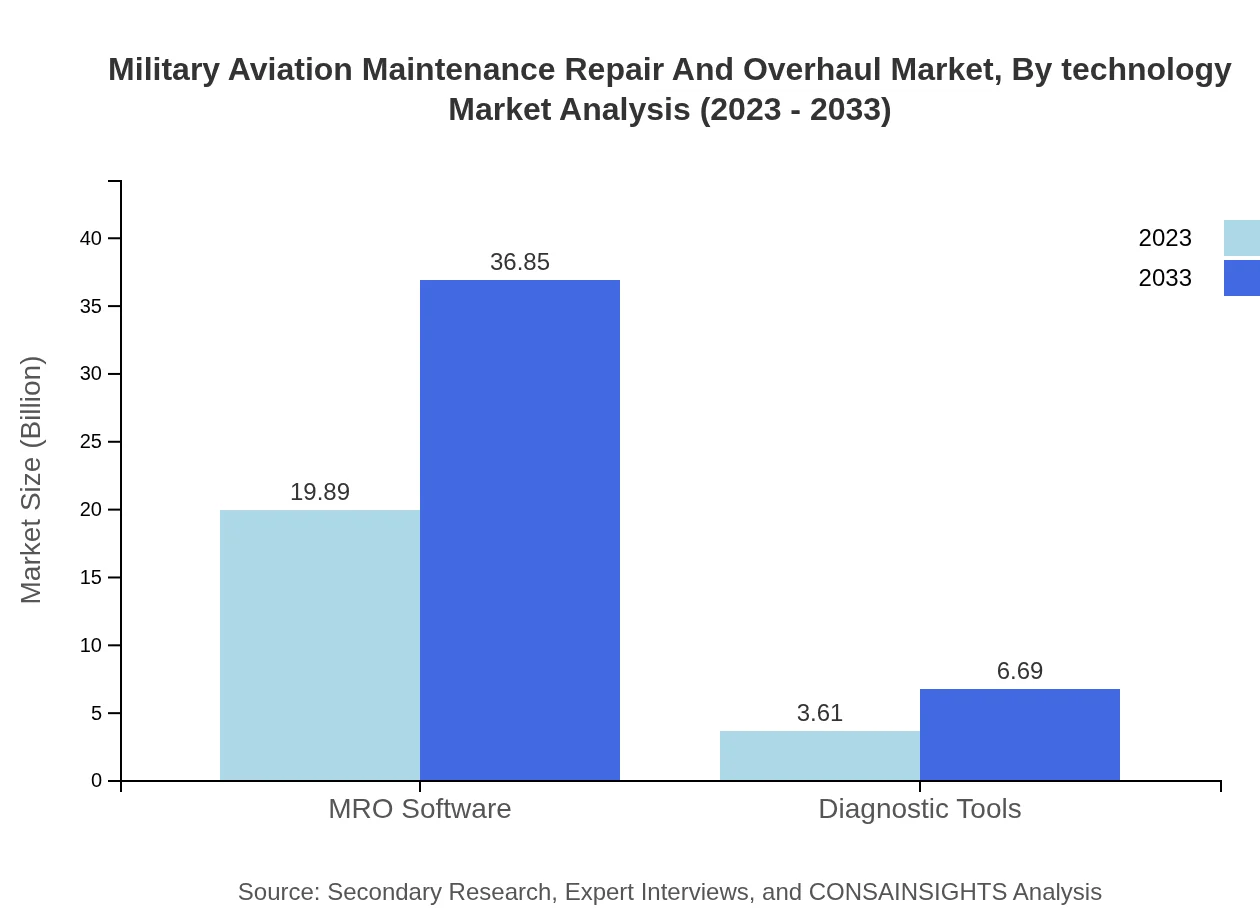

Military Aviation Maintenance Repair And Overhaul Market Analysis By Technology

The technology analysis underscores the essential role of MRO software, with a market size of $19.89 billion in 2023. Advanced diagnostic tools, valued at $3.61 billion, are critical in ensuring timely repairs and maintenance, thus improving operational readiness within military frameworks.

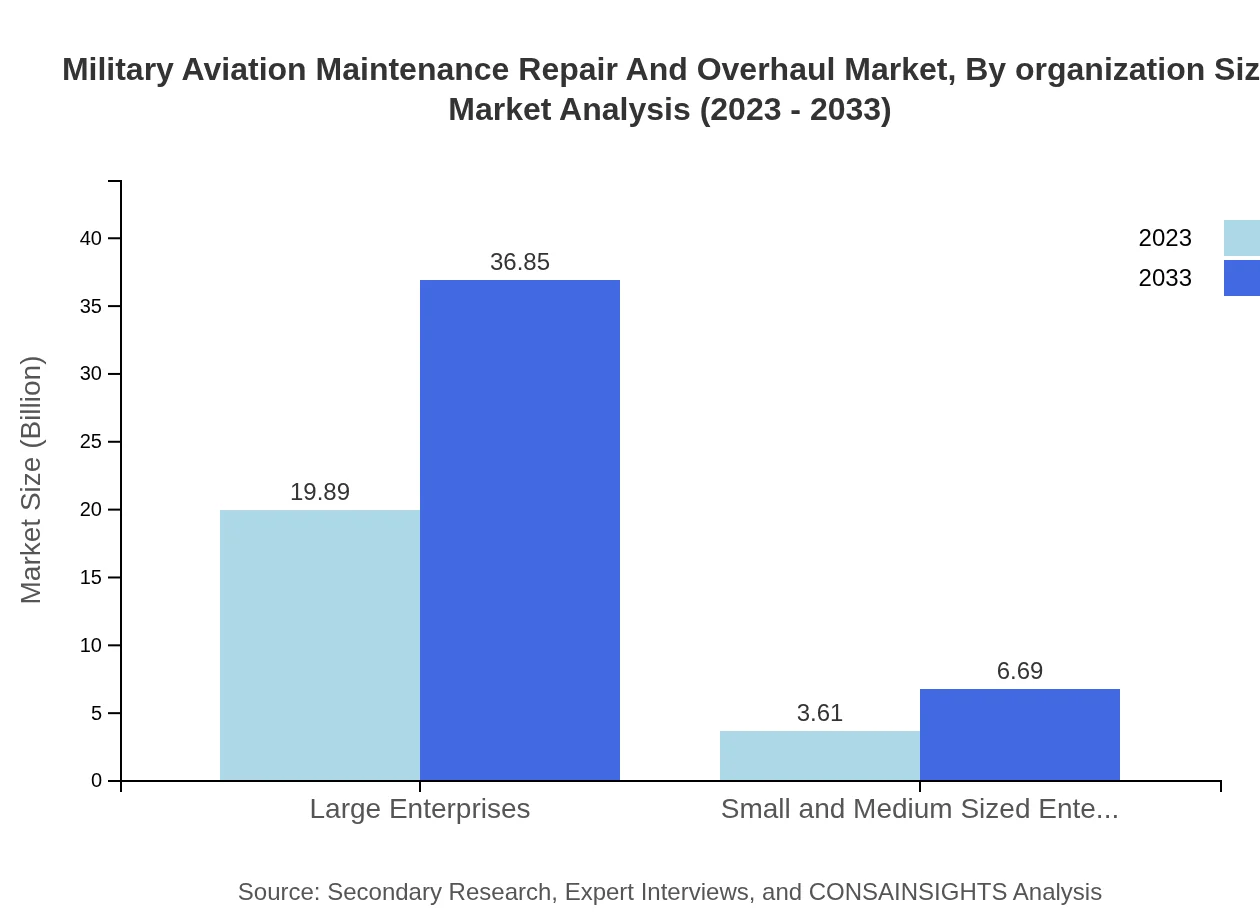

Military Aviation Maintenance Repair And Overhaul Market Analysis By Organization Size

In terms of organization size, large enterprises dominate the Military Aviation MRO market with $19.89 billion in 2023 and 84.63% market share. This is due to the extensive capabilities and resources they possess compared to small and medium-sized enterprises, which are projected to grow gradually in this sector.

Military Aviation Maintenance Repair And Overhaul Market Analysis By Application

The application segment reveals military operations as the leading contributor to MRO services, valued at $14.99 billion in 2023. Peacekeeping missions and training and simulations also make significant impacts, underlining the necessity of specialized MRO tailored for various military applications.

Military Aviation Maintenance Repair And Overhaul Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Military Aviation Maintenance Repair And Overhaul Industry

Lockheed Martin:

A major player in defense contracting, Lockheed Martin provides comprehensive MRO services for military aircraft, focusing on cutting-edge technology and operational efficiency.Boeing :

Boeing is pivotal in the MRO sector, offering a wide range of services from aircraft maintenance to complete overhaul and modification for military aircraft.Northrop Grumman:

Northrop Grumman specializes in advanced systems integration and provides MRO services for various military platforms, enhancing readiness and sustainability.BAE Systems:

BAE Systems offers comprehensive support services including maintenance, repair, and logistic support for military aerospace applications, focusing on modernizing fleet capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of military aviation maintenance, repair, and overhaul?

The military aviation maintenance, repair, and overhaul (MRO) market size reached $23.5 billion in 2023, with a projected CAGR of 6.2% over the next ten years, indicating robust growth driven by increasing defense budgets and modernization initiatives.

What are the key market players or companies in the military aviation maintenance, repair, and overhaul industry?

Key players in the military aviation MRO industry include Boeing, Lockheed Martin, Northrop Grumman, and Raytheon Technologies, which dominate through technological advancements, extensive service portfolios, and government contracts.

What are the primary factors driving the growth in the military aviation maintenance, repair, and overhaul industry?

Growth in the military aviation MRO sector is driven by increasing demand for modernization, rising defense budgets, technological advancements, and the need for improved operational efficiency among armed forces worldwide.

Which region is the fastest Growing in the military aviation maintenance, repair, and overhaul?

The North America region is the fastest-growing market for military aviation MRO, with a size expected to grow from $8.93 billion in 2023 to $16.55 billion by 2033, fueled by significant defense expenditures.

Does ConsaInsights provide customized market report data for the military aviation maintenance, repair, and overhaul industry?

Yes, ConsaInsights offers customized market report data for the military aviation MRO industry, allowing clients to obtain in-depth insights tailored to their specific business needs and market dynamics.

What deliverables can I expect from this military aviation maintenance, repair, and overhaul market research project?

Deliverables from the military aviation MRO market research project typically include comprehensive reports, regional analyses, segment data, competitive landscape overview, and actionable insights for strategic planning.

What are the market trends of military aviation maintenance, repair, and overhaul?

Key trends in the military aviation MRO market include increasing automation, adoption of digital technologies, emphasis on sustainability, and a shift towards predictive maintenance practices to enhance operational readiness.