Mobile Crane Market Report

Published Date: 02 February 2026 | Report Code: mobile-crane

Mobile Crane Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Mobile Crane market spanning from 2023 to 2033, encompassing insights on market size, growth trends, regional performances, and key players, offering a comprehensive view of future opportunities and challenges.

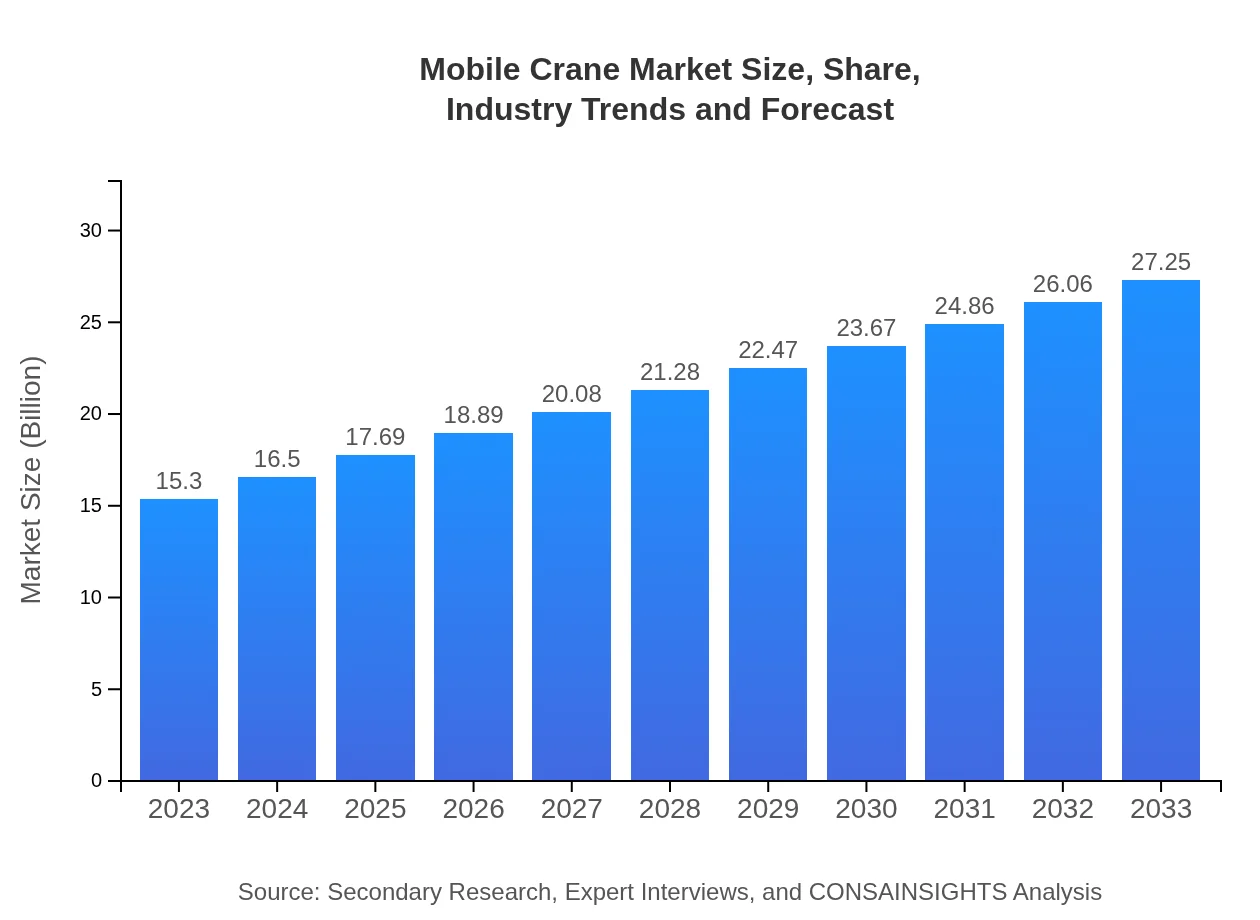

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.30 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $27.25 Billion |

| Top Companies | Liebherr Group, Terex Corporation, Hitachi Sumitomo Heavy Industries Construction Cranes Co., Ltd., Zoomlion Heavy Industry Science & Technology Co., Ltd., XCMG Group |

| Last Modified Date | 02 February 2026 |

Mobile Crane Market Overview

Customize Mobile Crane Market Report market research report

- ✔ Get in-depth analysis of Mobile Crane market size, growth, and forecasts.

- ✔ Understand Mobile Crane's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mobile Crane

What is the Market Size & CAGR of Mobile Crane market in 2023 and 2033?

Mobile Crane Industry Analysis

Mobile Crane Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mobile Crane Market Analysis Report by Region

Europe Mobile Crane Market Report:

In Europe, the market size is expected to rise from 4.40 billion USD in 2023 to 7.84 billion USD by 2033, with countries like Germany and the UK spearheading infrastructural advancement and renewable energy projects, thereby increasing the demand for efficient lifting equipment.Asia Pacific Mobile Crane Market Report:

The Asia Pacific region is expected to witness rapid growth in the mobile crane market, increasing from 3.03 billion USD in 2023 to approximately 5.40 billion USD by 2033, driven by booming infrastructure projects and urbanization trends, particularly in countries like China and India.North America Mobile Crane Market Report:

North America is anticipated to grow from 5.57 billion USD in 2023 to 9.91 billion USD by 2033. The U.S. is at the forefront of this growth, with ongoing residential and non-residential construction projects driving a consistent demand for mobile cranes.South America Mobile Crane Market Report:

In South America, the market is projected to grow from 1.20 billion USD in 2023 to 2.14 billion USD in 2033. Brazil and Argentina are notable contributors, with substantial investments in transport and building infrastructure poised to fuel demand for mobile cranes.Middle East & Africa Mobile Crane Market Report:

The Middle East and Africa market is projected to increase from 1.10 billion USD in 2023 to 1.95 billion USD by 2033, with significant contributions from the UAE and Saudi Arabia, driven by mega construction projects and investments in oil and gas.Tell us your focus area and get a customized research report.

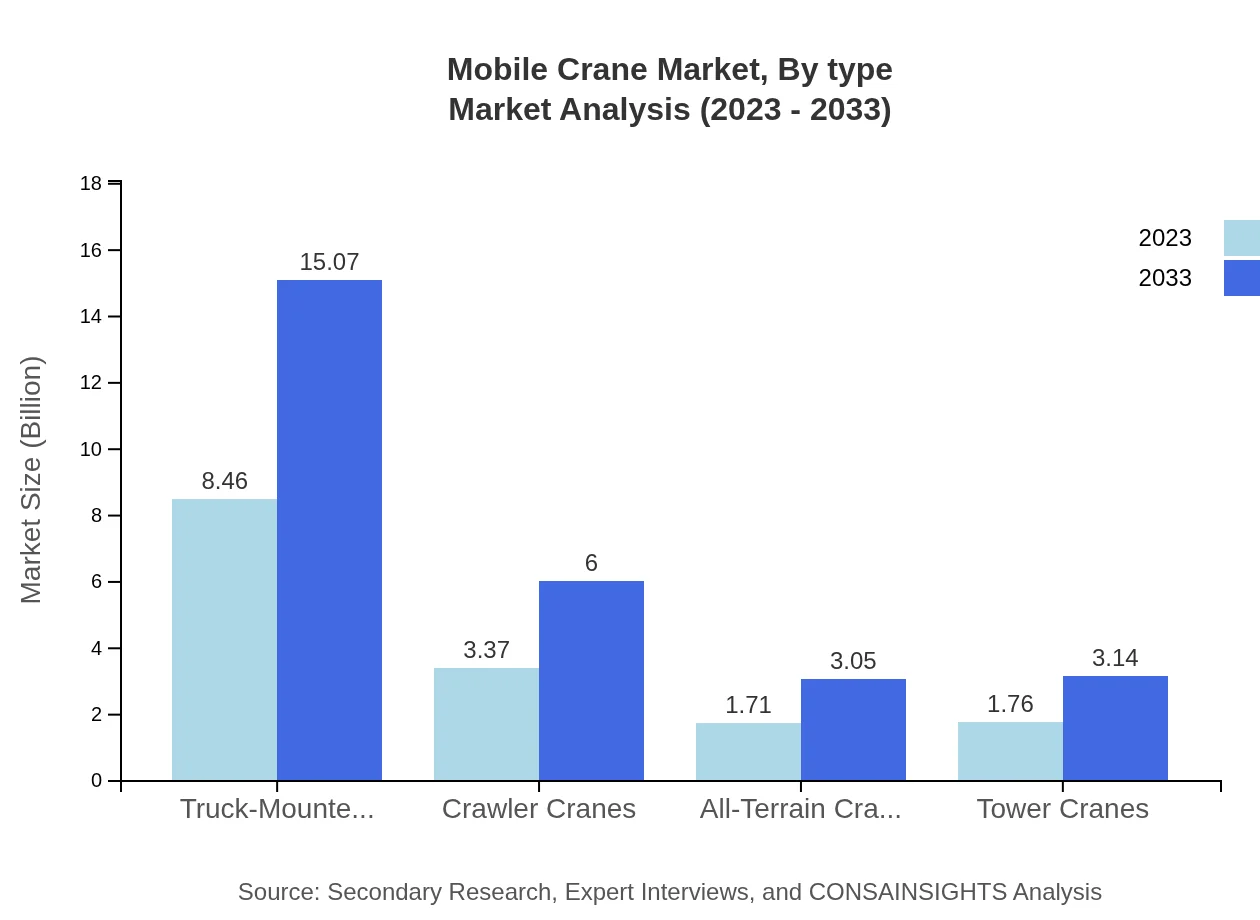

Mobile Crane Market Analysis By Type

Truck-mounted cranes dominate the mobile crane segment, with an estimated market size of 8.46 billion USD in 2023, reaching 15.07 billion USD by 2033, maintaining a share of 55.3%. Crawler cranes follow with 3.37 billion USD and are expected to grow to 6.00 billion USD. All-terrain cranes and tower cranes are also significant players, showcasing diverse capabilities for varied lifting tasks.

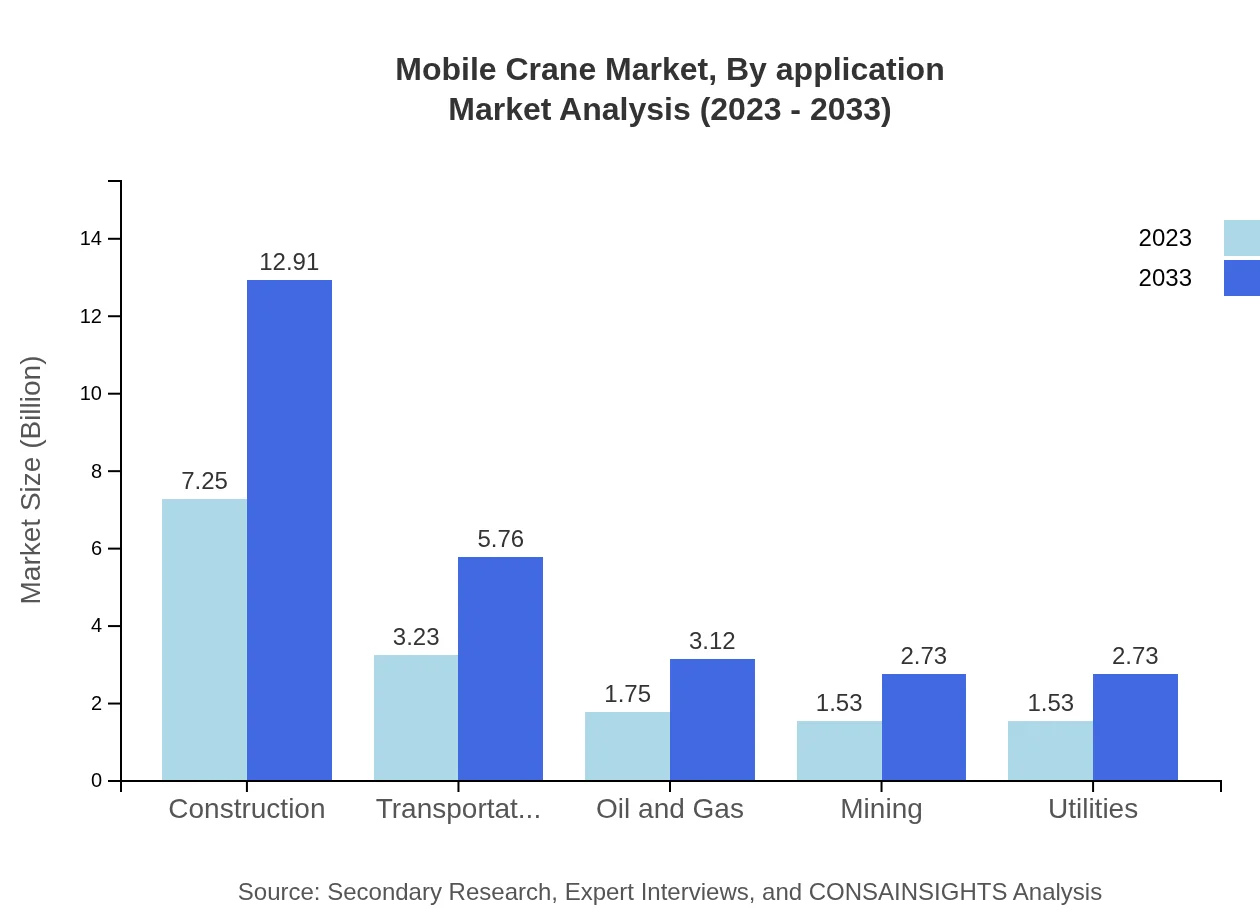

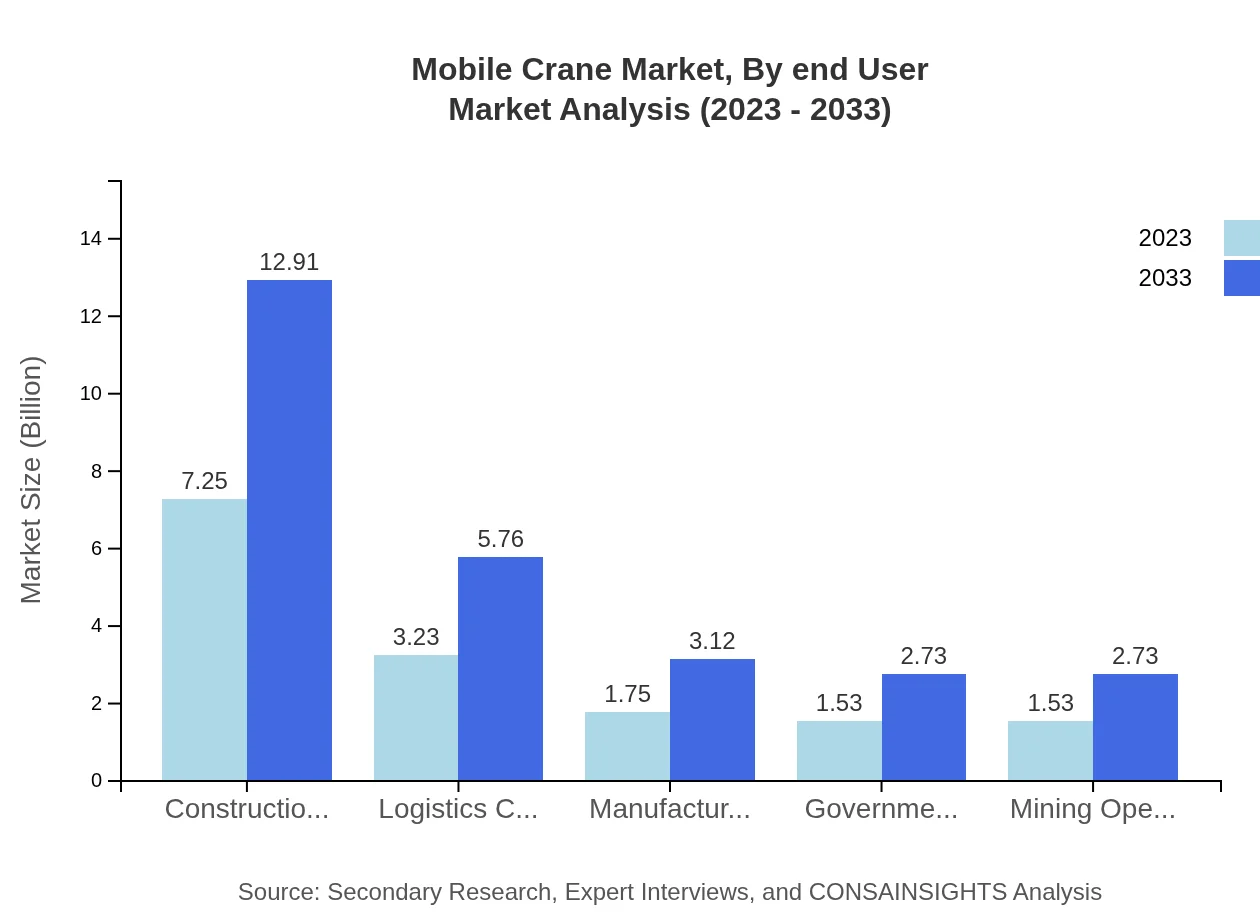

Mobile Crane Market Analysis By Application

Construction remains the largest application segment, accounting for approximately 7.25 billion USD in 2023, forecasted to rise to 12.91 billion USD by 2033, driven by ongoing global infrastructure projects. Logistics companies are also a critical segment, projected to grow from 3.23 billion USD to 5.76 billion USD, highlighting the equipment's role in efficient supply chain operations.

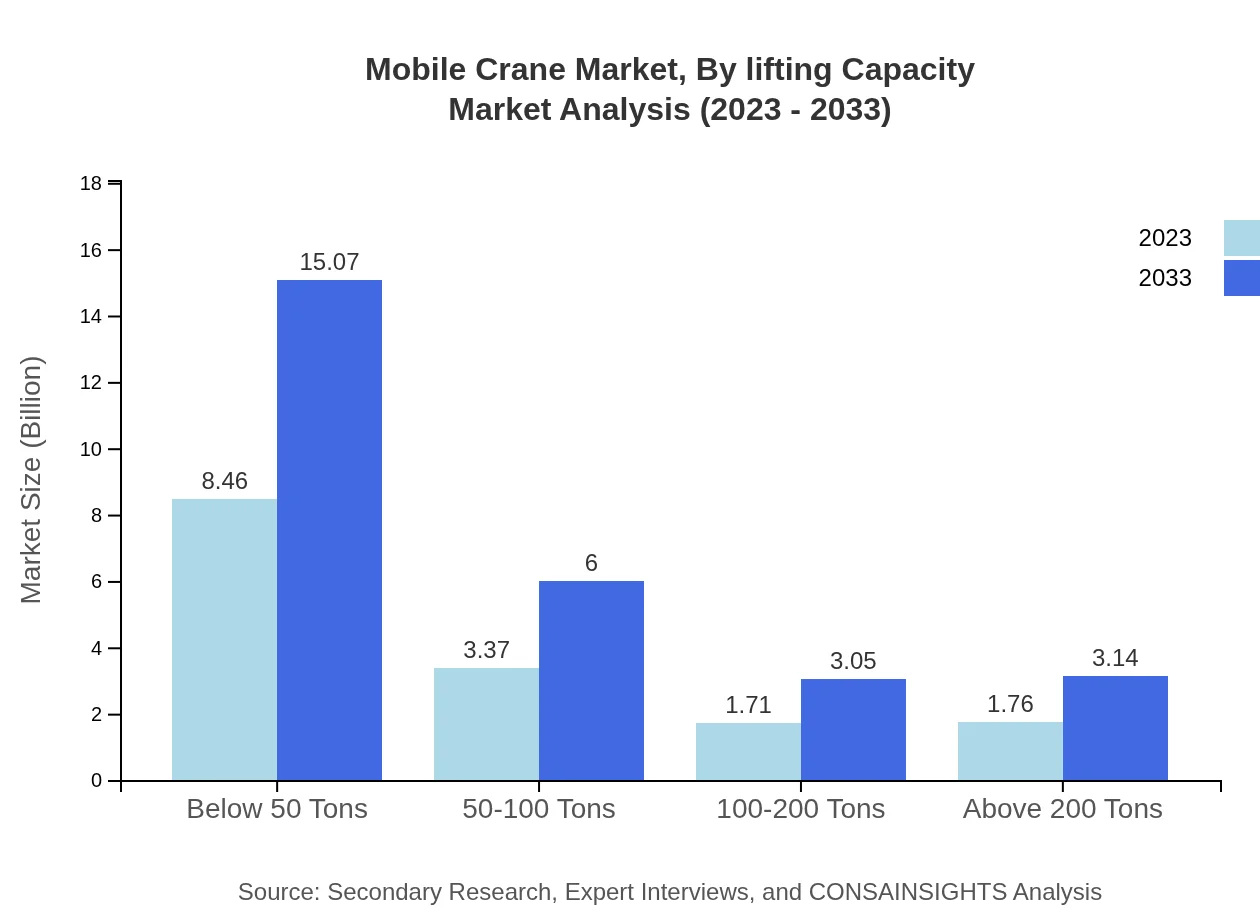

Mobile Crane Market Analysis By Lifting Capacity

Mobile cranes are categorized largely between below 50 tons and above 200 tons, with the below 50 tons segment leading the market at 8.46 billion USD in 2023, expected to grow to 15.07 billion USD. Cranes in the 50-100 tons category and above 200 tons also play significant roles, reflecting diverse usage scenarios in various industries.

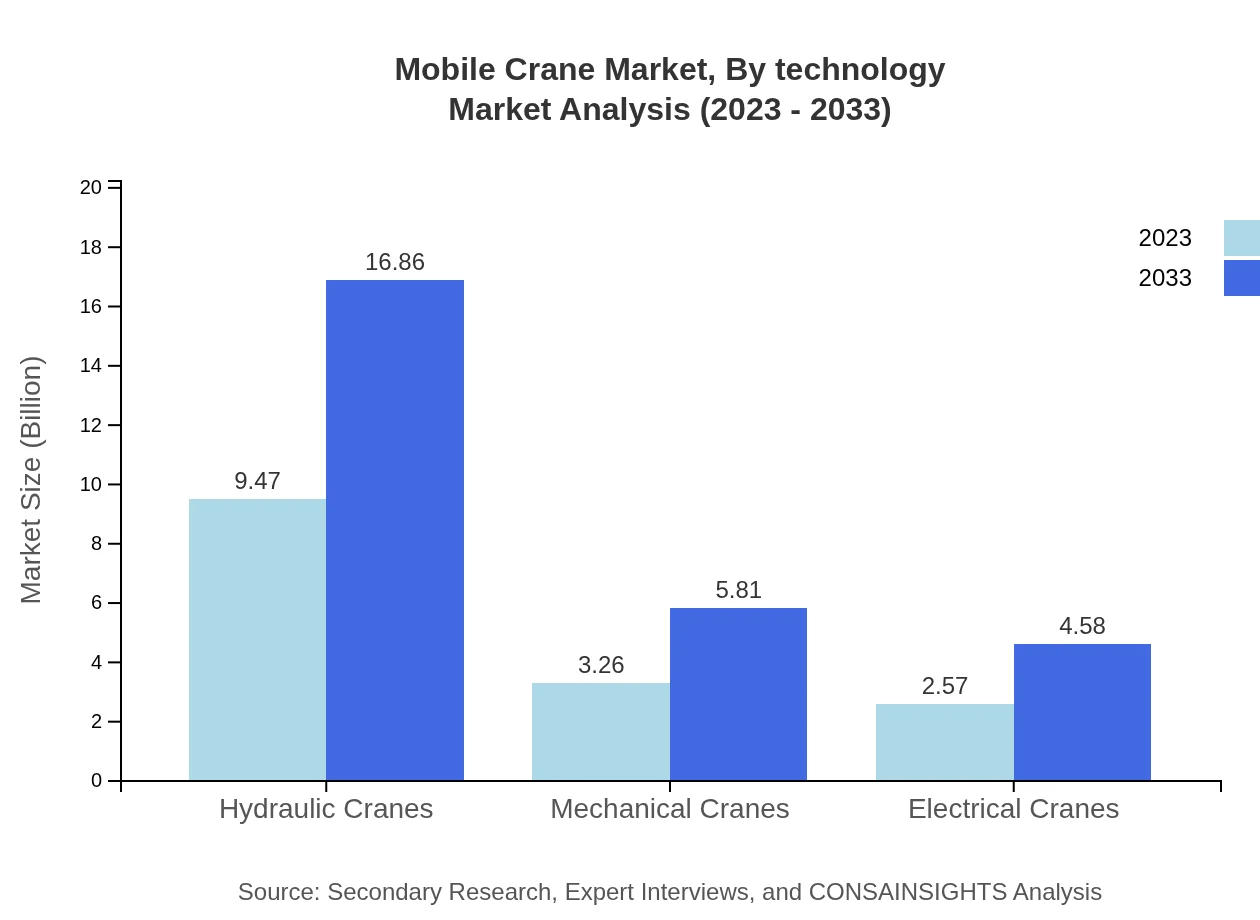

Mobile Crane Market Analysis By Technology

Technological advancements are transforming the crane market, with hydraulic and mechanical cranes represented significantly, comprising 61.88% and 21.31% of the market share respectively. Companies are increasingly adopting smart technologies, enhancing operational efficiency and safety.

Mobile Crane Market Analysis By End User

The construction sector remains the dominant end-user, responsible for approximately 47.39% of the market share in 2023. However, logistics, manufacturing, and mining also contribute significantly, reflecting the mobile crane's versatility across various sectors.

Mobile Crane Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mobile Crane Industry

Liebherr Group:

A leading manufacturer of construction machinery, Liebherr Group excels in producing innovative mobile cranes known for their exceptional quality and advanced technology.Terex Corporation:

Terex Corporation is a prominent player in the mobile crane market, offering a wide range of products with a focus on efficiency and performance across construction and mining sectors.Hitachi Sumitomo Heavy Industries Construction Cranes Co., Ltd.:

Hitachi is recognized for its contributions to the mobile crane industry through advanced design and manufacturing processes that enhance operational capabilities.Zoomlion Heavy Industry Science & Technology Co., Ltd.:

A major global player from China, Zoomlion leads in mobile crane innovations, integrating smart technology for enhanced performance.XCMG Group:

XCMG Group is one of the largest construction machinery manufacturers in China, providing a diverse range of mobile cranes tailored to various lifting needs.We're grateful to work with incredible clients.

FAQs

What is the market size of mobile crane?

The global mobile crane market is projected to reach approximately $15.3 billion by 2033, growing at a CAGR of 5.8% from an estimated size of $15 billion in 2023. This steady growth is fueled by rising construction and infrastructure development.

What are the key market players or companies in the mobile crane industry?

Key players in the mobile crane industry include leading manufacturers such as Liebherr, Terex, and Manitowoc. These companies are known for their innovative engineering and extensive product ranges to address diverse customer needs across various sectors.

What are the primary factors driving the growth in the mobile crane industry?

Growth in the mobile crane industry is primarily driven by increasing urbanization, growing demand for infrastructure development, and advancements in crane technology. The need for efficient and high-capacity lifting solutions further accelerates market expansion.

Which region is the fastest Growing in the mobile crane market?

The Asia Pacific region is the fastest-growing market for mobile cranes, projected to increase from $3.03 billion in 2023 to $5.4 billion by 2033. This growth is bolstered by rapid urbanization and substantial investment in infrastructure projects.

Does ConsaInsights provide customized market report data for the mobile crane industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the mobile crane industry. This includes segmentation by region, application, and technology trends, ensuring relevant and actionable insights.

What deliverables can I expect from this mobile crane market research project?

In a mobile crane market research project, clients can expect detailed reports including market size analysis, growth forecasts, competitive landscape assessments, and insights into key trends and consumer behaviors.

What are the market trends of mobile crane?

Current trends in the mobile crane market include the increasing use of electric and hybrid cranes, advancements in automation technology, and a growing focus on sustainability. These trends reflect the industry's response to environmental concerns and operational efficiency.