Mountain Warfare Market Report

Published Date: 03 February 2026 | Report Code: mountain-warfare

Mountain Warfare Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Mountain Warfare market, covering insights into market dynamics, size, trends, and forecasts from 2023 to 2033, focusing on technological advancements and regional growth patterns.

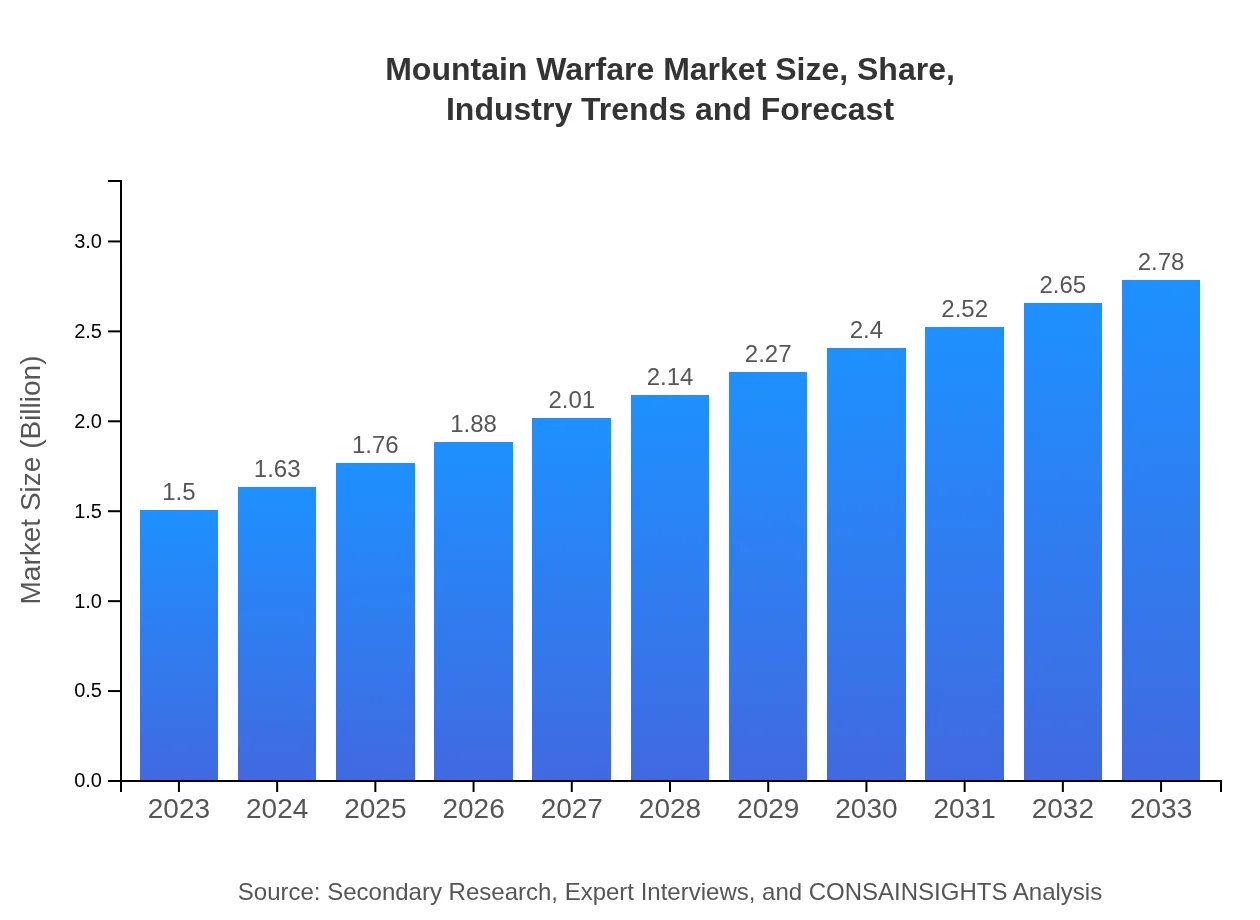

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Lockheed Martin, BAE Systems, Northrop Grumman, Thales Group, General Dynamics |

| Last Modified Date | 03 February 2026 |

Mountain Warfare Market Overview

Customize Mountain Warfare Market Report market research report

- ✔ Get in-depth analysis of Mountain Warfare market size, growth, and forecasts.

- ✔ Understand Mountain Warfare's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mountain Warfare

What is the Market Size & CAGR of Mountain Warfare market in 2023?

Mountain Warfare Industry Analysis

Mountain Warfare Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mountain Warfare Market Analysis Report by Region

Europe Mountain Warfare Market Report:

Europe's market is anticipated to grow from $0.48 billion in 2023 to $0.89 billion by 2033. Nations such as NATO member states focus on collective defense strategies and calibration of equipment suited for alpine operations, reflecting a systematic modernization approach.Asia Pacific Mountain Warfare Market Report:

The Asia Pacific region is estimated at $0.27 billion in 2023, with projections of reaching $0.49 billion by 2033. Rising defense budgets in countries like India, China, and Japan are attributed to escalating security challenges, prompting investments in mountain warfare capabilities including advanced surveillance and communication systems.North America Mountain Warfare Market Report:

North America leads the market with a value of $0.56 billion in 2023, projected to grow to $1.03 billion by 2033. The U.S. military continues to enhance its mountain warfare capabilities through significant defense spending on advanced technology and equipment for critical mountain operations.South America Mountain Warfare Market Report:

South America currently stands at $0.08 billion in the Mountain Warfare market for 2023, expected to grow to $0.15 billion by 2033. The increasing necessity for government modernization alongside regional collaboration for anti-narcotics operations drives interest in specialized equipment.Middle East & Africa Mountain Warfare Market Report:

In the Middle East and Africa, the market size is forecasted to increase from $0.12 billion in 2023 to $0.22 billion by 2033. Political instability in the region amplifies the demand for reliable military operational capabilities in varied terrains, hence elevating interest in mountain warfare applications.Tell us your focus area and get a customized research report.

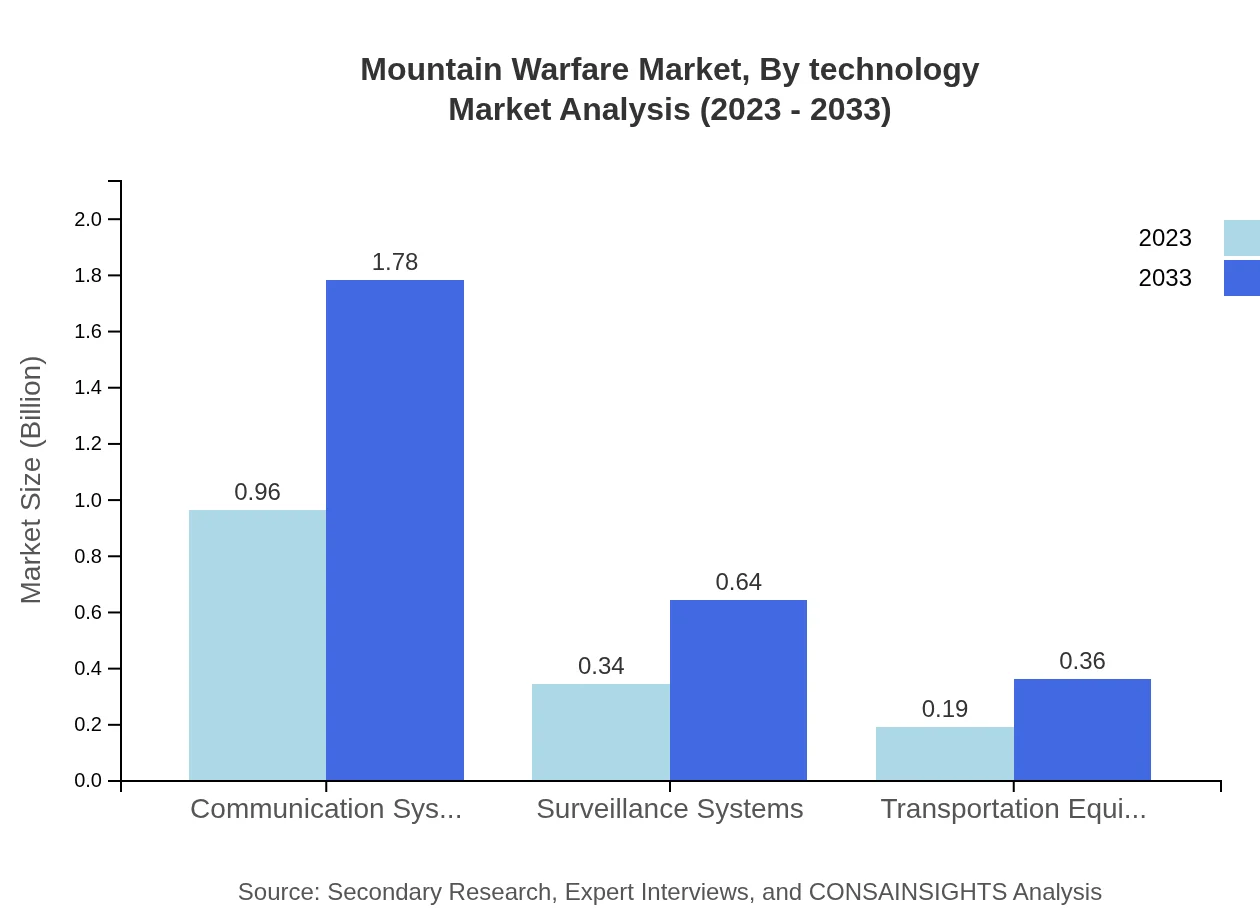

Mountain Warfare Market Analysis By Technology

The Mountain Warfare Market, By Technology primarily comprises communication systems, surveillance systems, and weapons technology. In 2023, communication systems hold a market size of $0.96 billion, expected to grow to $1.78 billion by 2033, and represent 64.03% market share continuously. Surveillance systems, valued at $0.34 billion in 2023, are projected to increase to $0.64 billion, while weapons technology currently also shares similar growth patterns, highlighting a trend towards integrating technology.

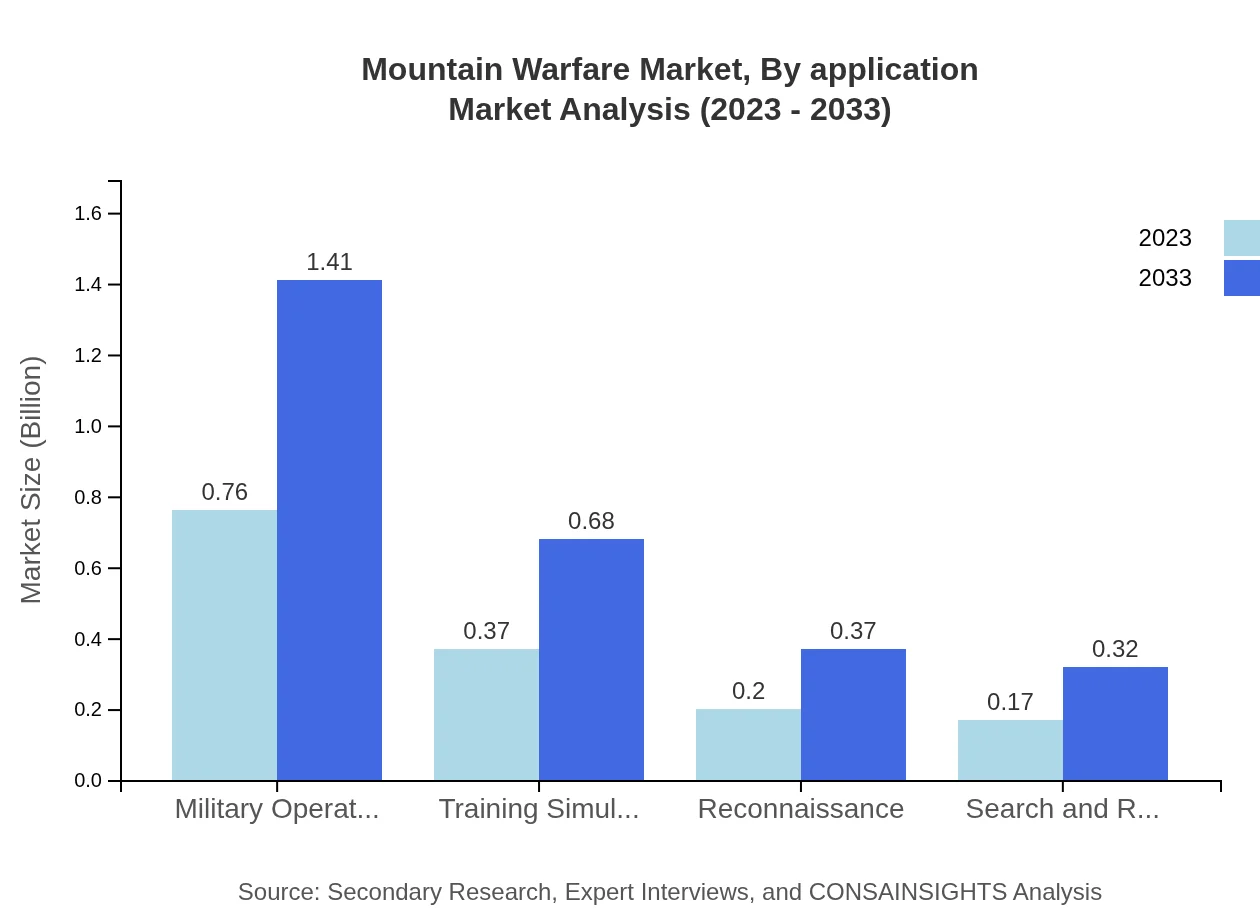

Mountain Warfare Market Analysis By Application

Applications within the Mountain Warfare market are classified into military operations, training simulations, reconnaissance, search and rescue, and more. Military operations dominate with a significant market size of $0.76 billion in 2023, evolving to $1.41 billion by 2033, commanding a 50.75% share of the market. Each segment indicates a robust expansion corresponding with increased military readiness and the importance of elevated resilience training.

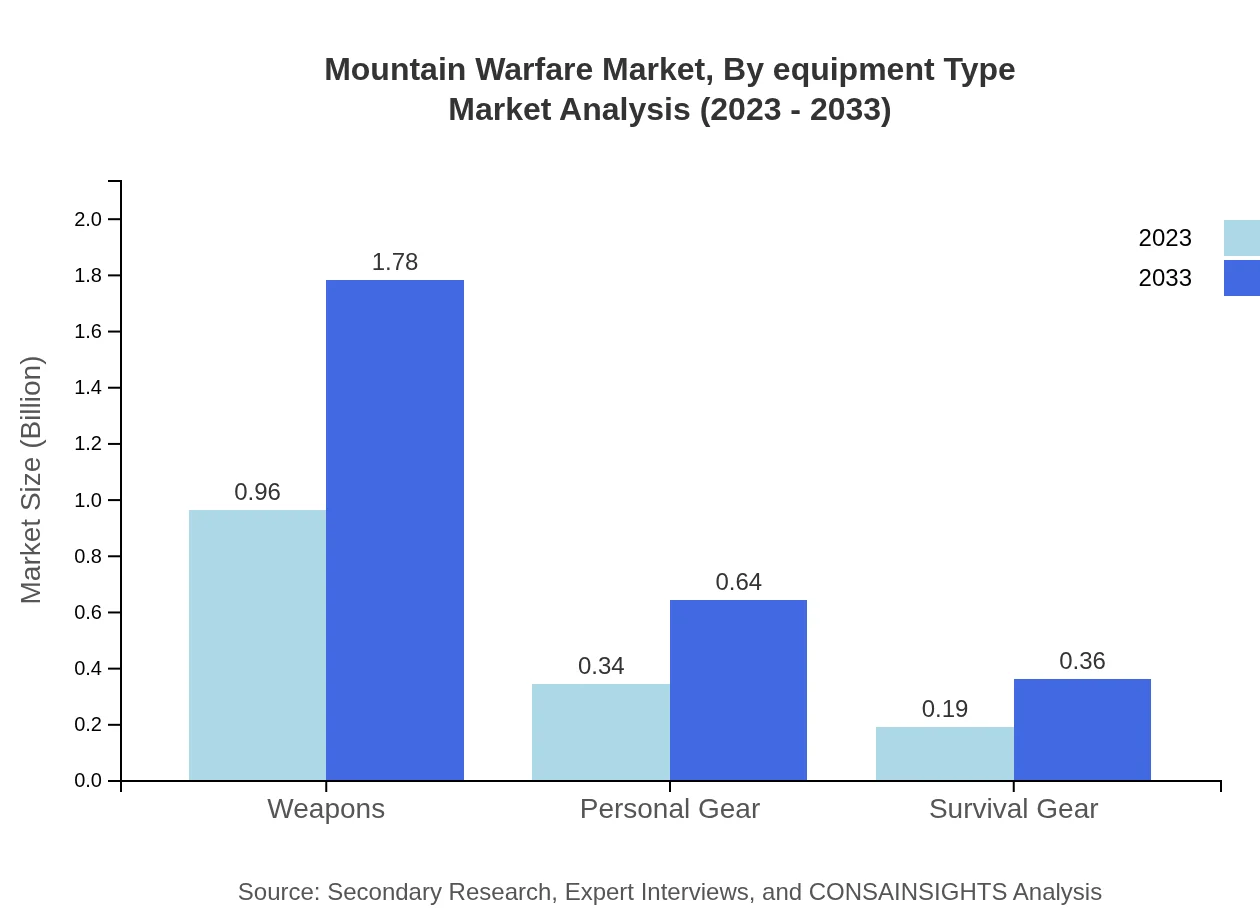

Mountain Warfare Market Analysis By Equipment Type

The Mountain Warfare market is segmented by equipment types including personal gear, survival gear, and transportation equipment. For instance, personal gear holds a market size of $0.34 billion in 2023 with expectations for growth to $0.64 billion by 2033. Each gear type plays a crucial role in ensuring troop safety and effectiveness in harsh, mountainous environments, emphasizing the vertical niche within military operations.

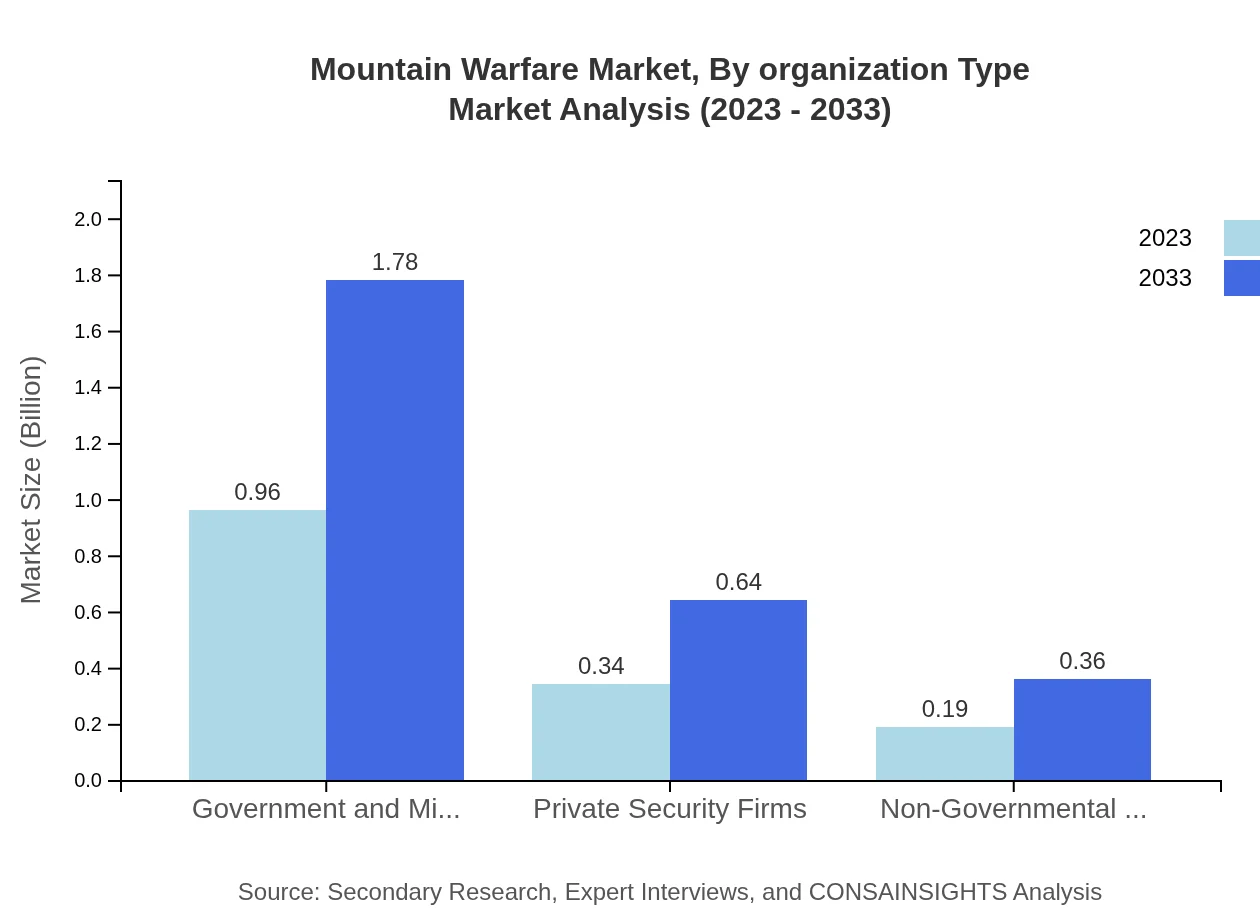

Mountain Warfare Market Analysis By Organization Type

The market is influenced by organization types such as government and military, private security firms, and non-governmental organizations (NGOs). The government and military sector dominates the market, valued at $0.96 billion in 2023 and anticipated to reach $1.78 billion by 2033. This reflects the responsibility of state-owned entities to ensure national security and strategic operational effectiveness in high-altitude scenarios.

Mountain Warfare Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mountain Warfare Industry

Lockheed Martin:

Lockheed Martin is a key player in the mountain warfare sector, supplying advanced communication and combat systems tailored for steep terrain usage.BAE Systems:

BAE Systems specializes in defense technologies and armored systems that provide crucial support for military operations in mountainous regions.Northrop Grumman:

Northrop Grumman leads in providing intelligence and reconnaissance systems suitable for mountain warfare applications.Thales Group:

Thales offers comprehensive communication solutions for military coordinations in rugged environments, enhancing troop efficacy.General Dynamics:

General Dynamics develops advanced equipment and personal gear for soldiers operating in high-altitude conditions, focusing on survivability and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of mountain Warfare?

The mountain-warfare market is currently valued at approximately $1.5 billion, with a projected growth at a CAGR of 6.2% over the next decade, highlighting increasing investment in specialized military capabilities.

What are the key market players or companies in the mountain Warfare industry?

Key players in the mountain-warfare industry include major defense contractors and manufacturers, such as Lockheed Martin, Thales Group, and BAE Systems, which provide advanced military technologies and equipment tailored for mountainous terrains.

What are the primary factors driving the growth in the mountain Warfare industry?

Factors driving growth in the mountain-warfare industry include rising military budgets, the need for specialized equipment in difficult terrains, and increasing geopolitical tensions that necessitate enhanced military operational capabilities.

Which region is the fastest Growing in the mountain Warfare?

North America is the fastest-growing region in the mountain-warfare market, expected to expand from $0.56 billion in 2023 to $1.03 billion by 2033, driven by significant defense investments and modernization programs.

Does ConsaInsights provide customized market report data for the mountain Warfare industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the mountain-warfare industry, ensuring that stakeholders receive relevant insights specific to their business needs.

What deliverables can I expect from this mountain Warfare market research project?

Deliverables from the mountain-warfare market research project include comprehensive reports, market size analyses, growth forecasts, regional insights, and strategic recommendations tailored to industry trends.

What are the market trends of mountain Warfare?

Market trends in mountain-warfare include increased investment in communication systems and surveillance capabilities, greater focus on military operations preparedness in rugged terrains, and an emphasis on advanced training simulations for personnel.