Neobanking Market Report

Published Date: 31 January 2026 | Report Code: neobanking

Neobanking Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed analysis of the neobanking market, including current trends, future forecasts, and segmentation insights from 2023 to 2033. It encompasses market sizes, regional breakdowns, technological advancements, and competitive landscapes.

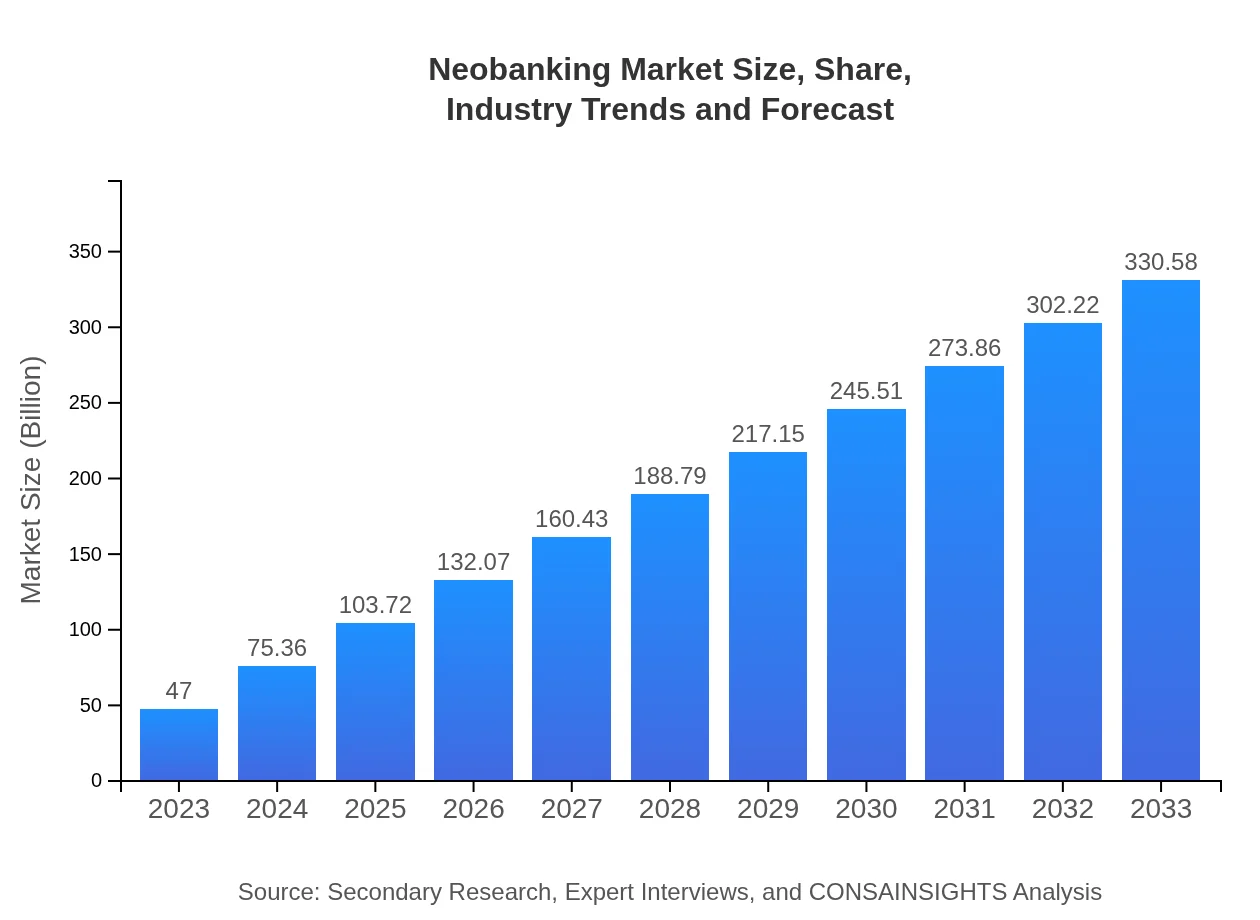

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $47.00 Billion |

| CAGR (2023-2033) | 20.3% |

| 2033 Market Size | $330.58 Billion |

| Top Companies | Chime, N26, Revolut, Starling Bank, Monzo |

| Last Modified Date | 31 January 2026 |

Neobanking Market Overview

Customize Neobanking Market Report market research report

- ✔ Get in-depth analysis of Neobanking market size, growth, and forecasts.

- ✔ Understand Neobanking's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Neobanking

What is the Market Size & CAGR of Neobanking Market in 2023?

Neobanking Industry Analysis

Neobanking Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Neobanking Market Analysis Report by Region

Europe Neobanking Market Report:

The European neobanking market is expected to expand from $16.34 billion in 2023 to $114.91 billion by 2033. Major European cities are witnessing the emergence of several neobanking platforms, driven by a strong regulatory environment and high consumer trust in digital financial services.Asia Pacific Neobanking Market Report:

In 2023, the Asia Pacific neobanking market is valued at approximately $8.92 billion and is expected to grow to around $62.71 billion by 2033. Countries like India and China are key players, where a large unbanked population presents enormous growth potential. Technological advancements and the application of digital payment methods further boost market acceptance.North America Neobanking Market Report:

North America stands as a robust market, beginning with a valuation of $15.09 billion in 2023 and forecasted to reach $106.12 billion by 2033. The growing base of tech-savvy consumers and collaborative banking models are intensifying competition among neobanks and traditional banks.South America Neobanking Market Report:

The South American neobanking sector is projected to increase from $4.63 billion in 2023 to $32.60 billion by 2033. The increasing smartphone penetration and demand for accessible financial solutions in countries like Brazil and Argentina are driving market expansion.Middle East & Africa Neobanking Market Report:

The neobanking market in the Middle East and Africa, while starting smaller at $2.03 billion in 2023, is projected to hit $14.25 billion by 2033. The nascent financial technology scene, coupled with increasing smartphone adoption, enables significant growth opportunities in the region.Tell us your focus area and get a customized research report.

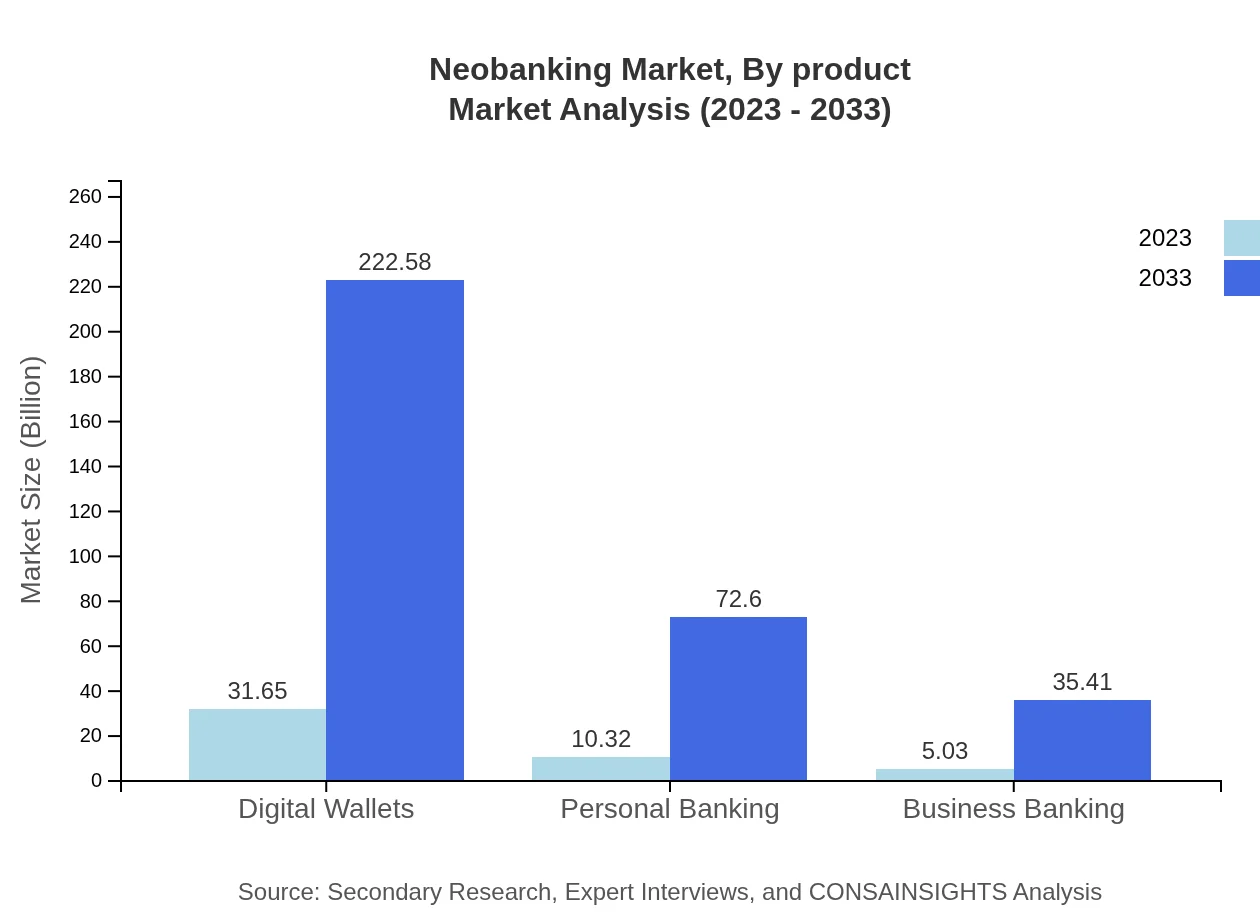

Neobanking Market Analysis By Product

The neobanking market's product offerings are diverse, encompassing digital wallets, personal banking, business banking, and investment services. Each product segment showcases impressive growth forecasts, with digital wallets projected to grow from $31.65 billion in 2023 to $222.58 billion by 2033, due to a shift in consumer preference towards cashless transactions.

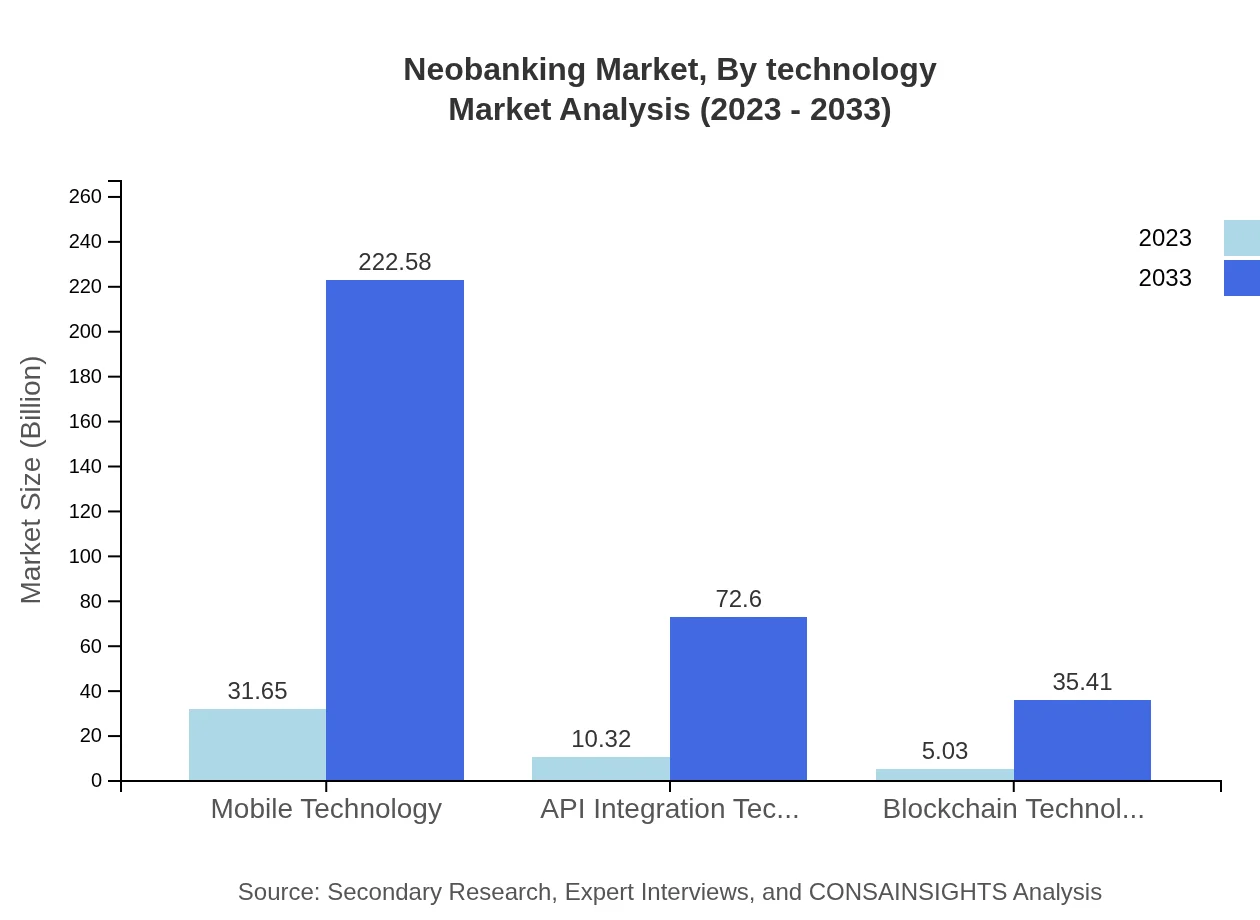

Neobanking Market Analysis By Technology

Technological advancements play a critical role in the neobanking landscape. Key technologies include mobile technologies, API integration, and blockchain. Mobile technologies alone are projected to grow from $31.65 billion to $222.58 billion from 2023 to 2033 as users increasingly rely on their smartphones for banking transactions.

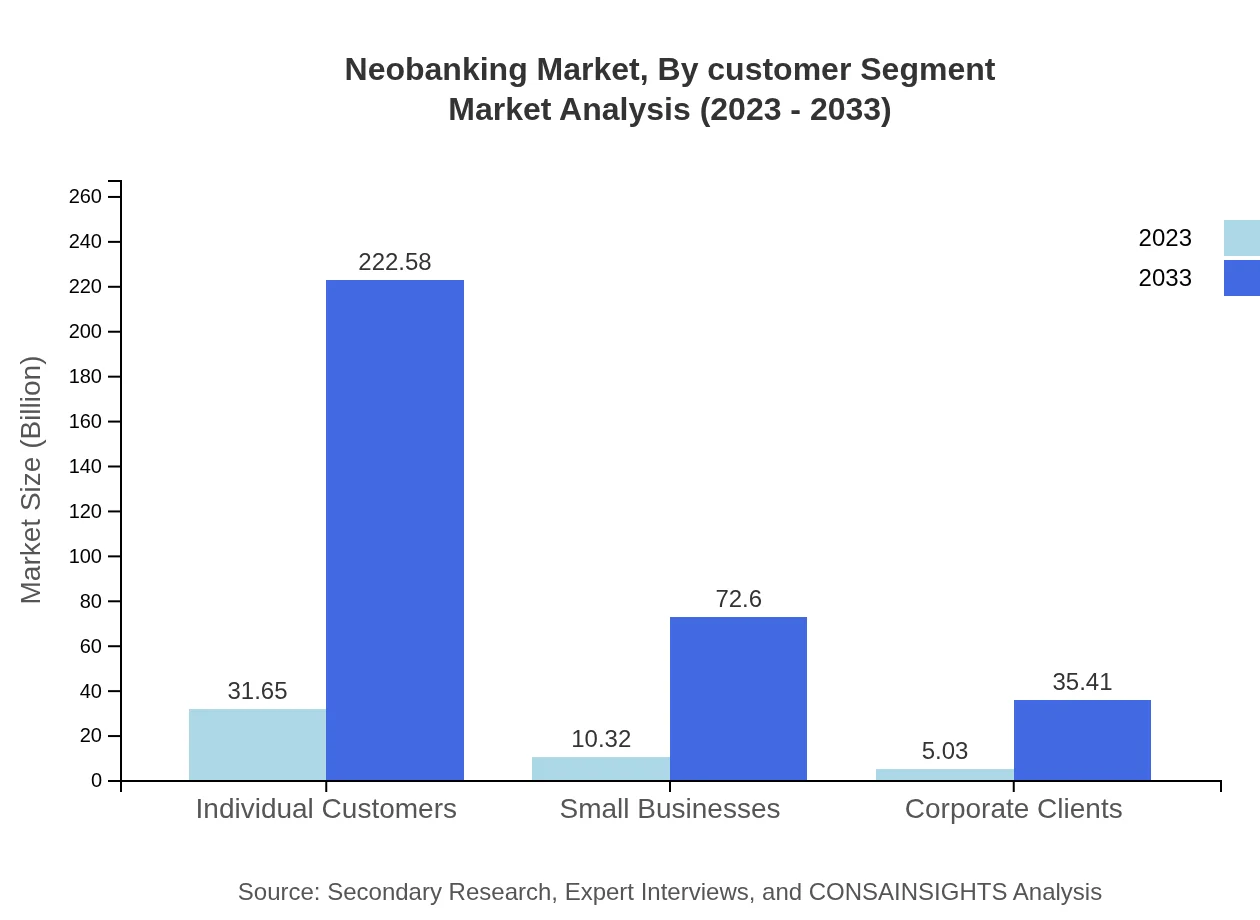

Neobanking Market Analysis By Customer Segment

Customer segments in the neobanking market primarily include individual customers, small businesses, and corporate clients. Individual consumers represent the largest share, growing from $31.65 billion in 2023 to $222.58 billion by 2033, driven by younger demographics seeking user-friendly banking experiences.

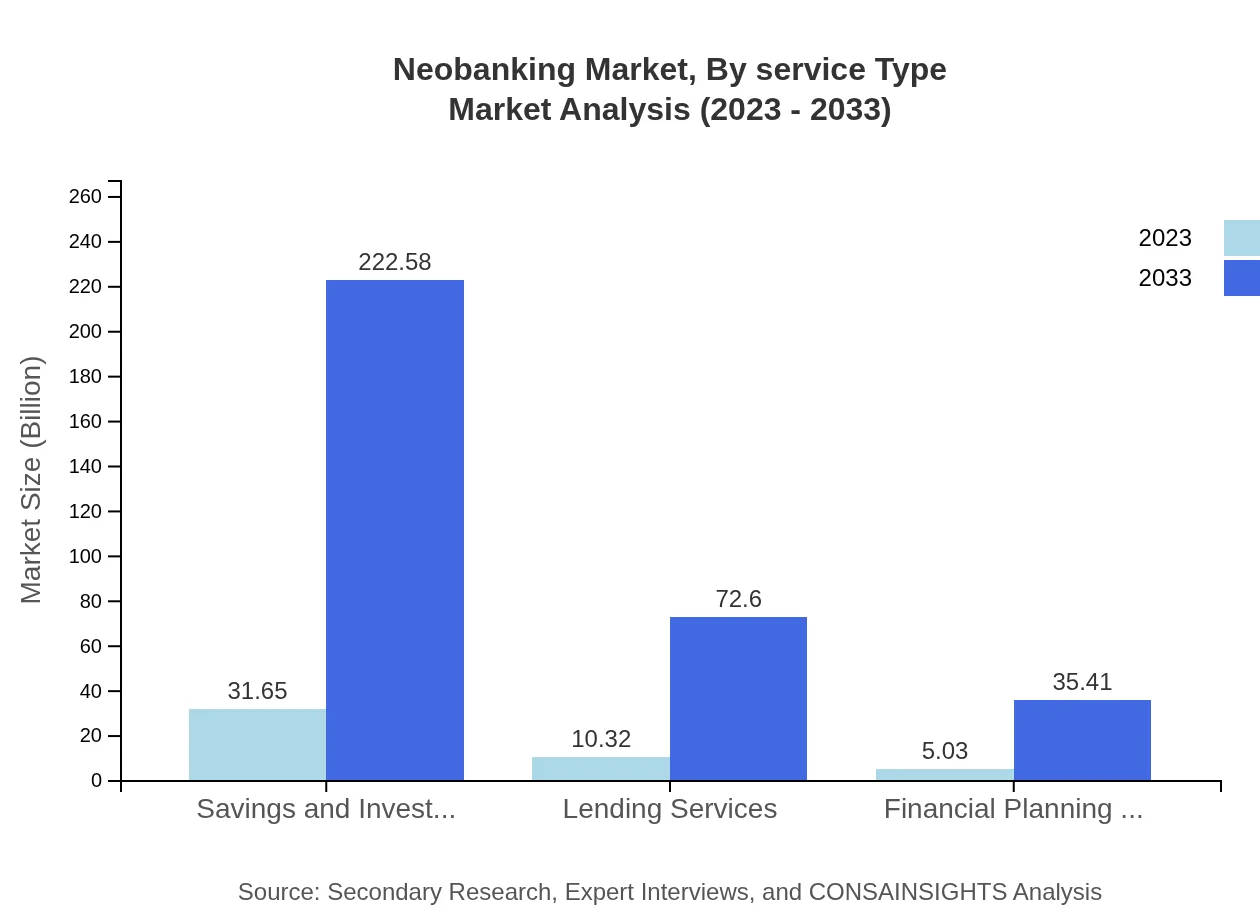

Neobanking Market Analysis By Service Type

Service types offered by neobanks range from lending services to savings and investment. Lending services are forecasted to grow from $10.32 billion to $72.60 billion between 2023 and 2033, indicating a strong demand for personal and small business loans through digital platforms.

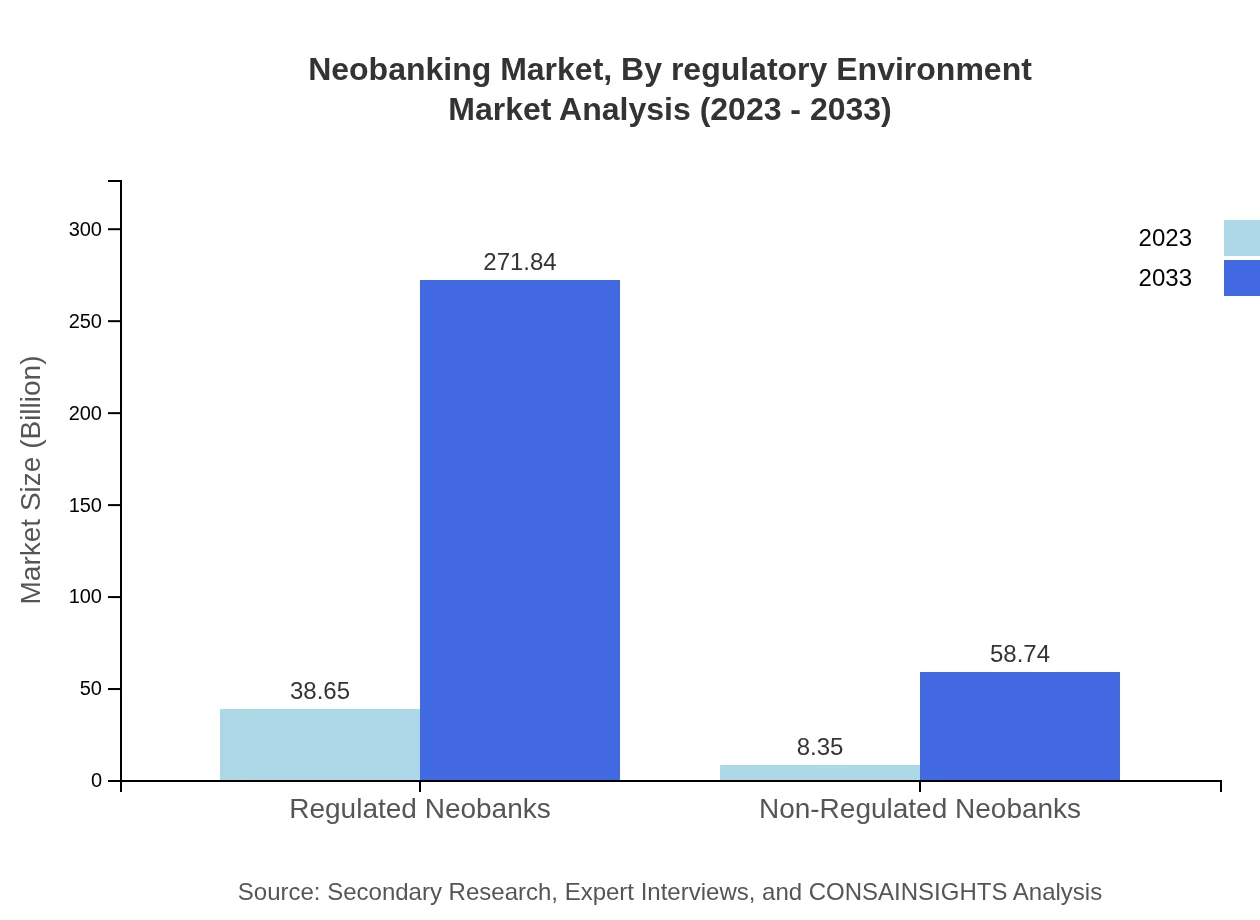

Neobanking Market Analysis By Regulatory Environment

The regulatory environment for neobanks can be segmented into regulated and non-regulated institutions. Regulated neobanks are expected to expand significantly from $38.65 billion in 2023 to $271.84 billion by 2033, benefiting from consumer confidence and legal assurance compared to non-regulated players.

Neobanking Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Neobanking Industry

Chime:

Chime is a leading neobank in the U.S., providing a range of financial services through a mobile application, focusing on transaction efficiency and customer satisfaction.N26:

N26 is a European neobank that offers digital banking services in several countries, known for its user-friendly interface and transparent fee structure.Revolut:

Based in the UK, Revolut provides digital banking, currency exchange, and trading services worldwide, emphasizing low-cost international transactions.Starling Bank:

Starling Bank is a prominent British neobank that offers personal, business, and joint accounts while focusing on innovative banking features and customer service.Monzo:

Monzo is a popular mobile bank in the UK, known for its budgeting tools and real-time transaction notifications, catering primarily to younger demographics.We're grateful to work with incredible clients.

FAQs

What is the market size of neobanking?

The global neobanking market is valued at $47 billion in 2023 and is projected to grow at a CAGR of 20.3% from 2023 to 2033, reflecting a significant increase in demand for digital banking solutions.

What are the key market players or companies in the neobanking industry?

Key players in the neobanking market include major fintech companies and digital banks that are revolutionizing banking services through technology-driven platforms, enhancing customer experience while reducing operational costs.

What are the primary factors driving the growth in the neobanking industry?

Growth in the neobanking industry is driven by technological advancements, increased mobile banking adoption, consumer demand for convenience, and regulatory support for digital financial services.

Which region is the fastest Growing in the neobanking market?

Europe is the fastest-growing region in the neobanking market, expected to increase from $16.34 billion in 2023 to $114.91 billion by 2033, showcasing strong growth opportunities in digital banking.

Does ConsaInsights provide customized market report data for the neobanking industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the neobanking industry, providing insights and analytics that cater to diverse market segments.

What deliverables can I expect from this neobanking market research project?

Deliverables from the neobanking market research project include detailed reports, data analysis, market forecasts, and strategic recommendations that empower informed decision-making.

What are the market trends of neobanking?

Current trends in neobanking include the rise of digital wallets, API integration, increased competition among fintechs, and a shift toward personalized banking experiences through advanced technology.