Occupancy Sensor Market Report

Published Date: 31 January 2026 | Report Code: occupancy-sensor

Occupancy Sensor Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the occupancy sensor market from 2023 to 2033, detailing insights into market trends, size, segmentation, and regional analyses. It presents valuable forecasts, industry challenges, and key players shaping the market landscape.

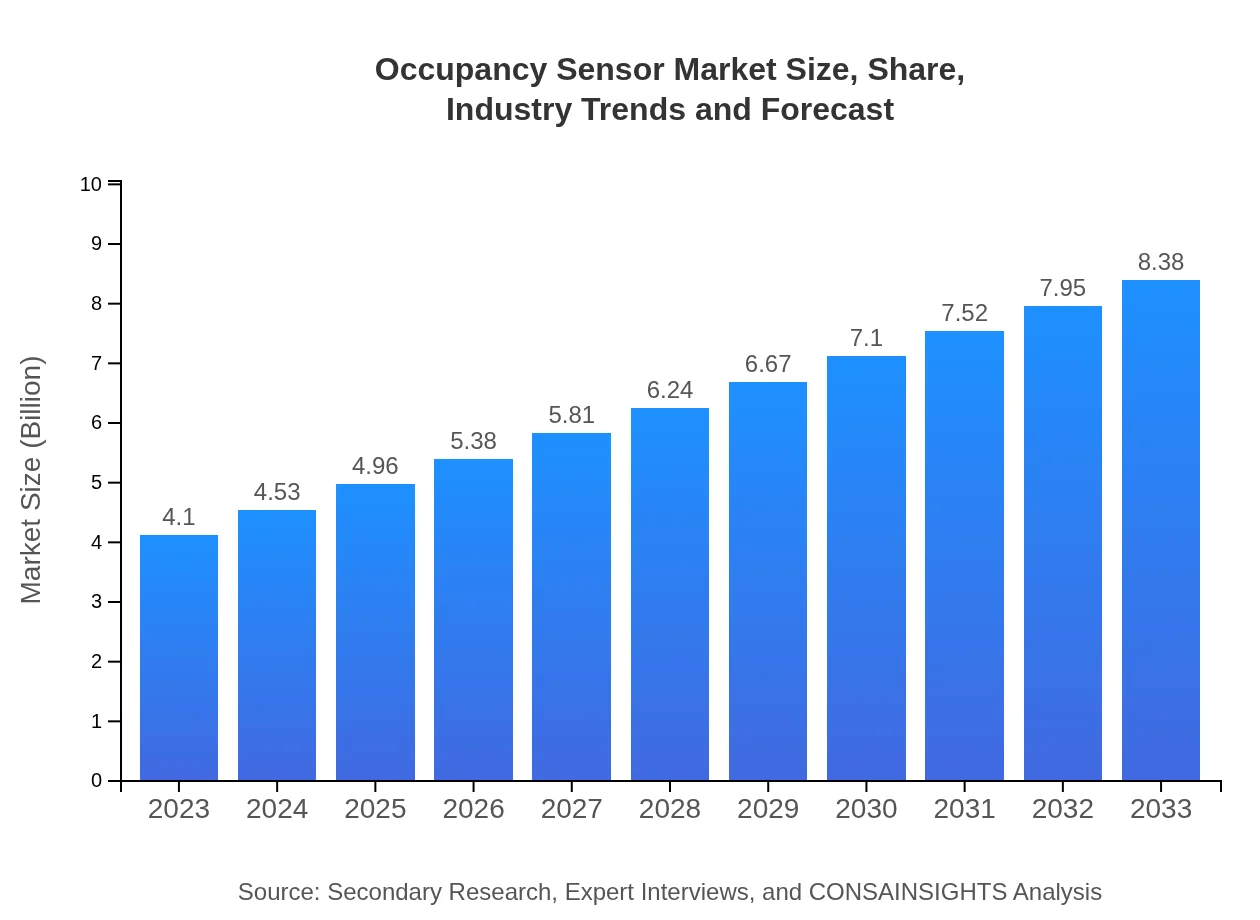

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.10 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $8.38 Billion |

| Top Companies | Philips Lighting, Honeywell International Inc., Schneider Electric, Siemens AG |

| Last Modified Date | 31 January 2026 |

Occupancy Sensor Market Overview

Customize Occupancy Sensor Market Report market research report

- ✔ Get in-depth analysis of Occupancy Sensor market size, growth, and forecasts.

- ✔ Understand Occupancy Sensor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Occupancy Sensor

What is the Market Size & CAGR of the Occupancy Sensor market in 2023?

Occupancy Sensor Industry Analysis

Occupancy Sensor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Occupancy Sensor Market Analysis Report by Region

Europe Occupancy Sensor Market Report:

The European market is anticipated to increase from USD 1.06 billion in 2023 to USD 2.16 billion by 2033, propelled by government mandates for energy efficiency and sustainability efforts in the European Union.Asia Pacific Occupancy Sensor Market Report:

In Asia Pacific, the occupancy sensor market is projected to grow from USD 0.85 billion in 2023 to USD 1.75 billion by 2033, driven by increased urbanization and smart city initiatives that emphasize energy-efficient technologies.North America Occupancy Sensor Market Report:

North America dominates the occupancy sensor market, with a forecasted growth from USD 1.48 billion in 2023 to USD 3.02 billion in 2033. This is driven by stringent energy efficiency regulations and significant adoption in commercial sectors.South America Occupancy Sensor Market Report:

In South America, the market is expected to grow from USD 0.14 billion in 2023 to USD 0.29 billion by 2033, attributed to growing investments in building automation systems, particularly in Brazil and Chile.Middle East & Africa Occupancy Sensor Market Report:

The Middle East and Africa occupancy sensor market is poised to grow from USD 0.56 billion in 2023 to USD 1.15 billion by 2033, spurred by infrastructural advancements and increased awareness regarding energy savings.Tell us your focus area and get a customized research report.

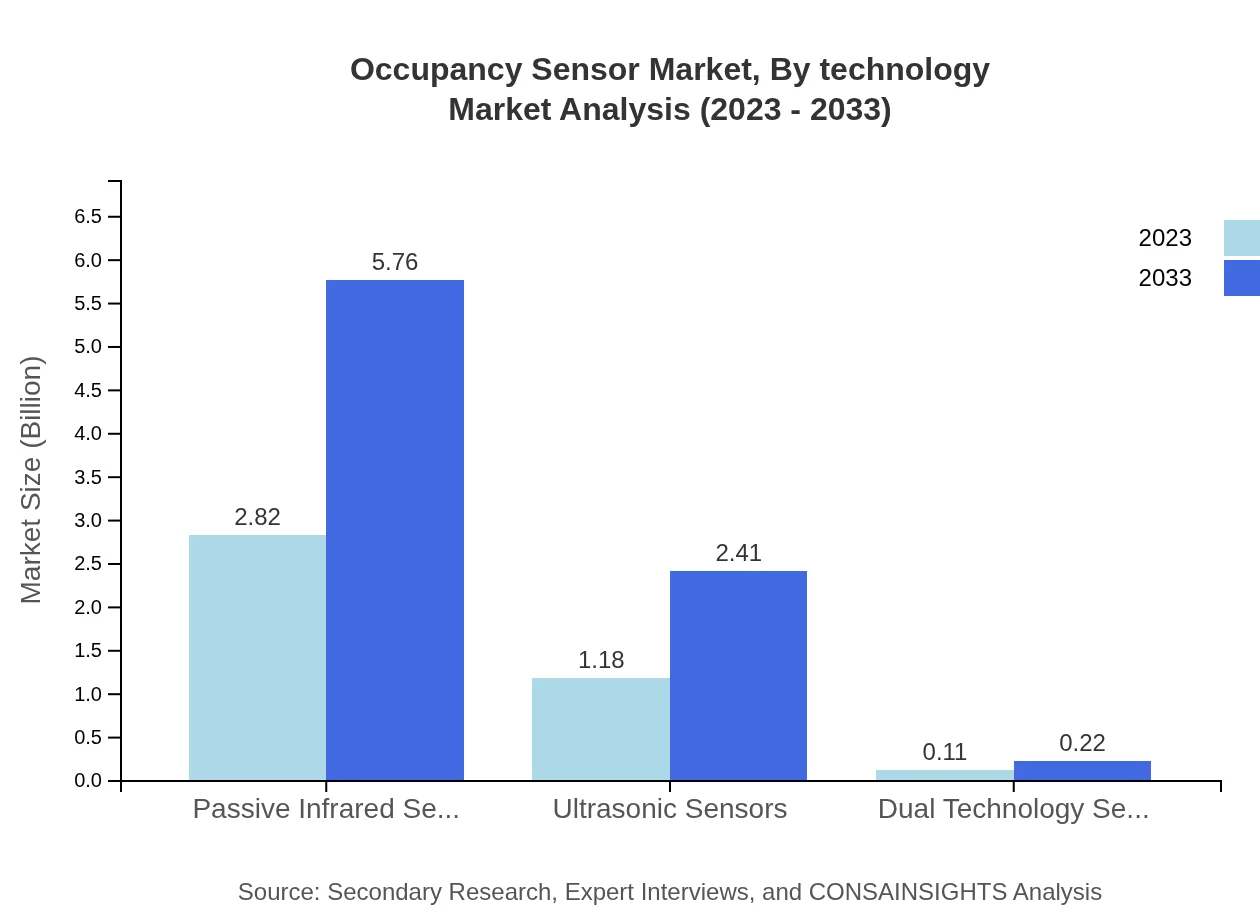

Occupancy Sensor Market Analysis By Technology

In 2023, the passive infrared sensors segment leads the market with USD 2.82 billion, holding 68.71% share, significantly driven by wide usage in residential and commercial applications. Ultrasonic sensors, however, are growing, currently valued at USD 1.18 billion and expected to reach USD 2.41 billion by 2033, with a 28.7% market share. Dual technology sensors, though smaller, are gaining traction, projected to grow to USD 0.22 billion by 2033.

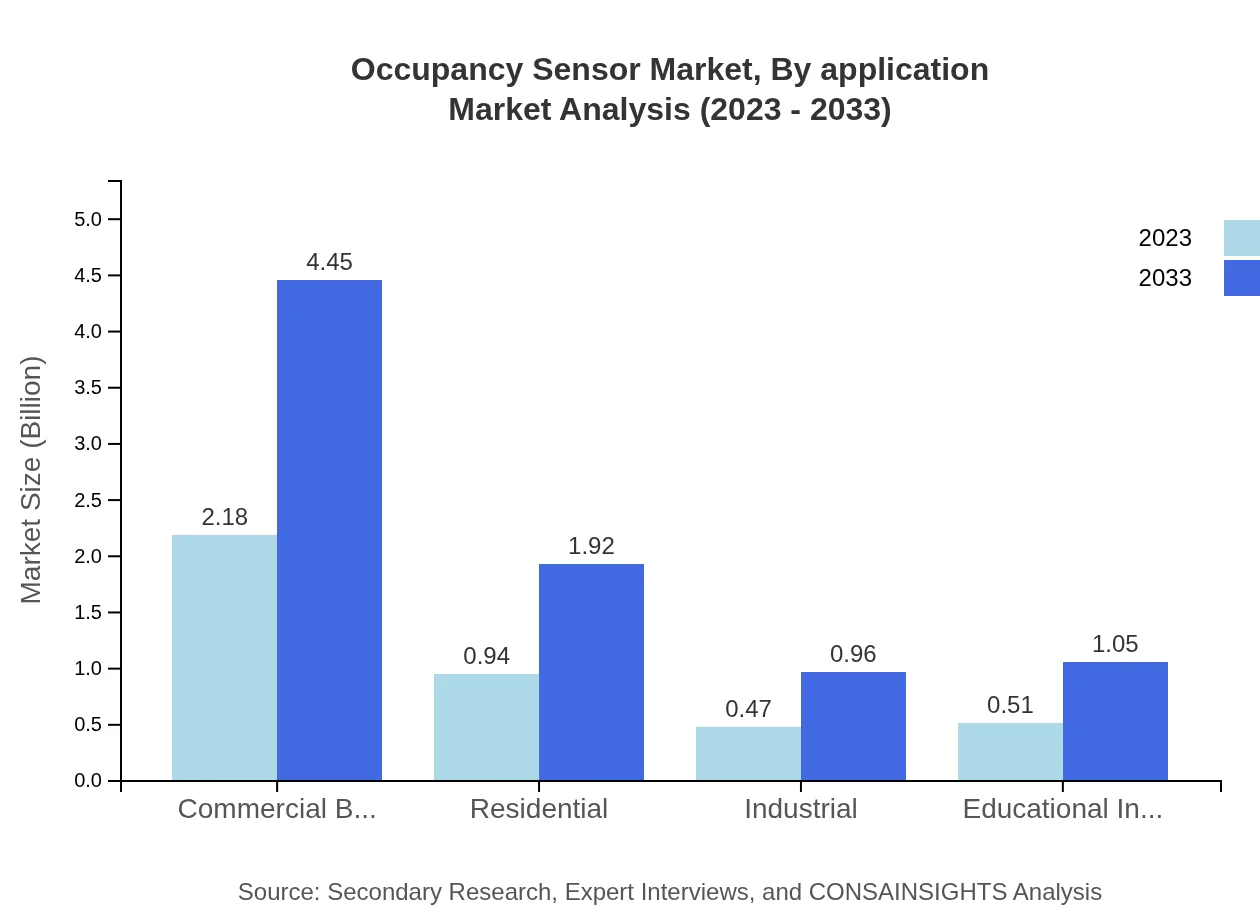

Occupancy Sensor Market Analysis By Application

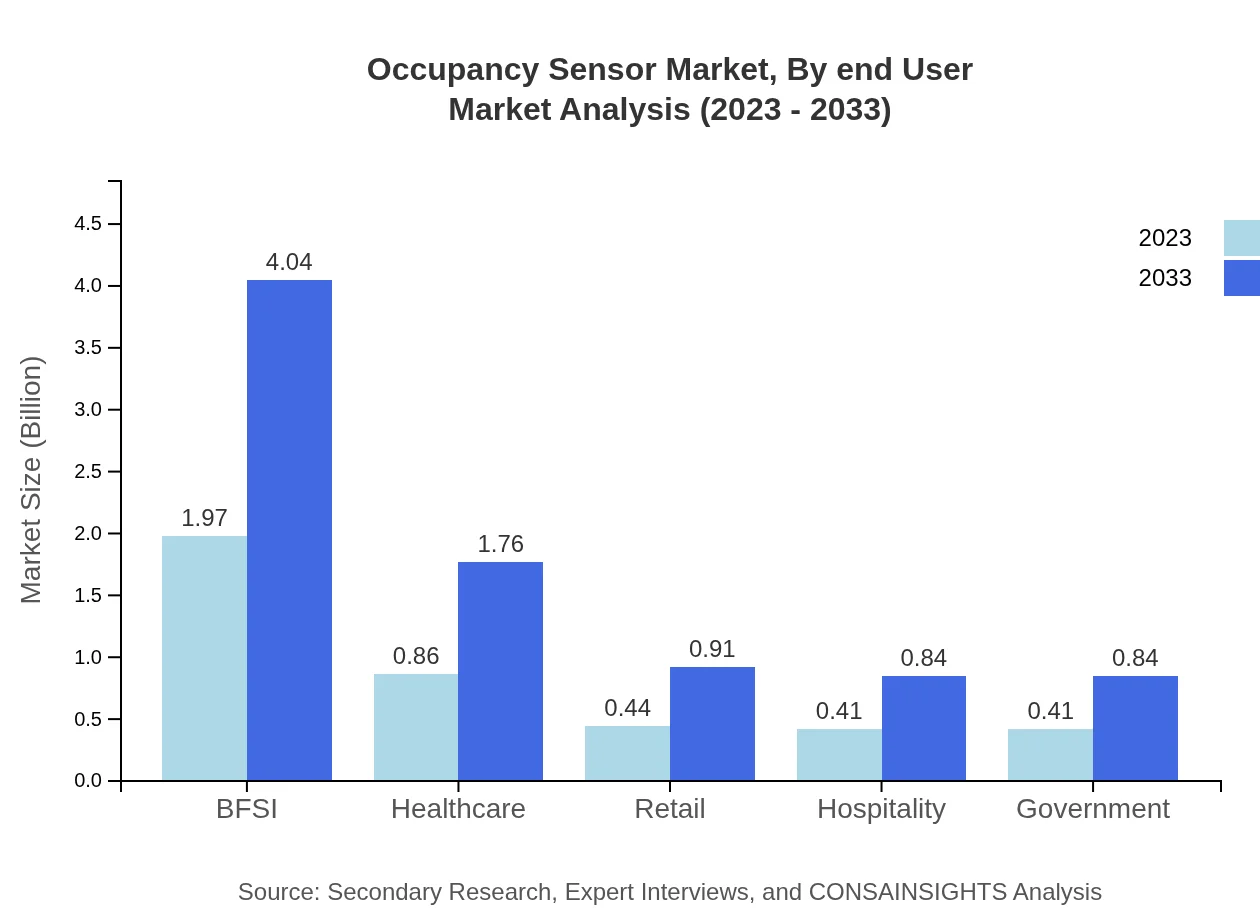

The BFSI sector stands out, with a market size of USD 1.97 billion in 2023, maintaining a 48.15% share, and projected to grow to USD 4.04 billion by 2033. Other important segments include healthcare, retail, and hospitality, each contributing significantly as the need for automation rises in various fields.

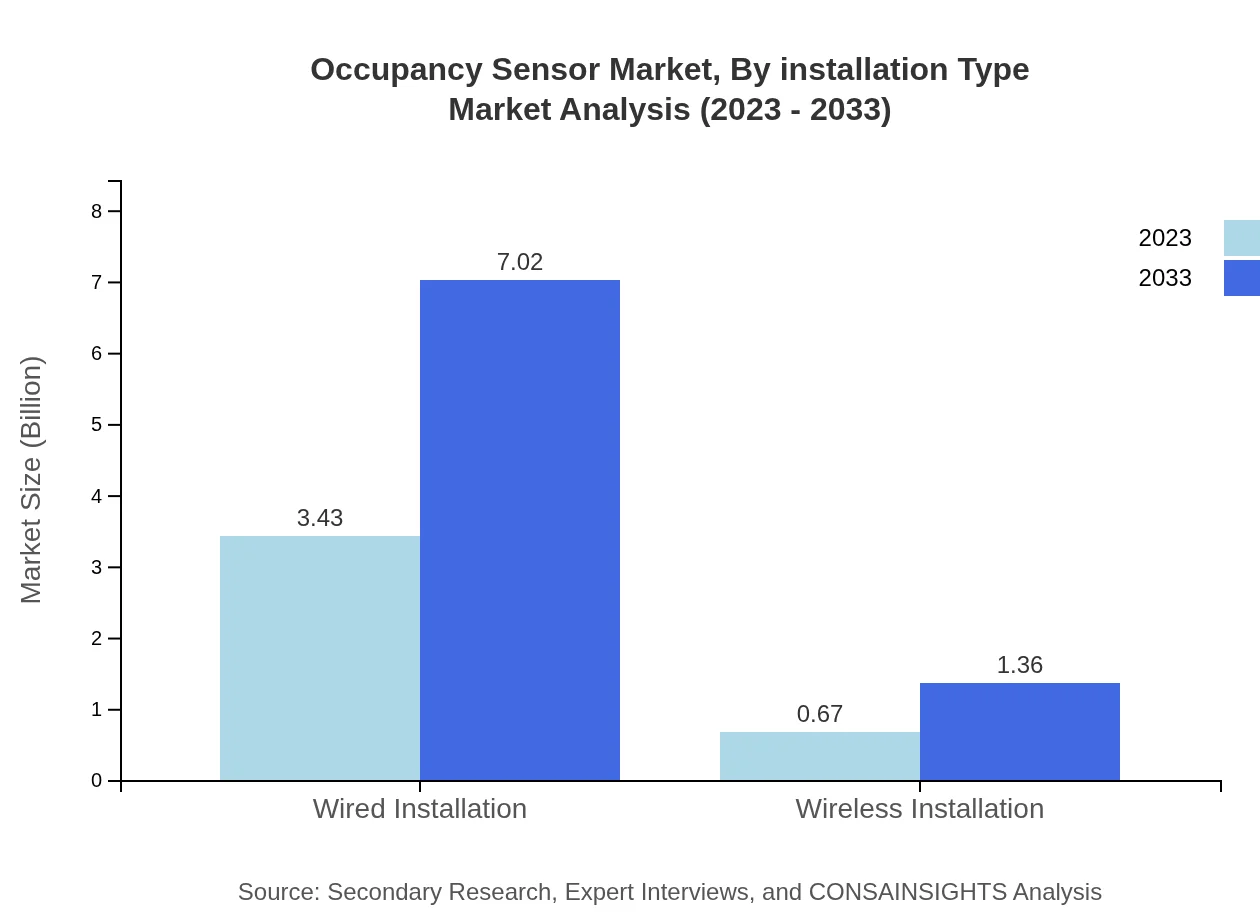

Occupancy Sensor Market Analysis By Installation Type

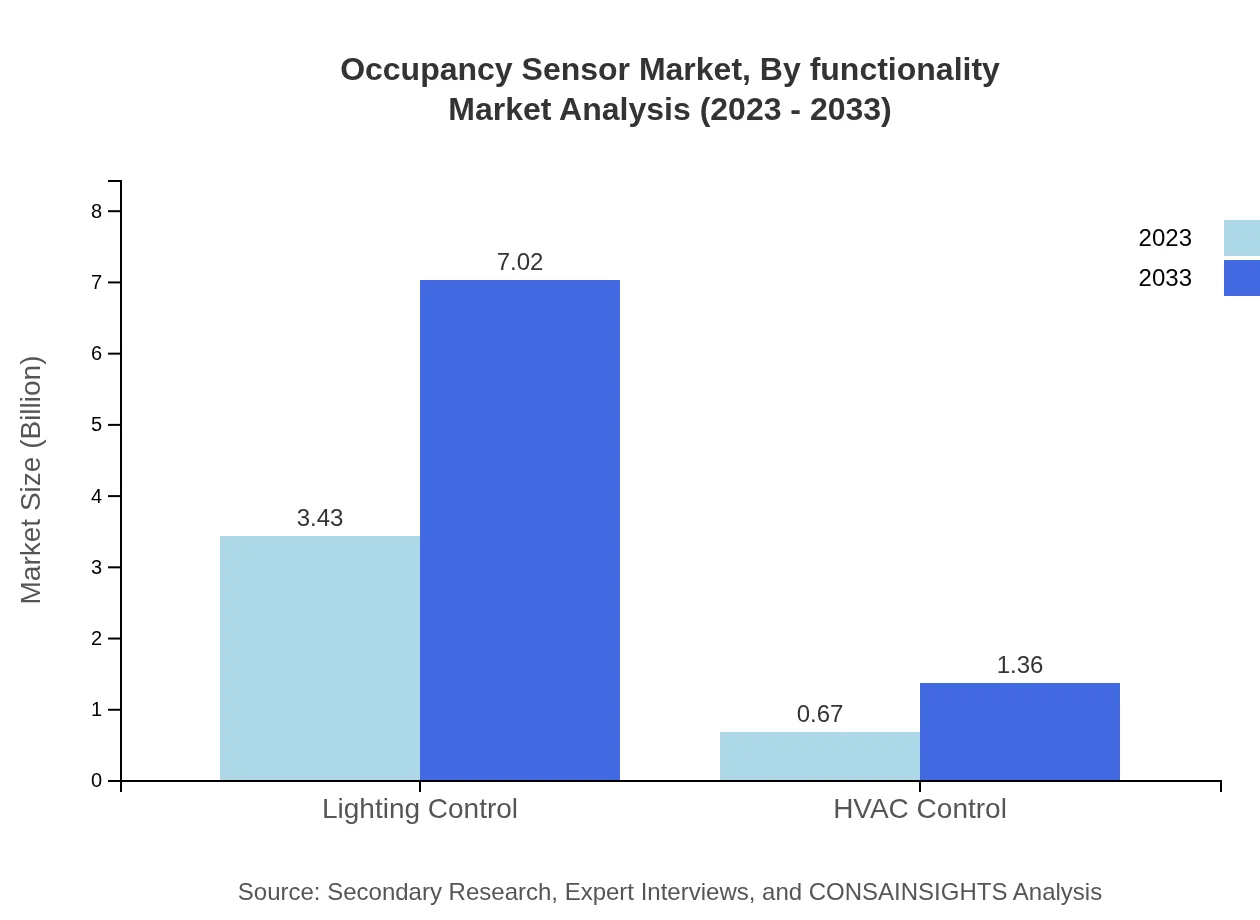

Wired installation remains the preferred choice, valued at USD 3.43 billion in 2023 and expected to grow to USD 7.02 billion by 2033. Wireless installation, while a smaller segment at USD 0.67 billion, is rapidly expanding reflecting the trend towards flexibility and convenience in installation.

Occupancy Sensor Market Analysis By End User

The commercial building sector commands 53.15% of the market share, valued at USD 2.18 billion in 2023, with projections reaching USD 4.45 billion by 2033. Other sectors like residential and industrial are also key participants, pushing for greater energy savings and operational efficiencies.

Occupancy Sensor Market Analysis By Functionality

The market segment focusing on lighting control leads with a significant share of 83.75% in 2023, expanding to USD 3.43 billion. HVAC control follows, commanding 16.25% of the share, growing alongside innovations in energy management and smart building technologies.

Occupancy Sensor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Occupancy Sensor Industry

Philips Lighting:

Philips Lighting is a global leader in lighting solutions, providing advanced occupancy sensor technology that integrates with smart building automations.Honeywell International Inc.:

Honeywell offers a wide array of sensors as part of its building technologies, driving energy efficiency and operational performance.Schneider Electric:

A leading player in energy management, Schneider Electric delivers innovative occupancy sensors that enhance energy savings in commercial and residential applications.Siemens AG:

Siemens specializes in automation and digitalization solutions, providing cutting-edge occupancy sensors that facilitate smart building initiatives.We're grateful to work with incredible clients.

FAQs

What is the market size of occupancy Sensor?

The global occupancy sensor market is valued at $4.1 billion in 2023 and is projected to grow at a CAGR of 7.2%, reaching substantial growth by 2033.

What are the key market players or companies in the occupancy Sensor industry?

Key players in the occupancy sensor industry include Siemens, Legrand, Schneider Electric, Honeywell, and Eaton, which significantly contribute to market development and innovation.

What are the primary factors driving the growth in the occupancy sensor industry?

Growth is driven by increased energy efficiency demands, smart building adoption, and advancements in sensor technology, improving building management systems and energy conservation.

Which region is the fastest Growing in the occupancy sensor market?

North America is the fastest-growing region, with market size increasing from $1.48 billion in 2023 to $3.02 billion by 2033, driven by heightened focus on energy efficiency.

Does ConsaInsights provide customized market report data for the occupancy sensor industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs and focuses, addressing unique aspects of the occupancy sensor market.

What deliverables can I expect from this occupancy sensor market research project?

Expect detailed market analysis, trend assessments, competitive landscape insights, segmented data, and regional analysis as deliverables from the occupancy sensor report.

What are the market trends of occupancy sensor products?

Emerging trends include the growing integration of IoT in occupancy sensors, enhanced data analytics for energy management, and a surge in demand for wireless technologies.