Olefins Market Report

Published Date: 02 February 2026 | Report Code: olefins

Olefins Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Olefins market, detailing market size, segmentation, regional analysis, and future forecasts from 2023 to 2033, offering strategic insights for stakeholders in the industry.

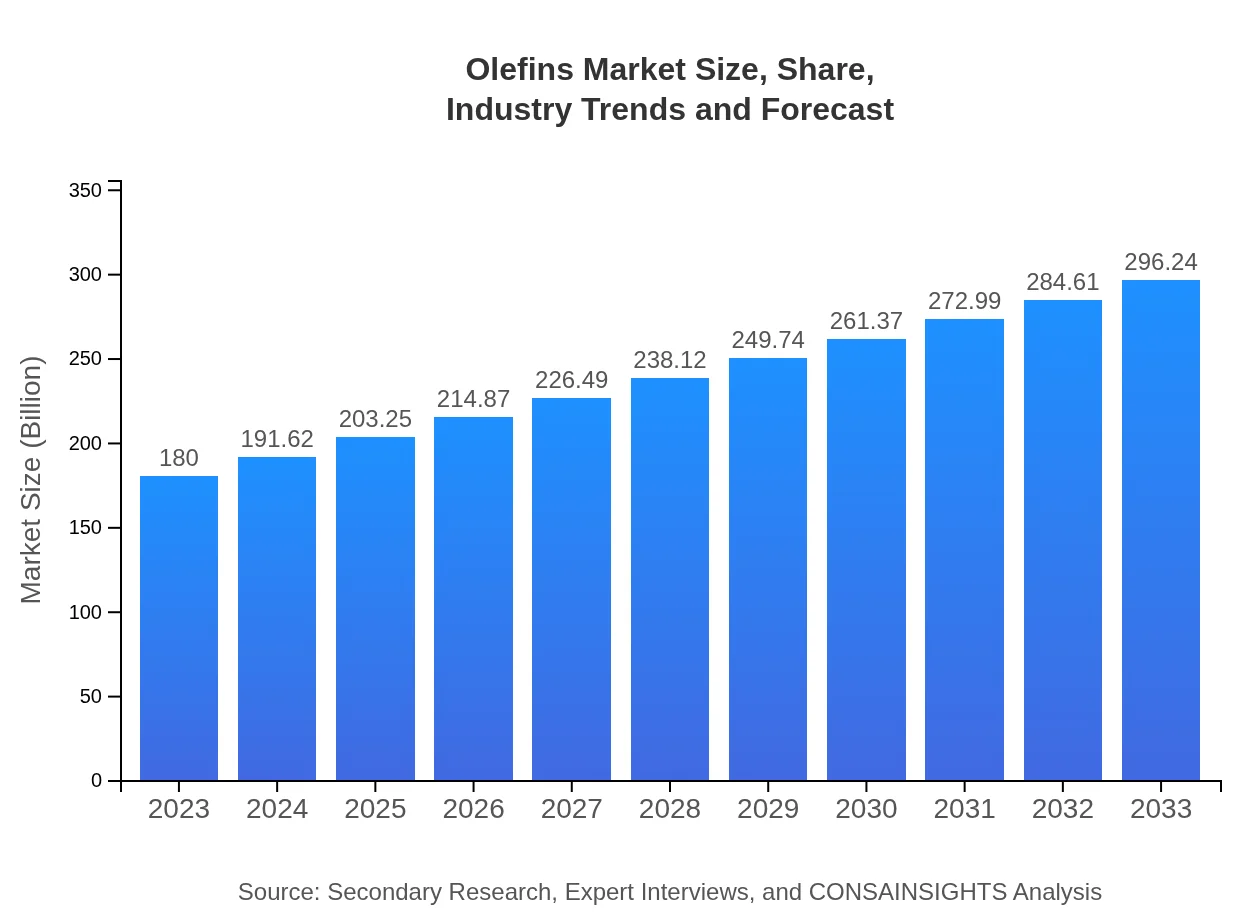

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $180.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $296.24 Billion |

| Top Companies | BASF SE, SABIC, LyondellBasell Industries, ExxonMobil Chemical, Dow Inc. |

| Last Modified Date | 02 February 2026 |

Olefins Market Overview

Customize Olefins Market Report market research report

- ✔ Get in-depth analysis of Olefins market size, growth, and forecasts.

- ✔ Understand Olefins's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Olefins

What is the Market Size & CAGR of Olefins market in 2023?

Olefins Industry Analysis

Olefins Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Olefins Market Analysis Report by Region

Europe Olefins Market Report:

The European Olefins market, valued at $49.01 billion in 2023, is projected to reach $80.67 billion by 2033. The focus on sustainability and innovations in production technology are key growth drivers in this region.Asia Pacific Olefins Market Report:

In 2023, the Olefins market in Asia-Pacific is valued at approximately $34.40 billion and is expected to reach about $56.61 billion by 2033. This region is a significant consumer of olefins due to the booming manufacturing sectors, particularly in China and India, which drive demand in plastics and automotive industries.North America Olefins Market Report:

North America's Olefins market is valued at $69.32 billion in 2023, with expectations to rise to $114.08 billion by 2033. The region's market is significantly driven by the United States, where advancements in shale gas extraction have reduced production costs and improved competitiveness.South America Olefins Market Report:

The South American Olefins market in 2023 stands at around $2.70 billion and is projected to grow to approximately $4.44 billion by 2033. The growth is attributed to increasing industrial activities and a rising demand for plastic products.Middle East & Africa Olefins Market Report:

The Olefins market in the Middle East and Africa is set at $24.57 billion in 2023, with projections reaching $40.44 billion by 2033. The growth is driven by increasing investments in petrochemical plants and rising domestic demand for olefin derivatives.Tell us your focus area and get a customized research report.

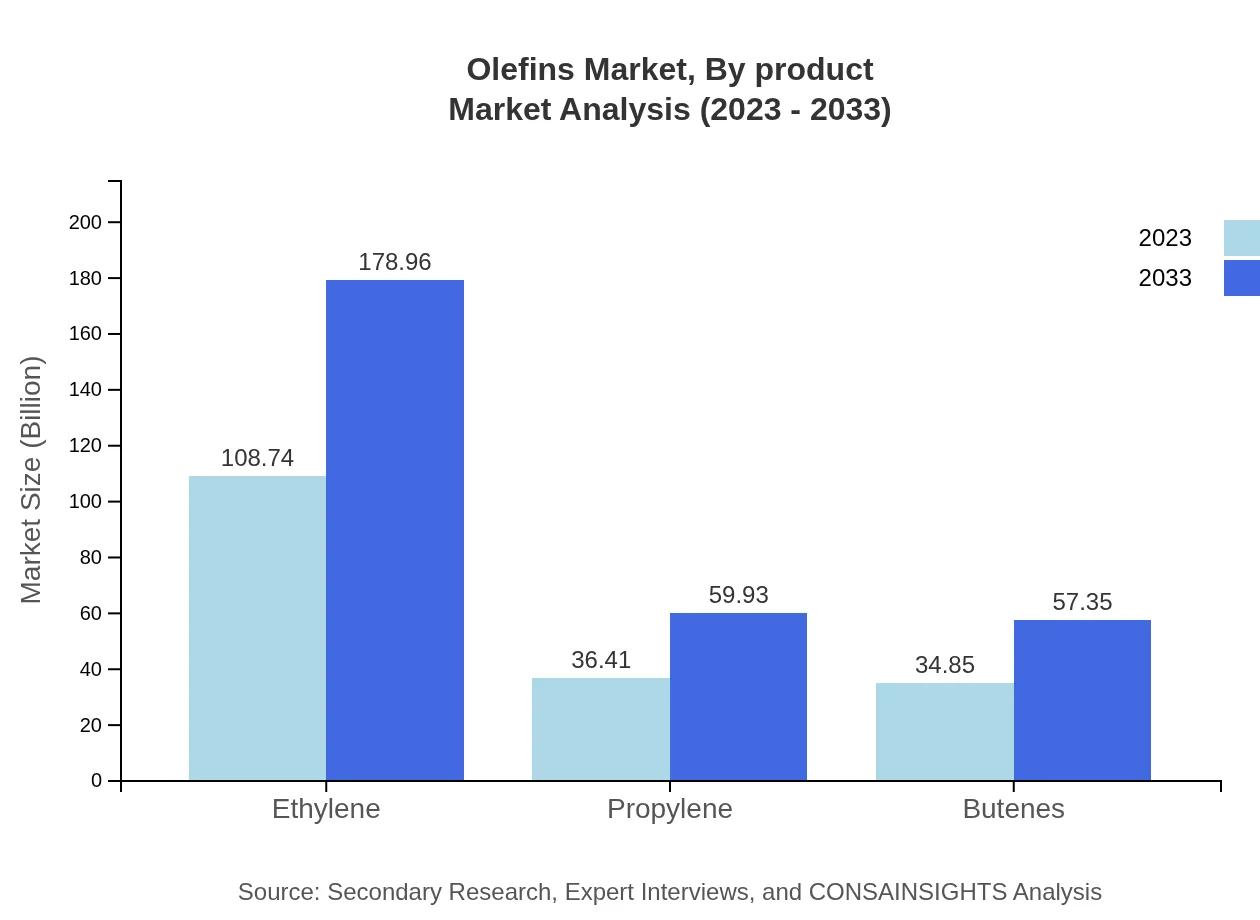

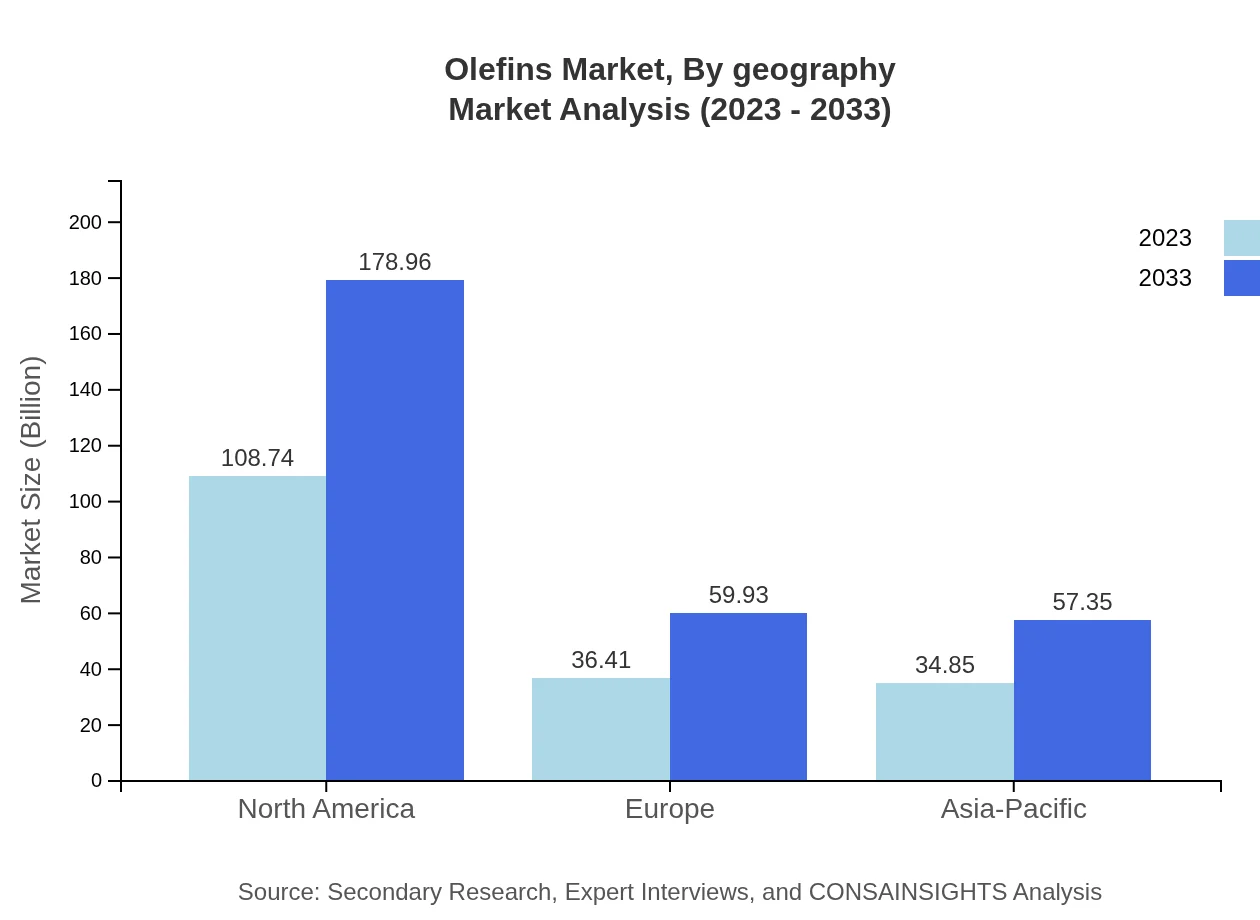

Olefins Market Analysis By Product

In terms of product segmentation, the olefins market is dominated by ethylene, which accounted for approximately $108.74 billion in 2023, expected to grow to $178.96 billion by 2033. Propylene follows, with a market valuation of $36.41 billion in 2023 and a projected growth up to $59.93 billion by 2033. Butenes also contribute significantly to the market, projected to rise from $34.85 billion in 2023 to $57.35 billion by 2033.

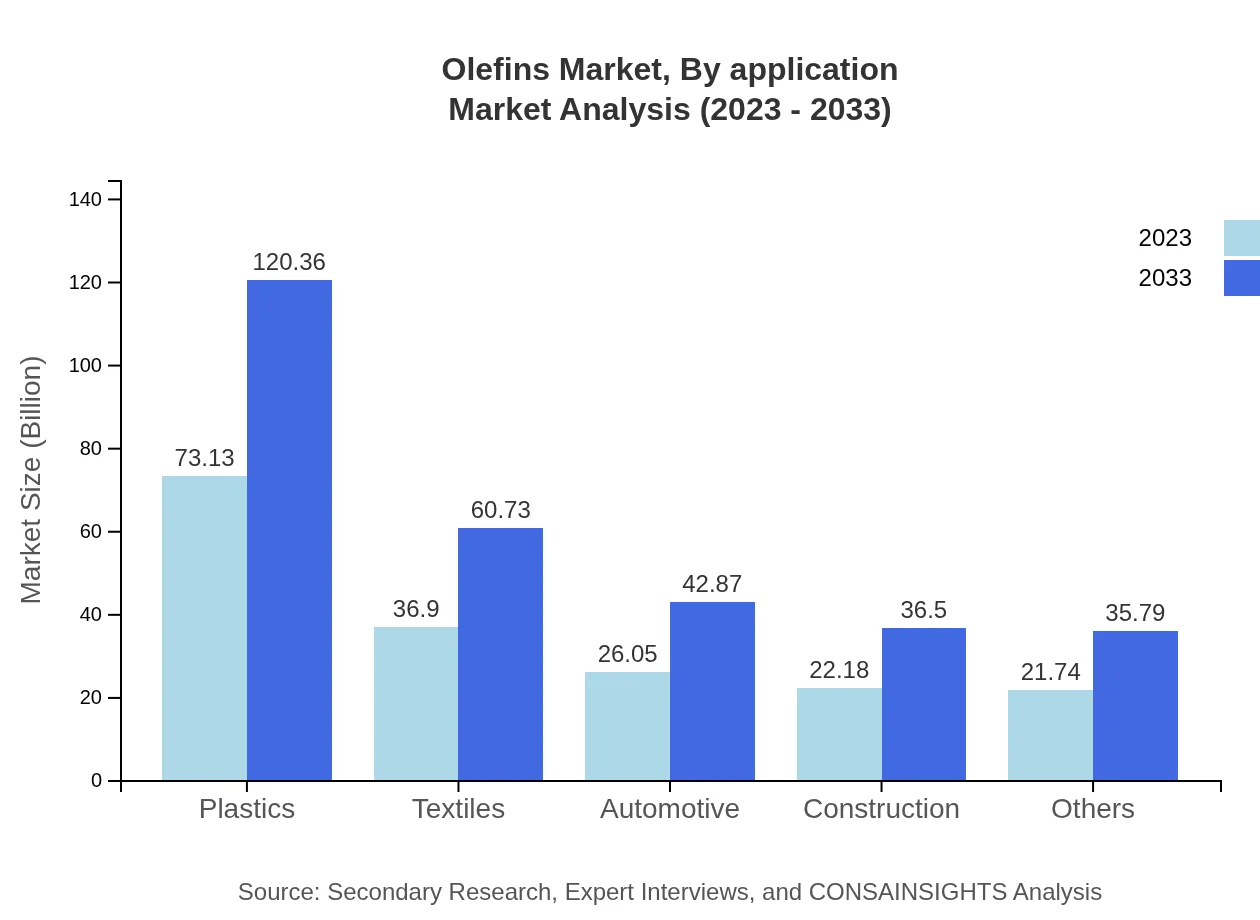

Olefins Market Analysis By Application

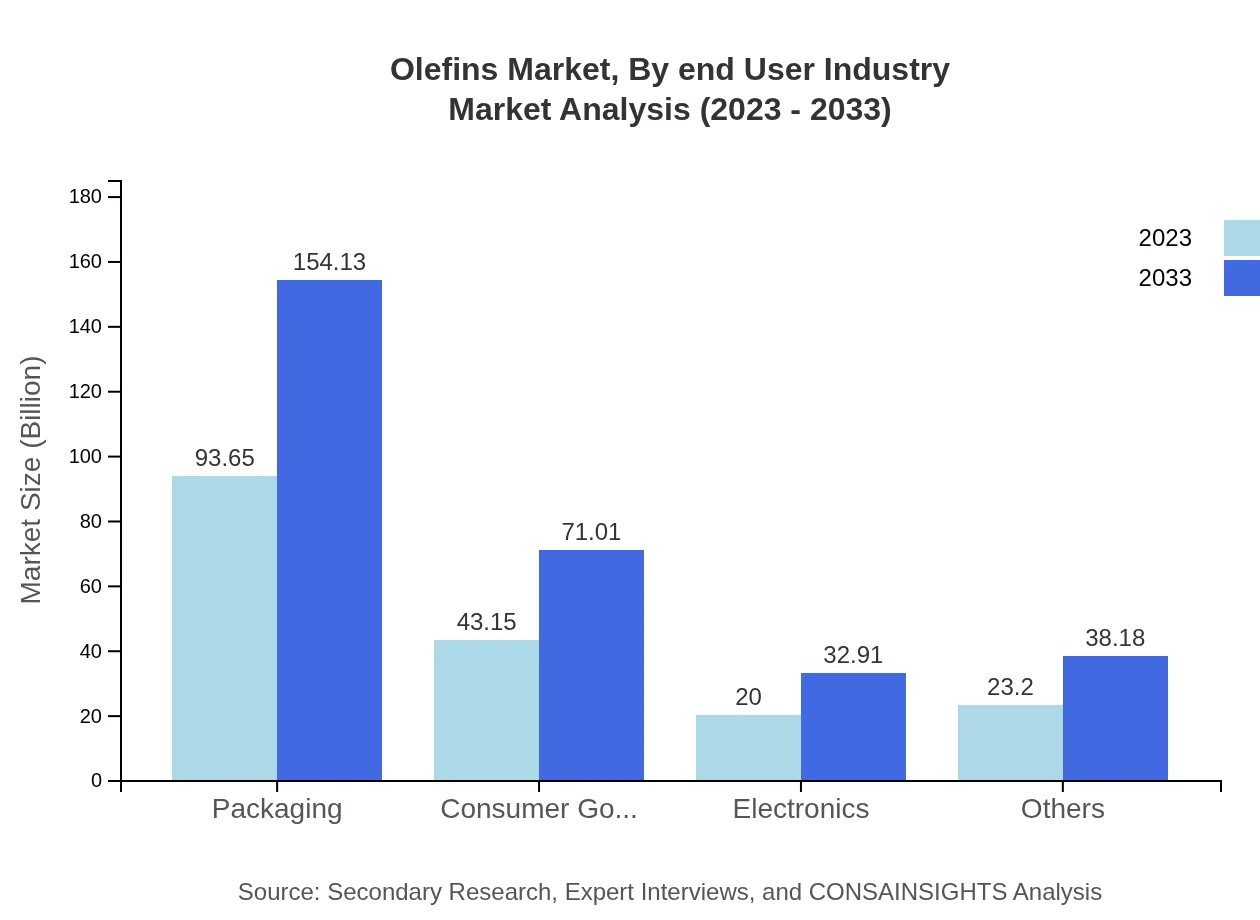

The application of olefins spans across multiple industries, with the packaging sector leading at $93.65 billion in 2023, likely to reach $154.13 billion by 2033. Other notable applications include consumer goods, automotive, and textiles. The demand in these sectors is influenced by market trends towards lightweight materials and improved product performance.

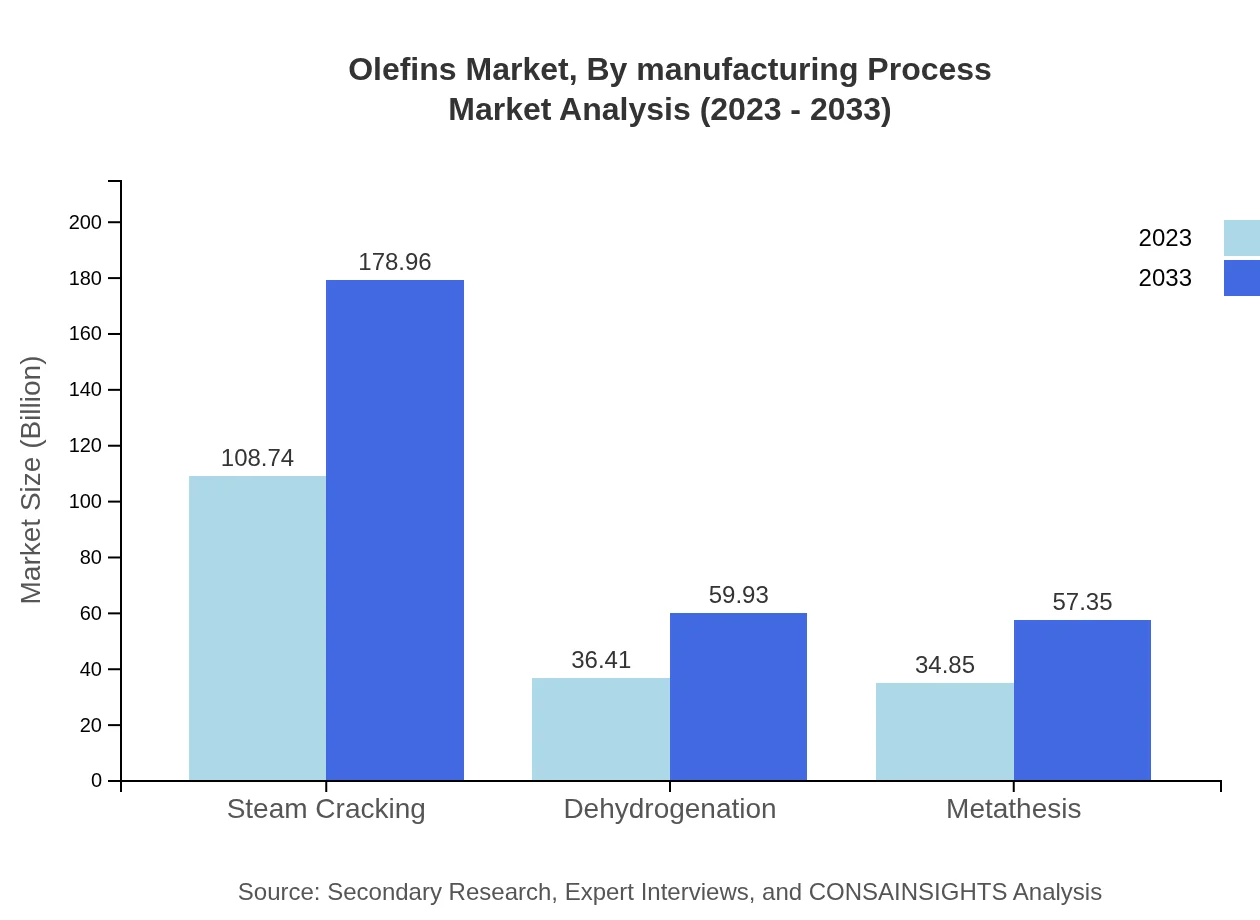

Olefins Market Analysis By Manufacturing Process

The olefins manufacturing processes primarily include steam cracking, which accounts for $108.74 billion in 2023 and is expected to continue being a dominant process. Dehydrogenation and metathesis processes also play crucial roles, with projected market sizes of $36.41 billion and $34.85 billion respectively by 2023.

Olefins Market Analysis By End User Industry

End-user industries such as packaging and construction dominate the olefins market, driven by demand for durable and lightweight materials. The packaging industry alone is expected to capture over 52% of the market share by 2033, illustrating its significance in the overall olefins market.

Olefins Market Analysis By Geography

Geographical segmentation reveals North America, Europe, and Asia-Pacific as key markets. North America remains a leader due to advanced production technologies and the availability of feedstock, while Asia-Pacific is recognized for its rapid industrial growth. Each region's demand dynamics reflect local economic conditions and industrial trends.

Olefins Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Olefins Industry

BASF SE:

BASF is a German multinational chemical company, the largest chemical producer in the world, which plays a crucial role in producing innovative solutions in the chemicals sector, particularly olefins.SABIC:

SABIC is a global leader in the petrochemical industry based in Saudi Arabia, focusing on providing sustainable olefin products and contributing significantly to the global market.LyondellBasell Industries:

LyondellBasell is one of the world’s largest plastics, chemicals, and refining companies, leading in olefin production and innovation.ExxonMobil Chemical:

ExxonMobil Chemical is a prominent player in the global petrochemical industry, known for its expertise in the production and distribution of olefins.Dow Inc.:

Dow is a leading diversified science and technology company that produces a wide range of chemical products, including olefins that are crucial for various applications.We're grateful to work with incredible clients.

FAQs

What is the market size of the olefins market?

The global olefins market was valued at approximately $180 billion in 2023, with a projected CAGR of 5% from 2023 to 2033. This growth is reflective of increasing demand across various applications, particularly in plastics and petrochemicals.

What are the key market players or companies in the olefins industry?

Key players in the olefins market include major companies like Dow Chemical, Exxon Mobil, LyondellBasell, Royal Dutch Shell, and Chevron Phillips Chemical. Their strategic initiatives and robust production capabilities contribute significantly to market growth.

What are the primary factors driving the growth in the olefins industry?

The growth of the olefins industry is driven by rising demand in the plastics sector, technological advancements in production processes, and increasing application in automotive and construction industries. Urbanization and the growing need for consumer goods also contribute to market expansion.

Which region is the fastest Growing in the olefins market?

The fastest-growing region in the olefins market is Asia-Pacific, expected to see significant growth from $34.40 billion in 2023 to $56.61 billion by 2033. This growth is fueled by rising industrial activities and increasing population.

Does ConsaInsights provide customized market report data for the olefins industry?

Yes, ConsaInsights offers customized market report data specific to the olefins industry. Clients can request tailored insights and analyses that fit their specific needs or focus areas, empowering better decision-making.

What deliverables can I expect from this olefins market research project?

Deliverables from the olefins market research project include detailed market reports, segment analysis, regional insights, and strategic recommendations. Clients will receive actionable data to inform investment and operational strategies.

What are the market trends of the olefins market?

Current market trends in the olefins segment include increasing utilization of bio-based olefins, advancements in manufacturing technologies, and a shift towards eco-friendly products. Demand in automotive and packaging applications continues to drive growth.