Oleochemicals Market Report

Published Date: 02 February 2026 | Report Code: oleochemicals

Oleochemicals Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the global oleochemicals market, including key trends, forecasts, and regional insights spanning the years 2023 to 2033. It details market size, growth rates, and industry dynamics critical for stakeholders in this sector.

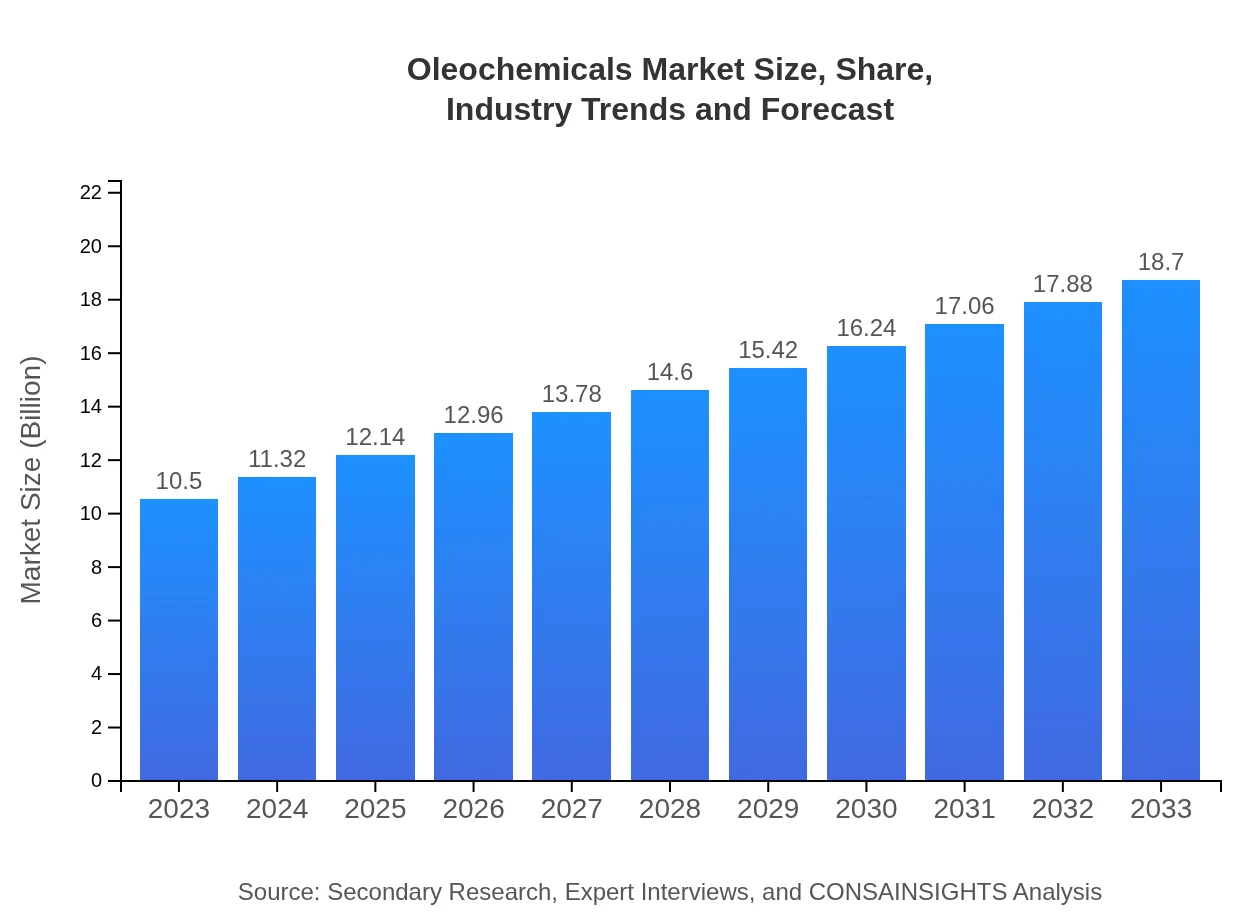

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | BASF SE, Kraton Corporation, Cargill, Incorporated, Emery Oleochemicals |

| Last Modified Date | 02 February 2026 |

Oleochemicals Market Overview

Customize Oleochemicals Market Report market research report

- ✔ Get in-depth analysis of Oleochemicals market size, growth, and forecasts.

- ✔ Understand Oleochemicals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oleochemicals

What is the Market Size & CAGR of Oleochemicals market in 2023?

Oleochemicals Industry Analysis

Oleochemicals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oleochemicals Market Analysis Report by Region

Europe Oleochemicals Market Report:

With a market value of USD 3.27 billion in 2023, the European oleochemicals market is set to expand to USD 5.82 billion by 2033. The stringent environmental regulations and the shift towards sustainable products strongly influence demand in this region, fostering innovations in oleochemical processes.Asia Pacific Oleochemicals Market Report:

The Asia Pacific region dominated the oleochemicals market in 2023, valued at USD 2.00 billion and expected to grow to USD 3.55 billion by 2033. The swift industrialization and rising consumer demand in countries like China and India propel market expansion. Additionally, there is a push for sustainable products in this region, further driving growth.North America Oleochemicals Market Report:

North America held a market size of USD 3.41 billion in 2023, projected to increase to USD 6.08 billion by 2033. The steady demand for oleochemicals in various applications, especially in personal care and food industries, coupled with supportive regulations for bio-based products, drives this growth.South America Oleochemicals Market Report:

In 2023, the oleochemicals market in South America was valued at USD 0.58 billion, anticipated to reach USD 1.02 billion by 2033. Factors contributing to this growth include increasing awareness about eco-friendly products and the rising trend of personal care and cosmetics in countries like Brazil.Middle East & Africa Oleochemicals Market Report:

The oleochemicals market in the Middle East and Africa was valued at USD 1.25 billion in 2023 and is expected to rise to USD 2.23 billion by 2033 as investments in sustainable chemical production grow and the demand for oleochemical applications increases across various sectors.Tell us your focus area and get a customized research report.

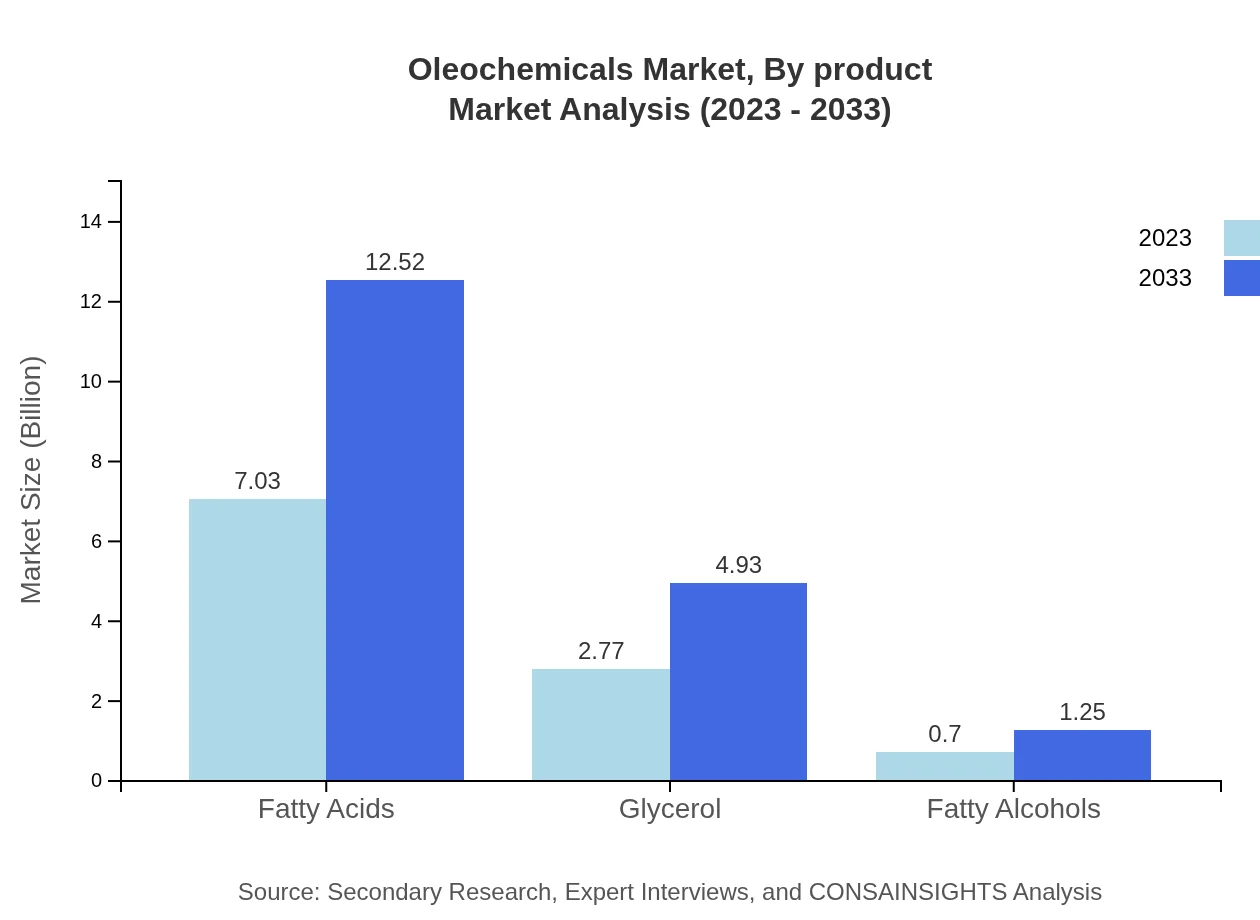

Oleochemicals Market Analysis By Product

The oleochemicals market by product primarily includes vegetable oils, fatty acids, fatty alcohols, and glycerol. In 2023, vegetable oils accounted for 66.96% of the market share, valued at approximately USD 7.03 billion, which is expected to increase to USD 12.52 billion by 2033. Fatty acids and glycerol also play significant roles, holding 26.34% and 6.7% market shares, respectively, reaffirming their importance in multiple applications.

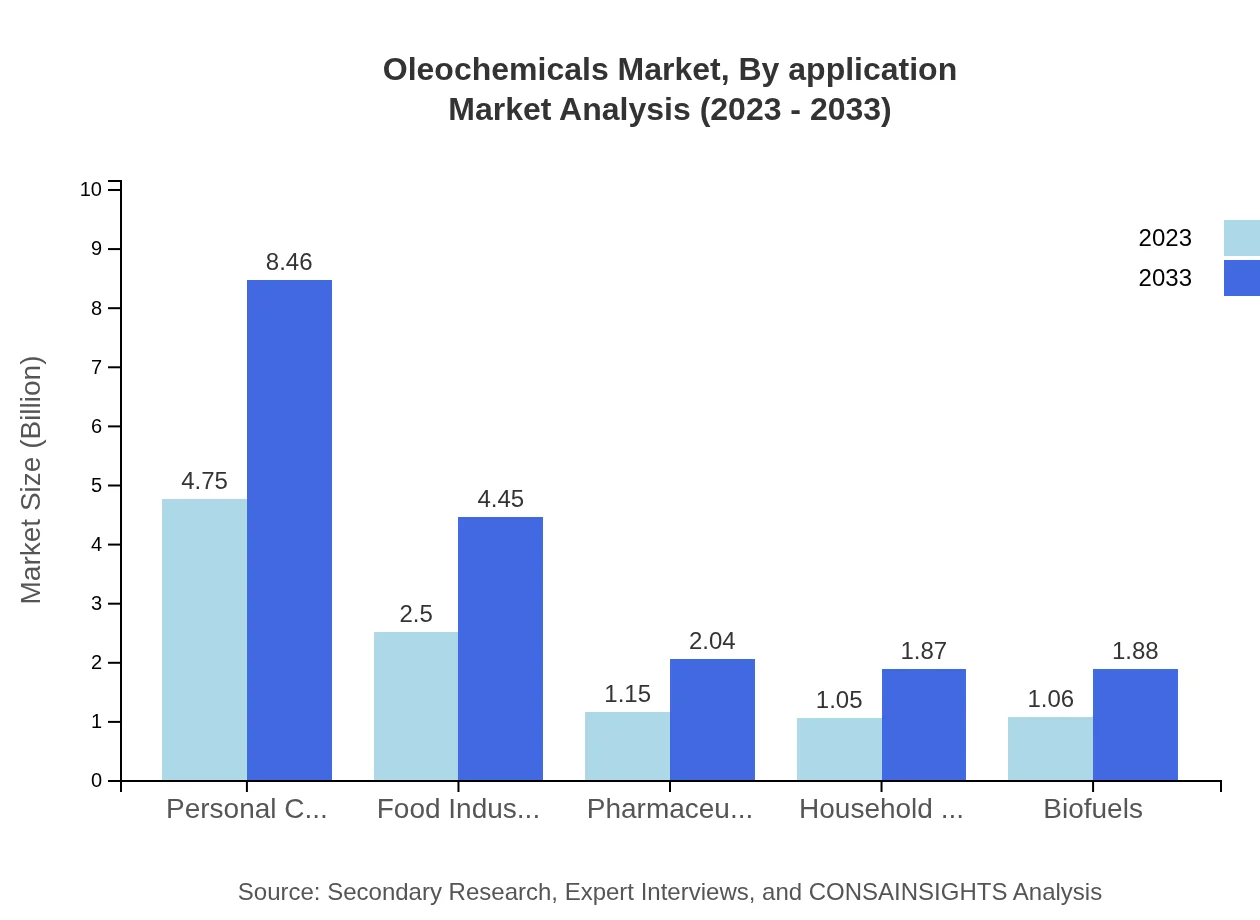

Oleochemicals Market Analysis By Application

By application, the oleochemicals market includes personal care products, food, pharmaceuticals, and biofuels. The personal care industry represented a significant segment with a market size of USD 4.75 billion in 2023, forecasted to grow to USD 8.46 billion by 2033, accounting for 45.23% of the market share. The food industry likewise plays a pivotal role, expected to grow from USD 2.50 billion in 2023 to USD 4.45 billion by 2033.

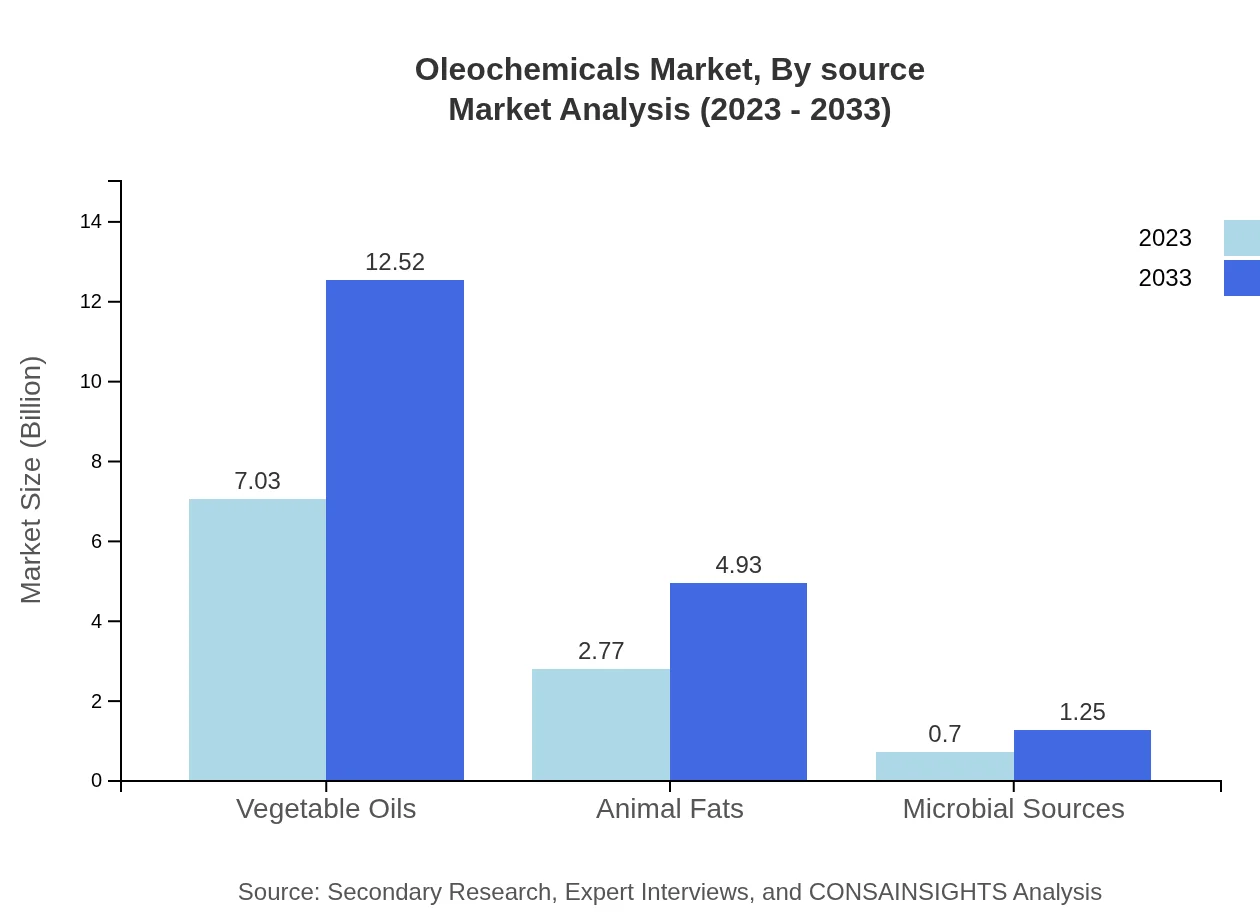

Oleochemicals Market Analysis By Source

Oleochemicals are sourced mainly from vegetable and animal fats, alongside microbial sources. Vegetable oils provide the bulk of the market, with a significant share due to increased cultivation of oil crops. The market segments reflect a growing trend towards animal fats and microbial sources, both of which are becoming increasingly popular due to sustainability considerations.

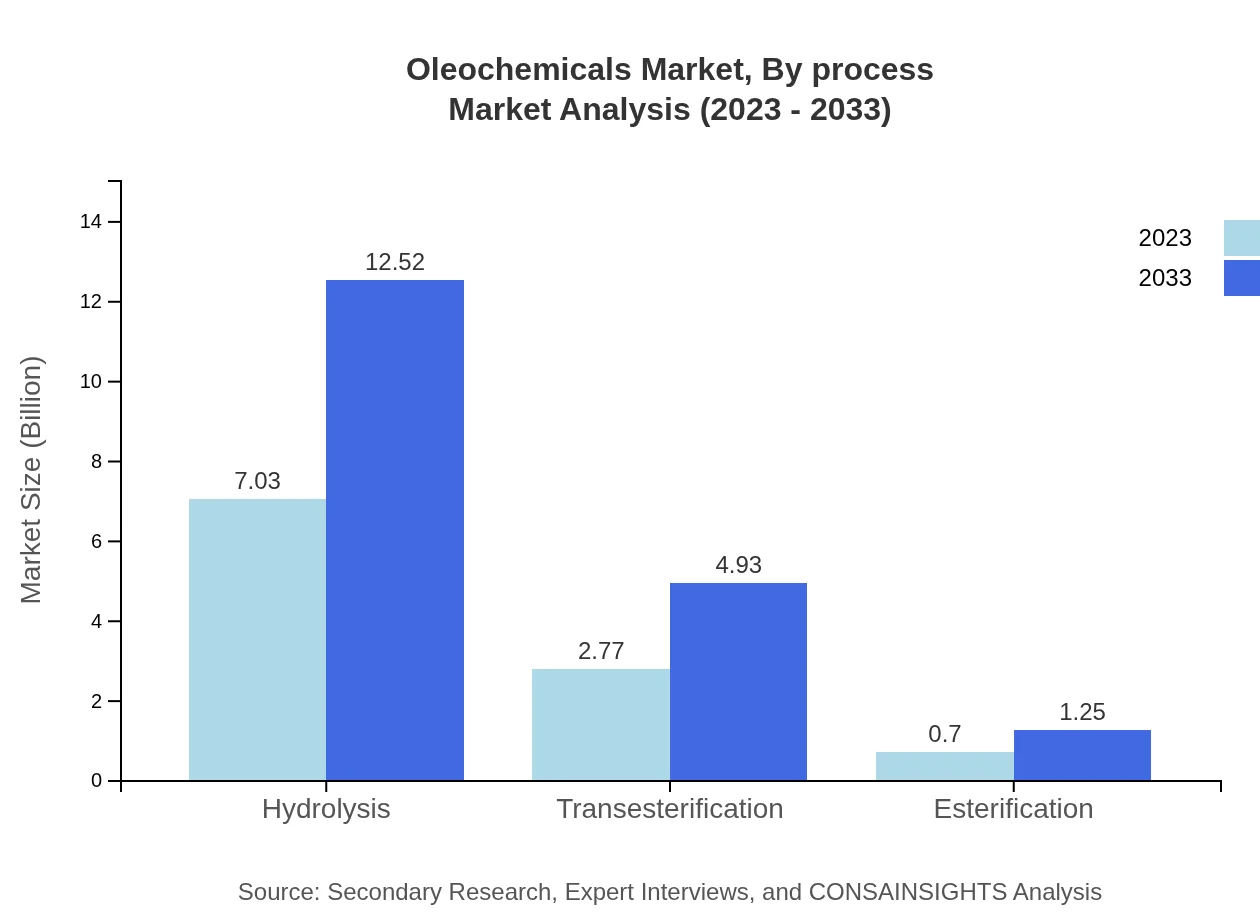

Oleochemicals Market Analysis By Process

The major processes in the oleochemicals market include hydrolysis, transesterification, and esterification. Hydrolysis leads the segment, anticipated to grow from USD 7.03 billion in 2023 to USD 12.52 billion by 2033, holding a significant market share due to its efficiency in producing fatty acids and glycerol. Transesterification, primarily used in biodiesel production, continues to expand as renewable energy becomes more prominent.

Oleochemicals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oleochemicals Industry

BASF SE:

BASF is a prominent player in the oleochemicals market, known for its extensive range of products and commitment to sustainable chemical solutions.Kraton Corporation:

Kraton specializes in producing bio-based performance polymers derived from renewable resources, leveraging innovative technologies to enhance product performance.Cargill, Incorporated:

Cargill is a global leader in agricultural products, actively involved in producing oleochemicals and promoting sustainable practices in chemical production.Emery Oleochemicals:

Emery Oleochemicals focuses on high-performance bio-based specialty chemicals, contributing actively to the global transition towards greener chemistry.We're grateful to work with incredible clients.

FAQs

What is the market size of oleochemicals?

The global oleochemicals market is projected to grow from approximately $10.5 billion in 2023 to significant values by 2033, with a CAGR of 5.8%, indicating robust growth driven by diverse applications across multiple sectors.

What are the key market players or companies in this oleochemicals industry?

Key players in the oleochemicals market include major companies like BASF, Cargill, and Wilmar International, which dominate production and innovation across various segments, contributing to market growth through advancements and sustainability initiatives.

What are the primary factors driving the growth in the oleochemicals industry?

Growth in the oleochemicals industry is driven by increasing demand for bio-based products, awareness of sustainable alternatives, and expanding applications in personal care, food, and biofuels, prompting investment in green chemistry technologies.

Which region is the fastest Growing in the oleochemicals?

The fastest-growing region in the oleochemicals market is North America, expecting growth from $3.41 billion in 2023 to $6.08 billion by 2033, driven by strong demand in personal care and food sectors alongside stringent environmental regulations.

Does ConsaInsights provide customized market report data for the oleochemicals industry?

Yes, ConsaInsights offers customized market reports tailored to client needs in the oleochemicals industry, providing targeted insights and data tailored to specific segments, regions, or challenges for better strategic decisions.

What deliverables can I expect from this oleochemicals market research project?

From an oleochemicals market research project, you can expect comprehensive reports including market size, forecasts, competitive analysis, as well as insights into trends, key players, and segment-specific data, enhancing market understanding.

What are the market trends of oleochemicals?

Market trends in oleochemicals indicate a shift towards renewable feedstocks, increased use in biodegradable products, and rising demand in cosmetics and household products, aligning with global sustainability goals and consumer preferences.