Organic Pigments Market Report

Published Date: 02 February 2026 | Report Code: organic-pigments

Organic Pigments Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the organic pigments market, covering trends, insights, and detailed forecasts from 2023 to 2033. It examines market size, growth rates, segmentation, and regional dynamics affecting industry players over the coming decade.

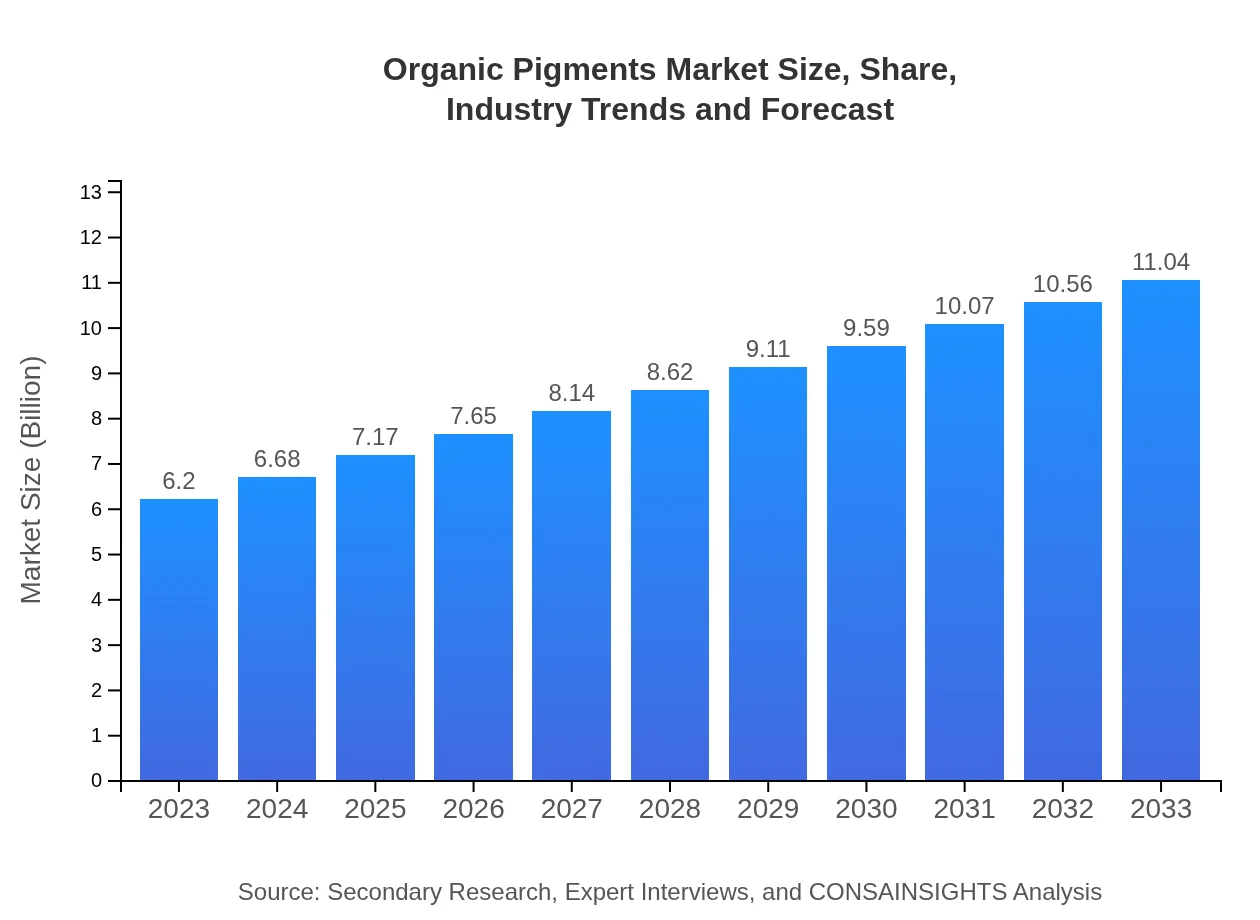

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.20 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $11.04 Billion |

| Top Companies | Clariant AG, Sun Chemical, BASF SE |

| Last Modified Date | 02 February 2026 |

Organic Pigments Market Overview

Customize Organic Pigments Market Report market research report

- ✔ Get in-depth analysis of Organic Pigments market size, growth, and forecasts.

- ✔ Understand Organic Pigments's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Organic Pigments

What is the Market Size & CAGR of Organic Pigments market in 2023?

Organic Pigments Industry Analysis

Organic Pigments Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Organic Pigments Market Analysis Report by Region

Europe Organic Pigments Market Report:

The European organic pigments market is anticipated to grow significantly from $1.80 billion in 2023 to $3.21 billion by 2033. The drive for sustainable products and adherence to environmental regulations are key factors influencing this growth, particularly in the coatings and plastics industries.Asia Pacific Organic Pigments Market Report:

The Asia Pacific region holds a major share of the organic pigments market, estimated at $1.16 billion in 2023 and projected to reach $2.06 billion by 2033. The growth is fueled by burgeoning industrial activities and increasing consumer goods manufacturing in countries like China and India, where demand for colorful and high-performance pigments is on the rise.North America Organic Pigments Market Report:

North America is witnessing robust growth in the organic pigments market, with a valuation of $2.32 billion in 2023, projected to expand to $4.14 billion by 2033. The region's stringent environmental regulations encourage manufacturers to adopt sustainable practices, boosting demand for eco-friendly organic pigments.South America Organic Pigments Market Report:

The South American market for organic pigments is expected to grow from $0.30 billion in 2023 to $0.54 billion by 2033. This growth is driven by rising investments in the automotive and construction sectors, where organic pigments are increasingly replacing traditional alternatives due to their superior performance.Middle East & Africa Organic Pigments Market Report:

In the Middle East and Africa, the organic pigments market is expected to increase from $0.62 billion in 2023 to $1.10 billion by 2033. Growth in this region is supported by infrastructural development projects and a rising number of manufacturing activities, particularly in the textile and coatings sectors.Tell us your focus area and get a customized research report.

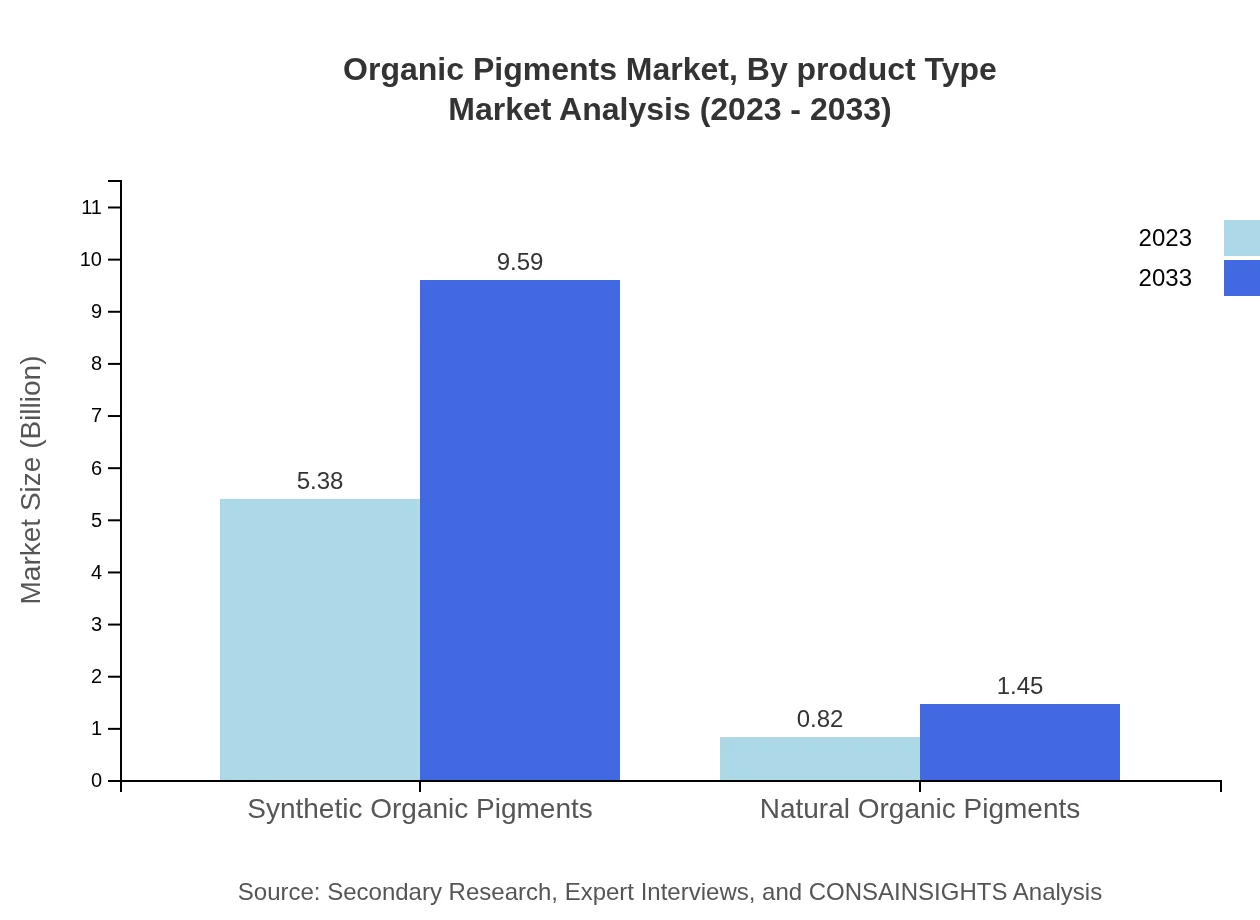

Organic Pigments Market Analysis By Product Type

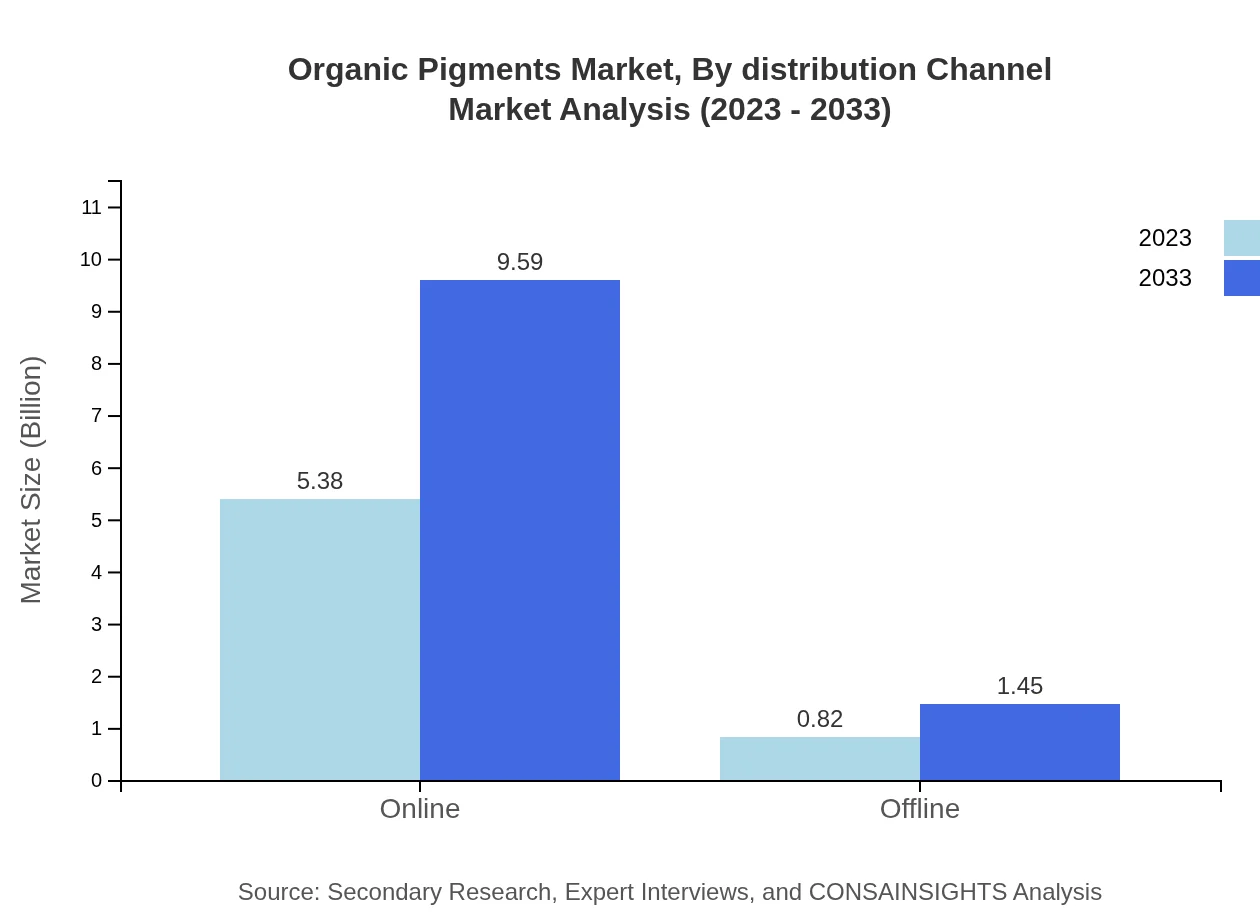

The market is predominantly led by synthetic organic pigments, with a market size of $5.38 billion in 2023, expected to reach $9.59 billion by 2033. This segment's market share is approximately 86.83%. Natural organic pigments, valued at $0.82 billion, are anticipated to grow to $1.45 billion, holding a share of 13.17%.

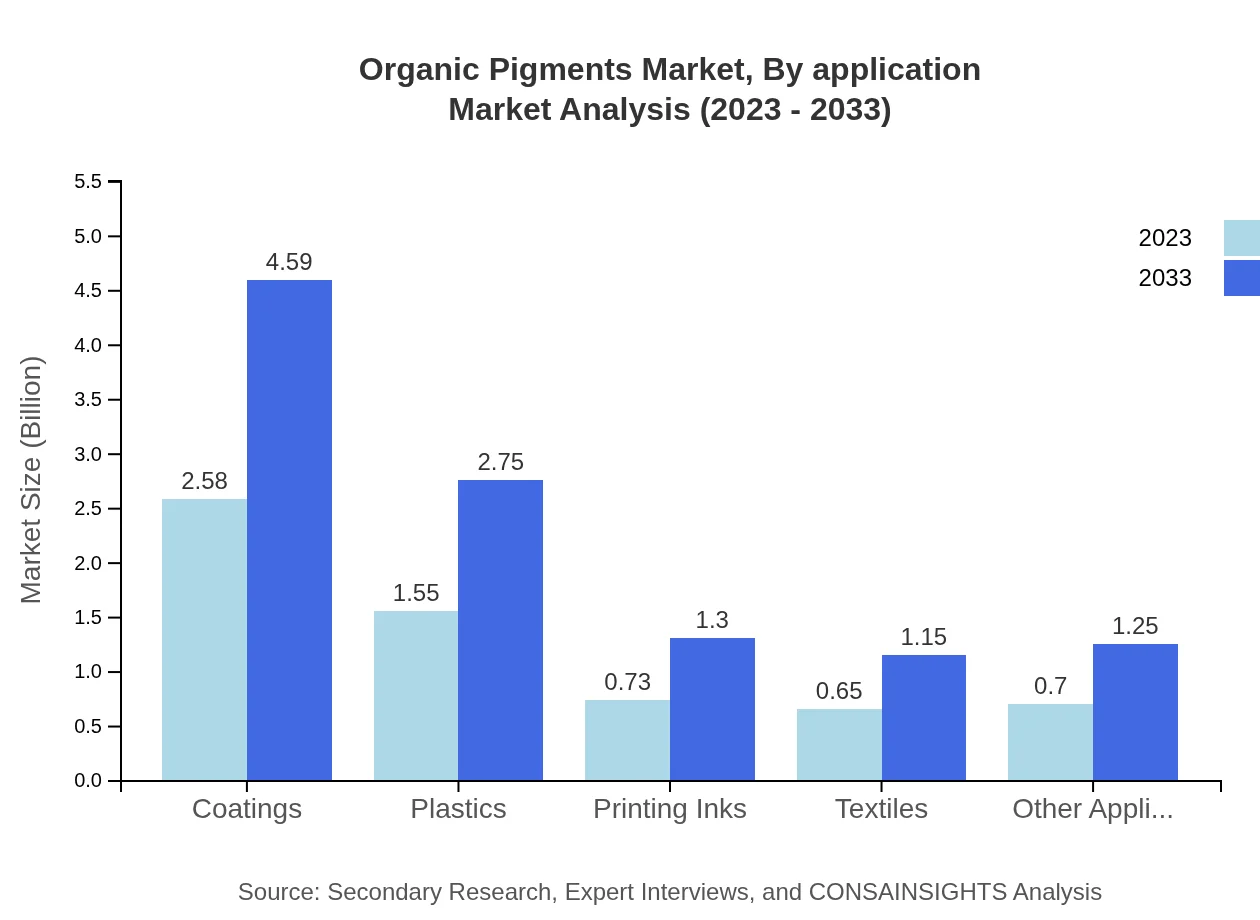

Organic Pigments Market Analysis By Application

Different applications of organic pigments reflect varied performance characteristics. In the coatings segment, the market size is $2.58 billion in 2023, expected to expand to $4.59 billion by 2033. Printing inks follow with a size of $0.73 billion, projected to grow to $1.30 billion during the same period, demonstrating their crucial presence across several industries.

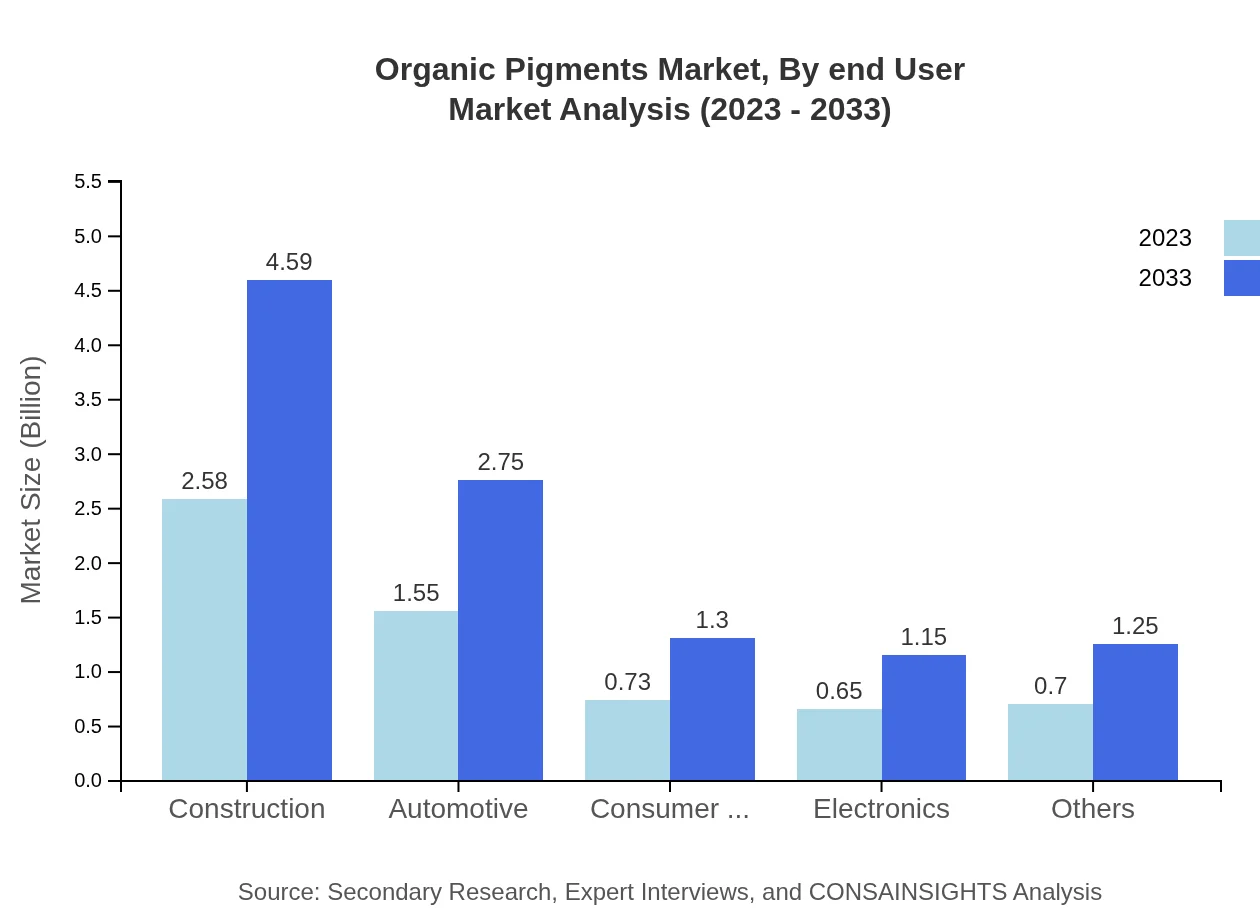

Organic Pigments Market Analysis By End User

Key end-user industries utilizing organic pigments include the construction industry, projected to grow from $2.58 billion to $4.59 billion. The automotive sector is also significant, with expected growth from $1.55 billion to $2.75 billion, reflecting the growing need for durable coatings and finishes.

Organic Pigments Market Analysis By Distribution Channel

The organic pigments market distribution channels include both online and offline platforms. Online channels dominate with a market size of $5.38 billion in 2023, expected to rise to $9.59 billion, representing 86.83% of the market shares. Offline channels are expected to grow as well from $0.82 billion to $1.45 billion, gaining a market share of 13.17%.

Organic Pigments Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Organic Pigments Industry

Clariant AG:

A global leader in specialty chemicals, Clariant AG offers a variety of innovative organic pigments known for their high performance in various applications, including plastics and coatings.Sun Chemical:

As one of the largest manufacturers of organic pigments, Sun Chemical provides a wide range of products used in the printing inks and coatings industries, focusing on sustainability and performance.BASF SE:

BASF SE is a major player in the chemical industry, supplying a diverse range of organic pigments with a strong emphasis on eco-friendly options and innovations that meet industry standards.We're grateful to work with incredible clients.

FAQs

What is the market size of organic Pigments?

The global organic pigments market is currently valued at approximately $6.2 billion, with a projected CAGR of 5.8% over the next decade, indicating steady growth reflecting increasing demand in various application sectors.

What are the key market players or companies in the organic Pigments industry?

Major players include manufacturers like Clariant, BASF, and Sun Chemicals. Their expertise and innovation significantly contribute to the market landscape, ensuring competitive dynamics through advancements in organic pigment technologies and sustainable practices.

What are the primary factors driving the growth in the organic pigments industry?

Key drivers include rising consumer demand for eco-friendly products, advancements in pigment technologies, and increasing applications across industries like construction, automotive, and textiles, pushing the market towards sustained expansion.

Which region is the fastest Growing in the organic pigments?

The Asia-Pacific region is the fastest-growing market for organic pigments, expected to grow from $1.16 billion in 2023 to $2.06 billion by 2033, showcasing significant industrial and economic developments supporting this growth.

Does ConsaInsights provide customized market report data for the organic pigments industry?

Yes, ConsaInsights offers customized market reports tailored to your specific needs in the organic pigments industry, enabling companies to gain insights relevant to their strategic planning and operational initiatives.

What deliverables can I expect from this organic pigments market research project?

Expect comprehensive deliverables like detailed market analysis, regional insights, growth projections, competitive landscapes, and segment performance, aiding strategic decisions in the organic pigments sector.

What are the market trends of organic pigments?

Current trends include a shift towards sustainable and natural pigments, increasing demand from the coatings industry, and innovations in synthetic organic pigments, shaping a more environmentally-friendly market direction.