Peer To Peer P2p- Lending Market Report

Published Date: 31 January 2026 | Report Code: peer-to-peer-p2p--lending

Peer To Peer P2p- Lending Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Peer To Peer (P2P) Lending market from 2023 to 2033, providing insights into market size, trends, regional analysis, and growth opportunities within the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

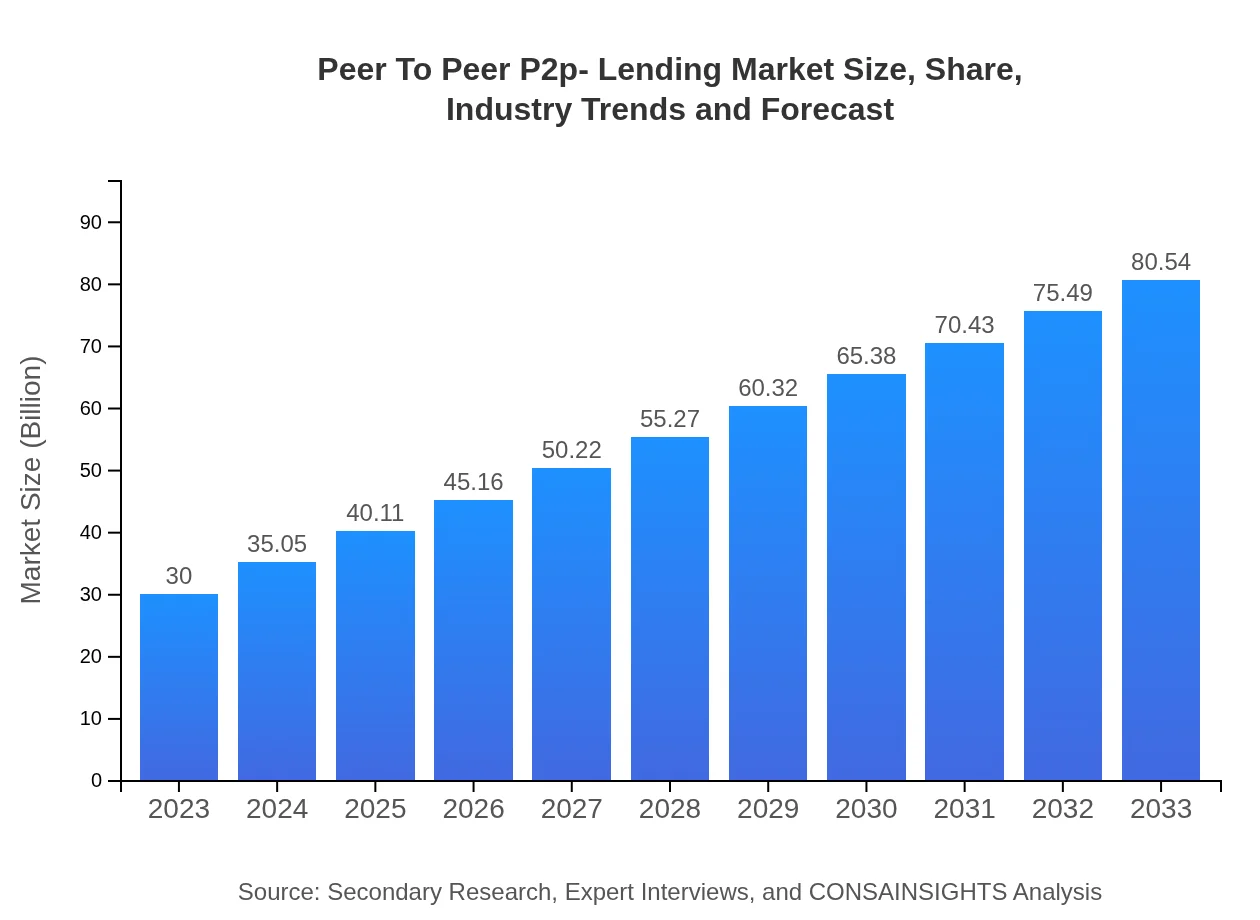

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $80.54 Billion |

| Top Companies | LendingClub, Prosper Marketplace, Funding Circle, Zopa, RateSetter |

| Last Modified Date | 31 January 2026 |

Peer To Peer P2p- Lending Market Overview

Customize Peer To Peer P2p- Lending Market Report market research report

- ✔ Get in-depth analysis of Peer To Peer P2p- Lending market size, growth, and forecasts.

- ✔ Understand Peer To Peer P2p- Lending's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Peer To Peer P2p- Lending

What is the Market Size & CAGR of Peer To Peer P2p- Lending market in 2023 and 2033?

Peer To Peer P2p- Lending Industry Analysis

Peer To Peer P2p- Lending Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Peer To Peer P2p- Lending Market Analysis Report by Region

Europe Peer To Peer P2p- Lending Market Report:

In Europe, the P2P lending market is projected to grow from $8.19 billion in 2023 to $21.99 billion by 2033. The growing shift towards digital financing options and a rise in entrepreneurial ventures promotes the use of P2P platforms across various nations. Countries like the UK, Germany, and the Netherlands are at the forefront, adopting comprehensive regulatory frameworks to support the market’s development.Asia Pacific Peer To Peer P2p- Lending Market Report:

In the Asia Pacific region, P2P lending is rapidly gaining traction, with a market size projected to grow from $5.78 billion in 2023 to $15.53 billion by 2033. Key drivers include a young population, increasing smartphone penetration, and the need for alternative financing solutions. China remains the largest market, followed by India and Southeast Asia, as growing fintech ecosystems foster substantial P2P lending platforms.North America Peer To Peer P2p- Lending Market Report:

North America stands as a significant contributor to the global P2P lending market, with a projected market value of $9.91 billion in 2023, expanding to $26.60 billion by 2033. The region benefits from a mature financial ecosystem, high consumer trust, and robust regulatory support. Many established P2P lending platforms are driving market growth through innovative lending products and improved user experiences.South America Peer To Peer P2p- Lending Market Report:

The South American P2P lending market, valued at $2.19 billion in 2023, is expected to reach $5.89 billion by 2033. The region is witnessing an increase in financial inclusion due to growing digital adoption and innovation in financial services, although regulatory challenges persist in some countries. Platforms in Brazil and Argentina are leading the way in establishing solid borrower bases.Middle East & Africa Peer To Peer P2p- Lending Market Report:

The Middle East and Africa region's P2P lending market, valued at $3.92 billion in 2023, is anticipated to reach $10.53 billion by 2033. Increasing investor appetite for innovative financing solutions and the growth of online platforms are key factors behind this growth. However, the market faces distinct challenges related to regulatory uncertainty and economic instability in various countries.Tell us your focus area and get a customized research report.

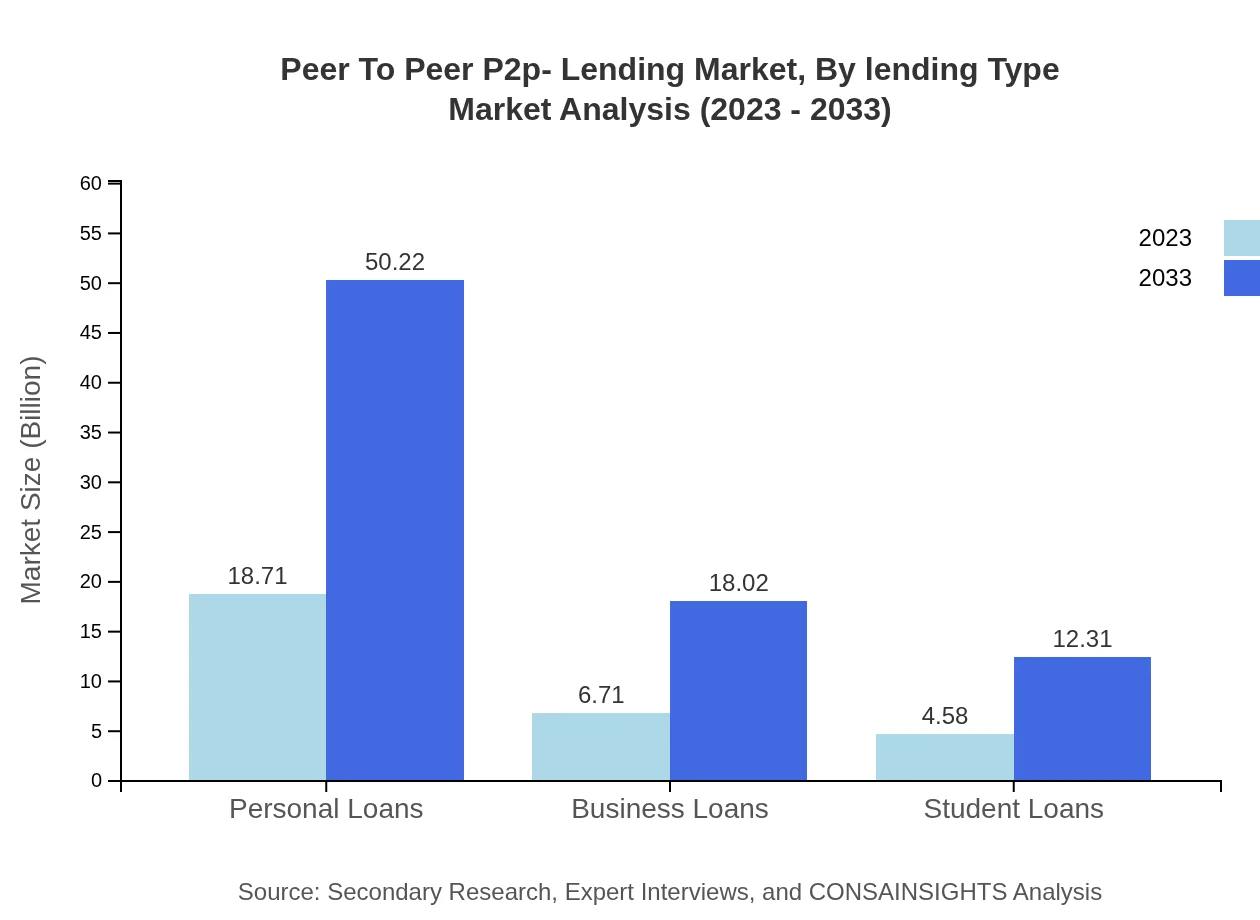

Peer To Peer P2p- Lending Market Analysis By Lending Type

The P2P lending market segment by lending type is dominated by personal loans, accounting for $18.71 billion in 2023 and expected to grow to $50.22 billion by 2033, making up approximately 62.35% of market share. Business loans represent a significant portion as well, particularly with a market size of $6.71 billion in 2023 and growth to $18.02 billion by 2033. Student loans are also a niche market with increasing recognition, projected to increase from $4.58 billion to $12.31 billion in the same time frame.

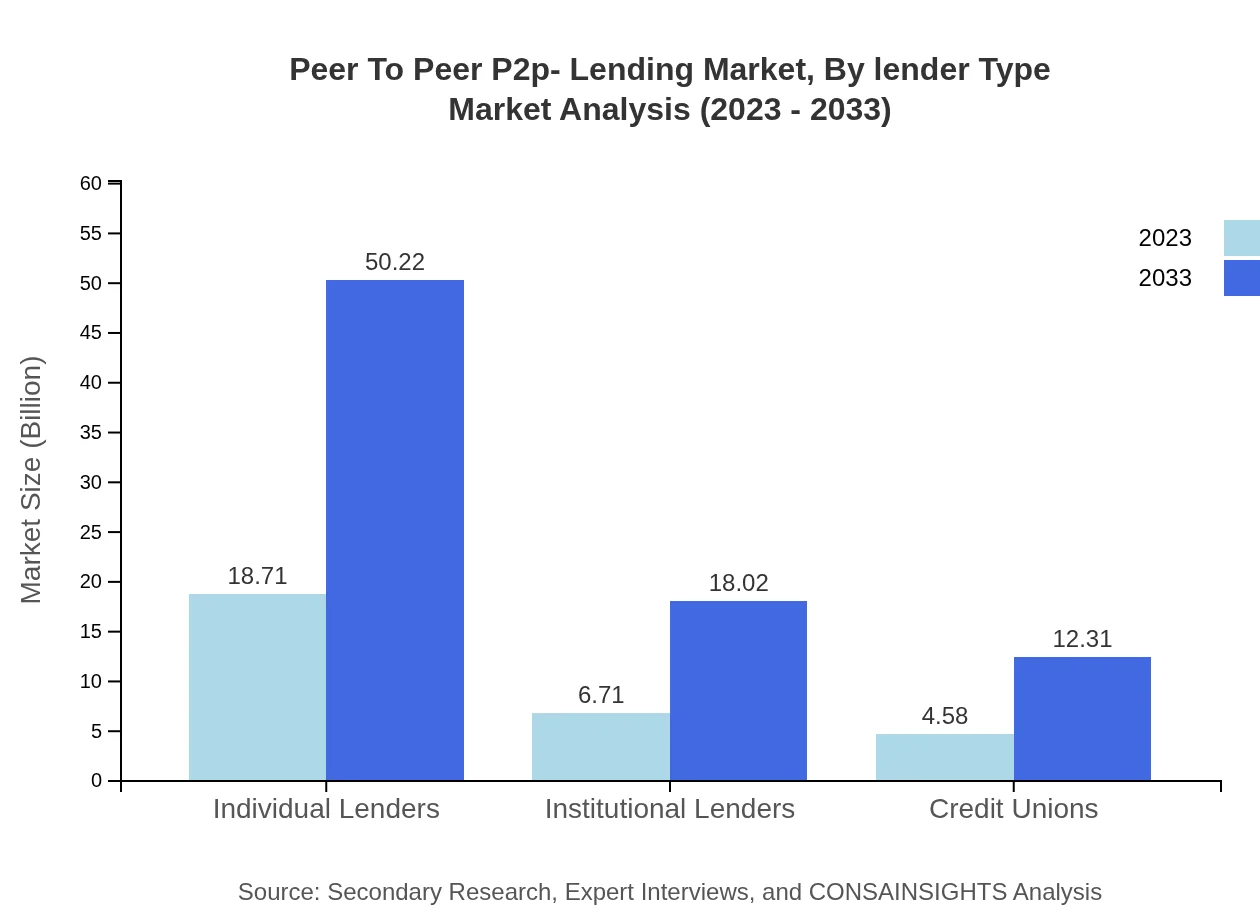

Peer To Peer P2p- Lending Market Analysis By Lender Type

In terms of lender type, individual lenders contribute the majority share of the P2P lending market, with a size of $18.71 billion in 2023, slated to grow to $50.22 billion by 2033. Institutional lenders also play a growing role, with their market share expected to increase significantly from $6.71 billion to $18.02 billion in the same period. Credit unions are lower, at $4.58 billion in 2023, but hold promise for future growth driven by technological innovation and regulatory frameworks.

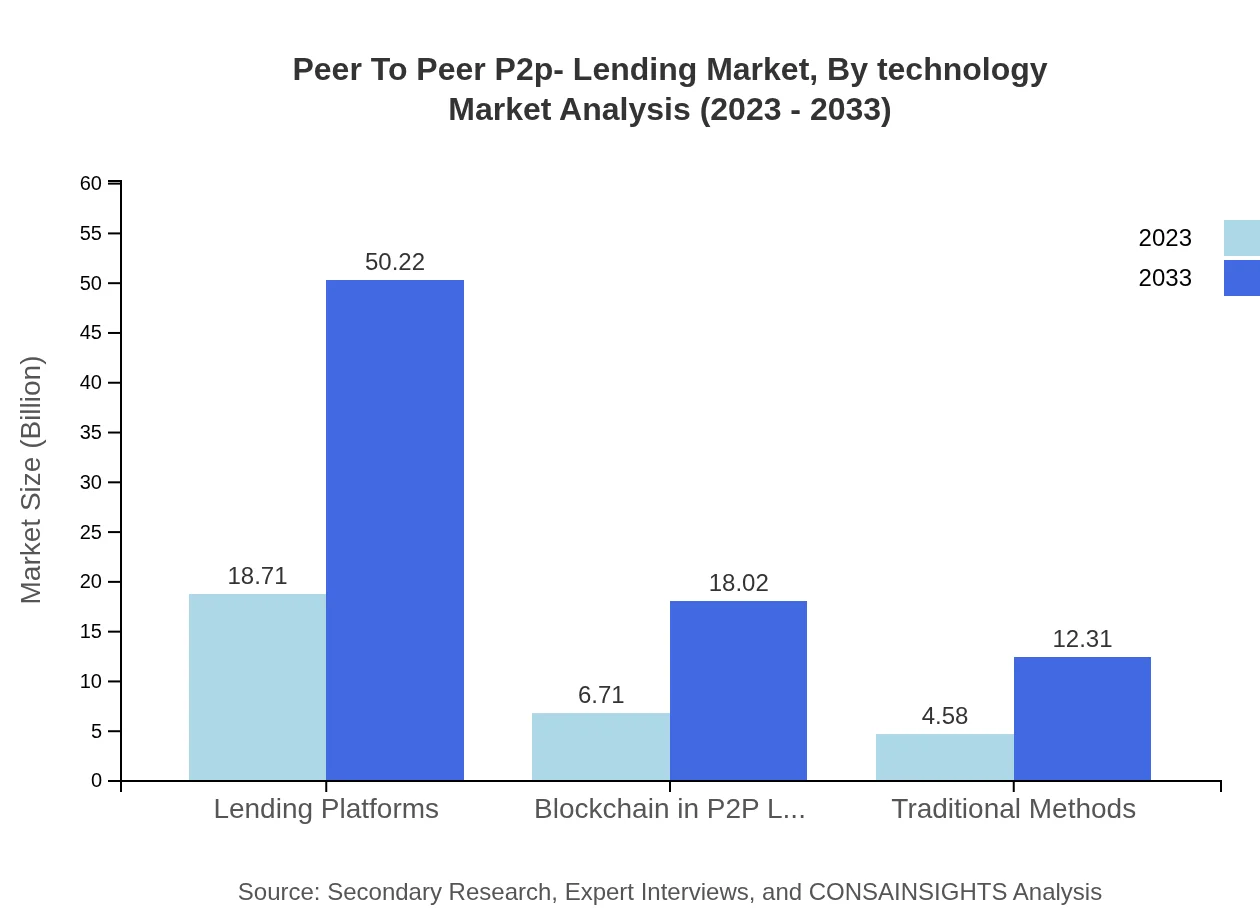

Peer To Peer P2p- Lending Market Analysis By Technology

The technology segment within P2P lending showcases rapid shifts, particularly with blockchain technology adoption. This sector is expected to see growth from $6.71 billion in 2023 to $18.02 billion by 2033, accounting for about 22.37% of the market share. Traditional methods still retain a stake at $4.58 billion in 2023 but are projected to grow comparably to $12.31 billion, emphasizing the need for improved service offerings and competitive pricing from established players.

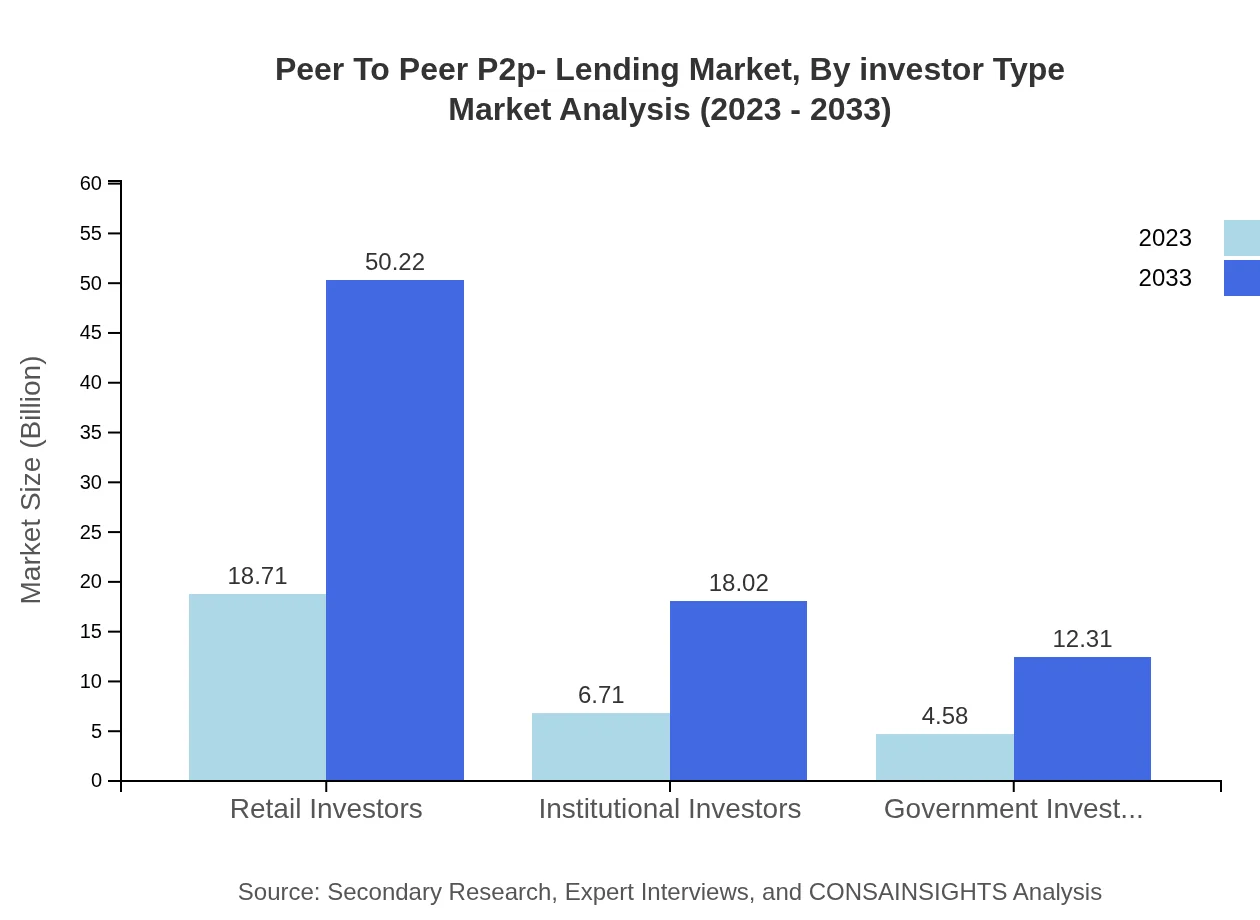

Peer To Peer P2p- Lending Market Analysis By Investor Type

Investor engagement in the P2P lending realm is primarily driven by retail investors, who hold a market size of $18.71 billion in 2023, expected to expand to $50.22 billion by 2033. Conversely, institutional investors, though smaller, are growing steadily from $6.71 billion to $18.02 billion, presenting significant room for expansion as institutions increasingly portfolio diversify into P2P lending ventures.

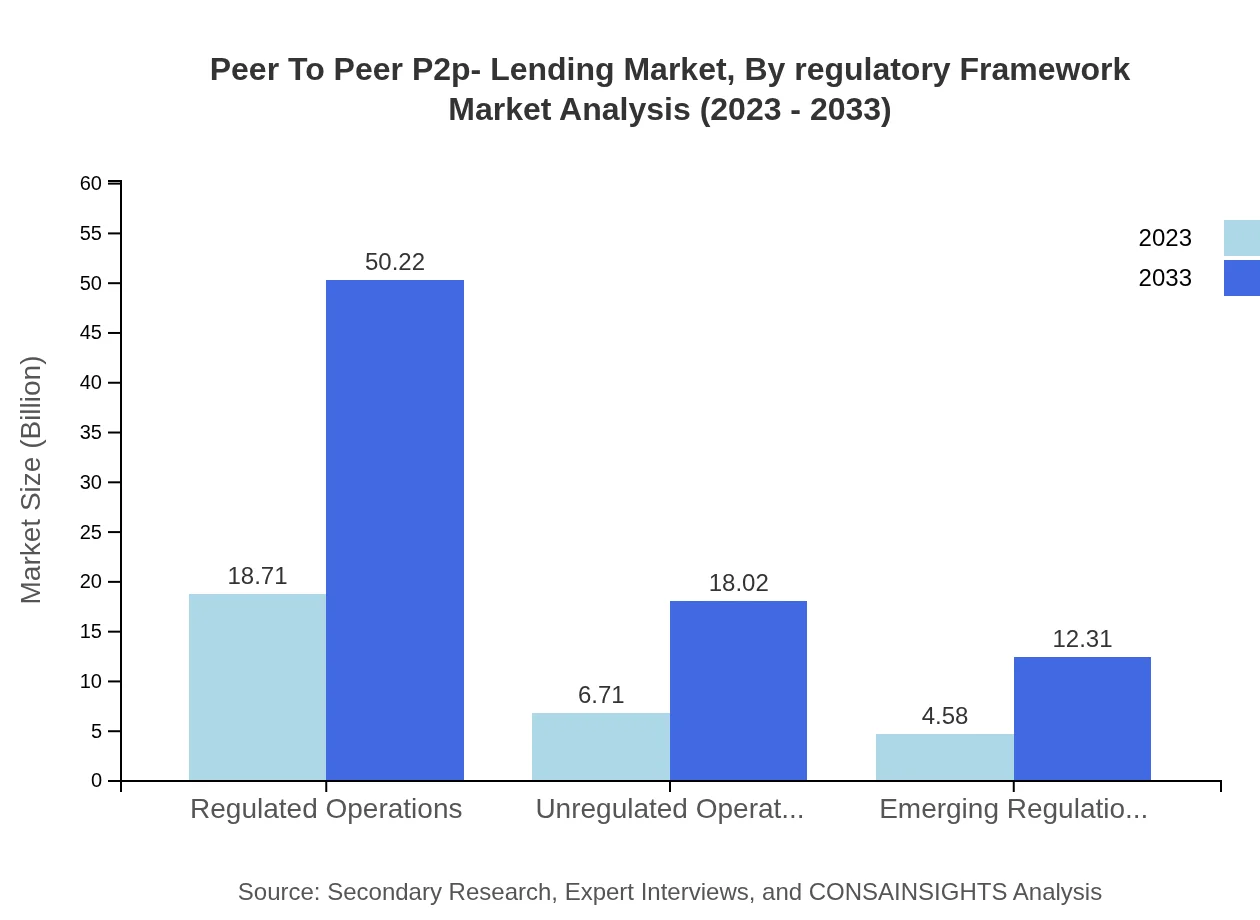

Peer To Peer P2p- Lending Market Analysis By Regulatory Framework

The regulatory landscape in P2P lending is characterized by a mix of regulated and unregulated operations. Regulated operations currently hold a substantial market share of $18.71 billion in 2023, projected to grow to $50.22 billion by 2033. Unregulated operations, while also presenting growth opportunities, are expected to increase from $6.71 billion to $18.02 billion. This segment would require diligent attention from both platform operators and regulatory bodies to ensure compliance and foster a secure lending environment.

Peer To Peer P2p- Lending Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Peer To Peer P2p- Lending Industry

LendingClub:

A pioneer in the P2P lending space, LendingClub connects borrowers and investors through its online platform and has facilitated billions in loans since its inception, making significant contributions to the industry's growth.Prosper Marketplace:

Prosper is one of the first P2P lending marketplaces in the United States, allowing individual investors to fund personal loans, and has set benchmarks in innovative lending practices, contributing to market expansion.Funding Circle:

Specializing in small business loans, Funding Circle has established itself as a leader in P2P lending for businesses, enhancing accessibility to credit and providing straightforward terms for borrowers.Zopa:

As a UK-based P2P company, Zopa was among the first to offer personal loans via a peer-to-peer model, leveraging technology to streamline loan processes and establish itself as a trusted platform in Europe.RateSetter:

RateSetter operates a significant P2P lending platform in the UK, allowing members to lend money to individuals and businesses while maintaining transparent lending practices and competitive interest rates.We're grateful to work with incredible clients.

FAQs

What is the market size of Peer To-Peer (P2P) Lending?

The global peer-to-peer (P2P) lending market is valued at $30 billion in 2023, with a projected CAGR of 10% through 2033. This signifies significant growth potential as the industry expands and evolves.

What are the key market players or companies in the Peer To-Peer (P2P) Lending industry?

Key players in the P2P lending market include established platforms and innovative fintech startups. Companies are actively contributing to market growth through technological advancements and customer-centric approaches, reshaping the lending landscape.

What are the primary factors driving the growth in the Peer To-Peer (P2P) Lending industry?

Factors driving growth in the P2P lending industry include increasing demand for alternative financing solutions, the rise of digital financial platforms, and enhanced user trust in online lending methods, fostering a more inclusive credit ecosystem.

Which region is the fastest Growing in the Peer To-Peer (P2P) Lending market?

The North American region is the fastest-growing within the P2P lending market, expected to expand from $9.91 billion in 2023 to $26.60 billion by 2033. This growth reflects the region's strong demand for innovative lending solutions.

Does ConsaInsights provide customized market report data for the Peer To-Peer (P2P) Lending industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the P2P lending space, enabling stakeholders to access nuanced insights and make informed strategic decisions.

What deliverables can I expect from this Peer To-Peer (P2P) Lending market research project?

Deliverables from the P2P lending market research project typically include comprehensive reports, trend analysis, market forecasts, segmentation data, and actionable recommendations to guide investment and business strategies.

What are the market trends of Peer To-Peer (P2P) Lending?

Key market trends in P2P lending include the growing adoption of blockchain technology, increasing interest in sustainable lending practices, and the rise of personalized lending solutions that cater to individual borrower needs.