Security Analytics Market Report

Published Date: 31 January 2026 | Report Code: security-analytics

Security Analytics Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report delves into the Security Analytics industry, providing actionable insights, market forecasts, and detailed analyses from 2023 to 2033. It explores market size, trends, regional dynamics, and key players that shape the industry's future.

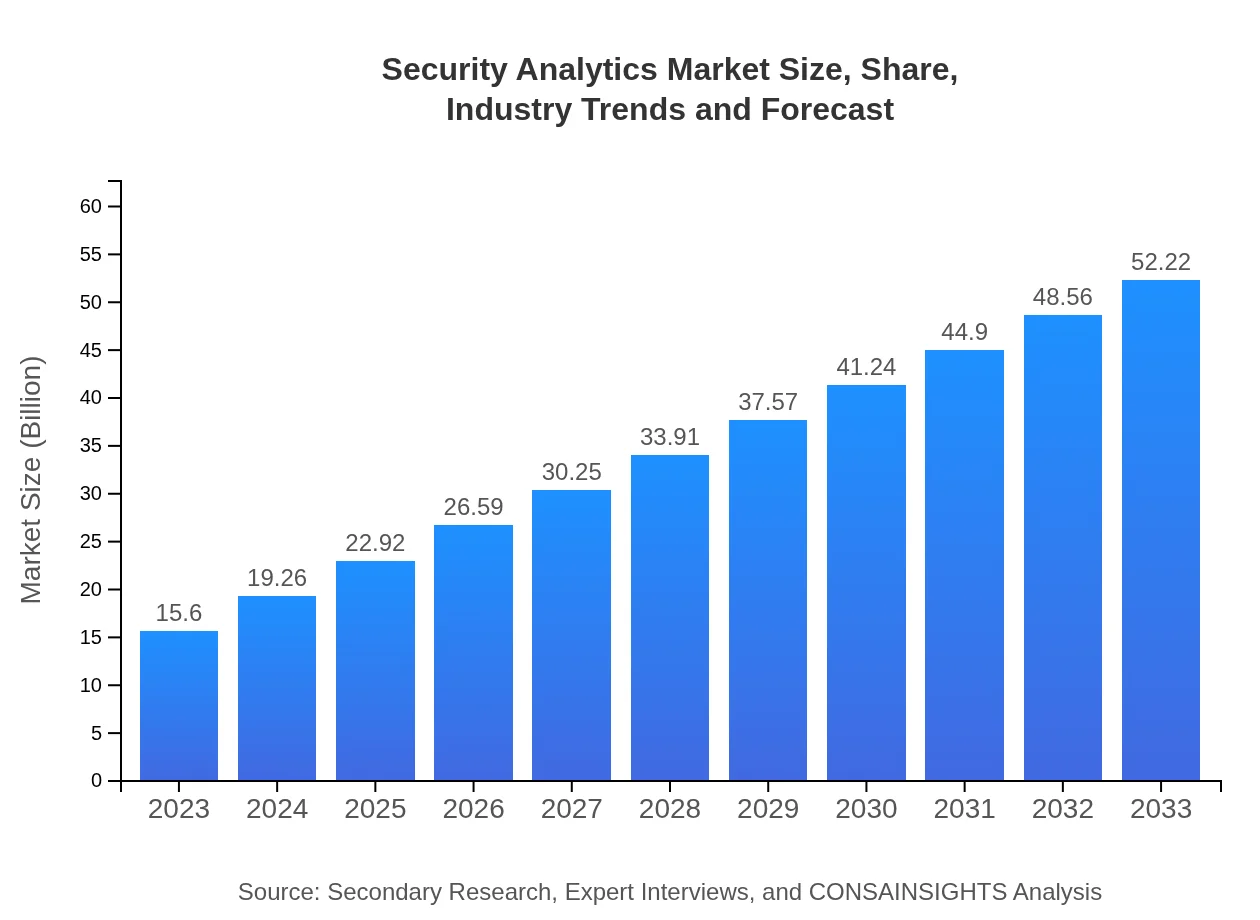

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $52.22 Billion |

| Top Companies | IBM, Splunk, McAfee, SAS Institute, Cisco |

| Last Modified Date | 31 January 2026 |

Security Analytics Market Overview

Customize Security Analytics Market Report market research report

- ✔ Get in-depth analysis of Security Analytics market size, growth, and forecasts.

- ✔ Understand Security Analytics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Security Analytics

What is the Market Size & CAGR of Security Analytics market in 2023?

Security Analytics Industry Analysis

Security Analytics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Security Analytics Market Analysis Report by Region

Europe Security Analytics Market Report:

Europe's market is estimated at USD 4.11 billion in 2023, with forecasts suggesting growth to USD 13.75 billion by 2033, largely driven by stringent regulations and increased investment in security infrastructure.Asia Pacific Security Analytics Market Report:

In 2023, the Asia Pacific security analytics market stands at USD 3.28 billion, with projections to reach USD 10.97 billion by 2033, showcasing a strong growth trajectory as businesses increasingly adopt advanced security measures amid escalating cyber threats.North America Security Analytics Market Report:

North America dominates the market, starting with a valuation of USD 5.38 billion in 2023, with an expected increase to USD 18.02 billion by 2033 due to its large technology base and high expenditure on cybersecurity solutions.South America Security Analytics Market Report:

The South American security analytics market is valued at USD 0.96 billion in 2023 and is expected to rise to USD 3.21 billion by 2033. The growing digitization and awareness around data protection among companies have contributed to this upward trend.Middle East & Africa Security Analytics Market Report:

The Middle East and Africa region begins with a market size of USD 1.87 billion in 2023 and is anticipated to grow to USD 6.27 billion by 2033, facilitated by rising adoption of security analytics among enterprises in this region.Tell us your focus area and get a customized research report.

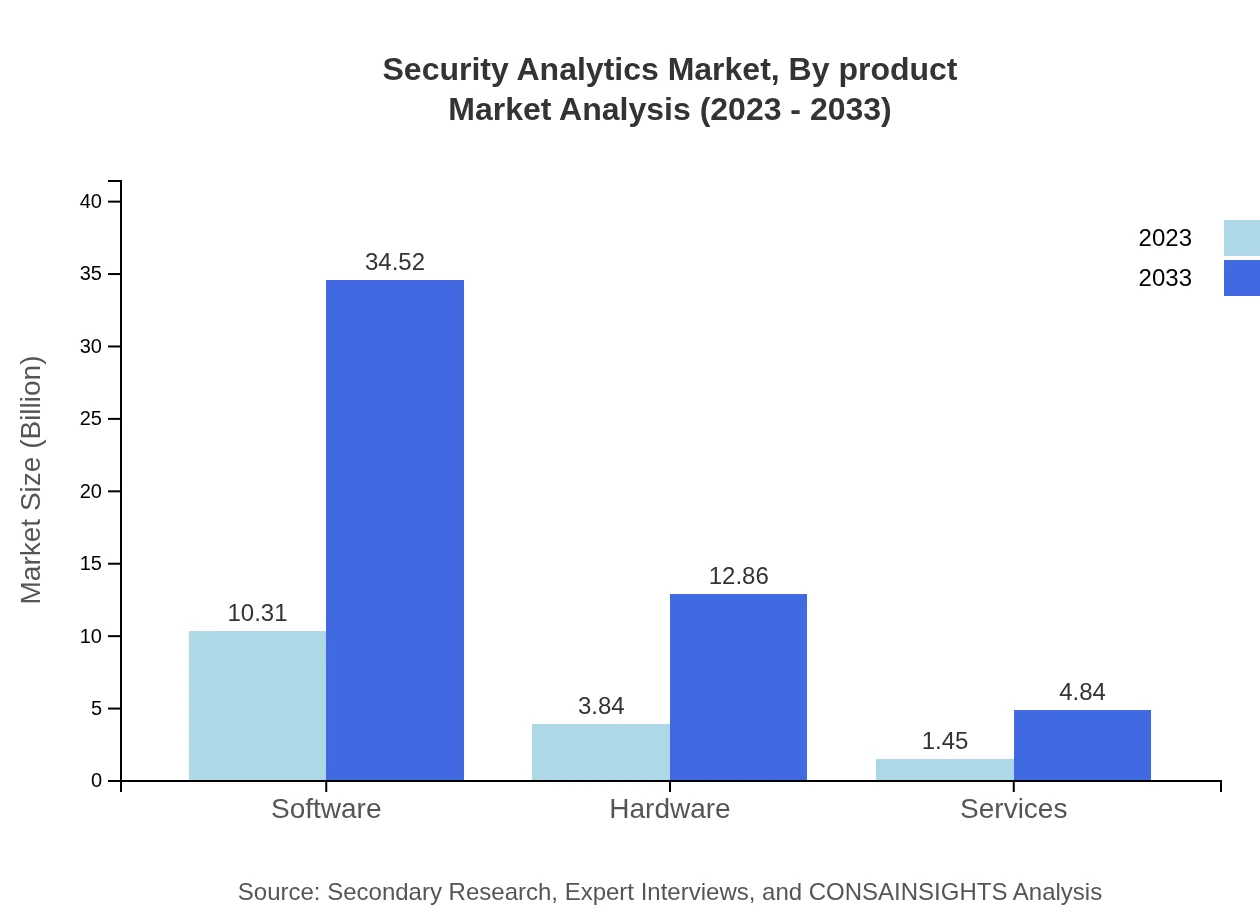

Security Analytics Market Analysis By Product

The Security Analytics market is primarily driven by software products, valued at USD 10.31 billion in 2023 and expected to grow to USD 34.52 billion by 2033. Hardware alignment in the sector holds a market value of USD 3.84 billion currently, anticipated to reach USD 12.86 billion. Services, although smaller at USD 1.45 billion, show potential growth up to USD 4.84 billion due to increasing demand for managed security services.

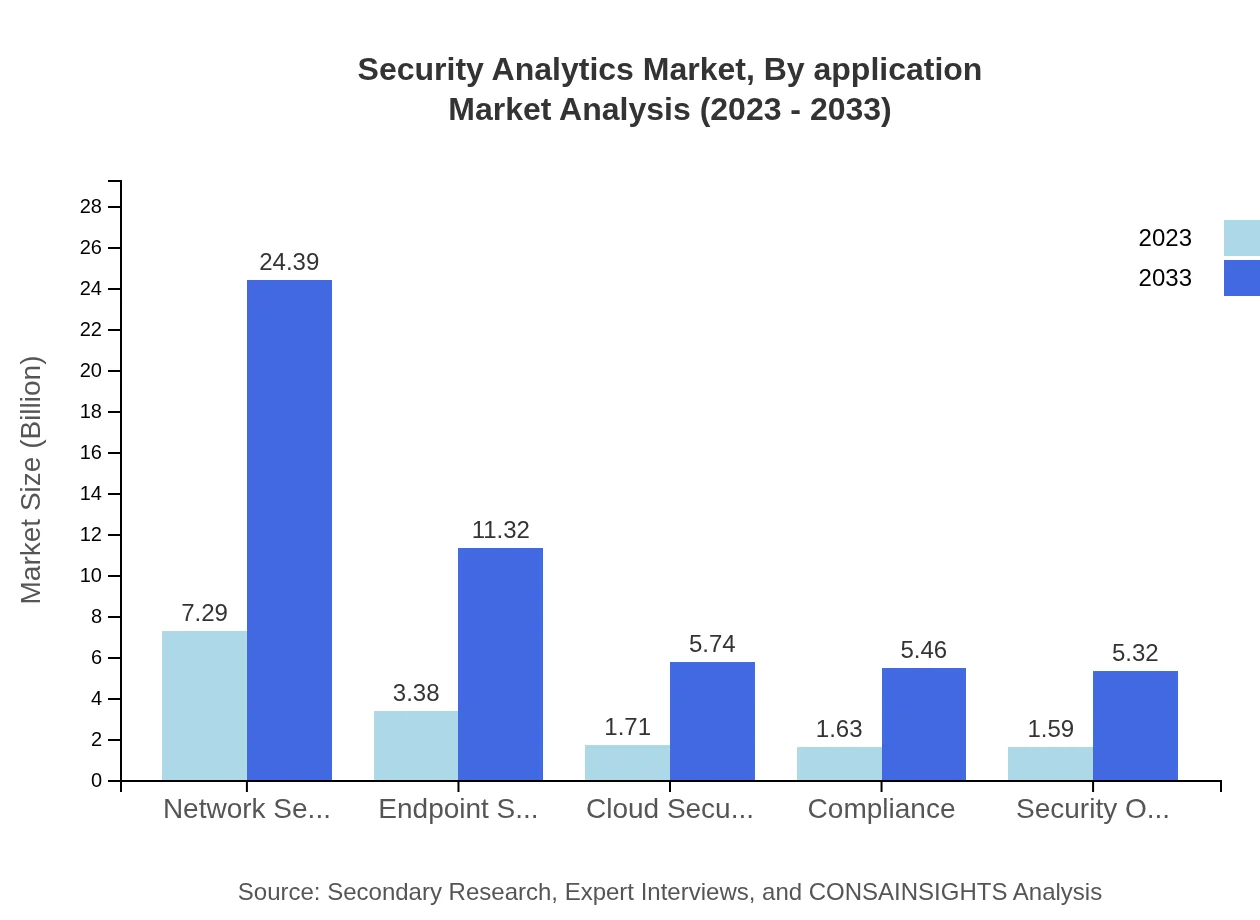

Security Analytics Market Analysis By Application

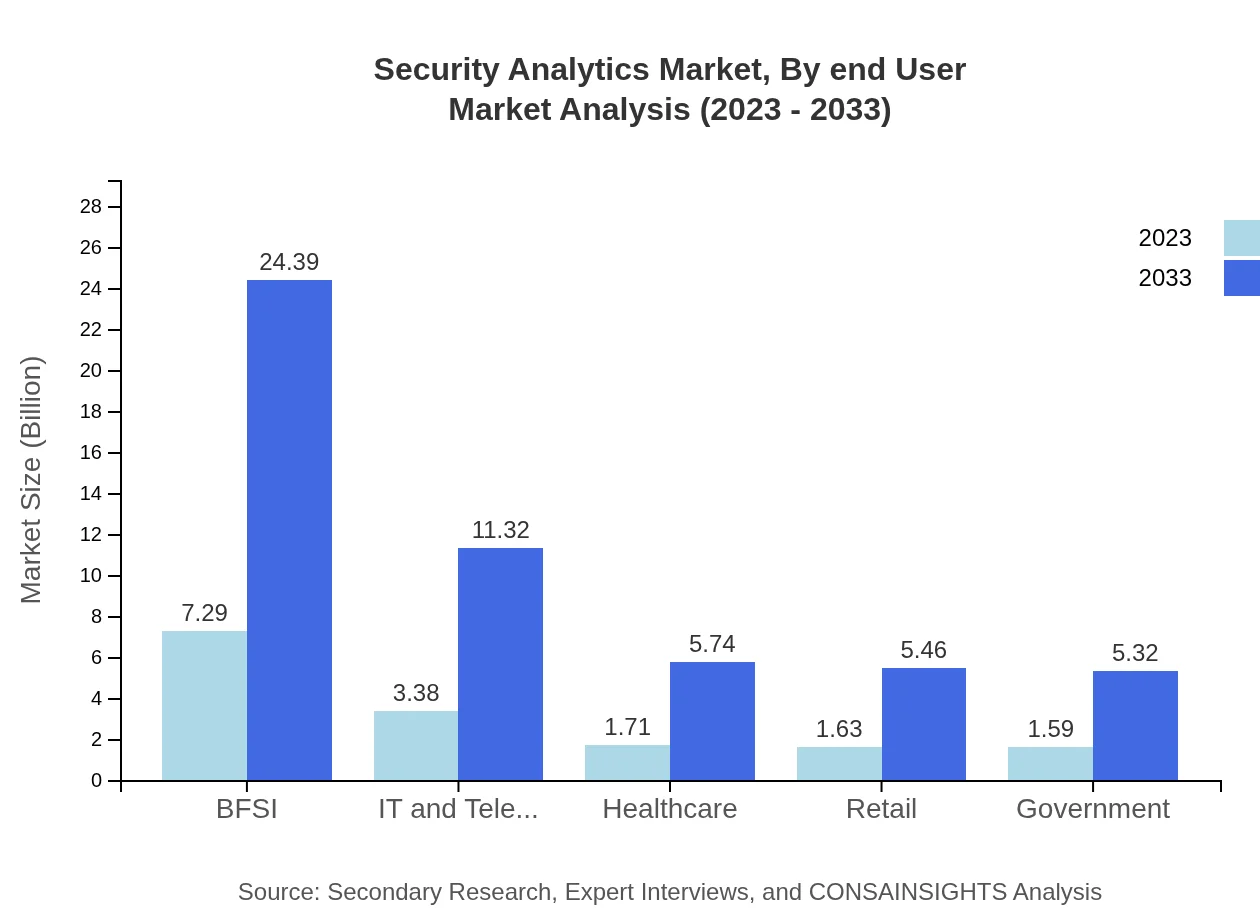

Various applications of Security Analytics such as BFSI, IT and Telecom, Healthcare, and Retail demonstrate notable engagement. The BFSI segment leads with a current size of USD 7.29 billion, expected to grow to USD 24.39 billion by 2033. IT and Telecom also contribute significantly, moving from USD 3.38 billion to USD 11.32 billion. Other sectors like Healthcare and Retail, although smaller, are growing as awareness around cybersecurity increases.

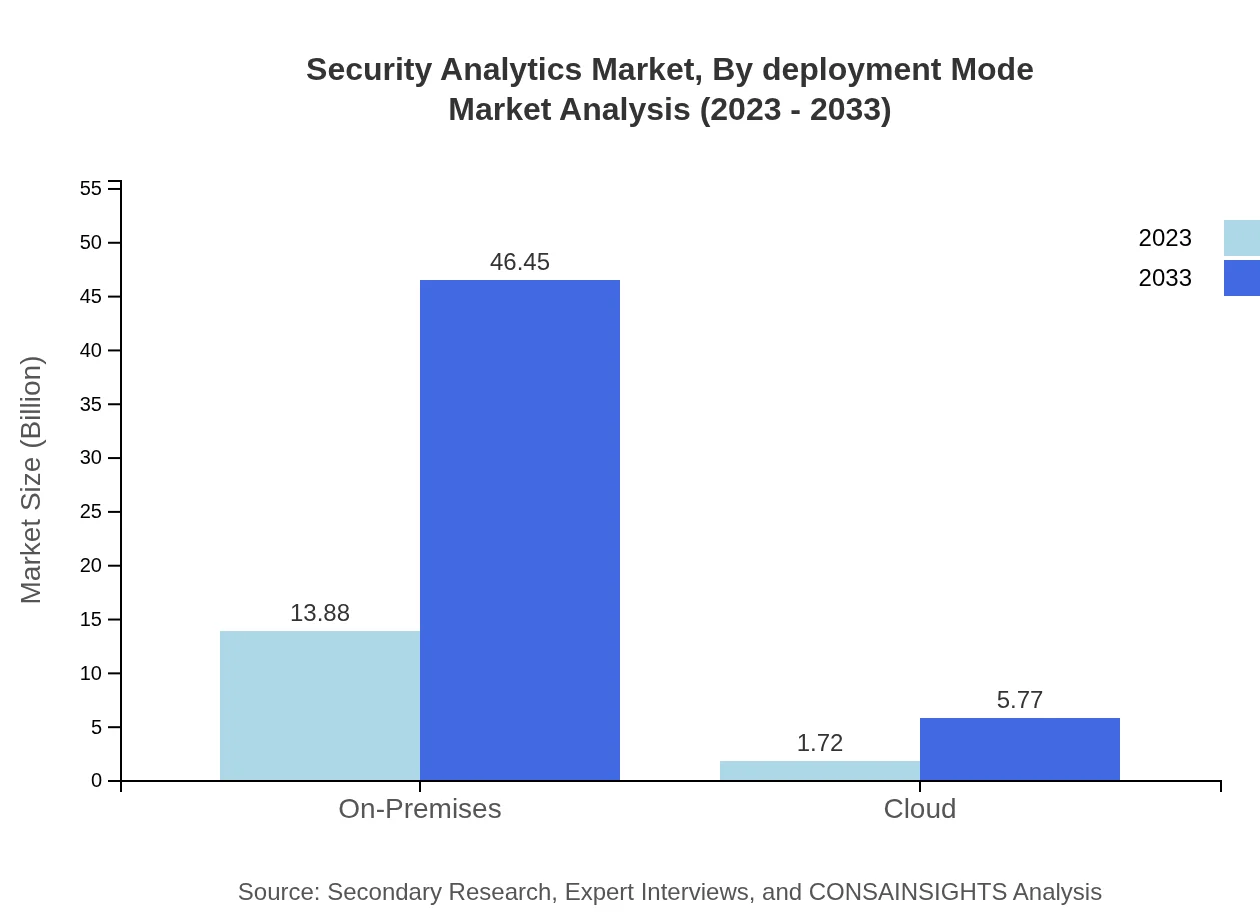

Security Analytics Market Analysis By Deployment Mode

From a deployment perspective, On-Premises solutions currently dominate with a market size of USD 13.88 billion, projected to expand to USD 46.45 billion. Conversely, the Cloud deployment segment starts at USD 1.72 billion, with forecasts to reach USD 5.77 billion, showcasing rising business migration toward cloud-driven security solutions.

Security Analytics Market Analysis By End User

In the end-user segment, BFSI, IT, and Government lead the way. The BFSI sector retains the highest market share at 46.7% in 2023, forecasted to continue its dominance. The IT and Telecom sector follows closely, capping off at 21.67% share due to extensive data handling, while Healthcare and Retail sectors are executing measures to bolster their cybersecurity frameworks.

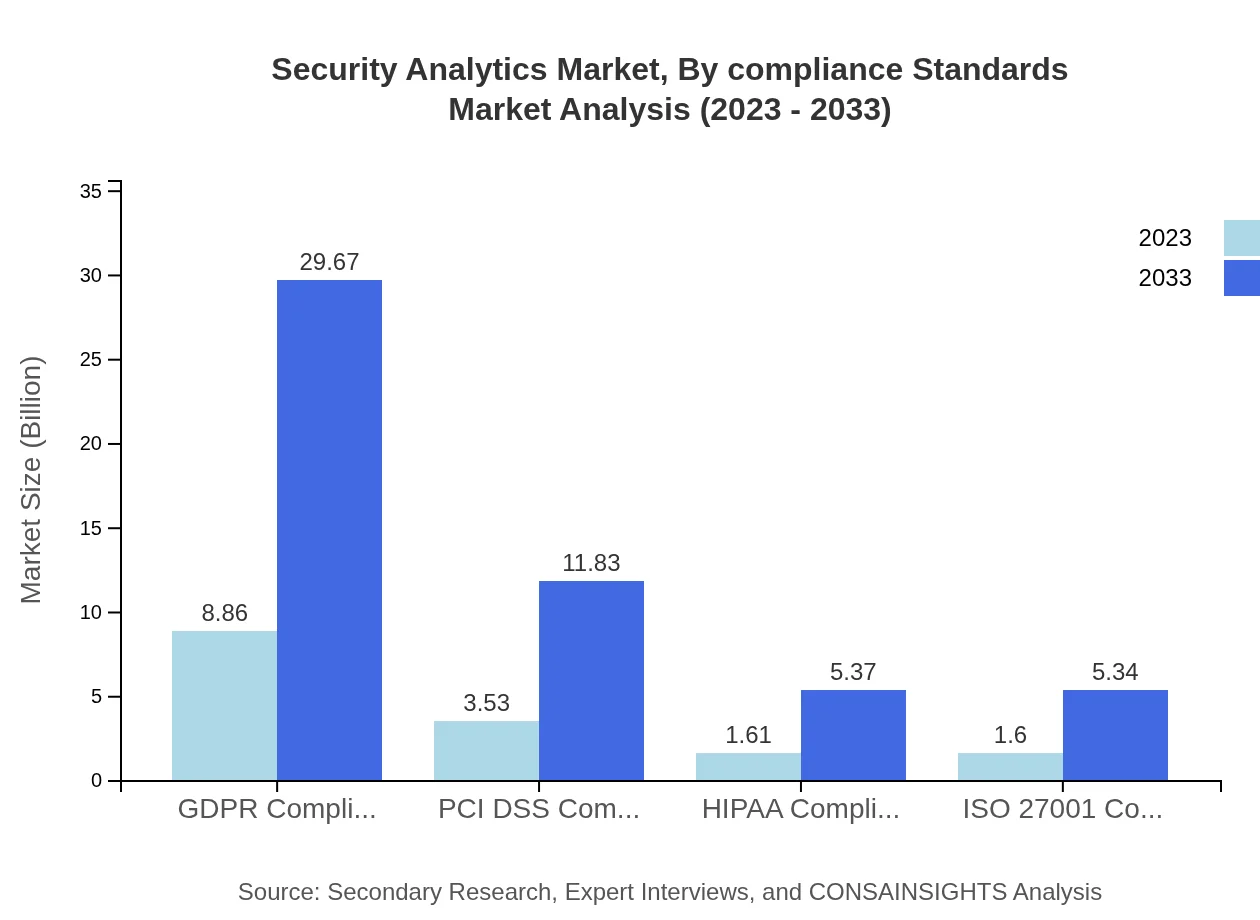

Security Analytics Market Analysis By Compliance Standards

Compliance standards influence implementation directions in the Security Analytics market. GDPR Compliance commands a considerable market share of 56.82%, reflecting the stringent data protection mandates in Europe. Other standards like PCI DSS and HIPAA comply with market demands for robust security practices among corporations.

Security Analytics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Security Analytics Industry

IBM:

A leader in security and analytics solutions, IBM offers a comprehensive suite of security tools that leverage AI to enhance threat detection and response.Splunk:

Code-named the 'Google for security,' Splunk excels in data analytics, providing real-time visibility and insights into security events.McAfee:

A pioneer in cybersecurity, McAfee's solutions focus on threat prevention, detection, and incident response through advanced analytics.SAS Institute:

SAS provides analytics and business intelligence software, specializing in predictive analytics that helps organizations combat security threats proactively.Cisco:

Cisco integrates security across its networking platform, enabling organizations to enhance their security posture through analytics.We're grateful to work with incredible clients.

FAQs

What is the market size of Security Analytics?

The global Security Analytics market is valued at approximately $15.6 billion in 2023, with a compound annual growth rate (CAGR) of 12.3%, indicating significant growth potential in the coming years. By 2033, this market is expected to expand considerably.

What are the key market players or companies in the Security Analytics industry?

Key players in the Security Analytics market include major companies such as IBM, Splunk, and McAfee, which innovate continuously to offer advanced security analytics solutions and enhance cybersecurity resilience across various sectors.

What are the primary factors driving the growth in the Security Analytics industry?

Factors driving growth include an increasing frequency of cyberattacks, stringent regulatory requirements, and rising demand for proactive security measures, which necessitate robust security analytics solutions to protect critical data and infrastructure.

Which region is the fastest Growing in the Security Analytics market?

The North America region is projected to be the fastest-growing market for Security Analytics. By 2033, it is expected to reach a valuation of $18.02 billion, driven by significant investment in cybersecurity measures and advanced technology adoption.

Does ConsaInsights provide customized market report data for the Security Analytics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Security Analytics industry, allowing stakeholders to gain deeper insights and make informed decisions based on unique market conditions.

What deliverables can I expect from this Security Analytics market research project?

Expect deliverables including comprehensive market analysis reports, segmentation data, competitive landscape reviews, growth forecasts, and actionable insights that guide strategic business decisions in the Security Analytics space.

What are the market trends of Security Analytics?

Current trends in the Security Analytics market include increased adoption of machine learning for threat detection, integration of AI in security frameworks, and a shift towards cloud-based solutions to enhance scalability and efficiency.