Server Software Market Report

Published Date: 31 January 2026 | Report Code: server-software

Server Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the global server software market, highlighting significant trends, projections, and data from 2023 to 2033. It offers insights into market sizes, growth rates, and emerging technologies shaping the landscape.

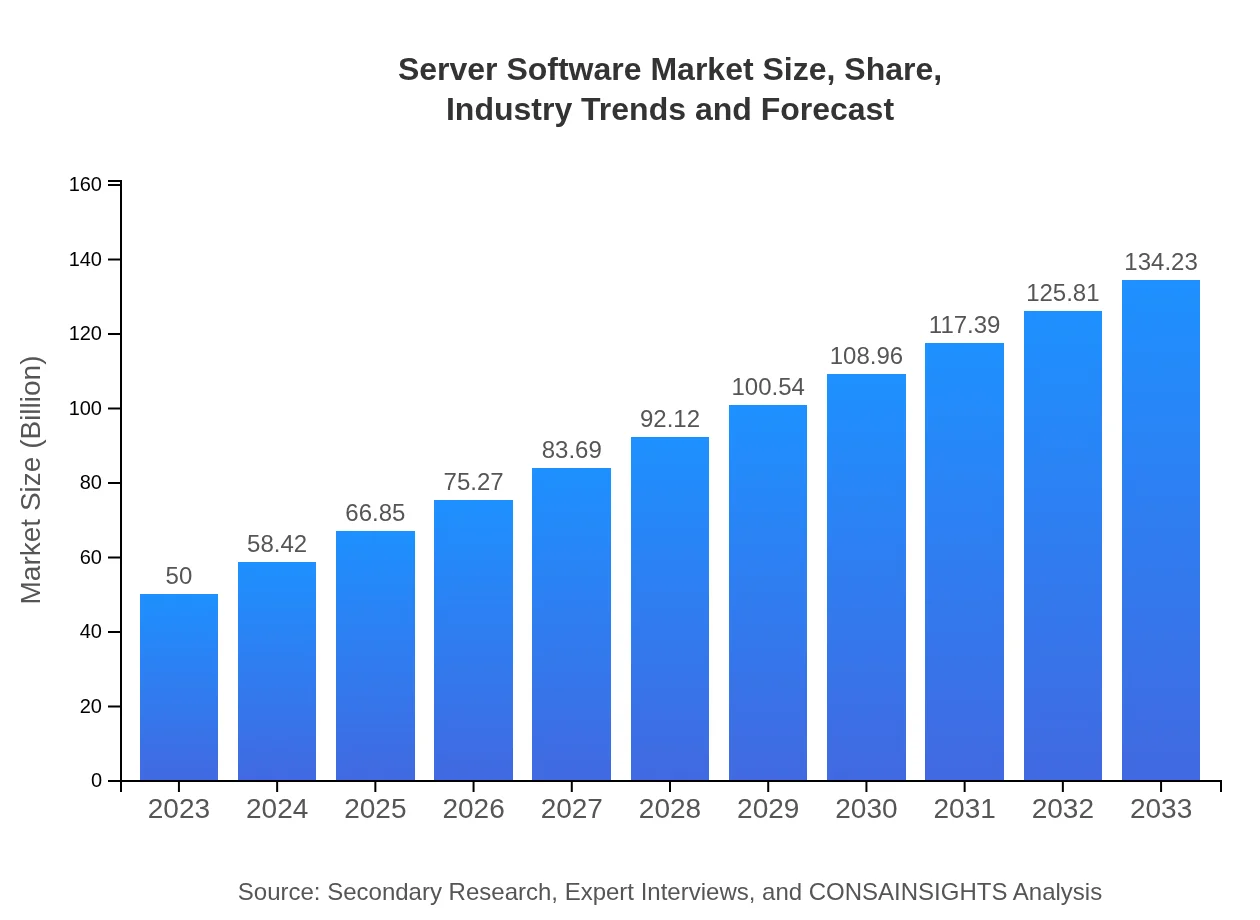

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $134.23 Billion |

| Top Companies | Microsoft Corporation, Oracle Corporation, IBM Corporation, Red Hat Inc. |

| Last Modified Date | 31 January 2026 |

Server Software Market Overview

Customize Server Software Market Report market research report

- ✔ Get in-depth analysis of Server Software market size, growth, and forecasts.

- ✔ Understand Server Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Server Software

What is the Market Size & CAGR of Server Software market in 2023?

Server Software Industry Analysis

Server Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Server Software Market Analysis Report by Region

Europe Server Software Market Report:

Europe's server software market is valued at $12.40 billion in 2023, projected to expand to $33.30 billion by 2033. This growth is attributed to regulatory compliance needs and the ongoing transition towards cloud services among European businesses.Asia Pacific Server Software Market Report:

In 2023, the Asia Pacific server software market is valued at approximately $9.71 billion, with a projection to grow to $26.05 billion by 2033. This growth is spurred by rapid digital transformation across the region, particularly in emerging economies. Increased investment in IT infrastructure and services by both private and public sectors further contributes to the rising demand for server software solutions.North America Server Software Market Report:

In North America, the market size for server software stands at approximately $17.97 billion in 2023, anticipated to grow to $48.24 billion by 2033, fueled by an increase in high-tech industries and a focus on cybersecurity enhancements. The presence of major tech companies and robust investment in research and development are pivotal in shaping this market.South America Server Software Market Report:

The South American market for server software is estimated at $2.96 billion in 2023, expected to reach $7.93 billion by 2033. The growth in this region is driven by gradual digitization and the increased reliance on cloud services by organizations seeking to improve operational efficiency.Middle East & Africa Server Software Market Report:

The Middle East and Africa server software market is valued at approximately $6.97 billion in 2023, with expectations to grow to $18.70 billion by 2033. The demand stems from digital upheavals and an increasing emphasis on cloud adoption across various sectors.Tell us your focus area and get a customized research report.

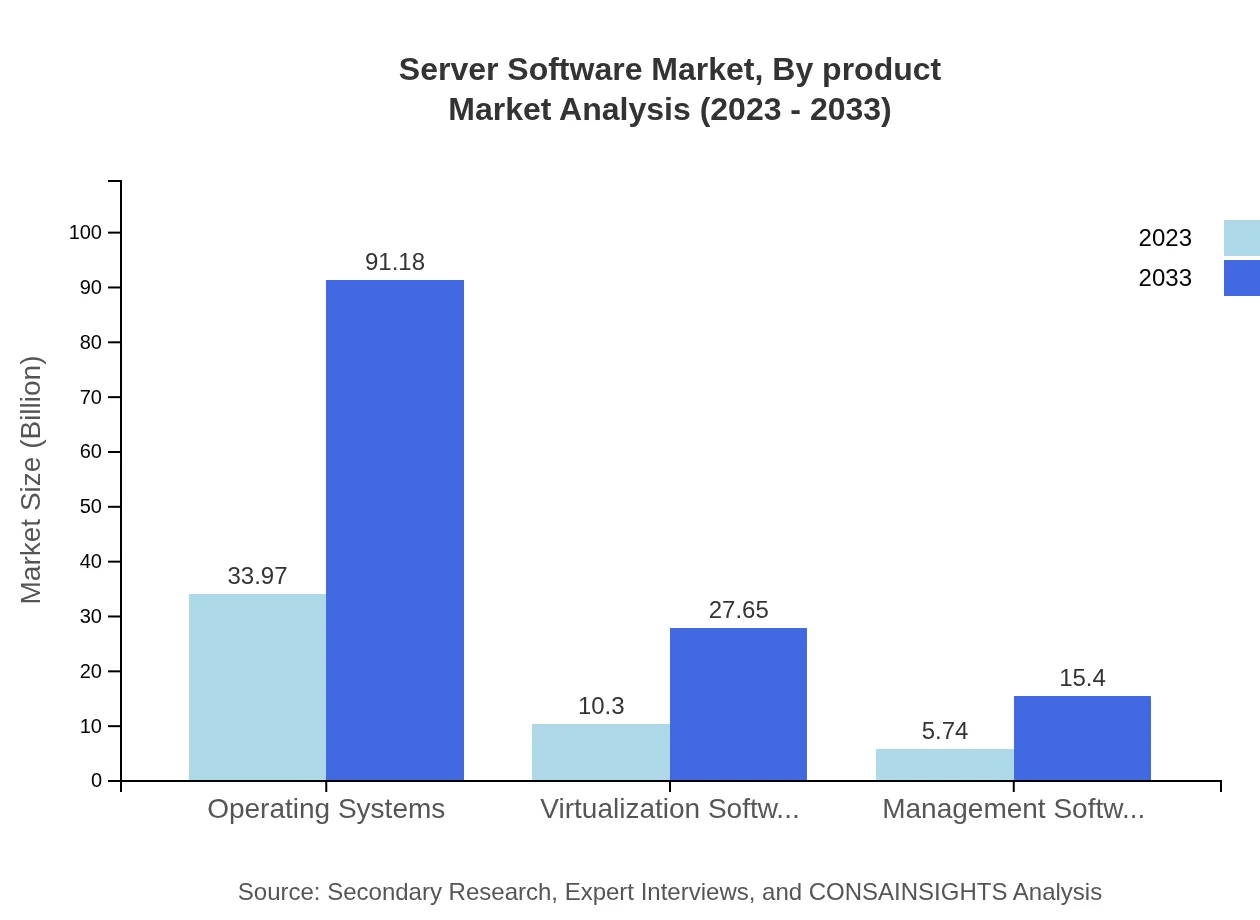

Server Software Market Analysis By Product

The server software market, by product, emphasizes diverse offerings that cater to specific needs. Operating systems dominate the category, valued at $33.97 billion in 2023, extending to $91.18 billion by 2033. Management and virtualization software also hold significant shares, indicating a shift towards comprehensive server management solutions.

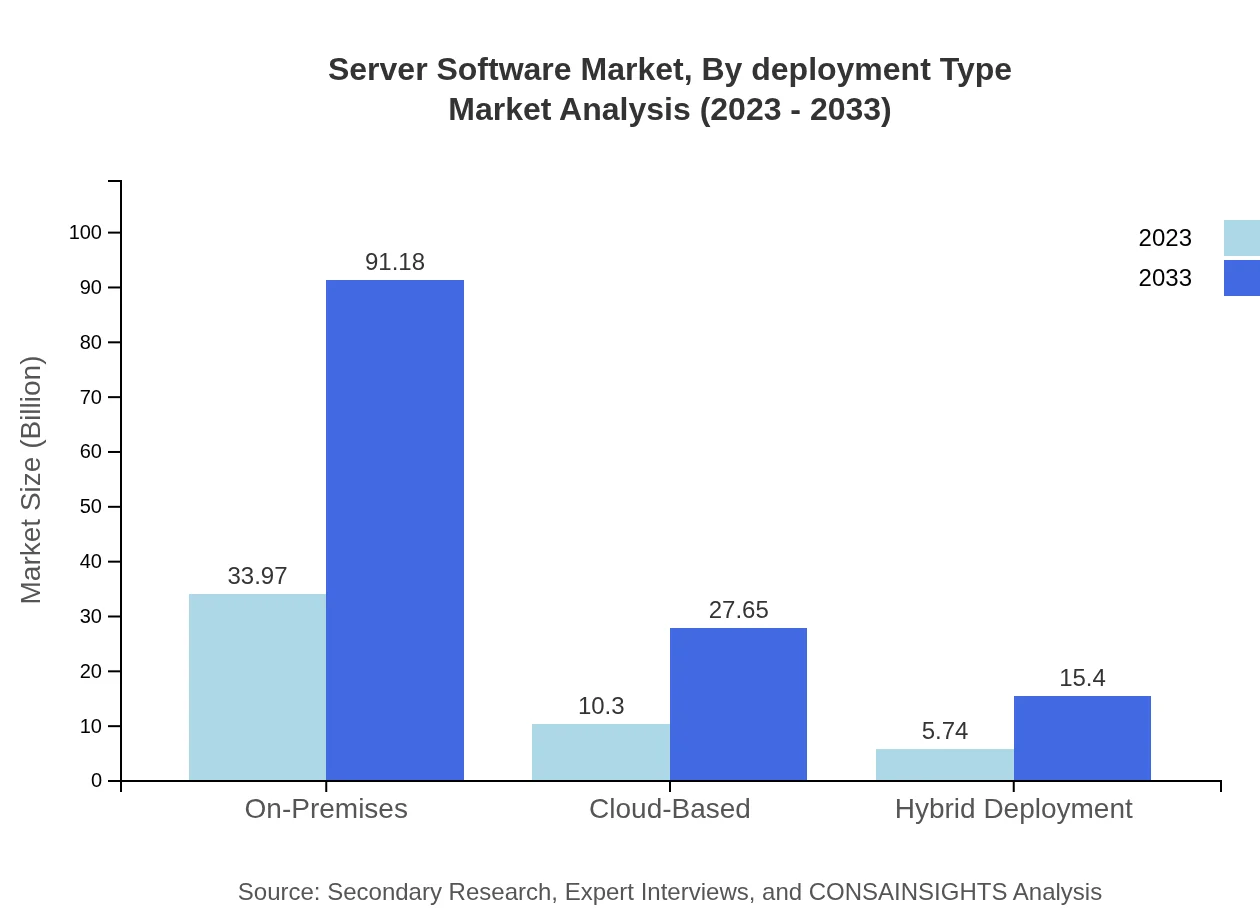

Server Software Market Analysis By Deployment Type

Segmented by deployment type, the on-premises solution currently leads with a market size of $33.97 billion in 2023, projected to rise to $91.18 billion by 2033. The cloud-based segment, currently at $10.30 billion, is gaining traction due to the increased acceptance of cloud solutions, while hybrid deployment models are also on the rise.

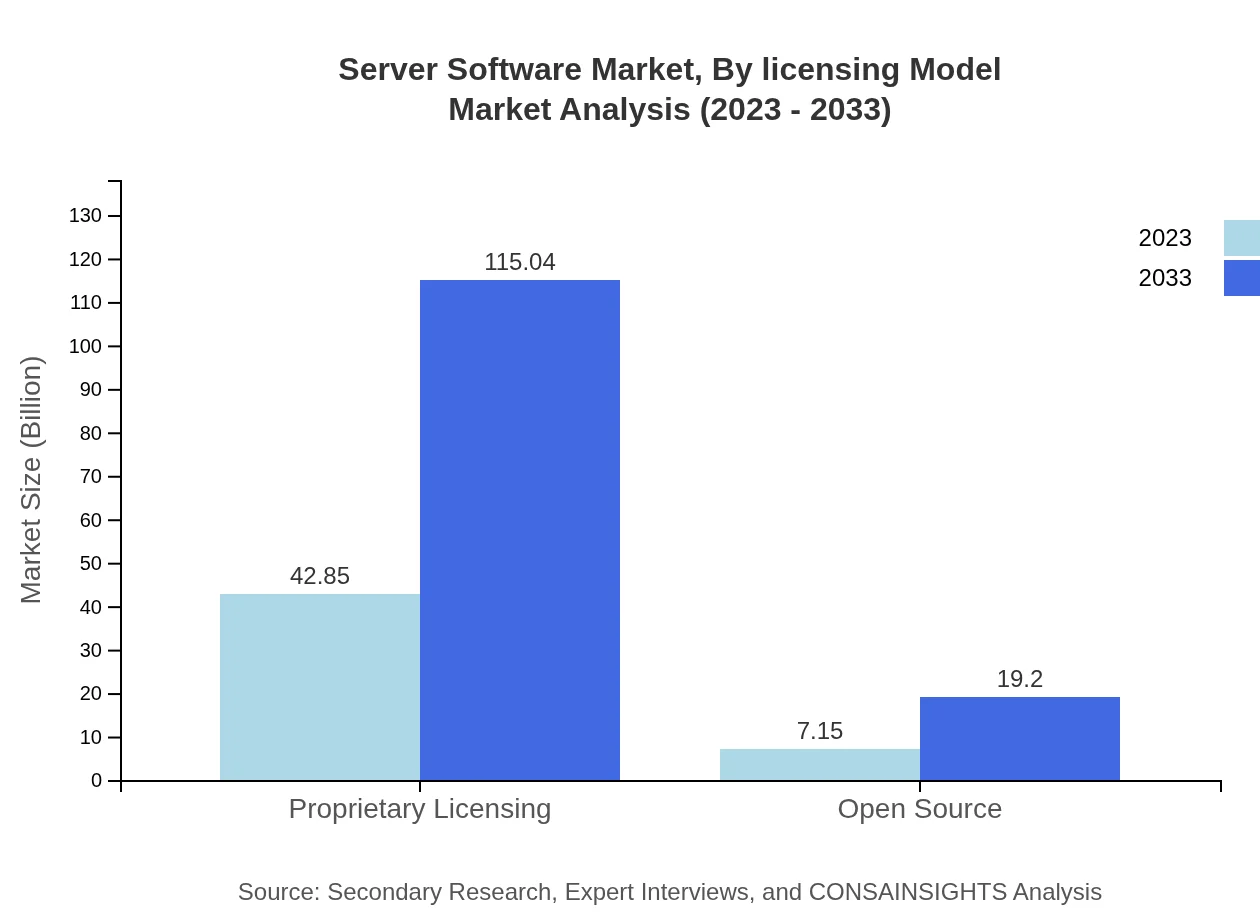

Server Software Market Analysis By Licensing Model

Proprietary licensing is the leading revenue generator in the server software market, accounting for $42.85 billion in 2023 with a forecast to reach $115.04 billion in 2033. Open-source solutions, albeit smaller, are showing a growing presence as businesses look for cost-effective alternatives.

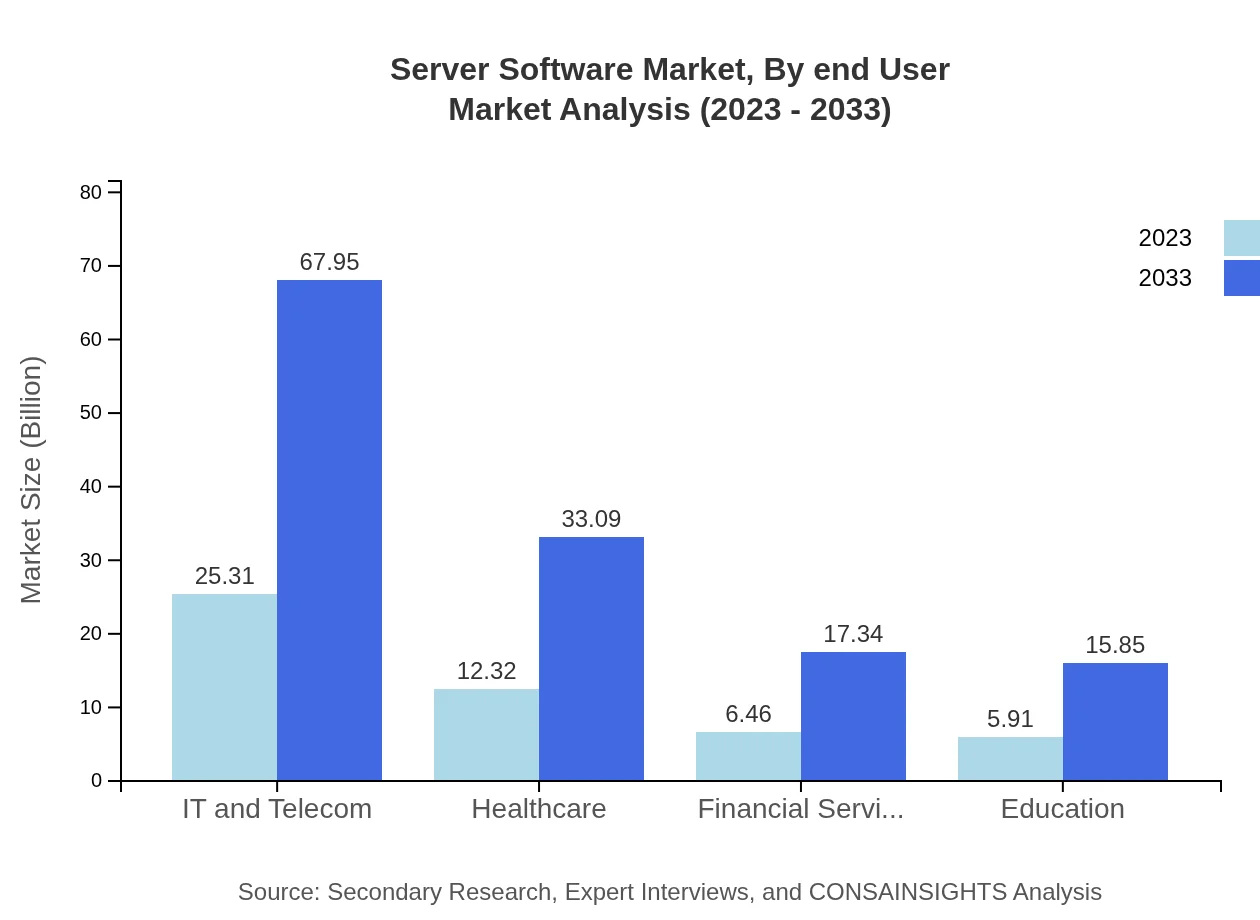

Server Software Market Analysis By End User

The IT and telecom sector remains the largest consumer of server software, with market shares of $25.31 billion and an expected growth to $67.95 billion by 2033. Other significant segments include healthcare and financial services, each experiencing robust growth due to increasing regulatory pressures and digital initiatives.

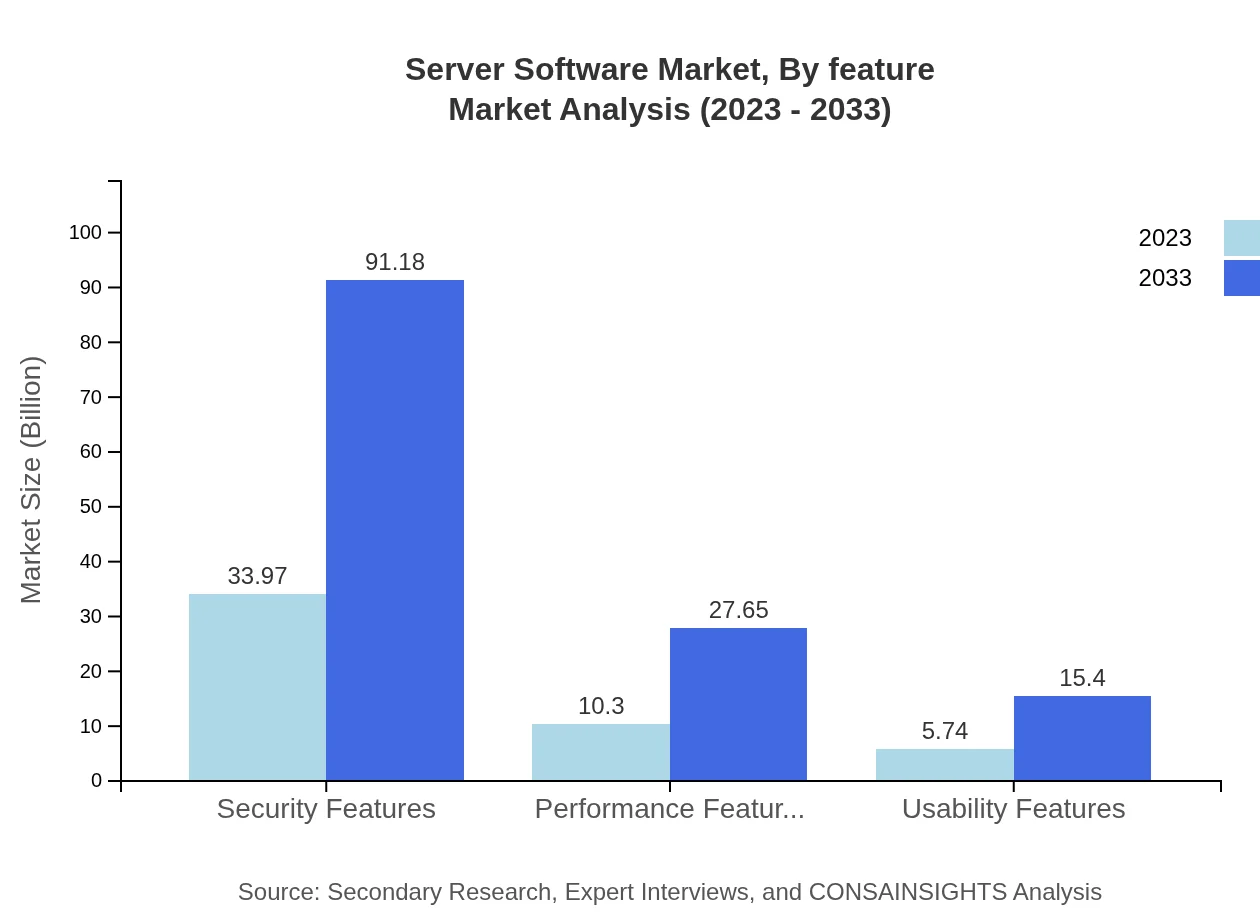

Server Software Market Analysis By Feature

Security features lead the market with a size of $33.97 billion in 2023, expected to balloon to $91.18 billion by 2033, highlighting the growing emphasis on data protection. Performance and usability features also contribute significantly to the market, reflecting the industry's focus on efficiency and user experience.

Server Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Server Software Industry

Microsoft Corporation:

A leading provider of server software solutions with its Windows Server offerings, Microsoft has a significant share in both public and private cloud markets.Oracle Corporation:

Oracle is prominent in the server management software sector, offering integrated cloud solutions that support enterprise applications.IBM Corporation:

IBM specializes in server solutions that prioritize security and cloud integration, catering to large organizations with complex needs.Red Hat Inc.:

As a key player in the open-source segment, Red Hat’s enterprise Linux solutions drive flexibility and integration for modern server environments.We're grateful to work with incredible clients.

FAQs

What is the market size of server Software?

The server software market is projected to reach approximately $50 billion by 2033, experiencing a substantial growth rate with a CAGR of 10% from 2023 to 2033.

What are the key market players or companies in the server Software industry?

Key players in the server software industry include major technology firms specializing in IT solutions, such as Microsoft, Oracle, IBM, and VMware, all of which are reputable leaders known for innovation and quality in their offerings.

What are the primary factors driving the growth in the server Software industry?

Major growth drivers include the rising demand for cloud computing services, increased focus on cybersecurity, and the necessity for effective data management solutions, alongside rapid digital transformation across various industries.

Which region is the fastest Growing in the server Software?

North America is the fastest-growing region in the server software market, expected to expand from $17.97 billion in 2023 to $48.24 billion in 2033, showcasing significant growth opportunities.

Does ConsaInsights provide customized market report data for the server Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the server software industry, helping businesses align their strategies with market trends and insights.

What deliverables can I expect from this server Software market research project?

Deliverables from the server software market research project include comprehensive market analysis, detailed segmentation studies, future market projections, competitive landscape assessments, and actionable strategic recommendations.

What are the market trends of server Software?

Current trends include increased adoption of cloud-based solutions, a significant focus on data security features, and growing investments in enterprise resource planning, shaping the future trajectory of the server software industry.