Smart Ports Market Report

Published Date: 02 February 2026 | Report Code: smart-ports

Smart Ports Market Size, Share, Industry Trends and Forecast to 2033

This report comprehensively analyzes the Smart Ports market from 2023 to 2033, offering insights on market size, segmentation, regional analysis, technology advancements, and future trends that shape this evolving industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

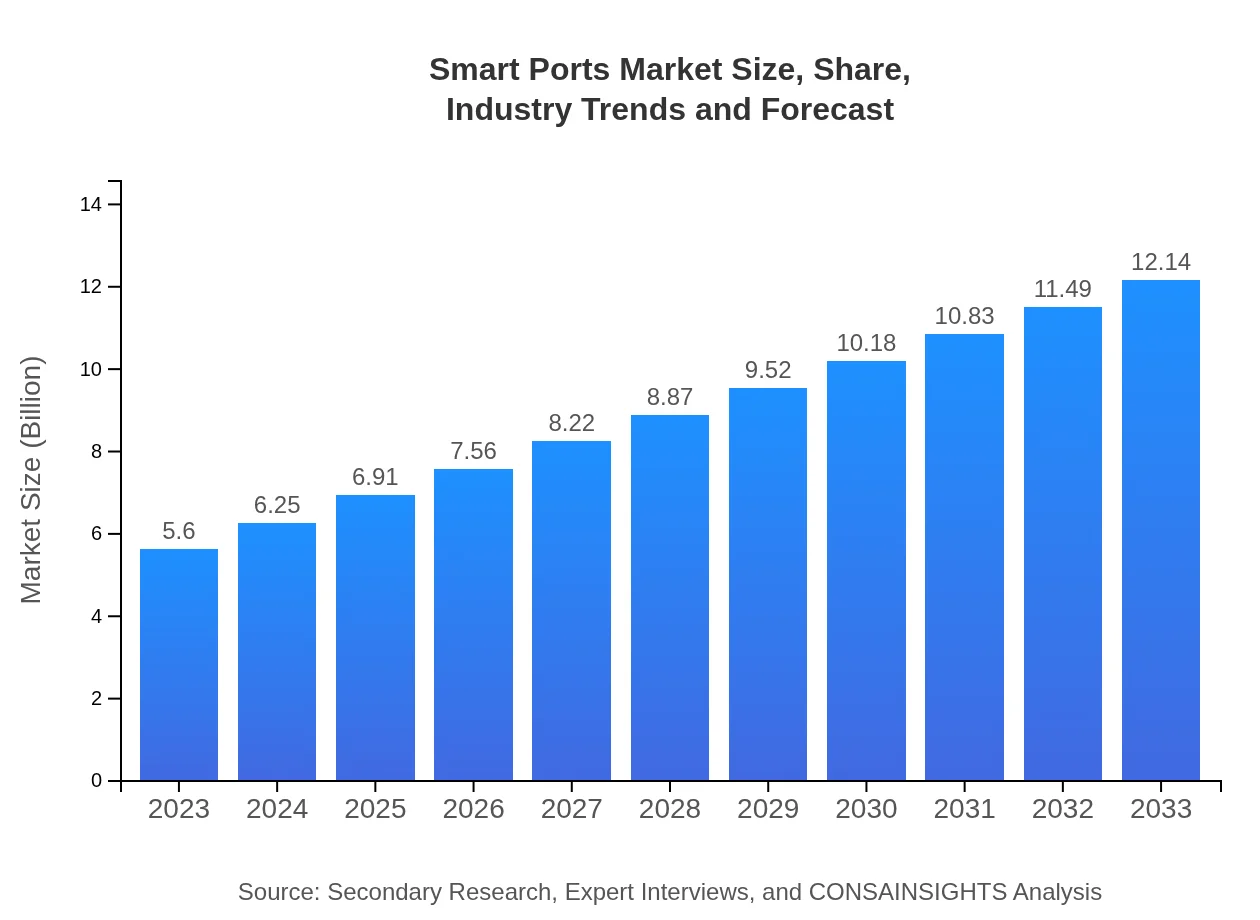

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $12.14 Billion |

| Top Companies | ABB, Siemens AG, Port of Rotterdam, Wipro |

| Last Modified Date | 02 February 2026 |

Smart Ports Market Overview

Customize Smart Ports Market Report market research report

- ✔ Get in-depth analysis of Smart Ports market size, growth, and forecasts.

- ✔ Understand Smart Ports's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Ports

What is the Market Size & CAGR of Smart Ports market in 2023?

Smart Ports Industry Analysis

Smart Ports Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Smart Ports Market Analysis Report by Region

Europe Smart Ports Market Report:

Europe is poised for notable growth, with projections showing the market expanding from $1.74 billion in 2023 to $3.77 billion by 2033, driven by initiatives focused on sustainability, digitalization, and smart logistics within port operations.Asia Pacific Smart Ports Market Report:

In the Asia Pacific region, the Smart Ports market is anticipated to grow from $1.12 billion in 2023 to $2.43 billion by 2033, driven by increased port activity in trade-heavy nations like China and India, and substantial investments in port modernization and technology.North America Smart Ports Market Report:

North America’s Smart Ports market is projected to rise from $1.90 billion in 2023 to $4.12 billion by 2033. The U.S. leads this expansion with significant investments in further automating port operations and enhancing trade capacities to support growing freight demands.South America Smart Ports Market Report:

The market in South America is expected to advance from $0.34 billion in 2023 to $0.73 billion by 2033, as countries focus on developing infrastructure to boost trade, coupled with governmental initiatives to implement smart technologies.Middle East & Africa Smart Ports Market Report:

The Middle East and Africa market is projected to grow from $0.50 billion in 2023 to $1.09 billion by 2033, primarily fueled by increasing trade activities and investments in smart port infrastructure to enhance operational efficiencies.Tell us your focus area and get a customized research report.

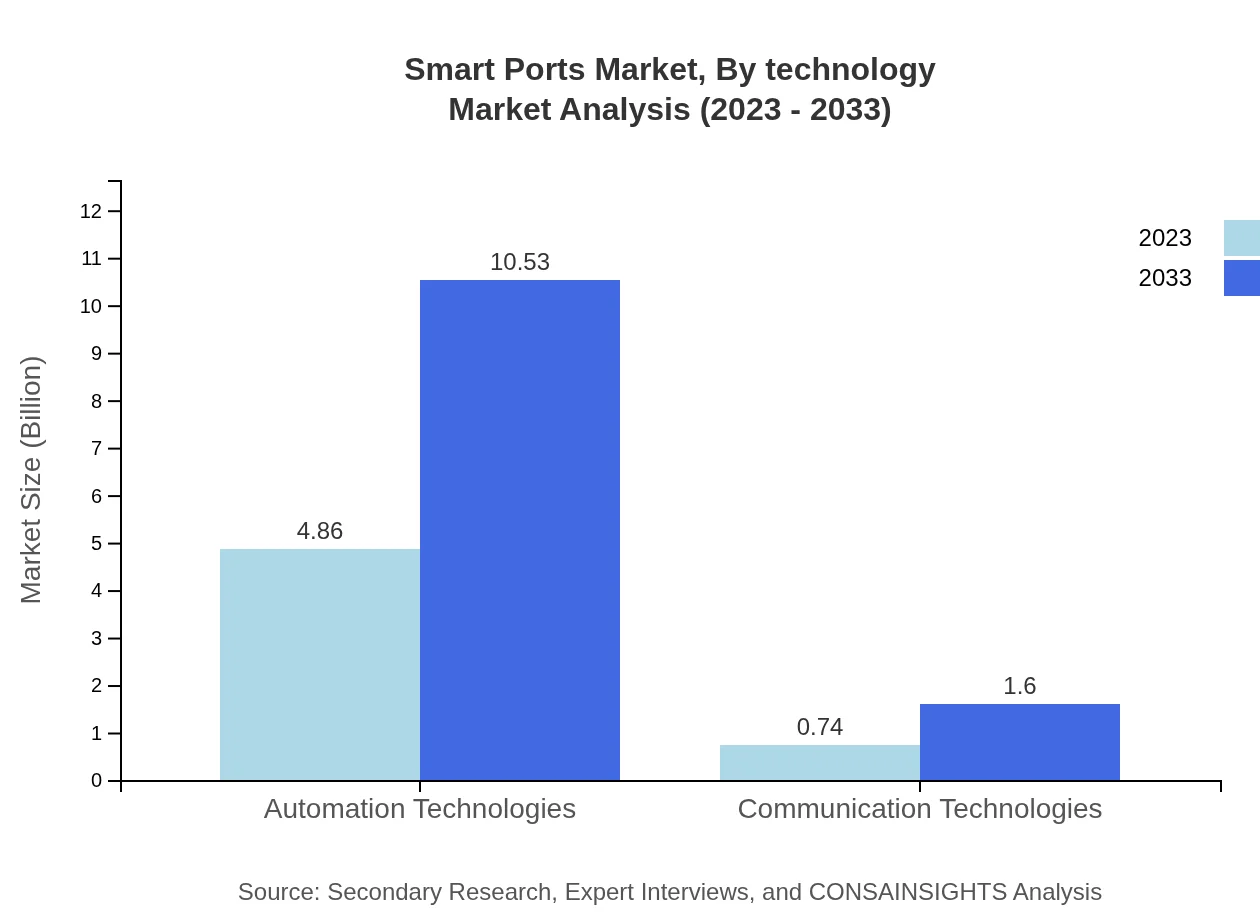

Smart Ports Market Analysis By Technology

In 2023, the automation technologies segment is leading the Smart Ports market with a size of $4.86 billion, expected to grow to $10.53 billion by 2033. Communication technologies and port management systems also play significant roles, with their shares remaining strong at 13.22% and 86.78%, respectively.

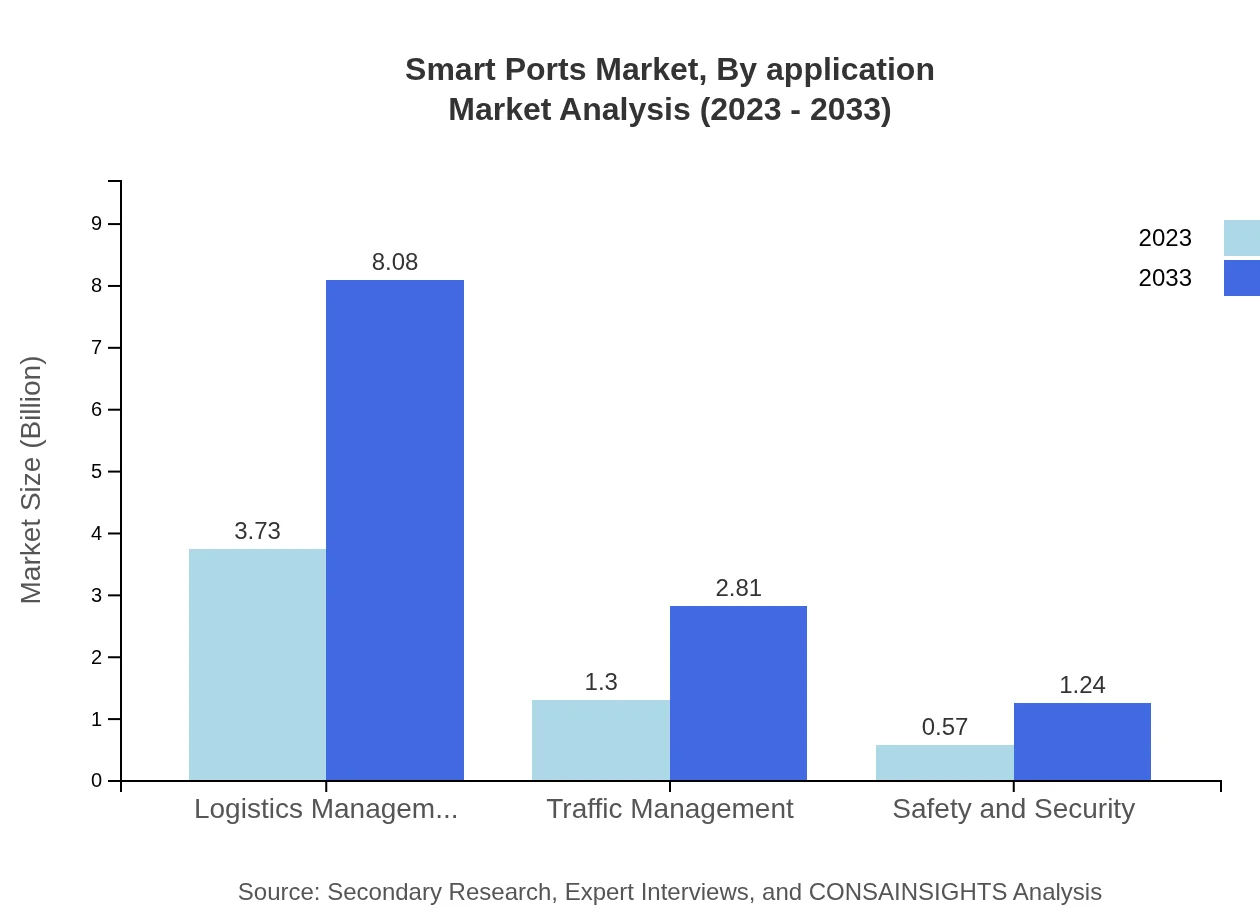

Smart Ports Market Analysis By Application

Logistics management dominates the application segment, valued at $3.73 billion in 2023 and projected to grow to $8.08 billion by 2033. Traffic management and safety and security applications also show significant market size and share, underlining their importance in comprehensive port management.

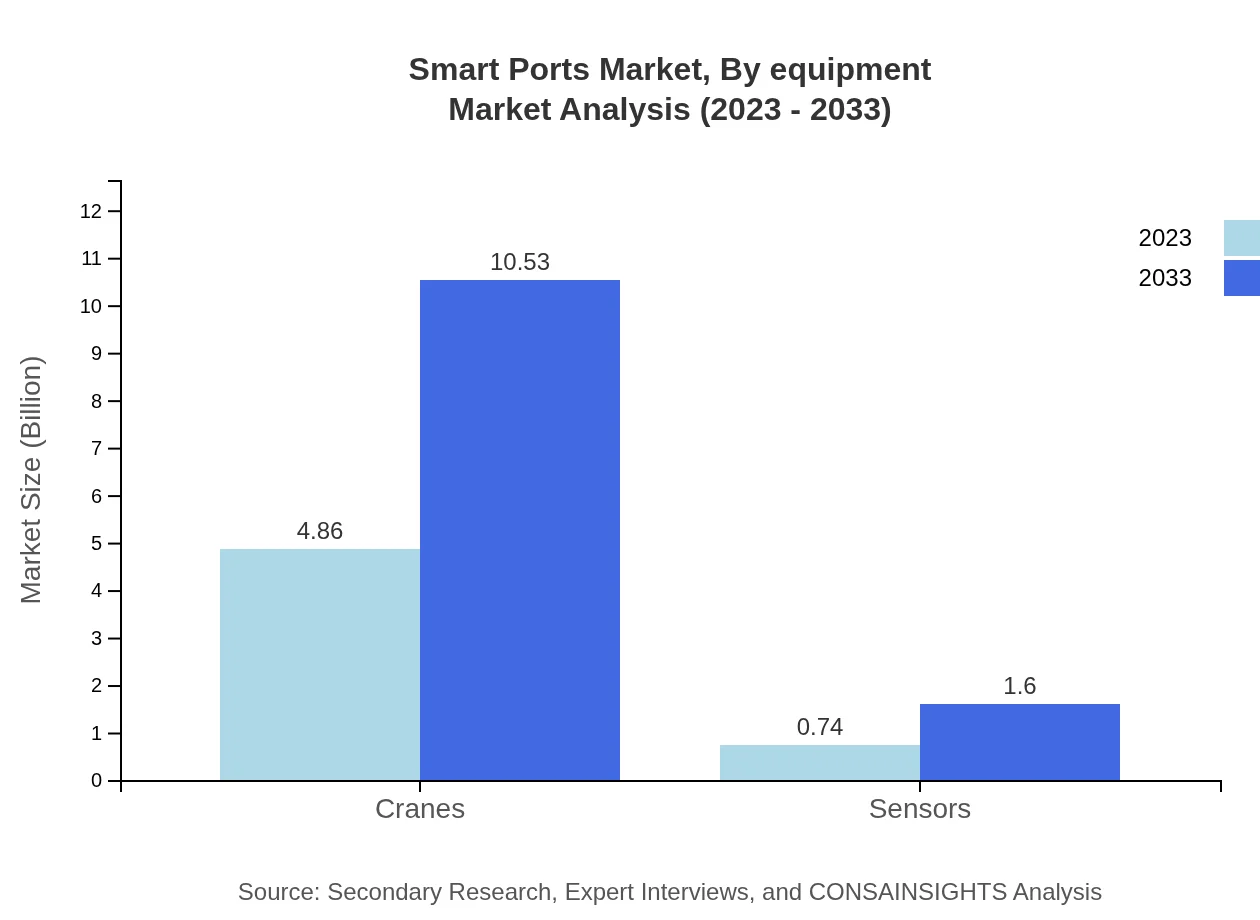

Smart Ports Market Analysis By Equipment

Cranes represent a vital equipment segment in the Smart Ports market, holding a market size of $4.86 billion in 2023, expected to reach $10.53 billion in 2033. Sensors and other equipment essential for operational efficiency are also critical components driving revenue growth.

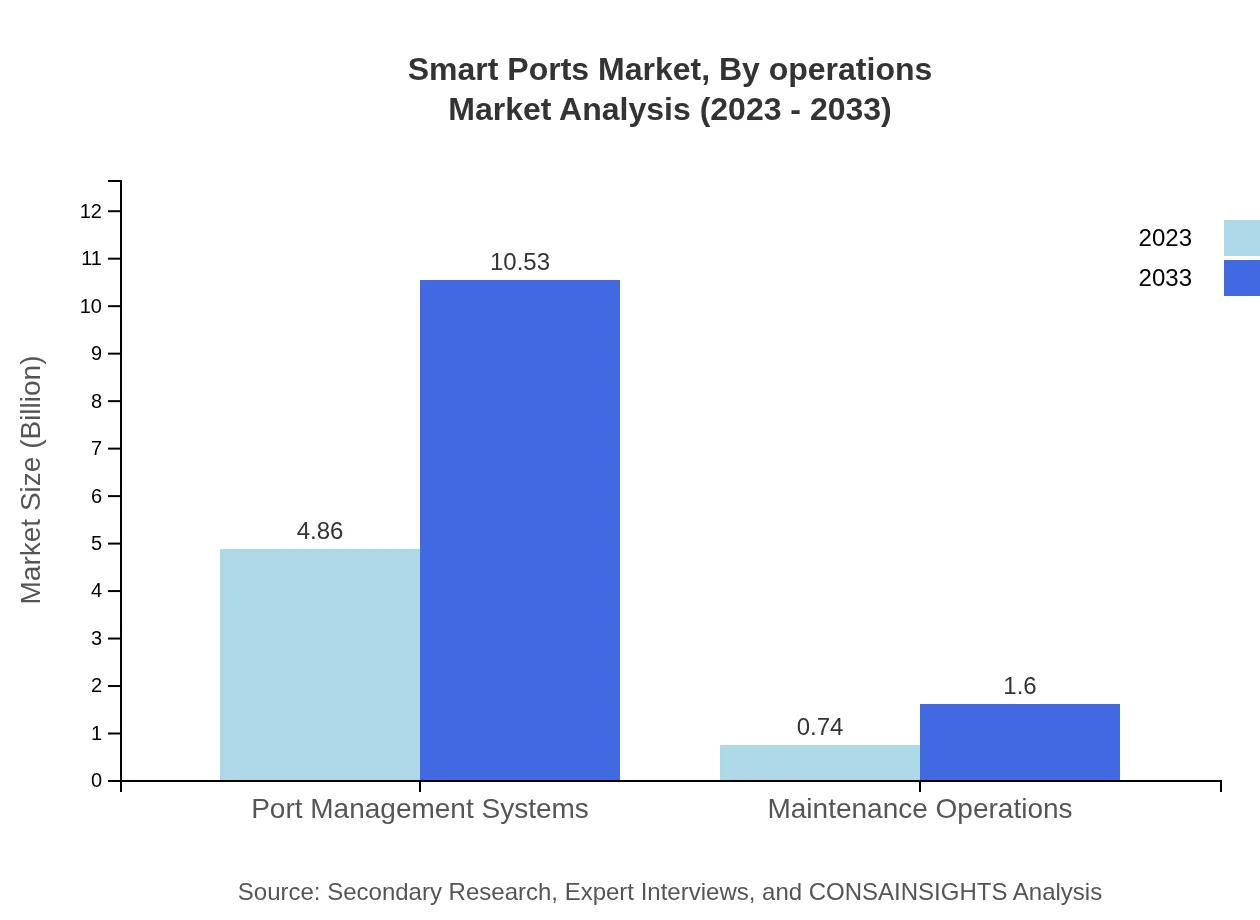

Smart Ports Market Analysis By Operations

The operations segment includes maintenance operations and traffic management systems, which are crucial for ensuring seamless port activities. The market size for these operations is expected to parallel growth in applications and technologies, sustaining operational performance and efficiency.

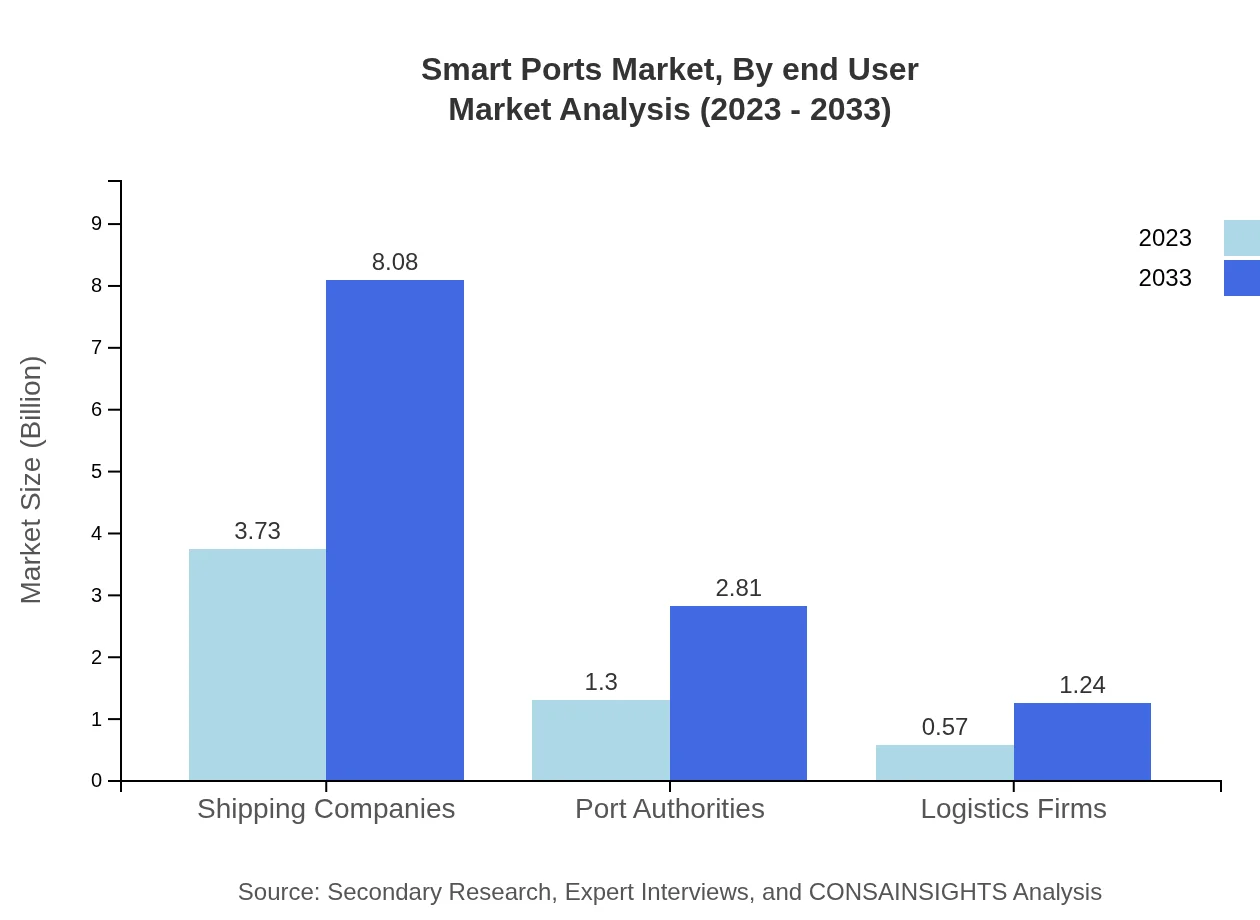

Smart Ports Market Analysis By End User

Shipping companies represent the largest end-user segment, with a market size of $3.73 billion in 2023 and anticipated to rise to $8.08 billion by 2033, reflecting their reliance on enhanced port operations for smoother and more effective logistics.

Smart Ports Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Ports Industry

ABB:

ABB specializes in automation and robotics, providing innovative solutions to streamline port operations while enhancing safety and efficiency.Siemens AG:

Siemens is a leader in digitalization and automation, offering smart mobility solutions that contribute to the efficient functioning of ports and logistics systems.Port of Rotterdam:

The Port of Rotterdam is recognized as one of the world's leading smart ports, implementing advanced technologies to optimize its operations and reduce environmental impact.Wipro:

Wipro provides technology consulting and digital solutions, enabling ports to transform their operations and leverage data for improved decision-making.We're grateful to work with incredible clients.

FAQs

What is the market size of smart Ports?

The global smart ports market is valued at $5.6 billion in 2023 and is expected to grow at a CAGR of 7.8%, reaching substantial growth by 2033. This expansion indicates robust demand for modernized port operations.

What are the key market players or companies in the smart Ports industry?

Key players in the smart ports industry include major shipping companies, port authorities, and technology firms specializing in automation and logistics solutions. These companies drive innovation, enhancing operational efficiency and safety.

What are the primary factors driving the growth in the smart Ports industry?

Growth in the smart ports industry is fueled by the need for operational efficiency, increased trade activities, digital transformation in logistics, and rising demands for sustainability, making technology integration crucial in modern port operations.

Which region is the fastest Growing in the smart Ports?

The North America region leads growth in the smart ports market, projected from $1.90 billion in 2023 to $4.12 billion by 2033. Europe also shows significant growth, expanding from $1.74 billion to $3.77 billion in the same timeframe.

Does ConsaInsights provide customized market report data for the smart Ports industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements, ensuring that clients receive data relevant to their needs within the smart ports industry for strategic decision-making.

What deliverables can I expect from this smart Ports market research project?

Expect comprehensive reports detailing market size, growth projections, regional analyses, segment insights, competitive landscape assessments, and strategic recommendations to navigate the smart ports market effectively.

What are the market trends of smart Ports?

Current trends in the smart ports market include increased automation, heightened cybersecurity measures, integration of IoT technologies, and analytics-driven decision-making, aligning with industry demands for efficiency and sustainability.