South Korea Diabetes Devices Market Report

Published Date: 31 January 2026 | Report Code: south-korea-diabetes-devices

South Korea Diabetes Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the South Korean diabetes devices market from 2023 to 2033, including market size, trends, segmentation, regional analysis, technology advancements, and key players in the industry.

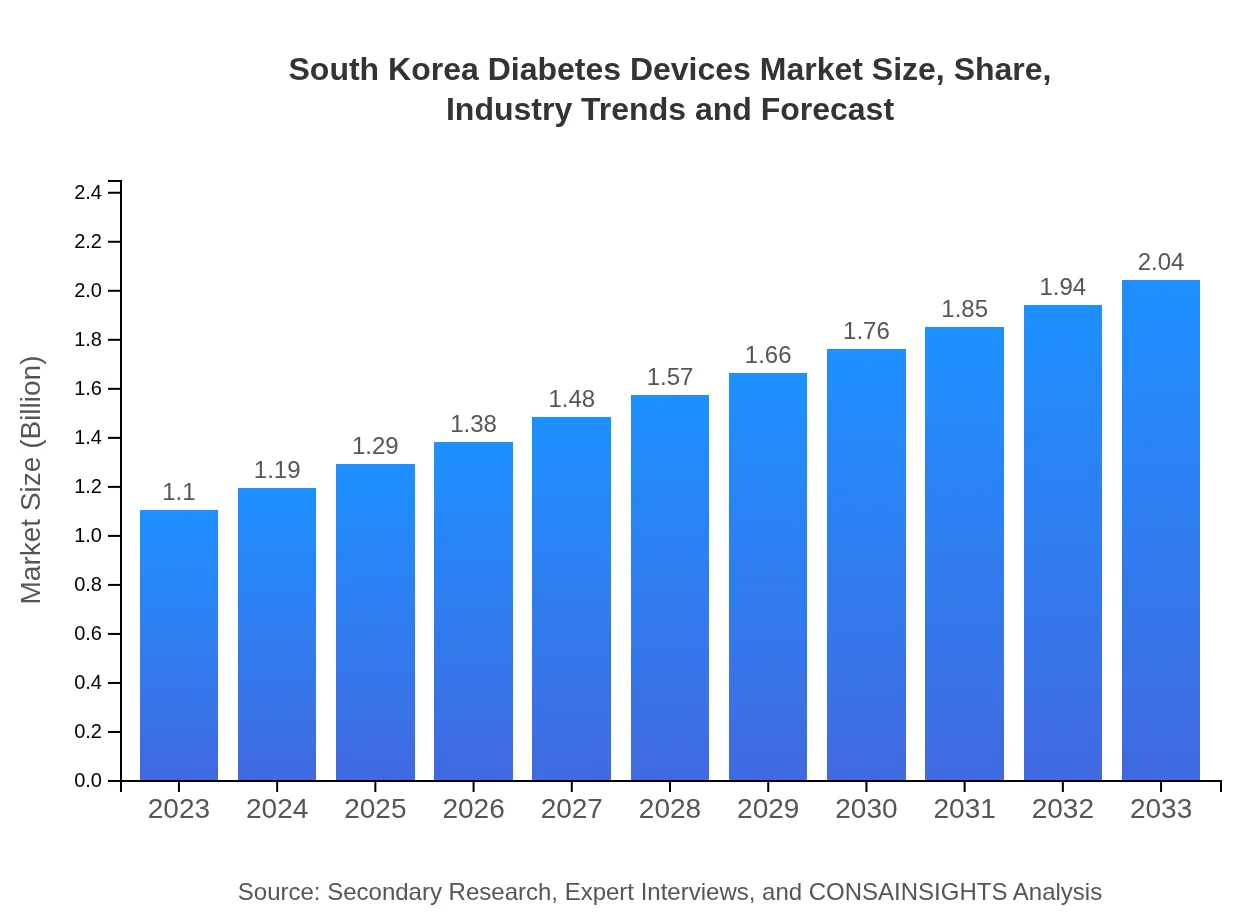

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.10 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.04 Billion |

| Top Companies | Roche Diabetes Care, Medtronic , Abbott Laboratories, Dexcom |

| Last Modified Date | 31 January 2026 |

South Korea Diabetes Devices Market Overview

Customize South Korea Diabetes Devices Market Report market research report

- ✔ Get in-depth analysis of South Korea Diabetes Devices market size, growth, and forecasts.

- ✔ Understand South Korea Diabetes Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in South Korea Diabetes Devices

What is the Market Size & CAGR of South Korea Diabetes Devices market in 2023?

South Korea Diabetes Devices Industry Analysis

South Korea Diabetes Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

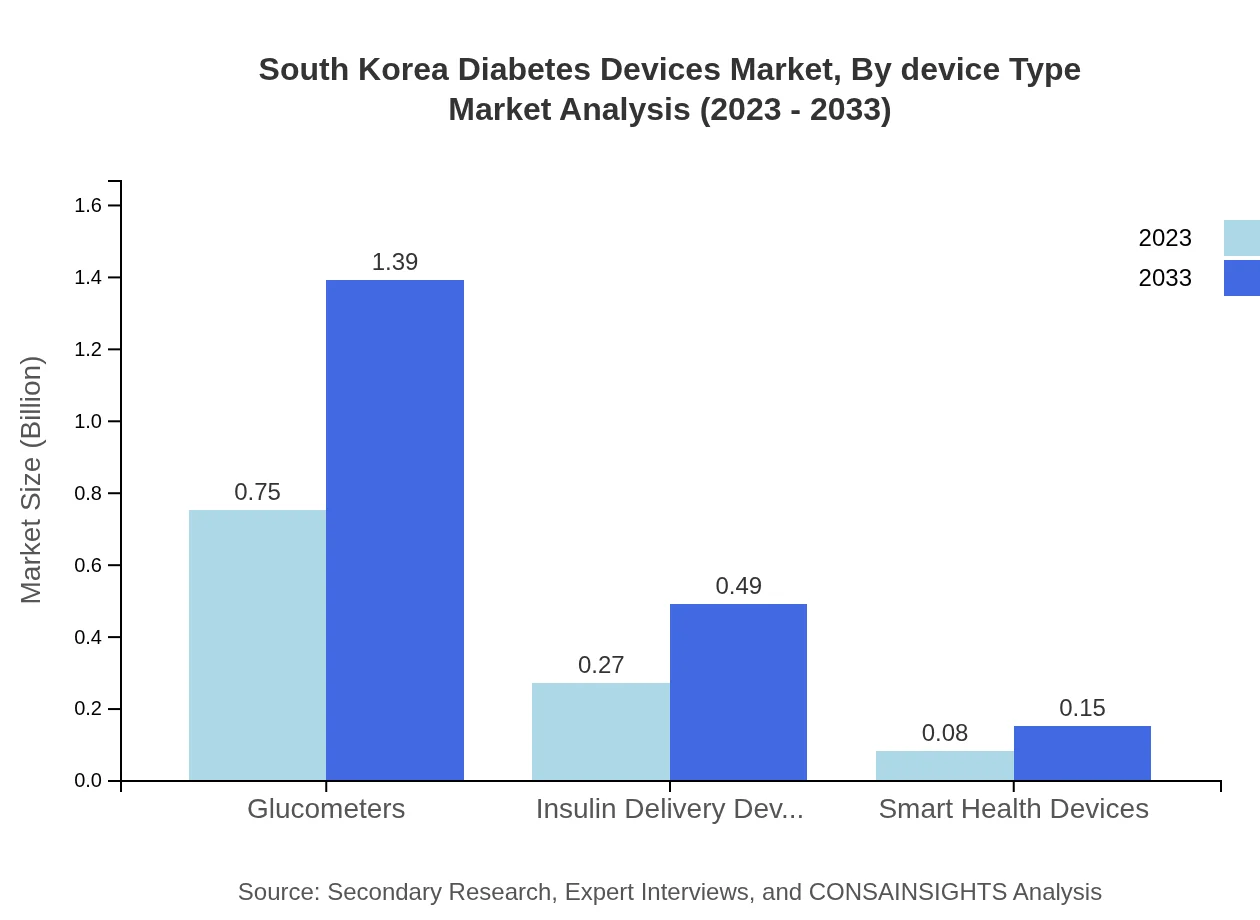

South Korea Diabetes Devices Market Analysis By Device Type

In the device type segment, glucometers accounted for 68.31% of the market share in 2023 and are expected to maintain this share by 2033, reflecting their dominance. Insulin delivery devices capture 24.21% of the market share, while new entrants in digital health devices account for 7.48%. By 2033, glucometer sales will increase to 1.39 billion USD, with insulin delivery devices also experiencing growth to 0.49 billion USD.

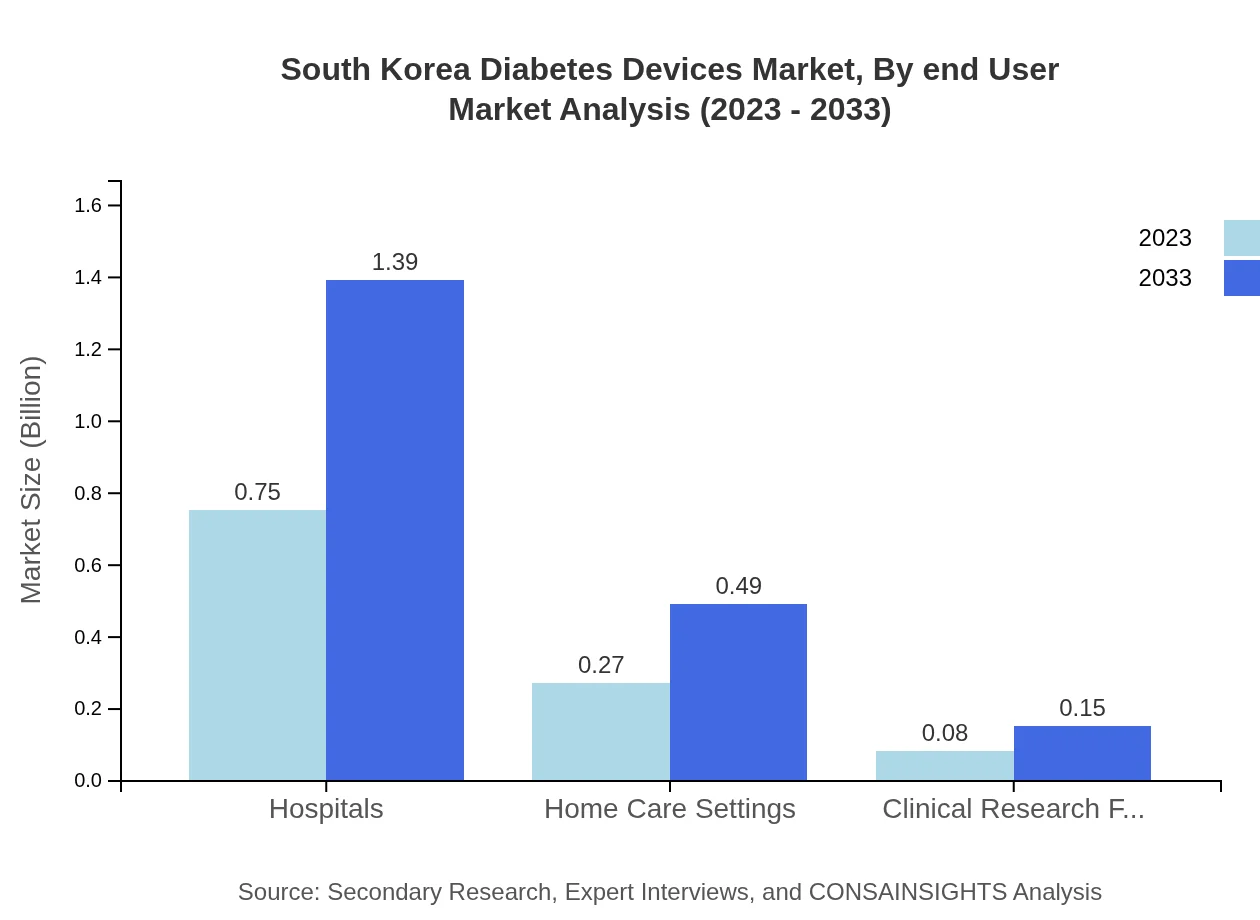

South Korea Diabetes Devices Market Analysis By End User

Hospitals dominate the end-user segment, accounting for 68.31% of the total market in 2023. Home care settings hold 24.21% market share and emphasize the shift towards patient self-management. Clinical research facilities represent 7.48% and are integral for innovation in diabetes care. Projections indicate hospital market size growing to 1.39 billion USD by 2033, while home care settings rise to 0.49 billion USD.

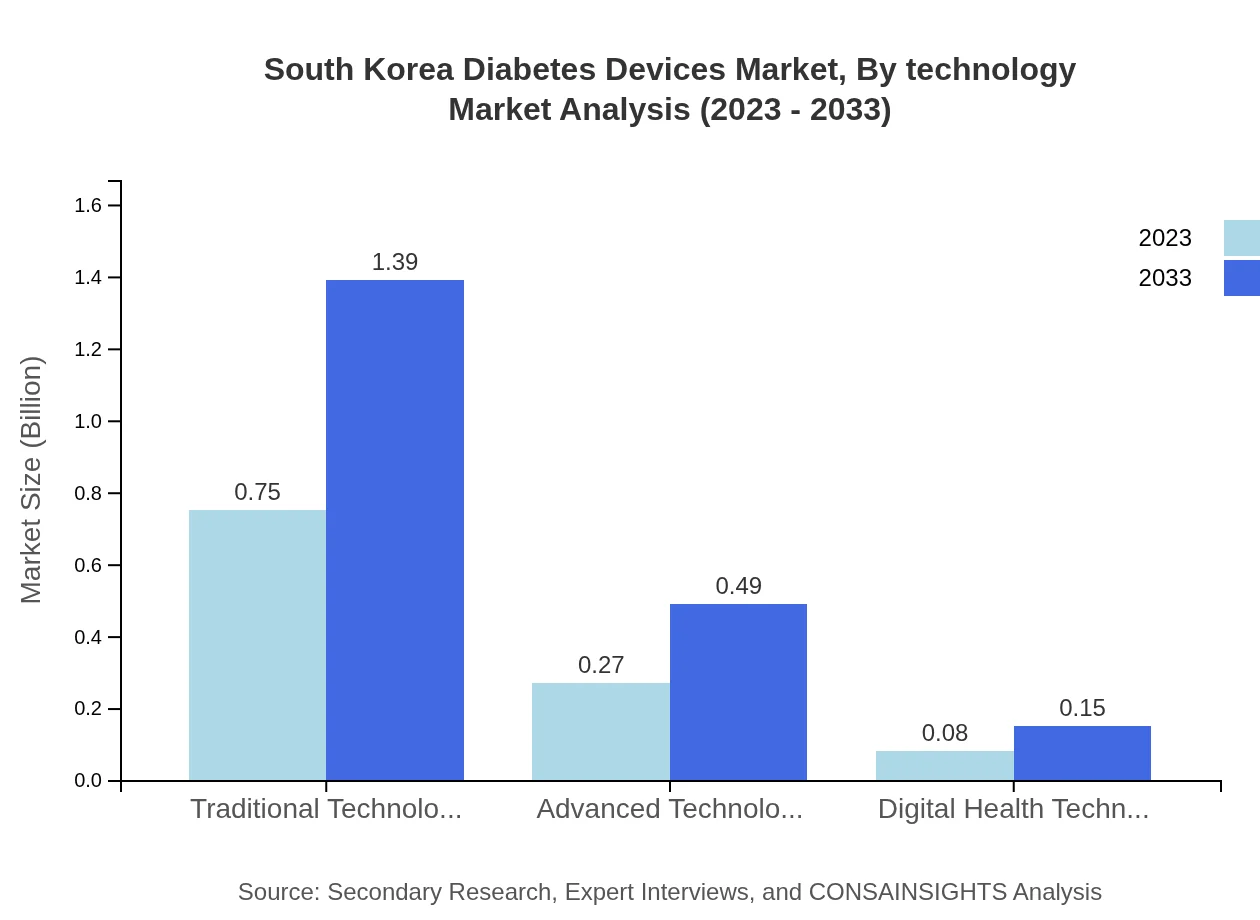

South Korea Diabetes Devices Market Analysis By Technology

The technological landscape is dominated by traditional monitoring technologies capturing 68.31% of the market share due to their established presence. Advanced technologies hold 24.21% of the market share while digital health technologies make up 7.48%. By 2033, combined advancements in technology will necessitate a significant market size increase for all segments.

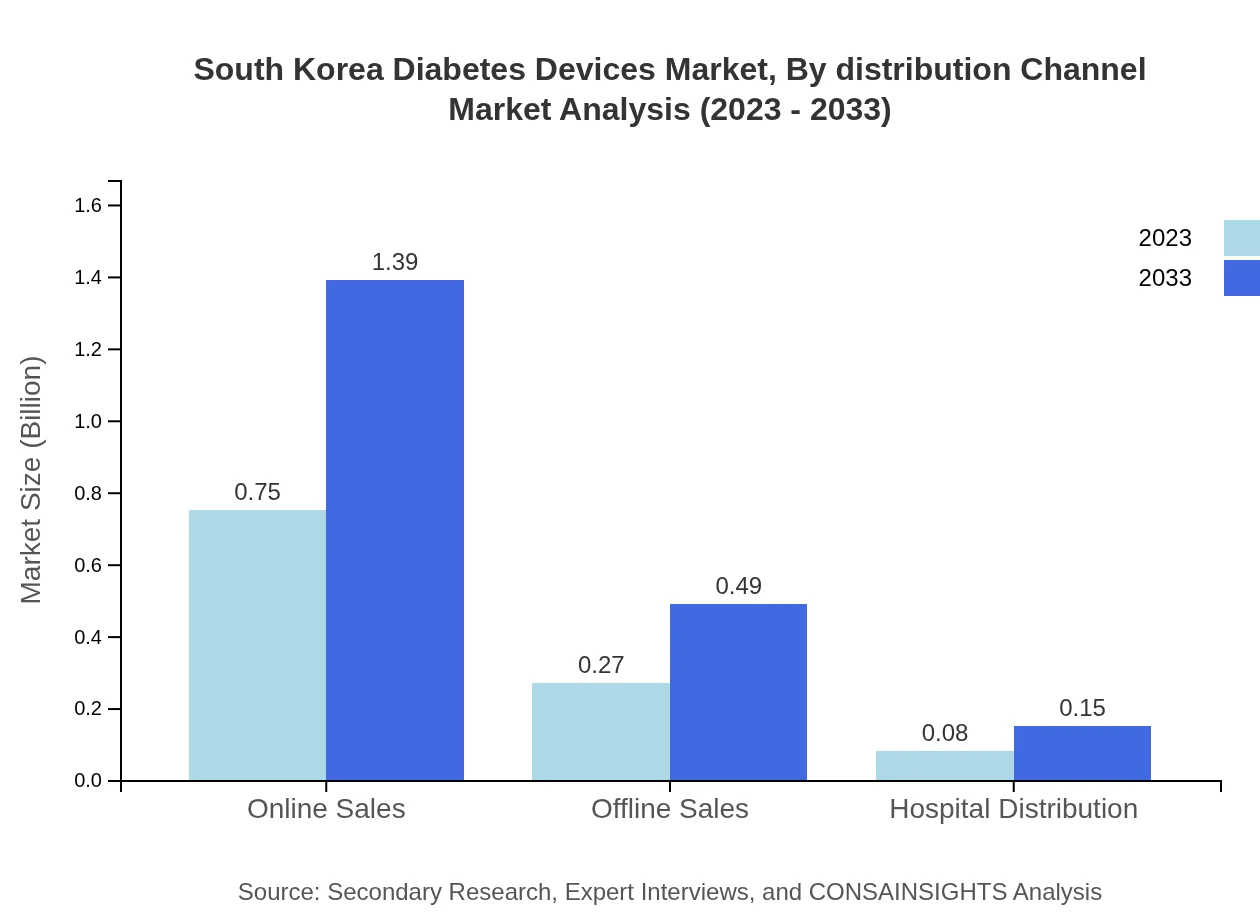

South Korea Diabetes Devices Market Analysis By Distribution Channel

Online sales channels are experiencing robust growth, currently making up 68.31% of the market. Offline channels, including pharmacies and medical supply stores, hold 24.21%. Hospital distribution is relatively smaller at 7.48%. By 2033, all channels will see growth, emphasizing trends towards e-commerce and telehealth solutions.

South Korea Diabetes Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in South Korea Diabetes Devices Industry

Roche Diabetes Care:

A leading player in blood glucose monitoring devices, Roche focuses on diabetes management innovation and patient-centric solutions.Medtronic :

Famous for its insulin delivery systems and advanced diabetes management technologies, Medtronic is pivotal in diabetes care solutions.Abbott Laboratories:

Abbott specializes in continuous glucose monitoring systems, driving advancements that allow for personalized diabetes management.Dexcom:

Dexcom offers innovative continuous glucose monitoring devices that provide real-time insights for diabetes patients.We're grateful to work with incredible clients.

FAQs

What is the market size of south Korea Diabetes Devices?

The South Korea diabetes devices market is valued at approximately $1.1 billion in 2023, with a projected CAGR of 6.2% over the next decade. This indicates a steady growth trajectory, reflecting increased healthcare expenditure and awareness.

What are the key market players or companies in this south Korea Diabetes Devices industry?

Key players in South Korea's diabetes devices market include major multinational companies and regional firms specializing in insulin delivery systems, continuous glucose monitors, and other diabetic care solutions. Their innovative offerings and strategic partnerships play a crucial role in market competitiveness.

What are the primary factors driving the growth in the south Korea Diabetes Devices industry?

Growth in the South Korea diabetes devices market is primarily driven by increasing diabetes prevalence, advancements in technology, a rising aging population, and government initiatives aimed at enhancing chronic disease management, all fostering greater demand for effective diabetes management solutions.

Which region is the fastest Growing in the south Korea Diabetes Devices?

The Asia Pacific region shows promising growth for diabetes devices, expected to increase from $0.21 billion in 2023 to $0.38 billion by 2033, reflecting a rapid adoption of advanced healthcare technologies and increasing patient awareness.

Does ConsaInsights provide customized market report data for the south Korea Diabetes Devices industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, allowing clients to access detailed insights and analytics that align with their strategic objectives in the South Korea diabetes devices sector.

What deliverables can I expect from this south Korea Diabetes Devices market research project?

Expect comprehensive deliverables, including detailed market analysis reports, segmentation breakdowns, competitive landscapes, forecasts, and actionable insights that cater specifically to the South Korea diabetes devices market.

What are the market trends of south Korea Diabetes Devices?

Significant market trends include rising digital health technology adoption, increased focus on home care settings, a shift toward personalized diabetes management solutions, and a growing emphasis on integrating advanced analytics in diabetes devices, enhancing patient outcomes.