Tachometer Market Report

Published Date: 31 January 2026 | Report Code: tachometer

Tachometer Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Tachometer market from 2023 to 2033, revealing insights on market dynamics, segmentation, regional developments, and industry trends that influence future growth.

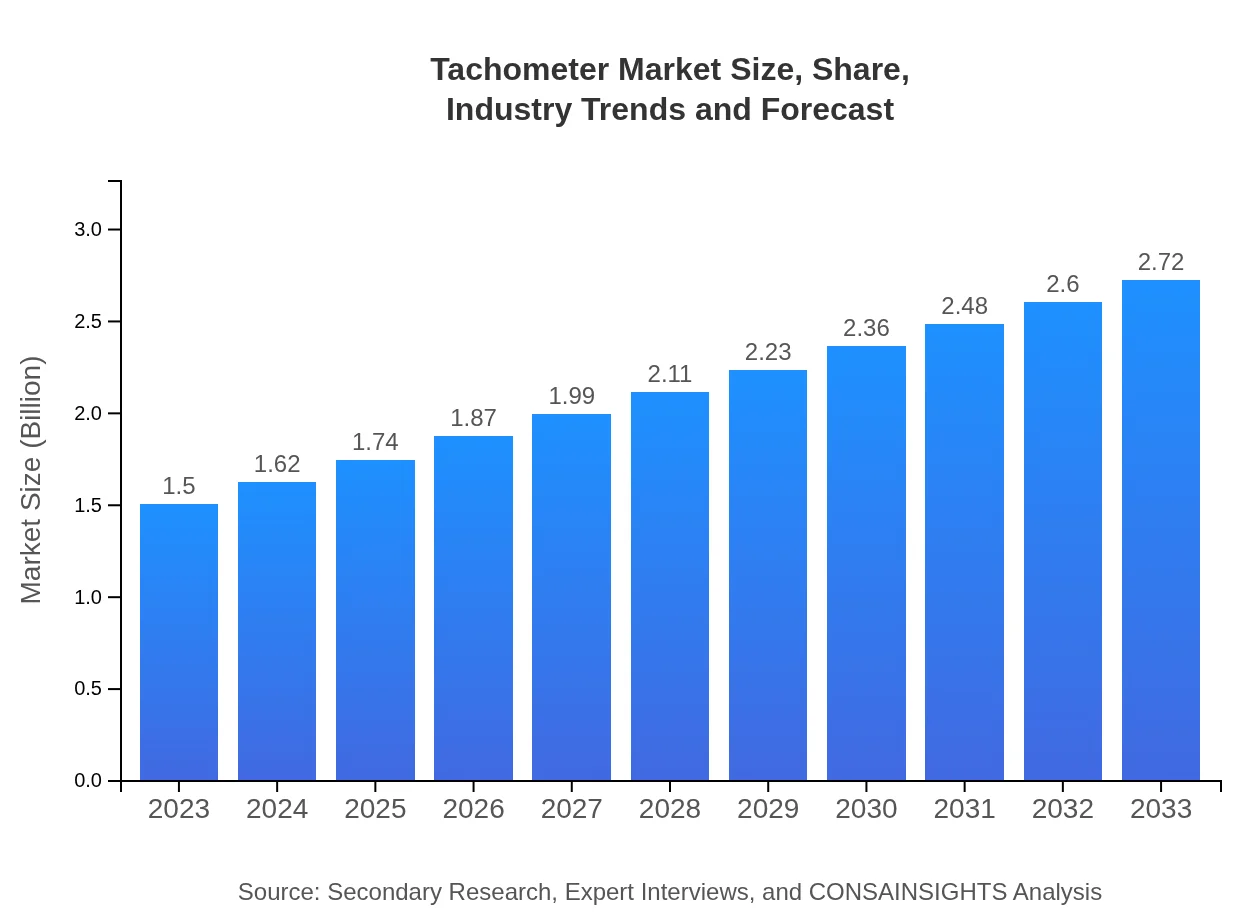

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.0% |

| 2033 Market Size | $2.72 Billion |

| Top Companies | Omega Engineering, Fluke Corporation, Honeywell , Siemens AG |

| Last Modified Date | 31 January 2026 |

Tachometer Market Overview

Customize Tachometer Market Report market research report

- ✔ Get in-depth analysis of Tachometer market size, growth, and forecasts.

- ✔ Understand Tachometer's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tachometer

What is the Market Size & CAGR of the Tachometer market in 2033?

Tachometer Industry Analysis

Tachometer Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tachometer Market Analysis Report by Region

Europe Tachometer Market Report:

In Europe, the Tachometer market is expected to grow from $0.46 billion in 2023 to $0.84 billion by 2033. The region is characterized by stringent regulations on equipment efficiency and safety, promoting the adoption of modern tachometric technologies across sectors.Asia Pacific Tachometer Market Report:

In 2023, the Tachometer market in Asia Pacific is valued at $0.28 billion, projected to grow to $0.52 billion by 2033. The growth is driven by rapid industrialization, expanded automotive production, and increased investments in manufacturing technologies in countries like China and India.North America Tachometer Market Report:

With a market size of $0.53 billion in 2023, North America is expected to reach $0.96 billion by 2033. The region benefits from strong automotive and aerospace industries, alongside advances in technology that drive demand for highly accurate measuring instruments.South America Tachometer Market Report:

The South American Tachometer market is valued at $0.07 billion in 2023 and is anticipated to grow to $0.12 billion by 2033. The growth is attributed to an expanding automotive sector and increasing emphasis on quality control mechanisms in manufacturing processes.Middle East & Africa Tachometer Market Report:

The market in the Middle East and Africa is set to grow from $0.16 billion in 2023 to $0.29 billion by 2033, driven by initiatives in infrastructure development and energy exploration projects that necessitate precision measurement tools.Tell us your focus area and get a customized research report.

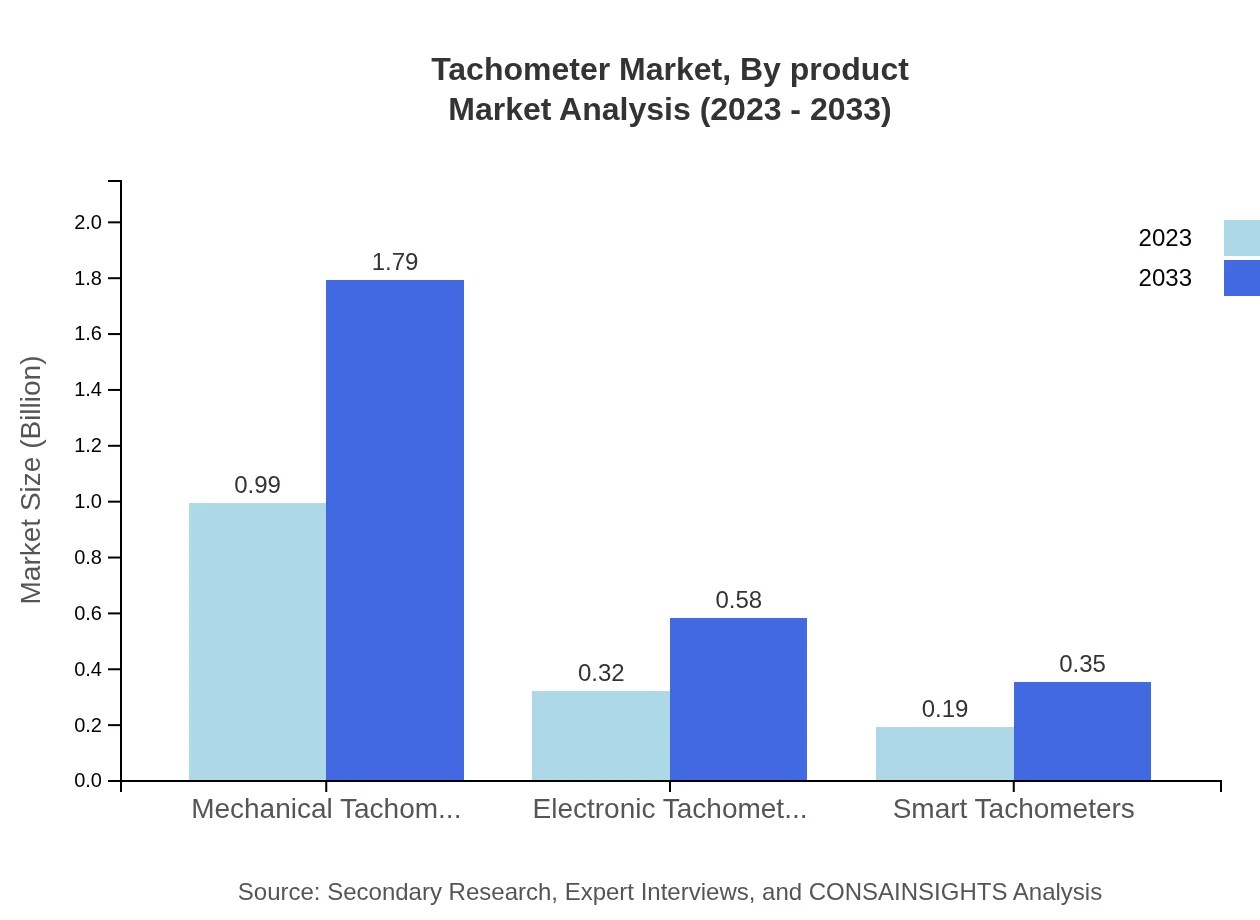

Tachometer Market Analysis By Product

The Tachometer market is segmented into Mechanical Tachometers, Electronic Tachometers, and Smart Tachometers. Mechanical Tachometers, valued at $0.99 billion in 2023, are projected to grow to $1.79 billion by 2033. Electronic Tachometers will increase from $0.32 billion to $0.58 billion during the same period, while Smart Tachometers are expected to rise from $0.19 billion to $0.35 billion.

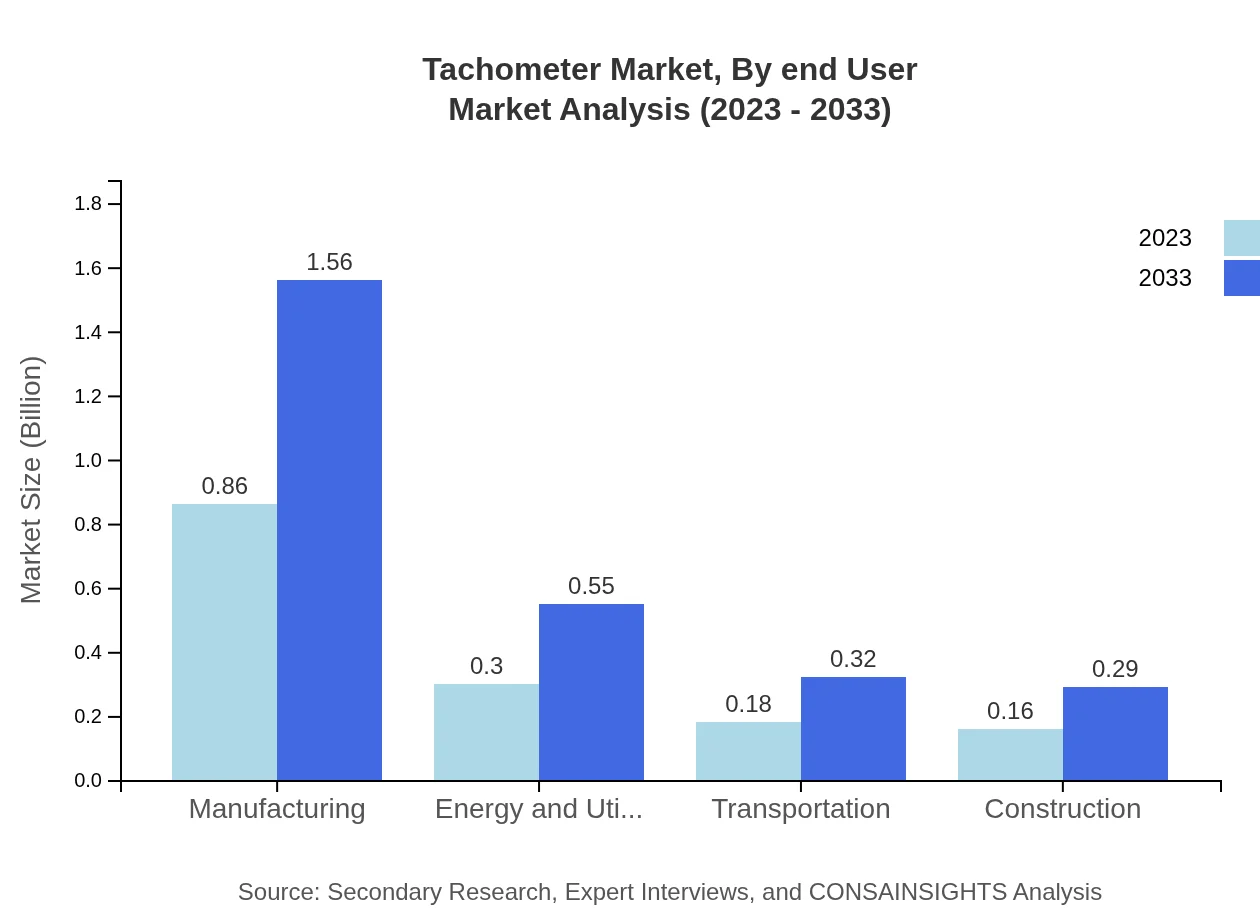

Tachometer Market Analysis By Application

Within the Tachometer market, key applications include Manufacturing, Energy and Utilities, Transportation, and Construction. Manufacturing leads the share with $0.86 billion in 2023, expected to grow to $1.56 billion by 2033. Energy and Utilities applications are valued at $0.30 billion, projected to grow to $0.55 billion, while Transportation and Construction applications are valued at $0.18 billion and $0.16 billion respectively in 2023.

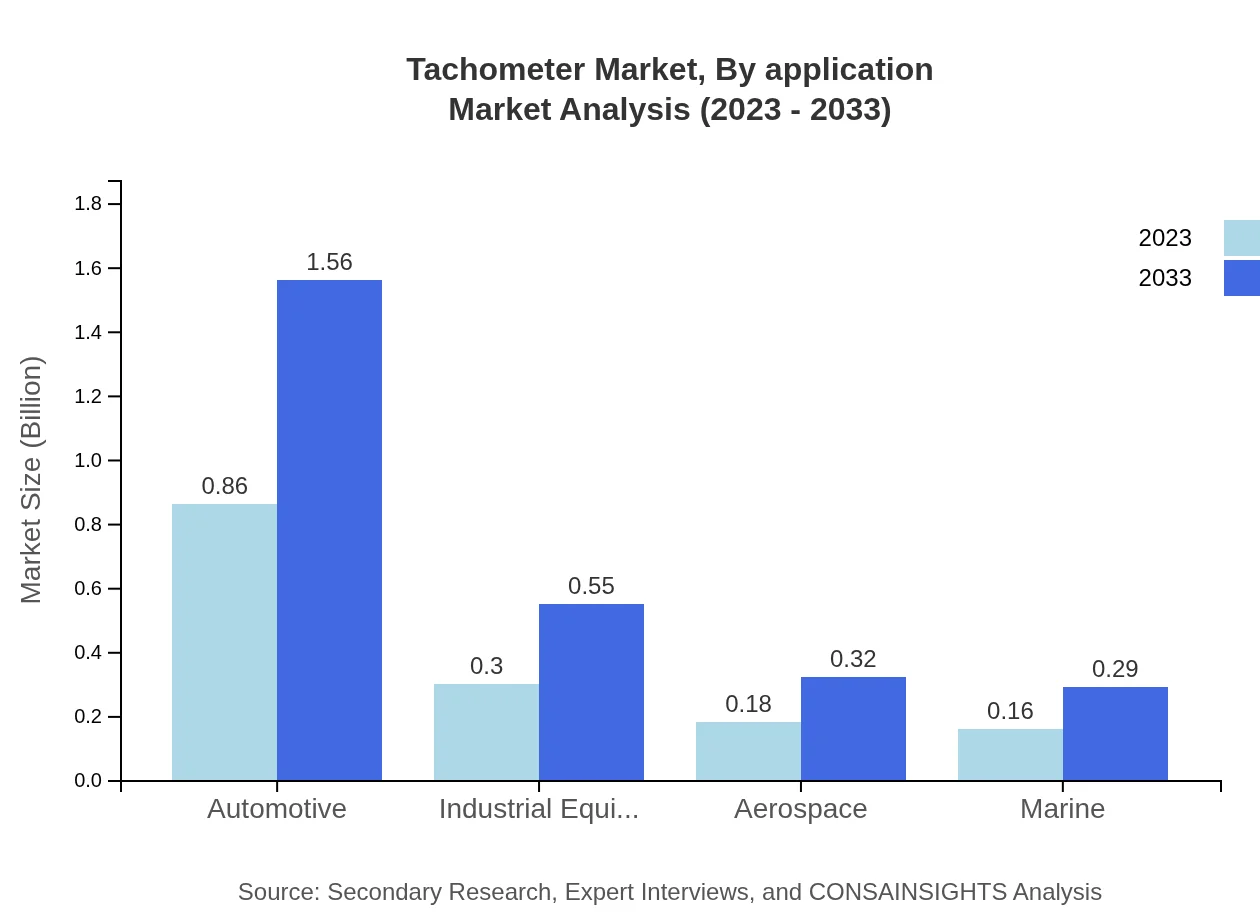

Tachometer Market Analysis By End User

The major end-users of Tachometers include Automotive, Industrial Equipment, Aerospace, and Marine industries. The Automotive sector commands a market share of $0.86 billion, expected to reach $1.56 billion as electric vehicles gain traction. Meanwhile, Industrial Equipment and Aerospace segments are projected to grow from $0.30 billion and $0.18 billion respectively, highlighting the critical importance of tachometers in these sectors.

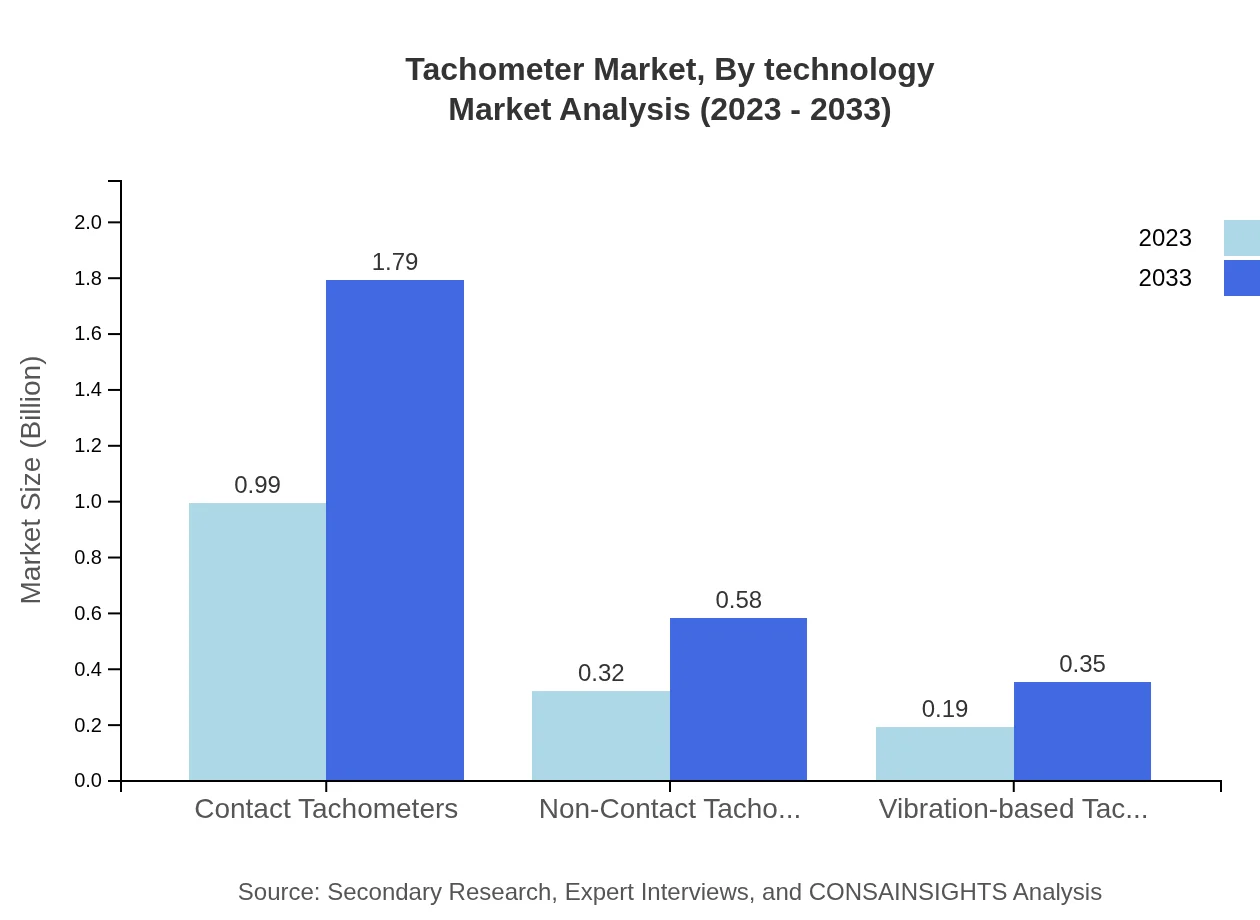

Tachometer Market Analysis By Technology

The Tachometer market showcases diverse technologies, with traditional mechanical systems transitioning towards more sophisticated electronic and digital systems. As technology advances, smart tachometers leveraging IoT capabilities are becoming more prominent, providing connectivity and data analytics for efficient operations.

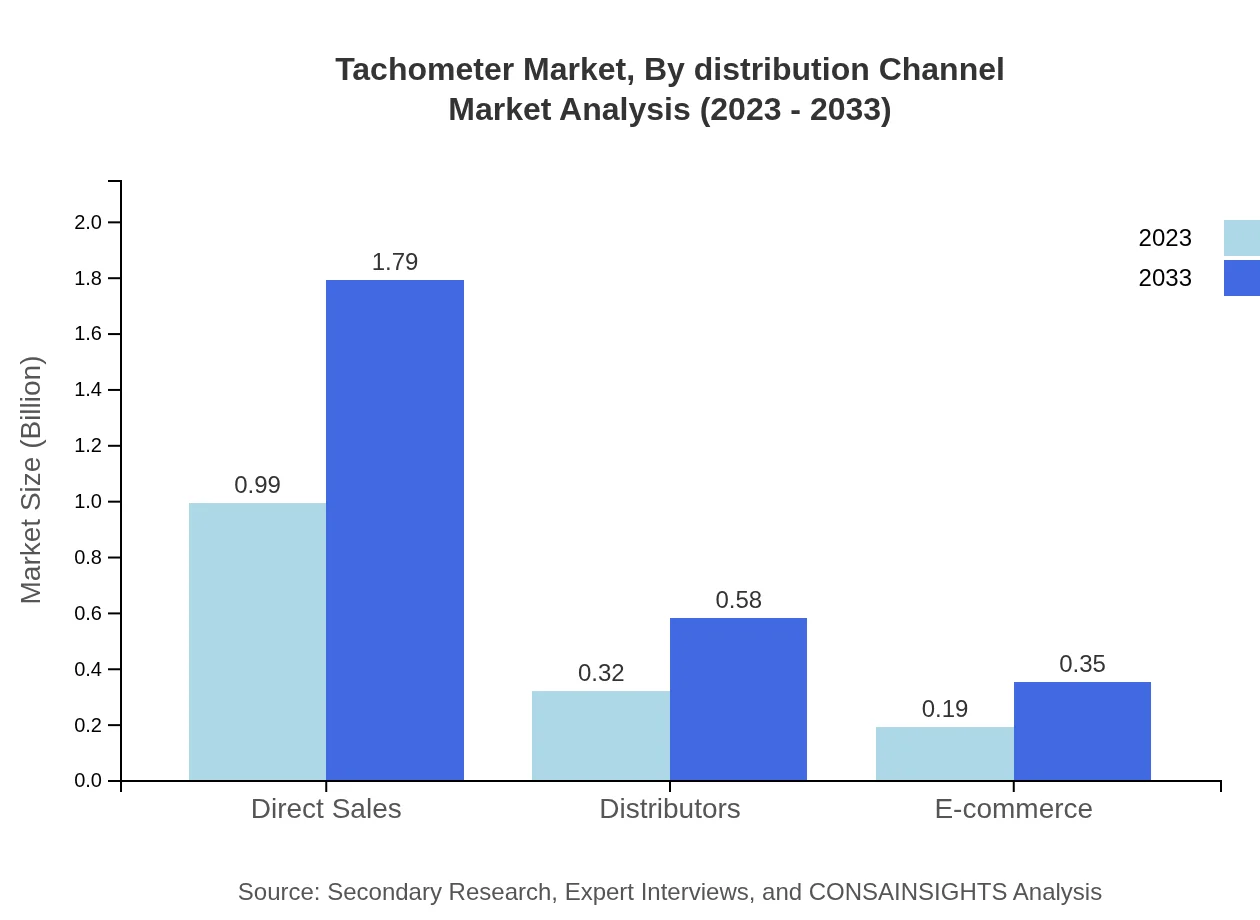

Tachometer Market Analysis By Distribution Channel

Distribution channels for Tachometers include Direct Sales, Distributors, and E-commerce. Direct Sales dominate the market, generating $0.99 billion in 2023, influenced by strong B2B engagements. E-commerce is growing rapidly, projected to increase as online purchasing becomes a prevalent method for acquiring measurement instruments.

Tachometer Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tachometer Industry

Omega Engineering:

A leader in providing high-quality measurement and control solutions, Omega Engineering specializes in products including tachometers, ensuring accuracy and reliability for various applications.Fluke Corporation:

Fluke Corporation is renowned for its precision measurement instruments, including advanced tachometers that integrate digital technology for enhanced performance in industrial environments.Honeywell :

Honeywell focuses on optimizing operational efficiency through its diverse instrumentation solutions, including tachometers designed for automotive and industrial use.Siemens AG:

A global powerhouse in technology, Siemens provides innovative tachometer solutions tailored to meet the demands of modern engineering and industrial tasks.We're grateful to work with incredible clients.

FAQs

What is the market size of tachometer?

The global tachometer market is valued at $1.5 billion in 2023, with a projected CAGR of 6.0% expected to significantly boost market revenue by 2033, reflecting increasing applications across various industries.

What are the key market players or companies in this tachometer industry?

Key players in the tachometer market include Fluke Corporation, Siemens AG, and Honeywell International Inc., among others. These companies are recognized for their innovative solutions and robust market presence.

What are the primary factors driving the growth in the tachometer industry?

Growth in the tachometer industry is driven by technological advancements, increasing industrial automation, and a rising demand for precise monitoring of machinery performance across various sectors.

Which region is the fastest Growing in the tachometer market?

North America is the fastest-growing region in the tachometer market, increasing from $0.53 billion in 2023 to $0.96 billion in 2033, attributed to a booming automotive and industrial sector.

Does ConsaInsights provide customized market report data for the tachometer industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the tachometer industry, ensuring comprehensive insights to guide decision-making and strategy development.

What deliverables can I expect from this tachometer market research project?

Expect detailed market analysis, segment data, growth forecasts, competitive landscape assessment, and actionable insights, tailored to specific needs in the tachometer market.

What are the market trends of tachometer?

Key market trends include the growth of smart tachometers, advancements in electronic technologies, and increased integration of IoT for enhanced operational efficiency within machinery monitoring.