Thirdparty Banking Software Market Report

Published Date: 31 January 2026 | Report Code: thirdparty-banking-software

Thirdparty Banking Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Thirdparty Banking Software market from 2023 to 2033, including market size, growth forecasts, segmentation, industry challenges, technological advancements, and regional insights.

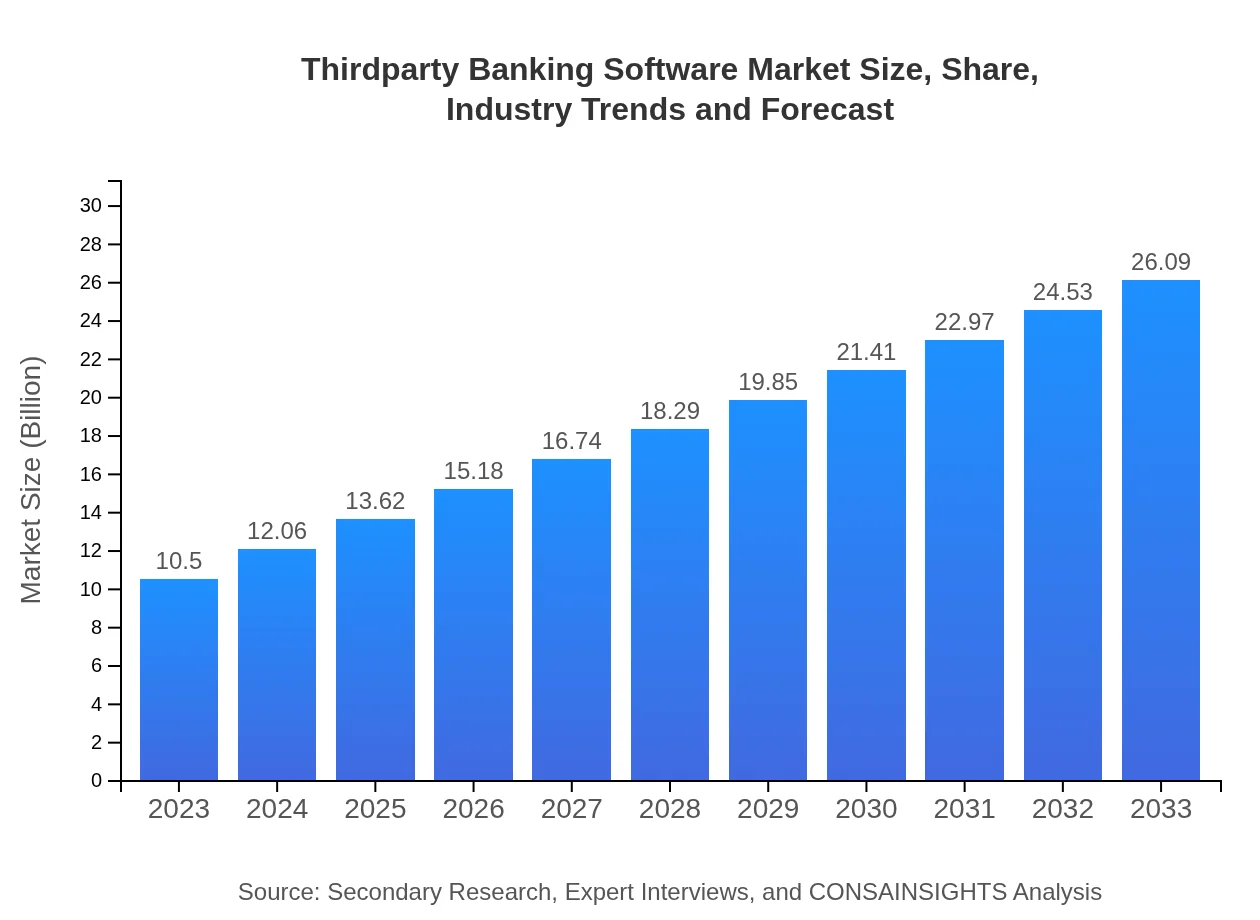

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $26.09 Billion |

| Top Companies | Oracle, FIS, Finastra, SAP, Infosys |

| Last Modified Date | 31 January 2026 |

Thirdparty Banking Software Market Overview

Customize Thirdparty Banking Software Market Report market research report

- ✔ Get in-depth analysis of Thirdparty Banking Software market size, growth, and forecasts.

- ✔ Understand Thirdparty Banking Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Thirdparty Banking Software

What is the Market Size & CAGR of Thirdparty Banking Software market in 2023?

Thirdparty Banking Software Industry Analysis

Thirdparty Banking Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Thirdparty Banking Software Market Analysis Report by Region

Europe Thirdparty Banking Software Market Report:

Europe's market is poised for growth, increasing from $2.71 billion in 2023 to $6.74 billion in 2033. The region's emphasis on regulatory compliance and security is driving the adoption of innovative software solutions.Asia Pacific Thirdparty Banking Software Market Report:

The Asia Pacific region is projected to witness significant growth, from a market value of $2.19 billion in 2023 to $5.43 billion by 2033. The growth is driven by rapid digitization, increased smartphone penetration, and a young tech-savvy population opting for digital banking services.North America Thirdparty Banking Software Market Report:

North America dominates the market, with a size of $3.48 billion projected to expand to $8.64 billion by 2033. The region benefits from advanced banking infrastructure, high investment in financial technology, and high consumer demand for digital banking solutions.South America Thirdparty Banking Software Market Report:

In South America, the market is expected to grow from $1.04 billion in 2023 to $2.59 billion in 2033. The adoption of third-party banking software is fueled by efforts to modernize banking operations and enhance customer service across the region's financial institutions.Middle East & Africa Thirdparty Banking Software Market Report:

The Middle East and Africa market starts at $1.08 billion in 2023, growing to $2.69 billion by 2033. The region is seeing increased investment in banking technology aimed at improving services and financial inclusion.Tell us your focus area and get a customized research report.

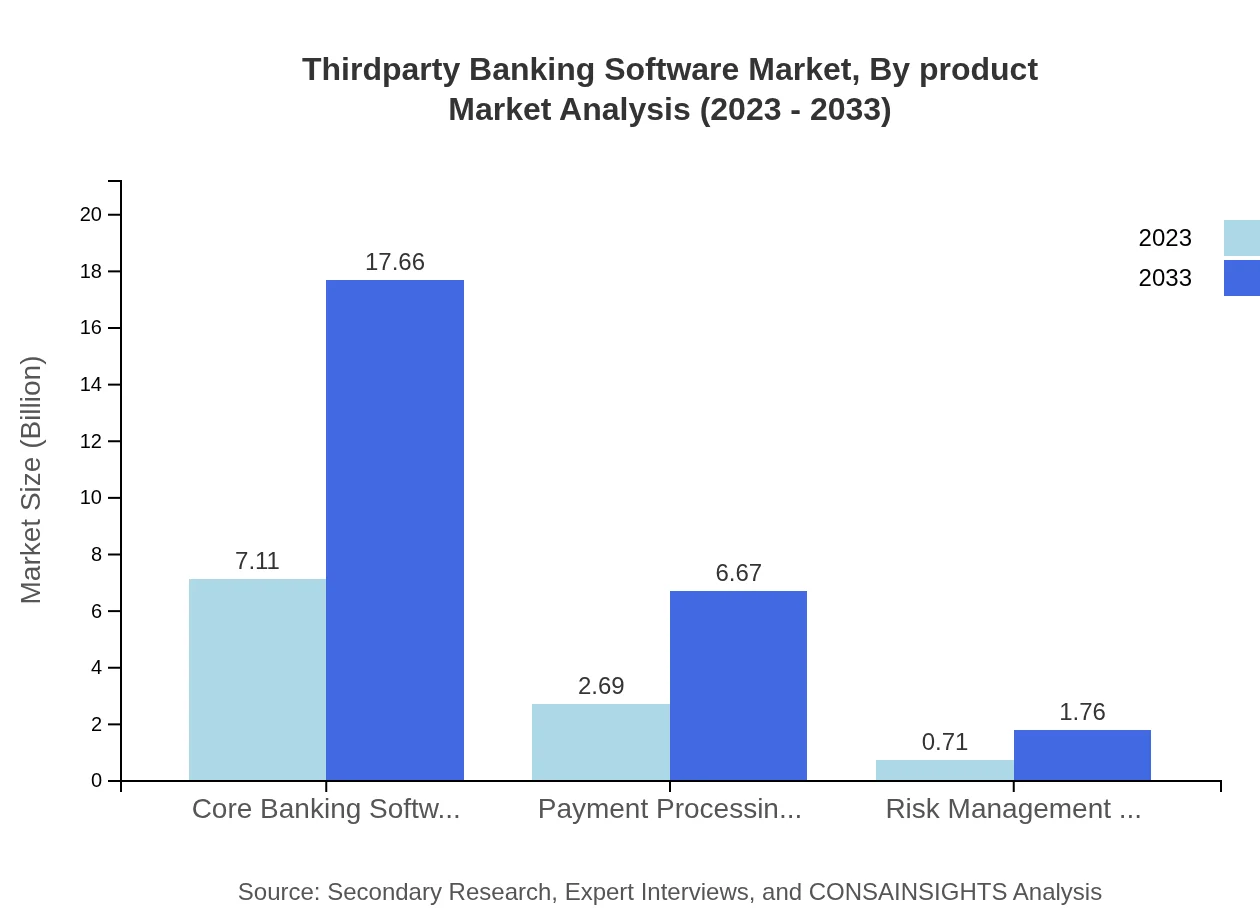

Thirdparty Banking Software Market Analysis By Product

The product segmentation indicates robust performance in core banking software, expected to grow from $7.11 billion in 2023 to $17.66 billion by 2033, claiming a substantial market share of 67.68%. Payment processing solutions also contribute significantly, expanding from $2.69 billion to $6.67 billion, with a steady market share of 25.58%.

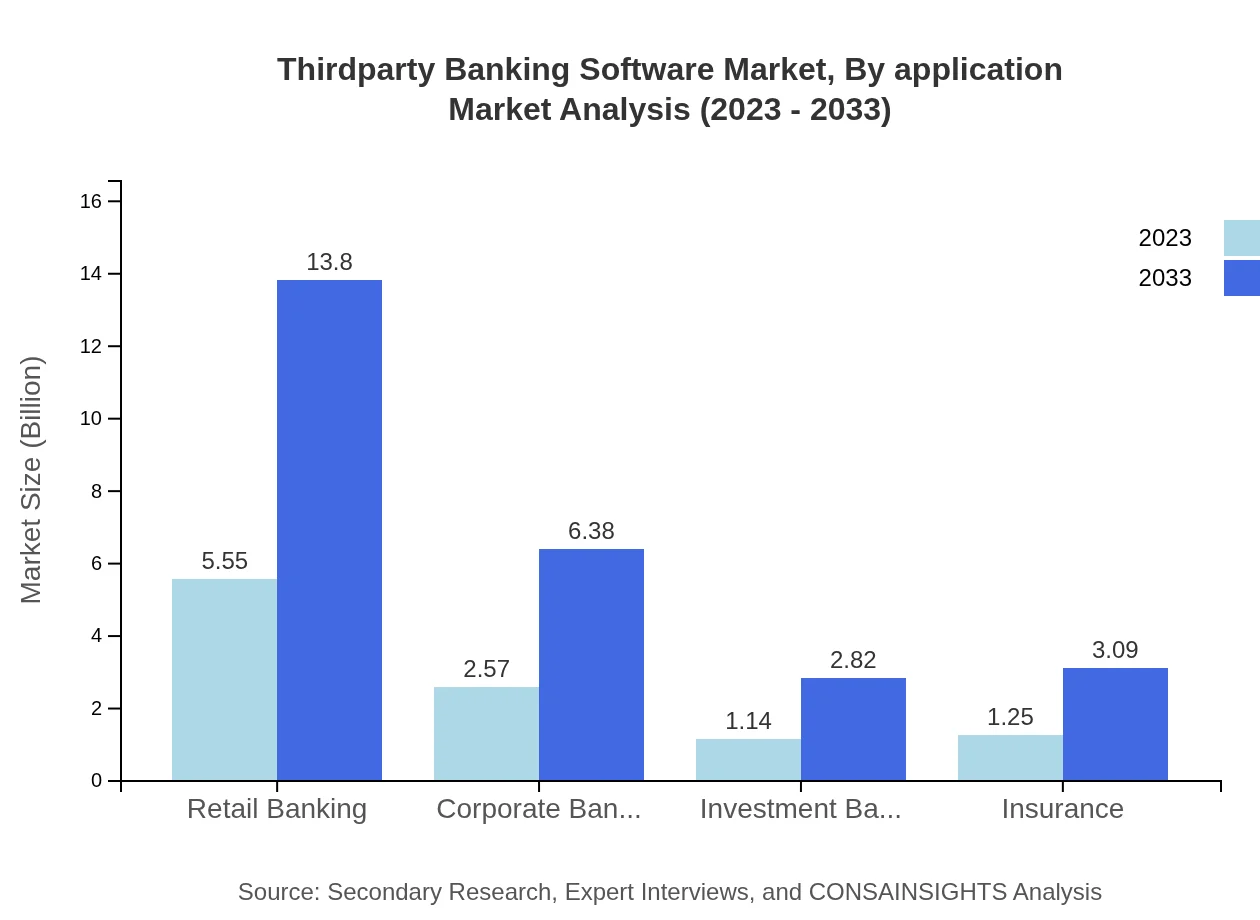

Thirdparty Banking Software Market Analysis By Application

By application, the retail banking segment is projected to grow from $5.55 billion in 2023 to $13.80 billion by 2033, representing 52.88% of the market share. Commercial banks and credit unions will similarly see growth, reflecting the increasing demand for advanced banking features.

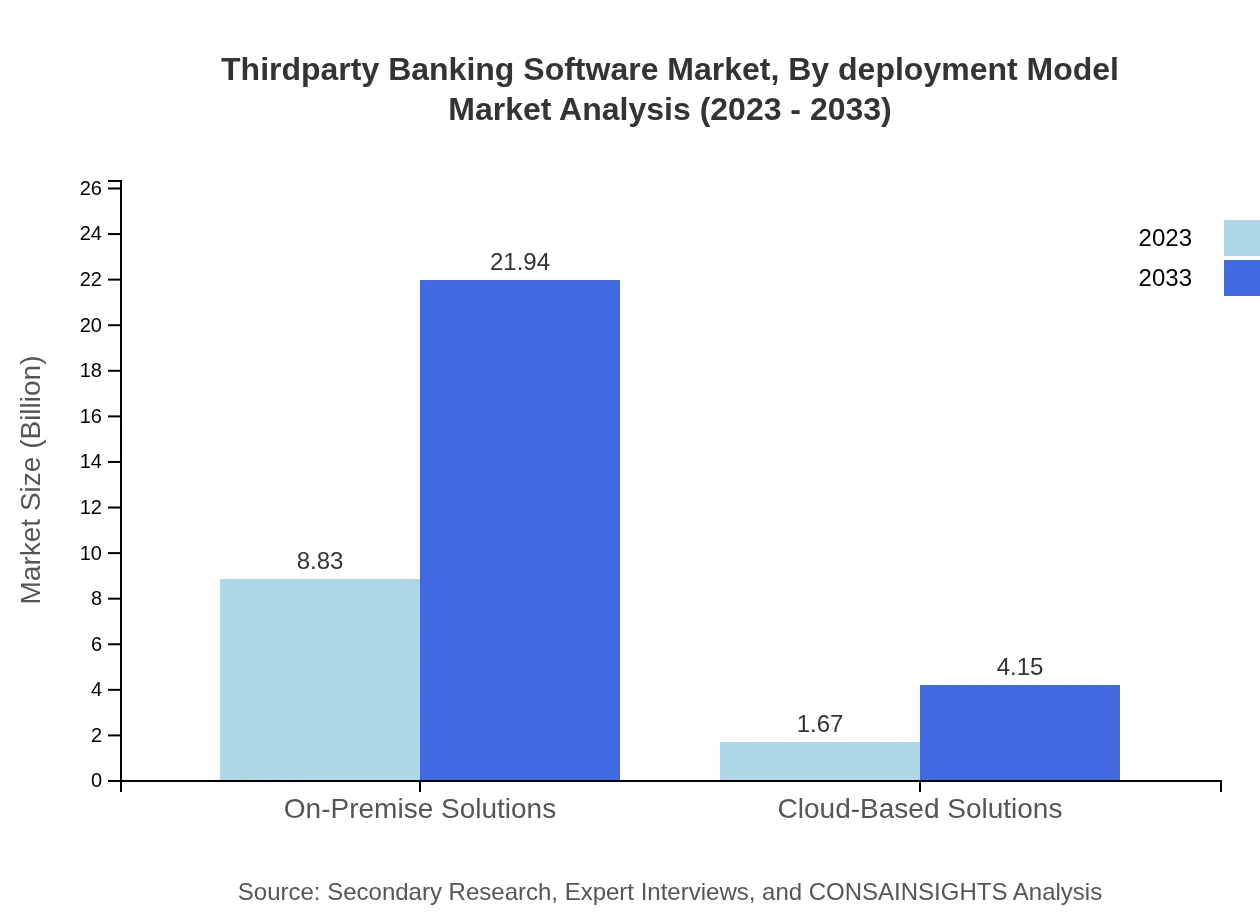

Thirdparty Banking Software Market Analysis By Deployment Model

The deployment model analysis highlights a leading trend in on-premise solutions, which will grow from $8.83 billion to $21.94 billion (84.1% market share) over the forecast period, while cloud-based solutions are predicted to grow from $1.67 billion to $4.15 billion (15.9% market share) as adoption rises.

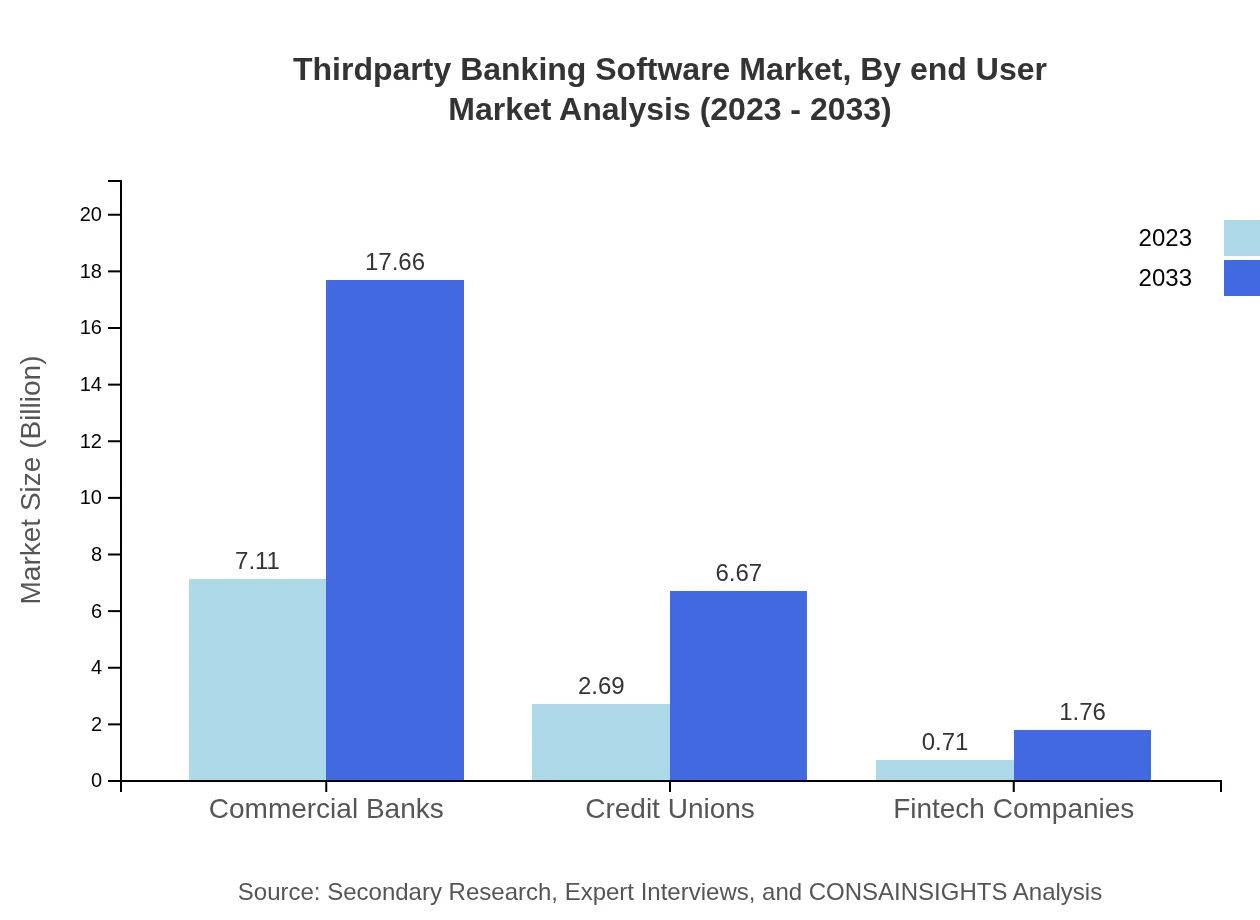

Thirdparty Banking Software Market Analysis By End User

End-user segmentation reflects a growing inclination towards banking software for commercial banks, expected to expand significantly, mirroring overall market trends and the digital push that's transforming banking operations.

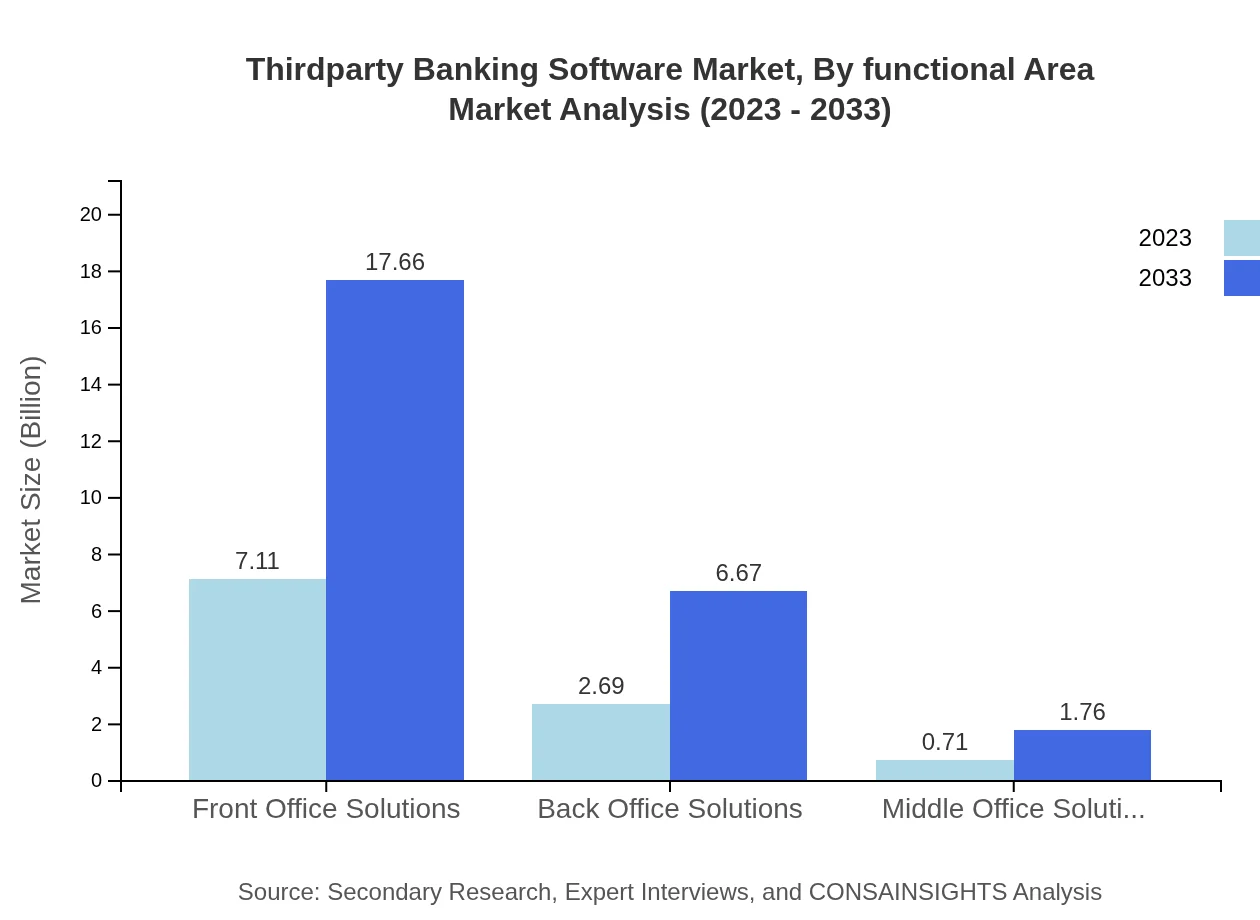

Thirdparty Banking Software Market Analysis By Functional Area

Functional area analysis indicates that front office solutions hold a major share, replicating the overall industry growth due to their direct impact on customer engagement and sales activities, while risk management software grows due to increasing compliance needs.

Thirdparty Banking Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Thirdparty Banking Software Industry

Oracle:

Oracle's banking software solutions focus on driving digital transformation, helping banks leverage advanced technology to enhance operations and customer service.FIS:

FIS provides a comprehensive suite of banking solutions, recognized for its innovation in payment systems and core banking platforms.Finastra:

Finastra is renowned for its open platform approach that promotes collaboration within the banking sector, offering solutions from retail to investment banking.SAP:

SAP specializes in enterprise resource planning solutions, including tailored banking software that enhances operational efficiency in financial services.Infosys:

Infosys stands out for its deep expertise in digital banking solutions, focusing on enhancing client engagement and operational agility.We're grateful to work with incredible clients.

FAQs

What is the market size of thirdparty Banking Software?

As of 2023, the market size of the third-party banking software industry is valued at approximately $10.5 billion, with a projected CAGR of 9.2%, indicating growing demand and expansion within the sector over the next decade.

What are the key market players or companies in this thirdparty Banking Software industry?

Key players in the third-party banking software market include major software vendors, fintech companies, and some traditional banks that have developed collaborative platforms to enhance service delivery and operational efficiency.

What are the primary factors driving the growth in the thirdparty Banking Software industry?

The growth in this industry is driven by digital transformation in banking, the increasing demand for automated financial solutions, and regulatory compliance requirements that push institutions to adopt modern technologies.

Which region is the fastest Growing in the thirdparty Banking Software?

Among the regions, Europe is the fastest-growing market, projected to grow from $2.71 billion in 2023 to $6.74 billion by 2033, indicating a significant opportunity for software providers.

Does ConsaInsights provide customized market report data for the thirdparty Banking Software industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the third-party banking software industry, providing insights on trends, competitors, and market dynamics.

What deliverables can I expect from this thirdparty Banking Software market research project?

Clients can expect detailed market analysis reports, segmented data insights, competitive landscape assessments, and actionable recommendations aimed at facilitating informed decision-making in the third-party banking software market.

What are the market trends of thirdparty Banking Software?

Trends in the third-party banking software market include a shift towards cloud-based solutions, increased investment in cybersecurity, and a growing emphasis on user experience and integration with emerging financial technologies.