3d Ic Market Report

Published Date: 31 January 2026 | Report Code: 3d-ic

3d Ic Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the 3D IC market, including market trends, size, growth forecasts, and insights into regional performance and key players from 2023 to 2033.

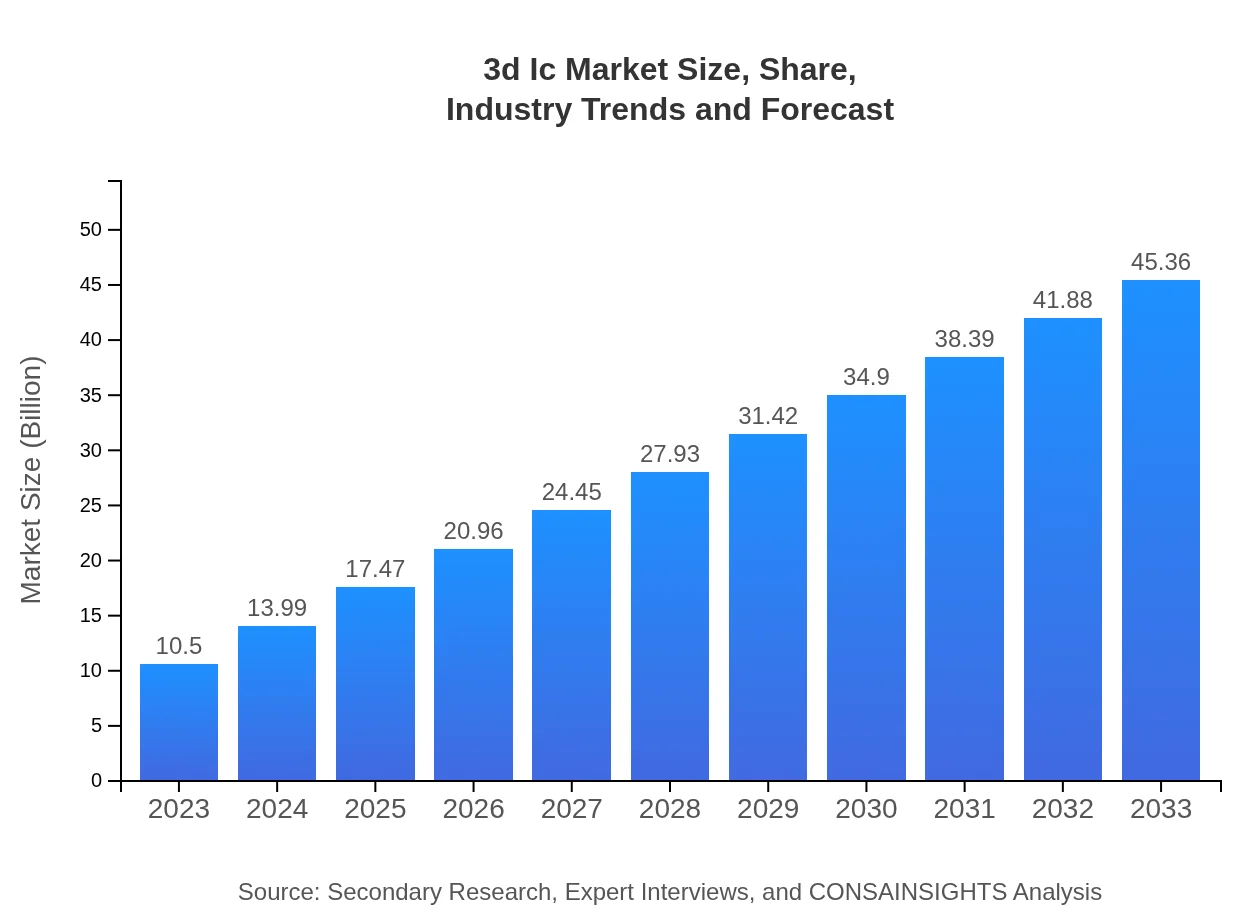

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 15% |

| 2033 Market Size | $45.36 Billion |

| Top Companies | TSMC, Intel Corporation, Samsung Electronics, Qualcomm |

| Last Modified Date | 31 January 2026 |

3D IC Market Overview

Customize 3d Ic Market Report market research report

- ✔ Get in-depth analysis of 3d Ic market size, growth, and forecasts.

- ✔ Understand 3d Ic's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in 3d Ic

What is the Market Size & CAGR of 3D IC market in 2023?

3D IC Industry Analysis

3D IC Market Segmentation and Scope

Tell us your focus area and get a customized research report.

3D IC Market Analysis Report by Region

Europe 3d Ic Market Report:

The European market for 3D ICs was valued at $2.63 billion in 2023, expected to increase significantly to $11.37 billion by 2033. Europe is focusing on research and innovation to enhance its semiconductor sector and remains an important market.Asia Pacific 3d Ic Market Report:

The Asia Pacific region was valued at $2.14 billion in 2023 and is expected to reach approximately $9.24 billion by 2033. The region is a hub for semiconductor manufacturing, with major companies investing in advanced packaging technologies, driving market growth.North America 3d Ic Market Report:

North America, a key player in the global 3D IC market, saw a market size of $3.85 billion in 2023, projected to grow to $16.64 billion by 2033. The presence of leading semiconductor companies and technological advancements propel growth in this region.South America 3d Ic Market Report:

The South American market was valued at $0.80 billion in 2023, with projections reaching $3.46 billion by 2033. Economic growth and increasing investments in technology infrastructure are expected to fuel demand in this region.Middle East & Africa 3d Ic Market Report:

The Middle East and Africa market stood at $1.08 billion in 2023 and is anticipated to grow to $4.66 billion by 2033. The increasing adoption of electronics in various industrial applications is likely to boost growth in this region.Tell us your focus area and get a customized research report.

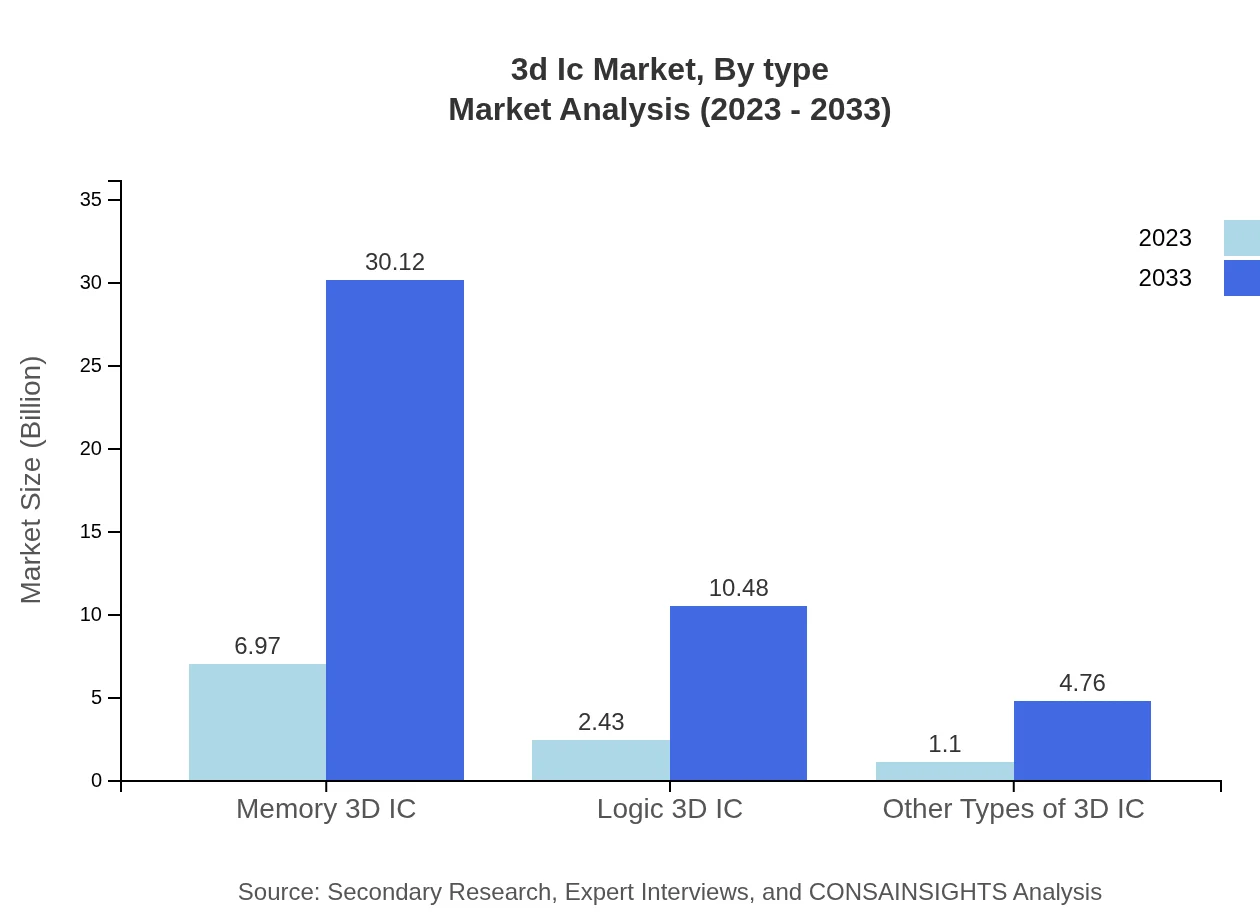

3d Ic Market Analysis By Type

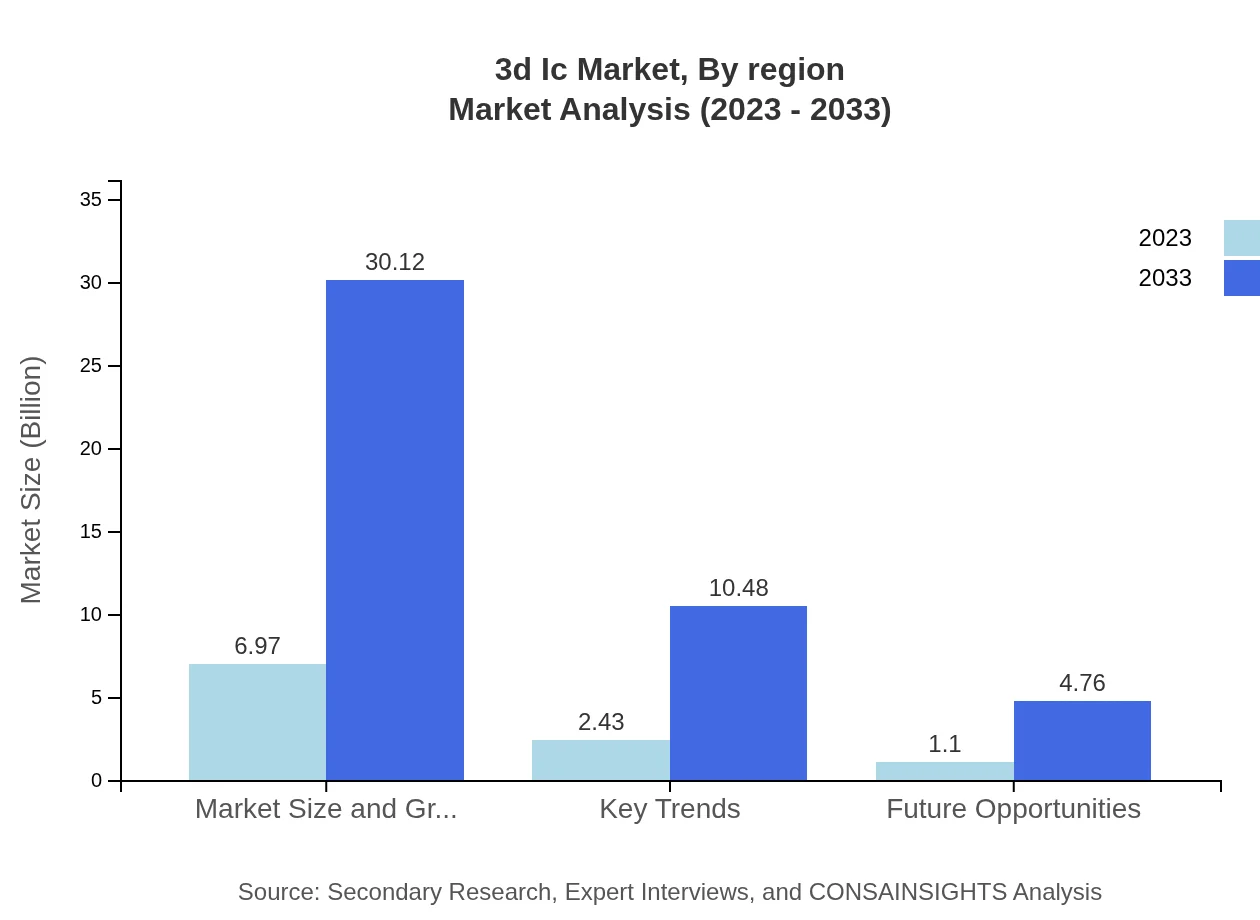

The Memory 3D IC segment leads the market, with a size of $6.97 billion in 2023 and expected to expand to $30.12 billion by 2033, maintaining a market share of 66.4%. The Logic 3D IC segment, valued at $2.43 billion in 2023, is anticipated to grow to $10.48 billion, contributing 23.11% to the market share. Other types represent a smaller but growing segment, sized at $1.10 billion in 2023 and expected to reach $4.76 billion.

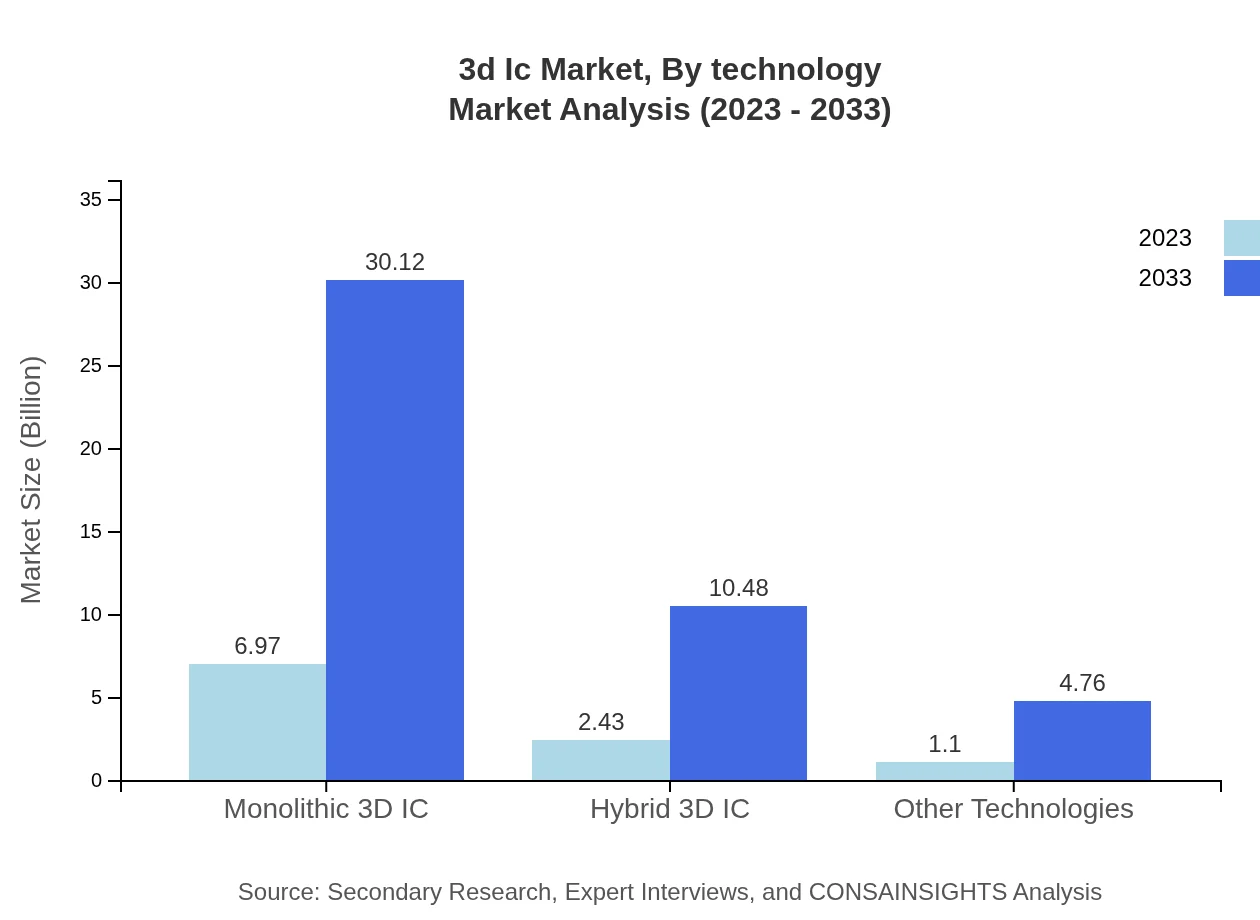

3d Ic Market Analysis By Technology

Monolithic 3D IC technology dominates with a market size of $6.97 billion in 2023, projected to grow to $30.12 billion, keeping a constant share of 66.4%. Hybrid 3D IC technology is also growing, from $2.43 billion in 2023 to $10.48 billion by 2033, comprising 23.11% of the market.

3d Ic Market Analysis By Application

In 2023, consumer electronics accounted for the largest market share at $4.64 billion, projected to reach $20.04 billion by 2033. Automotive applications are expected to grow from $2.32 billion in 2023 to $10.04 billion. The healthcare sector is anticipated to expand from $1.37 billion to $5.91 billion. Telecommunications and data centers will also see growth, driving demand for 3D IC technologies.

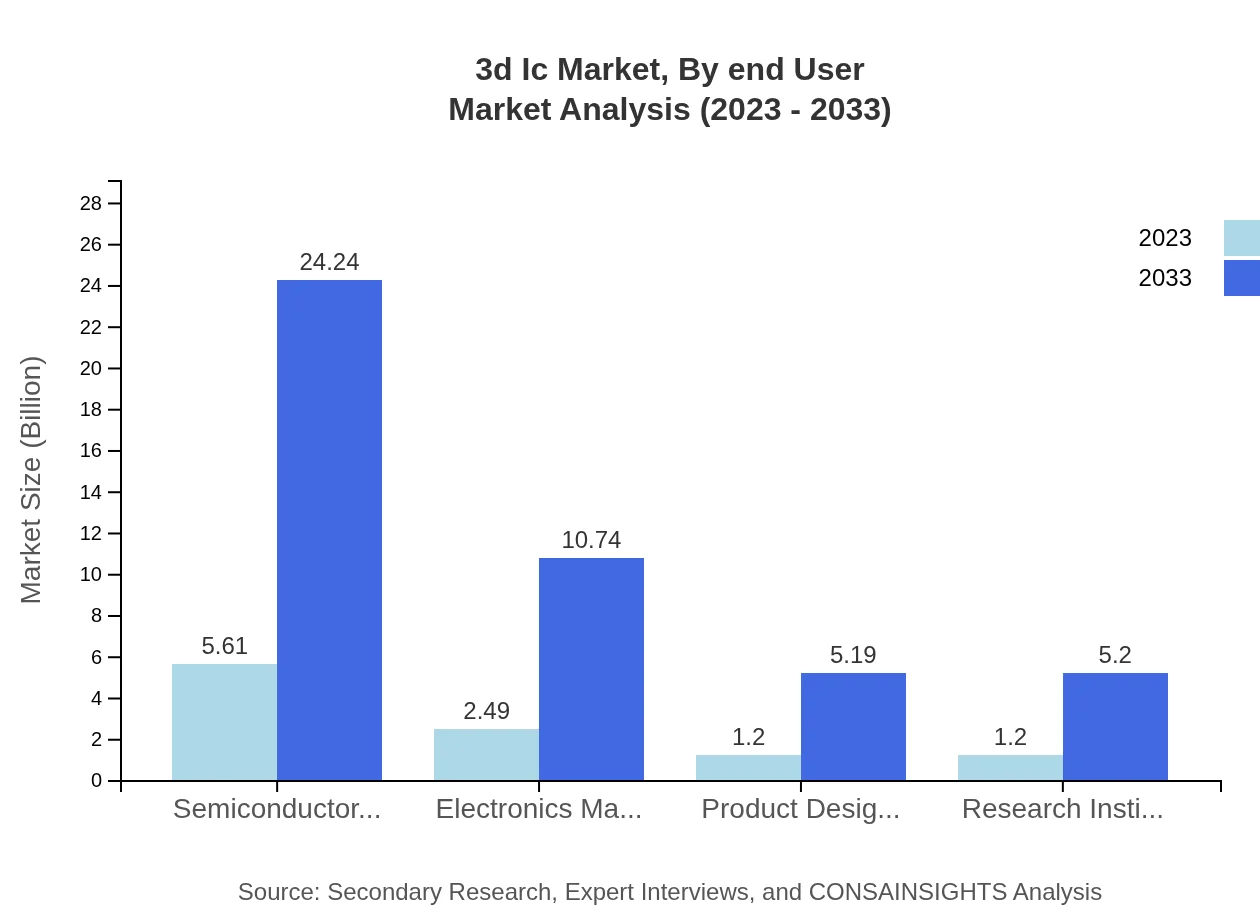

3d Ic Market Analysis By End User

The end-user analysis indicates strong demand from semiconductor manufacturers, who represented a market size of $5.61 billion in 2023, growing to $24.24 billion in 2033. Electronics manufacturers, valued at $2.49 billion in 2023, are projected to grow to $10.74 billion. Product design firms and research institutes are also crucial contributors to market growth.

3d Ic Market Analysis By Region

The overall trends show a robust growth outlook for the 3D IC market across all segments and regions, driven by competitive advancements in technology and increased demand across multiple applications. The regions show varying growth trajectories with Asia Pacific and North America exhibiting the most significant growth potential, followed by recovery strategies in Europe and emerging markets in South America.

3D IC Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in 3D IC Industry

TSMC:

Taiwan Semiconductor Manufacturing Company is a leading global semiconductor foundry that specializes in advanced chip fabrication and 3D IC technologies.Intel Corporation:

Intel is a key player in the semiconductor industry, focusing on innovative 3D packaging solutions to enhance device performance.Samsung Electronics:

Samsung is a prominent manufacturer of memory ICs and is heavily investing in 3D NAND flash memory technologies.Qualcomm :

Qualcomm is a technology leader in wireless communication, playing a key role in the development of 3D IC applications for mobile devices.We're grateful to work with incredible clients.

FAQs

What is the market size of 3D-IC?

The 3D-IC market is projected to reach approximately $10.5 billion by 2033, growing at a remarkable CAGR of 15%. This growth reflects the increasing demand for advanced packaging technologies in various electronic applications.

What are the key market players or companies in the 3D-IC industry?

Key players in the 3D-IC industry include major semiconductor manufacturers like Intel, Samsung, and TSMC. These companies are at the forefront of 3D integration technologies, leading innovations, and contributing significantly to market dynamics.

What are the primary factors driving the growth in the 3D-IC industry?

The growth in the 3D-IC industry is driven by increasing demand for miniaturization in electronics, higher functional density, and energy efficiency. Additionally, the rise of AI, cloud computing, and IoT applications is further propelling market expansion.

Which region is the fastest Growing in the 3D-IC market?

The North America region is the fastest-growing area in the 3D-IC market, projected to expand from $3.85 billion in 2023 to $16.64 billion by 2033. This growth is fueled by strong investments in advanced technologies and infrastructure.

Does ConsaInsights provide customized market report data for the 3D-IC industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the 3D-IC industry. This includes detailed analysis and insights that can address targeted business questions and market dynamics.

What deliverables can I expect from this 3D-IC market research project?

From the 3D-IC market research project, clients can expect comprehensive reports including market size, growth forecasts, competitive analysis, and regional insights, accompanied by strategic recommendations and actionable insights for informed decision-making.

What are the market trends of 3D-IC?

Current trends in the 3D-IC market include advancements in memory integration, the rise of hybrid technologies, and increased demand from sectors like consumer electronics and automotive, indicating a significant evolution in semiconductor packaging solutions.