3d Tsv And-2-5d Market Report

Published Date: 31 January 2026 | Report Code: 3d-tsv-and-2-5d

3d Tsv And-2-5d Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the 3D TSV and 2.5D market, covering detailed insights, current trends, and future forecasts from 2023 to 2033. It focuses on market size, regional analysis, technological advancements, and key players in the industry.

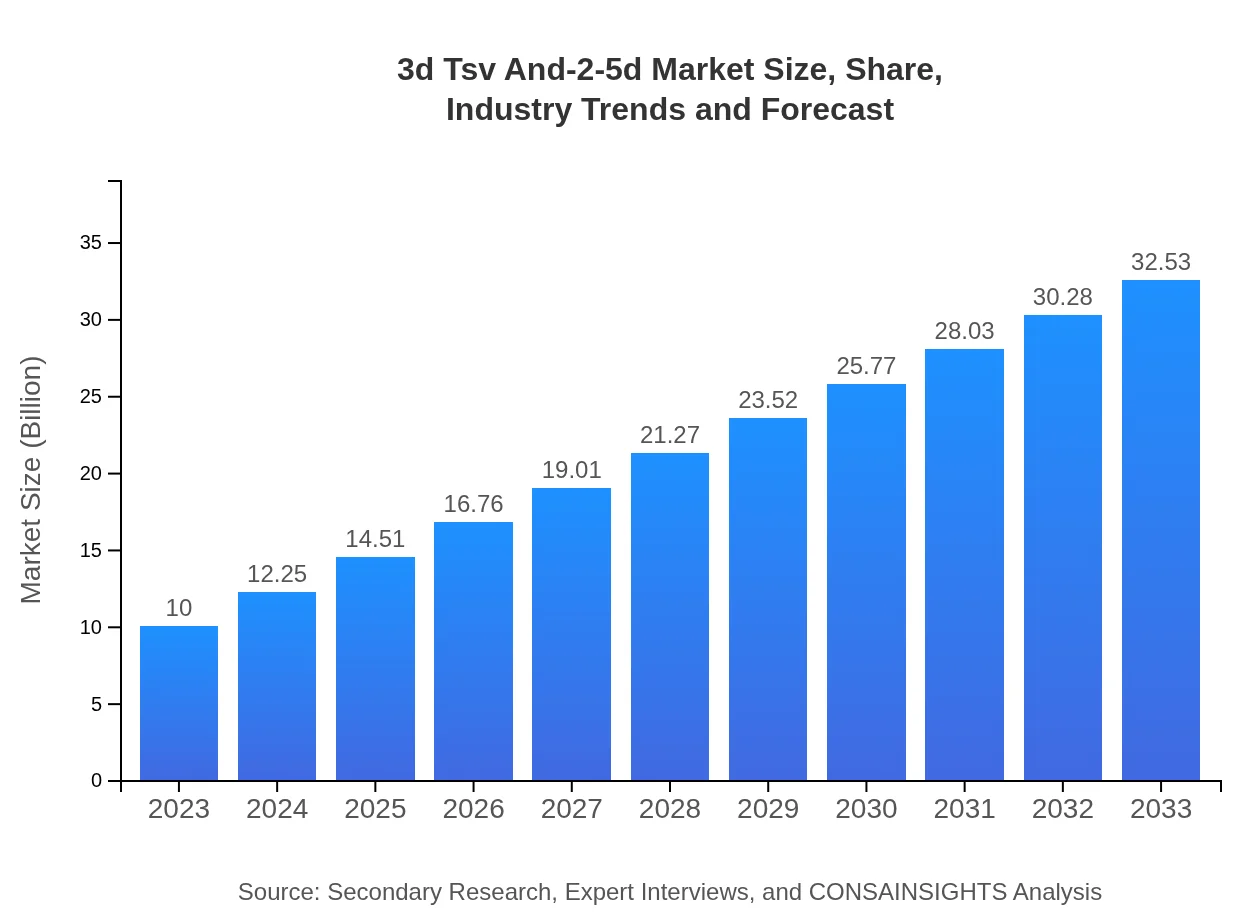

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $32.53 Billion |

| Top Companies | TSMC, Intel Corporation, Samsung Electronics, Micron Technology, Qualcomm |

| Last Modified Date | 31 January 2026 |

3d Tsv And-2-5d Market Overview

Customize 3d Tsv And-2-5d Market Report market research report

- ✔ Get in-depth analysis of 3d Tsv And-2-5d market size, growth, and forecasts.

- ✔ Understand 3d Tsv And-2-5d's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in 3d Tsv And-2-5d

What is the Market Size & CAGR of 3d Tsv And-2-5d market in 2023?

3d Tsv And-2-5d Industry Analysis

3d Tsv And-2-5d Market Segmentation and Scope

Tell us your focus area and get a customized research report.

3d Tsv And-2-5d Market Analysis Report by Region

Europe 3d Tsv And-2-5d Market Report:

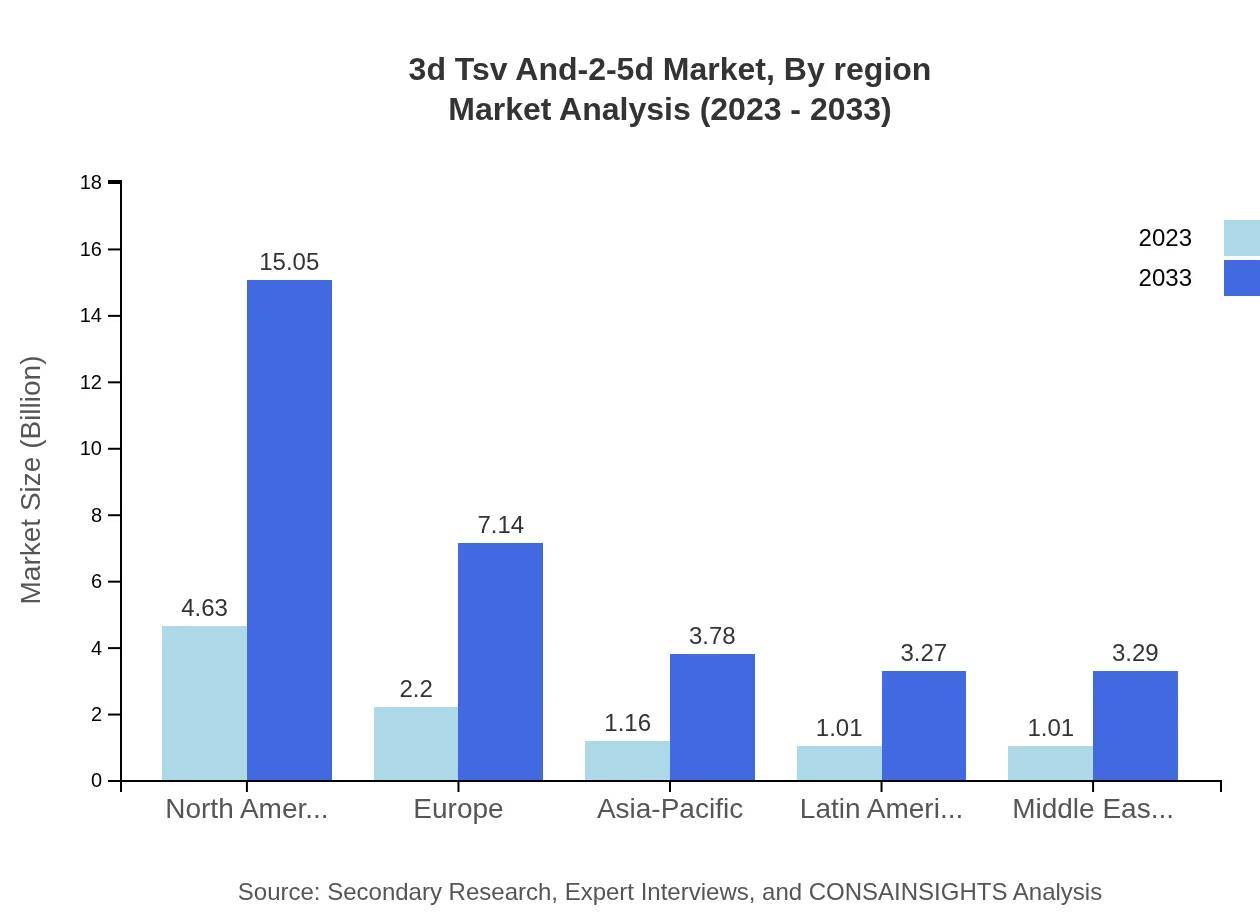

In Europe, the market was valued at $3.21 billion in 2023, with forecasts suggesting growth to $10.44 billion by 2033. Increased adoption of advanced semiconductor technologies in industries such as automotive and healthcare is fueling this growth.Asia Pacific 3d Tsv And-2-5d Market Report:

In the Asia-Pacific region, the market was valued at $1.63 billion in 2023, expected to reach $5.32 billion by 2033. The growth is driven by increasing demand in consumer electronics and automotive applications, with countries like China and Japan leading in semiconductor manufacturing.North America 3d Tsv And-2-5d Market Report:

North America dominated the market with an estimated value of $3.79 billion in 2023, projected to reach $12.33 billion by 2033. The presence of major OEMs and a strong focus on technological innovation in the U.S. are key growth drivers.South America 3d Tsv And-2-5d Market Report:

The South American market is projected to grow from $0.81 billion in 2023 to $2.64 billion by 2033. This growth reflects a higher investment in electronics and increased demand for advanced technology solutions within key industries.Middle East & Africa 3d Tsv And-2-5d Market Report:

The market in the Middle East and Africa is expected to expand from $0.56 billion in 2023 to $1.81 billion by 2033, driven by improvements in electronic infrastructure and rising demand for smart technologies.Tell us your focus area and get a customized research report.

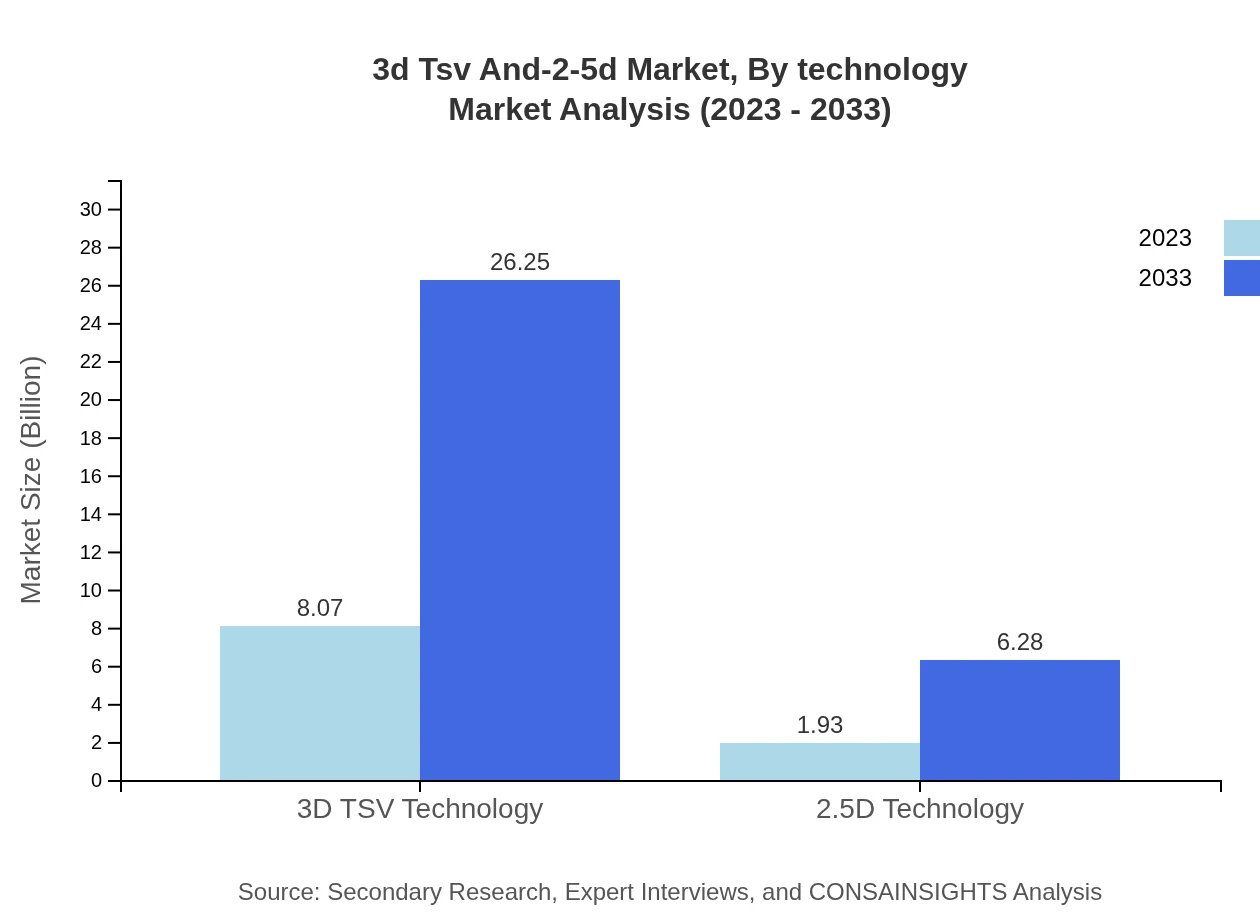

3d Tsv And-2-5d Market Analysis By Technology

The market is primarily driven by two technologies: 3D TSV which focuses on stacking multiple dice vertically, and 2.5D, which integrates chips side-by-side on an interposer. The 3D TSV technology is projected to hold about 80.7% market share in both 2023 and 2033 due to its benefits in reducing latency and enhancing performance. In contrast, 2.5D packaging is gaining traction for its cost-effectiveness, projected to grow significantly as design complexity increases.

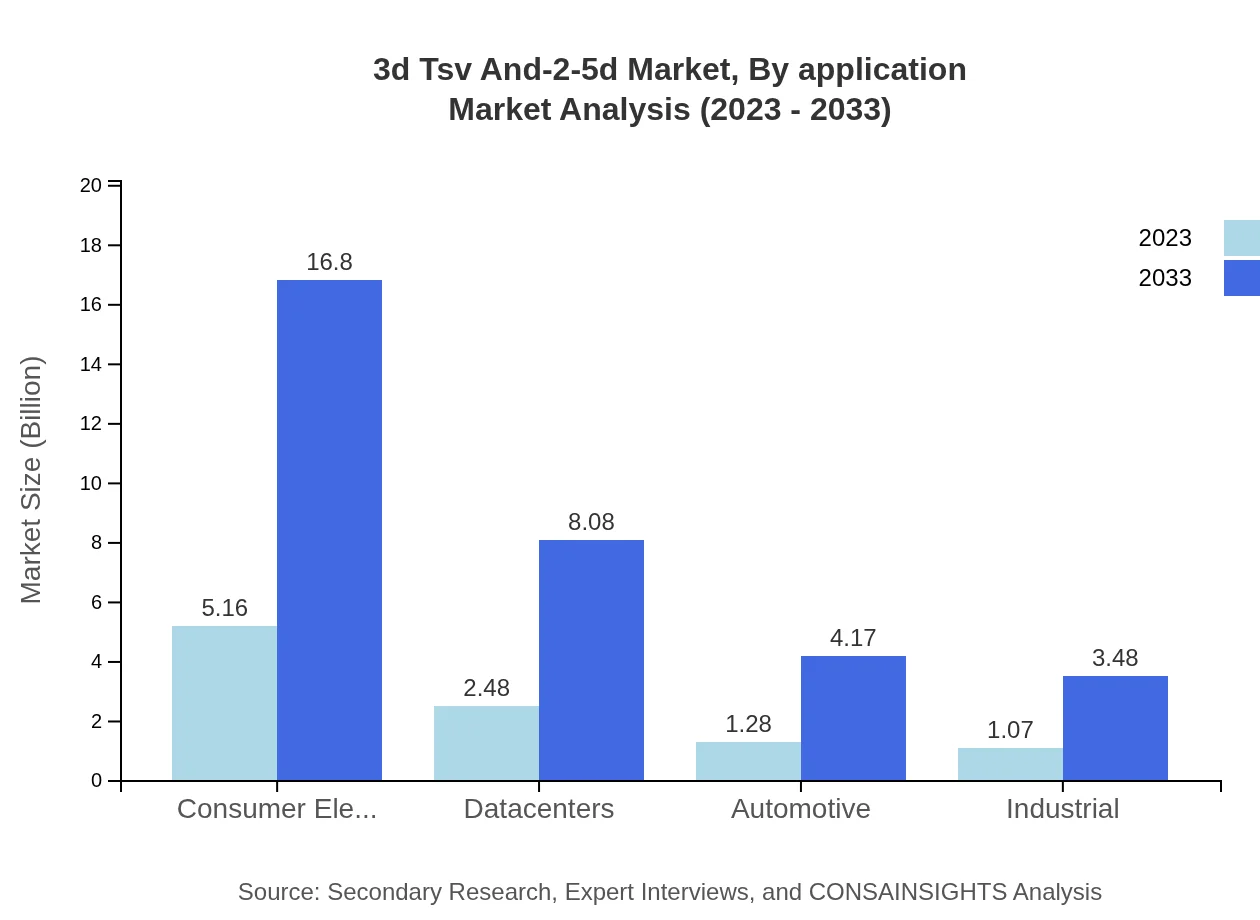

3d Tsv And-2-5d Market Analysis By Application

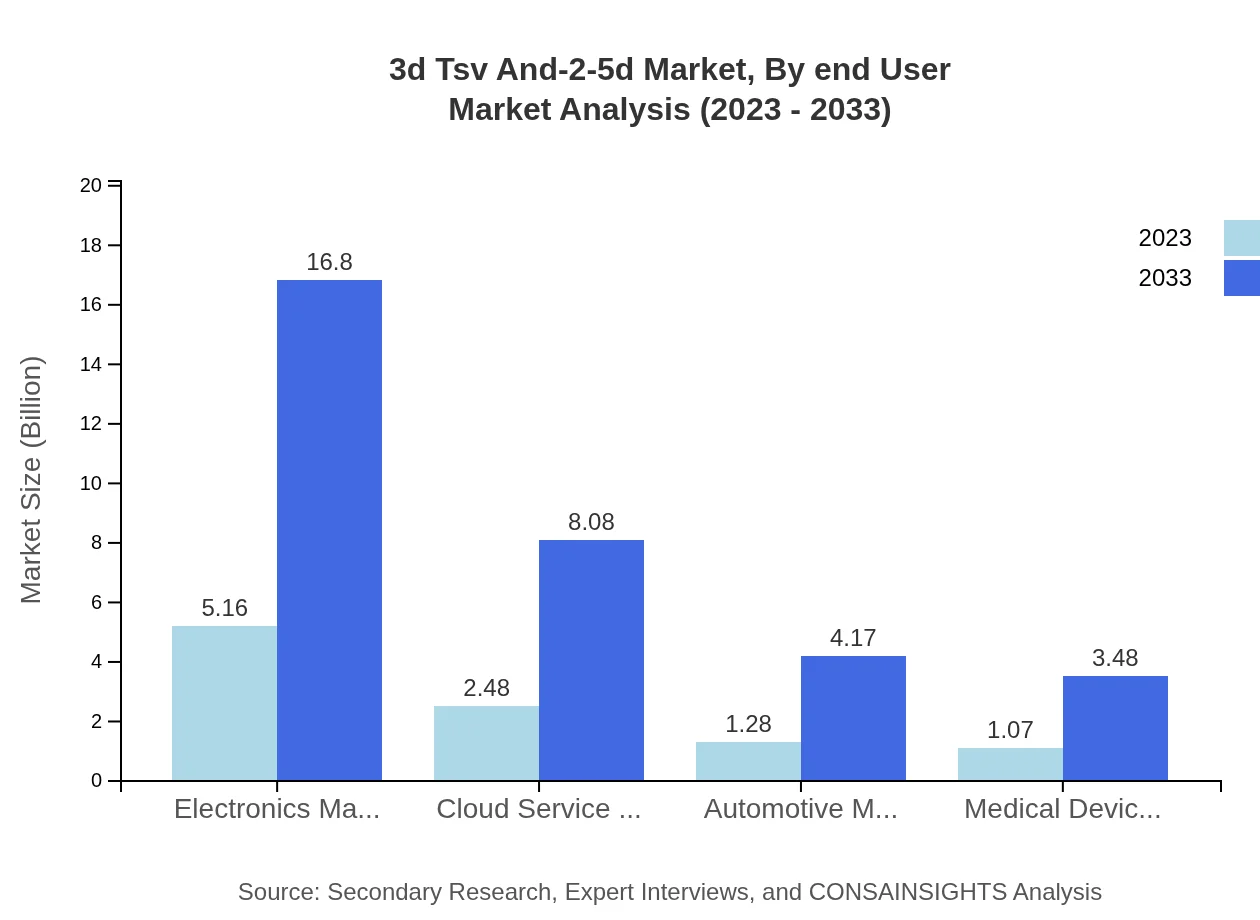

Applications span consumer electronics, datacenters, automotive, and industrial sectors. Consumer electronics command a significant share, with a valuation expected to grow from $5.16 billion in 2023 to $16.80 billion by 2033, reflecting the increasing drive for high-performance devices. Datacenters will also expand significantly due to the demand for faster data processing capabilities.

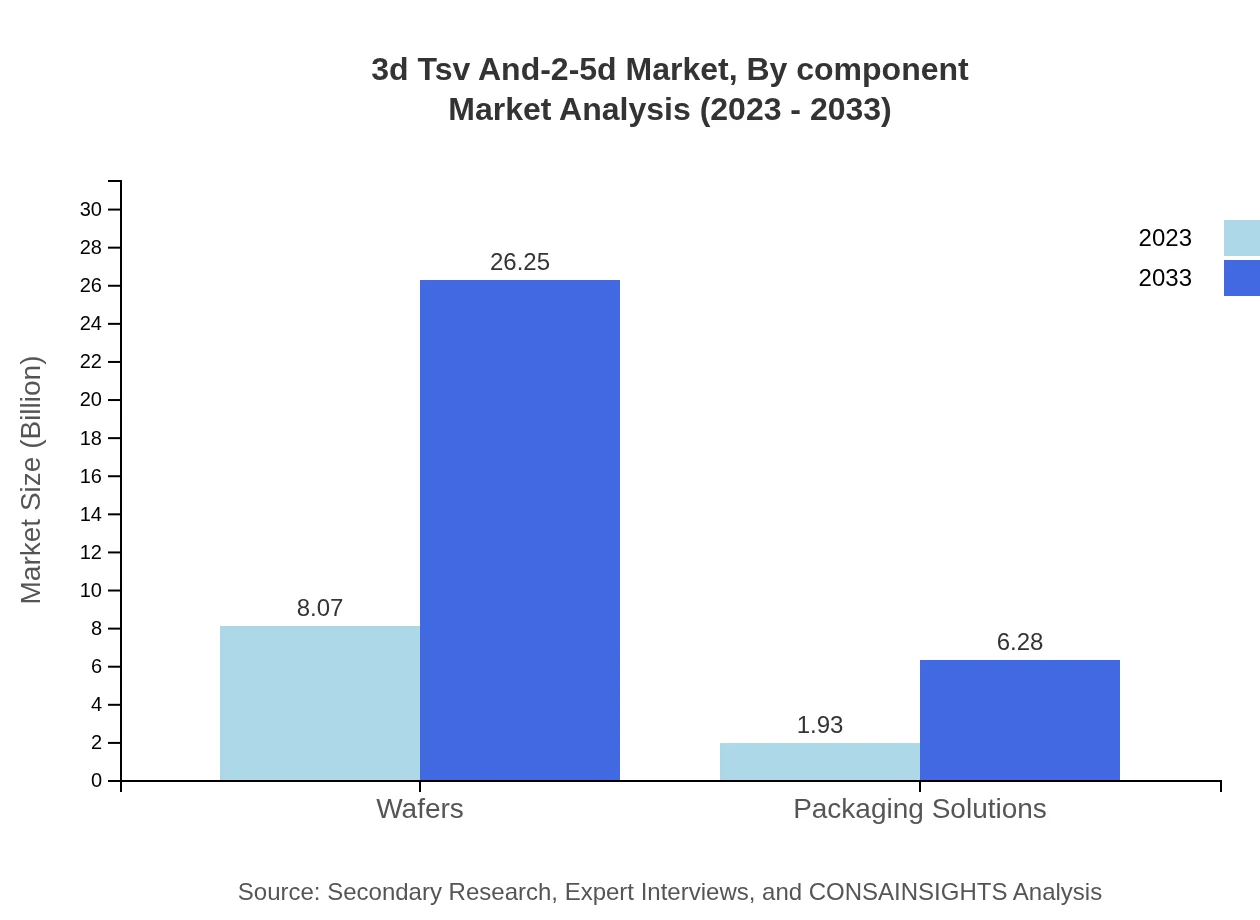

3d Tsv And-2-5d Market Analysis By Component

The components include wafers, packaging solutions, and support infrastructure. Wafers are the dominant segment, making up approximately 80.7% of the market in both 2023 and 2033 due to their essential role in chip fabrication and reliance on cutting-edge manufacturing technologies.

3d Tsv And-2-5d Market Analysis By End User

The end-user industries are diverse, featuring electronics manufacturers, automotive manufacturers, medical device manufacturers, and cloud service providers. Electronics manufacturers hold the largest portion of the market at 51.64%, driven by the need for advanced consumer electronics and computing devices.

3d Tsv And-2-5d Market Analysis By Region

The regional market dynamics are critical, indicating lucrative opportunities in Asia-Pacific and North America, reflecting the robust demand for technology in electronics and automotive sectors driven by large-scale manufacturers.

3d Tsv And-2-5d Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in 3d Tsv And-2-5d Industry

TSMC:

Taiwan Semiconductor Manufacturing Company is the world's largest semiconductor foundry, leading in 3D TSV technology innovations.Intel Corporation:

Intel is a key player in semiconductor technology and packaging solutions, pushing advancements in 3D packaging technologies.Samsung Electronics:

A leader in consumer electronics and semiconductor development, Samsung is pioneering the integration of TSV technology for improved performance.Micron Technology:

Micron specializes in memory and storage solutions, heavily leveraging TSV technologies for advancing data processing capabilities.Qualcomm :

Qualcomm drives innovation in mobile technologies and is also focusing on enhancements in 3D and 2.5D TSV packaging.We're grateful to work with incredible clients.

FAQs

What is the market size of 3D TSV and 2.5D?

The market size for the 3D TSV and 2.5D industry is projected to grow significantly. In 2023, the market is valued at approximately $10 billion, with an anticipated compound annual growth rate (CAGR) of 12%, reaching an estimated market size by 2033.

What are the key market players or companies in the 3D TSV and 2.5D industry?

Key players in the 3D TSV and 2.5D industry include leading electronics manufacturers, cloud service providers, and automotive manufacturers, highlighting the diverse application across sectors such as consumer electronics, industrial products, and medical devices. Their innovations drive market dynamics.

What are the primary factors driving the growth in the 3D TSV and 2.5D industry?

The growth of the 3D TSV and 2.5D industry is driven by increasing demand for advanced electronics, miniaturization of components, and need for higher performance in consumer devices. These trends fuel investment and innovation in related technologies.

Which region is the fastest Growing in the 3D TSV and 2.5D?

The fastest-growing region in the 3D TSV and 2.5D market is North America, expecting to rise from $3.79 billion in 2023 to $12.33 billion by 2033. Other notable regions include Europe and Asia-Pacific, reflecting robust tech adoption.

Does ConsaInsights provide customized market report data for the 3D TSV and 2.5D industry?

Yes, ConsaInsights offers customized market report data tailored to the 3D TSV and 2.5D industry. Clients can expect insights specific to market trends, regional analyses, and competitive landscapes, fulfilling diverse informational needs.

What deliverables can I expect from this 3D TSV and 2.5D market research project?

Upon completion of the 3D TSV and 2.5D market research project, clients can expect comprehensive reports, data analysis, trend forecasts, and actionable insights presented in a structured format, providing a clear understanding of market dynamics across regions.

What are the market trends of 3D TSV and 2.5D?

Current market trends in the 3D TSV and 2.5D industry include a surge in adoption of advanced packaging technologies, rising investments in R&D, and an increasing shift towards high-performance computing solutions, indicating a strong future trajectory.