Acoustic Camera Market Report

Published Date: 01 February 2026 | Report Code: acoustic-camera

Acoustic Camera Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Acoustic Camera market from 2023 to 2033, covering market size, trends, segmentation, regional insights, and key players, offering valuable insights into the industry's future growth and direction.

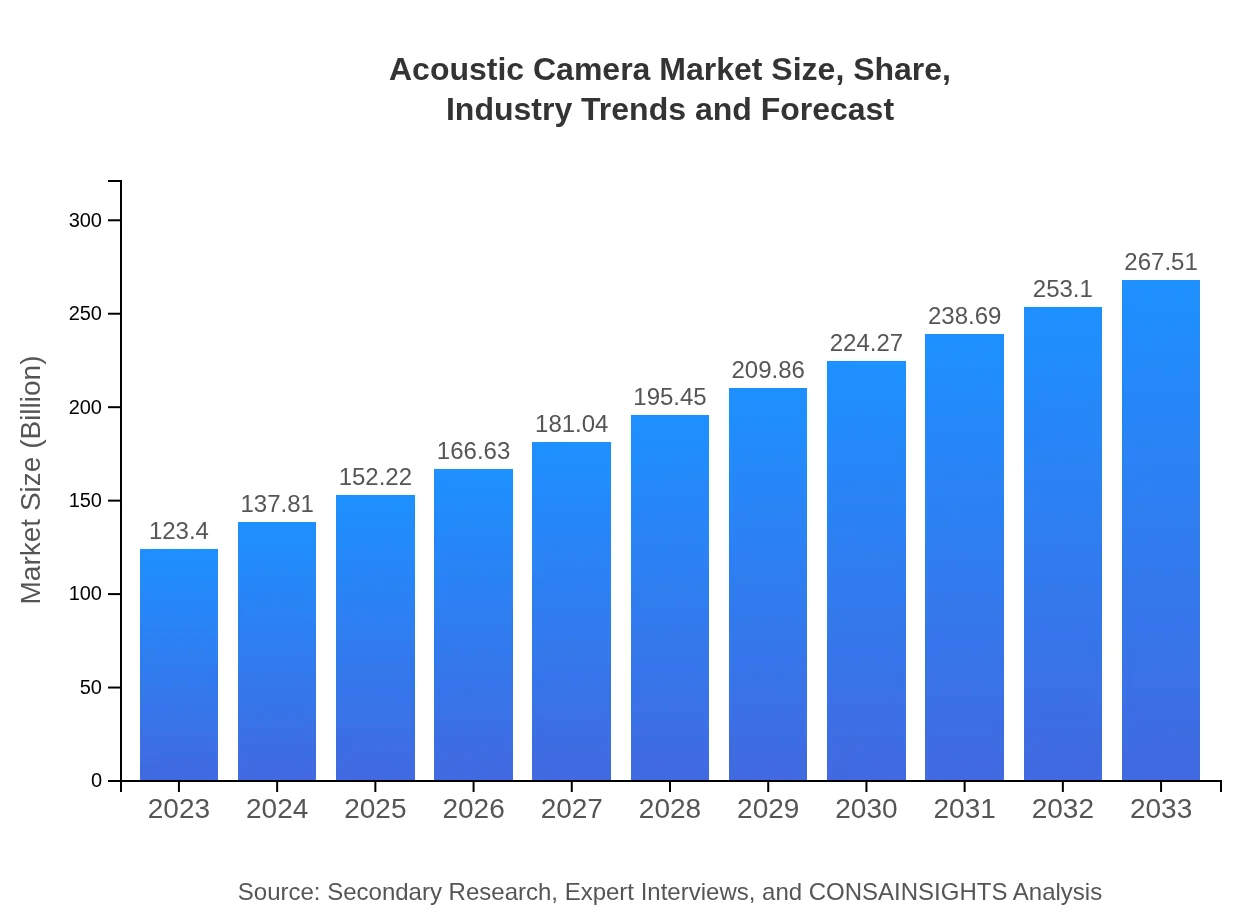

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $123.40 Million |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $267.51 Million |

| Top Companies | Bruel & Kjaer, Norsonic, FLIR Systems, Metris, Sonoscan |

| Last Modified Date | 01 February 2026 |

Acoustic Camera Market Overview

Customize Acoustic Camera Market Report market research report

- ✔ Get in-depth analysis of Acoustic Camera market size, growth, and forecasts.

- ✔ Understand Acoustic Camera's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Acoustic Camera

What is the Market Size & CAGR of Acoustic Camera market in 2033?

Acoustic Camera Industry Analysis

Acoustic Camera Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Acoustic Camera Market Analysis Report by Region

Europe Acoustic Camera Market Report:

Europe's market size will increase from USD 29.95 million in 2023 to USD 64.92 million by 2033, driven by stringent environmental regulations and a focus on sustainable urban development.Asia Pacific Acoustic Camera Market Report:

The Asia Pacific region exhibits considerable growth potential, with a market size projected to grow from USD 25.63 million in 2023 to USD 55.56 million by 2033. Increasing investments in industrial automation and noise pollution control measures drive this growth.North America Acoustic Camera Market Report:

North America holds a significant share of the Acoustic Camera market, with forecasts indicating growth from USD 45.53 million in 2023 to USD 98.71 million in 2033. Strong regulatory measures related to noise management in industries bolster market expansion.South America Acoustic Camera Market Report:

In South America, the market is predicted to expand from USD 11.49 million in 2023 to USD 24.90 million by 2033. Growth factors include rising construction activities and increasing awareness regarding building acoustics.Middle East & Africa Acoustic Camera Market Report:

The market in the Middle East and Africa is expected to grow from USD 10.80 million in 2023 to USD 23.41 million by 2033, as various countries invest in infrastructure and environmental compliance.Tell us your focus area and get a customized research report.

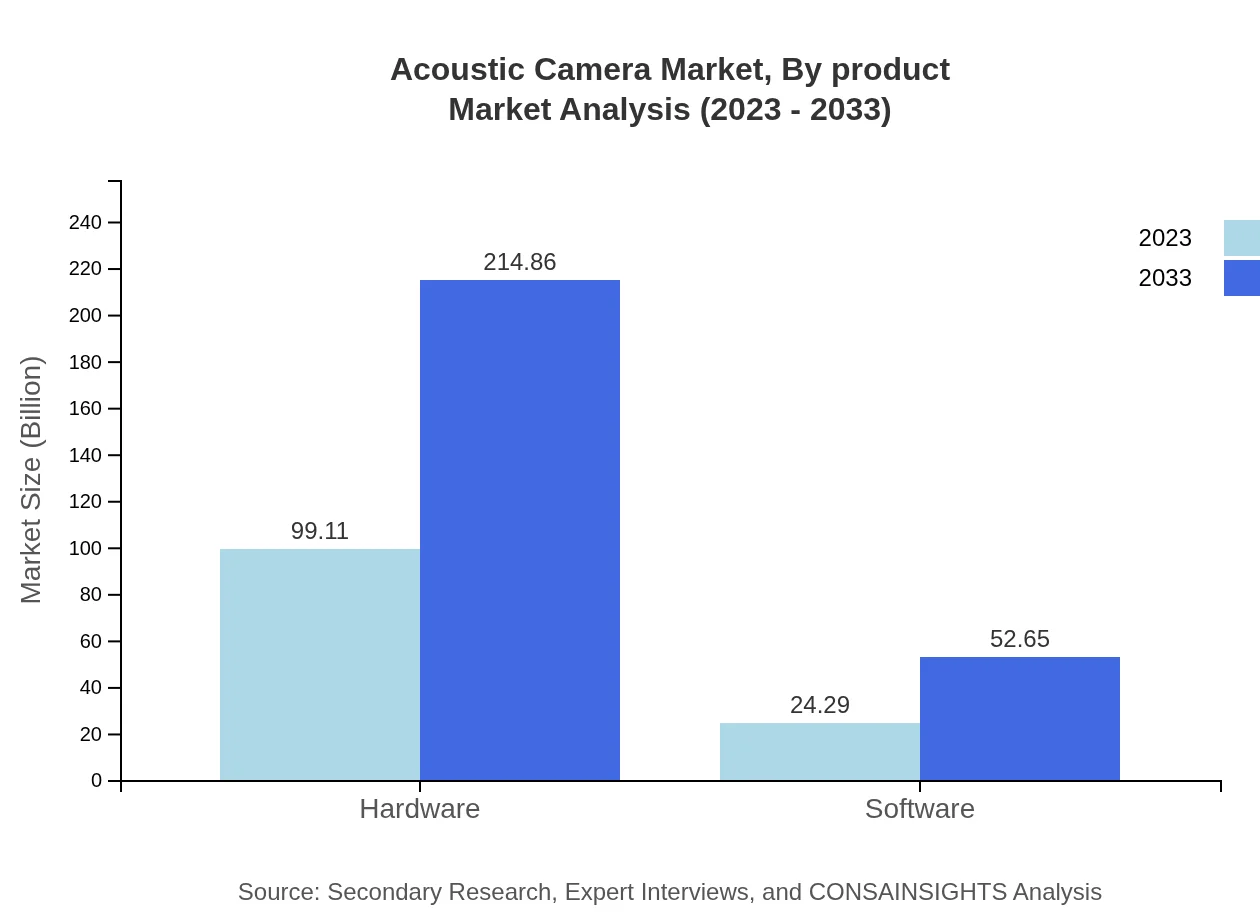

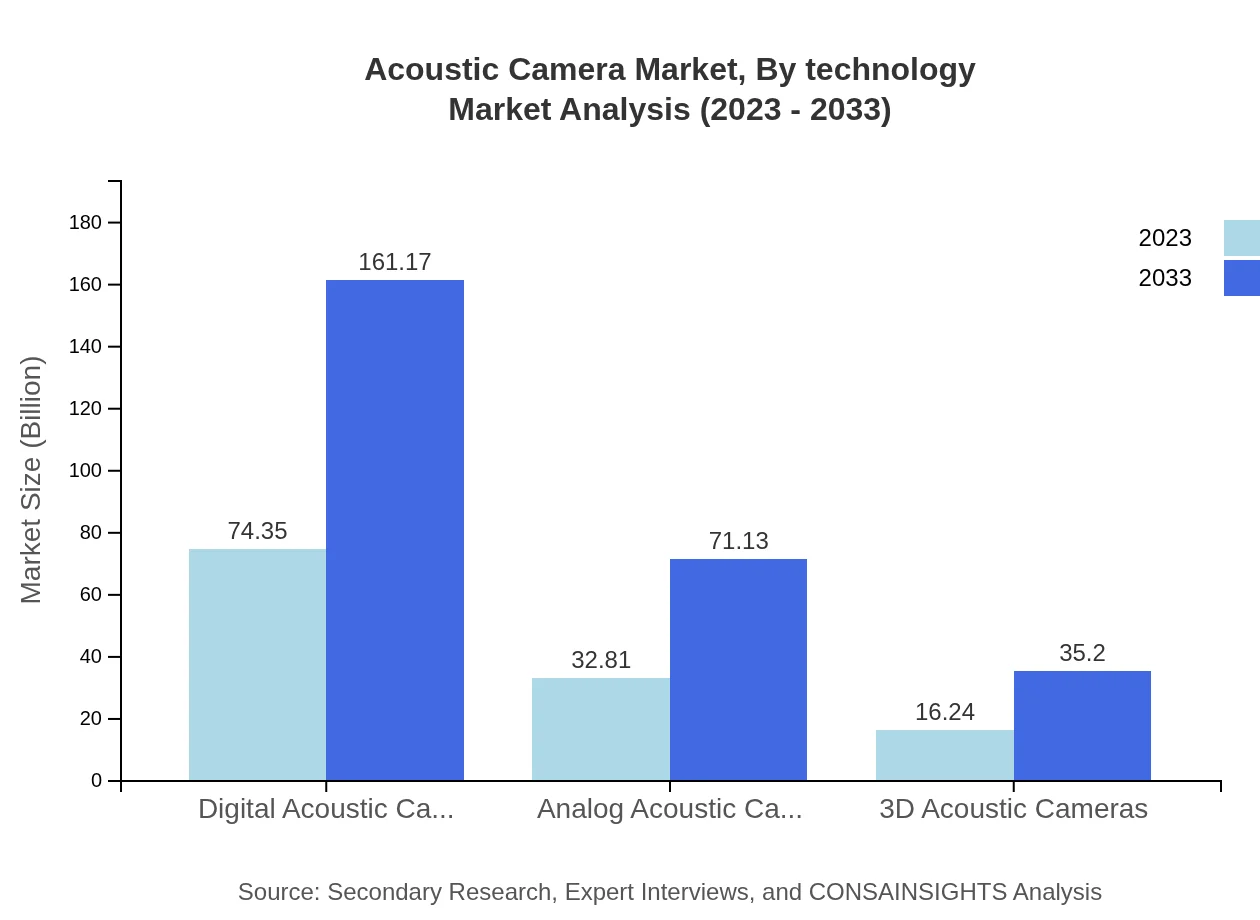

Acoustic Camera Market Analysis By Product

The product segment demonstrates significant diversity, with Digital Acoustic Cameras leading the market size, growing from USD 74.35 million in 2023 to USD 161.17 million by 2033. Analog and 3D Acoustic Cameras follow, adapting to niche applications in various industries.

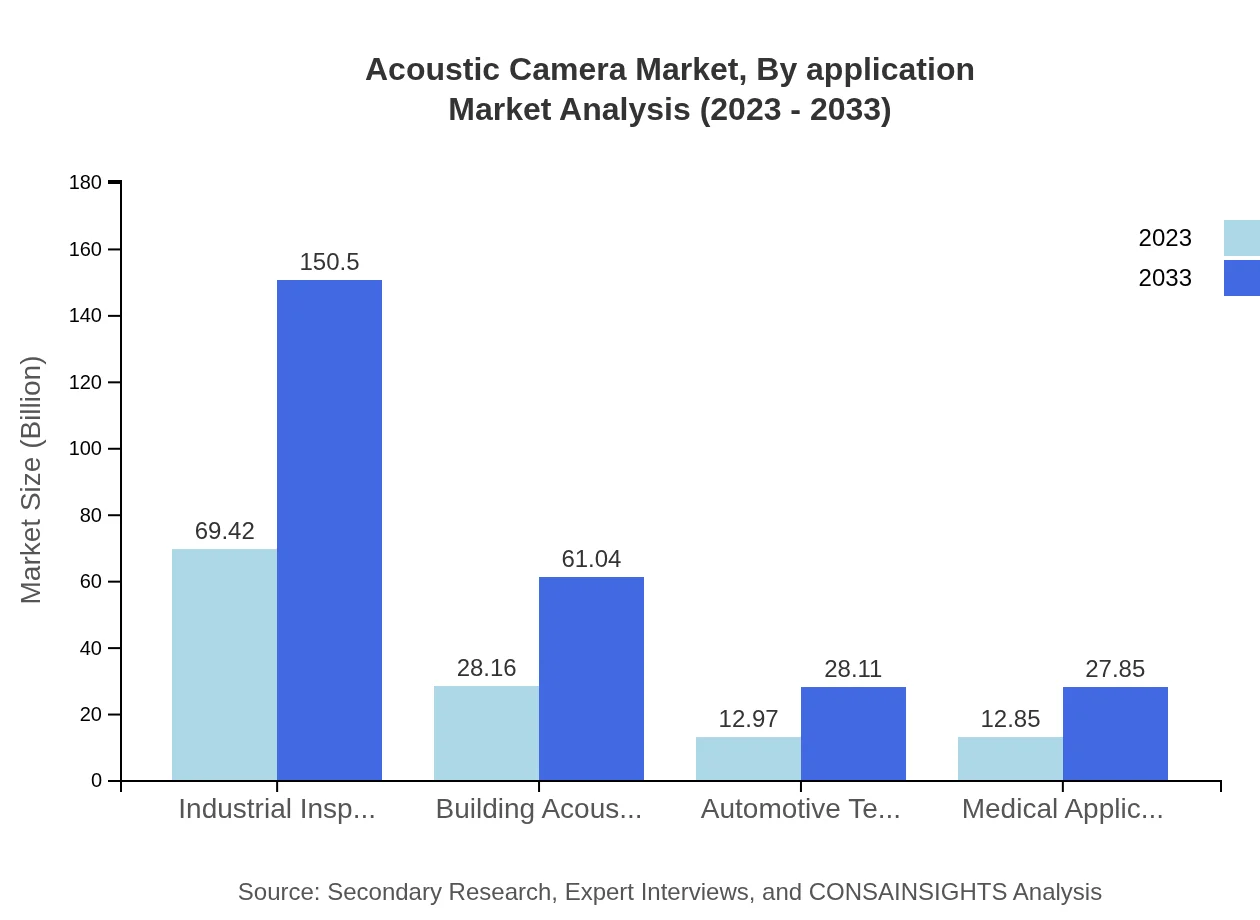

Acoustic Camera Market Analysis By Application

Applications within the Acoustic Camera market include Industrial Inspection, Healthcare, and Construction. Industrial Inspection is the largest contributor, projected to reach USD 150.50 million by 2033, thanks to the growing need for quality assurance in manufacturing processes.

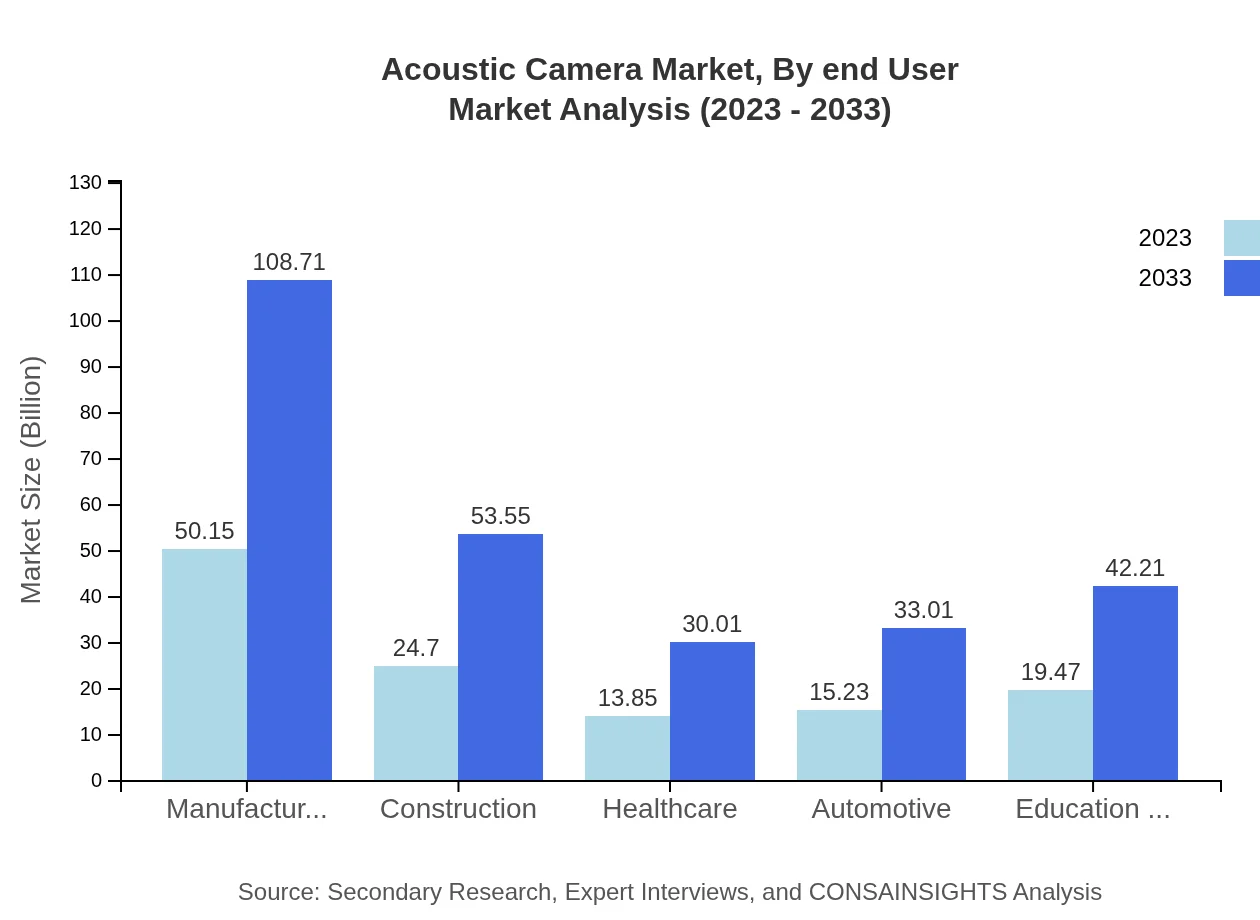

Acoustic Camera Market Analysis By End User

The end-user industry segmentation comprises healthcare, education, manufacturing, and automotive sectors. The healthcare segment is witnessing increased adoption for diagnostics and monitoring, while the automotive sector is focusing on acoustic testing during vehicle development to enhance noise comfort.

Acoustic Camera Market Analysis By Technology

Technologically, advancements in sensor technology and data analytics are prominent. Enhanced capabilities in sound visualization and measurement improve user experience and provide actionable insights for diverse applications.

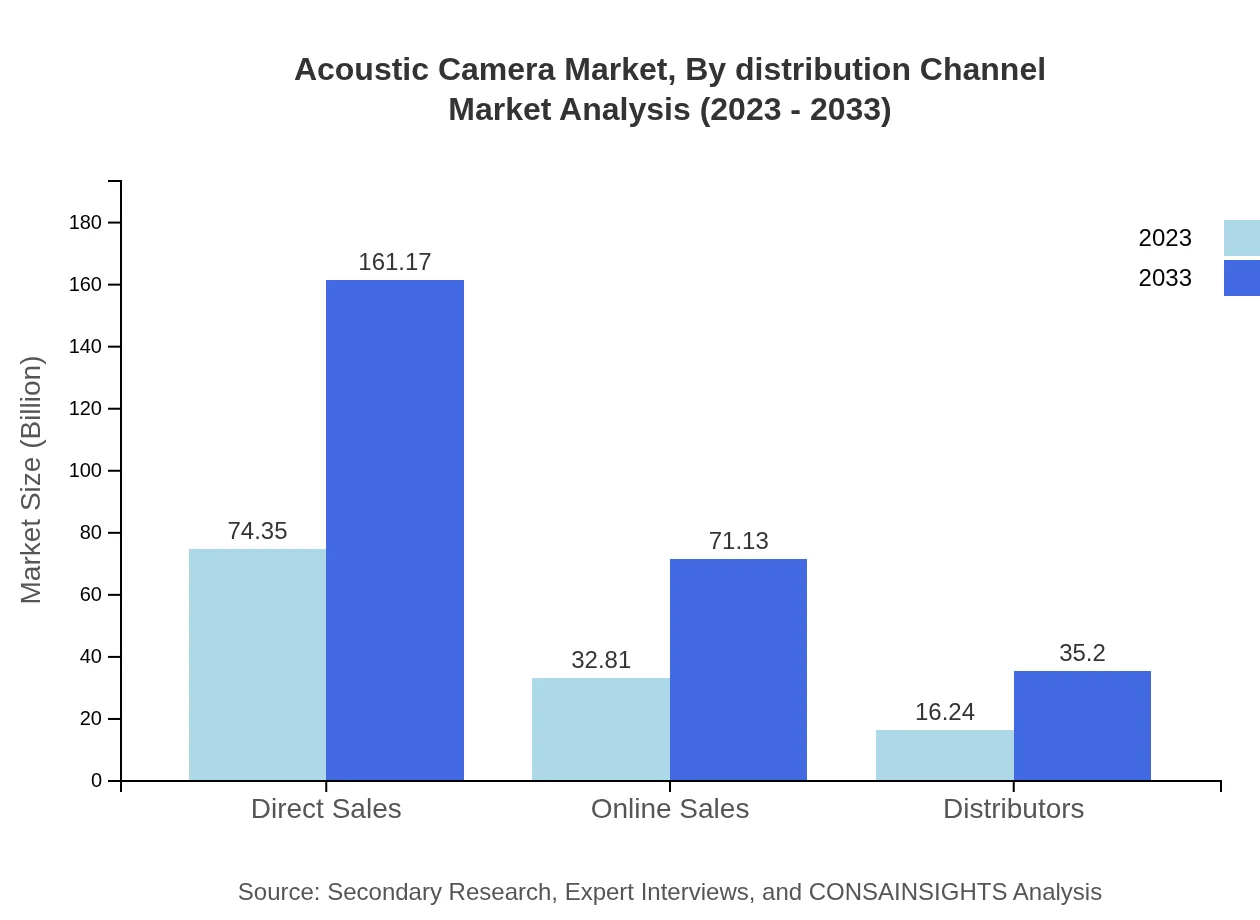

Acoustic Camera Market Analysis By Distribution Channel

Distribution channels focus on Direct Sales, Online Sales, and Distributors. Direct Sales dominate the market, expected to grow from USD 74.35 million in 2023 to USD 161.17 million by 2033, owing to direct customer engagement strategies by manufacturers.

Acoustic Camera Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Acoustic Camera Industry

Bruel & Kjaer:

A leading provider of acoustic measurement solutions, Bruel & Kjaer specializes in noise and vibration measurement systems, offering widely used acoustic cameras for various applications.Norsonic:

Norsonic is known for its innovative sound and vibration measurement instruments and has a strong presence in the environmental noise measurement segment.FLIR Systems:

FLIR Systems is a prominent player in infrared imaging and diagnostics, leveraging its expertise to develop acoustic cameras offering unique features for industrial applications.Metris:

Metris specializes in acoustic measurement systems, providing advanced solutions for industrial inspections and environmental assessments.Sonoscan:

Sonoscan focuses on non-destructive testing and has developed a range of acoustic imaging equipment suitable for various industries.We're grateful to work with incredible clients.

FAQs

What is the market size of acoustic Camera?

The acoustic camera market is valued at approximately $123.4 million in 2023, with a projected growth rate (CAGR) of 7.8% over the next decade, reflecting a robust demand in various sectors.

What are the key market players or companies in the acoustic Camera industry?

Leading players in the acoustic camera market include brands like Brüel & Kjær, Fluke Corp, and Norsonic. These companies drive innovation and technological advances in sound visualization and noise measurement.

What are the primary factors driving the growth in the acoustic Camera industry?

The growth of the acoustic camera industry is primarily driven by increasing demand in industrial inspections, building acoustics, and automotive testing, alongside advancements in digital technologies and software integration for enhanced analysis.

Which region is the fastest Growing in the acoustic Camera?

In the acoustic camera market, North America is the fastest-growing region, expected to rise from $45.53 million in 2023 to $98.71 million in 2033, driven by high adoption rates across various industries.

Does ConsaInsights provide customized market report data for the acoustic Camera industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the acoustic camera industry, ensuring clients receive relevant insights to make informed decisions.

What deliverables can I expect from this acoustic Camera market research project?

Expect detailed reports including market size, segment analysis, competitive landscape, growth forecast, and regional insights, alongside infographics and presentations summarizing key findings for better comprehension.

What are the market trends of acoustic Camera?

Current trends in the acoustic camera market involve increased automation, a shift towards digital acoustic cameras, and a growing emphasis on sustainable practices in industries, providing opportunities for technological advancements.