Aerospace And Defense Elastomers Market Report

Published Date: 02 February 2026 | Report Code: aerospace-and-defense-elastomers

Aerospace And Defense Elastomers Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Aerospace and Defense Elastomers market from 2023 to 2033, including key insights on market size, trends, forecasts, and challenges faced by the industry.

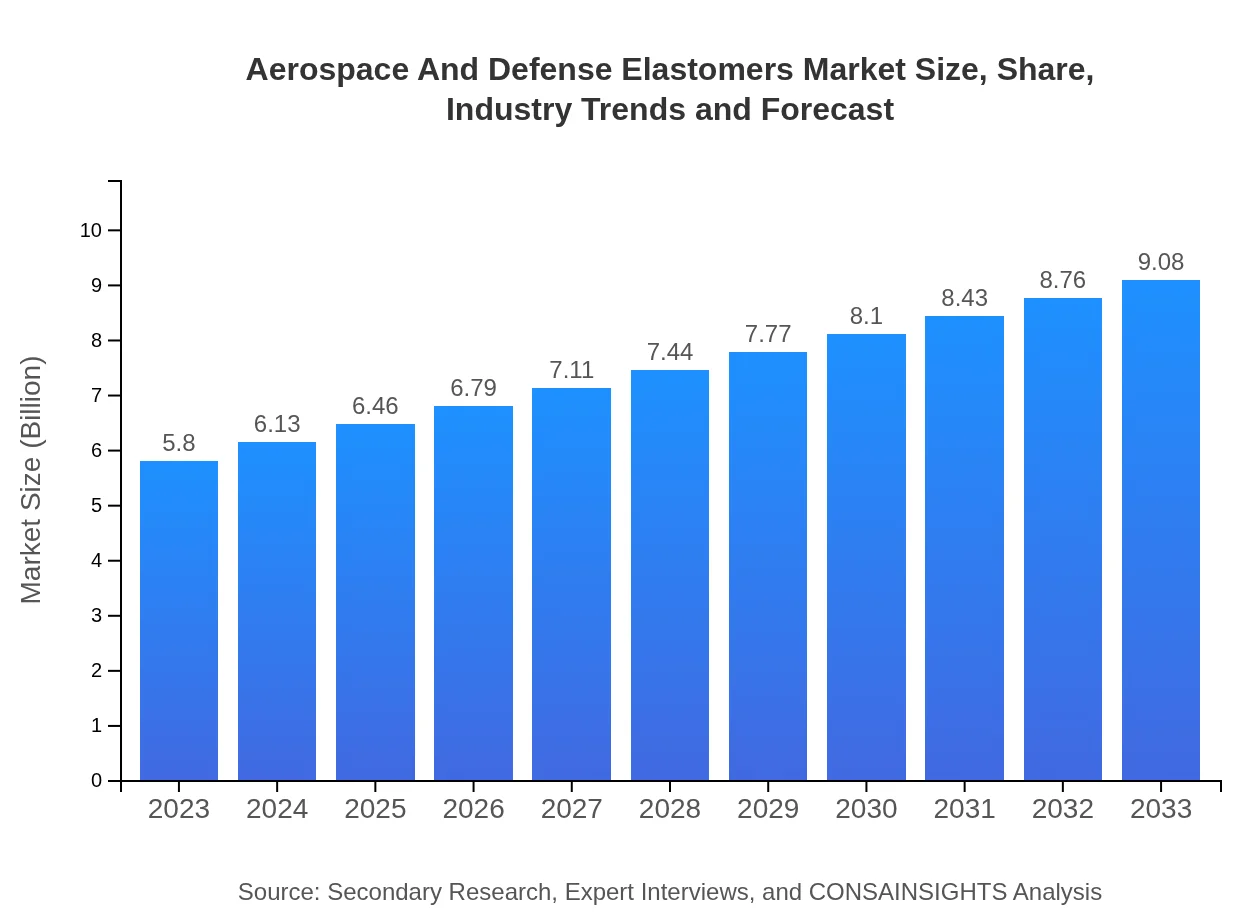

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $9.08 Billion |

| Top Companies | The Dow Chemical Company, DuPont de Nemours, Inc., Huntsman Corporation, BASF SE |

| Last Modified Date | 02 February 2026 |

Aerospace And Defense Elastomers Market Overview

Customize Aerospace And Defense Elastomers Market Report market research report

- ✔ Get in-depth analysis of Aerospace And Defense Elastomers market size, growth, and forecasts.

- ✔ Understand Aerospace And Defense Elastomers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aerospace And Defense Elastomers

What is the Market Size & CAGR of Aerospace And Defense Elastomers market in 2023?

Aerospace And Defense Elastomers Industry Analysis

Aerospace And Defense Elastomers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aerospace And Defense Elastomers Market Analysis Report by Region

Europe Aerospace And Defense Elastomers Market Report:

Europe accounted for a market value of USD 1.91 billion in 2023, projected to grow to USD 2.99 billion by 2033. The region's aerospace industry remains robust, driven by established manufacturers and a shift toward sustainable practices.Asia Pacific Aerospace And Defense Elastomers Market Report:

In 2023, the Asia Pacific region held a market size of approximately USD 1.06 billion, projected to reach USD 1.66 billion by 2033. The growth in this region is fueled by increasing investments in the aerospace sector, particularly in countries like China and India, alongside burgeoning defense budgets attributed to regional security dynamics.North America Aerospace And Defense Elastomers Market Report:

North America ranked as the largest market with an estimated size of USD 2.00 billion in 2023, projected to grow to USD 3.14 billion by 2033. The region benefits from a strong aerospace industry, high defense expenditures, and continuous innovations in elastomer formulations.South America Aerospace And Defense Elastomers Market Report:

The South American market, valued at USD 0.23 billion in 2023, is expected to expand to USD 0.36 billion by 2033. Growth factors include rising demand for commercial aircraft and local military enhancements, despite economic challenges in the region.Middle East & Africa Aerospace And Defense Elastomers Market Report:

The Middle East and Africa market was valued at USD 0.60 billion in 2023, with estimates suggesting it could reach USD 0.94 billion by 2033. This market is gaining traction driven by increased military investments and strategic collaborations in aerospace initiatives.Tell us your focus area and get a customized research report.

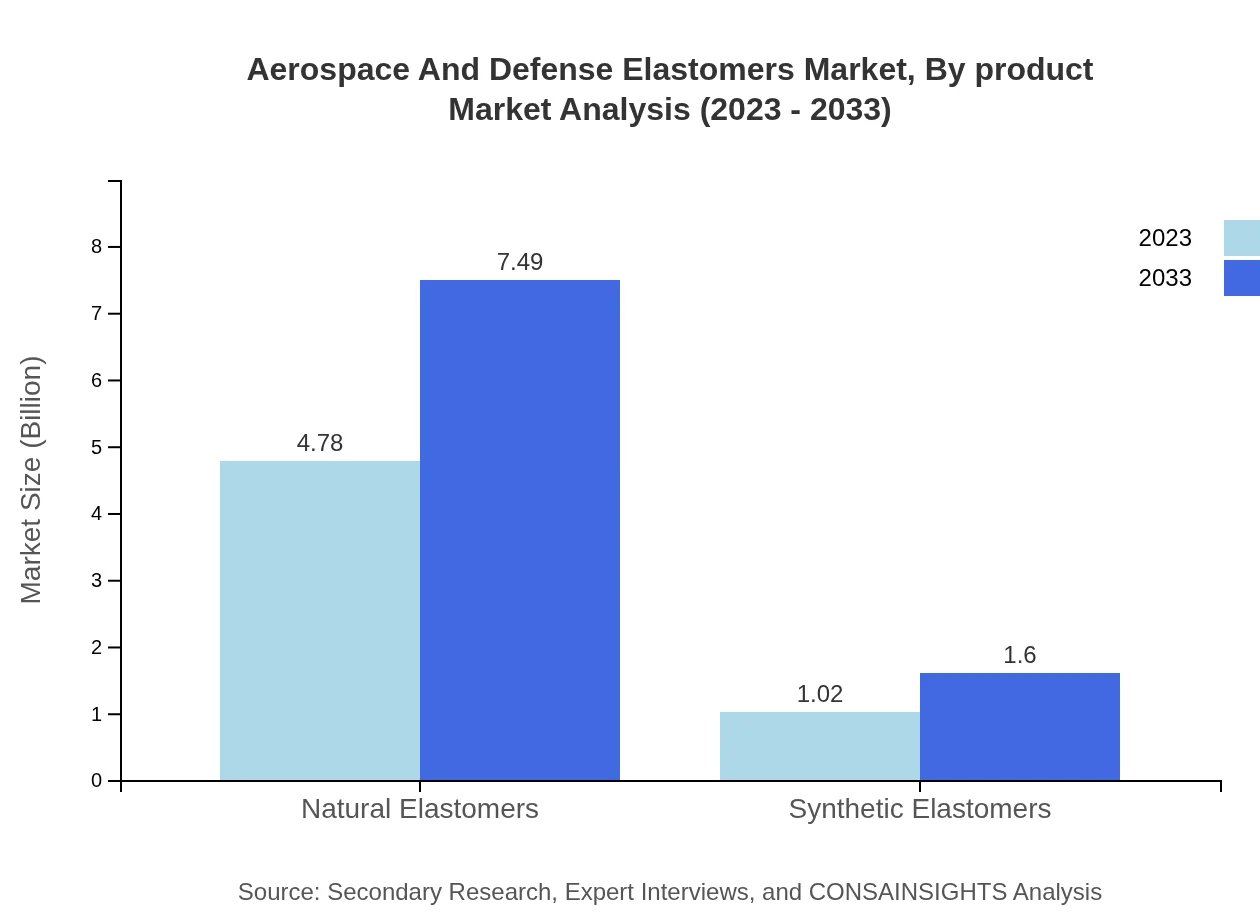

Aerospace And Defense Elastomers Market Analysis By Product

The market offerings include both natural and synthetic elastomers. Natural elastomers dominate, capturing an 82.43% market share in 2023, expected to maintain this position with a size of USD 4.78 billion in 2033. Synthetic elastomers, although smaller, are growing, representing 17.57% with a projected size of USD 1.60 billion by 2033.

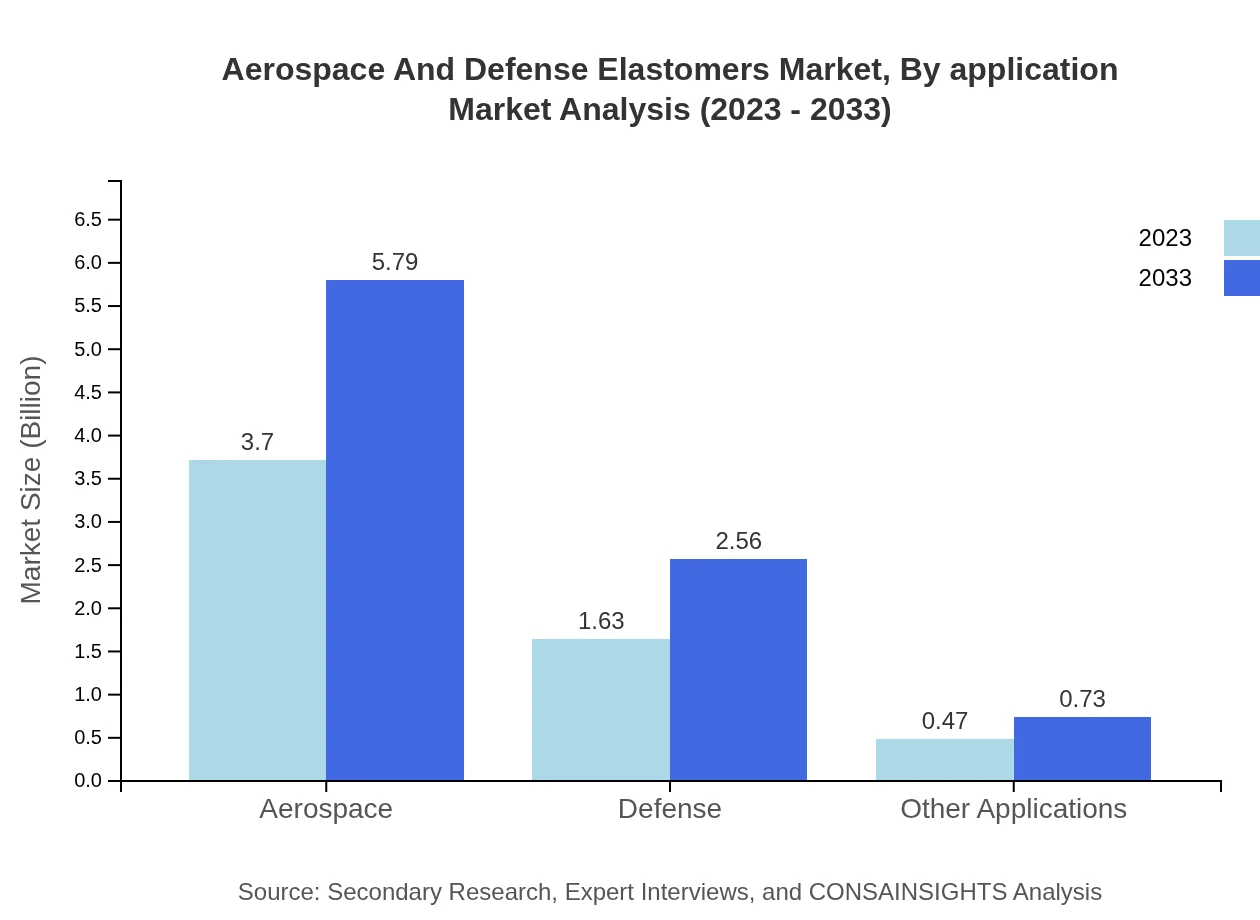

Aerospace And Defense Elastomers Market Analysis By Application

The application market highlights segments such as commercial airlines, military, and space. Commercial airlines are the largest segment with 63.79% share in 2023, projected to rise to USD 5.79 billion by 2033. Military applications account for 28.16% share, while space endeavors capture approximately 8.05% of the market share.

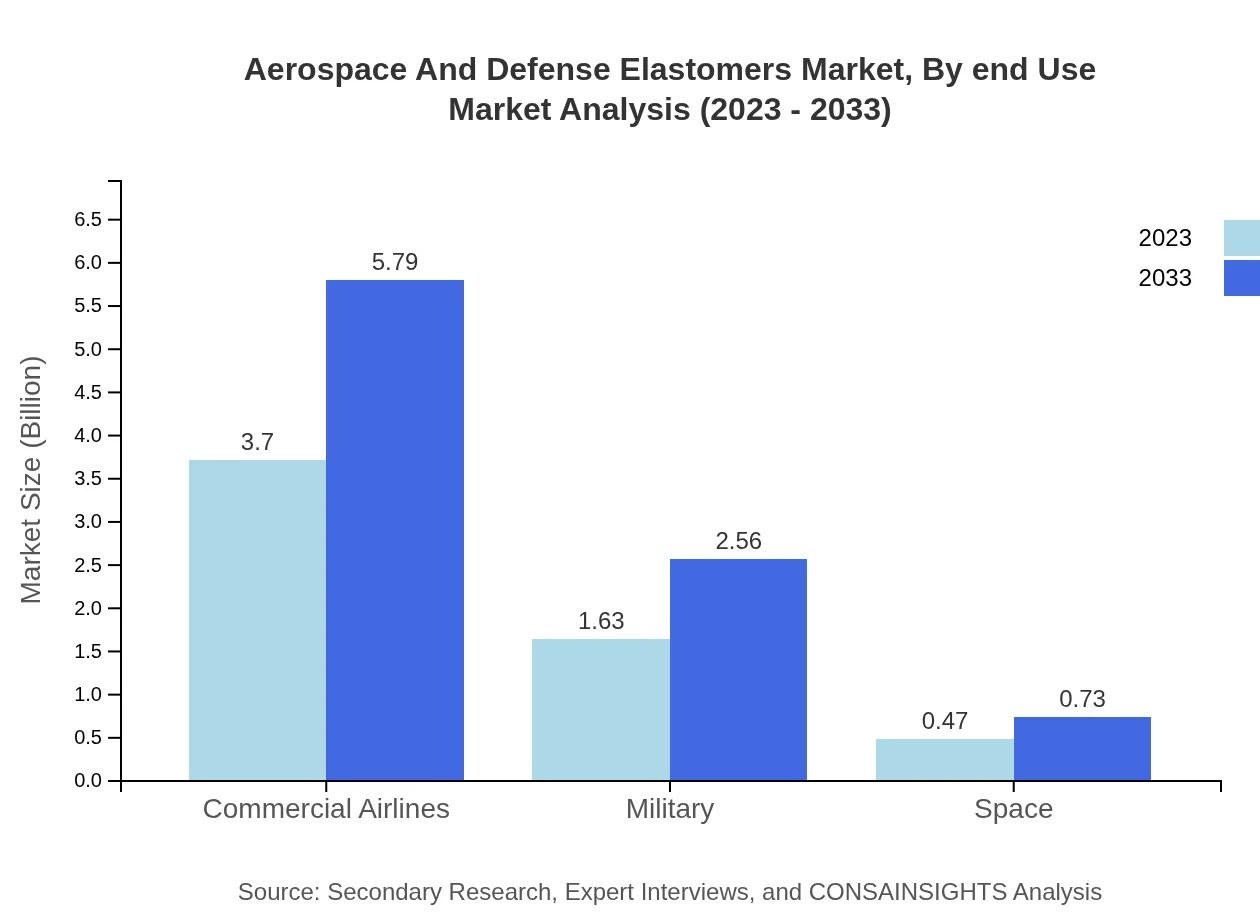

Aerospace And Defense Elastomers Market Analysis By End Use

End-user analysis reveals that aerospace and defense dominate elastomer usage across sectors. The aerospace segment, holding a 63.79% market share in 2023, shows sustained relevance through innovations. The defense sector, holding a 28.16% share, continues to grow, ensuring elastomers support next-generation military applications.

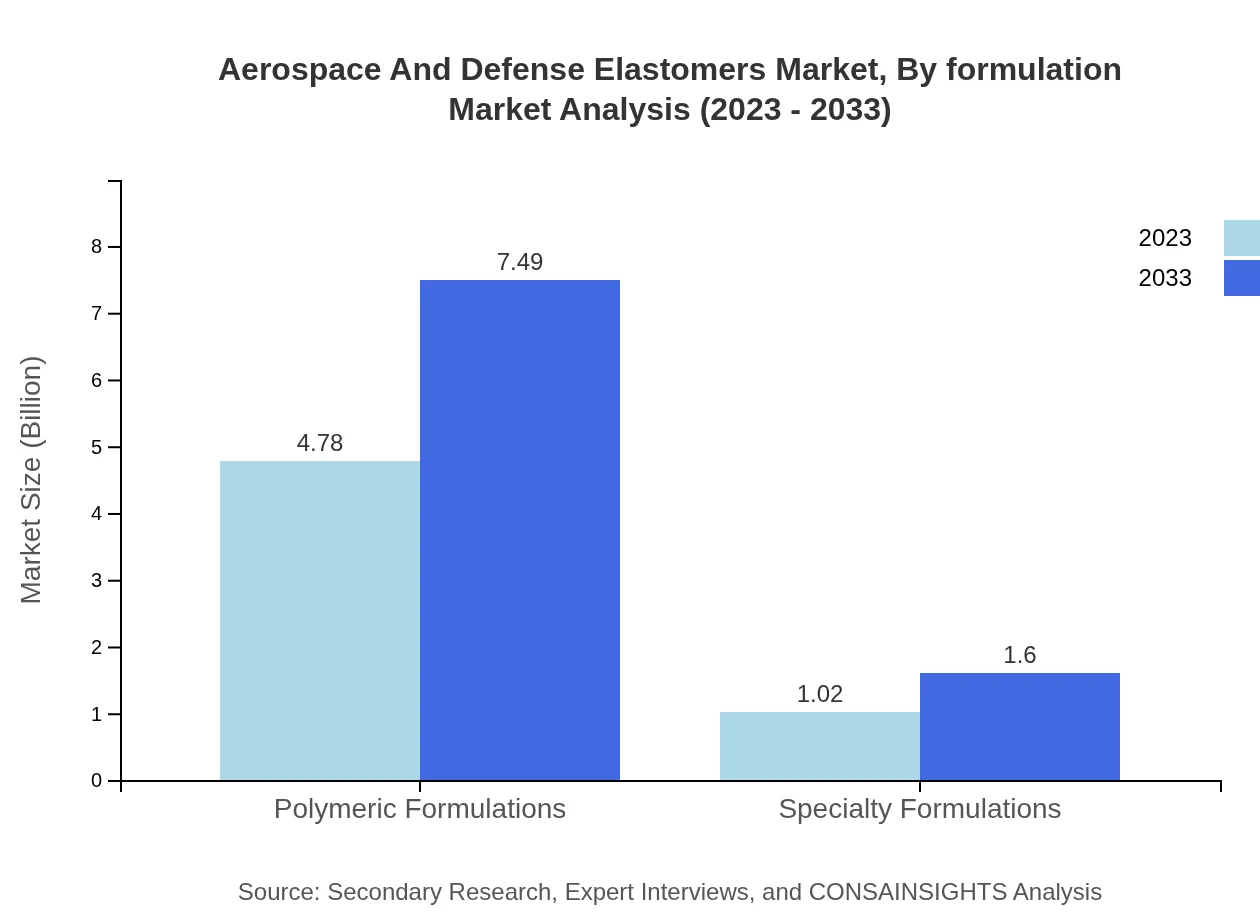

Aerospace And Defense Elastomers Market Analysis By Formulation

Formulation types include polymeric and specialty formulations. Polymeric formulations, controlling 82.43% of market share in 2023, exhibit strength due to their adaptable properties and cost-effectiveness. Specialty formulations increasingly cater to niche requirements, capturing 17.57% of market share in 2023.

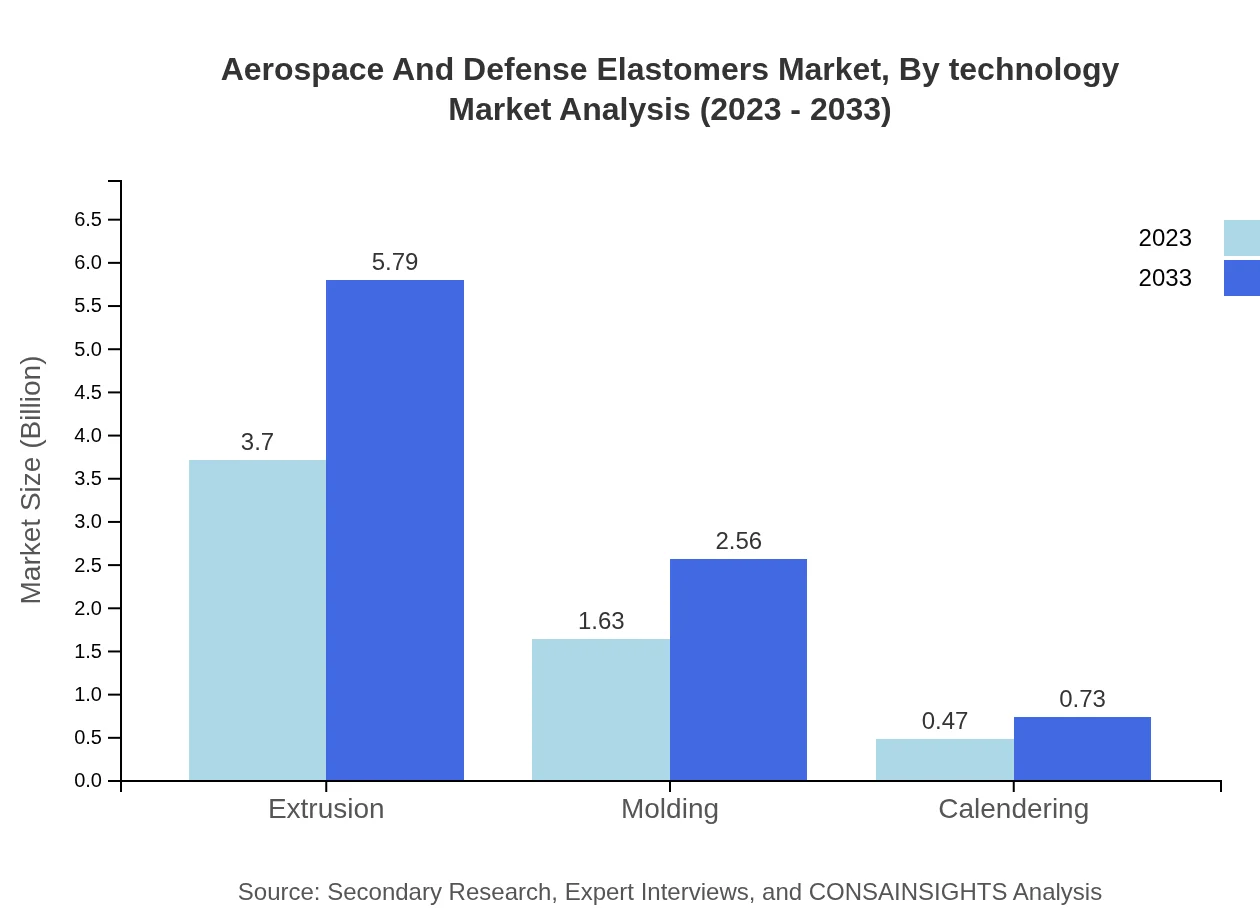

Aerospace And Defense Elastomers Market Analysis By Technology

Technological advancements play a vital role in elastomer evolution. Key processes such as extrusion and molding dominate, comprising 63.79% and 28.16% of the segments, respectively. Innovations in calendering techniques promote efficiency, supporting application-specific elastomer development.

Aerospace And Defense Elastomers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aerospace And Defense Elastomers Industry

The Dow Chemical Company:

A leader in elastomer innovation, Dow provides high-performance elastomers tailored for aerospace use, focusing on safety and application efficiency.DuPont de Nemours, Inc.:

DuPont offers advanced elastomer solutions, integrating sustainable practices and cutting-edge technology across the aerospace sector.Huntsman Corporation:

Huntsman is known for its performance products, enhancing the lifespan and safety of aerospace elastomers through engineered solutions.BASF SE:

BASF leads in specialty chemicals and elastomers, providing customized solutions adapted to aerospace and defense sector exigencies.We're grateful to work with incredible clients.

FAQs

What is the market size of aerospace And Defense Elastomers?

The aerospace and defense elastomers market is valued at approximately $5.8 billion in 2023, with a projected CAGR of 4.5% from 2023 to 2033, expanding the market significantly over the decade.

What are the key market players or companies in this aerospace And Defense Elastomers industry?

Key players in the aerospace and defense elastomers industry include major manufacturers and suppliers specializing in elastomers and polymer materials. They are pivotal in driving innovation and developing high-performance materials suited for aerospace and defense applications.

What are the primary factors driving the growth in the aerospace And Defense Elastomers industry?

The growth of the aerospace and defense elastomers market is driven by increasing demand for lightweight materials, advancements in technology, and growing aerospace traffic. Additionally, stringent safety regulations necessitate the development of high-quality elastomers for durability and performance.

Which region is the fastest Growing in the aerospace And Defense Elastomers?

The fastest-growing region in the aerospace and defense elastomers market is North America. The market is projected to rise from $2.00 billion in 2023 to $3.14 billion by 2033, reflecting significant growth opportunities driven by innovation in aerospace technologies.

Does ConsaInsights provide customized market report data for the aerospace And Defense Elastomers industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs within the aerospace and defense elastomers industry, ensuring clients receive relevant insights and analyses that are pertinent to their business objectives.

What deliverables can I expect from this aerospace And Defense Elastomers market research project?

Deliverables from the aerospace and defense elastomers market research project include comprehensive market analysis reports, detailed segmentation data, regional forecasts, competitive landscape assessments, and tailored insights that help inform strategic decision-making.

What are the market trends of aerospace And Defense Elastomers?

Current market trends in aerospace and defense elastomers include a rising focus on sustainable materials, innovations in high-performance elastomers, and an increased application of advanced manufacturing techniques like 3D printing, which enhances product customization and reduces waste.