Ai In Finance Market

Published Date: 31 January 2026 | Report Code: ai-in-finance-market

Ai In Finance Market Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the AI in Finance Market, offering valuable insights into market trends, growth factors, and technological advancements forecasted between 2024 and 2033. The report examines market size, segmentation, regional contributions, and industry leaders, ensuring stakeholders are well-informed about the market dynamics and future prospects.

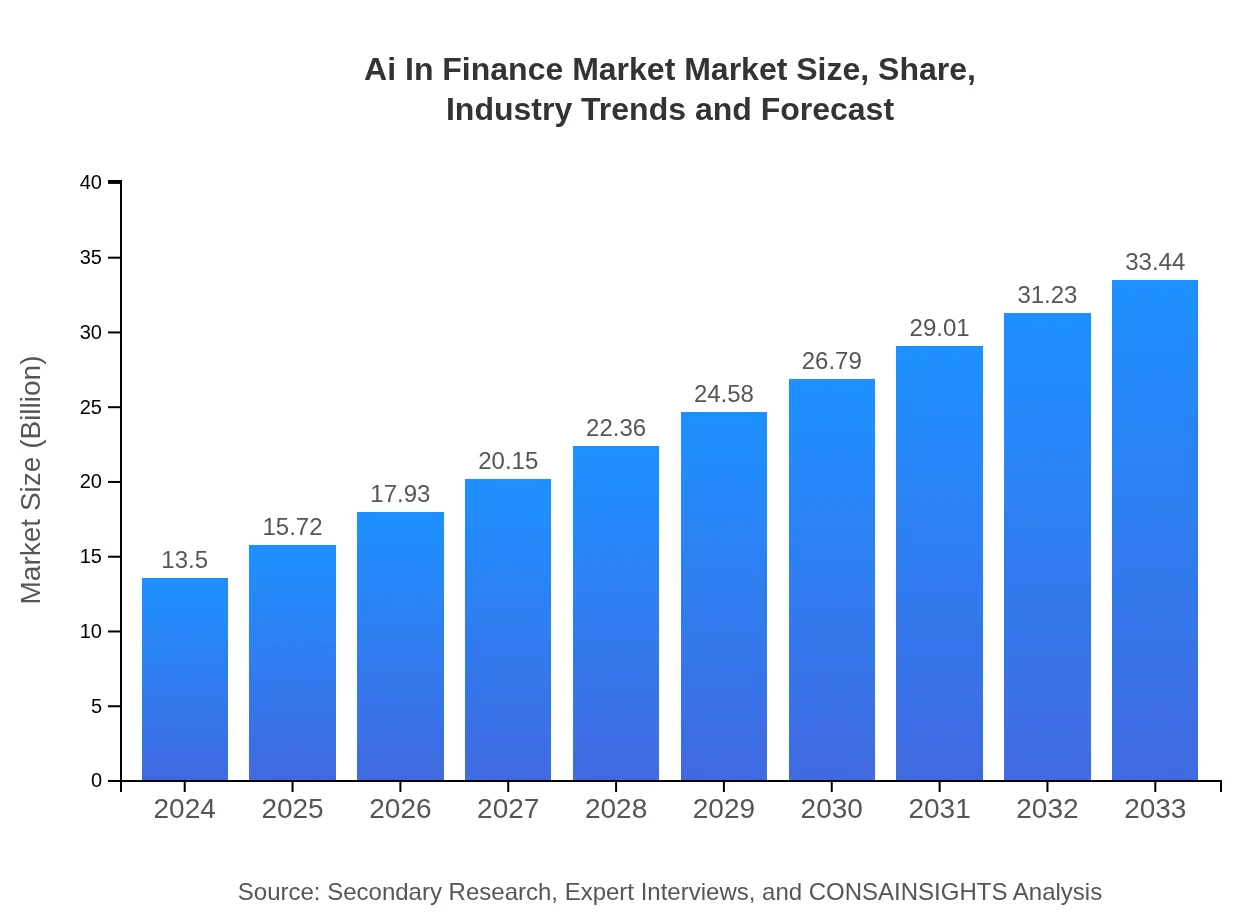

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $13.50 Billion |

| CAGR (2024-2033) | 10.2% |

| 2033 Market Size | $33.44 Billion |

| Top Companies | FinTech Innovators Inc., AI Financial Solutions, BankTech Corp, InsureAI Ltd. |

| Last Modified Date | 31 January 2026 |

Ai In Finance Market Market Overview

Customize Ai In Finance Market market research report

- ✔ Get in-depth analysis of Ai In Finance Market market size, growth, and forecasts.

- ✔ Understand Ai In Finance Market's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Finance Market

What is the Market Size & CAGR of Ai In Finance Market market in 2024?

Ai In Finance Market Industry Analysis

Ai In Finance Market Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Finance Market Market Analysis Report by Region

Europe Ai In Finance Market:

Europe is showing a steady upward trend in the AI in Finance Market, with market size figures moving from 3.54 in 2024 to 8.76 in 2033. The region’s stringent regulatory environment and focus on data privacy and cybersecurity are steering the development and implementation of compliant AI-based solutions. European companies are at the forefront of integrating AI to improve operational efficiency and enhance the customer experience.Asia Pacific Ai In Finance Market:

The Asia Pacific region is emerging as a critical hub for the adoption of AI in finance, with market values projected to grow from 2.63 in 2024 to 6.51 in 2033. This growth is driven by rapid digitalization, an expanding middle-class population, and strong governmental support for technological innovation. Countries in this region are investing heavily in fintech and AI research, positioning themselves as competitive players in the global market.North America Ai In Finance Market:

North America remains a formidable market for AI in finance, with values increasing from 5.05 in 2024 to 12.51 in 2033. The region benefits from robust technological infrastructure, advanced research capabilities, and significant investments in AI R&D. These factors combine to make North America a leader in deploying AI solutions for risk management, customer service, and fraud detection across banking and financial institutions.South America Ai In Finance Market:

In South America, particularly within the realms of Latin America, the market is experiencing modest growth. With market size figures rising from 0.60 in 2024 to 1.49 in 2033, the region is slowly embracing AI solutions. Emerging economies and an increasing appetite for technological advancements are catalyzing improvements in financial services efficiency and regulatory adherence.Middle East & Africa Ai In Finance Market:

The Middle East and Africa region is also witnessing significant momentum, with market projections increasing from 1.68 in 2024 to 4.17 in 2033. Although currently at a nascent stage compared to other regions, ongoing investments in digital infrastructure and a rapidly evolving financial landscape are driving growth. These regions are progressively leveraging AI to tackle challenges related to regulatory compliance, fraud prevention, and risk management.Tell us your focus area and get a customized research report.

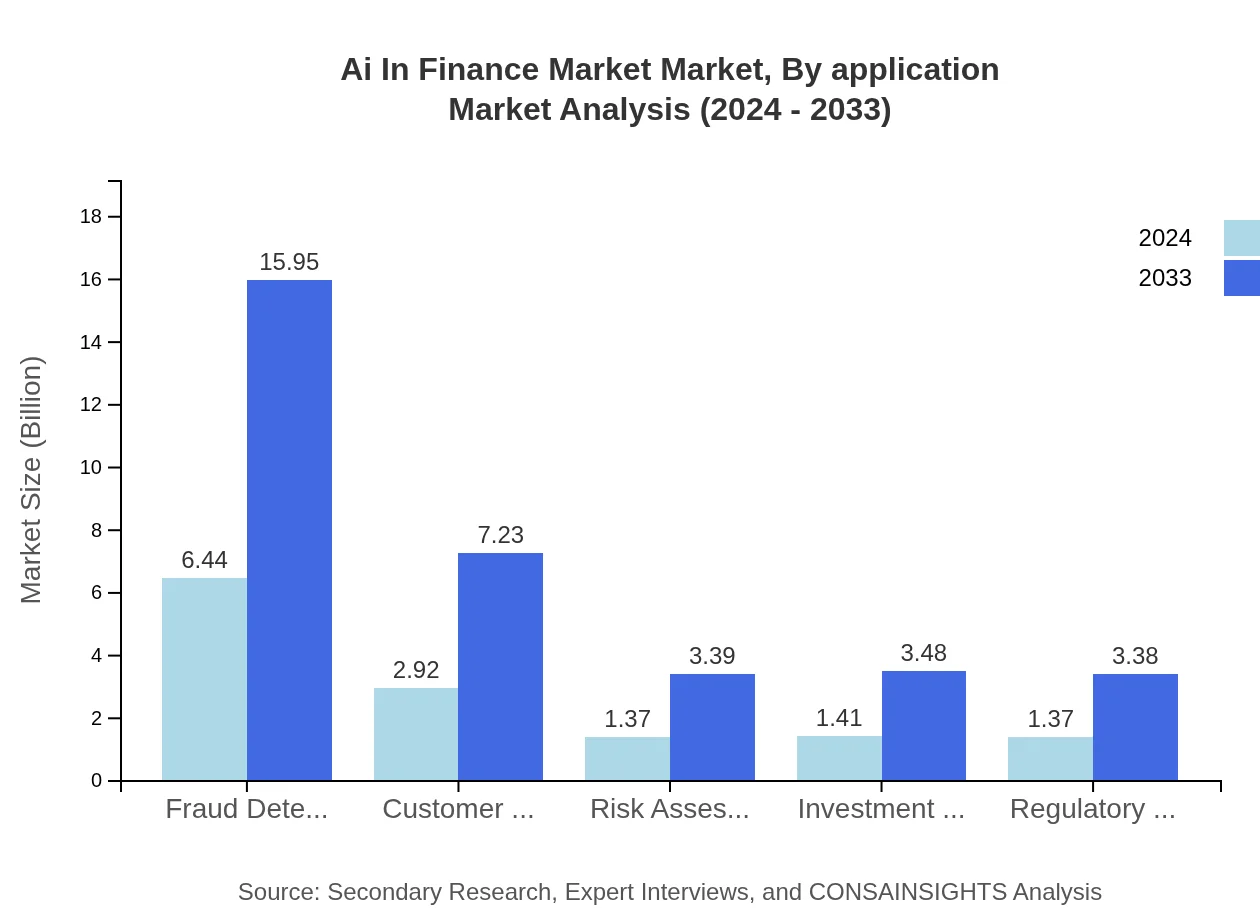

Ai In Finance Market Market Analysis By Application

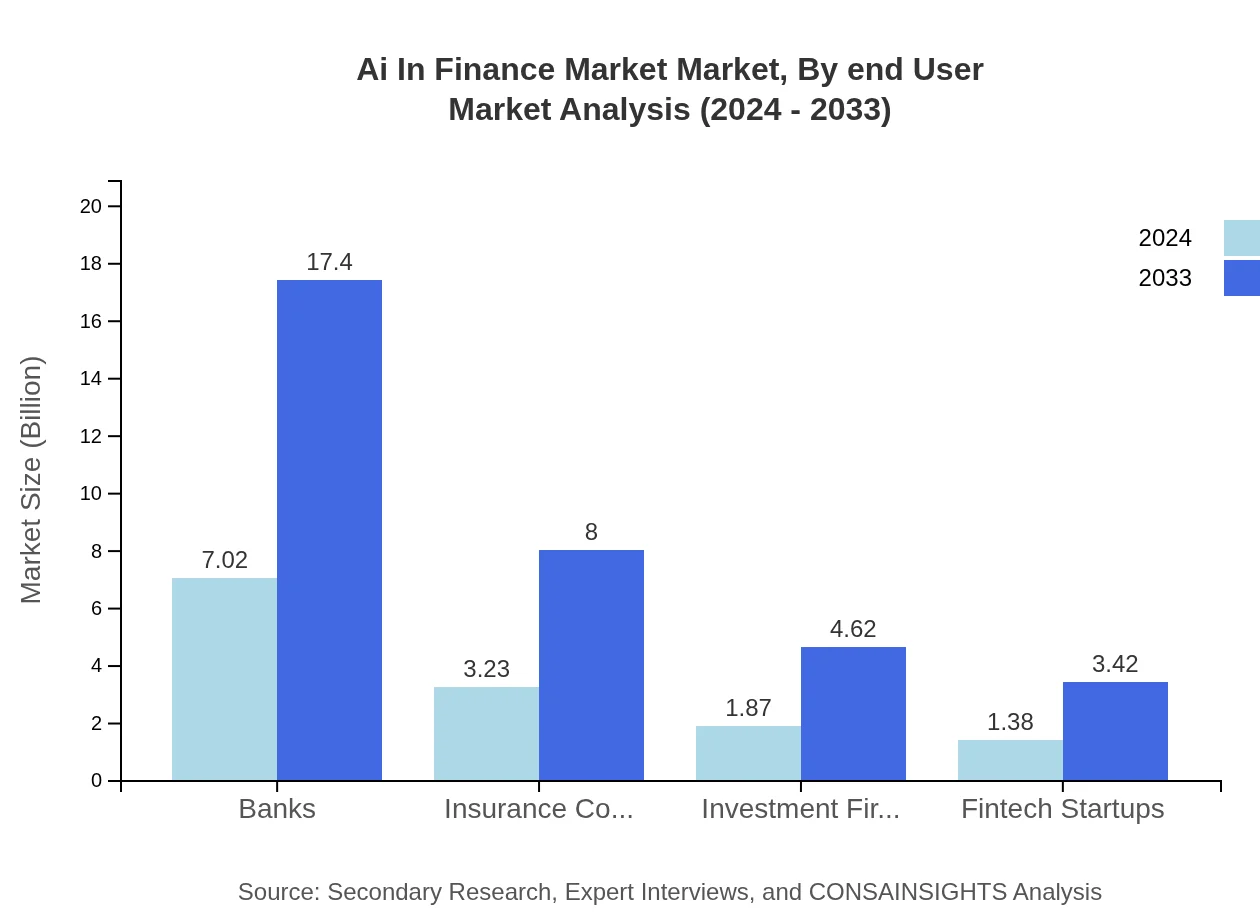

The by-application segment of the AI in Finance Market is broadly categorized into banking, insurance, investment, and fintech startup applications. Banks, with size metrics rising from 7.02 in 2024 to 17.40 in 2033 and maintaining a consistent market share of 52.03%, are major adopters of AI solutions for customer service, risk assessment, and fraud detection. Insurance companies follow closely, driving improvements in claim processing and underwriting through intelligent automation, with their market size increasing from 3.23 to 8.00. Investment firms are integrating AI to optimize portfolio management and predictive analytics, as reflected by growth from 1.87 to 4.62, while fintech startups are capitalizing on innovative AI applications to disrupt conventional financial services, growing from 1.38 to 3.42. This segmentation highlights the diverse use cases and strategic importance of AI across various financial applications.

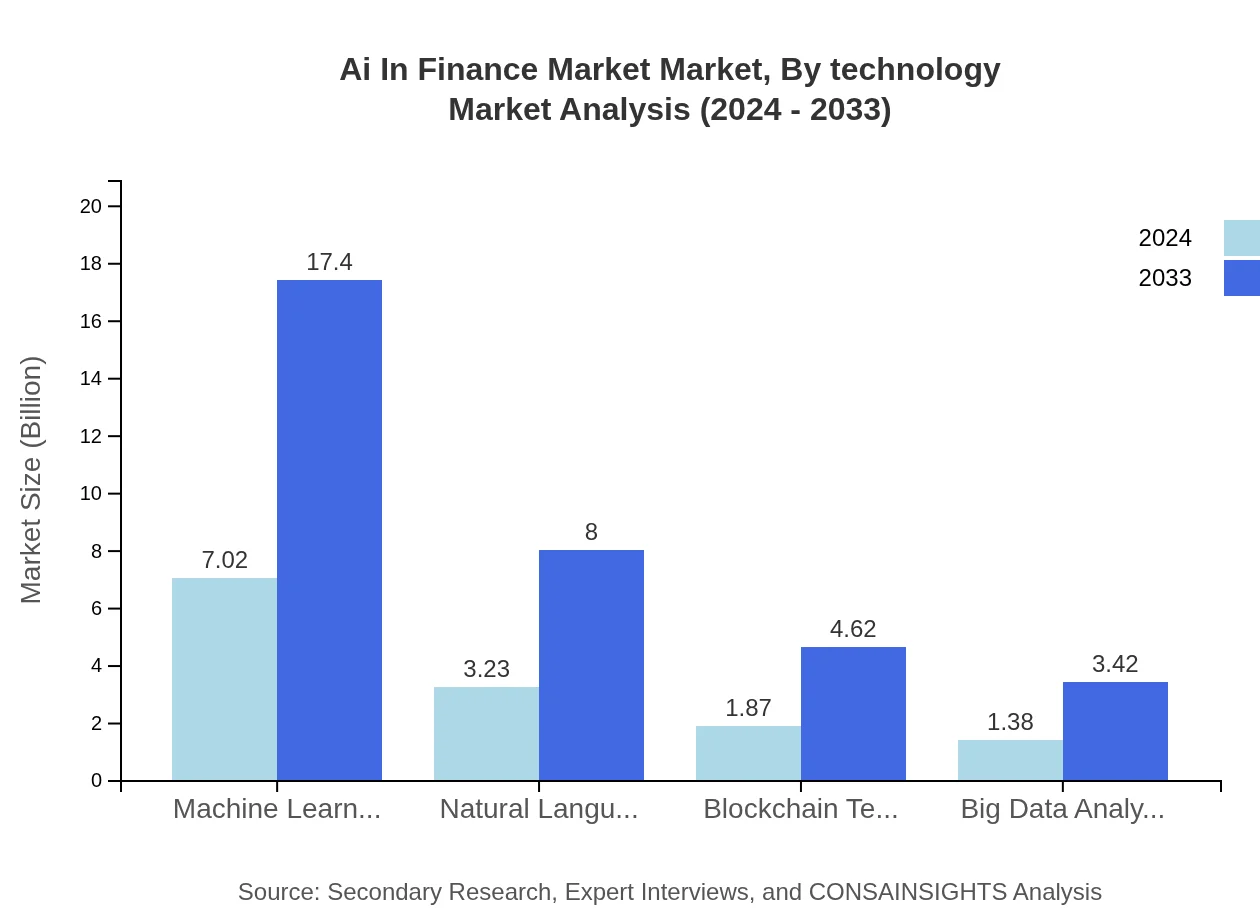

Ai In Finance Market Market Analysis By Technology

Under the technology category, key trends include the adoption of machine learning, natural language processing, blockchain, big data analytics, and specialized algorithms for fraud detection and customer service improvement. Machine learning, with market sizes of 7.02 in 2024 and 17.40 in 2033, continues to dominate, ensuring high-level predictive capabilities. Natural language processing, growing from 3.23 to 8.00, enhances customer interactions and sentiment analysis. Blockchain technology and big data analytics, with growth from 1.87 to 4.62 and 1.38 to 3.42 respectively, are vital for secure, transparent, and efficient data handling. Additionally, fraud detection technology, marked by an increase from 6.44 to 15.95, fortifies financial institutions against cyber threats, while risk assessment, investment management, and regulatory compliance maintain steady contributions, reinforcing the integral role of advanced technologies in modern financial operations.

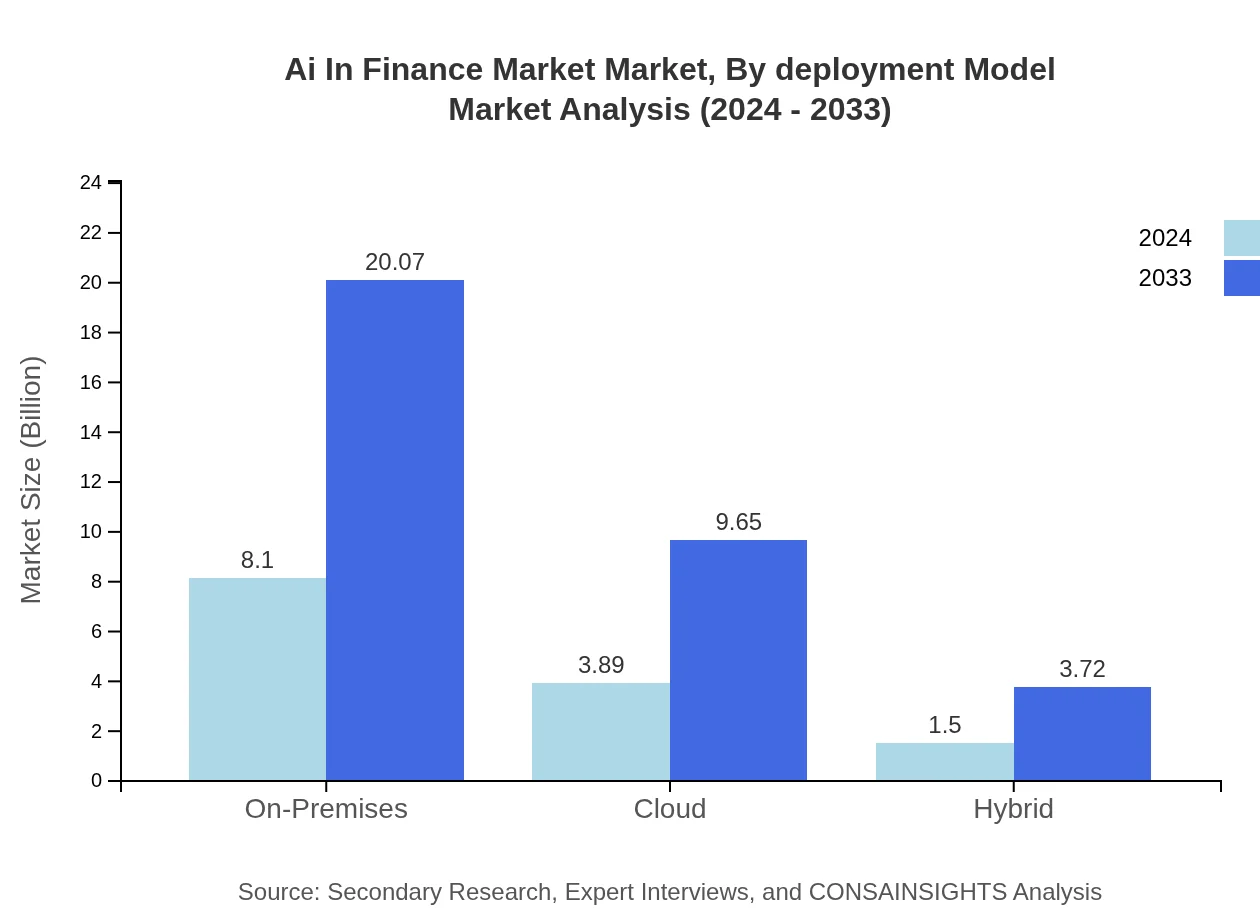

Ai In Finance Market Market Analysis By Deployment Model

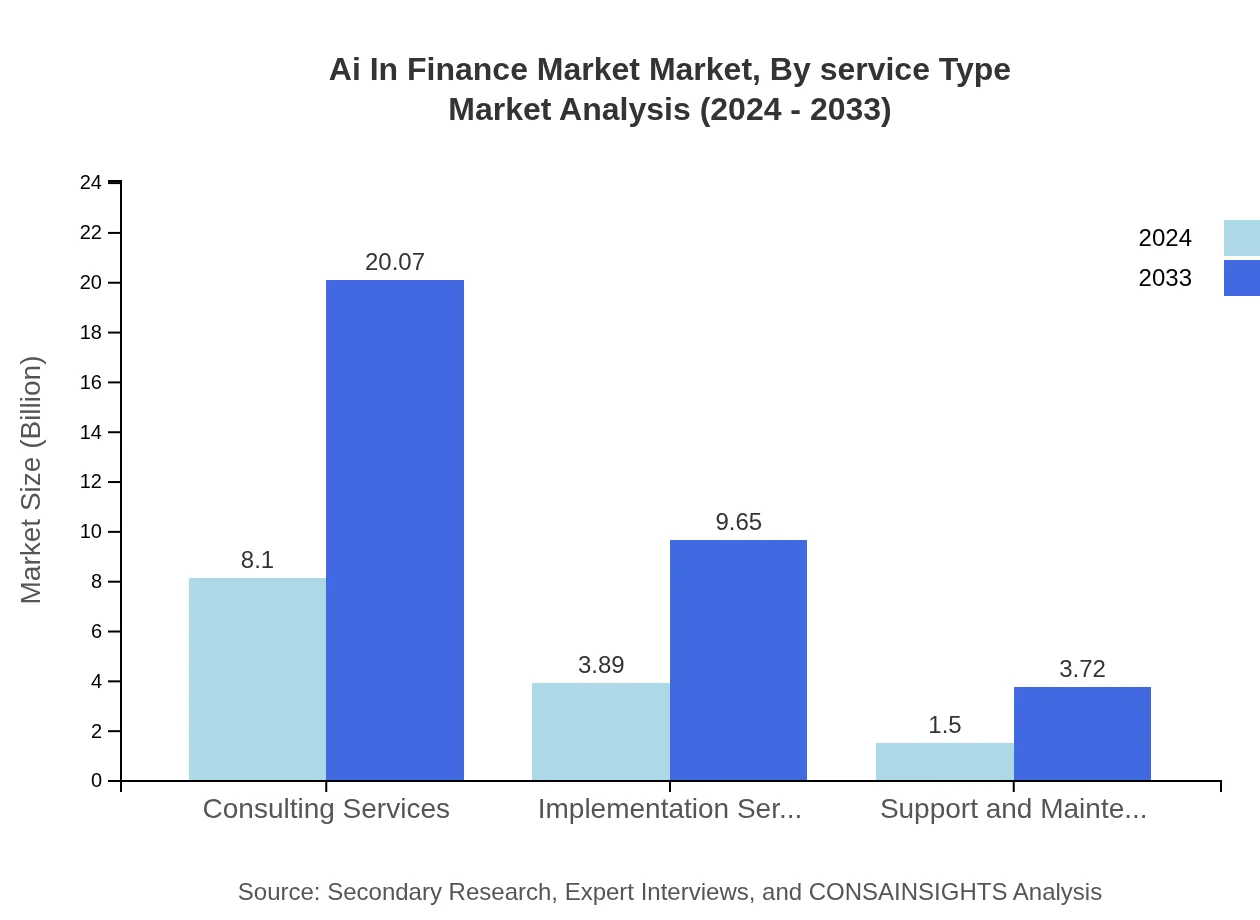

The deployment model analysis focuses on how AI solutions are implemented within financial institutions. Consulting services are a predominant segment, growing from 8.10 in 2024 to 20.07 in 2033, as firms seek expert guidance for AI integration. Implementation services, with values rising from 3.89 to 9.65, indicate the importance of customized deployment strategies that align with operational needs. Support and maintenance services, evolving from 1.50 to 3.72, ensure that AI systems are continuously updated and optimized. These services collectively form an essential framework that facilitates seamless integration and sustained performance of AI technologies across the finance sector, ensuring a balanced and scalable deployment model.

Ai In Finance Market Market Analysis By End User

The end-user segmentation reflects the diverse clientele that benefits from AI innovations. Traditional financial institutions, digital banks, and specialized investment firms are increasingly investing in AI-driven solutions to improve operational efficiency. The focus here is on leveraging advanced analytics for enhanced decision-making and strategic investments in technology. Institutions are employing AI for real-time risk assessment and regulatory adherence, which has proven critical in navigating volatile market conditions. As end-users become more sophisticated in their technology adoption, the demand for tailored AI solutions continues to grow, ultimately driving a more competitive and responsive financial ecosystem.

Ai In Finance Market Market Analysis By Service Type

The by-service-type segment dissects the market based on the delivery model of AI solutions. Under this classification, services are categorized into On-Premises, Cloud, and Hybrid models. The On-Premises model, with market values from 8.10 in 2024 to 20.07 in 2033, is favored by institutions with stringent data security needs. The Cloud model, growing from 3.89 to 9.65, offers flexibility and scalability while reducing upfront infrastructure costs. The Hybrid model, which combines the benefits of both on-premises and cloud services, is set to grow from 1.50 to 3.72, providing a balanced approach to managing sensitive data along with leveraging modern technologies. Collectively, these service types reflect the nuanced ways in which financial institutions are adopting AI solutions to meet diverse operational requirements.

Ai In Finance Market Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Finance Market Industry

FinTech Innovators Inc.:

A leading company known for integrating cutting-edge AI technologies in financial services, this firm assists banks and fintech startups in enhancing operational efficiency and transforming legacy systems through advanced analytics.AI Financial Solutions:

Renowned for its innovative AI-driven portfolio management and risk assessment solutions, AI Financial Solutions plays a pivotal role in assisting diverse institutions in adapting to an evolving financial landscape.BankTech Corp:

An industry giant specializing in advanced technology frameworks for banking, BankTech Corp drives improvements in digital customer service, fraud detection, and compliance through state-of-the-art AI solutions.InsureAI Ltd.:

Focusing on delivering specialized AI-powered tools for claim processing and fraud prevention, InsureAI Ltd. has significantly impacted the insurance sector by enhancing efficiency and customer service quality.We're grateful to work with incredible clients.

FAQs

How can the ai In Finance market report help align our marketing strategy with customer adoption trends?

The ai-in-finance market, projected at $13.5 Billion with a CAGR of 10.2%, provides insights into customer preferences and trends. Understanding these dynamics helps companies tailor their marketing strategies to enhance customer adoption and engagement.

What product features are in highest demand according to the ai In Finance trends?

Features such as fraud detection, machine learning, and natural language processing are in high demand. These functionalities improve efficiency and customer experience in financial services, driving investment towards these technological advancements within the growing market.

Which regions offer the best market entry and expansion opportunities in the ai In Finance industry?

North America leads with a projected increase from $5.05 Billion in 2024 to $12.51 Billion by 2033, while Europe and Asia Pacific also show strong growth, expanding to $8.76 Billion and $6.51 Billion respectively. Targeting these regions may optimize market entry strategies.

What emerging technologies and innovations are shaping the ai In Finance market?

Innovations in machine learning, blockchain, and big data analytics are redefining the finance sector. With market capabilities expanding, these technologies enhance operational efficiencies and create new financial products tailored to changing consumer demands.

Does the ai In Finance market report include competitive landscape and market share analysis?

Yes, the report provides a thorough competitive landscape analysis, detailing market shares across segments such as banks, insurance, and fintech startups, which are essential for understanding competitive dynamics in this rapidly evolving market.

How can executives use the ai In Finance report to evaluate investment risks and ROI?

Executives can utilize the market report to analyze trends and forecasts, helping them identify high-potential investment opportunities. The data on segment growth and regional performance assists in assessing risk and return expectations effectively.

What is the market size of the ai In Finance market?

The ai-in-finance market size is projected at $13.5 Billion, with an expected CAGR of 10.2% from 2024 to 2033, signaling robust growth driven by increasing demand for automated financial solutions.

What is the projected market growth in various regions from 2024 to 2033 for the ai In Finance market?

Projected market sizes include North America $5.05B to $12.51B, Europe $3.54B to $8.76B, Asia Pacific $2.63B to $6.51B, Latin America $0.60B to $1.49B, and Middle East & Africa $1.68B to $4.17B, showcasing diverse growth opportunities.